|

市场调查报告书

商品编码

1911474

法国POS终端市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)France POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

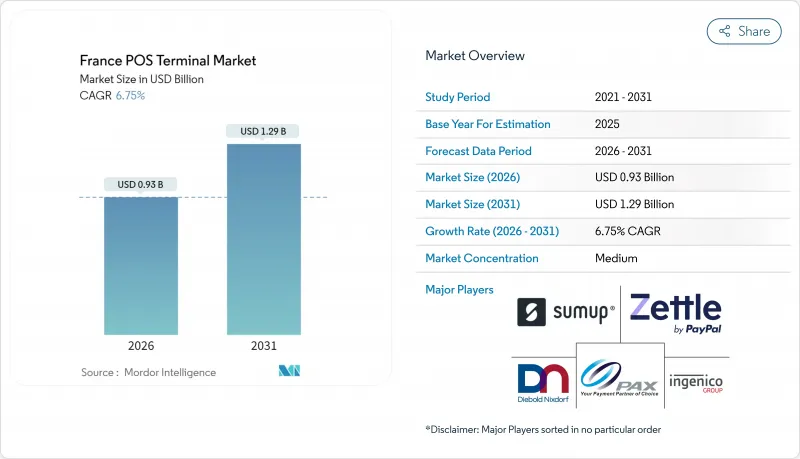

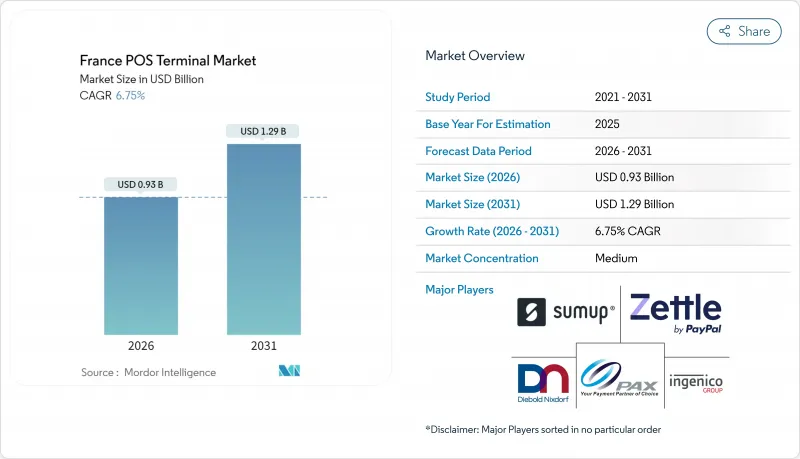

法国POS终端市场预计将从2025年的8.7亿美元成长到2026年的9.3亿美元,到2031年达到12.9亿美元,2026年至2031年的复合年增长率为6.75%。

强劲的需求主要受非接触式支付使用量成长、PSD2(支付服务指令II)相关监管要求和强客户认证以及欧洲支付倡议组织 (EPI) wero 服务的推广等因素驱动,这些因素都促使商家升级旧终端。硬体供应商受惠于覆盖约230万个商家分行的更新换代週期,而软体供应商则透过降低小规模企业总体拥有成本 (TCO) 的 SoftPOS 解决方案不断扩大市场份额。儘管固定终端在高交易量零售环境中仍占据主导地位,但随着饭店、零工经济和路边取货业者优先考虑支付柔软性,行动终端正在逐步成长。市场竞争依然适中。 Worldline 透过 Ingenico 占据 35% 的市场份额,而 Verifone、PAX Technology 和快速成长的 SoftPOS参与企业正在加剧价格竞争并加速产品创新。

法国POS终端市场趋势与洞察

非接触式支付的激增正在重塑终端要求。

到2024年,法国消费者将推动非接触式支付在POS交易中的比例达到70%,超过欧洲58%的平均水准。 50欧元的消费限额提高了平均交易额,促使商家优先考虑支援NFC和传统非接触式支付的双介面终端。家乐福和欧尚等大型零售商已在商店交易中使用非接触式支付,而随着非接触式支付率下降23%,老旧终端的更新换代正在加速。因此,法国POS终端市场正着力提升NFC性能、电池续航力以及适用于户外市场和配送车辆的离线非接触式功能。区域差异依然存在,法兰西岛大区的渗透率超过85%,而农村地区的渗透率仅为62%,这给提供连接优化解决方案的供应商造成了地理上的缺口。

全通路零售数位化加速基础设施现代化

整合商务策略正迫使零售商透过整合设备同步线上、行动装置和商店资料流。 Fnac-Darty在2024年部署了15,000台整合终端,这表明市场对能够透过单一萤幕处理订单、退货和库存查询的系统有着强劲的需求。在销售额超过1,000万欧元的连锁店中,约有68%计划在2026年前完成升级,随着零售商越来越多地从固定收银台转向可在店内移动的行动终端,法国POS终端市场也将随之扩大。行动终端的普及缩短了顾客等待时间,提高了员工效率,并将忠诚度分析数据连接到云端平台,这促使以软体为中心的供应商将支付应用程式、客户关係管理(CRM)和库存管理工具打包成订阅方案。

中小企业的成本意识是采用新技术的一大障碍。

约73%的法国中小企业表示,成本是升级硬体的主要障碍。设备价格从200欧元到800欧元不等,每月费用从15欧元到45欧元不等,这给利润微薄、业务量大的企业带来了沉重负担。在仍需使用GPRS作为备用网路的遍远地区,网路连线的不足进一步加剧了预算压力。政府透过「法国远距」(France Le Rance)计画提供500欧元的补贴,但繁琐的申请流程限制了参与,并将许多服务供应商排除在外。供应商正透过提供24至36个月的设备分期付款计划和推广SoftPOS应用程式来应对这一问题,但普及速度仍然缓慢。

细分市场分析

至2025年,非接触式终端将占法国POS终端市场55.92%的份额,并将以8.11%的复合年增长率成长,到2031年成为市场主流。这项转变与计画于2026年推出的数位欧元密切相关,届时将强制要求使用能够进行央行数位货币(CBDC)交易的双模终端。目前,高价值奢侈品和汽车经销商在50欧元以上的交易中仍然依赖基于PIN码的晶片认证,但消费者的偏好表明,近场通讯(NFC)具有明显的优势。

非接触式支付的未来成长将主要得益于2023年起双界面卡94%的发行率以及Carte Bancaire计划中25欧元的离线非接触式支付限额。这些因素将扩大非接触式支付在户外市场和网路连接较差的配送车辆中的应用,从而推动对小型化、节能型读卡器的需求成长。区域差异依然存在:法兰西岛大区的非接触式支付普及率已达85%,而农村地区的普及率仍仅为62%,这促使厂商推出低覆盖范围的读卡器以挖掘尚未开发的潜在需求。随着非接触式支付部署的扩大,预计法国POS终端市场的非接触式硬体销售量将超过整体市场平均水平,这将促使供应商更加关注NFC无线电的可靠性、天线设计以及EMV 3级认证週期。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 法国消费者非接触式支付方式普及率激增

- 全通路零售数位化加速POS系统更新周期

- 根据支付服务指令2 (PSD2) 制定的欧盟和各国无现金经济促进措施和加强安全措施

- 基于智慧型手机的软POS系统和非接触式支付降低了中小型零售商的整体硬体拥有成本。

- 欧洲支付倡议(EPI) 正准备支持在传统 POS 机上进行帐户间QR CODE支付。

- 消费者对店内先买后付/短期分期付款选项的需求日益增长。

- 市场限制

- 对于法国的中小型企业来说,设备的初始成本和维护成本都非常高。

- PCI-DSS/SCA网路安全合规负担加重

- 即将到来的后量子密码技术升级将使韧体生命週期更加复杂。

- 随着顾客流量从实体店转向电子商务,传统固定POS终端的运转率正在下降。

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过付款方式

- 联繫类型

- 非接触式

- 按POS类型

- 固定式POS系统

- 行动/可携式POS系统

- 按最终用户行业划分

- 零售

- 饭店业

- 卫生保健

- 运输/物流

- 其他的

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ingenico Group SA(Worldline)

- Verifone Systems, Inc.

- PAX Technology Ltd.

- NCR Corporation

- Castles Technology Co., Ltd.

- SumUp Payments Limited

- Zettle(Paypal)

- myPOS World Ltd.

- NEC Corporation

- AURES Group SA

- Diebold Nixdorf

- BBPOS Limited

- Newland Payment Technology Co., Ltd.

- Shenzhen Xinguodu Technology Co., Ltd.

- Fujian Centerm Information Co., Ltd.

- Bitel Co., Ltd.

- Wiseasy Technology Co., Ltd.

- Fujian Landi Commercial Equipment Co., Ltd.

- dejamobile SAS

- Innovorder SAS

第七章 市场机会与未来展望

The France POS Terminal Market is expected to grow from USD 0.87 billion in 2025 to USD 0.93 billion in 2026 and is forecast to reach USD 1.29 billion by 2031 at 6.75% CAGR over 2026-2031.

Robust demand arises from rising contactless-payment usage, regulatory mandates linked to PSD2 and Strong Customer Authentication, and the rollout of the European Payments Initiative's wero service, all of which compel merchants to refresh legacy devices. Hardware suppliers benefit from a replacement cycle encompassing roughly 2.3 million merchant locations, while software vendors gain share through SoftPOS offerings that lower total cost of ownership for micro-enterprises. Fixed terminals still dominate high-volume retail environments, yet mobile devices capture incremental growth as hospitality, gig-economy and curbside-pickup operators prioritize payment flexibility. Competition remains moderate: Worldline commands a 35% position via Ingenico, but Verifone, PAX Technology and fast-scaling SoftPOS players intensify pricing pressure and speed product innovation.

France POS Terminal Market Trends and Insights

Contactless Payment Surge Reshapes Terminal Requirements

French consumers pushed contactless uptake to 70% of POS transactions in 2024, eclipsing the 58% European average. The higher EUR 50 limit enhanced average ticket values and motivated merchants to prioritize dual-interface devices that support both NFC and traditional contact entry. Retailers Carrefour and Auchan already see contactless exceeding 80% of in-store volume, accelerating refresh cycles as aging terminals correlate with 23% lower contactless rates. The France POS terminal market consequently concentrates on NFC performance, battery longevity and offline contactless functions that suit outdoor markets and delivery fleets. Regional disparities remain, penetration tops 85% in Ile-de-France but lags at 62% in rural departements, offering vendors geographic white space for connectivity-optimized solutions.

Omnichannel Retail Digitalisation Accelerates Infrastructure Modernisation

Unified commerce strategies compel retailers to synchronize online, mobile and in-store data streams through integrated devices. Fnac-Darty installed 15,000 unified terminals in 2024, showcasing demand for systems that process orders, returns and inventory queries from a single screen. Nearly 68% of chains above EUR 10 million revenue plan upgrades by 2026, boosting the France POS terminal market as operators replace fixed checkout lanes with mobile stations that roam shop floors. Mobile deployments shorten wait times, improve staff efficiency and feed loyalty analytics into cloud platforms, encouraging software-centric suppliers to bundle payment apps, CRM and inventory tools via subscription.

SME Cost Sensitivity Creates Adoption Friction

Almost 73% of French SMEs cite cost as the main barrier to hardware refresh, as devices priced at EUR 200-800 and monthly fees of EUR 15-45 erode thin margins. Connectivity gaps further inflate budgets in rural areas that still require GPRS fall-back. Though the government offers EUR 500 subsidies under France Relance, complex paperwork limits participation, leaving many service providers outside the program. Vendors respond by financing terminals over 24-36 months or promoting SoftPOS apps, yet penetration gains remain gradual.

Other drivers and restraints analyzed in the detailed report include:

- EU Policy Framework Mandates Security and Interoperability Upgrades

- SoftPOS Technology Reduces Barriers for Micro-Merchant Adoption

- Cybersecurity Compliance Burden Intensifies Operational Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contact-based solutions controlled 55.92% of the France POS terminal market share in 2025, yet contactless devices are forecast to record an 8.11% CAGR, pushing the segment toward majority status well before 2031. This transition parallels the digital euro pilot slated for 2026, which requires dual-mode devices capable of CBDC transactions. High-value luxury and automotive merchants still lean on PIN-based chip entry for transactions above EUR 50, but consumer preference signals inexorable NFC dominance.

Subsequent growth in contactless acceptance stems from 94% dual-interface card issuance since 2023 and the Carte Bancaire scheme's offline-contactless limit of EUR 25. These features broaden applicability to outdoor markets and delivery vans with intermittent connectivity, spurring incremental volumes for compact, battery-efficient readers. Regional disparities persist: Ile-de-France logs 85% contactless penetration, whereas rural areas hover at 62%, encouraging suppliers to launch low-connectivity variants that exploit untapped potential. As these deployments scale, the France POS terminal market size for contactless hardware is set to outpace overall market averages, reinforcing vendors' focus on NFC radio integrity, antenna design and EMV Level 3 certification cycles.

The France POS Terminal Market Report is Segmented by Mode of Payment Acceptance (Contact-Based, and Contactless), POS Type (Fixed Point-Of-Sale Systems, and Mobile/Portable Point-Of-Sale Systems), End-User Industry (Retail, Hospitality, Healthcare, Transportation and Logistics, and Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ingenico Group SA (Worldline)

- Verifone Systems, Inc.

- PAX Technology Ltd.

- NCR Corporation

- Castles Technology Co., Ltd.

- SumUp Payments Limited

- Zettle (Paypal)

- myPOS World Ltd.

- NEC Corporation

- AURES Group SA

- Diebold Nixdorf

- BBPOS Limited

- Newland Payment Technology Co., Ltd.

- Shenzhen Xinguodu Technology Co., Ltd.

- Fujian Centerm Information Co., Ltd.

- Bitel Co., Ltd.

- Wiseasy Technology Co., Ltd.

- Fujian Landi Commercial Equipment Co., Ltd.

- dejamobile SAS

- Innovorder SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in contactless-payment penetration among French consumers

- 4.2.2 Omnichannel retail digitalisation accelerating POS refresh cycles

- 4.2.3 EU and national policies promoting cash-lite economy and PSD2-driven security upgrades

- 4.2.4 SoftPOS and Tap-to-Pay on smartphones slashing hardware TCO for micro-merchants

- 4.2.5 European Payments Initiative (EPI) preparing account-to-account QR acceptance on legacy POS

- 4.2.6 Rising demand for in-terminal BNPL / short-instalment options at checkout

- 4.3 Market Restraints

- 4.3.1 High upfront terminal and maintenance costs for French SMEs

- 4.3.2 Heightened PCI-DSS/SCA cybersecurity compliance burden

- 4.3.3 Looming post-quantum crypto upgrades complicating firmware lifecycles

- 4.3.4 Foot-traffic shift to e-commerce leaving legacy fixed POS capacity under-utilised

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Mode of Payment Acceptance

- 5.1.1 Contact-based

- 5.1.2 Contactless

- 5.2 By POS Type

- 5.2.1 Fixed Point-of-Sale Systems

- 5.2.2 Mobile / Portable Point-of-Sale Systems

- 5.3 By End-User Industry

- 5.3.1 Retail

- 5.3.2 Hospitality

- 5.3.3 Healthcare

- 5.3.4 Transportation and Logistics

- 5.3.5 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ingenico Group SA (Worldline)

- 6.4.2 Verifone Systems, Inc.

- 6.4.3 PAX Technology Ltd.

- 6.4.4 NCR Corporation

- 6.4.5 Castles Technology Co., Ltd.

- 6.4.6 SumUp Payments Limited

- 6.4.7 Zettle (Paypal)

- 6.4.8 myPOS World Ltd.

- 6.4.9 NEC Corporation

- 6.4.10 AURES Group SA

- 6.4.11 Diebold Nixdorf

- 6.4.12 BBPOS Limited

- 6.4.13 Newland Payment Technology Co., Ltd.

- 6.4.14 Shenzhen Xinguodu Technology Co., Ltd.

- 6.4.15 Fujian Centerm Information Co., Ltd.

- 6.4.16 Bitel Co., Ltd.

- 6.4.17 Wiseasy Technology Co., Ltd.

- 6.4.18 Fujian Landi Commercial Equipment Co., Ltd.

- 6.4.19 dejamobile SAS

- 6.4.20 Innovorder SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment