|

市场调查报告书

商品编码

1911499

印度整车运输 (FTL):份额分析、产业趋势、统计数据、成长预测 (2026-2031)India Full-Truck-Load (FTL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

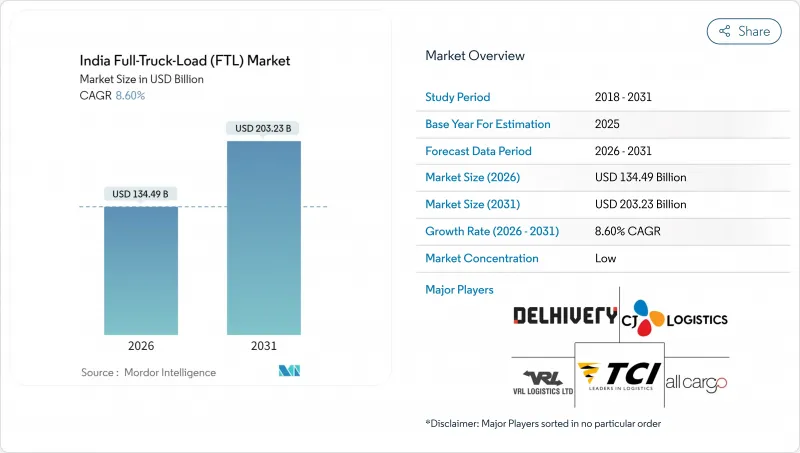

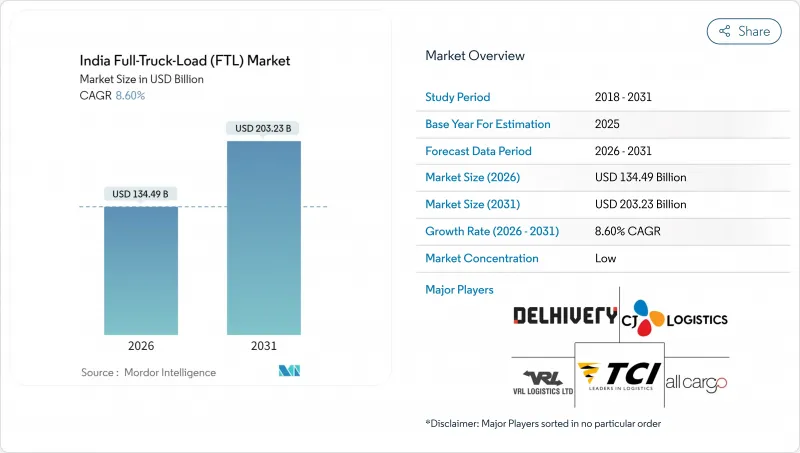

2025年印度整车运输(FTL)市值为1,238.5亿美元,预计2031年将达到2,032.3亿美元,而2026年为1,344.9亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 8.60%。

这一持续成长归功于有组织的零售活动日益活跃、生产连结奖励计画计划下的本地化製造业发展,以及基础设施现代化进程的加速,特别是专用货运走廊的建设,这些走廊已将主要路线的运输时间缩短了高达 65%。商品及服务税 (GST) 支援的枢纽辐射式仓库、国家物流政策激励措施以及即时数位货运平台正在进一步重塑货运流程,使承运商能够优化运力、减少空驶里程并实现更稳定的收入。同时,FASTag 98% 的普及率消除了现金收费站的拥堵,每日通行费收入达 1.78 亿卢比(12.8 亿美元),是 2021 财年的两倍多,直接提高了卡车运转率和准时交付率。日益激烈的竞争、轻资产营运商的逐步整合、电子商务物流、快速消费需求以及跨国公司采购策略的转变,持续推动印度整车运输 (FTL) 市场的上升趋势。

印度整车运输 (FTL) 市场趋势与洞察

有组织的零售和电子商务出货量激增

电子商务的快速普及促使零售商采用即时库存策略,导致整车运输更加频繁、规模更小,价格也更高。如今,快消业者期望在城市内实现数小时的补货週期,这迫使承运商配备更先进的温控和远端资讯处理追踪系统的城市车队。在印度政府为食品加工产业提供的1,090亿卢比生产环节奖励计画(PLI)的支持下,大型连锁超市已在加工中心和大都会圈配销中心之间建立了可预测的长途运输路线。同时,全通路零售商正在重新设计其配送网络,利用干线整车运输车连接区域履约中心,从而增加了对中程短途运输和交叉转运的需求。这些转变有利于拥有可扩展的枢纽辐射式网路而非点对点配送的营运商,巩固了电子商务作为印度整车运输市场可持续成长驱动力的地位。

透过扩建专用货运走廊缩短运输时间

东西向专用货运走廊目前每天运行391列货运列车,预计2025年12月全面运作后,铁路运力将呈指数级增长。低成本的铁路运输能够长途运输超过1500公里的大宗货物,而这种模式转换也同时扩展了公路运输网络在新建铁路枢纽附近的「最后一公里」和「首端」运输业务。运输业者正在重新配置资产,以应对那些对时间要求高、价值高且易损的货物,这些货物需要盈利、高附加价值的处理。投资于铁路公路连锁规划软体的营运商正在利用该走廊25%的铁路成本优势,透过协调取货和送货时间,将原本被视为竞争关係的局面转变为互补的收入来源。此外,三条规划中的走廊,总投资达2兆卢比(约240亿美元),代表着一项持续的基础设施发展计划,该计划将在未来十年重塑印度整车运输市场的地理分布格局。

司机严重短缺且离职率率高

儘管重型商用车司机在州际路线上的月收入在 3 万至 5 万印度卢比之间,但人员留任仍然是一个挑战。缺乏休息设施、在收货码头停留时间过长以及社会保障体係不完善阻碍了新从业者的加入,导致司机平均年龄超过 38 岁。儘管 2025 财年货运需求有所增长,但重型商用车 (HCV) 的零售交付量同比下降了 4.07%,凸显了印度整车运输 (FTL) 市场供需失衡的加剧。业者通常会僱用 15% 至 20% 的额外员工以应对缺勤,从而推高了固定成本。虽然政府的干预措施,例如总理 Mudra Yojana 贷款计划和 E-Shram 保险,具有建设性意义,但尚未带来观念上的根本转变。由于离职率徘徊在 28% 左右,车队管理人员正在实施技能培训、远端医疗支援和奖励薪资计画。然而,在自主安全装置得到更广泛应用和道路基础设施加强之前,不太可能出现显着改善。

细分市场分析

2025年,製造业占印度整车运输(FTL)市场份额的30.62%,预计2026年至2031年将以10.02%的惊人复合年增长率增长,凸显其在核心货运量和增量增长中的核心作用。先进化学电池、电子组装和特殊化学品(两者均受益于1.97兆印度卢比(1.97兆美元)的生产关联激励(PLI)计画)需要特殊的卡车规格,包括危险物品处理和隔热性能。同时,在高速公路和物流园区等基础设施投资的推动下,建设业确保了大量建材的稳定供应,并支持了运输网路的重新规划。农业、渔业和林业与食品加工的生产关联激励计划挂钩,该计划刺激了对冷藏货物的季节性但利润丰厚的需求。其他产业,包括可再生能源设备和国防製造,被归类为「其他」类别,其规模正从试点阶段逐步扩大。随着工厂使用率接近75%,以及出口商扩大成品运往沿海地区和内陆边境地区的规模,印度製造业整车运输市场规模持续成长。

在营运方面,製造商倾向于采用多年期合约的专属车队,这些合约结合了远端资讯处理、低温运输完整性保障和周转时间保证。利用预测性维护分析和路线规划API的运输公司报告称,与传统的点对点调度相比,准点率提高了5-7%。此外,工业走廊的建设减少了空驶路段,提高了服务可靠性并扩大了利润空间。这些趋势已使製造业成为印度整车运输(FTL)市场的结构性基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 按经济活动分類的GDP分配

- 按经济活动分類的GDP成长

- 经济表现及概况

- 电子商务产业的趋势

- 製造业趋势

- 运输和仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输营运成本

- 卡车运输车队规模(按车辆类型划分)

- 主要卡车供应商

- 公路货运量趋势

- 公路货运价格趋势

- 透过交通方式分享

- 通货膨胀

- 法律规范

- 价值炼和通路分析

- 市场驱动因素

- 有组织的零售和电子商务配送量激增

- 拓宽专用货运走廊以缩短运输时间

- 消费税的实施将促进中心辐射式仓储业的发展

- 国家物流政策主导的多模态物流园区提升枢纽连结性

- 利用数位化货运市场提高资产利用率

- 强制使用 Fastag 和基于距离的收费系统收取通行费将减少车辆停留时间。

- 市场限制

- 司机严重短缺且离职率率高

- 儘管燃油税合理化,柴油价格仍波动不定。

- 小规模车辆所有者的所有权结构分散,他们占总数的95%以上

- 都市区货运枢纽的基础设施瓶颈

- 市场创新

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 终端用户产业

- 农业、渔业、林业

- 建设业

- 製造业

- 石油天然气、采矿和采石

- 批发和零售

- 其他的

- 目的地

- 国内的

- 国际的

第六章 竞争情势

- 市场集中度

- 关键策略倡议

- 市占率分析

- 公司简介

- ABC Express

- Abhi Impact Logistics

- Allcargo Logistics Ltd.(including Gati Express)

- BLR Logistiks

- CJ Darcl Logistics Limited

- Delhivery Ltd.

- DHL Group

- KRS Logistics Services

- Navata SCS

- Om Logistics Supply Chain

- Relay Express Pvt. Ltd.

- Sahara Logistics

- Shree Azad Transport Co.Pvt.Ltd

- Skyblue Logistics

- SRD Logistics Pvt.Ltd

- Suntek Axpress

- Transport Corporation of India Ltd.(TCI)

- VRL Logistics Ltd.

- V-TRANS

- XpressBees

第七章 市场机会与未来展望

The India full-truck-load market was valued at USD 123.85 billion in 2025 and estimated to grow from USD 134.49 billion in 2026 to reach USD 203.23 billion by 2031, at a CAGR of 8.60% during the forecast period (2026-2031).

This sustained expansion stems from rising organized-retail activity, localization of manufacturing under Production Linked Incentive schemes, and accelerating infrastructure modernization-especially the dedicated freight corridors that are cutting transit times on trunk routes by as much as 65%. GST-enabled hub-and-spoke warehousing, National Logistics Policy incentives, and real-time digital freight platforms are further reshaping freight flows and allowing carriers to optimize capacity, cut empty miles, and achieve steadier yields. Meanwhile, FASTag's 98% penetration is eliminating cash toll queues and yielding daily toll receipts of INR 178 crore (USD 1.28 billion)-more than doubling FY21 levels-which directly boosts truck utilization and on-time delivery ratios. Heightened competition dovetails with progressive consolidation among asset-light operators, all while e-commerce logistics, quick-commerce demand, and multinational sourcing shifts continue to set an upward trajectory for the India Full-Truck-Load market.

India Full-Truck-Load (FTL) Market Trends and Insights

Surge in Organized Retail and E-Commerce Shipments

Rapid e-commerce penetration has prompted retailers to adopt just-in-time inventory strategies, generating higher-frequency yet smaller-batch full-truck runs that command premium rates. Quick-commerce players now expect intra-city refill cycles measured in hours, compelling carriers to dedicate urban-compatible fleets with superior temperature control and telematics tracking. Organized grocery chains supported by food-processing PLI incentives worth INR 10,900 crore have carved out predictable long-haul lanes between processing hubs and metropolitan distribution centers. In parallel, omnichannel retailers redesign distribution footprints using regional fulfillment nodes connected by trunk-route FTL shuttles, raising demand for medium-distance drayage and cross-dock operations. These changes reward operators that own scalable hub-and-spoke networks rather than point-to-point dispatch, cementing e-commerce as a durable growth flywheel for the India Full-Truck-Load market.

Expansion of Dedicated Freight Corridors Lowering Transit Times

The Western and Eastern Dedicated Freight Corridors already host 391 freight trains daily, and full commissioning by December 2025 is set to expand railhaul capacity dramatically. Although lower-cost rail captures bulk commodities on 1,500 km-plus hauls, the modal shift simultaneously widens first-mile and last-mile obligations for trucking fleets around new rail terminals. Carriers are repositioning assets toward time-critical, high-value, or fragile consignments that command higher yields and value-added handling. Operators investing in synchronized rail-road planning software benefit from the corridor's 25% rail cost advantage by aligning pickup and drop windows, thereby turning perceived competition into complementary revenue streams. Additionally, three more corridors worth INR 2 lakh (USD 24 billion) crore are in planning, indicating a sustained infrastructure pipeline that will reshape geographic demand distribution within the India Full-Truck-Load market over the next decade.

Acute Driver Shortage and High Attrition

Heavy-commercial-vehicle driver wages range from INR 30,000-50,000 per month for interstate lanes, yet retention remains problematic. Limited rest facilities, protracted dwell times at consignee docks, and inconsistent social-security coverage deter new entrants, pushing average driver age beyond 38 years. FY25 saw HCV retail deliveries slide 4.07% year-over-year even as freight demand climbed, underscoring a widening supply imbalance in the India Full-Truck-Load market. Operators routinely over-staff fleets by 15-20% to buffer against no-show risk, inflating fixed costs. Government interventions such as PM Mudra Yojana loans and E-Shram insurance are constructive but have yet to shift structural sentiment. As attrition hovers near 28%, fleet managers are rolling out skilling academies, telemedicine support, and incentive pay programs, yet meaningful relief is unlikely before wider adoption of autonomous safety aids and enhanced roadside infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- GST-Enabled Hub-and-spoke Warehousing Growth

- National Logistics Policy-Driven Multimodal Logistics Parks Boosting Hub Connectivity

- Volatile Diesel Prices Despite Fuel Tax Rationalization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing contributed 30.62% of the India full-truck-load market share in 2025 while registering a stellar 10.02% CAGR between 2026 and 2031, underscoring its pivotal role in both baseline freight generation and incremental growth. Advanced chemistry cell batteries, electronics assembly, and specialty chemicals-all beneficiaries of INR 1.97 lakh crore (USD 1.97 trillion) in Production Linked Incentive allocation-command specialized truck specs spanning hazardous-goods compliance and thermal shielding. Simultaneously, construction, boosted by infrastructure outlays on highways and logistics parks, supplies a steady stream of bulk building materials that anchor fleet backhaul planning. Agriculture, fishing, and forestry ride on food-processing PLI cues that trigger seasonal but high-yield refrigerated loads. Remaining verticals, including renewable-energy equipment and defense manufacturing, coalesce into an "Others" pocket that is emerging from pilot stage into scalable lane volumes. The India Full-Truck-Load market size for manufacturing-bound transport continues to widen as factory capacity utilization edges toward 75% and exporters scale finished-goods shipments to both coast-bound and regional land-border outlets.

On the operating front, manufacturers prefer multi-year dedicated fleet contracts bundling telematics, cold-chain integrity, and guaranteed turnaround windows. Carriers leveraging predictive-maintenance analytics and route-planning APIs now report 5-7% higher on-time service compared with conventional point-to-point dispatch. Additionally, upgraded industrial corridors reduce empty repositioning legs, sharpening service reliability and amplifying margins. These dynamics establish manufacturing as the structural backbone of the India Full-Truck-Load market.

The India Full-Truck-Load (FTL) Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Destination (Domestic and International). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABC Express

- Abhi Impact Logistics

- Allcargo Logistics Ltd. (including Gati Express)

- BLR Logistiks

- CJ Darcl Logistics Limited

- Delhivery Ltd.

- DHL Group

- KRS Logistics Services

- Navata SCS

- Om Logistics Supply Chain

- Relay Express Pvt. Ltd.

- Sahara Logistics

- Shree Azad Transport Co.Pvt.Ltd

- Skyblue Logistics

- SRD Logistics Pvt.Ltd

- Suntek Axpress

- Transport Corporation of India Ltd. (TCI)

- VRL Logistics Ltd.

- V-TRANS

- XpressBees

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Surge in Organised Retail and E-Commerce Shipments

- 4.20.2 Expansion of Dedicated Freight Corridors Lowering Transit Times

- 4.20.3 GST-Enabled Hub-and-Spoke Warehousing Growth

- 4.20.4 National Logistics Policy-Driven Multimodal Logistics Parks Boosting Hub Connectivity

- 4.20.5 Digital Freight Marketplaces Improving Asset Utilisation

- 4.20.6 Mandatory Fastag Tolling and Distance-Based Pricing Cutting Haulage Dwell Times-

- 4.21 Market Restraints

- 4.21.1 Acute Driver Shortage and High Attrition

- 4.21.2 Volatile Diesel Prices Despite Fuel Tax Rationalisation

- 4.21.3 Fragmented Ownership Among >95 % Small Fleet Operators

- 4.21.4 Infrastructure Bottlenecks at Urban Freight Consolidation Nodes

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 ABC Express

- 6.4.2 Abhi Impact Logistics

- 6.4.3 Allcargo Logistics Ltd. (including Gati Express)

- 6.4.4 BLR Logistiks

- 6.4.5 CJ Darcl Logistics Limited

- 6.4.6 Delhivery Ltd.

- 6.4.7 DHL Group

- 6.4.8 KRS Logistics Services

- 6.4.9 Navata SCS

- 6.4.10 Om Logistics Supply Chain

- 6.4.11 Relay Express Pvt. Ltd.

- 6.4.12 Sahara Logistics

- 6.4.13 Shree Azad Transport Co.Pvt.Ltd

- 6.4.14 Skyblue Logistics

- 6.4.15 SRD Logistics Pvt.Ltd

- 6.4.16 Suntek Axpress

- 6.4.17 Transport Corporation of India Ltd. (TCI)

- 6.4.18 VRL Logistics Ltd.

- 6.4.19 V-TRANS

- 6.4.20 XpressBees

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment