|

市场调查报告书

商品编码

1911272

欧洲维护、维修和营运 (MRO) 市场:市场份额分析、行业趋势、统计数据和成长预测 (2026-2031)Europe Maintenance, Repair, And Operations (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

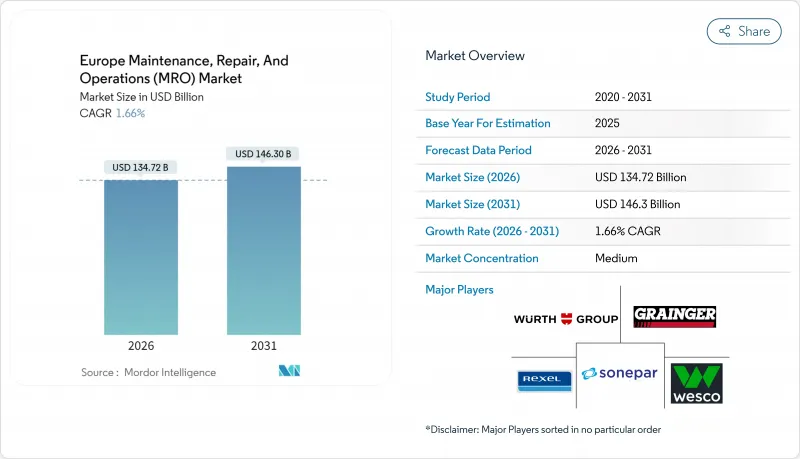

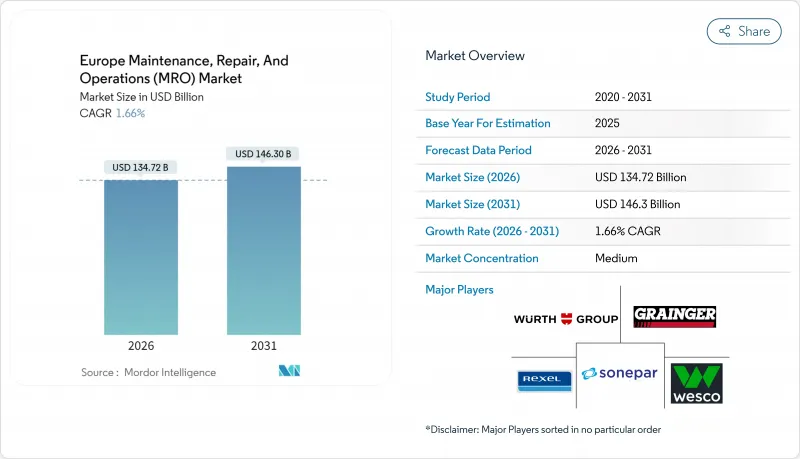

2025年欧洲MRO(维护、修理和营运)市场价值为1,325.2亿美元,预计到2031年将达到1,463亿美元,高于2026年的1,347.2亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 1.66%。

这一日趋成熟且稳定发展的趋势,是由强制性维修权法规、循环经济立法以及该地区多元化工业基础对数据驱动型维护策略日益增长的依赖所推动的。德国先进自动化技术的广泛应用、欧洲绿色交易以及供应链韧性计画的强化,正在推动对整合维护解决方案的长期需求。快速的数位化提升了能够将机械、电气和软体支援整合到单一协调服务中的服务供应商的竞争力。同时,製造商正将预算重点从资本支出转向营运支出,加速采用外部服务,并为专业供应商创造新的收入来源。最后,企业永续发展报告指令 (CSRD) 强制要求揭露永续性讯息,推动了对面向生命週期的维护文件的需求,并进一步促进了具备分析能力的维护服务合约的签订。

欧洲MRO(维护、修理与营运)市场趋势与洞察

欧洲工业界推动预测性维护的监管倡议

《网路弹性法案》要求互联设备製造商在其机器中整合持续监控功能,实际上将预测性维护列为合规要求。早期采用者已将计划外停机时间减少了高达 50%,这些节省成本的措施进一步刺激了对分析驱动型 MRO 合约的需求。德国政府已拨款 21 亿欧元(22.6 亿美元)用于支持工业 4.0 的普及,其中 40% 将用于预测性基础建设。随着大型 OEM 厂商越来越要求下游供应商共用机器健康数据,即使是中型工厂也必须部署感测器和基于云端的分析技术才能继续留在核准供应商名单中。随着分阶段法规的实施持续到 2027 年,欧洲 MRO 市场正受益于多年分阶段的投资週期,这将维持其成长动能。

製造业对工业自动化和运作的需求日益增长

与其他地区相比,欧洲工厂的产能接近运作运转,其中德国主要工厂的整体设备效率 (OEE) 接近 90%。疫情期间半导体短缺凸显了单一机器故障可能波及整个供应链的风险,使得这一重要性急剧上升。汽车电气化增加了高压系统和电池处理的复杂性,促使大众汽车等公司投资 890 亿欧元(958 亿美元)用于电动车基础设施建设,而这些基础设施需要专门的维护。捷克和波兰的出口商也正在效仿德国的标桿,进一步强化了全部区域对运作的重视。随着数位双胞胎、智慧感测器和人工智慧驱动的诊断技术从“锦上添花”转变为“竞争必需品”,这些趋势正吸引对欧洲 MRO 市场的持续投资。

熟练认证技术人员短缺

预计到2030年,欧洲将需要新增多达14.5万名维修技师,相关训练成本将达14亿欧元(15.1亿美元)。德国拥有着名的学徒制体系,但目前面临的压力最大,该国维修岗位空缺高达4.5万个。航空业受到的衝击尤为严重。营运一架飞机需要漫长的认证过程,在某些情况下,新员工必须等待两年以上才能执行关键任务。人口结构的变化也加剧了这个问题:目前40%的维修人员年龄超过50岁,这使得寻找替代人员变得更加紧迫。持续的人才短缺推高了服务价格,延误了维修进度,并限制了欧洲MRO(维修、修理和大修)市场的发展速度。

细分市场分析

到2025年,工业MRO(维护、维修和大修)将占总收入的45.88%,这主要得益于其与欧洲庞大製造业生态系统的深度融合,以及需要定期维护的自动化技术。随着工厂现代化进程的推进,欧洲工业工厂的MRO市场规模持续稳定成长,其中电气领域的成长速度更快,这主要得益于可再生能源的普及和智慧工厂维修。光是德国电动车充电网路的扩建就需要数千名精通机械和数位技术的高压技术人员。虽然暖通空调和建筑自动化等设施服务能够提供稳定的收入,但氢电解维护等新兴细分领域表明,环境法规正在不断拓展市场的技术边界。

电气维护、维修和营运 (MRO) 行业 2.69% 的复合年增长率 (CAGR) 由多种趋势共同驱动:感测器的广泛应用、电网的数位化以及可再生能源资产运转率目标的日益严格。随着太阳能发电厂和电池阵列併入电网,对开关设备、电缆和逆变器进行主动检查至关重要。结合机械维修和软体更新的混合服务合约正日益普及,进一步模糊了传统的服务类别界线。能够同时掌控这两个领域的公司预计将从资产所有者那里获得高于平均水平的市场份额,因为资产所有者要求在不断扩展的技术体系中由单一责任方负责。

预防性维护计画仍将是欧洲可靠性文化的重要组成部分,预计到2025年将占总支出的57.02%。然而,预测分析正以6.82%的复合年增长率快速发展,并正在重塑产业格局。即时数据使营运商能够仅在指标超过风险阈值时才安排工作,从而减少备件消耗,并将劳动力解放出来用于更具战略意义的活动。 BMW等早期采用者报告称,非计划停机时间减少了40%,这直接转化为更高的利润率和更强的供应链可靠性。因此,欧洲MRO市场中分配给感测器、云端平台和人工智慧模型的份额正在逐年增长。

然而,预测性维护模型无法预测所有故障,因此采取纠正措施仍然至关重要。当涡轮机、引擎或机器人单元发生意外故障时,停机成本可能超过每小时 10 万欧元(10.8 万美元)。供应商目前正在部署扩增实境(AR) 头戴设备来加速复杂的维修工作,而无人机巡检正在减少高层建筑和海上资产的停机时间。随着服务组合的变化,能够在数据驱动的预测和快速危机管理之间灵活切换的供应商,即使预测技术日益普及,也能保障其收入来源。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲工业预测性维护监管的进展

- 製造业对工业自动化和运作的需求日益增长

- 对老旧航太和运输设备大修週期的需求

- 从资本支出转向营运成本有利于外包的MRO合约

- 一个优化MRO供应链的电子商务平台

- 永续性立法鼓励使用循环利用和翻新零件。

- 市场限制

- 技术纯熟劳工认证技术人员短缺

- 原物料价格波动给经销商的利润率带来了压力。

- OEM 资料垄断限制了对独立服务的访问

- 关键备件的地缘政治供应链中断

- 产业价值链分析

- 宏观经济因素的影响

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按MRO类型

- 工业维护、维修和运行

- 电气维护、维修和运行

- 设施维护、维修和大修

- 其他MRO类型

- 按维护类型

- 预防性维护

- 预测性维护

- 修正性维护

- 透过采购方式

- 内部MRO

- 外部MRO

- 按最终用户行业划分

- 製造业

- 航太

- 车

- 能源与公共产业

- 其他的

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Wurth Group GmbH

- WW Grainger Inc.

- Sonepar SA

- Rexel SA

- WESCO International Inc.

- Airgas Inc.(Air Liquide SA)

- Fastenal Company

- MSC Industrial Supply Co.

- Ferguson PLC

- Parker Hannifin Corporation

- Motion Industries Inc.

- Genuine Parts Company

- Applied Industrial Technologies Inc.

- Eriks NV

- Wolseley Limited

- RS Group plc

- Brammer Buck and Hickman

- Descours and Cabaud

- Cromwell Group Holdings Ltd.

- Bodo Moller Chemie GmbH

- Mento AS

- Gazechim Composites

- Lindberg and Lund AS

- Graco BVBA

第七章 市场机会与未来展望

The European MRO market was valued at USD 132.52 billion in 2025 and estimated to grow from USD 134.72 billion in 2026 to reach USD 146.3 billion by 2031, at a CAGR of 1.66% during the forecast period (2026-2031).

This mature yet steadily expanding trajectory stems from mandatory right-to-repair rules, circular economy legislation, and a growing reliance on data-driven maintenance strategies across the region's diversified industrial base. Germany's deep automation footprint, the European green-deal agenda, and heightened supply-chain resilience programs all reinforce long-term demand for integrated maintenance solutions. Rapid digitalization raises the competitive stakes for service providers who can merge mechanical, electrical, and software support into a single, coordinated offer. Meanwhile, manufacturers are shifting budget priorities from capital investments to operating expenses, accelerating the uptake of external services, and creating new revenue streams for specialized vendors. Finally, sustainability disclosures mandated by the Corporate Sustainability Reporting Directive (CSRD) intensify the requirement for life-cycle-oriented maintenance documentation, providing an extra boost to analytics-enabled service contracts.

Europe Maintenance, Repair, And Operations (MRO) Market Trends and Insights

Regulatory Push for Predictive Maintenance in European Industry

The Cyber Resilience Act requires connected-equipment manufacturers to incorporate continuous monitoring into their machines, effectively making predictive maintenance a compliance requirement. Companies that comply early are already reducing unplanned downtime by up to 50%, a cost-saving measure that further stimulates demand for analytics-heavy MRO contracts. Germany's government reserves EUR 2.1 billion (USD 2.26 billion) to subsidize Industry 4.0 rollouts, with 40% of that package specifically allocated for predictive infrastructure. As large OEMs increasingly require downstream suppliers to share machine health data, even mid-sized plants must adopt sensors and cloud-based analytics to remain on approved vendor lists. As the phased regulation runs until 2027, the European MRO market benefits from a staggered, multi-year investment cycle that sustains growth.

Industrial Automation and the Need for Uptime Across the Manufacturing Base

Europe's factories operate closer to full capacity than most of their global peers, with leading German plants posting overall equipment effectiveness rates of nearly 90%. The stakes rose sharply after pandemic-era semiconductor shortages revealed how a single machine failure could ripple through entire supply networks. Automotive electrification now introduces high-voltage and battery-handling complexity, prompting firms such as Volkswagen to allocate EUR 89 billion (USD 95.8 billion) for electric-mobility infrastructure that requires specialized maintenance. Czech and Polish exporters are following suit to keep pace with German benchmarks, reinforcing the region-wide priority on uptime. These dynamics draw continuous spending into the European MRO market as digital twins, smart sensors, and AI-driven diagnostics evolve from a nice-to-have to a competitive imperative.

Skilled Labor Shortage of Certified Technicians

Europe is expected to require up to 145,000 additional maintenance technicians by 2030, resulting in a training expenditure of EUR 1.4 billion (USD 1.51 billion). Germany shoulders the heaviest burden, with 45,000 unfilled maintenance roles despite its renowned apprenticeship programs. Aviation is hit hardest because aircraft operations require lengthy certification processes; in some cases, recruits wait two years or more before they can sign off on critical tasks. The demographic reality compounds the issue: 40% of today's maintenance workforce is over 50, which raises the urgency of replacement. Persistent scarcity raises service prices, delays repairs, and restricts the speed at which the European MRO market can scale.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Capex to Opex, Favoring Outsourced MRO Contracts

- Sustainability Legislation Driving Circular and Remanufactured Parts Use

- Volatile Raw-Material Prices Squeezing Distributor Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial MRO retained 45.88% of 2025 revenue owing to Europe's vast manufacturing ecosystem and the deep integration of automation technologies that demand regular servicing. The European MRO market size for industrial plants continues to grow modestly as facilities modernize; however, the electrical segment is growing faster, driven by renewable energy rollouts and smart factory retrofits. Germany's ramp-up of electric-vehicle charging networks alone calls for thousands of high-voltage technicians trained to both mechanical and digital standards. Although facility services like HVAC and building automation offer steady returns, emerging niches-such as the maintenance of hydrogen electrolyzers-illustrate how environmental legislation constantly extends the market's technical frontier.

Electrical MRO's 2.69% CAGR springs from converging trends: wider sensor deployment, grid digitalization, and stricter uptime targets for renewable assets. As more solar parks and battery-storage arrays connect to the network, preventive testing of switchgear, cables, and inverters becomes mission-critical. Hybrid service contracts, which combine mechanical fixes with software upgrades, are gaining favor, further blurring traditional category boundaries. Those who master both domains are poised to capture above-average wallet share from asset owners seeking single-source accountability across a growing array of technologies.

Preventive programs accounted for 57.02% of 2025 spending and remain the backbone of European reliability culture; yet, predictive analytics is rewriting the rulebook by growing at a 6.82% CAGR. Real-time data enables operators to schedule work only when indicators cross risk thresholds, thereby reducing spare parts consumption and freeing labor for more strategic tasks. Early adopters such as BMW report 40% fewer unscheduled stops, which translates into direct margin gains and stronger supply-chain credibility. Consequently, the European MRO market size allocated to sensors, cloud platforms, and AI models climbs each year.

Corrective tasks still matter because no predictive model can foresee every failure. When turbines, engines, or robotic cells break unexpectedly, downtime losses can exceed EUR 100,000 (USD 108,000) per hour. Vendors now deploy augmented-reality headsets to accelerate complex repairs, while drone inspection shrinks outage windows for high-rise or offshore assets. As the service mix shifts, providers who can pivot between data-driven forecasting and responsive crisis management will protect their revenue streams, even as predictive penetration deepens.

The Europe Maintenance, Repair, and Operations Market Report is Segmented by MRO Type (Industrial MRO, Electrical MRO, Facility MRO, Other MRO Types), Maintenance Type (Preventive, Predictive, Corrective), Sourcing Type (Internal MRO, External MRO), End-User Industry (Manufacturing, Aerospace, Automotive, Energy and Utilities, Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Wurth Group GmbH

- W.W. Grainger Inc.

- Sonepar SA

- Rexel SA

- WESCO International Inc.

- Airgas Inc. (Air Liquide SA)

- Fastenal Company

- MSC Industrial Supply Co.

- Ferguson PLC

- Parker Hannifin Corporation

- Motion Industries Inc.

- Genuine Parts Company

- Applied Industrial Technologies Inc.

- Eriks NV

- Wolseley Limited

- RS Group plc

- Brammer Buck and Hickman

- Descours and Cabaud

- Cromwell Group Holdings Ltd.

- Bodo Moller Chemie GmbH

- Mento AS

- Gazechim Composites

- Lindberg and Lund AS

- Graco BVBA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory push for predictive maintenance in European industry

- 4.2.2 Industrial automation and need for uptime across manufacturing base

- 4.2.3 Ageing aerospace and transportation fleets demanding overhaul cycles

- 4.2.4 Shift from capex to opex favouring outsourced MRO contracts

- 4.2.5 E-commerce platforms optimising MRO supply chains

- 4.2.6 Sustainability legislation driving circular and remanufactured parts use

- 4.3 Market Restraints

- 4.3.1 Skilled labour shortage of certified technicians

- 4.3.2 Volatile raw-material prices squeezing distributor margins

- 4.3.3 OEM data monopolies limiting independent service access

- 4.3.4 Geopolitical supply-chain disruptions for critical spares

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By MRO Type

- 5.1.1 Industrial MRO

- 5.1.2 Electrical MRO

- 5.1.3 Facility MRO

- 5.1.4 Other MRO Types

- 5.2 By Maintenance Type

- 5.2.1 Preventive

- 5.2.2 Predictive

- 5.2.3 Corrective

- 5.3 By Sourcing Type

- 5.3.1 Internal MRO

- 5.3.2 External MRO

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Aerospace

- 5.4.3 Automotive

- 5.4.4 Energy and Utilities

- 5.4.5 Others

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Wurth Group GmbH

- 6.4.2 W.W. Grainger Inc.

- 6.4.3 Sonepar SA

- 6.4.4 Rexel SA

- 6.4.5 WESCO International Inc.

- 6.4.6 Airgas Inc. (Air Liquide SA)

- 6.4.7 Fastenal Company

- 6.4.8 MSC Industrial Supply Co.

- 6.4.9 Ferguson PLC

- 6.4.10 Parker Hannifin Corporation

- 6.4.11 Motion Industries Inc.

- 6.4.12 Genuine Parts Company

- 6.4.13 Applied Industrial Technologies Inc.

- 6.4.14 Eriks NV

- 6.4.15 Wolseley Limited

- 6.4.16 RS Group plc

- 6.4.17 Brammer Buck and Hickman

- 6.4.18 Descours and Cabaud

- 6.4.19 Cromwell Group Holdings Ltd.

- 6.4.20 Bodo Moller Chemie GmbH

- 6.4.21 Mento AS

- 6.4.22 Gazechim Composites

- 6.4.23 Lindberg and Lund AS

- 6.4.24 Graco BVBA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment