|

市场调查报告书

商品编码

1910888

欧洲印刷基板市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Printed Circuit Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

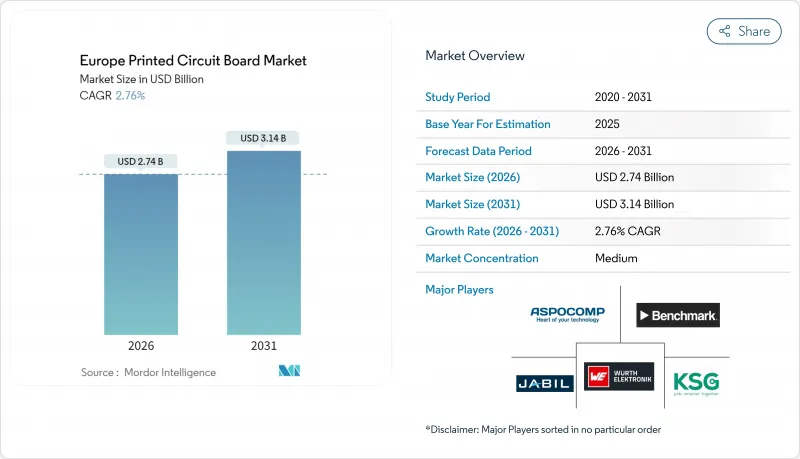

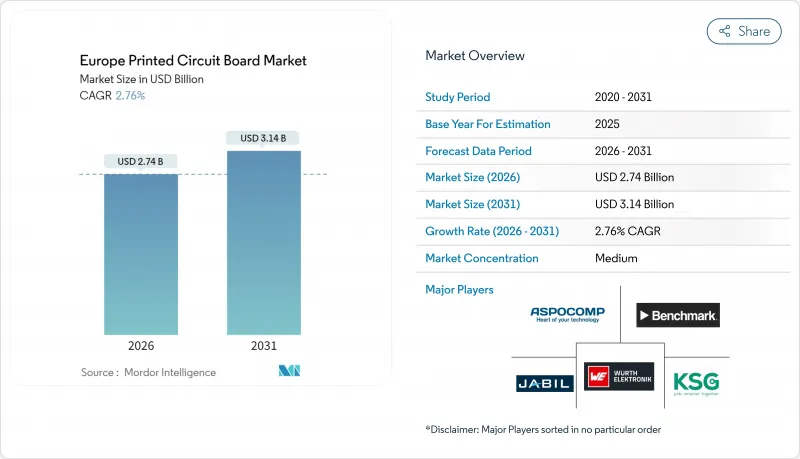

欧洲印刷基板(PCB) 市场规模预计到 2026 年将达到 27.4 亿美元,高于 2025 年的 26.7 亿美元,预计到 2031 年将达到 31.4 亿美元,2026 年至 2031 年的复合年增长率为 2.76%。

这一成长轨迹反映了欧洲PCB市场策略的转变,即从商品化的大规模生产转向受监管的高价值细分市场,例如汽车、医疗和工业自动化领域,这些领域支撑着高溢价。欧盟430亿欧元(486亿美元)的「晶片法案」为欧洲PCB市场提供了经济奖励策略,该法案旨在促进对半导体製造厂、先进封装厂和相关互连供应商的投资。儘管欧洲PCB的产量仅占全球整体的不到2%,但供应链安全、合规性以及与高要求原始设备製造商(OEM)的地理位置接近性仍然是推动区域订单的主要因素。儘管来自亚洲低成本产品的竞争压力仍然存在,但欧洲企业正透过其在HDI领域的领先地位、严格的品质管理计画和专业的设计服务来缓解利润压力。正如SOMACIS收购医用级产品以及Cicor创纪录的订单订单所表明的那样,随着整合的持续进行,欧洲PCB市场的格局正在日益清晰,剩余企业正转向规模化或专业化发展。

欧洲印刷基板市场趋势与分析

对小型化和高密度互连 (HDI)基板的需求日益增长

对小型化和轻量化的不懈追求迫使原始设备製造商 (OEM) 指定使用 HDI 和 Ultra HDI基板,这使得欧洲 PCB 市场在微孔製造领域占据了主导地位。目前,区域供应商已具备生产 50微米导体宽度和 75微米以下微孔的资格,从而能够采用讯号完整性更高的多层堆迭结构来取代传统的通孔设计。对雷射钻孔平台、改进的半添加剂处理和 X 射线检测的投资为这些能力提供了支持,同时,NCAB 集团和奥地利的专业製造商正在加速推进其工厂运作计划,目标是在 2025 年前完成。这将使欧洲 PCB 市场透过技术差异化来增强韧性,从而抑制价格竞争。此外,汽车和医疗产业的严格标准奖励那些能够记录製程控制和可追溯性的生产商,从而提升 HDI 生产的价值创造。随着 HDI 技术的应用范围从德国的汽车产业丛集扩展到荷兰的工业IoT中心,HDI 需求将继续成为推动区域收入成长的中期动力。

电动车的快速普及需要先进的汽车印刷电路板

随着欧洲更严格的二氧化碳排放法规将于2025年生效,仅1月份电池式电动车的註册量就超过25万辆,年增21%,这推动了每辆车所需复杂多层基板的数量激增。电池管理系统、驱动逆变器和ADAS模组目前均依赖八层或更高层的HDI设计,以满足IPC-6012汽车标准配件中认证的严格振动和热循环要求。因此,欧洲PCB市场持续收到来自一级供应商的订单,这些供应商要求在德国、法国和义大利的电动车工厂附近进行在地化生产,以实现即时组装。电动车细分市场是汽车产业中复合年增长率最高的,预计到2030年仍将是持续的销售成长推动要素。供应商正利用较长的认证週期和严格的缺陷处罚来保护利润免受进口产品的衝击,同时也与OEM厂商合作,在有限的电池组尺寸内共同优化基板布局和功率密度。

铜材和层压板价格的波动给利润率带来了压力。

2024年5月,铜价突破每吨11,000美元,但同年稍后跌破9,000美元。研究预测,在电气化需求的推动下,铜价将在2025年底回升至每吨1万美元以上。铜占原料成本的40%,而原料成本约占总成本的40%。价格波动直接影响欧洲晶圆厂的息税折旧摊提前利润(EBITDA),这些晶圆厂本来就面临高昂的人事费用和能源成本。在2024年的供应紧张时期,基板供应商还加收了两位数的附加费,迫使许多基板製造商重新谈判年度价格或实施季度调整条款。因此,欧洲PCB市场面临利润率波动,这对没有避险计画或长期供应协议的中小型企业尤其严重。一些公司透过专注于 HDI 原型来降低风险,因为 HDI 原型的材料成本与销售比率较低;而其他公司则实施动态报价软体,即时重新计算铜和层压板指数。

细分市场分析

截至2025年, 基板和基板将占据欧洲PCB市场份额的30.88%,这标誌着汽车ECU和工业控制设备对复杂互连解决方案的需求正在成长。随着OEM厂商从传统的通孔设计转向多层微孔结构,从而缩小晶片面积并提升讯号性能,欧洲HDI应用PCB市场规模将持续稳定成长。软硬复合基板虽然目前在销售上占比不高,但预计到2031年将实现3.13%的复合年增长率,这主要得益于微型医疗设备和汽车雷达线束中对刚性区域间柔性连接的需求。

标准多层基板在对成本高度敏感的工业模组领域仍占据重要地位,但价格压力正推动大宗商品生产转移到亚洲。柔性电路应用于需要生物相容性和灭菌性能的植入式和穿戴式生物感测器,而欧洲的製造地受益于ISO 13485认证。由于低利润产品的退出,刚性单面或双面基板的市占率正在萎缩。整体而言,欧洲PCB市场展现出韧性,这主要得益于对高密度互连(HDI)和软硬复合的需求,这些需求优先考虑的是接近性、专业化和文件记录,而非最低成本。

到2025年,汽车产业将占据欧洲PCB市场份额的26.12%,这主要得益于电动车平台的发展,预计到2031年,电动车平台的复合年增长率将达到3.08%。随着电池管理系统、车载充电器和ADAS单元的整合度不断提高,并采用耐热增强型基板,欧洲汽车电子PCB市场规模持续扩大。工业自动化和工业4.0计划透过在智慧工厂中整合高密度感测器控制器基板,保持适度的个位数成长。

通讯基础设施的扩张,特别是5G和边缘资料中心的建设,将推动对多层基板的需求;而航太和国防领域仍将是小规模但价值极高的细分市场,需要严格的认证流程。医疗电子领域将受益于基于生物相容性软式电路板的植入式刺激器和穿戴式诊断设备而成长。家用电子电器仍将是成长最弱的板块,因为欧洲製造商正逐步放弃大批量生产的通用型行动电话和平板电脑,转而专注于需要监管认证的专业设备。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对小型化和高密度印刷电路基板(PCB)的需求不断增长

- 电动车的快速普及需要先进的汽车印刷电路基板

- 欧洲基板製造厂研发投入不断成长

- 政府对国内半导体和封装产能的补贴

- 推广符合REACH标准的无卤层压板

- 生物相容性柔性印刷电路板在植入式医疗器材的应用日益广泛。

- 市场限制

- 铜材和基板价格的波动给利润率带来了压力。

- 下一代HDI生产线资本密集度高

- 由于层压基板供应集中在亚洲,前置作业时间较长。

- 在整个价值链中逐步淘汰 PFAS 的成本

- 宏观经济因素的影响

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类别

- 标准多层印刷电路基板

- 刚性单面或双面印刷基板

- HDI/微孔/堆积

- 软式电路板

- 软硬复合基板

- 其他类别

- 终端用户产业

- 工业电子

- 航太与国防

- 家用电子电器

- 沟通

- 车

- 医疗保健

- 其他终端使用者区域

- 按基板

- FR-4

- 金属核

- 聚酰亚胺

- 陶瓷製品

- 其他印刷基板基板

- 按层数

- 1-2层

- 4-6层

- 8-10层

- 10层或更多层

- 透过组装方法

- 表面黏着技术

- 通孔技术

- 混合实施

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AT&S Austria Technologie und Systemtechnik AG

- Wurth Elektronik Group

- KSG GmbH

- NCAB Group AB

- Aspocomp Group Plc

- Jabil Inc.

- TTM Technologies Inc.

- Benchmark Electronics Inc.

- ICAPE Group

- Schweizer Electronic AG

- LeitOn GmbH

- MicroCirtec Micro Circuit Technology GmbH

- Becker and Muller Schaltungsdruck GmbH

- Elvia PCB Group

- Cicor Group AG

- Multek Corporation

- MEKTEC Europe GmbH(Nippon Mektron Ltd.)

- Fujikura Ltd.

- Lab Circuits SA

- Exception PCB Ltd.

第七章 市场机会与未来展望

Europe PCB market size in 2026 is estimated at USD 2.74 billion, growing from 2025 value of USD 2.67 billion with 2031 projections showing USD 3.14 billion, growing at 2.76% CAGR over 2026-2031.

This trajectory reflects a strategic pivot away from commoditized volumes toward regulated high-value niches in automotive, medical, and industrial automation that support premium pricing. The Europe PCB market benefits from the European Union's EUR 43 billion (USD 48.6 billion) Chips Act stimulus, which channels investment into semiconductor fabs, advanced packaging hubs, and supporting interconnect suppliers. Supply-chain security, regulatory conformity, and proximity to demanding OEMs continue to reinforce regional orders, even as production represents less than 2% of global output. Competitive stress from low-cost Asian imports persists, yet European companies mitigate margin pressure through HDI leadership, rigorous quality programs, and specialized design services. Consolidation further defines the Europe PCB market, as illustrated by SOMACIS's medical-grade acquisition and Cicor's record intake, signaling a flight to scale or specialization among remaining players.

Europe Printed Circuit Board Market Trends and Insights

Growing Demand for Miniaturisation and High-Density Interconnect PCBs

The relentless push toward smaller, lighter electronic assemblies compels OEMs to specify HDI and ultra-HDI boards, elevating the Europe PCB market to a leadership role in microvia fabrication. Regional suppliers now qualify 50 micrometer conductor widths and microvias below 75 micrometers, enabling multilayer stack-ups that replace older through-hole designs with improved signal integrity. Investments in laser-drilling platforms, modified semi-additive processes, and X-ray inspection underpin these capabilities, with NCAB Group and Austrian specialists accelerating factory-readiness programs throughout 2025. The Europe PCB market thereby gains resilience through technical differentiation that deters price-based competition. In addition, stringent automotive and medical standards reward producers that document process control and traceability, reinforcing value extraction from HDI production. As adoption scales from German automotive clusters to Dutch industrial IoT hubs, HDI demand sustains a mid-term lift on regional revenue growth

Rapid Proliferation of Electric Vehicles Requiring Advanced Automotive PCBs

Tighter 2025 European CO2 thresholds ignited a 21% year-over-year spike in battery-electric vehicle registrations to more than 250,000 units in January alone, translating to a sharp uptick in complex multilayer board content per vehicle. Battery-management systems, traction inverters, and ADAS modules now rely on eight-plus-layer HDI designs with stringent vibration and thermal cycling prescriptions certified under IPC-6012 automotive addenda. Consequently, the Europe PCB market secures recurring orders from tier-one suppliers that mandate regional production for just-in-time assembly near German, French, and Italian EV plants. The electric-vehicle subsegment posts the fastest CAGR within automotive, ensuring a durable volume driver through 2030. Suppliers leverage long qualification cycles and punitive defect penalties to defend margins against imports, while collaborating with OEMs to co-optimize board layout and power-density within constrained pack footprints.

Volatile Copper and Laminate Prices Squeezing Margins

Copper traded above USD 11,000 per metric ton in May 2024 before retreating below USD 9,000 later that year, and research anticipates a rebound past USD 10,000 by late 2025 on electrification demand. Because copper forms 40% of raw-material spend and materials consume about 40% of total cost, swings directly compress EBITDA for European fabs already grappling with elevated labor and energy overheads. Laminate suppliers likewise pushed double-digit surcharges during the 2024 squeeze, compelling many board houses to renegotiate annual pricing or pass through quarterly adjustment clauses. The Europe PCB market therefore confronts margin volatility that disproportionately hurts smaller firms lacking hedging programs or long-term supply contracts. Some mitigate exposure by specializing in HDI prototypes where material share of selling price is lower, while others adopt dynamic quoting software that recalculates copper and laminate indices in real time.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidies for On-Shore Semiconductor and Packaging Capacity

- Increasing R and D Investment in European PCB Fabs

- High Capital Intensity of Next-Gen HDI Production Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HDI and micro-via boards accounted for 30.88% of the Europe PCB market share in 2025, underscoring the region's pivot to complex interconnect solutions for automotive ECUs and industrial controls. The Europe PCB market size for HDI applications continues to expand steadily as OEMs convert legacy through-hole designs to multilayer micro-via architectures that shrink footprint and enhance signal performance. Rigid-Flex formats, while only a fraction of volume, achieve a 3.13% CAGR to 2031 as medical device miniaturization and automotive radar harness bendable linkages between rigid zones.

Standard multilayer boards retain relevance in cost-sensitive industrial modules, though price pressure pushes commodity production toward Asia. Flexible circuits serve implantables and wearable biosensors that demand biocompatibility and sterilization compliance, domains where European fabs leverage ISO 13485 accreditation. Rigid 1-2-sided boards erode as producers exit low-margin runs. Overall, the Europe PCB market derives resilience from HDI and Rigid-Flex demand that values proximity, expertise, and documentation over lowest cost.

Automotive accounted for 26.12% of the Europe PCB market share in 2025, buoyed by surging electric-vehicle platforms that register a 3.08% CAGR through 2031. The Europe PCB market size for automotive electronics grows as battery-management systems, on-board chargers, and ADAS units integrate higher layer counts and thermal-enhanced substrates. Industrial automation and Industry 4.0 initiatives sustain mid-single-digit growth by embedding sensor-dense controller boards across smart factories.

Communications build-out, notably 5G and edge-data centers, uplifts multilayer demand, whereas aerospace and defense persist as small yet premium niches with rigorous qualification cycles. Medical electronics expand on the back of implantable stimulators and diagnostic wearables that rely on biocompatible flex boards. Consumer electronics remains the weakest cohort as European players relinquish high-volume commodity handsets and tablets, instead concentrating on specialized equipment demanding regulatory assurance.

The Europe PCB Market Report is Segmented by Category (Standard Multilayer PCBs, Rigid 1-2-Sided PCBs, and More), End-User Vertical (Industrial Electronics, Consumer Electronics, and More), PCB Substrate (FR-4, Metal Core, Polyimide, and More), Layer Count (1-2 Layers, 4-6 Layers, 8-10 Layers, and More), Assembly Type (Surface-Mount Technology, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AT&S Austria Technologie und Systemtechnik AG

- Wurth Elektronik Group

- KSG GmbH

- NCAB Group AB

- Aspocomp Group Plc

- Jabil Inc.

- TTM Technologies Inc.

- Benchmark Electronics Inc.

- ICAPE Group

- Schweizer Electronic AG

- LeitOn GmbH

- MicroCirtec Micro Circuit Technology GmbH

- Becker and Muller Schaltungsdruck GmbH

- Elvia PCB Group

- Cicor Group AG

- Multek Corporation

- MEKTEC Europe GmbH (Nippon Mektron Ltd.)

- Fujikura Ltd.

- Lab Circuits S.A.

- Exception PCB Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Miniaturisation and High-Density Interconnect PCBs

- 4.2.2 Rapid Proliferation of Electric Vehicles Requiring Advanced Automotive PCBs

- 4.2.3 Increasing Research and Development Investment in European PCB Fabs

- 4.2.4 Government Subsidies for On-Shore Semiconductor and Packaging Capacity

- 4.2.5 Regulatory Push For REACH-Compliant Halogen-Free Laminates

- 4.2.6 Surging Adoption of Bio-Compatible Flexible PCBs for Implantable Medical Devices

- 4.3 Market Restraints

- 4.3.1 Volatile Copper and Laminate Prices Squeezing Margins

- 4.3.2 High Capital Intensity of Next-Gen HDI Production Lines

- 4.3.3 Extended Lead Times Due To Asia-Centric Laminate Supply

- 4.3.4 PFAS Phase-Out Compliance Costs Across the Value Chain

- 4.4 Impact of Macroeconomic Factors

- 4.5 Industry Ecosystem Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Standard Multilayer PCBs

- 5.1.2 Rigid 1-2-sided PCBs

- 5.1.3 HDI / Micro-via / Build-up

- 5.1.4 Flexible PCBs

- 5.1.5 Rigid-Flex PCBs

- 5.1.6 Other Categories

- 5.2 By End-User Vertical

- 5.2.1 Industrial Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Consumer Electronics

- 5.2.4 Communications

- 5.2.5 Automotive

- 5.2.6 Medical

- 5.2.7 Other End-User Verticals

- 5.3 By PCB Substrate

- 5.3.1 FR-4

- 5.3.2 Metal Core

- 5.3.3 Polyimide

- 5.3.4 Ceramic

- 5.3.5 Other PCB Substrates

- 5.4 By Layer Count

- 5.4.1 1-2 Layers

- 5.4.2 4-6 Layers

- 5.4.3 8-10 Layers

- 5.4.4 more than 10 Layers

- 5.5 By Assembly Type

- 5.5.1 Surface-Mount Technology

- 5.5.2 Through-Hole Technology

- 5.5.3 Mixed Assembly

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AT&S Austria Technologie und Systemtechnik AG

- 6.4.2 Wurth Elektronik Group

- 6.4.3 KSG GmbH

- 6.4.4 NCAB Group AB

- 6.4.5 Aspocomp Group Plc

- 6.4.6 Jabil Inc.

- 6.4.7 TTM Technologies Inc.

- 6.4.8 Benchmark Electronics Inc.

- 6.4.9 ICAPE Group

- 6.4.10 Schweizer Electronic AG

- 6.4.11 LeitOn GmbH

- 6.4.12 MicroCirtec Micro Circuit Technology GmbH

- 6.4.13 Becker and Muller Schaltungsdruck GmbH

- 6.4.14 Elvia PCB Group

- 6.4.15 Cicor Group AG

- 6.4.16 Multek Corporation

- 6.4.17 MEKTEC Europe GmbH (Nippon Mektron Ltd.)

- 6.4.18 Fujikura Ltd.

- 6.4.19 Lab Circuits S.A.

- 6.4.20 Exception PCB Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment