|

市场调查报告书

商品编码

1911425

工业紧固件:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

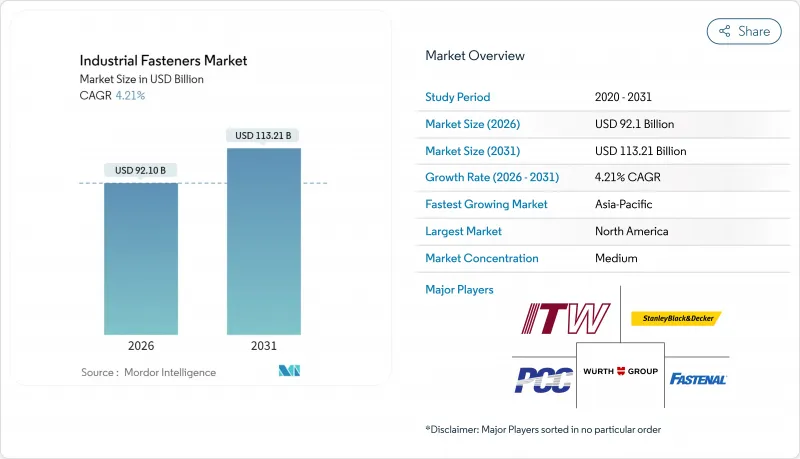

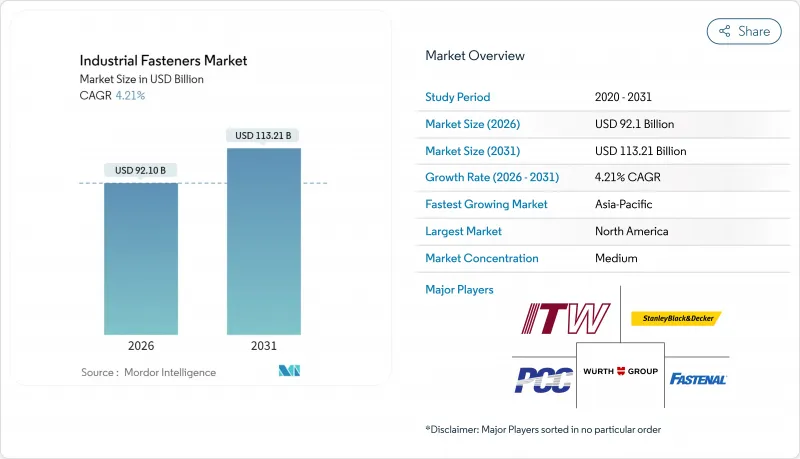

预计工业紧固件市场将从 2025 年的 883.8 亿美元成长到 2026 年的 921 亿美元,到 2031 年将达到 1,132.1 亿美元,2026 年至 2031 年的复合年增长率为 4.21%。

製造自动化、重型机械升级以及精密组装要求推动了市场需求,这些都要求复杂设备之间必须采用可靠、高强度的连接。工业4.0平台的普及加速了智慧感测器紧固件的应用,这些紧固件能够收集扭矩和预紧力数据,帮助製造商减少停机时间并提高可追溯性。回流和本地化策略透过缩短前置作业时间和降低全球物流风险,正在增强工业紧固件市场。同时,亚洲和北美地区基础设施升级和工业产能扩张投资的增加,也为结构件和特种产品的大宗订单提供了稳定的支援。

全球工业紧固件市场趋势与洞察

需要精密微型紧固件的工业自动化设备

如今,电子、医疗设备和半导体工厂需要重量仅为几克的微型螺丝。这些螺丝必须提供可重复的夹紧力,且循环时间小于一秒钟。 JR Automation 等整合商报告称,其定位精度可达微米级,这推动了对定制紧固件几何形状、扭矩小于 1 N·m 以及能够减少快速负载循环下螺纹变形的先进涂层的需求。电动工具製造商正在积极回应,推出无线、感测器控制的扳手,这些扳手能够记录每一次拧紧事件,并将资料无线传输到 MES 控制面板。PanasonicAccuPulse 平台就展示了这项功能。製造商指出,这些产品能够即时带来品质和成本方面的效益,例如减少返工站和缩短节拍时间,从而巩固高产量自动化生产线中工业紧固件市场的成长动能。随着工厂数位化的不断提高,製造商越来越多地指定使用内建 ID 晶片的紧固件,以实现可追溯性,并确保其能够顺利通过碗式送料器而不会发生堵塞。这一趋势已经从电子产品转向汽车电池模组和协作机器人关节,确保未来两年持续成长。

製造业的復苏正在推动国内对工业紧固件的需求。

疫情期间的地缘政治不确定性和港口拥堵迫使美国和欧洲的原始设备製造商 (OEM) 重新评估的不仅是单价,还有总到岸成本。目前,美国消费的紧固件中约有三分之二是国内生产的,扭转了十年前的境外外包趋势。本地供应商受益于更紧密的工程合作、更少的库存缓衝以及遵守公共基础设施合约中规定的「购买美国货」条款。从小型区域加工厂到跨国公司,对冷镦生产线、热处理炉和自动化分类单元的资本投资正在加速,从而提高了整个工业紧固件市场的运转率。虽然人事费用仍然高于亚洲,但 OEM 认为运输成本降低和产品过时风险减少是至关重要的优势。预计这种回流趋势将至少持续到 2028 年,并对市场规模产生正面影响,尤其是对于适合短期供应链的中高强度等级产品。

先进的连接技术取代了传统的工业紧固件

大批量设备製造商正在尝试将结构性黏着剂、雷射焊接和摩擦搅拌焊接应用于机壳和底盘等可接受永久性连接的领域。铆钉或螺栓与黏合剂圆角相结合的混合设计可以减少零件数量并改善负载分布,促使一些原始设备製造商 (OEM) 要求每个组装使用更少的机械紧固件。铝挤型製造商尤其积极地采用摩擦搅拌焊接技术来製造轻量化框架,从而在某些应用中减少螺栓的消费量。然而,泵浦、齿轮箱和製程阀组件等高维护环境仍需要可拆卸连接,这为工业紧固件市场维持了庞大的核心客户群。未来三年,这项阻碍因素的实际影响将取决于可拆卸性和轻量化之间的平衡。

细分市场分析

2025年,金属紧固件占总收入的91.45%,其中抗拉强度超过800兆帕的紧固件被广泛应用于重型机械、工业机器人和冲压生产线。 AISI 316等不锈钢牌号在食品加工和製药高压釜领域占据了高端市场,因为在这些领域,耐腐蚀性是首要考虑因素。合金钢和碳钢螺栓作为结构框架、齿轮箱外壳和炉门的标准选择,继续支撑工业紧固件市场。钛合金和镍合金特殊产品被用于涡轮机壳体和石油化学反应器,但与海绵合金生产相关的供应限制不时导致交货时间延长。这些趋势为金属产业在成熟市场持续稳定成长奠定了基础,而新兴国家的产能扩张则进一步推动了这一成长。

塑胶紧固件目前仅占市场份额的8.55%,但其成长速度迅猛,预计2031年将以6.72%的复合年增长率成长。尼龙螺丝是PLC机柜和LED驱动器外壳的标准配置,其优异的介电强度和化学惰性为其增添了价值。聚碳酸酯卡扣具有抗衝击性和易于回收的特性,常用于AGV车队中感测器模组的固定。智慧电錶组装对轻量化机壳的需求激增,进一步推动了聚合物材料的普及应用。随着洁净室产业自动化程度的不断提高,工程师开始使用PVDF和PEEK紧固件来消除粒状物排放。因此,预计到2031年,塑胶工业紧固件市场规模将接近97亿美元,凸显了材料组合多元化的明显趋势。

预计到2025年,外螺纹产品(螺栓、螺丝和螺柱)将占工业紧固件市场收入的44.30%。直径大于M24的螺栓主要应用于起重机、压力机和挤出机组件,而直径小于M6的机螺丝则用于固定伺服马达支架和线性致动器。国际标准化组织(ISO)的标准化工作正在推动这一细分市场的发展,简化了跨国原始设备製造商(OEM)的库存管理策略。此外,自动化料箱填充系统支援精实生产,也促进了互通性的发展,从而增强了工业紧固件市场大规模生产的成长。

航太级紧固件虽然出货量占比不高,但正以5.88%的复合年增长率成长。在工业用燃气涡轮机和高精度工具机中,超合金螺栓能够承受超过650°C的循环热负荷。抗振结构(例如,带有预紧螺母的柄部夹紧螺栓)为航太的技术向高循环压力机滑台的转移提供了宝贵的途径。随着国防合约的增加,拥有NADCAP认证的热处理和测试设施的供应商能够获得更高的价格。预计到2031年,航太级工业紧固件市场规模将成长15.3亿美元,反映出高性能连接件在关键任务型工业环境中的应用日益广泛。

区域分析

预计到2025年,亚洲将占全球收入的44.60%,年复合成长率达7.38%,主要得益于中国、印度和东南亚国协製造设施日益精进。政府对机器人应用的财政激励措施,以及大型工业园区的建设,正推动大批量碳钢和高端不銹钢产品订单的稳定成长。中国半导体製造设备的本土化生产带动了对超洁净、无颗粒紧固件的特殊需求,而印度的「印度製造」计画则促进了需要大直径螺栓的重型机械的本土化生产。这些计划共同推动了主要供应商和区域供应商的整体工业紧固件市场发展。

由于国防采购的回归、能源基础设施现代化以及汽车和电子产品组装的增加,北美仍然是关键市场。美国原始设备製造商 (OEM) 正在扩大国内紧固件采购,以减轻物流中断和外汇波动的影响。墨西哥等新兴地区正利用接近性美国买家的优势,为轻型车辆平台和家用电子电器的最终组装提供紧固件。加拿大由于资源开采设备需要用于矿用铲车和油砂加工生产线的耐高温紧固件,因此保持着成长动能。总体而言,稳定的计划储备支撑着该地区工业紧固件市场实现个位数的温和成长。

在欧洲,德国的精密机械工业、义大利的工具机出口以及法国的航太供应链正在创造强劲的价值。优先考虑永续性的法规结构鼓励材料可追溯性和闭合迴路回收,促使供应商采用QR码识别和再生金属含量。英国脱欧后的复杂情况导致部分供应链转移到欧洲大陆枢纽,但英国离岸风力发电电场对镀锌结构螺栓的需求仍然强劲。在工业4.0加速普及的推动下,预计到2031年,该地区的工业紧固件市场将以3.74%的复合年增长率成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车电气化将推动对电池相容型紧固件的需求。

- 抗震建筑标准要求的高强度结构螺栓

- 大直径耐腐蚀螺栓对于离岸风力发电设施至关重要。

- 航太紧固件供应链本地化

- 用于工业自动化设备的精密微型紧固件

- 新兴经济体的基础设施奖励策略

- 市场限制

- 在内饰模组中,黏合剂和胶带可替代金属紧固件。

- 镍和钼价格波动推高了不銹钢成本。

- 中小型製造商的认证负担(AS9100、IATF 16949)

- 钛合金短缺限制了航太紧固件的生产能力。

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值,十亿美元)

- 按原料

- 金属

- 碳钢

- 合金钢

- 不銹钢

- 非铁金属(铝、钛、铜)

- 塑胶

- 尼龙

- 聚碳酸酯

- 聚氯乙烯(PVC)及其他

- 金属

- 副产品

- 外螺纹紧固件

- 螺栓

- 拧紧

- 钉子

- 内螺纹紧固件

- 坚果

- 插入

- 无螺纹紧固件

- 铆钉

- 垫圈

- 别针和夹子

- 航太级紧固件

- 钛合金拉炼

- 超合金紧固件

- 外螺纹紧固件

- 透过使用

- 车

- 航太与国防

- 建筑/施工

- 工业机械与机器人

- 家用电器和电子产品

- 管道和暖通空调产品

- 其他工业应用

- 按销售管道

- OEM

- 售后市场/MRO

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Acument Global Technologies, Inc.

- Arconic Corporation

- LISI Group

- Nifco Inc.

- Hilti Corporation

- Stanley Black and Decker, Inc.

- MacLean-Fogg Company

- MISUMI Group Inc.

- Precision Castparts Corp.

- SFS Group

- Illinois Tool Works Inc.

- Fastenal Company

- Wurth Group

- Bossard Group

- PennEngineering

- Bulten AB

- KAMAX Holding GmbH

- Sundram Fasteners Ltd.

- Shanghai Prime Machinery Co. Ltd.

- TriMas Corporation

- Nitto Seiko Co., Ltd.

第七章 市场机会与未来展望

The industrial fasteners market is expected to grow from USD 88.38 billion in 2025 to USD 92.1 billion in 2026 and is forecast to reach USD 113.21 billion by 2031 at 4.21% CAGR over 2026-2031.

Demand is supported by manufacturing automation, heavy-machinery upgrades, and precision-assembly requirements that call for reliable, high-strength joints across complex equipment. Adoption of Industry 4.0 platforms is accelerating the use of smart, sensor-enabled fasteners that capture torque and preload data, helping manufacturers cut downtime and enhance traceability. Reshoring and localization strategies are reinforcing the industrial fasteners market by shortening lead times and reducing exposure to global logistics risks. Meanwhile, rising investment in infrastructure renewal and industrial capacity expansions in Asia and North America underpins a steady flow of large-volume orders for structural and specialty products.

Global Industrial Fasteners Market Trends and Insights

Industrial Automation Equipment Requiring Precision Micro-Fasteners

Electronics, medical-device, and semiconductor plants now specify micro-screws that weigh a fraction of a gram yet must deliver repeatable clamp loads at cycle times below one second. Integrators such as JR Automation report micron-level placement accuracy, and this drives demand for bespoke fastening geometries, torques under 1 N*m, and advanced coatings that mitigate galling under rapid load cycles. Power-tool suppliers are responding with cordless transducer-controlled wrenches that log every tightening event and transmit data wirelessly to MES dashboards, a capability showcased in Panasonic's AccuPulse platform. Manufacturers cite immediate quality-cost benefits, including fewer rework stations and shorter takt times, reinforcing the industrial fasteners market trajectory in high-volume automated lines. As more plants digitize, specifiers increasingly insist on fasteners that integrate ID chips for traceability and can be fed through bowl feeders without jamming. The trend has already migrated from electronics to automotive battery modules and collaborative-robot joints, ensuring sustained growth over the next two years

Manufacturing Reshoring Driving Domestic Industrial Fastener Demand

Geopolitical uncertainty and pandemic-era port congestion have prompted US and EU OEMs to reevaluate total landed costs rather than unit price alone. Roughly two-thirds of fasteners consumed in the United States are now produced domestically, a reversal of the offshoring trend observed a decade earlier. Local suppliers benefit from closer engineering collaboration, lower inventory buffers, and compliance with Buy-America clauses embedded in public-infrastructure awards. Capital investment in cold-heading lines, heat-treatment furnaces, and automated sorting cells is accelerating at both regional job shops and multinational firms, lifting utilization rates across the industrial fasteners market. While labor costs remain higher than in Asia, OEMs cite freight savings and reduced obsolescence risk as decisive advantages. The reshoring dynamic is expected to maintain a positive thrust on market volumes through at least 2028, especially for medium-to-high-strength grades that favor short supply chains.

Advanced Joining Technologies Substituting Traditional Industrial Fasteners

High-volume equipment producers are trialing structural adhesives, laser welding, and friction-stir welding for enclosures and chassis where permanent bonds are acceptable. Hybrid designs that combine a rivet or bolt with adhesive fillets reduce component counts and improve load distribution, compelling some OEMs to specify fewer mechanical fasteners per assembly. Aluminum extrusion manufacturers are particularly active in adopting friction-stir welding for lightweight frames, eroding bolt consumption in select applications. Nonetheless, maintenance-heavy environments such as pumps, gearboxes, and process-valve assemblies still require removable joints, preserving a large core base for the industrial fasteners market. The balance between removability and weight savings will define this restraint's real-world impact over the next three years.

Other drivers and restraints analyzed in the detailed report include:

- Heavy Machinery Modernization in Emerging Industrial Markets

- Industry 4.0 Implementation Requiring Smart Fastening Solutions

- Raw Material Cost Volatility Affecting Industrial Fastener Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal fasteners held 91.45% of 2025 revenue as heavy-duty machinery, industrial robots, and press lines demanded tensile strengths above 800 MPa. Stainless-steel grades such as AISI 316 captured a premium niche in food processing and pharmaceutical autoclaves where corrosion resistance is paramount. Alloy-steel and carbon-steel bolts remain the default choices for structural frames, gearbox casings, and furnace doors, underpinning the industrial fasteners market. Titanium and nickel-alloy specialty items serve turbine housings and petrochemical reactors, yet supply constraints tied to sponge production cause periodic lead-time extensions. These dynamics underpin a metal segment that, while mature, continues to accrue incremental gains from capacity expansions in emerging economies.

Plastic fasteners, though only 8.55% of volume, are scaling quickly on a 6.72% CAGR through 2031. Nylon screws are now routine in PLC cabinets and LED driver housings, where dielectric strength and chemical inertness add value. Polycarbonate clips secure sensor modules in AGV fleets because they resist impact and allow simplified recycling at end-of-life. Fast-growing demand for lightweight enclosures in smart-meter assemblies further propels polymer uptake. As automation spreads across clean-room industries, engineers are turning to PVDF and PEEK fasteners to eliminate particulate shedding. Consequently, the industrial fasteners market size for plastic variants is projected to approach USD 9.7 billion by 2031, highlighting a clear diversification trend across material portfolios.

Externally threaded products-bolts, screws, studs-delivered 44.30% of industrial fasteners market revenue in 2025. Bolts exceeding M24 diameter dominate crane, press, and extruder assemblies, while machine screws below M6 secure servo-motor mounts and linear actuators. The segment benefits from International Organization for Standardization (ISO) harmonization, which simplifies stocking strategies for multinational OEMs. Interchangeability also supports automatic bin-filling systems that underpin lean manufacturing, reinforcing high-volume growth in the industrial fasteners market.

Aerospace-grade fasteners, although a small slice of shipments, are advancing at 5.88% CAGR. In industrial gas turbines and high-precision machine tools, super-alloy bolts resist cyclical thermal loads exceeding 650 °C. Vibration-resistant configurations-such as shank-grip bolts with prevailing-torque nuts-bring transfer value from aerospace to high-cycle press slides. As defense contracts ramp, suppliers with NADCAP-certified heat-treatment and lab facilities enjoy premium pricing. The industrial fasteners market size for aerospace-grade variants is projected to add USD 1.53 billion by 2031, reflecting broader acceptance of high-performance joints in mission-critical industrial settings.

The Industrial Fasteners Market Report is Segmented by Raw Materials (Metal, Plastic), Products (Externally Threaded Fasteners, Internally Threaded Fasteners, Non-Threaded Fasteners, Aerospace Grade Fasteners), by Application (Automotive, Aerospace, Building and Construction, Industrial Machinery, Home Appliances, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia generated 44.60% of global revenue in 2025 and is projected to expand at 7.38% CAGR on the back of manufacturing upgrades across China, India, and ASEAN nations. Fiscal incentives for robotics adoption, combined with large-scale industrial park developments, funnel steady orders into both high-volume carbon-steel and premium stainless-steel categories. China's localization of semiconductor equipment drives specialty demand for ultra-clean, particle-free fasteners, while India's Make-in-India policy pushes local production of heavy machinery that relies on large-diameter bolts. Collectively, these projects elevate the industrial fasteners market across tier-one and regional suppliers.

North America remains a critical node, supported by defense procurement, energy-infrastructure modernization, and reshoring of automotive and electronics assembly. US OEMs have ramped domestic fastener sourcing to mitigate logistics shocks and currency swings. Emerging hubs in Mexico supply fasteners for light-vehicle platforms and consumer-electronics final assembly, leveraging proximity to US buyers. Canada retains momentum through resource extraction equipment that demands extreme-temperature fasteners in mining shovels and oil-sands processing lines. Overall, stable project pipelines maintain mid-single-digit gains in the regional industrial fasteners market.

Europe contributes robust value through Germany's precision-machinery sector, Italy's machine-tool exports, and France's aerospace supply chain. Regulatory frameworks that prioritize sustainability encourage material traceability and closed-loop recycling, motivating suppliers to adopt QR-coded identification and reclaimed-metal content. Post-Brexit complexity has redirected some supply flows toward continental hubs, but UK offshore-wind installations sustain niche demand for galvanized structural bolts. With Industry 4.0 adoption accelerating, the region's industrial fasteners market is forecast to register a 3.74% CAGR through 2031.

- Acument Global Technologies, Inc.

- Arconic Corporation

- LISI Group

- Nifco Inc.

- Hilti Corporation

- Stanley Black and Decker, Inc.

- MacLean-Fogg Company

- MISUMI Group Inc.

- Precision Castparts Corp.

- SFS Group

- Illinois Tool Works Inc.

- Fastenal Company

- Wurth Group

- Bossard Group

- PennEngineering

- Bulten AB

- KAMAX Holding GmbH

- Sundram Fasteners Ltd.

- Shanghai Prime Machinery Co. Ltd.

- TriMas Corporation

- Nitto Seiko Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive Electrification Boosting Demand for Battery-Ready Fasteners

- 4.2.2 Seismic-Resistant Building Codes Driving High-Strength Structural Bolts

- 4.2.3 Offshore Wind Installations Requiring Large-Diameter Corrosion-Resistant Bolts

- 4.2.4 Localization of Aerospace Fastener Supply Chains

- 4.2.5 Precision Micro-Fasteners for Industrial Automation Equipment

- 4.2.6 Infrastructure Stimulus Programs in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 Adhesives and Tapes Substituting Metal Fasteners in Interior Modules

- 4.3.2 Volatile Nickel/Molybdenum Prices Inflating Stainless-Steel Costs

- 4.3.3 Certification Burden (AS9100, IATF 16949) for Small Manufacturers

- 4.3.4 Titanium Alloy Shortages Limiting Aerospace Fastener Capacity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD BN)

- 5.1 By Raw Material

- 5.1.1 Metal

- 5.1.1.1 Carbon Steel

- 5.1.1.2 Alloy Steel

- 5.1.1.3 Stainless Steel

- 5.1.1.4 Non-Ferrous (Aluminum, Titanium, Copper)

- 5.1.2 Plastic

- 5.1.2.1 Nylon

- 5.1.2.2 Polycarbonate

- 5.1.2.3 PVC and Others

- 5.1.1 Metal

- 5.2 By Product

- 5.2.1 Externally Threaded Fasteners

- 5.2.1.1 Bolts

- 5.2.1.2 Screws

- 5.2.1.3 Studs

- 5.2.2 Internally Threaded Fasteners

- 5.2.2.1 Nuts

- 5.2.2.2 Inserts

- 5.2.3 Non-Threaded Fasteners

- 5.2.3.1 Rivets

- 5.2.3.2 Washers

- 5.2.3.3 Pins and Clips

- 5.2.4 Aerospace-Grade Fasteners

- 5.2.4.1 Titanium Fasteners

- 5.2.4.2 Super-Alloy Fasteners

- 5.2.1 Externally Threaded Fasteners

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Building and Construction

- 5.3.4 Industrial Machinery and Robotics

- 5.3.5 Home Appliances and Electronics

- 5.3.6 Plumbing and HVAC Products

- 5.3.7 Other Industrial Applications

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket / MRO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acument Global Technologies, Inc.

- 6.4.2 Arconic Corporation

- 6.4.3 LISI Group

- 6.4.4 Nifco Inc.

- 6.4.5 Hilti Corporation

- 6.4.6 Stanley Black and Decker, Inc.

- 6.4.7 MacLean-Fogg Company

- 6.4.8 MISUMI Group Inc.

- 6.4.9 Precision Castparts Corp.

- 6.4.10 SFS Group

- 6.4.11 Illinois Tool Works Inc.

- 6.4.12 Fastenal Company

- 6.4.13 Wurth Group

- 6.4.14 Bossard Group

- 6.4.15 PennEngineering

- 6.4.16 Bulten AB

- 6.4.17 KAMAX Holding GmbH

- 6.4.18 Sundram Fasteners Ltd.

- 6.4.19 Shanghai Prime Machinery Co. Ltd.

- 6.4.20 TriMas Corporation

- 6.4.21 Nitto Seiko Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment