|

市场调查报告书

商品编码

1910717

身份验证(ID):市场份额分析、行业趋势和统计数据、成长预测(2026-2031)Identity (ID) Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

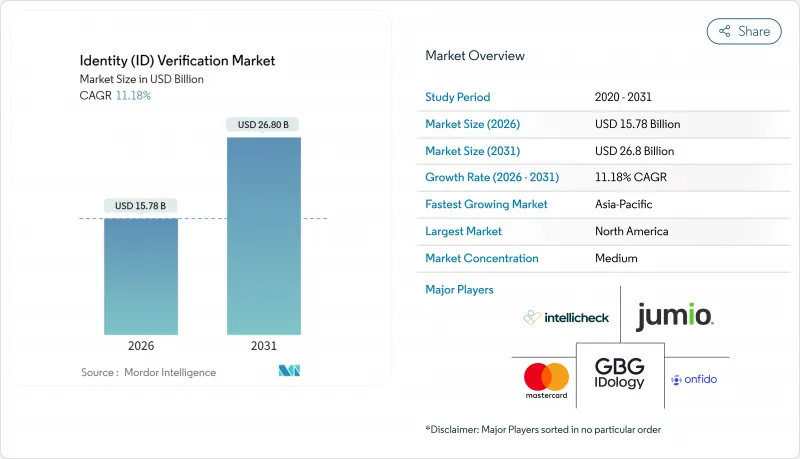

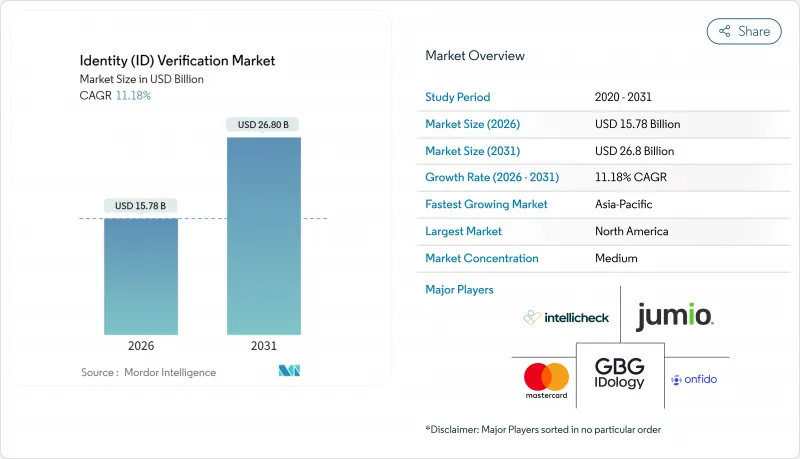

身分验证市场预计将从 2025 年的 141.9 亿美元成长到 2026 年的 157.8 亿美元,预计到 2031 年将达到 268 亿美元,2026 年至 2031 年的复合年增长率为 11.18%。

这项扩张反映出企业正从简单的合规性检查转向策略性安全投资,因为企业面临着人工智慧产生的诈骗、深度造假攻击以及日益增长的监管罚款。仅深度造假一项就激增了3000%,迫使供应商将被动生物识别和行为分析直接整合到用户註册流程中。云端原生部署现在已成为大多数新部署的预设选择,它允许将模型更新即时推送至全球所有租户,从而加速创新。同时,对可携式、隐私保护凭证的需求不断增长,推动了将政府颁发的行动驾驶执照、检验凭证和Web3钱包整合到单一用户流程中的试点计画。随着全端安全公司越来越多地收购细分领域的专业公司以获取人工智慧文件鉴识科技,市场整合正在活性化。然而,没有一家供应商的收入超过15%,这为那些专注于解决边缘风险和特定产业法规的专业新参与企业留下了充足的成长空间。

全球身分检验市场趋势与洞察

网路诈骗和监管罚款都在增加

预计2024年,诈欺性开户将占金融交易总量的2.1%,较两年前的1.27%大幅增加。据估计,约42.5%的已侦测诈骗事件利用了生成式人工智慧技术,迫使银行部署多层防御系统,以即时侦测合成身分资讯、深度造假语音等。监理机关也采取了同样强硬的立场,2023年全球金融机构因违反KYC(了解你的客户)规定而被罚款66亿美元。风险上升和罚款增加的双重压力正促使买家转向企业级编配平台,这些平台透过单一API整合文件取证、生物识别验证和持续行为监控功能。

远端入职和电子KYC要求的激增

亚太地区78%的消费者认为,在使用新的金融应用程式之前,进行数位身分验证至关重要。监管机构正在将这一趋势纳入法律法规。欧盟强制要求成员国在24个月内发行数位身分钱包,从而有效地将电子身分验证(e-KYC)制度化。一家美国排名前十的银行在实施语音认证后发现,采用自动化检验的机构可以将服务台处理时间缩短多达45秒。当检验的凭证可以在不同服务提供者之间传输时,就会产生网路效应,从而将重新註册的门槛降低一半,并增强平台规模优势。

碎片化世界中的监管标准

KYC(了解你的客户)法规不仅因国家而异,即使在同一地区,不同监管机构的监管规定也存在差异,这迫使平台运行并行的身份验证流程和资料居住架构。美国强调可移植性,而欧盟的GDPR则提倡在地化,这使得统一的云端部署变得更加复杂。在亚洲,日本要求获得金融服务厅的许可,而韩国则强制要求加密货币交易所与银行合作。合规团队在应对这些复杂的法规时,扩张週期被延长,营运成本也随之上升。

细分市场分析

到2025年,云端部署将占身分验证市场65.12%的份额,年复合成长率(CAGR)为12.72%,因为企业更倾向于弹性使用而非资本密集伺服器。预计到2031年,与云端部署相关的身份验证市场规模将达到187亿美元,这反映了数位银行和零工经济平台对API的快速采用。持续的模型更新、集中式威胁情报共用和零停机修补更新已使云端成为标准架构。本地部署仅在法规要求本地资料处理的情况下才强制执行,但一旦提供者建立经认证的区域中心,云端部署在这些司法管辖区通常也是允许的。

韧性也是一项驱动因素。万事达卡每年分析 1,430 亿笔交易,以更新其异常检测评分程序,从而为所有租户带来即时的收益。 Cloud 云端集线器还简化了与检验凭证和行动驾驶执照的集成,将计划週期从数月缩短至数週。随着边缘资料中心的普及,延迟问题逐渐消失,即使是需要亚秒往返时间的生物识别视讯串流,也能在云端部署。

预计到2025年,生物识别引擎将占据身份验证市场35.84%的份额,并在2031年之前保持12.86%的复合年增长率,超越仅依赖文件的认证方式。到2031年,与生物识别相关的身份验证市场规模预计将超过101亿美元,这主要得益于被动式活体检测技术的发展,该技术可在背景影片帧中隐蔽运行。供应商正在融合脸部、语音和行为讯号,以实现持续认证,从而减少帐户被盗用的风险。

文件验证仍将持续,但会逐渐退居次要地位。 Aware 等供应商正在发布即时合成媒体侦测技术,该技术能够侦测肉眼无法辨识的 GPU 渲染痕迹。金融机构已实施多模态生物识别,准确率提高了 250%,人工审核成本降低,客户转换率也得到提升。基于知识的问题和静态资料库匹配往往仅限于特定应用场景,例如低风险的年龄限制。

身份验证市场按部署模式(本地部署、云端部署)、解决方案类型(文件/身份验证、生物识别等)、最终用户行业垂直领域(金融服务(BFSI)、零售/电子商务等)、组织规模(大型企业、中小企业(SME))和地区进行细分。市场预测以美元(USD)为单位。

区域分析

北美地区在2025年维持了32.43%的识别市场份额,这得益于积极的诈欺防范措施和生物识别的早期应用。美国计划从2025年5月起在全国范围内的TSA查核点接受行动驾驶执照,这反映了运输安全局对数位身分的信心。加拿大的开放银行蓝图将进一步加速跨平台身分可携性的发展。

亚太地区预计将以11.52%的复合年增长率实现显着增长,这主要得益于新加坡的金融科技沙盒、印度的Aadhaar整合付款基础以及日本金融厅的加密货币监管政策。 Trulioo在新加坡设立办事处后,企业认证率达到了90%,显示该地区对其KYC API的需求强劲。智慧型手机普及率的不断提高以及即时支付方案的兴起,预计将使亚太地区在预测期内成为Trulioo最大的增量收入来源。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 网路诈骗和监管罚款增加

- 远端入职和电子KYC要求的激增

- 人工智慧驱动的文檔检验准确性提升

- 跨境数位身分互通性试点项目

- 新兴市场金融科技普惠计划

- 检验凭证和 Web3 身分钱包的兴起

- 市场限制

- 碎片化世界中的监管标准

- 深度造假和生成式人工智慧欺骗威胁

- 传统核心系统的高昂整合成本

- 数据主权障碍限制了云端技术的普及

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 评估市场中的宏观经济因素

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 按解决方案类型

- 文件/身分核实

- 生物识别

- 身份验证和活体检测

- 其他的

- 按最终用户行业划分

- 金融服务(BFSI)

- 零售与电子商务

- 政府/公共部门

- 卫生保健

- 通讯/IT

- 其他的

- 按组织规模

- 大公司

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mastercard

- Onfido

- GBG(Idology)

- Intellicheck

- Jumio

- Trulioo

- Mitek Systems

- Veriff

- IBM

- AuthenticID

- Experian

- TransUnion

- LexisNexis Risk Solutions

- Pindrop

- ComplyCube

- Nuance Communications

- Thales Group

- IDEMIA

- Okta

- Ping Identity

- Equifax

- NEC Corporation

- Acuant

- Persona

第七章 市场机会与未来展望

The identity verification market is expected to grow from USD 14.19 billion in 2025 to USD 15.78 billion in 2026 and is forecast to reach USD 26.8 billion by 2031 at 11.18% CAGR over 2026-2031.

The expansion reflects a decisive shift from checkbox compliance toward strategic security investment as enterprises confront AI-generated fraud, deepfake attacks, and rising regulatory fines. Deepfakes alone jumped 3,000%, compelling vendors to embed passive liveness and behavioral analytics directly into onboarding workflows. Cloud-native deployment, now the default choice for most new rollouts, accelerates innovation because model updates can be pushed instantly across global tenants. Meanwhile, demand for portable, privacy-preserving credentials is spurring pilots that link government-issued mobile driver's licenses, verifiable credentials, and Web3 wallets into a single user journey. Consolidation is intensifying as full-stack security firms buy niche specialists to acquire AI document-forensics talent, yet no provider controls more than 15% revenue, leaving ample headroom for focused entrants that solve edge-case risks or industry-specific regulations.

Global Identity (ID) Verification Market Trends and Insights

Increasing Cyber-Fraud and Regulatory Fines

Fraudulent account openings spiked to 2.1% of financial transactions in 2024, a sharp rise from 1.27% two years earlier.An estimated 42.5% of detected fraud events now leverage generative AI, which forces banks to deploy multi-layer defences that spot synthetic IDs and deepfake voices in real time. Regulators are equally assertive: global institutions paid USD 6.6 billion in KYC-related penalties during 2023. The combined pressure of higher risk and higher fines is pushing buyers toward enterprise-grade orchestration platforms that integrate document forensics, biometric liveness, and continuous behavioural monitoring in a single API.

Surge in Remote Onboarding and e-KYC Mandates

Seventy-eight percent of APAC consumers deem digital identity checks essential before using new financial apps. Regulators are codifying that preference: the EU requires every member state to issue a Digital Identity Wallet within 24 months, effectively institutionalising electronic KYC. Organisations that automate verification cut service-desk handle times by up to 45 seconds, as a top-10 US bank confirmed after rolling out voice authentication. Network effects then arise when verified credentials become transferable across providers, halving repeat onboarding friction and reinforcing platform scale advantages.

Fragmented Global Regulatory Standards

KYC rules vary not only by country but sometimes by banking supervisor inside the same region, forcing platforms to run parallel verification flows and data-residency architectures. The United States stresses portability, whereas EU GDPR pushes localisation, complicating unified cloud deployments. In Asia, Japan insists on FSA licences while South Korea demands bank partnerships for cryptocurrency exchanges. As compliance teams juggle this patchwork, expansion timetables lengthen and operating costs rise.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Accuracy Improvements in Document Forensics

- Cross-Border Digital ID Interoperability Pilots

- Deepfake and Generative-AI Spoofing Threats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment captured 65.12% identity verification market share in 2025 and is expanding at a 12.72% CAGR as firms prefer elastic consumption to capital-heavy servers. The identity verification market size associated with cloud deployments is projected to reach USD 18.7 billion by 2031, reflecting rapid API adoption among digital banks and gig-economy platforms. Continuous model updates, centralised threat-intel sharing, and zero-downtime patching position cloud as the reference architecture. On-premise remains mandatory only where statutes mandate local data processing, yet even those jurisdictions accept cloud when providers open certified regional centres.

Resilience is another driver. Mastercard analyses 143 billion annual transactions to update anomaly-scoring routines that instantly benefit every tenant. Cloud hubs also simplify integration with verifiable credentials and mobile driver's licenses, cutting project timelines from months to weeks. As edge data centres proliferate, latency concerns fade, allowing cloud adoption even for biometric video streams that demand sub-second round-trip times.

Biometric engines held 35.84% of identity verification market share in 2025 and post a 12.86% CAGR through 2031, outpacing document-only approaches. The identity verification market size tied to biometric modalities is forecast to surpass USD 10.1 billion by 2031, driven by passive liveness that operates invisibly in background video frames. Vendors blend facial, voice, and behavioural signals to deliver continuous authentication, narrowing the attack surface for account takeover.

Document checks will persist yet increasingly act as a secondary step. Providers like Aware release real-time synthetic-media detection that flags GPU-rendered artefacts invisible to the naked eye Aware. Financial institutions deploying multi-modal biometrics report 250% accuracy gains, which lowers manual review cost and boosts customer conversion. Knowledge-based questions and static database lookups now serve niche use cases such as low-risk age gating.

Identity Verification Market is Segmented by Deployment (On-Premises, Cloud), Solution Type (Document / ID Verification, Biometric Verification, and More), End User Industry (Financial Services (BFSI), Retail and E-Commerce, and More), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 32.43% identity verification market share in 2025, buoyed by aggressive fraud enforcement and early biometric rollouts. The United States plans nationwide mobile driver's license acceptance at TSA checkpoints from May 2025, signalling federal confidence in digital credentials. Canada's open-banking roadmap further accelerates cross-platform identity portability.

Asia-Pacific stands out with 11.52% CAGR, propelled by Singapore's fintech sandbox, India's Aadhaar-linked payment rails, and Japan's FSA crypto rules. Trulioo reached a 90% business-verification rate after opening its Singapore hub, illustrating demand for regional KYC APIs. Rising smartphone penetration and real-time payment schemes make APAC the largest incremental revenue pool over the forecast horizon.

- Mastercard

- Onfido

- GBG (Idology)

- Intellicheck

- Jumio

- Trulioo

- Mitek Systems

- Veriff

- IBM

- AuthenticID

- Experian

- TransUnion

- LexisNexis Risk Solutions

- Pindrop

- ComplyCube

- Nuance Communications

- Thales Group

- IDEMIA

- Okta

- Ping Identity

- Equifax

- NEC Corporation

- Acuant

- Persona

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing cyber-fraud and regulatory fines

- 4.2.2 Surge in remote onboarding and e-KYC mandates

- 4.2.3 AI-driven accuracy improvements in document forensics

- 4.2.4 Cross-border digital ID interoperability pilots

- 4.2.5 Fintech inclusion programmes in emerging markets

- 4.2.6 Rise of verifiable credentials and Web3 identity wallets

- 4.3 Market Restraints

- 4.3.1 Fragmented global regulatory standards

- 4.3.2 Deepfake and generative-AI spoofing threats

- 4.3.3 High integration cost for legacy core systems

- 4.3.4 Data-sovereignty barriers limiting cloud roll-outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution Type

- 5.2.1 Document / ID Verification

- 5.2.2 Biometric Verification

- 5.2.3 Authentication and Liveness

- 5.2.4 Others

- 5.3 By End-user Industry

- 5.3.1 Financial Services (BFSI)

- 5.3.2 Retail and E-commerce

- 5.3.3 Government and Public Sector

- 5.3.4 Healthcare

- 5.3.5 Telecom and IT

- 5.3.6 Others

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mastercard

- 6.4.2 Onfido

- 6.4.3 GBG (Idology)

- 6.4.4 Intellicheck

- 6.4.5 Jumio

- 6.4.6 Trulioo

- 6.4.7 Mitek Systems

- 6.4.8 Veriff

- 6.4.9 IBM

- 6.4.10 AuthenticID

- 6.4.11 Experian

- 6.4.12 TransUnion

- 6.4.13 LexisNexis Risk Solutions

- 6.4.14 Pindrop

- 6.4.15 ComplyCube

- 6.4.16 Nuance Communications

- 6.4.17 Thales Group

- 6.4.18 IDEMIA

- 6.4.19 Okta

- 6.4.20 Ping Identity

- 6.4.21 Equifax

- 6.4.22 NEC Corporation

- 6.4.23 Acuant

- 6.4.24 Persona

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment