|

市场调查报告书

商品编码

1910678

核能发电:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Nuclear Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

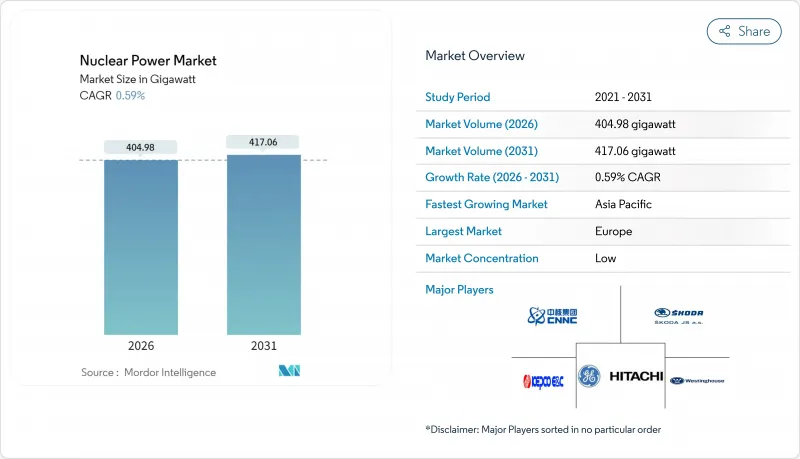

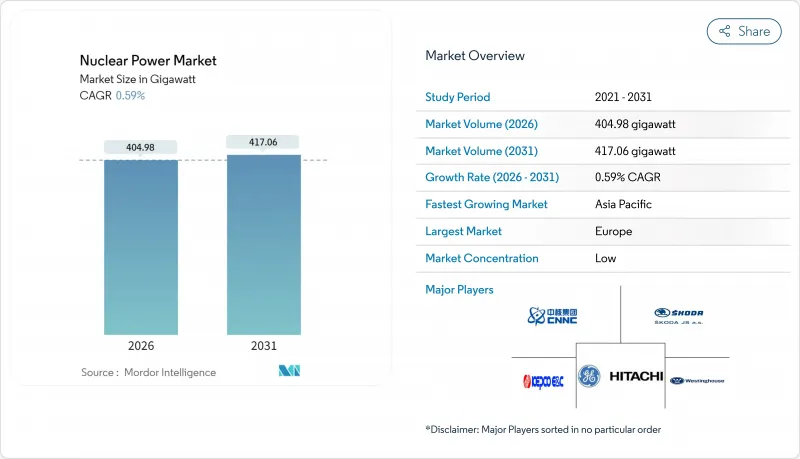

预计核能发电市场将从 2025 年的 402.60 吉瓦成长到 2026 年的 404.98 吉瓦,到 2031 年达到 417.06 吉瓦,2026 年至 2031 年的复合年增长率为 0.59%。

儘管持续的装置容量成长依然温和,但核电产业正经历结构性转变。小型模组化反应器(SMR)正从研发阶段迈向商业部署阶段,而延寿计画则为现有基本负载发电提供支援。开发商正专注于工厂预製模组以降低建设风险,而传统的吉瓦级计划则面临着不断上涨的资本成本、更长的前置作业时间以及日益严格的资金筹措规则。区域趋势体现在:欧洲拥有庞大的现有核电厂群,亚太地区建设步伐迅猛,而北美则专注于延寿计画。此外,工业脱碳的需求也带来了新的机会。高温核能製程热可望取代钢铁、水泥和化学工业的煤炭和天然气燃气锅炉。

全球核能发电市场趋势及展望

对清洁基本负载电力的需求不断增长

随着电力产业脱碳目标的不断收紧,电网营运商在不影响供电可靠性的前提下,难以整合大量可变再生能源来源。因此,各国政府正在运作核能作为全天候无碳能源的潜力,尤其是在电力消耗每年增长15%至20%的资料中心集群中。包括日本和韩国在内的一些经济体,先前计划逐步淘汰核能发电为了确保能源安全,它们正在调整策略。容量费和辅助业务收益正被纳入核能产业计画,从而缩小了核电与太阳能和风能之间的成本差距。这为核能市场提供了政策支持,即使在现货电价波动的情况下也是如此。同时,监管机构要求更严格的安全裕度,这延长了许可证审批週期,并提高了公众对核电的接受度。

延长运行週期和提高功率输出计划

电力公司意识到,运作一座已有40年历史的核子反应炉60年甚至80年,每千瓦的成本为500至1000美元,而新建设的成本则为每千瓦6000至12000美元。美国美国核能管理委员会已核准95项延期许可,法国目前正在进行一项耗资494亿欧元的维修计划,旨在加固存储壳并更换关键零件。升级涡轮机和内部核心零件通常可使每座反应器的发电量提高4%至7%,这是在不争夺新位置的情况下扩大核能市场的最快途径。电力公司仍然必须解决核子反应炉压力容器的脆化和仪器老化问题。儘管60年后的监管不确定性阻碍了长期规划,但许多电力公司将延寿视为在2030年代部署下一代核子反应炉的过渡方案。

成本超支和资金筹措挑战

乔治亚的沃古尔3-4号机组扩建计划预算已飙升至350亿美元,是最初预算的两倍多;英国欣克利角C核电厂的预算也接近430亿美元。这些超支是由于供应链短缺、施工期间的设计变更以及由于数十年来新建设数量低迷导致的技术纯熟劳工流失造成的。因此,贷款方要求政府担保、受监管的资产支持模式或长期购电协议才能获得资金。开发商正在大力推进模组化以加快建造速度,但首批小型模组化反应器(SMR)仍需证明其成本曲线的可靠性。政府贷款担保和税收优惠可以降低风险,但私人企业主导的核能计划仍然十分罕见。

细分市场分析

到2025年,压水反应器将占总装置容量的74.02%,巩固其作为核能市场支柱的地位。然而,受中国600兆瓦CFR-600反应器和印度原型反应器计画的推动,快滋生式反应炉预计在2031年实现19.4%的复合年增长率。气冷反应器和熔盐反应器目前仍处于试验阶段,但其高温能力正吸引工业供热用户的注意。

因此,轻水反应器设计在中期内将维持其核能市场份额,而示范快堆将为闭式燃料循环奠定知识基础。监管机构对钠铅冷却系统有了更深入的了解,但商业资金筹措将取决于早期在安全性和经济性验证方面的成功。如果CFR-600能够达到其性能目标,增殖反应器技术可望在2030年代占据核能市场的重要份额。

到2025年,500-1000兆瓦的中型机组将占总装置容量的48.12%,并将继续成为电网成熟国家的首选。 500兆瓦以下的小型反应器预计将以19.2%的复合年增长率成长,反映出电力公司对模组化扩容以降低风险资本的兴趣。 20兆瓦以下的微型反应器主要面向采矿和国防应用,可在离网环境中提供电力保障。

工厂化生产对小型核子反应炉的经济效益至关重要。供应商正在推动标准化,在10-12台机组运作后,经验累积将降低成本,有助于扩大小型模组化反应器(SMR)市场。然而,装置容量超过1000兆瓦的大型核子反应炉在小规模国家面临成本压力和併网限制,这限制了除中国和印度以外的新订单。

核能市场报告按核子反应炉类型(压水慢化冷却反应器、快滋生式反应炉等)、核子反应炉规模(大型、中型、小型)、燃料类型(低浓缩铀等)、应用(併网电力、工业过程的热能和蒸气等)、最终用户(电力公司、独立发电商、工业和石化等)以及地区(欧洲、亚太地区分析。

区域分析

到2025年,欧洲仍将维持核能市场最大份额,达到39.35%,这主要得益于法国拥有的56座核子反应炉,这些反应堆供应了该国65%的电力。欧盟已在其绿色能源分类体系中将核能定位为过渡性资产,从而开闢了永续的资金筹措途径。然而,在福岛核事故后,延长运作寿命和加强安全措施的成本给营运商的财务状况带来了压力。德国核能发电厂于2023年关闭,使得中欧越来越依赖从法国进口电力。英国正在推动3.2吉瓦的欣克利角C核能发电厂,并考虑引进六座欧洲压水反应器(EPR),这些反应器可望维持英国国内核能技术发展至2050年。

亚太地区核电年均复合成长率(CAGR)高达6.6%,是成长最快的地区,主要得益于中国新建的24座核子反应炉以及印度自主研发的重水反应器(PHWR)和快堆计画。中国正努力核能扩张与2060年实现碳中和的承诺相衔接,并计画在2030年实现120吉瓦(GW)的装置容量。日本正透过分阶段运作的方式增加运转率,但公众的疑虑仍是阻碍因素。同时,韩国拥有28座核子反应炉,并向阿联酋出口APR-1400型机组。越南和印尼等新兴经济体正在进行可行性研究,但进入核能市场仍面临资金筹措和监管方面的障碍。

在北美,核电厂的延期运作和选择性新建设十分普遍。美国20%的总发电量和50%的无碳电力都依赖核能。延期运行计画旨在支持老旧核电厂的运营,而联邦税额扣抵和贷款担保则推动了爱达荷州和怀俄明州的小型模组化反应器(SMR)计划。加拿大正在维修其CANDU反应器,计画于2024年为达灵顿2号机组增加881兆瓦的装置容量。此外,面向偏远北极社区和重油矿区的小型模组化反应器示范计画也在进行中。墨西哥目前仍在营运两座拉古纳维德反应炉,但没有新建设计画。在全部区域,通往先进反应器的道路取决于高浓缩铀(HALEU)的供应和简化的许可程序。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对清洁基本负载电力的需求不断增长

- 生命延长和能量提升计划

- 先进小型模组化反应器(SMR)的商业化

- 工业脱碳製程—热需求

- 核能製氢和氨业务

- 核能发电资料中心与海洋应用的兴起

- 市场限制

- 成本超支和资金筹措挑战

- 来自低成本可再生能源的竞争

- 高浓缩铀燃料供应瓶颈

- 出口管制和扩散监测

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争强度

第五章 市场规模与成长预测

- 按反应器类型

- 压水慢化反应器(PWR)

- 压水慢化冷却反应器(PHWR)

- 沸水冷却轻慢化反应器(BWR)

- 气冷石墨慢化反应器(GCR)

- 高温反应炉(HTGR)

- 轻型水冷石墨慢化核子反应炉(LWGR)

- 快滋生式反应炉(FBR)

- 其他的

- 按反应器尺寸

- 大型(1000兆瓦或以上)

- 中型(500-1000兆瓦)

- 小型(小于 500 兆瓦;包括小型模组化反应器 (SMR) 和微型反应器)

- 按燃料类型

- 低浓缩铀(U-235含量低于5%)

- 高检出率 LEU (U-235 5-20%)

- 混合氧化物燃料(MOX)

- 钍基燃料

- 透过使用

- 併网电力

- 离网/偏远地区电气化

- 工业製程热和蒸气

- 海水淡化和区域供热

- 国防/军事基地

- 按最终用户行业划分

- 公共产业和独立发电商(IPP)

- 工业和石油化工

- 采矿和远端作业

- 政府/国防

- 研究所

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 瑞典

- 西班牙

- 乌克兰

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性措施(併购、合资、资金筹措、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- Electricite de France SA(EDF)

- Rosatom State Atomic Energy Corporation

- China National Nuclear Corporation(CNNC)

- Westinghouse Electric Company LLC

- GE-Hitachi Nuclear Energy

- Framatome SA

- Mitsubishi Heavy Industries Ltd

- Korea Hydro & Nuclear Power/KEPCO E&C

- BWX Technologies Inc.

- Bechtel Corporation

- Doosan Enerbility Co. Ltd

- Fluor Corporation(NuScale)

- SKODA JS as

- Holtec International

- TerraPower LLC

- Rolls-Royce SMR Ltd

- X-Energy LLC

- General Fusion Inc.

- Ontario Power Generation

- Babcock International Group

- Bilfinger SE

- Duke Energy Corporation

- Japan Atomic Power Company

- Ansaldo Nucleare

第七章 市场机会与未来展望

The Nuclear Power market is expected to grow from 402.60 gigawatt in 2025 to 404.98 gigawatt in 2026 and is forecast to reach 417.06 gigawatt by 2031 at 0.59% CAGR over 2026-2031.

Sustained capacity additions remain modest, yet the sector is undergoing a structural transition in which lifetime-extension programs shore up existing baseload generation even as small modular reactors (SMRs) move from the development stage toward commercial roll-out. Developers are focusing on factory-built modules to mitigate construction risk, while traditional gigawatt-scale projects contend with rising capital costs, lengthy lead times, and stricter financing rules. Regional dynamics are shaped by Europe's large installed base, the Asia-Pacific's rapid build-out pace, and North America's focus on life extension. Opportunities also arise from industrial decarbonization needs, where high-temperature nuclear process heat can displace coal and natural-gas boilers in the steel, cement, and chemicals industries.

Global Nuclear Power Market Trends and Insights

Increase in Demand for Clean Baseload Power

Electric-sector decarbonization targets continue to tighten, and grid managers struggle to integrate large shares of variable renewable energy sources without eroding reliability. Governments, therefore, revisit nuclear as a 24/7 carbon-free source, especially for data-center clusters whose electricity use rises 15-20% each year. Several economies that once planned to phase out nuclear power, such as Japan and South Korea, are reversing course to safeguard energy security. Capacity-value payments and ancillary-service revenues now feature in nuclear business cases, narrowing the apparent cost gap with solar and wind. The nuclear power market thereby secures a policy floor even where spot electricity prices remain volatile. At the same time, regulators insist on stricter safety margins, which lengthen licensing reviews while also reinforcing public acceptance.

Lifetime Extension & Uprate Programs

Operators find that keeping a 40-year-old reactor running for 60 or even 80 years costs USD 500-1,000 per kW, a fraction of the USD 6,000-12,000 per kW needed for new construction. The U.S. Nuclear Regulatory Commission has granted 95 license renewals, while France's EUR 49.4 billion grand carenage project strengthens containment structures and replaces key components. Uprating turbines and core internals typically adds 4-7% capacity per unit, making these projects the swiftest way to expand the nuclear power market without new siting battles. Operators must still address the embrittlement of reactor pressure vessels and the obsolescence of instrumentation. Uncertainty about regulations beyond 60 years weighs on longer-range planning; yet, most utilities view life extension as a bridge to advanced-reactor deployment in the 2030s.

Cost Overruns & Financing Challenges

The Vogtle 3-4 expansion in Georgia has more than doubled its initial budget to USD 35 billion, and Hinkley Point C in the United Kingdom now stands at nearly USD 43 billion. Such overruns stem from supply-chain gaps, design changes during construction, and the loss of skilled labor after decades of limited new build. Lenders, therefore, demand sovereign guarantees, regulated asset-based models, or long-term power-purchase agreements before committing funds. Developers pursue modularization to compress schedules; yet, first-of-a-kind SMRs must still demonstrate credible cost curves. Government loan guarantees and tax incentives mitigate risk, but merchant nuclear projects remain rare.

Other drivers and restraints analyzed in the detailed report include:

- Commercialization of Advanced SMRs

- Industrial Decarbonization Process-Heat Demand

- Competition from Low-Cost Renewables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pressurized light-water reactors accounted for 74.02% of total capacity in 2025, solidifying their role as the backbone of the nuclear power market. Fast breeder reactors, however, are on track for a 19.4% CAGR through 2031, propelled by China's 600 MWe CFR-600 and India's prototype reactor programs. Although gas-cooled and molten-salt concepts remain at the pilot stage, their high-temperature capabilities attract industrial heat clients.

The nuclear power market, therefore, sees light-water designs maintaining share in the medium term, while demonstration fast reactors build the knowledge base for closed-fuel cycles. Regulators gain familiarity with sodium and lead-coolant systems, but commercial financing hinges on early successes that demonstrate safety and economic viability. Should the CFR-600 hit performance milestones, breeder technologies may capture a meaningful nuclear power market share in the 2030s.

Medium-scale 500-1,000 MWe units held 48.12% of the installed capacity in 2025 and remain the preferred option for countries with mature grids. Small reactors under 500 MWe are forecast to expand at a 19.2% CAGR, reflecting utility interest in modular additions that lower capital at-risk. Micro-reactors with a capacity below 20 MWe target mining and defense applications, offering off-grid resilience.

Factory production is crucial to the economics of small reactors. Vendors pursue standardization so that the nuclear power market size for SMRs benefits from learning-curve cost declines after 10-12 units are in operation. Meanwhile, large reactors exceeding 1,000 MWe face cost headwinds and grid integration limits in smaller countries, curbing new orders outside China and India.

The Nuclear Power Market Report is Segmented by Reactor Type (Pressurized Light-Water Moderated and Cooled Reactor, Fast Breeder Reactor, and More), Reactor Size (Large, Medium, and Small), Fuel Type (Low-Enriched Uranium, and More), Application (Grid-Connected Power, Industrial Process Heat and Steam, and More), End-User (Utilities and IPPs, Industrial and Petro-Chemical, and More), and Geography (Europe, Asia-Pacific, and More).

Geography Analysis

Europe retained the largest 39.35% share of the nuclear power market in 2025, buoyed by France's 56-reactor fleet, which supplies 65% of the country's electricity. The European Union includes nuclear energy as a transitional asset under its green taxonomy, unlocking sustainable finance channels. Yet lifetime-extension costs and post-Fukushima upgrades strain operator balance sheets, and Germany's 2023 shutdown leaves Central Europe more reliant on French exports. The United Kingdom advances the 3.2 GW Hinkley Point C and explores a fleet of six EPRs that will sustain domestic nuclear skills through 2050.

Asia-Pacific delivers the fastest 6.6% CAGR, led by China's pipeline of 24 reactors under construction and India's indigenous PHWR and fast-reactor programs. China aligns its nuclear growth with its 2060 carbon neutrality pledge and targets 120 GW by 2030. Japan's gradual restarts lift capacity factors but remain constrained by public skepticism, while South Korea maintains a 28-reactor fleet and exports APR-1400 units to the United Arab Emirates. Emerging economies, such as Vietnam and Indonesia, conduct feasibility studies; however, financing and regulatory readiness remain hurdles before they can join the nuclear power market.

North America opts for life extension and selective new build. The United States relies on nuclear power for 20% of its total generation and 50% of its carbon-free power. License renewals keep aging plants online, while federal tax credits and loan guarantees encourage SMR projects in Idaho and Wyoming. Canada refurbishes its CANDU fleet, adding 881 MWe from Darlington unit 2 in 2024, and advances SMR demonstrations for remote Arctic communities and heavy-oil sites. Mexico retains its two-unit Laguna Verde plant with no new build on the horizon. Across the region, deployment pathways for advanced reactors hinge on HALEU supply and streamlined licensing.

- Electricite de France SA (EDF)

- Rosatom State Atomic Energy Corporation

- China National Nuclear Corporation (CNNC)

- Westinghouse Electric Company LLC

- GE-Hitachi Nuclear Energy

- Framatome SA

- Mitsubishi Heavy Industries Ltd

- Korea Hydro & Nuclear Power / KEPCO E&C

- BWX Technologies Inc.

- Bechtel Corporation

- Doosan Enerbility Co. Ltd

- Fluor Corporation (NuScale)

- SKODA JS a.s.

- Holtec International

- TerraPower LLC

- Rolls-Royce SMR Ltd

- X-Energy LLC

- General Fusion Inc.

- Ontario Power Generation

- Babcock International Group

- Bilfinger SE

- Duke Energy Corporation

- Japan Atomic Power Company

- Ansaldo Nucleare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in demand for clean baseload power

- 4.2.2 Lifetime extension & uprate programs

- 4.2.3 Commercialization of advanced SMRs

- 4.2.4 Industrial decarbonization process-heat demand

- 4.2.5 Nuclear-produced hydrogen & ammonia initiatives

- 4.2.6 Emergence of nuclear-powered data-center & marine applications

- 4.3 Market Restraints

- 4.3.1 Cost overruns & financing challenges

- 4.3.2 Competition from low-cost renewables

- 4.3.3 HALEU fuel-supply bottlenecks

- 4.3.4 Export-control & proliferation scrutiny

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Reactor Type

- 5.1.1 Pressurized Light-Water Moderated and Cooled Reactor (PWR)

- 5.1.2 Pressurized Heavy-Water Moderated and Cooled Reactor (PHWR)

- 5.1.3 Boiling Light-Water Cooled and Moderated Reactor (BWR)

- 5.1.4 Gas Cooled, Graphite Moderated Reactor (GCR)

- 5.1.5 High-Temperature Gas-Cooled Reactor (HTGR)

- 5.1.6 Light-Water Cooled, Graphite Moderated Reactor (LWGR)

- 5.1.7 Fast Breeder Reactor (FBR)

- 5.1.8 Others

- 5.2 By Reactor Size

- 5.2.1 Large (Above 1,000 MWe)

- 5.2.2 Medium (500 to 1,000 MWe)

- 5.2.3 Small (Below 500 Mwe; includes SMRs and Micro-reactors)

- 5.3 By Fuel Type

- 5.3.1 Low-Enriched Uranium (Below 5% U-235)

- 5.3.2 High-Assay LEU (5 to 20% U-235)

- 5.3.3 Mixed Oxide (MOX)

- 5.3.4 Thorium-based Fuels

- 5.4 By Application

- 5.4.1 Grid-Connected Power

- 5.4.2 Off-grid/Remote Electrification

- 5.4.3 Industrial Process Heat and Steam

- 5.4.4 Desalination and District Heating

- 5.4.5 Defense and Military Bases

- 5.5 By End-User Sector

- 5.5.1 Utilities and IPPs

- 5.5.2 Industrial and Petro-chemical

- 5.5.3 Mining and Remote Operations

- 5.5.4 Government/Defense

- 5.5.5 Research Institutions

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 France

- 5.6.2.3 Sweden

- 5.6.2.4 Spain

- 5.6.2.5 Ukraine

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Egypt

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Electricite de France SA (EDF)

- 6.4.2 Rosatom State Atomic Energy Corporation

- 6.4.3 China National Nuclear Corporation (CNNC)

- 6.4.4 Westinghouse Electric Company LLC

- 6.4.5 GE-Hitachi Nuclear Energy

- 6.4.6 Framatome SA

- 6.4.7 Mitsubishi Heavy Industries Ltd

- 6.4.8 Korea Hydro & Nuclear Power / KEPCO E&C

- 6.4.9 BWX Technologies Inc.

- 6.4.10 Bechtel Corporation

- 6.4.11 Doosan Enerbility Co. Ltd

- 6.4.12 Fluor Corporation (NuScale)

- 6.4.13 SKODA JS a.s.

- 6.4.14 Holtec International

- 6.4.15 TerraPower LLC

- 6.4.16 Rolls-Royce SMR Ltd

- 6.4.17 X-Energy LLC

- 6.4.18 General Fusion Inc.

- 6.4.19 Ontario Power Generation

- 6.4.20 Babcock International Group

- 6.4.21 Bilfinger SE

- 6.4.22 Duke Energy Corporation

- 6.4.23 Japan Atomic Power Company

- 6.4.24 Ansaldo Nucleare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Advanced Small Modular Reactors

- 7.3 Floating Nuclear Plants

- 7.4 Nuclear Hydrogen & Ammonia Production

- 7.5 Data-Center & Marine Micro-reactors

- 7.6 Lifetime Extension Services Market

- 7.7 Decommissioning & Waste-Management Services