|

市场调查报告书

商品编码

1910846

医药管瓶和安瓿市占率分析、产业趋势与统计、成长预测(2026-2031)Pharmaceutical Glass Vials And Ampoules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

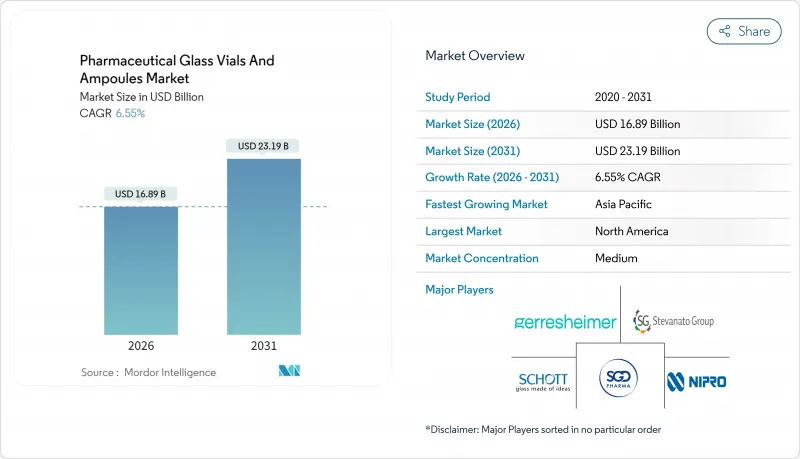

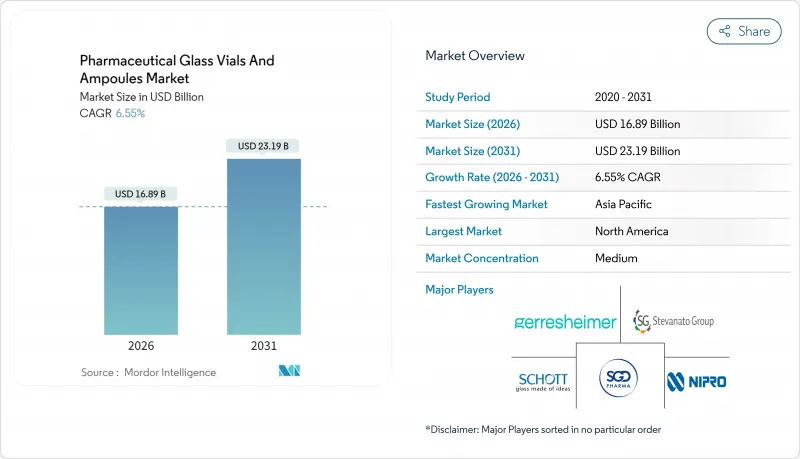

预计到 2026 年,医药管瓶和安瓿市场规模将达到 168.9 亿美元,高于 2025 年的 158.5 亿美元。预计到 2031 年,该市场规模将达到 231.9 亿美元,2026 年至 2031 年的复合年增长率为 6.55%。

生物製药产品线不断扩展、mRNA疗法对低温运输要求严格以及全球序列化强制规定等强劲基本面因素,持续推动玻璃材质优于聚合物材质。 I型硼硼硅酸玻璃凭藉其化学惰性和热稳定性保持优势,能够有效保护高价值注射剂免受萃取物污染和破损。即用型(RTU)灭菌平台等技术创新降低了污染风险,缩短了填充和表面处理工程的週期,从而增强了供应商的定价权。从区域来看,亚太地区在管瓶製造领域获得了特别显着的资本流入,而北美则凭藉其严格的FDA标准保持了主导地位。市场竞争较为温和,主要企业将投资重点放在表面涂层技术、氢气燃烧炉和自动化视觉检测等方面,以在成本敏感的环境中保障利润。

全球医药管瓶及安瓿市场趋势及展望

疫情后疫苗研发推动了管瓶需求

季节性疫苗宣传活动结束后,全球疫苗研发并未放缓,多病原体疫苗计画已扩展至呼吸道合胞病毒(RSV)、疟疾以及联合加强剂。为满足多剂量製剂的需求,小容量I型管瓶的产能正在提升,这得益于诸如肖特公司(SCHOTT)11.3亿美元的扩建计划等倡议。监管机构要求从I期临床试验开始对最终包装容器进行稳定性测试,将使每个项目的玻璃消费量增加约40%。儿童疫苗通常指定使用2毫升和5毫升的管瓶,这提高了对尺寸精度和严格颗粒阈值的要求。儘管在疫情储备恢復正常后采购曾出现间歇性暂停,但这些趋势共同推动了核心管瓶需求的长期成长。

生物製药迁移到化学惰性的硼硅酸玻璃上

大分子药物的研发管线需要耐碱性浸出和耐表面反应的容器。 FDA于2024年发布的指南强调了相容性测试通讯协定,这实际上引导研发人员选择I型硼硼硅酸玻璃。 Stevanato的EZ-fill平台可将萃取物含量降低至1ppm以下,这对于生物相似药的上市而言极具阈值,因为生物类似药的工艺可比性会受到严格审查。财务计算也很简单:一次产品召回可能造成5000万美元的成品损失,而高成本的玻璃可以有效对冲稳定性不足的风险。因此,即使聚合物容器正在蚕食低风险的通用填充市场,硼硅酸玻璃供应商仍维持高价。

聚合物管瓶正在蚕食通用玻璃容器的市场份额。

环烯烃聚合物容器,例如West公司的Crystal和Zenith系列产品,在诊断剂和早期生物製药领域表现出色,因为在这些领域,抗破损性和灵活的前置作业时间比长期相容性更为订单。考虑到搬运损耗和二次包装,聚合物容器的单位成本优势可达20-30%。儘管FDA的合规性障碍阻碍了聚合物在商业治疗领域的应用,但在大批量、低风险的应用中,替代风险仍然是一个令人担忧的问题。因此,标准吹製管瓶的供应商面临着价格下降带来的销售压力,促使他们进行策略转型,转向利润更高的包覆和即用型(RTU)包装。

细分市场分析

硼硅酸盐玻璃(I型)预计将占2025年销售额的64.71%,这得益于其强大的监管认可度和庞大的稳定性资料库。这种材料在製药管瓶和安瓿瓶市场占据主导地位,因为规避风险的製药公司优先考虑在新应用中使用已知性能的玻璃。然而,随着基因治疗有效载荷进一步降低可萃取物容差,混合型和涂层玻璃瓶将以7.4%的复合年增长率实现最快的增长。肖特公司的Everic系列产品展示了等离子体处理表面如何减少颗粒生成,而颗粒生成这一指标正日益受到美国药典<790>指南的严格审查。随着诉讼成本飙升,采购部门正在权衡钢化玻璃的高昂成本与生物製药失败造成的毁灭性损失,从而形成了一个价格弹性较低的细分市场,在这个市场中,质量比单位成本经济性更为重要。钠钙玻璃(II型和III型)主要仍用于传统的注射剂和诊断剂领域,但其市场份额正稳步下降,取而代之的是高等级的材料。铝硅酸盐混合玻璃的应用范围较为小众,仅限于极端热衝击环境的应用,例如高价值抗癌原料药的冷冻干燥。

展望未来五年,分析师预测硼硼硅酸玻璃将继续保持其主导地位,同时将部分市场份额让给专为高pH值病毒载体悬浮液设计的表面改性混合玻璃。供应商对氢辅助熔炉和电熔炉的投资正在缩小不同材料类别之间的碳排放强度差距,并满足环境、社会和治理(ESG)主导的采购要求。早期采用的合约研发生产机构(CDMO)正在将容器规格咨询纳入技术转移方案,从而在製程验证阶段有效地锁定混合玻璃,进而为优质等级产品建立多年可预测的需求。

到2025年,疫苗将占单位需求的45.88%,这主要得益于儿童免疫接种的持续成长和新兴的旅游健康市场。可预测的需求正推动管瓶规格向标准化瓶颈尺寸靠拢,从而促进可互换瓶塞和自动化填充线的应用。同时,生物製药和生物相似药将以8.09%的最高成长率成长,这主要得益于专利到期单株抗体的上市。为减少高价值治疗药物的浪费,小容量填充的趋势正在改变药用管瓶和安瓿的市场份额。即用型嵌套管式包装与多产品生产设施中的生物製药生产线相容,可实现更快的换型速度并提高整体设备效率(OEE)。

小分子注射剂在药物稳定性而非包装限制其保质期的领域仍然具有重要意义。然而,自动注射器和预填充式注射器的日益普及正逐渐改变市场对传统管瓶的需求。虽然胰岛素得益于完善的低温运输体係而保持着稳定的分销量,但持续给药装置的出现正在重新调整对包装容器的需求预测。诊断试剂虽然对成本较为敏感,但由于溶剂极性和缓衝液会腐蚀聚合物容器,因此仍需要玻璃容器。这确保了即使聚合物容器技术不断进步,诊断试剂仍能维持稳定的基准需求。

区域分析

预计到2025年,北美将占全球收入的38.92%,这主要得益于生物製药产能的扩张、生物製品上市核准申请(BLA)的推进,以及美国食品药品监督管理局(FDA)优先采用I型硼硅酸玻璃的严格容器密封通讯协定。加拿大的联邦生物製造倡议正在创造更多需求,并透过多年承购协议加强区域供应承诺。亚太地区的药用玻璃管瓶和安瓿市场虽然绝对规模较小,但正以9.02%的复合年增长率快速增长,这主要得益于中国GMP规范的加强以及印度为支持熔炉现代化而生产连结奖励计画。韩国和新加坡的合约包装商凭藉价格极具竞争力的即用型(RTU)产品,吸引了许多全球品牌的目光。这些产品符合ICH标准,并能缩短运往日本和澳洲的前置作业时间。

欧洲凭藉着成熟的製造商和完善的永续性框架,保持着强大的市场份额。然而,不断上涨的碳信用成本正在挤压利润空间,迫使采购部门评估混合采购模式,并利用泰国和印尼的工厂来确保供货量。拉丁美洲受惠于美国製药公司的近岸外包策略,尤其是在墨西哥,美墨加协定(USMCA)的贸易条款简化了管瓶供应的海关手续。中东和非洲虽然仍处于发展初期,但具有重要的战略意义。波湾合作理事会(GCC)成员国正在资助疫苗填充和包装中心,并强制要求在地采购生产,这预示着该地区对初级包装容器的新需求。整体而言,地域多元化降低了单一地区供应中断的风险,但也迫使供应商在不同的监管环境下协调品质系统。多地点认证已成为评估提案的关键标准,迫使小规模的区域生产者进行合作或合併。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 疫情后疫苗开发平臺推动了管瓶的需求

- 生物製药迁移到化学惰性的硼硅酸玻璃上

- 永续性和可回收性法规赋予玻璃优势。

- 颜色编码安瓿瓶必须进行RFID序列化

- mRNA低温运输需要超低温膨胀玻璃

- 市场限制

- 聚合物管瓶正在蚕食通用玻璃产品的市场份额

- 由于产品缺陷/故障导致召回次数增加,推高了风险缓解成本。

- 高pH基因治疗填充剂中的钠离子洗脱

- 高耗能炉具面临碳定价的压力

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 依材料类型

- I型硼硼硅酸玻璃

- II/III型钠钙玻璃

- 铝硅酸盐玻璃

- 混合/表面镀膜玻璃

- 透过使用

- 疫苗

- 胰岛素

- 生物製药和生物相似药

- 小分子注射药物

- 诊断剂

- 最终用户

- 製药公司

- 生技公司

- CDMO/CMO

- 研究和学术机构

- 医院和诊所

- 透过製造技术

- 管状玻璃模压

- 模压玻璃製造

- 即用型(RTU)灭菌

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SCHOTT AG

- Gerresheimer AG

- Stevanato Group SpA

- Nipro Corporation

- SGD SA(SGD Pharma)

- Corning Incorporated

- Bormioli Pharma SpA

- Stoelzle Oberglas GmbH

- Accu-Glass LLC

- APPL Solutions Pvt Ltd

- Shandong Pharmaceutical Glass Co., Ltd

- Chongqing Zhengchuan Pharmaceutical Packaging Co., Ltd

- Cangzhou Four Star Glass Co., Ltd

- Origin Pharma Packaging Ltd

- DWK Life Sciences GmbH

- West Pharmaceutical Services Inc.

- Sisecam Cambalkon Sanayi AS

- Stoelzle Glass Group

- Ardagh Group SA

- Beatson Clark Ltd

第七章 市场机会与未来展望

pharmaceutical glass vials and ampoules market size in 2026 is estimated at USD 16.89 billion, growing from 2025 value of USD 15.85 billion with 2031 projections showing USD 23.19 billion, growing at 6.55% CAGR over 2026-2031.

Robust fundamentals including expanding biologics pipelines, demanding cold-chain requirements for mRNA therapeutics, and global serialization mandates continue to favor glass over polymer alternatives. Type I borosilicate retains primacy because its chemical inertness and thermal stability safeguard high-value injectables from leachables and breakage. Technology upgrades such as ready-to-use (RTU) sterile platforms lower contamination risk and trim fill-finish cycle times, strengthening supplier pricing power. Regionally, Asia-Pacific registers outsized capital inflows into vial manufacturing, while North America's stringent FDA standards solidify its dominant share position. Competitive intensity remains moderate, with leaders funneling investment into surface-coating science, hydrogen-fired furnaces, and automated visual inspection to defend margins in an otherwise cost-sensitive environment.

Global Pharmaceutical Glass Vials And Ampoules Market Trends and Insights

Post-pandemic Vaccine Pipeline Boosts Vial Demand

Global vaccine development no longer tapers after seasonal campaigns; instead, multi-pathogen programs targeting RSV, malaria, and combination boosters are expanding. Capacity additions such as SCHOTT's USD 1.13 billion upgrade elevate small-volume Type I production to meet multi-dose presentation needs. Regulators insist on final-container stability testing from Phase I onward, lifting glass consumption per program by roughly 40%. Pediatric formulations often specify 2 mL and 5 mL vials, accentuating demand for dimensional accuracy and stringent particulate thresholds. These dynamics collectively reinforce a secular uplift in core vial volumes despite intermittent procurement pauses once pandemic stockpiles normalize.

Biologics Shift Toward Chemically Inert Borosilicate

Large-molecule pipelines demand containers that resist alkali leaching and surface reactivity. FDA guidance released in 2024 underscores compatibility testing protocols that implicitly steer developers toward Type I borosilicate. Stevanato's EZ-fill platform reduces extractables below 1 ppm, a threshold attractive to biosimilar launches where process comparability is scrutinized. The financial calculus is direct: a single product recall can erase USD 50 million in finished-goods value, making higher unit-price glass a rational hedge against stability failures. Consequently, borosilicate suppliers preserve premium pricing even while polymer containers nibble away at low-risk, commodity fills.

Polymer Vials Cannibalising Commodity Glass Share

Cyclic olefin polymer containers such as West's Crystal Zenith line secure orders for diagnostic reagents and early-phase biologics, where break-resistance and flexible lead times outrank lifetime compatibility. Unit economics favor polymers by 20-30% once handling losses and secondary packaging are tallied. Although FDA compatibility hurdles deter polymer uptake for commercial therapeutics, high-volume, lower-risk segments remain vulnerable to substitution. Suppliers of standard blown V-ials therefore experience volume compression at the low end, prompting a strategic pivot toward higher-margin, coated or RTU formats.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and Recyclability Regulations Favour Glass

- RFID-Serialisation Mandates for Colour-Coded Ampoules

- Fragility/Breakage Recalls Increase Risk-Mitigation Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type I borosilicate retained 64.71% of 2025 revenues, underscoring its entrenched regulatory acceptance and vast stability data bank. The pharmaceutical glass vials and ampoules market size attributed to this material outpaces all other substrates because risk-averse drug makers prioritize known performance envelopes when filing new applications. Hybrid and coated variants, however, deliver the fastest 7.4% CAGR as gene-therapy payloads push extractable allowances ever lower. SCHOTT's Everic series demonstrates how plasma-enhanced surfaces reduce particle generation, a metric increasingly scrutinized under USP <790> guidelines. As litigation costs soar, procurement teams weigh the premium of enhanced glass against the catastrophic downside of biologic batch failures, creating a price-in-elastic niche where quality trumps unit economics. Soda-lime glass-types II and III-survive mostly in legacy, small-molecule injectables and diagnostic reagents, but their share steadily erodes in favor of higher-grade materials. Aluminum-silicate formulations remain niche, reserved for extreme thermal-shock scenarios such as freeze-drying of high-value oncology APIs.

Across a five-year horizon, analysts expect borosilicate to retain a majority stake yet cede incremental share to surface-engineered hybrids designed for high-pH viral vector suspensions. Supplier investments in hydrogen-assisted furnaces and electric melting reduce the carbon intensity gap between material classes, accommodating ESG-driven sourcing mandates. Early-adopter CDMOs are bundling container specification counseling into tech-transfer packages, effectively locking in hybrid glass at the process-validation stage and cementing multiyear demand visibility for premium grades.

Vaccines accounted for 45.88% of 2025 unit demand, undergirded by ongoing pediatric immunization and emerging travel-health indications. Given volume predictability, vial formats have converged on standardized neck dimensions facilitating interchangeable stoppers and automated filling lines. Meanwhile, biologics and biosimilars claim the highest 8.09% growth trajectory, fueled by monoclonal antibody launches post-patent cliff. Here, the pharmaceutical glass vials and ampoules market share shifts toward smaller fill volumes that mitigate wastage for high-price therapies. RTU nest-and-tub formats resonate with biologics lines operating in multiproduct facilities, offering rapid changeovers that boost overall equipment effectiveness.

Small-molecule injectables preserve relevance where drug stability, not packaging, constrains shelf life; however, rising adoption of auto-injectors and prefilled syringes gradually siphons volume from traditional vials. Insulin maintains steady throughput thanks to entrenched cold-chain infrastructure, but continuous-delivery devices are beginning to recalibrate container demand forecasts. Diagnostic reagents, although cost-sensitive, continue to specify glass where solvent polarity or buffered media attack polymer walls, ensuring a residual baseline volume even amid polymer advances.

The Pharmaceutical Glass Vials and Ampoules Market Report is Segmented by Material Type (Type I Borosilicate Glass, Type II/III Soda-Lime Glass and More), Application (Vaccines, Insulin and More), End User (Pharmaceutical Manufacturers, Biotechnology Companies and More), Manufacturing Technology (Tubular Glass Forming, Moulded Glass Forming and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.92% of 2025 revenues, buoyed by expansive biologics capacity, Biologics License Application pipelines, and the FDA's strict container-closure protocols that privilege Type I borosilicate. Canada's federal bio-manufacturing initiative adds incremental demand, reinforcing regional supply commitments with multi-year offtake agreements. The pharmaceutical glass vials and ampoules market size in Asia-Pacific, while smaller in absolute terms, grows at a 9.02% CAGR on the back of Chinese GMP enhancements and Indian production-linked incentives that subsidize furnace modernization. Contract packagers in South Korea and Singapore lure global brands with competitively priced RTU offerings that meet ICH standards, trimming lead times into Japan and Australia.

Europe commands robust share underpinned by legacy manufacturers and a strong sustainability framework; yet rising carbon-credit costs pressure margins, nudging procurement to evaluate mixed sourcing models tapping Thai and Indonesian plants for commodity volumes. Latin America benefits from near-shoring strategies by U.S. pharma, particularly in Mexico where USMCA trade provisions smooth customs hurdles for vial supply. The Middle East and Africa remain nascent but strategic, with Gulf Cooperation Council nations funding vaccine fill-finish hubs that stipulate local content thresholds, foreshadowing fresh regional demand for primary containers. Collectively, geographic diversification mitigates single-region disruption risk, but it forces suppliers to harmonize quality systems across heterogeneous regulatory landscapes. Multisite qualification emerges as a decisive criterion in request-for-proposal scoring, pushing small regional producers to partner or consolidate.

- SCHOTT AG

- Gerresheimer AG

- Stevanato Group S.p.A.

- Nipro Corporation

- SGD S.A. (SGD Pharma)

- Corning Incorporated

- Bormioli Pharma S.p.A.

- Stoelzle Oberglas GmbH

- Accu-Glass LLC

- APPL Solutions Pvt Ltd

- Shandong Pharmaceutical Glass Co., Ltd

- Chongqing Zhengchuan Pharmaceutical Packaging Co., Ltd

- Cangzhou Four Star Glass Co., Ltd

- Origin Pharma Packaging Ltd

- DWK Life Sciences GmbH

- West Pharmaceutical Services Inc.

- Sisecam Cambalkon Sanayi A.S.

- Stoelzle Glass Group

- Ardagh Group S.A.

- Beatson Clark Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic vaccine pipeline boosts vial demand

- 4.2.2 Biologics shift toward chemically inert borosilicate

- 4.2.3 Sustainability and recyclability regulations favour glass

- 4.2.4 RFID-serialisation mandates for colour-coded ampoules

- 4.2.5 mRNA cold-chain needs ultra-low expansion glass

- 4.3 Market Restraints

- 4.3.1 Polymer vials cannibalising commodity glass share

- 4.3.2 Fragility/breakage recalls increase risk-mitigation cost

- 4.3.3 Sodium-ion leaching in high-pH gene-therapy fills

- 4.3.4 Energy-intensive furnaces face carbon-pricing pressure

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Type I Borosilicate Glass

- 5.1.2 Type II/III Soda-Lime Glass

- 5.1.3 Aluminum-Silicate Glass

- 5.1.4 Hybrid / Surface-Coated Glass

- 5.2 By Application

- 5.2.1 Vaccines

- 5.2.2 Insulin

- 5.2.3 Biologics and Biosimilars

- 5.2.4 Small-Molecule Injectables

- 5.2.5 Diagnostic Reagents

- 5.3 By End User

- 5.3.1 Pharmaceutical Manufacturers

- 5.3.2 Biotechnology Companies

- 5.3.3 CDMOs / CMOs

- 5.3.4 Research and Academic Laboratories

- 5.3.5 Hospitals and Clinics

- 5.4 By Manufacturing Technology

- 5.4.1 Tubular Glass Forming

- 5.4.2 Moulded Glass Forming

- 5.4.3 Ready-to-Use (RTU) Sterile

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 SCHOTT AG

- 6.4.2 Gerresheimer AG

- 6.4.3 Stevanato Group S.p.A.

- 6.4.4 Nipro Corporation

- 6.4.5 SGD S.A. (SGD Pharma)

- 6.4.6 Corning Incorporated

- 6.4.7 Bormioli Pharma S.p.A.

- 6.4.8 Stoelzle Oberglas GmbH

- 6.4.9 Accu-Glass LLC

- 6.4.10 APPL Solutions Pvt Ltd

- 6.4.11 Shandong Pharmaceutical Glass Co., Ltd

- 6.4.12 Chongqing Zhengchuan Pharmaceutical Packaging Co., Ltd

- 6.4.13 Cangzhou Four Star Glass Co., Ltd

- 6.4.14 Origin Pharma Packaging Ltd

- 6.4.15 DWK Life Sciences GmbH

- 6.4.16 West Pharmaceutical Services Inc.

- 6.4.17 Sisecam Cambalkon Sanayi A.S.

- 6.4.18 Stoelzle Glass Group

- 6.4.19 Ardagh Group S.A.

- 6.4.20 Beatson Clark Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment