|

市场调查报告书

商品编码

1910917

媒体流:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Media Streaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

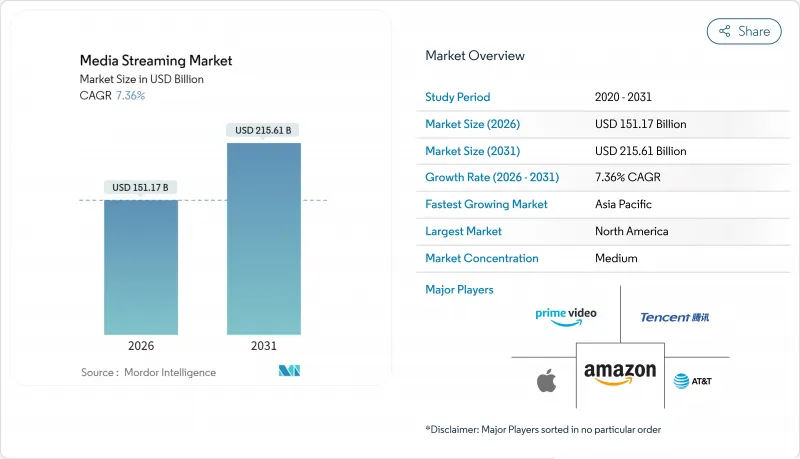

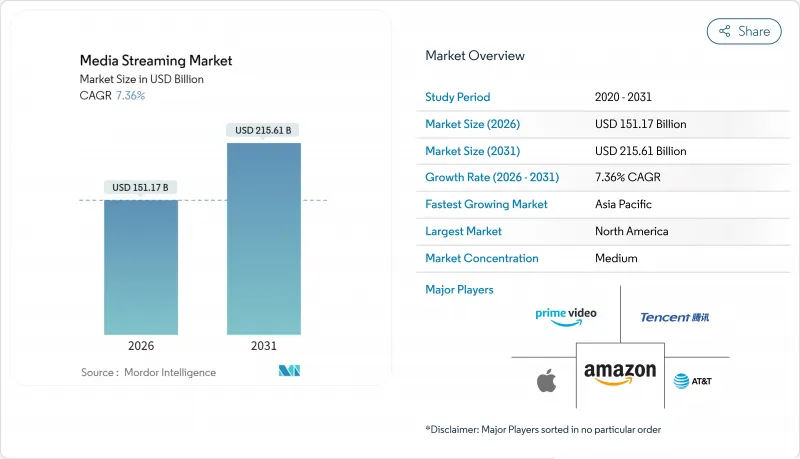

预计到 2025 年,媒体串流市场规模将达到 1,408 亿美元,到 2026 年将达到 1,511.7 亿美元,到 2031 年将达到 2,156.1 亿美元,预测期(2026-2031 年)的复合年增长率为 7.36%。

这一强劲前景的基础在于,平台正从纯订阅提案向混合盈利模式进行果断转型,将付费计划与广告相结合,从而抵消不断上涨的获客成本并提高盈利。竞争差异化日益依赖对广告科技堆迭、即时推荐引擎的控制,以及取得独家内容版权以实现高价定价。网路升级,尤其是5G的部署,支援高位元率传输,而边缘运算的采用则降低了延迟,使4K和8K串流媒体能够流畅地触及行动用户。体育赛事版权的分散化推动了以赛事主导的用户成长和更高的每千次展示成本(CPM),而区域性内容库则在低渗透率的农村市场吸引了新的受众。同时,每年高达180亿美元的广告曝光率预算带来的利润压力迫使营运商在原创内容製作和内容库共用协议之间寻求平衡,从而加速了整个行业向每个用户成本优化转型的趋势。

全球媒体串流媒体市场趋势与洞察

亚太地区低成本5G资料方案的普及

经济实惠的 5G 网路的推出改变了用户的消费模式,使得用户能够透过行动连线流畅地观看高清和 4K 影片。营运商正在补贴数据流量套餐,因为影片流量的成长有助于他们将高端网路投资变现,从而形成良性循环,推动基础设施部署和内容互动。靠近用户的边缘节点进一步降低了延迟,使得个人化建议能够即时更新。因此,在对价格敏感的新兴经济体中,媒体串流市场正经历持续成长。

SVOD平台正向北美和欧洲的区域城市扩张

随着大都会圈日益饱和,主流服务商正将目光转向区域性城市,因为光纤网路的铺设和农村宽频的改善降低了分发成本。虽然本地製作的预算与全球热门剧集相比较为有限,但具有文化相关性的剧集正在帮助提升服务不足观众群体的忠诚度。先进的建议演算法能够考虑方言和观看时间,在不增加内容支出的情况下维持用户参与度,从而为串流媒体市场带来增量收入。

内容授权成本上涨对利润率带来压力。

Netflix 预测其 2025 年的支出将达到 180 亿美元,这凸显了通膨螺旋式上升的趋势,即使是领导企业也面临着盈利压力。对加值内容库的激烈竞标战削弱了差异化优势,因为竞争对手只能将部分成本转嫁给用户。虽然共用协议可以减少短期现金流出,但却削弱了用户获取所依赖的垄断优势,从而挑战了整个串流媒体市场的经济规律。

细分市场分析

即使到了2025年,影片内容仍将保持其在收入中的主导地位,占比高达77.35%。这反映了用户已形成的观看习惯以及对独家剧集的大量投入,而这些投入有助于提高用户留存率。同时,音乐服务将继续以8.82%的复合年增长率成长,这主要得益于檔案体积小巧,即使在网路受限的环境下也能保证稳定的串流媒体播放。随着人工智慧驱动的播放清单提高每日收听频率并扩大广告库存,音讯媒体串流市场也将持续扩张。

音乐平台凭藉着低廉的製作成本和跨国界的吸引力,能够迅速实现全球用户群的盈利,而影片平台则面临着不断增长的长篇内容预算压力。这种成本差异促使跨格式商品搭售,预示着未来音讯和影片提案将整合在单一应用程式中,以巩固市场份额。

儘管到2025年点播内容库将占总收入的86.76%,但直播9.44%的复合年增长率表明,人们对即时体验的需求正在不断增长。体育赛事直播和大型真人秀节目能够吸引广告商进行“预订观看”,并且其单次播放成本高于点播内容。

技术复杂性增强了竞争优势。边缘运算和自订通讯协定能够应对流量高峰,并将延迟保证在两秒以下,从而降低用户接受的心理阈值。掌握这些技术的平台有望在全球大型活动期间占据越来越大的媒体流市场。

区域分析

北美地区预计到2025年将占总营收的34.48%,目前正步入成熟阶段,营运商的策略重心正从用户获取转向提升用户终身价值。正如Verizon的融合策略所示,透过光纤和行动合约捆绑销售,Verizon得以锁定用户群体,并在无需大规模行销投入的情况下提升每位用户平均收入(ARPU)。儘管体育赛事转播权的竞争推高了节目製作成本,但成熟的广告市场支撑着混合型营运商的盈利。

亚太地区预计将以8.97%的复合年增长率成长,这得益于政府对本地内容製作的激励措施以及5G的加速普及。 Netflix在推出具有文化敏感度的原创内容后,当地观众人数激增20%,显示本土化的故事能够吸引大量用户。各国政府正在提供创作者支持基金(尤其是印度10亿美元的计画),以刺激新内容的供应并促进串流媒体市场的发展。然而,不同的资料本地化法规迫使企业建立平行的基础设施,这提高了中小型品牌的进入门槛。在欧洲,GDPR合规性和语言市场的碎片化推高了营运成本,导致成长不平衡。像Netflix与TF1的合作这样的分销协议,展现了混合模式,在这种模式下,串流媒体营运商和传统广播公司携手合作,以满足监管机构和观众的需求。在拉丁美洲,巴西77.2%和智利70.9%的光纤普及率正开始转化为高清串流媒体的广泛应用,从而创造了新的商机。非洲仍然是行动优先的地区,因此低频宽优化和可下载内容选项对于挖掘潜在需求至关重要。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区低成本5G资料方案的普及

- SVOD平台向北美和欧洲二、三线城市的扩张

- 争夺独家体育赛事版权的战争推高了价格

- 透过云端原生 CDN 和边缘运算的集成,实现超低延迟直播。

- 由于免费广告支援电视(FAST)频道的兴起,广告库存增加。

- 透过捆绑通讯和媒体服务提高用户留存率

- 市场限制

- 内容授权成本上升导致利润率下降

- 分散的版权管理阻碍了全球发行时间

- 新兴经济体「最后一公里」延误问题依然存在。

- 加强对资料隐私和本地化的监管审查

- 监理展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按内容类型

- 影片串流

- 音乐串流媒体

- 按服务类型

- 直播

- 点播串流媒体

- 按收入模式

- 订阅(SVOD/AVOD/混合模式)

- 广告(AVOD/FAST)

- 透过串流媒体品质

- SD

- HD

- 4K/UHD

- 8K

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 墨西哥

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- Strategic Developments

- Vendor Positioning Analysis

- 公司简介

- Netflix Inc.

- Spotify Technology SA

- Apple Inc.(Apple TV+, Apple Music)

- Amazon.com Inc.(Prime Video, Amazon Music)

- Alphabet Inc.(YouTube, YouTube Music)

- Tencent Holdings Ltd.(Tencent Video, QQ Music)

- The Walt Disney Company(Disney+, ESPN+)

- AT&T Inc.(Max/HBO, DirecTV Stream)

- Comcast Corp.(Peacock, NOW TV)

- Roku Inc.

- Deezer SA

- Baidu Inc.(iQIYI, Qian Qian Music)

- British Broadcasting Corporation(BBC iPlayer)

- Hulu LLC

- Pandora Media LLC

- ViacomCBS Inc.(Paramount+)

- Sony Group Corp.(Crunchyroll, Sony LIV)

- Naspers Ltd.(Showmax)

- FuboTV Inc.

- DAZN Group Ltd.

第七章 市场机会与未来展望

The media streaming market was valued at USD 140.80 billion in 2025 and estimated to grow from USD 151.17 billion in 2026 to reach USD 215.61 billion by 2031, at a CAGR of 7.36% during the forecast period (2026-2031).

This strong outlook rests on a decisive pivot from subscription-only propositions toward hybrid monetization that combines paid tiers with advertising inventory, enabling platforms to offset rising customer-acquisition costs and improve profitability. Competitive differentiation increasingly stems from control of advertising technology stacks, real-time recommendation engines, and exclusive content rights that secure premium pricing. Network upgrades-in particular 5G rollouts-support higher-bitrate delivery, while edge compute adoption cuts latency, allowing 4K and 8K streams to reach mobile users without buffering. Sports rights fragmentation drives event-led subscriber spikes and higher CPMs, whereas localized content libraries draw new viewers in under-penetrated rural markets. At the same time, margin pressure from USD 18 billion annual content budgets forces operators to balance original production with catalog sharing pacts, accelerating a sector-wide shift toward revenue-per-user optimization.

Global Media Streaming Market Trends and Insights

Proliferation of Low-Cost 5G Data Plans Across Asia-Pacific

Deployment of affordable 5G networks has reshaped consumption patterns by supporting uninterrupted HD and 4K streams on mobile connections. Operators subsidize data packages because elevated video traffic monetizes premium network investments, creating a feedback loop that spurs both infrastructure build-out and content engagement. Edge nodes positioned close to viewers further trim latency, enabling personalized recommendations to refresh in real time. The result is sustained growth for the media streaming market in price-sensitive emerging economies.

SVOD Platform Expansion into Tier-II/III Cities in North America and Europe

Having saturated major metropolitan areas, leading services are targeting secondary cities where fiber rollout and improved rural broadband have lowered delivery cost. Localized production budgets are modest relative to global tent-pole titles, yet culturally tailored series drive higher loyalty among underserved audiences. Sophisticated recommendation algorithms that account for regional dialects and viewing times maintain engagement without raising content outlays, adding incremental revenue to the media streaming market.

Escalating Content-Licensing Costs Compressing Margins

Netflix's USD 18 billion outlay in 2025 underscores an inflationary spiral that squeezes profitability even for scale leaders. Fierce bidding for premium libraries diminishes differentiation because rival services can only pass a portion of costs to subscribers. Sharing agreements reduce immediate cash burn but blunt exclusivity advantages that underpin subscriber acquisition, challenging overall economics of the media streaming market.

Other drivers and restraints analyzed in the detailed report include:

- Exclusive Sports-Rights Wars Driving Premium Pricing

- Integration of Cloud-Native CDN and Edge Compute for Ultra-Low-Latency Live Streams

- Heightened Regulatory Scrutiny on Data Privacy and Localization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Video maintained a commanding 77.35% revenue slice in 2025, reflecting entrenched viewing habits and heavy investment in exclusive series that anchor user retention. Music services, however, are expanding at an 8.82% CAGR aided by compact file sizes that stream reliably on constrained networks. The media streaming market size for audio is swelling as AI-driven playlists raise daily listening frequency and enlarge ad inventory.

Lower production costs and borderless appeal allow music platforms to monetize global audiences rapidly, while video players shoulder rising budgets for long-form content. This cost asymmetry encourages cross-format bundling, signalling a future where audio and video propositions converge within a single app to protect market share.

On-demand libraries accounted for 86.76% of 2025 revenue, yet live streaming's 9.44% CAGR illustrates growing appetite for real-time experiences. Sporting fixtures and tent-pole reality shows create appointment viewing that advertisers value, lifting revenue per stream above on-demand averages.

Technical complexity strengthens competitive moats: edge compute and custom protocols manage traffic spikes, ensuring latency below the two-second psychological threshold. Platforms mastering these capabilities are positioned to capture incremental media streaming market share during peak global events.

The Media Streaming Market Report is Segmented by Content Type (Video Streaming, Music Streaming), Service Type (Live Streaming, On-Demand Streaming), Revenue Model (Subscription, Advertising), Streaming Quality (SD, HD, 4K/UHD, 8K), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.48% of 2025 revenue but is maturing, prompting operators to pivot from user acquisition toward higher lifetime value. Bundling with fiber and mobile contracts, as demonstrated by Verizon's convergence strategy, locks in households and widens ARPU without heavy marketing spend. Sports-rights competition inflates programming costs, yet the presence of established ad markets sustains hybrid-tier profitability.

Asia-Pacific is projected to expand at a 8.97% CAGR, buoyed by governmental encouragement of local content creation and accelerating 5G coverage. Netflix recorded a 20% regional viewing surge after debuting culturally tailored originals, confirming that local narratives unlock outsized engagement. Governments are offering creator funds-India's USD 1 billion initiative is emblematic-that feed fresh catalogs and stimulate the media streaming market. Nonetheless, diverse data-localization rules compel parallel infrastructure builds, raising entry barriers for smaller brands. Europe shows uneven growth as GDPR compliance and fragmented language markets inflate operational overheads. Carriage agreements such as Netflix's tie-up with TF1 illustrate a hybrid model where streaming and traditional broadcasters collaborate to satisfy regulators and audiences. Latin America's fiber penetration-77.2% in Brazil and 70.9% in Chile-has started translating into higher-resolution streaming uptake, creating fresh addressable revenue. Africa remains mobile-first; low-bandwidth optimizations and downloadable content options are crucial to unlock latent demand.

- Netflix Inc.

- Spotify Technology S.A.

- Apple Inc. (Apple TV+, Apple Music)

- Amazon.com Inc. (Prime Video, Amazon Music)

- Alphabet Inc. (YouTube, YouTube Music)

- Tencent Holdings Ltd. (Tencent Video, QQ Music)

- The Walt Disney Company (Disney+, ESPN+)

- AT&T Inc. (Max / HBO, DirecTV Stream)

- Comcast Corp. (Peacock, NOW TV)

- Roku Inc.

- Deezer S.A.

- Baidu Inc. (iQIYI, Qian Qian Music)

- British Broadcasting Corporation (BBC iPlayer)

- Hulu LLC

- Pandora Media LLC

- ViacomCBS Inc. (Paramount+)

- Sony Group Corp. (Crunchyroll, Sony LIV)

- Naspers Ltd. (Showmax)

- FuboTV Inc.

- DAZN Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Low-Cost 5G Data Plans Across Asia-Pacific

- 4.2.2 SVOD Platform Expansion into Tier-II/III Cities in North America and Europe

- 4.2.3 Exclusive Sports-Rights Wars Driving Premium Pricing

- 4.2.4 Integration of Cloud-Native CDN andEdge Compute for Ultra-Low-Latency Live Streams

- 4.2.5 Rise of FAST (Free Ad-Supported TV) Channels Boosting Ad Inventory

- 4.2.6 Bundling of Telco andMedia Services Inducing Subscriber Stickiness

- 4.3 Market Restraints

- 4.3.1 Escalating Content-Licensing Costs Compressing Margins

- 4.3.2 Fragmented Rights Management Hindering Global Release Windows

- 4.3.3 Persistent Last-Mile Latency in Emerging Economies

- 4.3.4 Heightened Regulatory Scrutiny on Data Privacy andLocalization

- 4.4 Regulatory Outlook

- 4.5 Porters Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Content Type

- 5.1.1 Video Streaming

- 5.1.2 Music Streaming

- 5.2 By Service Type

- 5.2.1 Live Streaming

- 5.2.2 On-Demand Streaming

- 5.3 By Revenue Model

- 5.3.1 Subscription (SVOD/AVOD/Hybrid)

- 5.3.2 Advertising (AVOD/FAST)

- 5.4 By Streaming Quality

- 5.4.1 SD

- 5.4.2 HD

- 5.4.3 4K / UHD

- 5.4.4 8K

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products andServices, and Recent Developments)

- 6.3.1 Netflix Inc.

- 6.3.2 Spotify Technology S.A.

- 6.3.3 Apple Inc. (Apple TV+, Apple Music)

- 6.3.4 Amazon.com Inc. (Prime Video, Amazon Music)

- 6.3.5 Alphabet Inc. (YouTube, YouTube Music)

- 6.3.6 Tencent Holdings Ltd. (Tencent Video, QQ Music)

- 6.3.7 The Walt Disney Company (Disney+, ESPN+)

- 6.3.8 AT&T Inc. (Max / HBO, DirecTV Stream)

- 6.3.9 Comcast Corp. (Peacock, NOW TV)

- 6.3.10 Roku Inc.

- 6.3.11 Deezer S.A.

- 6.3.12 Baidu Inc. (iQIYI, Qian Qian Music)

- 6.3.13 British Broadcasting Corporation (BBC iPlayer)

- 6.3.14 Hulu LLC

- 6.3.15 Pandora Media LLC

- 6.3.16 ViacomCBS Inc. (Paramount+)

- 6.3.17 Sony Group Corp. (Crunchyroll, Sony LIV)

- 6.3.18 Naspers Ltd. (Showmax)

- 6.3.19 FuboTV Inc.

- 6.3.20 DAZN Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment