|

市场调查报告书

商品编码

1911795

自由职业平台:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Freelance Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

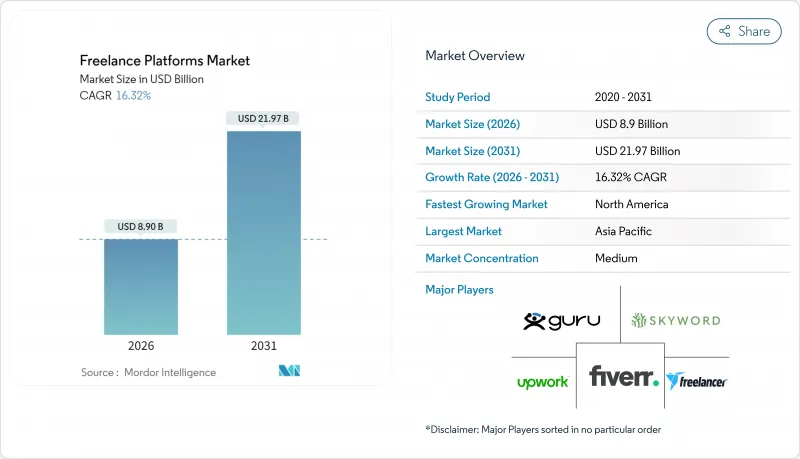

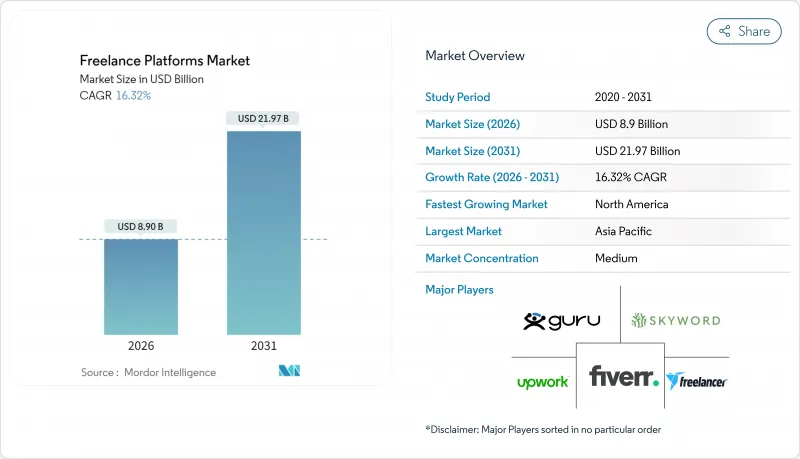

预计到 2026 年,自由职业平台市场规模将达到 89 亿美元,高于 2025 年的 76.5 亿美元。

预计到 2031 年将达到 219.7 亿美元,2026 年至 2031 年的复合年增长率为 16.32%。

混合办公模式的兴起、对小众数位技能日益增长的需求以及成本优化压力不断增加,都极大地推动了自由职业平台市场的成长。企业买家越来越倾向于透过能够确保合规性、提供灵活成本结构并能快速获取专业技能的平台来利用人才。人工智慧驱动的配对和生产力工具如今已成为竞争优势的基础,而新兴的跨境发票规则正在减少全球支付摩擦。从区域来看,北美在采用率方面保持主导,而亚太地区则随着企业加速推动数位转型计画而发展最为迅速。

全球自由职业平台市场趋势与洞察

向混合灵活办公模式过渡

美国劳工部于2024年发布了关于承包商分类的明确规定,为企业以合规的方式融合内部和外部人才铺平了道路,此后平台的使用率迅速提升。一家全球广告集团透过将咨询费转移到託管市场,一年内节省了960万美元的成本。如今,大型企业正将临时劳动力规划纳入其核心策略,并利用平台以比传统招募週期更快的速度获取新兴技能人才。受访企业报告称,自疫情爆发以来,非僱员人才的使用量增加了84%。因此,自由职业平台市场受益于劳动力预算的结构性而非週期性重新分配。

对专业数位技能的需求日益增长

对人工智慧、机器学习和高阶程式设计技能的需求年增了60%,推动自由工作者的时薪比平台平均高出44%。在日本,Go语言专家的月收入约为85.2万日圆(约5,680美元),而Ruby专家的月收入约为83.9万日圆(约5,593美元)。企业重视能够将技术建构与业务价值结合的跨职能专家,而该平台也努力提高人工智慧配对的准确性,以挖掘特定领域的专业人才。高定价权加上供不应求,维持了高价位的收费系统,从而增强了自由职业平台市场的成长前景。

对可靠性和支付安全性的担忧

对于向支付基础设施薄弱地区扩张的平台而言,担保交易工具和双因素认证如今已成为基本要求。儘管像 Guru 这样的服务在 SafePay 的实施方面有所改进,但诈骗手段仍在不断演变,因此需要持续投资于合规和反洗钱措施。因此,信任问题在短期内仍将对自由职业平台市场构成阻碍。

细分市场分析

平台收入主要来自于以交易量线性成长的收费模式,预计到2025年,平台收入将占自由职业平台市场份额的59.72%。 Upwork和Freelancer等平台依赖网路效应,随着用户群的不断扩大,主导地位也日益巩固。同时,在企业对确保合规性和计划成果的託管解决方案的需求推动下,服务业正以18.05%的复合年增长率加速成长。

像CXC Global这样的託管服务供应商每月管理超过12,000名用户,这显示市场对承包人才营运服务有着旺盛的需求。混合模式如今融合了市场平台的灵活性和精心策划的服务层级,为大规模买家打造分级产品。这种发展趋势表明,自由职业平台产业在整个人才管理生命週期中不断拓展价值获取的范围。

到 2025 年,计划管理工具将占自由职业平台市场规模的 23.12%,反映出对跨职能敏捷执行的普遍需求;而网页和平面设计领域将以 18.78% 的复合年增长率增长,这得益于人工智慧辅助的创新工作流程,降低了寻求高品质视觉效果的中小型企业的准入门门槛。

软体开发工作在新兴技术领域的预算中仍然占据主导地位,但随着企业转向基于绩效的合约模式,销售和行销领域的自由工作者也日益重要。 「其他应用」还包括法律合规和财务建模等细分领域,凸显了垂直专业化的机会。在每个应用层内进行更深入专业化的平台将获得更高的客户份额和留存率。

区域分析

亚太地区预计将以18.22%的复合年增长率领跑,这主要得益于快速的数位化以及诸如ViDA电子帐单等简化跨境交易的政策框架。日本企业通常每月向技术娴熟的自由工作者支付超过5000美元的报酬,这表明他们愿意为顶尖人才支付高薪。东南亚的成长速度也同样迅猛,当地企业正在克服传统的招募限制。

北美地区凭藉着成熟的基础设施和早期采用者的文化,在收入方面保持领先地位,市占率高达32.64%。美国的法规环境虽然复杂,但其清晰的联邦框架有利于承包商合规开展业务。在加拿大,各省推出的远距办公课税政策支援性指导方针正在推动远距办公市场的成长。

在欧洲,符合GDPR的资料保护措施提升了信任度,而计画于2030年实施的ViDA指令将确保欧盟内部的无缝结算,从而推动自由工作者市场的稳定成长。在拉丁美洲,货币波动是一项挑战,但该地货币钱包能够有效促进自由工作者的招募。中东和非洲仍处于发展初期,但展现出巨大的潜力,尤其是在波湾合作理事会(GCC)等科技中心,这些地区的政府创新政策正在推动对专业零工人才的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场驱动因素

- 向混合灵活办公模式过渡

- 对专业数位技能的需求日益增长

- 公司内部面临优化成本的压力

- 跨境电子帐单法规简化了自由工作者的付款流程。

- 生成式人工智慧副驾驶提昇平台员工生产力

- 借助人工智慧匹配演算法提高招募速度

- 市场限制

- 对可靠性和支付安全性的担忧

- 关于工人分类的规定含糊不清

- 算法偏见诉讼增加合规成本

- 数位广告管道的客户获取成本不断上升

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业生态系分析

- 主要用例和案例研究

- 宏观经济趋势评估

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 平台

- 服务

- 透过使用

- 计划管理

- 销售与行销

- 资讯科技和软体

- 网页和平面设计

- 其他用途

- 最终用户

- 雇主(大企业和小企业)

- 自由工作者

- 按组织规模

- 大公司

- 小型企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 新加坡

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Upwork Inc.

- Fiverr International Ltd.

- Freelancer Limited

- Toptal LLC

- Guru.com LLC

- PeoplePerHour.com Ltd.

- DesignCrowd Pty Ltd.

- Contently Inc.

- WorkGenius GmbH

- WorkMarket, Inc.

- Catalant Technologies, Inc.

- 99designs by Vista

- Behance(Adobe Inc.)

- TaskRabbit, Inc.

- Amazon Mechanical Turk(Amazon.com, Inc.)

- UpStack Technologies, Inc.

- Workana Inc.

- Gigster LLC

- Aquent LLC

- FlexJobs Corporation

第七章 市场机会与未来展望

Freelance platforms market size in 2026 is estimated at USD 8.9 billion, growing from 2025 value of USD 7.65 billion with 2031 projections showing USD 21.97 billion, growing at 16.32% CAGR over 2026-2031.

Shifts toward hybrid work, rising demand for niche digital skills, and growing cost-optimization pressures keep the momentum strong for the freelance platforms market. Enterprise buyers increasingly favor platform-mediated talent engagement because it delivers compliance, variable cost structures, and rapid access to specialized capabilities. AI-powered matching and productivity tools now underpin most competitive differentiation, while emerging cross-border invoicing rules reduce friction in global payments. Geographically, North America retains leadership in penetration rates, yet Asia-Pacific is expanding fastest as enterprises in the region accelerate digital transformation plans.

Global Freelance Platforms Market Trends and Insights

Shift toward hybrid and flexible workforce models.

Platform adoption accelerated after the U.S. Department of Labor's 2024 rule clarified contractor classification, giving enterprises a compliant path to blend internal and external talent . A global advertising group saved USD 9.6 million in one year by shifting consultant spend to a managed marketplace. Large corporations now bake contingent workforce planning into core strategy, using platforms to secure emerging skills faster than conventional hiring cycles allow. Surveyed firms report an 84% jump in non-employee talent use since the pandemic. The freelance platforms market, therefore, benefits from a structural rather than cyclical re-allocation of labor budgets.

Rising demand for specialized digital skills

Demand for AI, machine learning, and advanced programming skills rose 60% year-over-year, pushing freelance hourly rates up 44% above platform averages. Japanese data shows Go and Ruby specialists commanding monthly pay near JPY 852,000 (USD 5,680) and JPY 839,000 (USD 5,593), respectively. Enterprises prize cross-functional experts who can connect technology build-outs with business value, motivating platforms to refine AI-driven matching to surface niche talent. High pricing power and scarce supply combine to sustain premium fee structures, reinforcing growth prospects for the freelance platforms market.

Trust and payment-security concerns

Escrow tools and two-factor identity verification now form baseline requirements for platforms expanding into geographies with weak payment rails. SafePay adoption on Guru and similar services shows improvement, yet fraud techniques continue to evolve, forcing ongoing investment in compliance and anti-money-laundering safeguards. Trust issues therefore remain a near-term drag on the freelance platforms market.

Other drivers and restraints analyzed in the detailed report include:

- Cost-optimization pressure on enterprises

- Generative-AI copilots boost platform worker productivity.

- Algorithm-bias lawsuits are increasing compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform revenue streams captured 59.72% of the freelance platforms market share in 2025 on the strength of commission-based models that scale with transaction volume. Marketplaces such as Upwork and Freelancer rely on network effects, reinforcing their lead as user rolls deepen. The services component, however, is outpacing at an 18.05% CAGR, propelled by enterprise demand for managed solutions that guarantee compliance and project outcomes.

Managed service providers like CXC Global administer over 12,000 contractors monthly, showcasing an appetite for turnkey workforce orchestration. Hybrid models now blend marketplace agility with curated service layers, creating tiered offerings for large buyers. This evolution signals that the freelance platforms industry is widening its value capture along the full talent-management lifecycle.

Project management tools held 23.12% of the freelance platforms market size in 2025, reflecting universal demand for agile execution across functions. Yet web and graphic design is expanding at 18.78% CAGR, fueled by AI-assisted creative workflows that lower entry barriers for SMEs seeking premium visuals.

Software development assignments continue to command premium budgets in emerging tech stacks, while sales and marketing freelancers gain ground as firms migrate to performance-linked contracts. Niche domains such as legal compliance and financial modeling surface within "other applications," underscoring opportunities for vertical specialization. Platforms that deepen expertise within each application tier stand to capture higher wallet share and retention.

Freelance Platforms Market Report is Segmented by Component (Platform and Services), Application (Project Management, Sales and Marketing, IT and Software, Web and Graphic Design, and Other Applications), End-User (Employers, and Freelancers), Organization Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific posted the highest 18.22% CAGR outlook, underpinned by rapid digitalization and policy frameworks such as ViDA electronic invoicing that simplify cross-border transactions. Companies in Japan routinely pay skilled freelancers more than USD 5,000 monthly, signaling a robust willingness to pay for top talent . Growth in Southeast Asia is likewise accelerating as local firms leapfrog traditional hiring constraints.

North America remains the revenue leader with a 32.64% share, supported by mature infrastructure and an early-adopter enterprise culture. The U.S. regulatory environment, though complex, offers clear federal frameworks that encourage compliant contractor engagement. Canada adds momentum with supportive provincial guidelines around remote work taxation.

Europe sustains steady expansion as GDPR-aligned data safeguards increase trust and as the forthcoming 2030 ViDA mandate ensures seamless intra-EU invoicing. In Latin America, currency volatility poses challenges, yet localized wallets prove effective at promoting freelance adoption. The Middle East and Africa present nascent but promising pockets, especially among tech hubs in the Gulf Cooperation Council, where government innovation agendas boost demand for specialized gig talent.

- Upwork Inc.

- Fiverr International Ltd.

- Freelancer Limited

- Toptal LLC

- Guru.com LLC

- PeoplePerHour.com Ltd.

- DesignCrowd Pty Ltd.

- Contently Inc.

- WorkGenius GmbH

- WorkMarket, Inc.

- Catalant Technologies, Inc.

- 99designs by Vista

- Behance (Adobe Inc.)

- TaskRabbit, Inc.

- Amazon Mechanical Turk (Amazon.com, Inc.)

- UpStack Technologies, Inc.

- Workana Inc.

- Gigster LLC

- Aquent LLC

- FlexJobs Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward hybrid and flexible workforce models

- 4.2.2 Rising demand for specialised digital skills

- 4.2.3 Cost-optimisation pressure on enterprises

- 4.2.4 Cross-border e-invoicing regulation simplifying freelancer payments

- 4.2.5 Generative-AI copilots boosting platform worker productivity

- 4.2.6 AI-powered matching algorithms improving hire speed

- 4.3 Market Restraints

- 4.3.1 Trust and payment-security concerns

- 4.3.2 Regulatory ambiguity on worker classification

- 4.3.3 Algorithm-bias lawsuits increasing compliance costs

- 4.3.4 Escalating customer-acquisition costs on digital ad channels

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Project Management

- 5.2.2 Sales and Marketing

- 5.2.3 IT and Software

- 5.2.4 Web and Graphic Design

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Employers (Enterprises and SMBs)

- 5.3.2 Freelancers

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Upwork Inc.

- 6.4.2 Fiverr International Ltd.

- 6.4.3 Freelancer Limited

- 6.4.4 Toptal LLC

- 6.4.5 Guru.com LLC

- 6.4.6 PeoplePerHour.com Ltd.

- 6.4.7 DesignCrowd Pty Ltd.

- 6.4.8 Contently Inc.

- 6.4.9 WorkGenius GmbH

- 6.4.10 WorkMarket, Inc.

- 6.4.11 Catalant Technologies, Inc.

- 6.4.12 99designs by Vista

- 6.4.13 Behance (Adobe Inc.)

- 6.4.14 TaskRabbit, Inc.

- 6.4.15 Amazon Mechanical Turk (Amazon.com, Inc.)

- 6.4.16 UpStack Technologies, Inc.

- 6.4.17 Workana Inc.

- 6.4.18 Gigster LLC

- 6.4.19 Aquent LLC

- 6.4.20 FlexJobs Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment