|

市场调查报告书

商品编码

1911809

欧洲 SOCaaS(安全营运中心即服务)-市场占有率分析、产业趋势与统计、成长预测(2026-2031 年)Europe SOC As A Service (SOCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

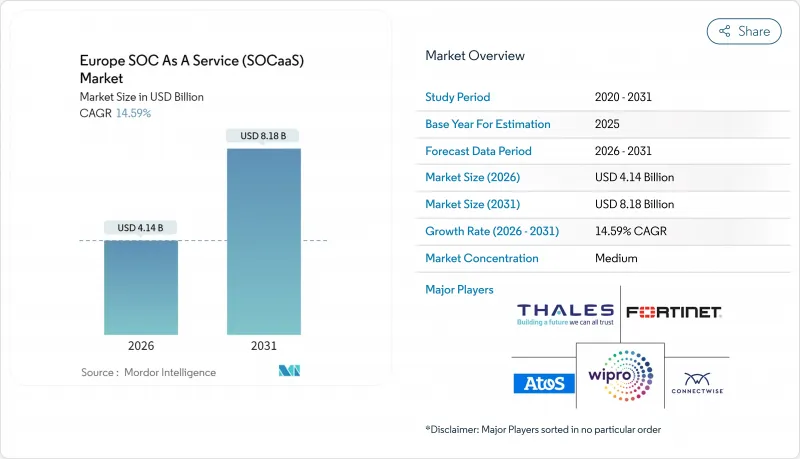

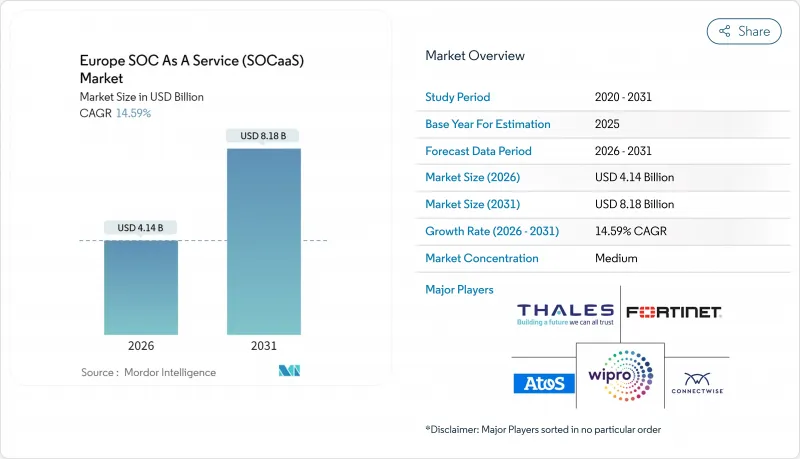

预计到 2026 年,欧洲 SOC 即服务 (SOCaaS) 市场规模将达到 41.4 亿美元。

这意味着从 2025 年的 36.1 亿美元成长到 2031 年的 81.8 亿美元,预计 2026 年至 2031 年的年复合成长率(CAGR)为 14.59%。

这一强劲的成长轨迹反映了关键领域的快速数位化、欧盟NIS2指令下日益严格的监管,以及对灵活的按需计量收费模式日益增长的需求,这些都促使企业将支出从资本支出转向营运支出。生成式人工智慧分析带来的更快侦测速度、云端优先架构带来的简化跨境部署,以及电信安全合作带来的整合连接和全天候监控,都在加速这一趋势的普及。同时,区域人才短缺和资料主权规则的碎片化限制了服务供应商的规模经济效益,从而维持了全球巨头和欧洲专业公司之间的竞争平衡。日益严格的网路保险要求、不断增加的操作技术(OT)风险以及持续不断的勒索软体攻击,使得企业高层持续专注于外包保全行动,从而推动了跨产业的需求成长。

欧洲SOCaaS(安全营运中心即服务)市场趋势与洞察

计量收费营运成本模式的采用率不断提高

欧洲企业正将安全支出从资本预算转向弹性营运模式,按监控事件或资产数量收费,从而能够即时调整成本以适应业务需求。这种模式加速了外包营运的普及,降低了中小企业的初始门槛,并使大型企业摆脱了频繁的硬体更新週期。付费使用制还允许跨国公司根据司法管辖区调整服务范围,这在欧洲安全营运中心即服务 (SOCaaS) 市场尤其重要,因为各国的监管义务各不相同。服务供应商也积极回应,提供分级套餐,将威胁情报、回应编配和合规性仪表板整合到单一帐单中。从中长期来看,这种定价结构的变化将重塑供应商选择标准,使透明度和使用分析与检测准确性同等重要。

中小企业的快速云端迁移

到2024年,78%的欧洲中小企业将把关键工作负载迁移到公共云端,这将带来传统单点工具无法保护的新型威胁面。这些企业目前正在寻找能够直接连接到超大规模资料中心业者服务商API并提供即时遥测资料的云端原生安全营运中心(SOC)平台,而无需昂贵的设备。北欧中小企业引领着这一采用趋势,受益于成熟的宽频基础设施和国家数位化措施。随着「数位十年」设定到2030年云端采用率达到75%的目标,欧洲安全营运中心即服务(SOCaaS)市场有望实现长期成长。服务供应商透过提供针对Microsoft 365、Google Workspace和多重云端场景的客製化方案来脱颖而出,从而减轻小规模IT团队的技能负担。

资料居住和主权问题的复杂性

各国不同的监管规定要求分别配置独立的储存、处理和日誌保留设施,这为多租户营运带来了结构性成本。法国的SecNumCloud和德国的C5认证提出了不同的框架,安全营运中心(SOC)供应商必须同时满足这些框架的要求,这往往迫使他们维护重复的基础设施。诸如欧盟数据法案等待决立法增加了未来跨境数据流动的不确定性,并延长了投资回报期。小规模的供应商面临不成比例的负担,这可能会延缓市场整合,并导致持续的价格战。

细分市场分析

到2025年,大型企业将占总收入的62.70%,为高复杂性、跨司法管辖区的监控奠定基础,从而推动欧洲安全营运中心即服务 (SOCaaS) 市场规模的成长。这些企业需要操作技术、供应链遥测和专用事件回应服务,因此需要签订包含客製化服务等级协定的高阶合约。然而,中小企业 (SME) 的复合年增长率 (CAGR) 为16.75%,凭藉整合在易于理解、简化的云端入口网站中的高级分析功能,它们拥有最大的收入成长潜力。付费使用制和与 Microsoft 365 的原生整合正在加速中小企业采用该服务,部署时间也成为服务提供者的关键绩效指标。

这种两极化的成长轨迹将迫使供应商在规模和专业化之间取得平衡。为大型企业复杂需求而最佳化的平台也需要为中小企业提供便利的入门管道,进而推动模组化架构的发展趋势。培训、客户成功资源和多语言介面将成为竞争优势,尤其是在英语程度差异较大的中欧和东欧地区。随着NIS2等法规降低合规阈值,欧洲安全营运中心即服务(SOCaaS)市场中小企业的比例将会增加,从而将收入重新分配给以规模为导向的服务层级。

到2025年,银行业、金融服务业和保险业将保持26.73%的市场份额,这反映了多年来在保全行动的投入以及严格的审核要求。与《数位营运弹性法案》的监管协调将进一步巩固对高级安全策略和即时报告的需求。医疗保健产业将以15.30%的复合年增长率成长,由于互联医疗设备、远端医疗和电子病历的普及导致攻击面扩大,该行业备受关注。欧洲药品管理局(EMA)发布的《2024年设备网路安全指南》强制要求持续监控,这将加速医院将全天候监控职能外包的趋势。

製造业正在部署安全营运中心 (SOC) 对工业控制系统进行监控,而零售业则专注于支付安全和客户资料完整性。欧盟网路包装等政府计画正在为公共部门的 SOC 提供资金,这些 SOC 通常与国家通讯业者合作运作。总体而言,行业特定的法规和独特的资产概况正在塑造客製化的检测技术和事件回应手册,从而提高了「一刀切」服务模式的进入门槛。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 宏观经济因素的影响

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 计量收费营运成本模式的采用率不断提高

- 加速中小企业云端迁移

- 提高网路保险对全天候监控的必要性

- 欧盟NIS2指令带来的合规要求日益提高

- 基于生成式人工智慧的威胁狩猎能力

- 通讯业者和MSP对託管式XDR商品搭售销售的需求激增

- 市场限制

- 资料居住和主权问题的复杂性

- 欧洲安全营运中心(SOC)层级网路安全人才短缺

- 多租户 SIEM 的隐性长期总拥有成本

- 与传统OT环境的整合存在摩擦

第五章 市场规模与成长预测

- 按组织规模

- 小型企业

- 大公司

- 最终用户

- 资讯科技和电信

- BFSI

- 零售和消费品

- 卫生保健

- 製造业

- 政府机构

- 其他的

- 按服务类型

- 託管侦测与回应

- 安全监控

- 脆弱性评估

- 事件回应

- 威胁情报

- 託管式安全资讯与事件管理 (SIEM)

- 其他服务类型

- 透过部署模式

- 云

- 本地部署

- 杂交种

- 按安全类型

- 网路安全

- 端点安全

- 应用程式安全

- 云端安全

- 其他安全类型

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 奥地利

- 比利时

- 瑞典

- 丹麦

- 波兰

- 捷克共和国

- 斯洛维尼亚

- 克罗埃西亚

- 保加利亚

- 白俄罗斯

- 其他欧洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- SecureWorks Inc.

- Fortinet Inc.

- Atos SE

- Thales Group

- Wipro Limited

- Cloudflare Inc.

- ConnectWise LLC

- Sophos Limited

- Ontinue Inc.

- PlusServer GmbH

- Teceze Limited

- Arctic Wolf Networks Inc.

- Rapid7 Inc.

- Orange Cyberdefense SA

- NTT Security Holdings Corporation

- Accenture PLC

- Telefonica Tech SLU

- Deloitte Touche Tohmatsu Limited

- KPMG International Limited

第七章 市场机会与未来展望

Europe Security Operations Center as a Service (SOCaaS) market size in 2026 is estimated at USD 4.14 billion, growing from 2025 value of USD 3.61 billion with 2031 projections showing USD 8.18 billion, growing at 14.59% CAGR over 2026-2031.

This strong trajectory reflects rapid digitization across critical sectors, the tightening grip of the EU NIS2 Directive, and the growing appeal of flexible pay-per-use models that shift spending from capital budgets to operating expenses. Adoption accelerates as generative-AI analytics shorten detection times, cloud-first architectures simplify cross-border deployment, and telecom-security partnerships bundle connectivity with 24X7 monitoring. At the same time, regional talent shortages and fragmented data-sovereignty rules temper scale advantages for service providers, keeping competition balanced between global giants and European specialists. Heightened cyber-insurance prerequisites, rising operational technology exposure, and persistent ransomware incidents keep board-level attention firmly on outsourced security operations, amplifying demand across industries.

Europe SOC As A Service (SOCaaS) Market Trends and Insights

Rise in Adoption of Pay-per-Use Opex Model

European organizations are shifting security spending from capital budgets to elastic operating models that bill by events or assets monitored, allowing real-time alignment of cost with business demand. The approach lowers upfront barriers for SMEs and frees large enterprises from periodic hardware refresh cycles, accelerating migration toward outsourced operations. Pay-per-use also helps multinational firms tune coverage per jurisdiction, a feature that resonates in the Europe SOC as a Service market where regulatory obligations diverge by country. Service providers respond by offering tiered packages that bundle threat intelligence, response orchestration, and compliance dashboards under a single invoice. Over the medium term, the pricing shift reshapes vendor selection criteria, making transparency and consumption analytics as important as detection accuracy.

Rapid Cloud Migration Among SMEs

Seventy-eight percent of European SMEs moved critical workloads to public clouds during 2024, exposing fresh threat surfaces that legacy point tools cannot secure. These companies now look to cloud-native SOC platforms that plug directly into hyperscaler APIs and deliver instant telemetry without costly appliance rollouts. Nordic SMEs lead adoption, benefiting from mature broadband infrastructure and national digital agendas. As the Digital Decade sets a 75% cloud-adoption target by 2030, the Europe SOC as a Service market gains a long runway for expansion. Providers differentiate through curated playbooks for Microsoft 365, Google Workspace, and multi-cloud scenarios, easing the skills burden for smaller IT teams.

Data Residency and Sovereignty Complexities

Fragmented national rules require separate storage, processing, and log-retention footprints, driving structural cost into multi-tenant operations. France's SecNumCloud and Germany's C5 certifications illustrate divergent frameworks that SOC vendors must satisfy in parallel, often maintaining duplicate infrastructure. Pending legislation such as the EU Data Act adds uncertainty on future cross-border flows, prolonging investment payback periods. Smaller providers face disproportionate burdens, potentially slowing market consolidation and sustaining price competition.

Other drivers and restraints analyzed in the detailed report include:

- EU NIS2 Directive Amplifying Compliance Demand

- Generative-AI Powered Threat Hunting Capabilities

- Scarcity of European SOC-Grade Cyber Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises commanded 62.70% of revenue in 2025, underpinning the Europe SOC as a Service market size for high-complexity, multi-jurisdiction monitoring. Their needs span operational technology, supply-chain telemetry, and dedicated incident response, fostering premium contracts with custom service-level agreements. Yet SMEs, growing at a 16.75% CAGR, inject the greatest volume upside as simplified cloud portals package advanced analytics into digestible bundles. Consumption pricing and native integration with Microsoft 365 accelerate SME onboarding, making onboarding time a key performance metric for providers.

The bifurcated trajectory places pressure on vendors to balance scale with specialization. Platforms tuned for large-enterprise complexity must also present easy paths for smaller customers, leading to modular architectures. Training, customer-success resources, and multilinguistic interfaces become competitive levers, especially in Central and Eastern Europe where English fluency varies. As compliance thresholds creep downward through regulations such as NIS2, SMEs will account for a rising portion of the Europe SOC as a Service market, redistributing revenue toward volume-oriented service tiers.

Banking, financial services, and insurance retained a 26.73% share in 2025, reflecting decades-long investment in security operations and stringent audit obligations. Regulatory alignment with the Digital Operational Resilience Act further cements demand for advanced playbooks and real-time reporting. Healthcare, advancing at a 15.30% CAGR, shifts the spotlight as connected medical devices, telehealth, and electronic records expand attack surfaces. The European Medicines Agency's 2024 guidance on device cybersecurity mandates ongoing monitoring, prompting hospitals to outsource round-the-clock oversight.

Manufacturing embraces SOC-enabled monitoring of industrial control systems, while retail focuses on payment security and customer-data integrity. Government programs such as the EU Cyber Package allocate funding to public-sector SOCs, often delivered in partnership with national telecoms. Overall, sector-specific regulation and unique asset profiles shape tailored detection-engineering and incident-response runbooks, strengthening barriers to entry for generic service models.

The Europe SOC As A Service Market Report is Segmented by Organization Size (Small and Medium-Sized Enterprises, and Large Enterprises), End User (IT and Telecom, BFSI, Healthcare, Manufacturing, Government, and More), Service Type (Managed Detection and Response, and More), Deployment Mode (Cloud, and More), Security Type (Network, Endpoint, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IBM Corporation

- SecureWorks Inc.

- Fortinet Inc.

- Atos SE

- Thales Group

- Wipro Limited

- Cloudflare Inc.

- ConnectWise LLC

- Sophos Limited

- Ontinue Inc.

- PlusServer GmbH

- Teceze Limited

- Arctic Wolf Networks Inc.

- Rapid7 Inc.

- Orange Cyberdefense SA

- NTT Security Holdings Corporation

- Accenture PLC

- Telefonica Tech S.L.U.

- Deloitte Touche Tohmatsu Limited

- KPMG International Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Industry Value-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Market Drivers

- 4.7.1 Rise in Adoption of Pay-per-Use Opex Model

- 4.7.2 Rapid Cloud Migration Among SMEs

- 4.7.3 Mounting Cyber-Insurance Prerequisites for 24x7 Monitoring

- 4.7.4 EU NIS2 Directive Amplifying Compliance Demand

- 4.7.5 Generative AI-Powered Threat Hunting Capabilities

- 4.7.6 Surge in Managed XDR Bundling by Telcos and MSPs

- 4.8 Market Restraints

- 4.8.1 Data Residency and Sovereignty Complexities

- 4.8.2 Scarcity of European SOC-Grade Cyber Talent

- 4.8.3 Hidden Long-Term TCO in Multi-Tenant SIEM

- 4.8.4 Integration Friction with Legacy OT Environments

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization Size

- 5.1.1 Small and Medium-sized Enterprises

- 5.1.2 Large Enterprises

- 5.2 By End User

- 5.2.1 IT and Telecom

- 5.2.2 BFSI

- 5.2.3 Retail and Consumer Goods

- 5.2.4 Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Government

- 5.2.7 Other End Users

- 5.3 By Service Type

- 5.3.1 Managed Detection and Response

- 5.3.2 Security Monitoring

- 5.3.3 Vulnerability Assessment

- 5.3.4 Incident Response

- 5.3.5 Threat Intelligence

- 5.3.6 Managed SIEM

- 5.3.7 Other Service Types

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-Premise

- 5.4.3 Hybrid

- 5.5 By Security Type

- 5.5.1 Network Security

- 5.5.2 Endpoint Security

- 5.5.3 Application Security

- 5.5.4 Cloud Security

- 5.5.5 Other Security Types

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Austria

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Denmark

- 5.6.11 Poland

- 5.6.12 Czechia

- 5.6.13 Slovenia

- 5.6.14 Croatia

- 5.6.15 Bulgaria

- 5.6.16 Belarus

- 5.6.17 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 SecureWorks Inc.

- 6.4.3 Fortinet Inc.

- 6.4.4 Atos SE

- 6.4.5 Thales Group

- 6.4.6 Wipro Limited

- 6.4.7 Cloudflare Inc.

- 6.4.8 ConnectWise LLC

- 6.4.9 Sophos Limited

- 6.4.10 Ontinue Inc.

- 6.4.11 PlusServer GmbH

- 6.4.12 Teceze Limited

- 6.4.13 Arctic Wolf Networks Inc.

- 6.4.14 Rapid7 Inc.

- 6.4.15 Orange Cyberdefense SA

- 6.4.16 NTT Security Holdings Corporation

- 6.4.17 Accenture PLC

- 6.4.18 Telefonica Tech S.L.U.

- 6.4.19 Deloitte Touche Tohmatsu Limited

- 6.4.20 KPMG International Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment