|

市场调查报告书

商品编码

1910825

欧洲电动卡车市场-份额分析、产业趋势与统计、成长预测(2026-2031)Europe Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

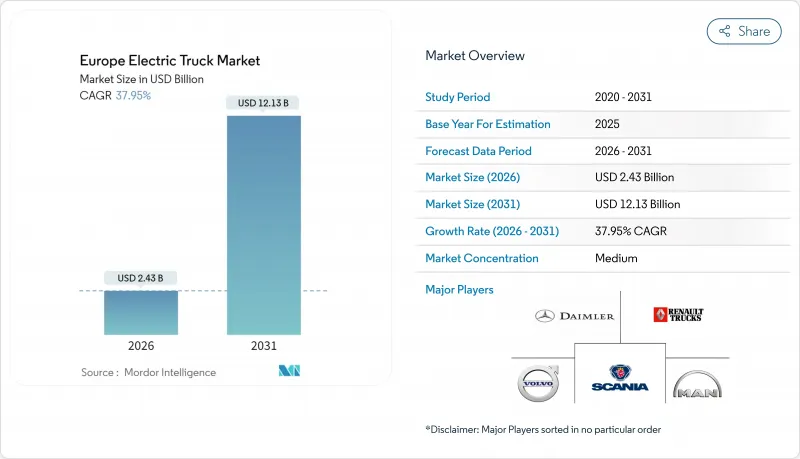

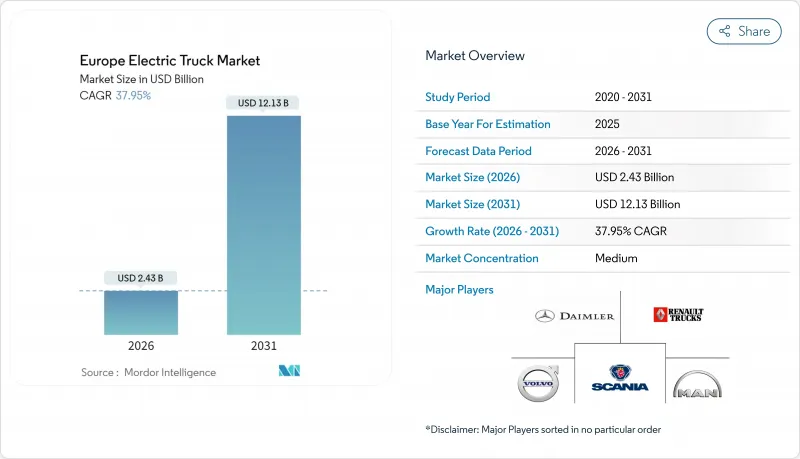

欧洲电动卡车市场预计将从 2025 年的 17.6 亿美元成长到 2026 年的 24.3 亿美元,预计到 2031 年将达到 121.3 亿美元,2026 年至 2031 年的复合年增长率为 37.95%。

欧盟具有约束力的二氧化碳减排目标、电池组价格的下降以及兆瓦级充电走廊的快速发展,共同推动了这一快速成长。这些因素正汇聚一堂,推动电动卡车从试点计划走向主流车队,尤其是在繁忙的物流路线上。监管期限迫使製造商扩大生产规模,而企业永续性措施则转化为稳定的订单,从而稳定需求并促进规模经济。同时,电池能量密度的提高、可再生能源的日益普及以及创新的资金筹措模式正在缩小电动卡车与柴油卡车的总拥有成本 (TCO) 差距,进一步加速了电动卡车在区域和长途货运领域的应用。因此,欧洲电动卡车市场正从早期采用者迈向覆盖整个欧洲大陆主要货运路线的广泛商业性部署阶段。

欧洲电动卡车市场趋势与洞察

欧盟二氧化碳排放标准及2040年零排放车辆销售义务

具有约束力的二氧化碳减排目标使零排放卡车成为一项法律要求,而非可永续性。 2030 年和 2035 年的中期目标提供了明确的销售指标,为製造商数十亿美元的电气化投资提供了基础。车队营运商若不遵守规定将面临严厉处罚,这推动了电池式电动车和燃料电池车型的大规模采购。德国的「零排放城市」政策等国家政策进一步收紧了合规标准,确保欧洲电动卡车市场在 2040 年截止日期前实现强劲成长。

电池组成本迅速下降

到2024年,电池组价格将下降20%,稳定在每度电115美元。年行驶里程超过8万公里的高里程物流车队将率先实现与柴油车成本持平,因为燃料节省将抵消资本成本溢价。磷酸铁锂电池技术的广泛应用降低了原料风险,并将充放电循环寿命延长至4000次以上,进一步降低了总拥有成本。欧洲超级工厂的建设将缩短供应链,增加本地采购,并增强规模经济效益,以应对快速的学习曲线。

与柴油车相比,车辆初始成本更优

与柴油卡车相比,电动卡车的价格仍然高出40%至60%,这对中欧和南欧对价格敏感的业者来说是一个障碍。这项溢价反映了电池成本、低产量和技术复杂性,但预计到2027-2028年,成本的快速下降将显着缓解此限制。低利率融资管道有限进一步加剧了小规模车队面临的这个问题。然而,卡车即服务(TaaS)模式和政府奖励正在加速推动透过将资本支出转变为更符合现金流模式的营运支出结构来抵消这一劣势。

细分市场分析

到2025年,纯电动卡车将占欧洲电动卡车市场规模的76.12%,而燃料电池卡车预计到2031年将以42.75%的复合年增长率(CAGR)实现最高增长。燃料电池卡车的初期优势在于充电站密度高、在小批量和区域货运中久经考验的可靠性,以及对于经常长途运输的车队而言营运成本低。在预测期内,氢气加註网路将在斯堪地那维亚和德国不断扩展,从而促进燃料电池在重型和温控货物运输领域的应用,这些领域对车辆的运转率和周转速度要求较高。随着零排放区法规逐步取消内燃机备用模式,插电式混合动力卡车的市占率将逐渐缩小。

由于车队使用场景的趋同,纯电动车将继续主导都市区和短途区域线路,因为在这些线路中,夜间在仓库充电是最方便的基础设施模式。燃料电池驱动在每日行驶里程超过 600 公里的线路上将特别强劲,因为大型电池组带来的负载容量损失可能会降低单次运输的收入。随着电池能量密度的提高和充电曲线的陡峭化,目前相当一部分燃料电池候选线路可能会转变为纯电动车方案,凸显了欧洲电动卡车市场竞争的动态性。

到2025年,12吨以上的重型刚性卡车将占欧洲电动卡车市场规模的47.05%。可预测的枢纽辐射式物流循环最大限度地提高了电池利用率,因此投资建造充电站设施是合理的。从2026年起,牵引车-半拖车细分市场将呈现最快成长,复合年增长率将达到39.05%,这得益于兆瓦级充电桩在欧洲货运网路中的部署,以及先进的温度控管技术在长途行驶循环下对电池组寿命的保障。 3.5吨以下的轻型卡车在排放气体法规适用的密集都市区持续维持稳定的市场需求。中型专用车辆,例如垃圾压缩车和配备起重机的底盘,正受到市政当局的日益关注,但年销量仍然较低。

重型牵引车领域的竞争日益激烈,Start-Ups纷纷新兴企业软硬体提案解决方案,试图降低总成本。现有厂商则以模组化平台应对,这些平台针对本地和跨境应用进行了最佳化,并力求保持其服务网路优势。因此,欧洲电动卡车市场牵引车细分市场的价格预计将迅速下降,并为整个产品组合树立新的标竿。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟二氧化碳排放标准与2040年零排放汽车销售义务

- 电池组成本迅速下降

- 商业车队脱碳计划

- 购屋奖励和道路通行费豁免

- 透过兆瓦级充电走廊开闢长途运输路线

- 卡车即服务 (TaaS) 融资模式

- 市场限制

- 与柴油车相比,车辆初始成本更高

- 重型电动车公共充电基础设施不足

- 仓库层面的电力容量限制

- 电动卡车维修技能和零件短缺

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元)及销售量(单位))

- 依推进类型

- 电池式电动车

- 燃料电池电动车

- 插电式混合动力

- 按卡车类型

- 小型卡车(3.5吨以下)

- 中型卡车(3.6至12吨)

- 大型卡车(超过12吨)

- 联结车

- 依电池类型

- 锂镍锰钴氧化物(NMC)

- 磷酸锂铁(LFP)

- 其他(NCA、LTO、固体原型)

- 按电池容量

- 少于50度

- 50至250千瓦时

- 250度或以上

- 按范围

- 最远可达 200 公里(都市区)

- 201-400公里(区域配送)

- 超过400公里(长途)

- 透过使用

- 物流/小型配送

- 市政服务(废弃物、道路清洁)

- 建筑和采矿

- 零售和消费品分销

- 公共产业及其他行业

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 西班牙

- 瑞典

- 挪威

- 丹麦

- 比利时

- 波兰

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AB Volvo

- Daimler Truck AG(Mercedes-Benz Trucks)

- Scania AB

- MAN Truck and Bus(SE)

- DAF Trucks NV

- Renault Trucks

- IVECO Group NV

- BYD Co. Ltd.

- Tesla Inc.

- Einride AB

- Tevva Motors Ltd.

- E-Force One AG

- Quantron AG

- Ford Motor Company

- Nikola Motor Europe

- Hyundai Motor Company

- E-Trucks Europe BV

- Lion Electric(EU operations)

第七章 市场机会与未来展望

The European electric truck market is expected to grow from USD 1.76 billion in 2025 to USD 2.43 billion in 2026 and is forecast to reach USD 12.13 billion by 2031 at 37.95% CAGR over 2026-2031.

This steep growth path is driven by the European Union's binding CO2-reduction targets, falling battery pack prices, and the rapid build-out of megawatt-class charging corridors. Together, these forces shift electric trucks from pilot projects to mainstream fleet assets, especially in high-utilization logistics routes. Regulatory deadlines compel manufacturers to ramp output, while corporate sustainability pledges translate into firm purchase orders that stabilize demand and spur scale economies. At the same time, improvements in battery energy density, rising renewable-power penetration, and innovative financing models narrow the remaining total-cost-of-ownership premium versus diesel, further accelerating adoption across regional and long-haul applications. As a result, the European electric truck market is moving from early-adopter clusters to a broad commercial footprint that touches every major freight corridor on the continent.

Europe Electric Truck Market Trends and Insights

EU CO2 Emission Standards and 2040 ZEV Sales Mandate

Binding CO2 reduction targets make zero-emission trucks a legal requirement rather than a voluntary sustainability choice. Interim 2030 and 2035 benchmarks provide a clear volume signal that enables manufacturers to justify multi-billion-dollar electrification investments. Fleet operators face steep non-compliance penalties, propelling procurement toward battery-electric and fuel-cell models at scale. National policies such as Germany's emission-free urban zones tighten the compliance net further, ensuring that the European electric truck market gains momentum well before the 2040 deadline.

Rapid Battery-Pack Cost Declines

In 2024, battery pack prices dropped by 20%, settling at USD 115 per kilowatt-hour (kWh). Cost parity with diesel emerges first in high-mileage logistics fleets that cover more than 80,000 km annually, where fuel savings offset capital premiums. Wider adoption of LFP chemistry cuts raw-material exposure, boosts cycle life beyond 4,000 charges, and further lowers total ownership cost. European gigafactory build-outs shorten supply chains and anchor regional content, reinforcing the scale economies that sustain the steep learning curve.

High Upfront Vehicle Cost Versus Diesel

Electric trucks still carry a 40-60% sticker premium compared with diesel, a barrier for price-sensitive operators in Central and Southern Europe. The premium reflects battery costs, low production volumes, and technology complexity, though rapid cost declines suggest this restraint will diminish significantly by 2027-2028. Limited access to cheap financing amplifies the issue for small fleets. However, truck-as-a-service models and government incentives increasingly neutralize this disadvantage by converting capital expenditure into operational expense structures that better align with cash flow patterns.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Fleet-Decarbonization Commitments

- Purchase Incentives and Road-Toll Exemptions

- Sparse Public HDV-Ready Charging Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery-electric trucks held 76.12% of the European electric truck market size in 2025, while fuel-cell models track the steepest 42.75% CAGR through 2031. The initial dominance arises from a dense charging-station footprint, proven reliability in parcel delivery and regional freight, and lower operating costs for fleets that rack up daily mileage. Over the forecast period, hydrogen refueling networks extend across Scandinavia and Germany, catalyzing fuel-cell uptake in heavy haul and temperature-sensitive commodities that demand high uptime and quick turnarounds. Plug-in hybrids occupy a narrowing transition niche as zero-emission zoning rules begin to exclude combustion back-up modes entirely.

Fleet use-case alignment will continue to favor battery-electric formats in city and short regional corridors because overnight depot charging remains the simplest infrastructure model. Fuel-cell traction intensifies in routes exceeding 600 km per day, especially where payload penalties from large battery packs would otherwise erode revenue per trip. As battery-energy density improves and charging curves steepen, a measurable share of current fuel-cell prospect routes may flip to pure battery solutions, underscoring the dynamic nature of competition inside the Europe electric truck market.

Heavy-duty rigid trucks over 12 tons currently deliver 47.05% of Europe's electric truck market size in 2025. Their predictable hub-and-spoke logistics cycles maximize battery utilization and justify depot-charging investment. From 2026 onward, the tractor-trailer segment shows the fastest ramp, with a 39.05% CAGR as megawatt chargers roll out on the pan-European freight network and advanced thermal management maintains pack longevity under long-haul duty cycles. Light trucks up to 3.5 tons continue experiencing steady adoption in dense urban zones governed by emission-free mandates. Medium-duty specials such as garbage compactors or crane-equipped chassis see growing municipal interest, but at lower annual volume.

The competitive theater is intensifying around heavy-duty tractors, where newcomers from China and emerging European startups pitch integrated hardware-plus-software stacks that promise lower total cost. Legacy OEMs respond with modular platforms optimized for both regional and cross-border applications, aiming to protect service-network advantages. As a result, the European electric truck market will witness fast price discovery in the tractor segment, setting reference points for the rest of the portfolio.

The Europe Electric Truck Market Report is Segmented by Propulsion (Battery-Electric and More), Truck Type (Light Truck, Medium-Duty Truck, and More), Battery (NMC, LFP, and Others), Capacity (Below 50kWh, 50-250kWh, and More), Range (Up To 200km, 201-400km, and More), Application (Logistics and Parcel, Municipal Services, and More), and Country (Germany, UK, and More). Market Forecasts in Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- AB Volvo

- Daimler Truck AG (Mercedes-Benz Trucks)

- Scania AB

- MAN Truck and Bus (SE)

- DAF Trucks N.V.

- Renault Trucks

- IVECO Group N.V.

- BYD Co. Ltd.

- Tesla Inc.

- Einride AB

- Tevva Motors Ltd.

- E-Force One AG

- Quantron AG

- Ford Motor Company

- Nikola Motor Europe

- Hyundai Motor Company

- E-Trucks Europe BV

- Lion Electric (EU operations)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU CO2 Emission Standards and 2040 ZEV Sales Mandate

- 4.2.2 Rapid Battery-Pack Cost Declines

- 4.2.3 Corporate Fleet-Decarbonisation Commitments

- 4.2.4 Purchase Incentives and Road-Toll Exemptions

- 4.2.5 Megawatt-Charging Corridors Unlocking Long-Haul Routes

- 4.2.6 Truck-As-A-Service Financing Models

- 4.3 Market Restraints

- 4.3.1 High Upfront Vehicle Cost Vs. Diesel

- 4.3.2 Sparse Public HDV-Ready Charging Infrastructure

- 4.3.3 Depot-Level Grid-Capacity Constraints

- 4.3.4 Shortage of E-Truck Maintenance Skills and Parts

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Propulsion Type

- 5.1.1 Battery-Electric

- 5.1.2 Fuel-Cell Electric

- 5.1.3 Plug-in Hybrid

- 5.2 By Truck Type

- 5.2.1 Light Truck (Up to 3.5 t)

- 5.2.2 Medium-Duty Truck (3.6 to 12 t)

- 5.2.3 Heavy-Duty Truck (Above 12 t)

- 5.2.4 Tractor-Trailer

- 5.3 By Battery Type

- 5.3.1 Lithium-Nickel-Manganese-Cobalt Oxide (NMC)

- 5.3.2 Lithium-Iron-Phosphate (LFP)

- 5.3.3 Others (NCA, LTO, solid-state prototypes)

- 5.4 By Battery Capacity

- 5.4.1 Less Than 50 kWh

- 5.4.2 50 to 250 kWh

- 5.4.3 Above 250 kWh

- 5.5 By Range

- 5.5.1 Up to 200 km (urban)

- 5.5.2 201 to 400 km (regional)

- 5.5.3 Above 400 km (long-haul)

- 5.6 By Application

- 5.6.1 Logistics and Parcel

- 5.6.2 Municipal Services (Waste, Street-sweep)

- 5.6.3 Construction and Mining

- 5.6.4 Retail and FMCG Delivery

- 5.6.5 Utility and Other Industrial

- 5.7 By Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 France

- 5.7.4 Italy

- 5.7.5 Netherlands

- 5.7.6 Spain

- 5.7.7 Sweden

- 5.7.8 Norway

- 5.7.9 Denmark

- 5.7.10 Belgium

- 5.7.11 Poland

- 5.7.12 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AB Volvo

- 6.4.2 Daimler Truck AG (Mercedes-Benz Trucks)

- 6.4.3 Scania AB

- 6.4.4 MAN Truck and Bus (SE)

- 6.4.5 DAF Trucks N.V.

- 6.4.6 Renault Trucks

- 6.4.7 IVECO Group N.V.

- 6.4.8 BYD Co. Ltd.

- 6.4.9 Tesla Inc.

- 6.4.10 Einride AB

- 6.4.11 Tevva Motors Ltd.

- 6.4.12 E-Force One AG

- 6.4.13 Quantron AG

- 6.4.14 Ford Motor Company

- 6.4.15 Nikola Motor Europe

- 6.4.16 Hyundai Motor Company

- 6.4.17 E-Trucks Europe BV

- 6.4.18 Lion Electric (EU operations)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment