|

市场调查报告书

商品编码

1910847

电子商务塑胶包装:市场占有率分析、产业趋势与统计、成长预测(2026-2031)E-commerce Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

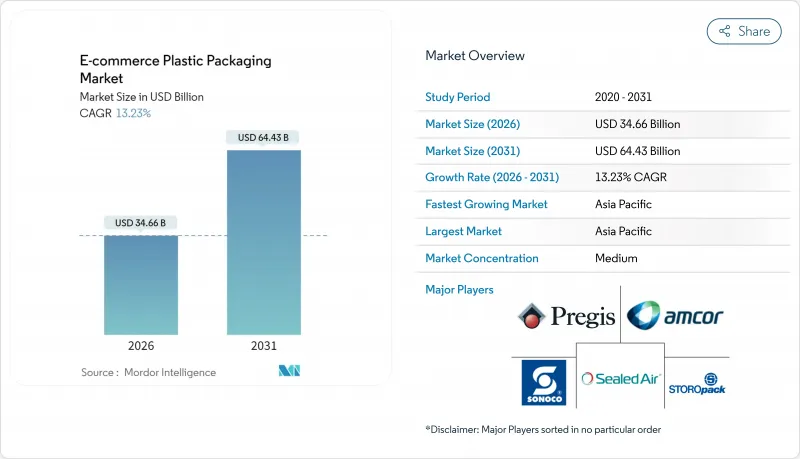

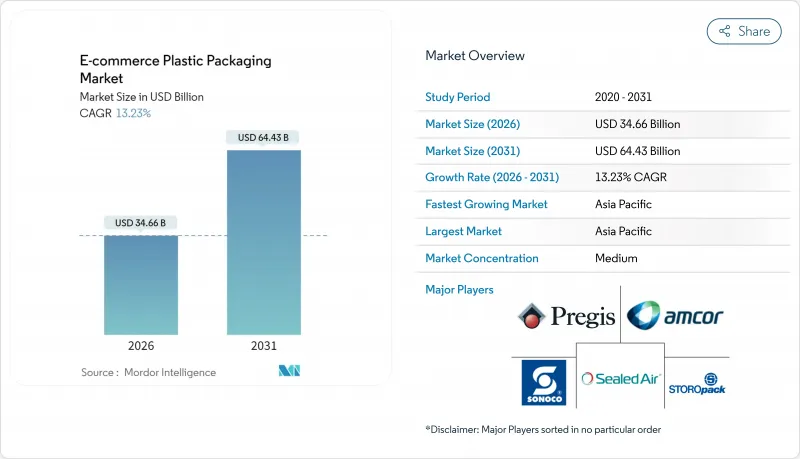

预计到2026年,电子商务塑胶包装市场规模将达到346.6亿美元,高于2025年的306亿美元。预计到2031年,该市场规模将达到644.3亿美元,2026年至2031年的复合年增长率为13.23%。

线上零售的快速成长、消费者对优质开箱体验日益增长的期望以及日益严格的永续性法规正在塑造中短期市场前景。轻巧灵活的薄膜、单一材质阻隔结构和时尚的基材有助于品牌降低运输成本、遵守回收法规并提升视觉吸引力。製造商正抓住智慧标籤、自动化填充线和温控解决方案带来的机会,以保护透过密集都市区配送网路运输的食品杂货和化妆品。随着一体化加工商收购利基市场专家、申请新型树脂专利并扩大化学回收以确保供应安全,竞争日益激烈。

全球电子商务塑胶包装市场趋势与洞察

线上零售渗透率不断提高

电子商务的持续成长推动了对能够承受自动化分类、多式联运和直接面向消费者开启的包装的需求。日本的订阅式美妆服务就是一个典型的例子,高端设计和防篡改密封正在取代商店体验。不断增长的小包裹量促使仓库采用标准化的包装尺寸,以最大限度地提高机器人处理能力和储存密度。

轻质柔性包装的成长

茂金属聚乙烯薄膜可在-40°C至120°C的温度范围内维持密封性能,同时厚度减少30%,进而降低运输排放和原料成本。奈米添加剂可增强阻隔强度,使电子产品包装袋更加轻薄。加工商正在用充气缓衝材料取代硬质衬垫,显着降低体积重量,并符合单一材料回收法规。

对一次性塑胶製品的禁令和课税

加州SB54法案强制规定到2032年产品中必须使用65%的再生材料,而欧盟新规也要求采用循环设计。虽然合规负担迫使企业进行高成本的生产线升级和产品系列精简,但也推动了单一材料复合材料的创新,从而简化了消费后塑胶的回收利用。各大品牌纷纷延后产品推出,等待相关指南更加稳定,但先行者凭藉其环保意识,已占了市场优势。

细分市场分析

到2025年,聚乙烯将占据电商塑胶包装市场42.12%的份额,这主要得益于其优异的密封性能以及在自动化成型-填充-封口生产线上的高产能。茂金属聚乙烯等级能够达到壁厚大幅减薄,从而在不牺牲抗穿刺性的前提下减轻运输重量。受大众市场邮袋和拉伸套的推动,聚乙烯基电商塑胶包装的市场规模预计将稳定成长。聚对苯二甲酸乙二醇酯(PET)预计将以14.42%的复合年增长率增长,其优异的氧气和水分阻隔性弥补了树脂成本较高的不足,因此在温控食品包装领域备受青睐。化学回收可以生产出100%由消费后材料製成的PET,同时维持其食品接触认证。聚丙烯(PP)正在确保可重复使用托特包和铰链盖盒的需求,而生质塑胶正在高端化妆品领域站稳脚跟,其可堆肥性为品牌提供了强大的价值。

第二波聚乙烯创新浪潮聚焦于单一材料结构,此结构无需金属化层即可达到类似的香气保留效果,简化了回收流程。在PET薄膜中,奈米黏土分散体可将氧气透过率降低15-20%,并可製成更薄的复合材料,减少小包裹运送过程中的体积。这些材料技术的进步正在巩固电子商务塑胶包装市场作为高性能、永续聚合物试验场的地位。

预计到2025年,包装袋和包装袋将占总收入的37.95%,这主要得益于它们在服装、家居用品和个人保健产品运输方面的多功能性。然而,受易碎消费电子产品出货量成长的推动,包括充气垫和模塑纸浆衬垫在内的保护性包装预计将以14.55%的复合年增长率(CAGR)在2031年之前实现最快增长。 VTT公司以摺纸技术为基础的纸板垫片可形成与塑胶气泡膜类似的减震空腔,同时还能减少废弃物。收缩膜和拉伸膜对于区域配送中心的托盘保护至关重要,但其成长速度落后于其他领先产品。随着食品杂货电商零售商对低温运输相容性认证的需求不断增长,特种保温邮袋正在开闢新的成长空间。

如今,防护解决方案中融入了生物基热塑性树脂转注不织布,这种材料能够保护产品免受跌落和震动的影响,同时可在工业堆肥中降解。这些进步符合欧洲的塑胶税收制度和企业净零排放承诺,确保永续的缓衝性能成为标准配置,而非额外付费项目。

区域分析

到2031年,亚太地区将以14.75%的复合年增长率引领成长,这主要得益于中国成熟的线上零售生态系统将先进的包装标准推广全部区域。本地加工商大规模生产适用于高速分类传送带的轻质邮袋,降低成本并缩短週期。日本的订阅模式推动了对优质阻隔复合材料的需求,这种材料能够保护化妆品免受潮湿夏季和严寒冬季的侵袭。韩国的行动商务市场青睐便于放入宅配柜的紧凑型品牌包装。同时,快速成长的印度市场则以超经济的单层壁包装袋为主导,这种包装袋既能承受粗暴搬运,又能保持成本效益。

在北美,先进的仓储机器人技术和高端拆箱体验文化(尤其是在美妆和电子产品行业)为大规模分销提供了支援。加州强制要求使用再生材料,推动了化学回收PET邮寄袋的早期应用。在加拿大,Mondi以500万美元收购了Hinton造纸厂,新增了牛皮纸产能,为结合纤维和聚合物的混合电商解决方案开闢了可能性。墨西哥一家近岸造纸厂为寻求更短前置作业时间的美国零售商供应Polymail包装袋。

更严格的一次性用品法规正在欧洲引领潮流,促使加工商转向单一材料和纸基替代品。德国的回收商实现了很高的PET回收率,从而建造了从瓶到袋的循环供应链。英国在脱欧后正在製定自己的框架,但与欧盟的再生材料含量目标保持一致,并继续推动原生树脂的使用。 Mondi推出的纸质邮袋表明,纤维基材既能满足运输所需的耐用性标准,又能实现塑胶减量目标。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 线上零售渗透率不断提高

- 轻质柔性包装的成长

- 扩大全通路履约地点

- 品牌对可印刷、可设计塑胶的需求

- 温控食品配送激增

- 可重复使用包装循环的快速扩展

- 市场限制

- 对一次性塑胶製品实施监管禁令和课税

- 原生聚合物价格波动

- 电子商务逆向物流的损坏率

- 品牌拥有者对纺织材料的ESG承诺

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素如何影响市场

- 波特五力分析

- 供应商的议价能力

- 买方和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 聚乙烯(PE)

- 聚丙烯

- 聚对苯二甲酸乙二醇酯(PET)

- 生质塑胶

- 其他材料类型

- 依产品类型

- 小袋和袋子

- 信封和邮寄袋

- 收缩拉伸膜

- 保护性包装

- 其他产品类型

- 按最终用户行业划分

- 家用电子电器与媒体

- 食品/饮料

- 个人护理和化妆品

- 时尚与服装

- 居家护理和家具

- 其他终端用户产业

- 透过包装功能

- 初级包装

- 二级包装

- 填充材和缓衝材料

- 托盘装载/拉伸缠绕

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- Sealed Air Corporation

- Pregis LLC

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Huhtamaki Oyj

- CCL Industries Inc.

- ProAmpac LLC

- Clondalkin Group Holdings BV

- Smurfit WestRock

- Mondi plc

- International Paper Company

- Intertape Polymer Group Inc.

- Constantia Flexibles GmbH

- Klockner Pentaplast GmbH & Co. KG

- TransPak Corporation

- ProMach Inc.

- FlexiPack Group Ltd.

第七章 市场机会与未来展望

E-commerce plastic packaging market size in 2026 is estimated at USD 34.66 billion, growing from 2025 value of USD 30.60 billion with 2031 projections showing USD 64.43 billion, growing at 13.23% CAGR over 2026-2031.

Rapid online retail growth, rising consumer expectations for premium unboxing and mounting sustainability mandates shape the near-to-mid-term outlook. Lightweight flexible films, mono-material barrier constructions and design-rich substrates help brands cut freight costs, comply with recycling rules and enhance visual appeal. Manufacturers seize opportunities in smart labels, automated filling lines and temperature-controlled solutions that protect groceries and cosmetics shipped through dense urban fulfillment networks. Competitive intensity grows as integrated converters acquire niche specialists, patent novel resins and scale chemical recycling that safeguards supply security.

Global E-commerce Plastic Packaging Market Trends and Insights

Rising penetration of online retail

Uninterrupted growth in e-commerce drives demand for packaging that endures automated sortation, multi-modal transport and direct-to-consumer unboxing. Subscription beauty services in Japan highlight how premium designs and tamper-evident seals substitute for in-store experience. Higher parcel volumes push warehouses to adopt standard pack dimensions that maximize robotic throughput and storage density.

Growth in lightweight flexible formats

Metallocene polyethylene films cut thickness by 30% yet keep seals intact between -40 °C and 120 °C, reducing freight emissions and raw-material spend. Nano-additives bolster barrier strength, enabling thinner walls for electronics pouches. Converters replace rigid inserts with inflatable cushioning to slash dimensional weight and comply with mono-material recycling rules.

Regulatory bans and taxes on single-use plastics

California SB 54 demands 65% recycled content by 2032 while forthcoming EU rules insist on circular design. The compliance burden triggers costly line upgrades and portfolio rationalization, yet it spurs innovation in mono-material laminates that streamline post-consumer recovery. Brands delay launches until guidelines stabilize, though early adopters secure green-branding advantages.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of omnichannel fulfillment nodes

- Brand demand for printable design-rich plastics

- Volatility in virgin polymer prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene contributed 42.12% to the e-commerce plastic packaging market share in 2025, supported by favorable sealability and high throughput on automated form-fill-seal lines. Metallocene grades permit aggressive downgauging that curbs shipping mass without compromising puncture resistance. The e-commerce plastic packaging market size derived from polyethylene is projected to climb steadily on the back of mass accessible mailers and stretch sleeves. Polyethylene terephthalate, expanding at 14.42% CAGR, finds favor in temperature-sensitive grocery packs where superior oxygen and moisture barriers outweigh higher resin cost. Chemical recycling yields PET with 100% post-consumer content that retains food-contact clearance. Polypropylene secures demand in reusable totes and hingelid boxes, while bioplastics gain a foothold in premium cosmetics where compostability carries strong brand equity.

A second wave of polyethylene innovation centers on mono-material structures that eliminate metallized layers yet deliver equal aroma retention, smoothing passage through recycling streams. In PET films, nano-clay dispersions cut oxygen ingress by 15-20% and permit thinner laminates that reduce cube size during parcel transit. Such material advances reinforce the e-commerce plastic packaging market as a proving ground for high-performance sustainable polymers.

Pouches and bags controlled 37.95% of 2025 revenue thanks to versatility across apparel, home and personal care shipments. Yet protective packaging, including inflatable cushions and molded pulp liners, will record the fastest 14.55% CAGR through 2031 as fragile consumer electronics volumes swell. Origami-engineered paperboard pads from VTT create shock-absorbing hollows that rival plastic bubble wrap while trimming waste. Shrink and stretch films stay essential for pallet integrity within regional fulfillment centers, though gains trail segment leaders. Specialty thermal mailers carve niche growth as grocery e-tailers demand certified cold-chain compliance.

Protective solutions now integrate bio-based thermoplastic-impregnated nonwovens that break down in industrial composters yet shield products from drops and vibration. Such advances align with European plastic-tax regimes and corporate net-zero pledges, ensuring sustainable cushioning becomes a standard rather than a premium upsell.

The E-Commerce Plastic Packaging Market Report is Segmented by Material Type (Polyethylene, Polypropylene, and More), Product Type (Pouches and Bags, Mailers and Envelopes, and More), End-User Industry (Consumer Electronics and Media, Food and Beverage, and More), Packaging Function (Primary, Secondary, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads growth with a 14.75% CAGR to 2031 as China's mature online retail ecosystem spreads sophisticated packaging standards across the region. Domestic converters mass-produce lightweight mailers tailored to high-speed sortation belts, keeping costs low and cycle times short. Japan's subscription culture drives demand for premium barrier laminates that preserve cosmetics in humid summers and sub-zero winters. South Korea's handheld commerce favors compact, brand-heavy packs that fit parcel lockers, while India's burgeoning volume tilts toward ultra-economical mono-layer bags that tolerate rough handling yet remain cost effective.

North America sustains large volumes through advanced warehouse robotics and a culture of premium unboxing, particularly in beauty and electronics. California's recycled-content mandate boosts early adoption of chemically recycled PET mailers. Canada benefits from new kraft paper capacity after Mondi's USD 5 million Hinton mill purchase, opening opportunities to blend fiber and polymer in hybrid e-commerce solutions. Mexico's near-shore plants supply poly mailers to U.S. retailers seeking shorter lead times.

Europe sets regulatory tone with stringent single-use rules, pushing converters toward mono-material and paper-based alternatives. German recyclers achieve high PET recovery rates that feed bottle-to-pouch loops. The United Kingdom shapes an independent framework after Brexit, yet still mirrors EU recyclate targets, keeping pressure on virgin resin use. Mondi's paper mailer launch shows how fiber substrates can meet durability thresholds for parcel journeys while satisfying plastic-reduction targets.

- Amcor plc

- Sealed Air Corporation

- Pregis LLC

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Huhtamaki Oyj

- CCL Industries Inc.

- ProAmpac LLC

- Clondalkin Group Holdings BV

- Smurfit WestRock

- Mondi plc

- International Paper Company

- Intertape Polymer Group Inc.

- Constantia Flexibles GmbH

- Klockner Pentaplast GmbH & Co. KG

- TransPak Corporation

- ProMach Inc.

- FlexiPack Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising penetration of online retail

- 4.2.2 Growth in lightweight flexible formats

- 4.2.3 Proliferation of omnichannel fulfilment nodes

- 4.2.4 Brand demand for printable, design-rich plastics

- 4.2.5 Surge in temperature-controlled grocery delivery

- 4.2.6 Rapid scaling of reusable packaging loops

- 4.3 Market Restraints

- 4.3.1 Regulatory bans and taxes on single-use plastics

- 4.3.2 Volatility in virgin polymer prices

- 4.3.3 E-commerce reverse-logistics damage rates

- 4.3.4 Brand-owner ESG pledges favouring fibre formats

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Polyethylene (PE)

- 5.1.2 Polypropylene

- 5.1.3 Polyethylene Terephthalate (PET)

- 5.1.4 Bioplastics

- 5.1.5 Other Material Types

- 5.2 By Product Type

- 5.2.1 Pouches and Bags

- 5.2.2 Mailers and Envelopes

- 5.2.3 Shrink and Stretch Films

- 5.2.4 Protective Packaging

- 5.2.5 Other Product Types

- 5.3 By End-user Industry

- 5.3.1 Consumer Electronics and Media

- 5.3.2 Food and Beverage

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Fashion and Apparel

- 5.3.5 Home Care and Furnishing

- 5.3.6 Other End-user Industries

- 5.4 By Packaging Function

- 5.4.1 Primary Packaging

- 5.4.2 Secondary Packaging

- 5.4.3 Void-Fill and Cushioning

- 5.4.4 Palletization/Stretch Wrap

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corporation

- 6.4.3 Pregis LLC

- 6.4.4 Sonoco Products Company

- 6.4.5 Storopack Hans Reichenecker GmbH

- 6.4.6 Huhtamaki Oyj

- 6.4.7 CCL Industries Inc.

- 6.4.8 ProAmpac LLC

- 6.4.9 Clondalkin Group Holdings BV

- 6.4.10 Smurfit WestRock

- 6.4.11 Mondi plc

- 6.4.12 International Paper Company

- 6.4.13 Intertape Polymer Group Inc.

- 6.4.14 Constantia Flexibles GmbH

- 6.4.15 Klockner Pentaplast GmbH & Co. KG

- 6.4.16 TransPak Corporation

- 6.4.17 ProMach Inc.

- 6.4.18 FlexiPack Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment