|

市场调查报告书

商品编码

1911478

德国POS终端市场:市场占有率分析、产业趋势、统计数据和成长预测(2026-2031年)Germany POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

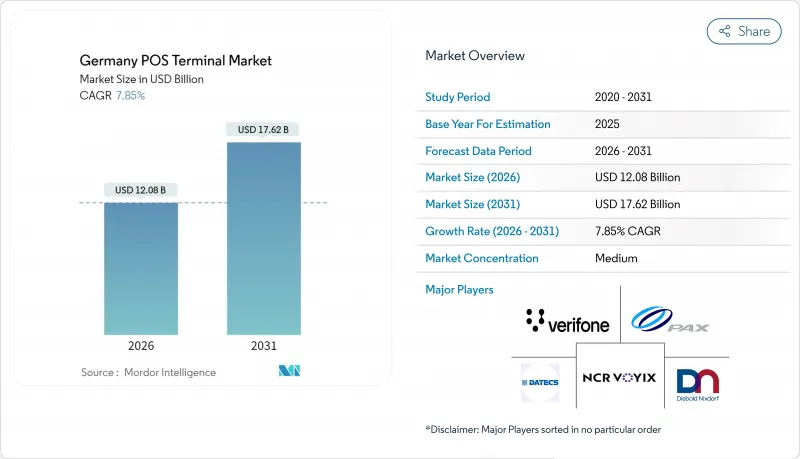

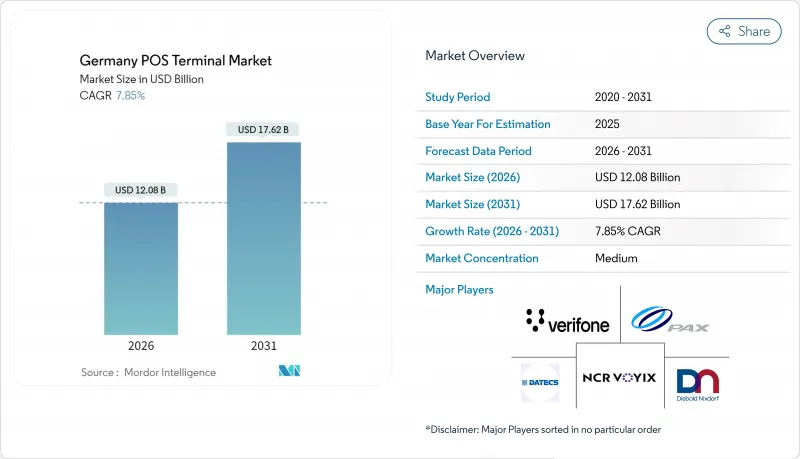

德国POS终端市场预计到2026年将达到120.8亿美元,高于2025年的112亿美元。预计到2031年将达到176.2亿美元,2026年至2031年的复合年增长率为7.85%。

这一强劲的市场前景得益于以下因素:现金支付的加速普及、非接触式支付的兴起,以及监管机构要求终端现代化以支持Giro卡和即将推出的数位欧元。智慧型手机普及率的提高、宽频网路的快速发展以及零售商的全通路策略,进一步推动了对支援NFC功能的终端、云端软体和增值支付服务的需求。现有企业正透过远端更新架构和人工智慧驱动的分析来应对这项挑战,而新参与企业则将行动POS读卡机与商家钱包捆绑销售,以降低传统价格。由此产生的交易数据爆炸性增长,为诈欺预防和客户洞察创造了新的机会,并为服务提供者带来了额外的收入来源。

德国POS终端市场趋势与洞察

非接触式支付的激增正在重塑终端要求。

到2024年12月,非接触式交易将透过Girocard完成,占比超过87%。这种快速成长迫使商家部署具备令牌化和多钱包功能的NFC读卡机。消费者越来越期望「即触即付」的便捷性,18%的消费者表示,如果他们首选的数位支付方式不可用,他们会感到不满,这促使不合规的商店进行现代化改造。德国实施的PCI DSS v4.0标准要求在设备层面采用更严格的加密和认证,这进一步加剧了这一趋势。这些因素共同推动了现代化终端的普及,并维持了德国POS终端市场的成长动能。

行动POS金融科技的兴起加速了中小企业对该技术的采用。

SumUp 和 Zettle 的行动 POS 系统硬体价格低于 35 欧元,透明的 girocard 手续费低于 1%,降低了部署成本,让电子支付即使是小规模零售商和独立咖啡馆也能轻鬆使用。简化的部署流程和「按需付费」模式消除了合约的复杂性,直接促成了店内交易无现金支付率提升 20 个百分点,达到 81%。餐饮企业可以享受餐桌支付和小费的便利,而快闪店则可以利用智慧型手机连线绕过固定终端。这些趋势正在扩大德国 POS 终端市场的潜在基本客群。

国际支付成本不断上升,对利润率带来压力。

使用Visa和万事达签帐金融卡支付,尤其是在国际支付网路预设使用行动钱包的情况下,通常会产生比国内信用卡费率高出数倍的商家手续费。对于小规模零售商而言,这些增加的手续费会显着削减其利润,迫使他们考虑收取附加费、设定支付限额或采用终端路由逻辑来自动选择成本更低的支付方式。儘管监管机构提倡竞争中立,但这在短期内会减缓部分终端的交易成长,并降低德国POS终端市场的潜在收入。

细分市场分析

预计到2025年,非接触式支付将占商店支付总额的65.18%,并以9.96%的复合年增长率持续成长。这一成长趋势将推动德国POS终端市场规模在整个预测期内持续扩大,尤其是在「一触即付」终端方面。这一增长反映了近乎普及的NFC技术在电子支付卡上的应用、智慧型手錶钱包的流行以及消费者对卫生、非接触式支付方式日益增长的信心。此外,交易速度的提升也增加了收购方的费用收入,从而促进了这一领域的成长。

非接触式支付在诸如高价值交易、超出非接触式支付限额且需要输入PIN码的交易以及加油站等行业仍将继续使用,但其相对份额将会下降。即将推出的数位欧元试点计画将进一步推动非接触式支付的普及,因为可程式设计的央行数位货币(CBDC)钱包专为快速小额支付而设计。因此,商家将部署能够同时支援离线CBDC和线上卡片认证的双介面终端,并提供现场升级功能。提供简化的空中韧体下载服务的供应商可能会更受欢迎,因为这可以最大限度地减少收银员的停机时间。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 非接触式支付的渗透率已超过商店卡片付款的65%。

- 强制性的Girocard/SEPA即时支付路由规则挤压收购方的利润空间

- 透过金融科技组合(SumUp、Zettle),中小企业迅速采用行动POS机。

- 零售云端POS系统的更新週期取决于软体生命週期结束时间(5-6年)。

- 试点人工智慧驱动的损失预防和电脑视觉自助结帐系统

- 德国零售商招标书中的欧元数位化条款(2026 年及以后)

- 市场限制

- 国际签帐金融卡的手续费较高(比 Girocard 高 3-4 倍)

- PCI DSS v4.0 和 NIS2 合规性的网路弹性成本

- 商业街店铺面积的萎缩将限制最终的绝对成长。

- 碎片化的软体架构会降低独立公司云端迁移的投资报酬率。

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对影响市场的宏观经济因素进行评估

第五章 市场规模及成长预测(美元)

- 透过付款方式

- 联繫类型

- 非接触式支付

- 按POS类型

- 固定式POS系统

- 行动/可携式POS系统

- 按最终用户行业划分

- 零售

- 饭店业

- 卫生保健

- 运输/物流

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Worldline SA

- Verifone Systems Inc.

- PAX Technology Limited

- NCR Voyix Corporation

- Diebold Nixdorf AG

- PayPal Holdings Inc.(Zettle)

- SumUp Payments Limited

- DATECS Ltd.

- Dspread Technology(Beijing)Inc.

- Castles Technology Co. Ltd.

- Fujian Newland Payment Technology Co. Ltd.

- Fujian Centerm Information Co. Ltd.

- myPOS World Ltd.

- Concardis GmbH(Nets Group)

- Vectron Systems AG

- AURES Technologies SA

- Nayax Ltd.

- CCV GmbH

- Bluebird Inc.

- BBPOS Limited

- New POS Technology Limited

第七章 市场机会与未来展望

Germany POS Terminal Market size in 2026 is estimated at USD 12.08 billion, growing from 2025 value of USD 11.20 billion with 2031 projections showing USD 17.62 billion, growing at 7.85% CAGR over 2026-2031.

This solid outlook rests on the accelerated shift away from cash, the dominance of contactless transactions, and a regulatory agenda that obliges merchants to modernize terminals for girocard routing and forthcoming digital-euro acceptance. Rising smartphone penetration, strong broadband coverage, and retail omnichannel strategies further reinforce demand for NFC-ready devices, cloud software, and value-added payment services. Market incumbents are responding with remote-update architectures and AI-driven analytics, while new entrants bundle mobile POS readers with merchant wallets to undercut traditional pricing. The accompanying surge in transaction data unlocks opportunities in fraud prevention and customer insight, giving providers additional revenue streams.

Germany POS Terminal Market Trends and Insights

Contactless payment surge reshapes terminal requirements

Contactless transactions processed via girocard surpassed 87% by December 2024, a leap that requires merchants to install NFC-capable readers with tokenization and multi-wallet functionality. Consumers increasingly expect tap-and-go convenience, and 18% experience rejection when a favorite digital option is unavailable, pushing hold-outs to modernize. Germany's PCI DSS v4.0 roll-out adds urgency by mandating stronger encryption and authentication at the device level. Together, these factors expand the installed base of modern terminals and sustain the Germany POS terminal market's momentum.

mPOS fintech disruption accelerates SME adoption

Mobile POS bundles from SumUp and Zettle lower entry costs with hardware priced below EUR 35 and transparent sub-1% girocard fees, bringing electronic acceptance to micro-retailers and independent cafes. The simplified onboarding and pay-as-you-grow model remove contractual complexity, directly contributing to a 20-point rise in cashless acceptance to 81% of in-store transactions. Hospitality operators benefit from tableside checkout and tipping features, while pop-up retailers leverage smartphone connectivity to avoid fixed terminals. These patterns are expanding the addressable customer base for the Germany POS terminal market.

Escalating international scheme costs pressure margins

Visa and Mastercard debit routing often carries merchant service charges several multiples above domestic girocard rates, particularly when transactions originate from mobile wallets that default to international rails. For small retailers, higher fees cut deeply into net margins, prompting them to weigh surcharges, acceptance limits, or terminal routing logic that automatically selects lower-cost instruments. Although regulators promote competitive neutrality, the near-term effect dampens transaction growth on some devices, trimming addressable revenue for the Germany POS terminal market.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory routing rules intensify competitive dynamics

- Cloud migration driven by software lifecycle pressures

- Compliance complexity elevates operational costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contactless transactions accounted for 65.18% of in-store payments in 2025 and are on track to advance at a 9.96% CAGR, a trajectory that will raise the Germany POS terminal market size attached to tap-and-go devices throughout the forecast window.This expansion reflects near-universal NFC support on girocards, the popularity of smartwatch wallets, and rising consumer confidence in hygienic, no-touch checkout. The segment's growth also benefits from higher transaction velocities that uplift acquirer fee pools.

Contact-based methods persist for larger-ticket purchases, PIN-required flows above the contactless limit, and verticals such as fuel retail, yet their relative share declines. Upcoming digital-euro pilots will further entrench contactless behavior, as programmable CBDC wallets target rapid low-value settlement. Accordingly, merchants procure terminals capable of dual-interface acceptance, field-upgradeable to handle both offline CBDC and online card authorizations. Vendors that streamline firmware downloads over-the-air gain favor because they minimize cashier downtime.

The Germany POS Terminal Market Report is Segmented by Mode of Payment Acceptance (Contact-Based and Contactless), POS Type (Fixed Point-Of-Sale Systems, Mobile/Portable Point-Of-Sale Systems), End-User Industry (Retail, Hospitality, Healthcare, Transportation and Logistics, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Worldline SA (includes Ingenico)

- Verifone Systems Inc.

- PAX Technology Limited

- NCR Voyix Corporation

- Diebold Nixdorf AG

- PayPal Holdings Inc. (Zettle)

- SumUp Payments Limited

- DATECS Ltd.

- Dspread Technology (Beijing) Inc.

- Castles Technology Co. Ltd.

- Fujian Newland Payment Technology Co. Ltd.

- Fujian Centerm Information Co. Ltd.

- myPOS World Ltd.

- Concardis GmbH (Nets Group)

- Vectron Systems AG

- AURES Technologies SA

- Nayax Ltd.

- CCV GmbH

- Bluebird Inc.

- BBPOS Limited

- New POS Technology Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Contactless payment penetration surpassing 65 % of in-store card spend

- 4.2.2 Mandatory girocard/SEPA instant-payment routing rules cut acquirer margins

- 4.2.3 Rapid mPOS adoption among SMEs via fintech bundles (SumUp, Zettle)

- 4.2.4 Retail cloud-POS refresh cycle driven by software end-of-life (5-6 yrs)

- 4.2.5 AI-enabled loss-prevention and computer-vision self-checkout pilots

- 4.2.6 Digital-euro readiness clauses in German retailer RFPs (2026-)

- 4.3 Market Restraints

- 4.3.1 Rising scheme fees on international debit (3-4X girocard)

- 4.3.2 Cyber-resilience costs for PCI DSS v4.0 and NIS2 compliance

- 4.3.3 Shrinking high-street footprint reduces absolute terminal growth

- 4.3.4 Fragmented software stack slows cloud-migration ROI for independents

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (USD)

- 5.1 By Mode of Payment Acceptance

- 5.1.1 Contact-based

- 5.1.2 Contactless

- 5.2 By POS Type

- 5.2.1 Fixed Point-of-Sale Systems

- 5.2.2 Mobile / Portable Point-of-Sale Systems

- 5.3 By End-User Industry

- 5.3.1 Retail

- 5.3.2 Hospitality

- 5.3.3 Healthcare

- 5.3.4 Transportation and Logistics

- 5.3.5 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Worldline SA (includes Ingenico)

- 6.4.2 Verifone Systems Inc.

- 6.4.3 PAX Technology Limited

- 6.4.4 NCR Voyix Corporation

- 6.4.5 Diebold Nixdorf AG

- 6.4.6 PayPal Holdings Inc. (Zettle)

- 6.4.7 SumUp Payments Limited

- 6.4.8 DATECS Ltd.

- 6.4.9 Dspread Technology (Beijing) Inc.

- 6.4.10 Castles Technology Co. Ltd.

- 6.4.11 Fujian Newland Payment Technology Co. Ltd.

- 6.4.12 Fujian Centerm Information Co. Ltd.

- 6.4.13 myPOS World Ltd.

- 6.4.14 Concardis GmbH (Nets Group)

- 6.4.15 Vectron Systems AG

- 6.4.16 AURES Technologies SA

- 6.4.17 Nayax Ltd.

- 6.4.18 CCV GmbH

- 6.4.19 Bluebird Inc.

- 6.4.20 BBPOS Limited

- 6.4.21 New POS Technology Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment