|

市场调查报告书

商品编码

1911735

非营利组织软体:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Non-Profit Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

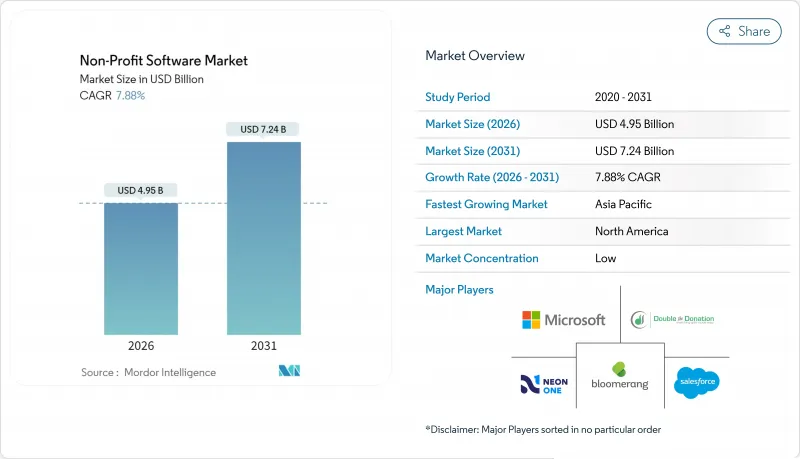

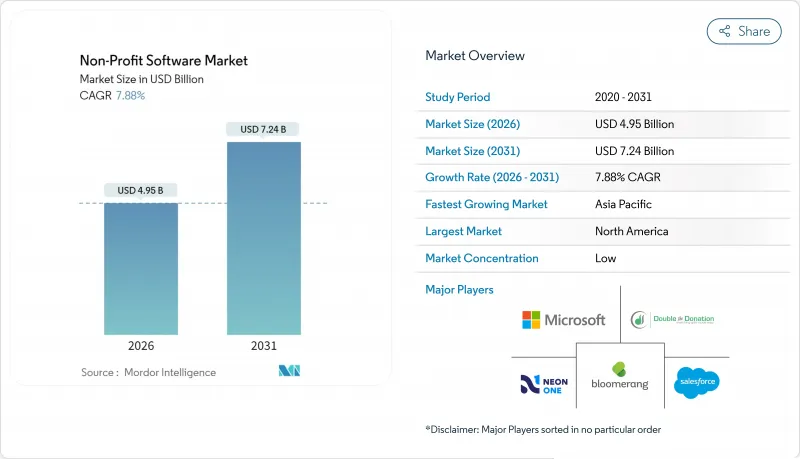

预计到 2026 年,非营利组织软体市场规模将达到 49.5 亿美元,高于 2025 年的 45.9 亿美元。预计到 2031 年,该市场规模将达到 72.4 亿美元,2026 年至 2031 年的复合年增长率为 7.88%。

市场规模的不断扩大反映了云端运算的显着普及、人工智慧技术的快速应用以及日益严格的资料隐私法规对软体合规性的高要求。市场对能够打破资料孤岛的整合式资金筹措套件和用于解决长期人手短缺问题的自动化工具的需求最为旺盛。那些整合了预测性捐赠者分析、行动优先捐赠选项和嵌入式支付功能的供应商正在获得明显的竞争优势。同时,GDPR 和 CCPA 等法规结构正促使非营利组织的董事会优先选择具有认证安全控制的平台,加速了传统本地部署系统的替换。

全球非营利组织软体市场趋势与洞察

云端SaaS解决方案的兴起

采用云端技术可以降低资本支出,并实现远端访问,这在疫情封锁期间变得尤为重要。采用率数据显示,从本地部署迁移到 SaaS 可以将总体拥有成本 (TCO) 降低约 30-40%。微软计划在 2026 年 12 月之前停止其「筹款与互动」产品,凸显了向云端原生架构的更广泛转变。订阅收费系统与非营利组织的现金流量週期相契合,而内建的合规功能对面临 GDPR 和 CCPA 合规义务的董事会来说极具吸引力。这些优势正在加速从电子表格和老旧的本地伺服器转向现代化、持续更新且可随宣传活动扩展的平台的转变。

对整合式资金筹措和捐赠者管理平台的需求日益增长

董事会期望获得整合的影响报告,而各自独立的、功能单一的解决方案会阻碍这一目标的实现。 OneCause 计划于 2025 年 1 月发布的 Salesforce Nonprofit Success Pack 连接器,展示了紧密整合如何帮助减少手动资料输入并提升对捐赠者的洞察。能够与现有 CRM 系统无缝同步的供应商将更具优势,因为非营利组织更倾向于渐进式升级,而非风险极高的全面改造计划。向整合套件的转变反映了该领域的成熟;如今,各组织需要企业级分析、自动化工作流程和全通路互动,而这些功能过去只有商业品牌才能提供。

小规模非营利组织的预算限制

纽西兰和澳洲每位全职员工的平均技术预算在2,537美元到3,942美元之间,显然资金短缺正在减缓软体更新的速度。即使有许可折扣,实施和培训成本也会对资源造成压力,而缺乏专职IT人员则阻碍了全部功能的发挥。免费增值模式和TechSoup补贴虽然降低了实施成本,但很少能涵盖持续的管理成本,这加剧了大型企业和小规模企业在软体采用方面的两极化。

细分市场分析

到2025年,云端技术在非营利组织软体市场的占比将达到61.72%,预计到2031年将以11.32%的复合年增长率成长。随着非营利组织淘汰老旧伺服器并转向能够适应会计週期和远端办公模式的SaaS解决方案,云端解决方案的成长速度预计将超过整个行业的成长速度。供应商正在提供迁移服务,以便在不中断服务的情况下迁移捐赠者历史资料、志工记录和资金帐户。微软募款和互动产品即将停止支持,迫使许多组织重新评估其基础设施,而GDPR也正在影响区域一般资料保护规则託管的决策。

如果大规模机构已对其资料中心进行了大量投资,或者必须满足严格的居住规定(例如医院基金会),它们将继续维持在地部署。然而,即使是这些机构也在采用混合模式,以保护敏感的医疗捐赠者文件,同时利用最新的分析技术。预计非营利软体市场中本地部署解决方案的份额将稳步下降,这表明人们越来越接受云端的弹性、自动修补和付费使用制。

大型非营利组织拥有更充足的预算、专业的IT团队和复杂的跨地域运营,预计到2025年,其支出将占总支出的52.05%。美国男孩女孩俱乐部在短短九个月内为旗下350个分会部署了一套通用的客户关係管理系统(CRM),证明了这种规模部署的可行性。然而,中小企业的成长速度最快,年复合成长率高达13.05%,这得益于软体即服务(SaaS)降低了进入门槛。云端订阅将传统的资本支出转化为可预测的营运支出,而免费增值计画则可在全面实施前提供部分功能。

儘管中小企业发展迅速,但其在人才和资金方面的限制使其难以获得高级功能。每位员工的平均技术预算仍然低于 4,000 美元,这使得那些提供强大的入职支援、模板化工作流程和同侪培训社群的供应商更具优势。 TechSoup 等平台持续提供的折扣计划对于提高软体的普及率至关重要。虽然中小企业预计将填补部分现有空白,但大型企业仍将占据非营利组织软体市场的大部分份额。

区域分析

北美地区将占2025年总收入的44.05%,这得益于其对慈善捐赠的优惠税收政策和完善的供应商生态系统。像美国男孩女孩俱乐部这样的大规模全国性部署项目,展现了美国组织在整合数百个地点数据方面的规模潜力。加拿大和墨西哥也蕴藏着成长空间,尤其是在云端迁移受到与美国标准相媲美的安全认证所推动的情况下。诸如《加州消费者隐私法案》(CCPA) 等资料保护法提升了具有可验证合规审核的平台的吸引力,进一步巩固了领先供应商的地位。

欧洲是一个成熟但监管严格的市场。 GDPR强制要求严格追踪用户同意情况并进行违规通知,这促使非营利组织选择拥有本地资料中心和完善审核功能的供应商。对永续性指标和社会影响报告的日益重视,推动了对能够将捐款与实际成果联繫起来的详细分析的需求。本地化(语言、货币和法定报告)仍然是区域供应商与全球平台之间的差异。儘管GDP成长较为温和,但欧盟委员会的数位转型资金仍在持续支持现代化非营利组织技术栈的投资。

亚太地区是成长最快的地区,预计到2031年复合年增长率将达到11.36%。目前只有27%的非营利组织已迁移到云端,这意味着仍有巨大的成长空间。智慧型手机的普及率远超过银行分店,为行动优先的捐赠应用程式提供了强有力的支援。 Google.org向Infoxchange提供的150万美元津贴,凸显了该地区慈善机构为实现营运数位化所做的共同努力。澳洲和纽西兰是早期采用者,而东南亚则是一个潜力巨大的未开发市场,非营利组织可以直接迁移到SaaS平台,而无需受到旧有系统的限制。提供轻量级、行动优化、客製化介面和区域特定支付选项的供应商将最快获得市场份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端SaaS解决方案的兴起

- 对整合式资金筹措和捐赠者管理平台的需求日益增长

- 提高非营利组织日常营运的自动化程度

- 拓展行动和数位捐赠管道

- 人工智慧驱动的预测性捐赠者分析的兴起提高了投资收益(ROI)

- 内建支付API,支持小额捐赠

- 市场限制

- 小规模非营利组织的预算限制

- 云端解决方案的资料安全和隐私问题

- 与现有志工管理资料库整合的复杂性

- 捐赠者疲劳会阻碍新软体工具的采用

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云

- 按公司规模

- 中小型非营利组织

- 大型非营利组织

- 按功能模组

- 资金筹措和捐赠管理

- 组件/CRM

- 行销互动

- 志工管理

- 津贴管理

- 财会

- 其他模组

- 按收入模式

- 基于订阅的SaaS

- 永久许可

- 免费加值软体和捐款软体

- 终端用户产业

- 教育非营利组织

- 医疗和医院基金会

- 基于信仰/宗教的

- 人类服务与国际援助

- 艺术与文化

- 环境/动物福利

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争情势

- 市场集中度分析

- 策略性措施(併购、合作、新服务推出)

- 市占率分析(前 15 家公司,2024 年)

- 公司简介

- Blackbaud, Inc.

- Salesforce, Inc.

- Bloomerang, LLC

- Bonterra Tech, Inc.(Network for Good & EveryAction)

- Neon One, LLC

- Microsoft Corporation

- SAP SE

- Intuit Inc.

- Oracle Corporation

- Double the Donation, LLC

- DonorSearch, LLC

- WealthEngine, Inc.

- Community Brands Intermediate, LLC

- Cvent Holding Corp.

- Classy, Inc.

- DonorPerfect(SofterWare, Inc.)

- Virtuous Software, Inc.

- Funraise, Inc.

- Qgiv, Inc.

- Give Lively LLC

第七章 市场机会与未来趋势

- 评估差距和未满足的需求

Non-Profit Software market size in 2026 is estimated at USD 4.95 billion, growing from 2025 value of USD 4.59 billion with 2031 projections showing USD 7.24 billion, growing at 7.88% CAGR over 2026-2031.

The market size expansion mirrors a pronounced shift toward cloud deployment, rapid uptake of artificial intelligence features, and stricter data-privacy regulation that elevates software compliance requirements. Demand is strongest for unified fundraising suites that collapse data silos and for automation tools that offset chronic staff shortages. Vendors that embed predictive donor analytics, mobile-first giving options, and embedded payment capabilities are carving out clear competitive advantage. Meanwhile, regulatory frameworks such as GDPR and CCPA encourage nonprofit boards to favor platforms with certified security controls, which in turn accelerates the replacement of legacy on-premises systems.

Global Non-Profit Software Market Trends and Insights

Proliferation of Cloud-Based SaaS Solutions

Cloud adoption trims capital expenditure and delivers remote access that became essential during pandemic lockdowns. Moving from on-premises to SaaS cuts total cost of ownership by around 30-40% according to implementation data. Microsoft's plan to retire its Fundraising and Engagement product by December 2026 underscores a wider pivot to cloud-native architectures. Subscription pricing meshes with nonprofit cash-flow cycles, and built-in compliance features appeal to boards grappling with GDPR and CCPA obligations. These attributes accelerate migration from spreadsheets and aging local servers into modern, continuously updated platforms that scale with campaign volume.

Growing Demand for Integrated Fundraising and Donor Management Platforms

Boards expect consolidated impact reporting, and siloed point solutions undermine that goal. OneCause's January 2025 connector for Salesforce Nonprofit Success Pack shows how tight integration reduces manual data entry and improves donor insights. Vendors able to sync seamlessly with existing CRMs gain an edge because nonprofits prefer evolutionary upgrades over risky rip-and-replace projects. The move toward unified suites reflects the sector's maturation: organizations now demand enterprise-grade analytics, automated workflows, and omnichannel engagement once reserved for commercial brands.

Budget Constraints Among Small Nonprofits

Average technology budgets of USD 2,537-3,942 per full-time employee in New Zealand and Australia reveal how limited funds delay software upgrades. Even when license discounts exist, implementation and training costs strain resources, and the absence of dedicated IT staff hampers full feature utilization. Freemium tiers and TechSoup subsidies alleviate entry costs yet rarely cover ongoing administration, reinforcing a two-speed adoption pattern between large and small organizations.

Other drivers and restraints analyzed in the detailed report include:

- Rising Automation of Routine Nonprofit Workflows

- Expansion of Mobile and Digital Giving Channels

- Data Security and Privacy Concerns with Cloud Solutions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments generated 61.72% of the Non-Profit Software market in 2025 and are projected to expand at an 11.32% CAGR through 2031. The Non-Profit Software market size for cloud solutions is therefore set to outpace overall sector growth as nonprofits retire aging servers in favor of SaaS that matches fiscal cycles and remote-work patterns. Vendors bundle migration services so that historical donor data, volunteer records, and fund accounts transfer without downtime. The looming sunset of Microsoft's Fundraising and Engagement product compels many organizations to reevaluate infrastructure, and GDPR is shaping decisions about regional data hosting.

On-premises installations persist within large institutions that already invested heavily in in-house data centers or that must meet strict residency rules, such as hospital foundations. Yet even these organizations are adopting hybrid models to tap modern analytics while safeguarding sensitive medical donor files. The Non-Profit Software market share of on-premises solutions is forecast to decline steadily, signaling widening acceptance of cloud resilience, automatic patching, and consumption-based pricing.

Large nonprofits held 52.05% of 2025 spending thanks to deeper budgets, dedicated IT teams, and complex multi-site operations. The Boys and Girls Clubs of America deployed a universal CRM across 350 chapters within nine months, highlighting the scale possible in this tier. However, the small and medium band grows fastest at 13.05% CAGR as SaaS lowers entry barriers. Cloud subscriptions convert what used to be capital expenditure into predictable operating outlays, while freemium plans introduce functionality before a full commitment.

Despite growth, SMEs confront staff and capital shortages that limit advanced feature usage. Average technology allocations remain under USD 4,000 per employee, so vendors that provide robust onboarding, templated workflows, and peer training communities stand to gain. Continued discount programs from platforms such as TechSoup will be critical in widening adoption. The Non-Profit Software market size for SMEs is expected to close part of today's gap, yet large organizations will still account for a majority of absolute dollars.

The Non-Profit Software Market Report is Segmented by Deployment (On Premises, Cloud), by Enterprise Size (SMEs, Large Enterprise), by Type (Admission-Based Nonprofit Software, Fundraising Software, Marketing Software, Volunteer Management, CRM, Other Types), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 44.05% of 2025 revenue, underpinned by favorable tax incentives for charitable giving and sophisticated vendor ecosystems. Large national implementations such as Boys and Girls Clubs of America highlight the scale potential when U.S. organizations unify data across hundreds of locations. Canada and Mexico add headroom, particularly for cloud migrations spurred by security certifications that now rival U.S. standards. Data-privacy laws such as CCPA reinforce the appeal of platforms with demonstrable compliance audits, further entrenching leading vendors.

Europe forms a mature but highly regulated landscape. GDPR mandates rigorous consent tracking and breach notification, so nonprofits select providers with local data centers and robust audit trails. Emphasis on sustainability metrics and social-impact reporting fuels demand for granular analytics that tie donations to outcomes. Localization-language, currency, and statutory reporting-remains a differentiator for regional vendors competing against global platforms. Despite modest GDP growth, digital-transformation funding from the European Commission keeps investment flowing into modern nonprofit stacks.

Asia-Pacific is the fastest-growing region at an 11.36% CAGR through 2031. Only 27% of nonprofits have migrated to cloud, revealing significant runway for uptake. Smartphone penetration vastly exceeds branch banking coverage, so mobile-first giving apps resonate strongly. Google.org's USD 1.5 million grant to Infoxchange underscores a coordinated push to digitize operations among regional charities. Australia and New Zealand provide early-adopter case studies, while Southeast Asia offers a greenfield prospect where nonprofits can leapfrog directly to SaaS without legacy baggage. Vendors that tailor lightweight, mobile-optimized interfaces and deliver regional payment options stand to gain share fastest.

- Blackbaud, Inc.

- Salesforce, Inc.

- Bloomerang, LLC

- Bonterra Tech, Inc. (Network for Good & EveryAction)

- Neon One, LLC

- Microsoft Corporation

- SAP SE

- Intuit Inc.

- Oracle Corporation

- Double the Donation, LLC

- DonorSearch, LLC

- WealthEngine, Inc.

- Community Brands Intermediate, LLC

- Cvent Holding Corp.

- Classy, Inc.

- DonorPerfect (SofterWare, Inc.)

- Virtuous Software, Inc.

- Funraise, Inc.

- Qgiv, Inc.

- Give Lively LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of cloud-based SaaS solutions

- 4.2.2 Growing demand for integrated fundraising & donor management platforms

- 4.2.3 Rising automation of routine nonprofit workflows

- 4.2.4 Expansion of mobile & digital giving channels

- 4.2.5 Emergence of AI-driven predictive donor analytics boosting ROI

- 4.2.6 Embedded payment APIs enabling micro-donations

- 4.3 Market Restraints

- 4.3.1 Budget constraints among small nonprofits

- 4.3.2 Data security & privacy concerns with cloud solutions

- 4.3.3 Integration complexity with legacy volunteer databases

- 4.3.4 Donor fatigue limiting uptake of new software tools

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premises

- 5.1.2 Cloud

- 5.2 By Enterprise Size

- 5.2.1 Small & Medium Nonprofits

- 5.2.2 Large Nonprofits

- 5.3 By Functional Module

- 5.3.1 Fundraising & Donation Management

- 5.3.2 Constituent / CRM

- 5.3.3 Marketing & Engagement

- 5.3.4 Volunteer Management

- 5.3.5 Grant Management

- 5.3.6 Finance & Accounting

- 5.3.7 Other Modules

- 5.4 By Revenue Model

- 5.4.1 Subscription SaaS

- 5.4.2 Perpetual License

- 5.4.3 Freemium & Donationware

- 5.5 By End-User Vertical

- 5.5.1 Education Nonprofits

- 5.5.2 Healthcare & Hospital Foundations

- 5.5.3 Faith-based & Religious

- 5.5.4 Human Services & International Aid

- 5.5.5 Arts & Culture

- 5.5.6 Environmental & Animal Welfare

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves (M&A, Partnerships, Launches)

- 6.3 Market Share Analysis (Top-15, 2024)

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Blackbaud, Inc.

- 6.4.2 Salesforce, Inc.

- 6.4.3 Bloomerang, LLC

- 6.4.4 Bonterra Tech, Inc. (Network for Good & EveryAction)

- 6.4.5 Neon One, LLC

- 6.4.6 Microsoft Corporation

- 6.4.7 SAP SE

- 6.4.8 Intuit Inc.

- 6.4.9 Oracle Corporation

- 6.4.10 Double the Donation, LLC

- 6.4.11 DonorSearch, LLC

- 6.4.12 WealthEngine, Inc.

- 6.4.13 Community Brands Intermediate, LLC

- 6.4.14 Cvent Holding Corp.

- 6.4.15 Classy, Inc.

- 6.4.16 DonorPerfect (SofterWare, Inc.)

- 6.4.17 Virtuous Software, Inc.

- 6.4.18 Funraise, Inc.

- 6.4.19 Qgiv, Inc.

- 6.4.20 Give Lively LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space & Unmet-Need Assessment