|

市场调查报告书

商品编码

1911467

北美工业紧固件市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)North America Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

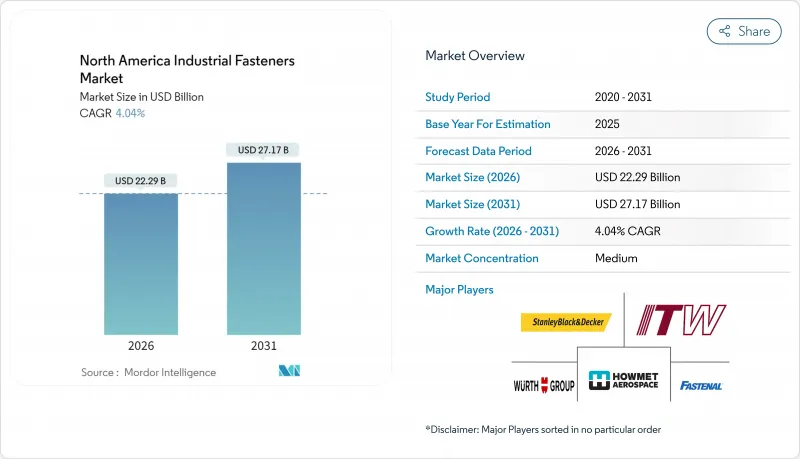

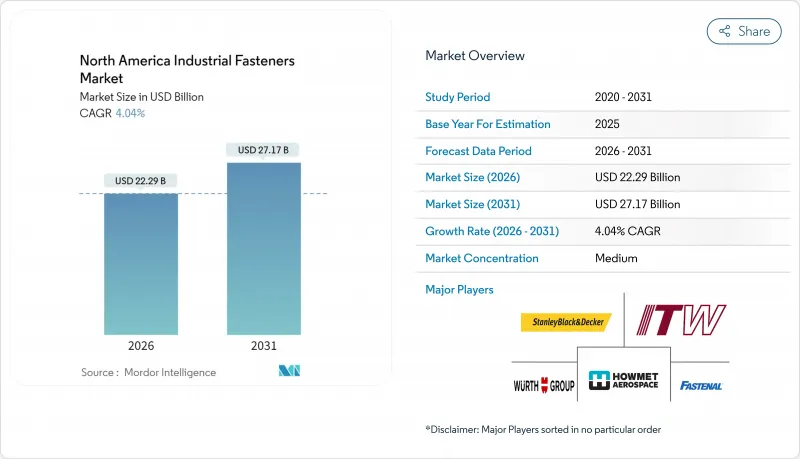

预计到 2026 年,北美工业紧固件市场规模将达到 222.9 亿美元,从 2025 年的 214.2 亿美元成长到 2031 年的 271.7 亿美元,2026 年至 2031 年的复合年增长率为 4.04%。

儘管投入成本有所波动,但稳健的基础设施投资、不断增长的电动车产量以及优先考虑国内製造业的回流计划,共同维持了成长动能。住宅、商业和民用工程计划的建设活动支撑了基本需求,而汽车和航太项目则带来了高价值的销售成长。供应商透过整合数位化可追溯性、耐腐蚀涂层和针对特定应用的设计,增强了自身的定价能力。终端使用者继续优先考虑能够缩短组装时间、延长使用寿命并简化合规流程的工程解决方案。市场竞争强度仍适中。主要现有企业正利用规模经济、深厚的经销网络和策略收购来巩固其市场地位。

北美工业紧固件市场趋势与洞察

建筑业的成长势头支撑了紧固件需求。

根据1.2兆美元的《基础设施投资和就业创造法案》,建筑支出确保了桥樑、交通枢纽和公共产业计划所需的高强度螺栓、锚栓和螺纹桿的稳定供应。德克萨斯州和佛罗里达州的住宅维修和多用户住宅开工建设推动建材经销商持续大量订购螺丝和钉子。预製和模组化建筑技术倾向于使用精密设计的紧固件,这些紧固件可以快速调整,并在起重机安装过程中保持公差。供应链管理人员越来越多地指定使用能够承受腐蚀性沿海和寒冷气候条件的涂层,从而降低终身维护成本。库存具有完整可追溯性的认证批次经销商商正在赢得要求遵守「购买美国」政策并即时交货的合约。

汽车电气化正在改变紧固件的要求

电池式电动车平台采用专用螺柱、套筒螺帽和铆钉来应对热循环,并在电池组内提供电气绝缘。汽车製造商在扩建其美国组装时,需要使用与铝相容的紧固件来限制轻量化底盘中的电流腐蚀。高速机器人组装提高了对扭矩和张力性能一致性的需求,并对供应商提出了更严格的尺寸公差要求。电动皮卡和SUV产量的成长增加了每辆车平均使用的紧固件数量,从而推高了符合APQP和PPAP标准的工程零件的价格。与电池製造商的合作正在加速下一代固态电池紧固方法的共同开发。

结构性黏着剂面临的挑战是挑战传统紧固件。

在电动车、飞机内装和家用电子电器领域,轻量化策略正逐渐取代机械硬体,尤其是在维护性要求不高的情况下,采用黏合剂连接。黏合剂能够均匀分散负荷,减少应力集中和钻孔。结合黏合剂的混合连接技术可以减少螺栓数量,从而缩短安装时间,降低零件数量,最终降低对紧固件的整体需求。紧固件供应商正积极响应这一趋势,推广可拆卸设计以提高维护性,并专注于扭矩管理至关重要的安全关键领域。易于拆卸涂层技术的研发旨在与黏合剂形成互补,而非直接竞争。

细分市场分析

2025年,金属紧固件占北美工业紧固件市场76.80%的份额,反映了其在建筑、机械和运输业的性价比优势。碳钢螺栓用于固定公路和桥樑结构,而不銹钢则用于食品加工和製药厂。铝製紧固件用于支撑航太面板和电动汽车电池机壳,其重量优势抵消了较高的单位成本。儘管金属紧固件占据主导地位,但钢材价格的周期性波动正在挤压利润空间,迫使製造商实现二次加工自动化并加强废料管理。标准化规范简化了各州和各省的采购流程,使这一领域持续受益。

复合材料和特殊材料将成为成长最快的细分市场,到2031年将以5.14%的复合年增长率成长。玻璃纤维增强聚合物、陶瓷和高温合金弥补了金属易受腐蚀、导电性和磁力干扰等性能缺陷的不足。在离岸风力发电涡轮机机舱中,碳纤维螺柱无需牺牲涂层即可承受海水侵蚀。半导体製造厂指定使用PEEK螺丝,以避免无尘室中颗粒扩散。成长取决于材料科学的持续创新以及终端市场附近成型能力的扩展,从而缩短前置作业时间。虽然目前价格溢价限制了其应用,但随着生命週期成本分析显示在恶劣环境下非金属材料更具优势,其应用正在稳步增长。这些趋势增强了北美工业紧固件市场的长期前景。

截至2025年,供应给木材经销商、维修店和批发商的标准级五金件占北美工业紧固件市场62.10%的份额。大直径六角螺栓、粗牙螺丝和钉子以散装桶装形式运输,用于日常维修和组装工作。自动化冷锻生产线实现了规模经济,从而能够以具有竞争力的价格抵御进口压力。然而,商品化降低了利润率,并使生产商面临原物料价格波动的风险。

受航太、国防和能源产业对耐热合金、精密螺纹和特殊涂层的需求所推动,高性能紧固件预计将以每年 4.98% 的速度成长。超合金螺柱用于固定喷射发动机机壳,而双相不銹钢螺栓则用于固定海底管线以承受循环压力。 AS9100 和 NADCAP 等认证会延长前置作业时间,但一旦核准,就能锁定供应商并带来可观的收入来源。许多公司正在试验积层製造技术,以生产无需昂贵模具的复杂原型。这些专用零件应用范围的扩大提高了价值密度,即使在产量放缓的情况下也能支撑收入,并推动北美工业紧固件市场的高端细分市场发展。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 建筑业成长

- 汽车和航太製造业的扩张

- 耐腐蚀涂层技术的进步

- 北美电动车供应链的快速成长

- 透过《美国采购法案》促进在地采购

- 数位追溯和智慧紧固件概念

- 市场限制

- 结构性黏着剂的广泛应用

- 钢铁和非铁金属价格波动

- 电镀业有严格的环境法规。

- 特种产品产能短缺是由回流主导的产能不足

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济趋势如何影响市场

第五章 市场规模与成长预测

- 材料

- 金属

- 塑胶

- 复合材料和特殊材料

- 按年级

- 标准

- 高效能

- 依产品类型

- 外螺纹

- 内螺纹

- 非螺纹式

- 专用/特殊用途

- 透过最终用户使用

- OEM

- 汽车/汽车产业

- 内燃机轻型车辆

- 中大型卡车和巴士采用内燃机(ICE)

- 电动车

- 航太

- 机械/资本财

- 电气和电子设备

- 金属加工

- 医疗设备

- 其他OEM应用

- 汽车/汽车产业

- 维护、修理和营运 (MRO)

- 建造

- OEM

- 透过涂层/表面处理

- 未上漆(未涂层)

- 镀锌

- 热镀锌

- 聚四氟乙烯和特殊涂层

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Illinois Tool Works Inc.

- Howmet Aerospace Inc.

- Stanley Black and Decker, Inc.

- Wurth Group

- Fastenal Company

- Fontana Gruppo(Acument Global Technologies, Inc.)

- LISI Group

- Nifco Inc.

- Bulten AB

- ARaymond Group

- Marmon Holdings, Inc.(Berkshire Hathaway)

- Hilti Corporation

- KAMAX Holding GmbH and Co. KG

- Bossard Holding AG

- PennEngineering and Manufacturing Corp.

- Simpson Manufacturing Co., Inc.

- Precision Castparts Corp.(SPS Technologies)

- TriMas Corporation

- Agrati Group

- SFS Group AG

- Optimas Solutions

第七章 市场机会与未来展望

North America industrial fasteners market size in 2026 is estimated at USD 22.29 billion, growing from 2025 value of USD 21.42 billion with 2031 projections showing USD 27.17 billion, growing at 4.04% CAGR over 2026-2031.

Healthy infrastructure outlays, rising electric-vehicle production, and reshoring programs that prioritize domestic manufacturing sustain momentum despite input-cost volatility. Construction activity across residential, commercial, and civil projects underpins baseline demand, while automotive and aerospace programs add high-value volume. Suppliers that integrate digital traceability, corrosion-resistant coatings, and application-specific designs strengthen pricing power. End-users continue to favor engineered solutions that cut assembly time, extend service life, and ease compliance. Competitive intensity remains moderate as leading incumbents leverage scale, distribution depth, and targeted acquisitions to solidify positions.

North America Industrial Fasteners Market Trends and Insights

Construction sector momentum sustains fastener demand

Construction outlays stemming from the USD 1.2 trillion Infrastructure Investment and Jobs Act maintain a steady pipeline of bridges, transit hubs, and utility projects that rely on high-strength bolts, anchors, and threaded rods. Residential remodeling and multifamily starts in Texas and Florida keep builders' merchants ordering large volumes of bulk screws and nails. Prefabricated and modular building techniques favor precision-engineered fasteners that align quickly and hold tolerances during crane placement. Supply-chain managers increasingly specify coatings that withstand corrosive coastal or cold-climate conditions to cut lifetime maintenance. Distributors stocking certified lots with full traceability win contracts that require Buy-American compliance and immediate delivery.

Automotive electrification reshapes fastener requirements

Battery-electric vehicle platforms include specialized studs, sleeve nuts, and rivets that manage thermal cycles and electrical isolation within battery packs. Automakers expanding U.S. assembly lines mandate aluminum-compatible fasteners that curb galvanic corrosion in lightweight chassis. High-speed robotic assembly drives demand for consistent torque-tension performance, pushing suppliers toward tighter dimensional tolerances. As production of electric pickups and SUVs scales, average fastener content per unit rises, supporting premium pricing for engineered parts certified to APQP and PPAP standards. Collaborations with cell manufacturers accelerate the co-development of fastening methods for next-generation solid-state batteries.

Structural adhesives challenge traditional fasteners

Lightweighting strategies in electric cars, aircraft interiors, and consumer electronics substitute bonded joints for mechanical hardware where serviceability is non-critical. Adhesives distribute loads evenly, lowering stress concentrations and reducing drill-hole preparation. Hybrid joining techniques that pair bonding with fewer bolts cut installation time and part counts, trimming overall fastener demand. Fastener suppliers counteract by promoting removable designs for maintenance and by targeting safety-critical zones where torque-auditable joints remain mandatory. R&D into disassembly-friendly coatings seeks to complement adhesive use rather than compete directly.

Other drivers and restraints analyzed in the detailed report include:

- Advances in corrosion-resistant coatings

- Rapid growth of the North American EV supply chain

- Steel price volatility creates margin pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal fasteners accounted for 76.80% of the North America industrial fasteners market in 2025, reflecting their strength-to-cost advantage in construction, machinery, and transportation. Carbon-steel bolts anchor highway bridges, while stainless grades service food-processing and pharmaceutical plants. Aluminum fasteners support aerospace panels and EV battery enclosures where weight savings offset higher unit prices. Despite dominance, cyclical shifts in steel prices can compress margins, prompting producers to automate secondary operations and tighten scrap control. The segment continues to benefit from standardized specifications that simplify procurement across state and provincial lines.

Composite and specialty materials represent the fastest-growing slice at a 5.14% CAGR through 2031. Glass-fiber reinforced polymers, ceramics, and high-temperature alloys fill performance gaps where metals suffer corrosion, electrical conductivity, or magnetic interference. In offshore wind nacelles, carbon-fiber studs resist seawater attack without sacrificial coatings. Semiconductor fabs specify PEEK screws to avoid particle shedding inside cleanrooms. Growth hinges on continued material-science breakthroughs and expanded molding capacity near end-markets to shorten lead times. Price premiums limit volume penetration today, yet adoption rises steadily as life-cycle cost analyses favor non-metallic options in harsh environments. These dynamics fortify the long-term outlook for the North America industrial fasteners market.

Standard-grade hardware supplied to lumber yards, maintenance shops, and bulk distributors captured 62.10% of the North America industrial fasteners market size in 2025. Large-diameter hex bolts, coarse-thread screws, and nails ship in high-volume keg packs to support routine repair and erection work. Automated cold-heading lines deliver economies of scale, allowing competitive pricing that resists import pressure. Nevertheless, commoditization breeds thin margins and exposes producers to raw-material swings.

High-performance fasteners are projected to grow 4.98% annually as aerospace, defense, and energy sectors specify heat-resistant alloys, close-tolerance threads, and proprietary coatings. Super-alloy studs secure jet-engine casings, while duplex-stainless bolts fasten subsea pipelines subjected to cyclic pressure. Qualification regimes such as AS9100 and NADCAP extend lead times but lock in suppliers once approved, enabling attractive returns. Many firms adopt additive-manufacturing pilots to prototype complex geometries without costly tooling. Expanded use of such specials lifts value density, bolstering revenue even if tonnage lags, and supports the premium tier of the North America industrial fasteners market.

The North America Industrial Fasteners Market is Segmented by Material (Metal, Plastic, and Composite and Specialty), Grade (Standard and High-Performance), Product Type (Externally Threaded, Internally Threaded, and More), End-User Application (OEM, MRO, and Construction), Coating/Finish (Plain, Zinc-Plated, and More), and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Illinois Tool Works Inc.

- Howmet Aerospace Inc.

- Stanley Black and Decker, Inc.

- Wurth Group

- Fastenal Company

- Fontana Gruppo (Acument Global Technologies, Inc.)

- LISI Group

- Nifco Inc.

- Bulten AB

- ARaymond Group

- Marmon Holdings, Inc. (Berkshire Hathaway)

- Hilti Corporation

- KAMAX Holding GmbH and Co. KG

- Bossard Holding AG

- PennEngineering and Manufacturing Corp.

- Simpson Manufacturing Co., Inc.

- Precision Castparts Corp. (SPS Technologies)

- TriMas Corporation

- Agrati Group

- SFS Group AG

- Optimas Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of the Construction Sector

- 4.2.2 Expansion of Automotive and Aerospace Manufacturing

- 4.2.3 Advances in Corrosion-Resistant Coatings

- 4.2.4 Rapid Growth of North American EV Supply Chain

- 4.2.5 Buy-American Acts Driving Local Sourcing

- 4.2.6 Digital Traceability and Smart-Fastener Initiatives

- 4.3 Market Restraints

- 4.3.1 Rising Adoption of Structural Adhesives

- 4.3.2 Volatility in Steel and Non-Ferrous Metal Prices

- 4.3.3 Stringent Environmental Regulations on Plating

- 4.3.4 Reshoring-led Capacity Bottlenecks for Specials

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material

- 5.1.1 Metal

- 5.1.2 Plastic

- 5.1.3 Composite and Specialty

- 5.2 By Grade

- 5.2.1 Standard

- 5.2.2 High-Performance

- 5.3 By Product Type

- 5.3.1 Externally Threaded

- 5.3.2 Internally Threaded

- 5.3.3 Non-Threaded

- 5.3.4 Application-Specific/Specialty

- 5.4 By End-User Application

- 5.4.1 OEM

- 5.4.1.1 Motor Vehicles/Automotive

- 5.4.1.1.1 ICE Light Vehicles

- 5.4.1.1.2 ICE Medium and Heavy Trucks/Buses

- 5.4.1.1.3 Electric Vehicles

- 5.4.1.2 Aerospace

- 5.4.1.3 Machinery and Capital Goods

- 5.4.1.4 Electrical and Electronics

- 5.4.1.5 Fabricated Metals

- 5.4.1.6 Medical Equipment

- 5.4.1.7 Other OEM Applications

- 5.4.1.1 Motor Vehicles/Automotive

- 5.4.2 Maintenance, Repair and Operations (MRO)

- 5.4.3 Construction

- 5.4.1 OEM

- 5.5 By Coating/Finish

- 5.5.1 Plain (Uncoated)

- 5.5.2 Zinc-Plated

- 5.5.3 Hot-Dip Galvanized

- 5.5.4 PTFE and Specialty Coatings

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Illinois Tool Works Inc.

- 6.4.2 Howmet Aerospace Inc.

- 6.4.3 Stanley Black and Decker, Inc.

- 6.4.4 Wurth Group

- 6.4.5 Fastenal Company

- 6.4.6 Fontana Gruppo (Acument Global Technologies, Inc.)

- 6.4.7 LISI Group

- 6.4.8 Nifco Inc.

- 6.4.9 Bulten AB

- 6.4.10 ARaymond Group

- 6.4.11 Marmon Holdings, Inc. (Berkshire Hathaway)

- 6.4.12 Hilti Corporation

- 6.4.13 KAMAX Holding GmbH and Co. KG

- 6.4.14 Bossard Holding AG

- 6.4.15 PennEngineering and Manufacturing Corp.

- 6.4.16 Simpson Manufacturing Co., Inc.

- 6.4.17 Precision Castparts Corp. (SPS Technologies)

- 6.4.18 TriMas Corporation

- 6.4.19 Agrati Group

- 6.4.20 SFS Group AG

- 6.4.21 Optimas Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet Need Assessment