|

市场调查报告书

商品编码

1911823

RISC-V技术:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)RISC-V Tech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

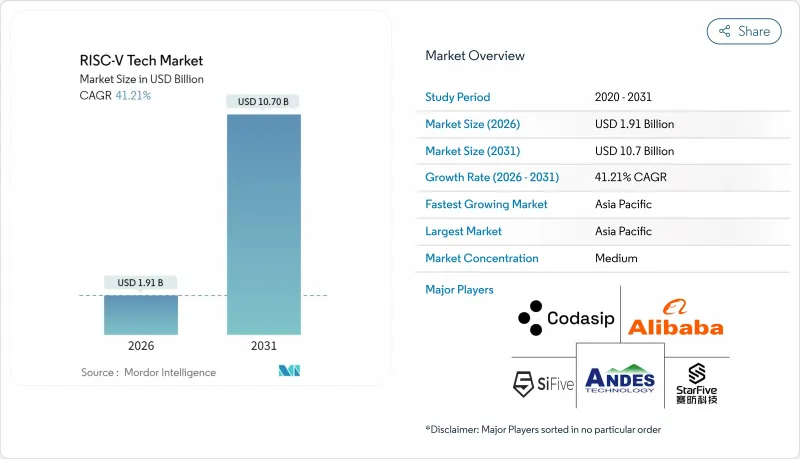

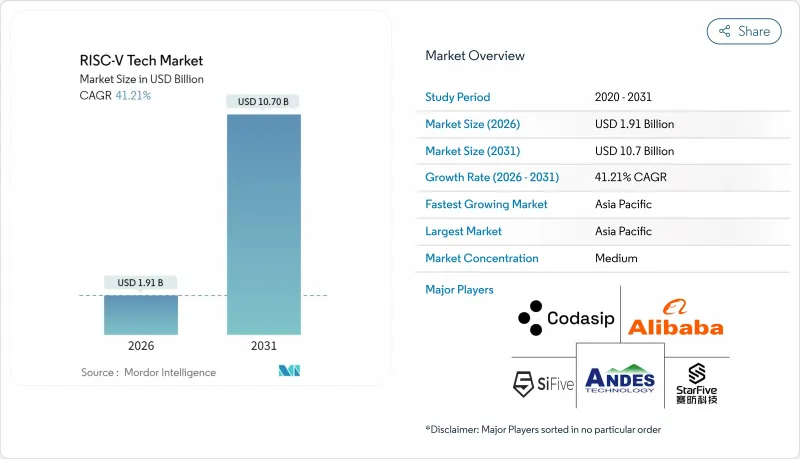

RISC-V 技术市场预计到 2025 年将达到 13.5 亿美元,到 2026 年将成长到 19.1 亿美元,到 2031 年将成长到 107 亿美元,在预测期(2026-2031 年)内复合年增长率为 41.21%。

亚太地区在2024年占据45.8%的主导地位,预计年复合成长率将达到65.2%,64位元核心在2024年占据42.4%的主导地位,以及家用电子电器、汽车、物联网和资料中心等领域的加速应用,是推动RISC-V技术成长的主要动力。可客製化的开放标准IP、美国、欧盟和中国的本土半导体项目,以及不断扩展的检验生态系统,都在推动设计方案的采用,加快产品上市速度,并吸引新企业进入RISC-V技术市场。然而,由于ISA扩展分散导致的软体复杂性、与ARM相比有限的向下相容性,以及成熟节点高阶EDA人才的短缺,仍然是可能减缓RISC-V技术普及速度的重大阻力。

物联网领域对成本高度敏感的设计要求,加上各国半导体自给自足政策,正在为RISC-V技术市场的垂直整合企业和区域领导者创造策略机会。 128位元核心的早期商业化、ISO 26262和ISO/SAE 21434认证IP的出现,以及透过RVA23规范推进的工具链标准化进程,都显示RISC-V技术在高效能运算、汽车和工业自动化领域具有持续的扩充性。对开源硬体Start-Ups的投资热情日益高涨,专利共用联盟的建立,以及IP供应商和EDA供应商之间的合作,进一步降低了准入门槛,并加速了软硬体一体化技术的整合。

全球 RISC-V 技术市场趋势与洞察

快速采用以人工智慧/机器学习为中心的边缘工作负载

边缘人工智慧的日益普及推动了对具有可调延迟和能耗的模组化处理器的需求,而RISC-V技术市场凭藉其向量扩展能力,能够加速摄影机、工业感测器和汽车系统中的神经网路推理,从而充分利用这一转变带来的机会。中国针对自主研发人工智慧晶片的半导体计画进一步巩固了这一优势,最大限度地降低了其受西方出口管制的影响。这项开放标准的柔软性催生了一个由IP供应商、工具链开发商和认证机构组成的网络,缩短了特定领域计算的设计週期,并为汽车安全和工厂自动化等领域的新型部署模式提供了可能。

软体工具链成熟度吸引一级原始设备製造商

与 GCC、LLVM 和 RVA23 规范的增强相容性提供了统一的工具链和强大的 Java/Python 执行时间环境,从而增强了市场对 RISC-V 技术的信心。随着 Intel、Google 和 NVIDIA 等主要支持者向上游贡献程式码,切换成本降低,一级 OEM 厂商现在可以使用单一开发工作流程支援多种效能等级。随着软体稳定性的提高,许多开发者和独立软体供应商 (ISV) 已开始移植其云端、边缘和嵌入式堆迭,进一步提升了 RISC-V 技术在企业和消费领域的市场渗透率。

碎片化的指令集架构扩展增加了软体的复杂度。

由于 RISC-V 规范允许自订扩展,数十家厂商纷纷推出各自的调整版本,这使得二进位檔案的可移植性和持续整合流程变得复杂。儘管 RVA23 规格规定了必要的 AI/ML 功能,但仍有许多选用功能,迫使作业系统厂商维护多个核心和工具链版本。这导致企业资讯长们必须同时维护基于 ARM 的平行蓝图,延缓了市场向 RISC-V 技术的全面过渡。

细分市场分析

截至2025年,64位设计将占据RISC-V技术市场41.85%的份额,市占率占比最高。半导体製造商青睐64位元内核,因为主流Linux发行版、Chromebook韧体和容器化云端软体均已支援64位元内核,这使得设计人员无需进行大规模重新设计即可获得大众市场收益。未来三年,随着工具链的日益成熟以及诸如SiFive的P870-D(可扩展至256个内核)等更大内核的蓝图,超大规模数据中心超大规模资料中心业者将能够在百亿亿次级(PB级)性能水平上测试RISC-V机架。

同时,128 位元架构的复合年增长率高达 58.2%,在 RISC-V 技术市场中位居榜首。这是因为百万兆级运算和参数超过一兆的 AI 模型需要庞大的位址空间和高精度的向量运算。基因组学和气候模拟等领域的记忆体密集型工作负载也促使研究机构开发 128 位元 RISC-V丛集原型。厂商们正竞相在作业系统、虚拟机器管理程式和编译器层级添加软体支持,目前 GCC 和 LLVM 的初始修补程式已经发布。虽然 32 位元核心在对成本敏感的物联网节点领域仍然占据主导地位,但随着更多 MCU 厂商效仿瑞萨电子的做法,将其高阶微控制器过渡到 64 位元位址空间,预计 32 位元核心的市场份额将逐渐萎缩。

区域分析

亚太地区预计到2025年将维持45.25%的营收占比,并在2031年之前以62.7%的复合年增长率成长,这主要得益于国家主导的资本推动晶圆厂扩张、智慧财产权池建设和检验实验室发展。中国的专利联盟降低了诉讼风险,使阿里巴巴、天海德和百度等公司能够扩大国内资料中心晶片和人工智慧晶片的规模。印度的「印度设计」宣传活动正在增加新的组装和测试能力,而Mindgrove计画在2025年开始量产MCU。

欧洲正透过投资2.4亿欧元,在DARE、eProcessor和SiPearl的Rhea等合资企业中建立自主化策略。 Rhea专案由巴塞隆纳超级运算中心设计。这些专案利用RISC-V架构来规避地缘政治风险并提升供应链韧性,使其成为EuroHPC长期发展蓝图的基石。优先发展领域包括百万兆级高效能运算、节能型边缘节点和安全型国防电子设备。

北美依然是创新的摇篮,资金筹措Start-Ups津贴、跨境计划人工智慧推理加速器和云端到边缘编配工具,所有这些都将推动RISC-V技术进入高性能市场。可客製化和降低成本是支撑转型投入的因素。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速采用以人工智慧/机器学习为中心的边缘工作负载

- 软体工具链成熟度吸引一级原始设备製造商

- 国家半导体主权计画(欧盟晶片法案、晶片与科学法案)

- 开放标准 IP 加速晶片上市

- 商业级检验生态系统(与 Imperus 和 Synopsys 合作)

- 第三方RISC-V加速器在特定领域运算中的兴起

- 市场限制

- 碎片化的指令集架构扩展增加了软体的复杂度。

- ARM指令集架构(ISA)的向后相容性保证有限

- 智慧财产权赔偿和专利诉讼的不确定性

- 成熟节点RISC-V EDA人才短缺

- 产业价值链分析

- 监管环境

- 技术展望(晶片组和异质整合)

- 宏观经济因素如何影响市场

- 投资分析

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依处理器核心类型

- 32 位元

- 64 位元

- 128 位元

- 透过使用

- 智慧型手机

- 5G设备

- 资料中心

- 个人电脑和游戏机

- 蜂巢式网路基础设施

- 物联网设备

- 其他用途

- 按最终用户行业划分

- 运算和储存

- 通讯基础设施

- 家用电子电器

- 汽车和运输设备

- 医疗保健

- 航太/军事

- 产业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Alibaba Group Holding Limited(T-Head Semiconductor)

- Andes Technology Corporation

- Antmicro Sp. z oo

- Apex Semiconductor(Shenzhen)Co., Ltd.

- Bluespec, Inc.

- C-Sky Microsystems Co., Ltd.

- CloudBEAR OU

- EMBEdded Logic Solutions Ltd.

- GreenWaves Technologies SA

- Huawei Technologies Co., Ltd.(HiSilicon)

- Imagination Technologies Limited

- Lattice Semiconductor Corporation

- Microchip Technology Incorporated

- MipSoC Ltd.

- Red Hat, Inc.(SiFive joint IP)

- Rivos Inc.

- SiFive, Inc.

- StarFive Technology Co., Ltd.

- Ventana Micro Systems, Inc.

- Western Digital Corporation

第七章 市场机会与未来展望

The RISC-V Tech market was valued at USD 1.35 billion in 2025 and estimated to grow from USD 1.91 billion in 2026 to reach USD 10.7 billion by 2031, at a CAGR of 41.21% during the forecast period (2026-2031).

Growth is powered by Asia-Pacific's 45.8% 2024 leadership and its projected 65.2% CAGR, the 64-bit core's 42.4% 2024 domination, and accelerating adoption in consumer electronics, automotive, IoT, and data-center segments. Customizable open-standard IP, sovereign semiconductor programs in the United States, European Union, and China, and an expanding verification ecosystem are amplifying design wins, shortening time-to-market, and attracting new entrants to the RISC-V Tech market.However, software complexity from fragmented ISA extensions, limited backward compatibility compared with ARM, and a shortage of senior EDA talent in mature nodes remain substantial headwinds that could temper adoption momentum.

Cost-sensitive design requirements in IoT are dovetailing with national chip-sovereignty mandates, creating a strategic opening for vertically integrated players and regional champions across the RISC-V Tech market. Early commercialization of 128-bit cores, the arrival of ISO 26262- and ISO/SAE 21434-certified IP, and growing tool-chain standardization through the RVA23 Profile point to sustained scalability into high-performance computing, automotive, and industrial automation. Investors' willingness to deploy capital into open-hardware startups, as well as alliances that pool patents or link IP vendors with EDA suppliers, are further diluting the barriers to entry and accelerating convergence toward a more cohesive software and hardware stack.

Global RISC-V Tech Market Trends and Insights

Rapid proliferation of AI/ML-centric edge workloads

Edge AI adoption is lifting demand for modular processors able to tune latency and energy consumption, and the RISC-V Tech market is capitalizing on that pivot through vector extensions that accelerate neural-network inference in cameras, industrial sensors, and in-vehicle systems. Chinese semiconductor programs targeting indigenous AI chips have pressed home this advantage, minimizing vulnerability to Western export controls. The same open-standard flexibility is spawning a network of IP vendors, tool-chain developers, and certification bodies, compressing design cycles for domain-specific compute and helping to unlock new deployment models in automotive safety and factory automation.

Software tool-chain maturity attracting Tier-1 OEMs

Growing alignment around GCC, LLVM, and the RVA23 Profile has strengthened confidence in the RISC-V Tech market by offering unified toolchains and robust Java and Python runtimes. Flagship backers such as Intel, Google, and Nvidia are contributing code upstream, lowering switching costs and enabling Tier-1 OEMs to target multiple performance tiers under a single development workflow. As software stability improves, broad-based developers and ISVs have begun porting cloud, edge, and embedded stacks, moving the RISC-V Tech market deeper into enterprise and consumer segments.

Fragmented ISA extensions are increasing software complexity

Because the RISC-V specification permits custom extensions, dozens of vendors have introduced proprietary tweaks that complicate binary portability and continuous-integration pipelines. While the RVA23 Profile sets out mandatory AI/ML features, optional elements remain numerous, forcing OS vendors to maintain multiple kernels and tool-chain variants. Enterprise CIOs cite this as a reason to keep ARM-based roadmaps in parallel, delaying full commitment to the RISC-V Tech market.

Other drivers and restraints analyzed in the detailed report include:

- National chip-sovereignty programs (EU Chips Act, CHIPS and Science Act)

- Open-standard IP accelerating silicon time-to-market

- Limited backward-compatibility guarantees versus ARM ISA

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

64-bit designs delivered 41.85% of the RISC-V Tech market share in 2025, translating into the largest slice of the RISC-V Tech market size. Semiconductor houses favor 64-bit cores because mainstream Linux distributions, Chromebook firmware, and containerized cloud software already support them, letting designers capture mass-market revenue without heavy re-engineering. Over the next three years, broader tool-chain maturity and big-core roadmaps such as SiFive's P870-D, which scales to 256 cores, will enable hyperscalers to test RISC-V racks at petascale performance levels.

The 128-bit cohort is registering a 58.2% CAGR, the fastest within the RISC-V Tech market, as exascale computing and AI models larger than 1 trillion parameters demand huge address spaces and high-precision vector math. Memory-intensive workloads in genomics and climate simulation are also nudging research centers to prototype 128-bit RISC-V clusters. Vendors are racing to add software support at the operating-system, hypervisor, and compiler levels, with early patches already appearing in GCC and LLVM. Although 32-bit cores remain the go-to choice for cost-sensitive IoT nodes, their share will compress modestly as more MCU vendors follow Renesas in migrating premium microcontrollers to 64-bit address spaces.

The RISC-V Tech Market Report is Segmented by Processor Core Type (32-Bit, 64-Bit, 128-Bit), Application (Smartphones, 5G Devices, Data Centers, and More), End-User Industry (Computing and Storage, Consumer Electronics, Medical, Industrial, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 45.25% of 2025 revenue and will grow at a 62.7% CAGR through 2031 as state-led capital drives fab expansion, IP pooling, and verification labs. China's patent alliance reduces litigation hazards and empowers firms like Alibaba, T-Head, and Baidu to scale indigenous data-center and AI silicon. India's design-in-India campaigns are adding new assembly and test capacity, with Mindgrove planning volume MCU shipments in 2025.

Europe is carving an autonomy pathway through EUR 240 million in joint ventures such as DARE, eProcessor, and SiPearl's Rhea, engineered at the Barcelona Supercomputing Center. These programs leverage RISC-V to hedge geopolitical risk and promote supply-chain resilience, making the architecture a linchpin of EuroHPC's long-term road map. Focus areas include exascale HPC, energy-efficient edge nodes, and secure defense electronics.

North America remains the innovation crucible: new funding for Rivos, Tenstorrent, and other Silicon Valley startups underscores deep-tech investor confidence. CHIPS Act grants reinforce domestic prototyping capacity, while cross-border projects with Japanese partners accelerate 2 nm process adoption. Regional priorities include chiplets, low-power AI inference accelerators, and cloud-to-edge orchestration tools, all of which extend the reach of the RISC-V Tech market into high-performance segments where customization and license savings justify transition costs.

- Alibaba Group Holding Limited (T-Head Semiconductor)

- Andes Technology Corporation

- Antmicro Sp. z o.o.

- Apex Semiconductor (Shenzhen) Co., Ltd.

- Bluespec, Inc.

- C-Sky Microsystems Co., Ltd.

- CloudBEAR OU

- EMBEdded Logic Solutions Ltd.

- GreenWaves Technologies S.A.

- Huawei Technologies Co., Ltd. (HiSilicon)

- Imagination Technologies Limited

- Lattice Semiconductor Corporation

- Microchip Technology Incorporated

- MipSoC Ltd.

- Red Hat, Inc. (SiFive joint IP)

- Rivos Inc.

- SiFive, Inc.

- StarFive Technology Co., Ltd.

- Ventana Micro Systems, Inc.

- Western Digital Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid proliferation of AI/ML-centric edge workloads

- 4.2.2 Software toolchain maturity attracting Tier-1 OEMs

- 4.2.3 National chip-sovereignty programs (EU Chips Act, CHIPS and Science Act)

- 4.2.4 Open-standard IP accelerating silicon time-to-market

- 4.2.5 Commercial-grade verification ecosystems (imperas, Synopsys partnerships)

- 4.2.6 Emergence of 3rd-party RISC-V accelerators for domain-specific compute

- 4.3 Market Restraints

- 4.3.1 Fragmented ISA extensions increasing software complexity

- 4.3.2 Limited backward-compatibility guarantees vs. ARM ISA

- 4.3.3 IP indemnification and patent-litigation uncertainties

- 4.3.4 Scarcity of RISC-V ready EDA talent in mature nodes

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Chiplet and Heterogenous Integration)

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Investment Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Threat of New Entrants

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Bargaining Power of Suppliers

- 4.9.4 Threat of Substitute Products

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Processor Core Type

- 5.1.1 32-bit

- 5.1.2 64-bit

- 5.1.3 128-bit

- 5.2 By Application

- 5.2.1 Smartphones

- 5.2.2 5G Devices

- 5.2.3 Data Centers

- 5.2.4 Personal Computers and Game Consoles

- 5.2.5 Cellular Network Infrastructure

- 5.2.6 IoT Devices

- 5.2.7 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Computing and Storage

- 5.3.2 Communication Infrastructure

- 5.3.3 Consumer Electronics

- 5.3.4 Automotive and Transportation

- 5.3.5 Medical

- 5.3.6 Aerospace and Military

- 5.3.7 Industrial

- 5.3.8 Other End-User Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South-East Asia

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Alibaba Group Holding Limited (T-Head Semiconductor)

- 6.4.2 Andes Technology Corporation

- 6.4.3 Antmicro Sp. z o.o.

- 6.4.4 Apex Semiconductor (Shenzhen) Co., Ltd.

- 6.4.5 Bluespec, Inc.

- 6.4.6 C-Sky Microsystems Co., Ltd.

- 6.4.7 CloudBEAR OU

- 6.4.8 EMBEdded Logic Solutions Ltd.

- 6.4.9 GreenWaves Technologies S.A.

- 6.4.10 Huawei Technologies Co., Ltd. (HiSilicon)

- 6.4.11 Imagination Technologies Limited

- 6.4.12 Lattice Semiconductor Corporation

- 6.4.13 Microchip Technology Incorporated

- 6.4.14 MipSoC Ltd.

- 6.4.15 Red Hat, Inc. (SiFive joint IP)

- 6.4.16 Rivos Inc.

- 6.4.17 SiFive, Inc.

- 6.4.18 StarFive Technology Co., Ltd.

- 6.4.19 Ventana Micro Systems, Inc.

- 6.4.20 Western Digital Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment