|

市场调查报告书

商品编码

1934711

硫酸软骨素:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Chondroitin Sulfate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

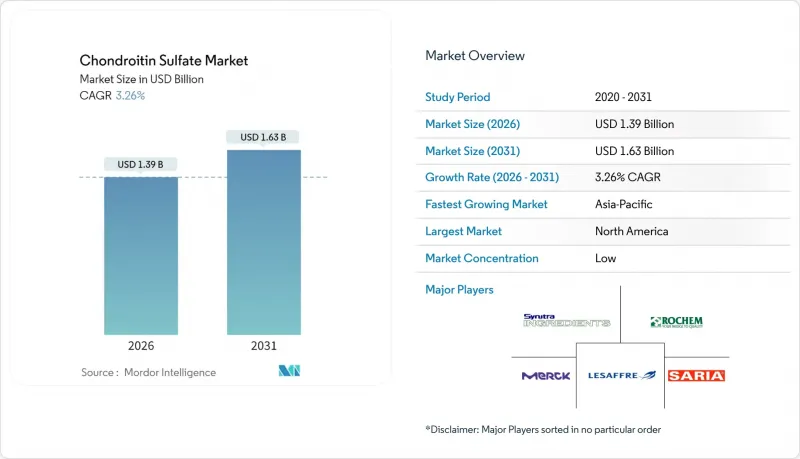

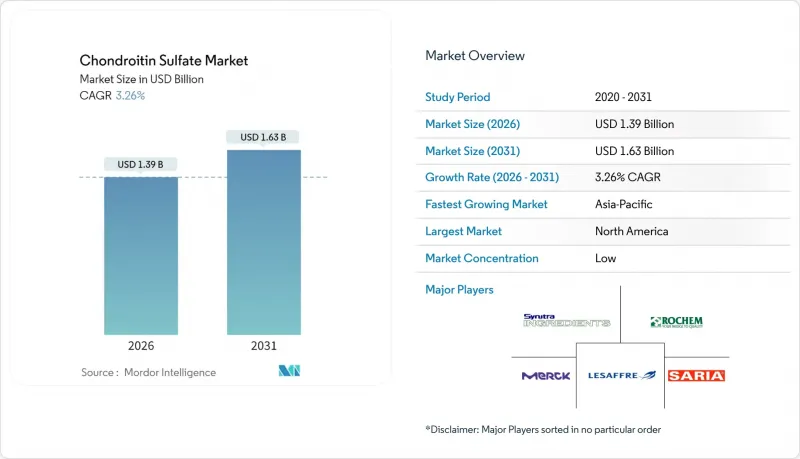

2025年硫酸软骨素市值为13.5亿美元,预计到2031年将达到16.3亿美元,高于2026年的13.9亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.26%。

这一稳定成长的趋势主要受以下因素驱动:45岁以上成年人骨关节炎发病率的急剧上升,导致动物源性成分面临越来越大的压力;以及临床疗效的不断提升,使得药用级成分成为行业标准。合成和发酵生产技术的加速创新为长期供应安全提供了保障,而与胶原蛋白、透明质酸或乳香等成分的复配製剂则拓展了其应用范围。竞争策略日益强调垂直整合,以品管并利用有利于高品质产品的监管差异。同时,亚太地区的生产能力也带来了成长机会,这有助于支持出口市场并缓解原材料价格波动对全球供应造成的周期性压力。

全球硫酸软骨素市场趋势及洞察

45岁及以上人群中骨关节炎的盛行率不断上升

预期寿命的延长和45岁以上人口的成长推动了对药用级硫酸软骨素的持续需求。骨关节炎影响美国3,250万成年人,而诸如MOVES试验等大型临床试验表明,经过六个月的治疗,其疗效与塞来昔布相当。亚太地区也呈现类似的人口结构变化,加速了对膳食补充剂的需求。最近一项以卷尾虫为模型的研究表明,内源性硫酸软骨素水平翻倍与寿命延长30.6%相关,进一步检验了其作为预防药物的作用。随着肌肉骨骼疾病在全球致残原因排名中不断上升,医疗保健系统正在将硫酸软骨素纳入复杂的治疗管理中,这正逐渐成为长期治疗的基础。

膳食补充剂对关节健康越来越受欢迎

预防性自我护理的趋势已将医药领域的研究成果转化为非处方产品,推动全球关节保健品市场规模超过1,000亿美元。在亚太地区,中产阶级消费者经常服用硫酸软骨素粉末、颗粒和咀嚼片,并青睐将其与胶原蛋白和乳香萃取物结合的复合产品,这些产品可在短短五天内缓解疼痛。儘管医药级和食品级之间的标准化差距依然存在,但高端营养补充剂正在弥合这一差距,一些品牌声称其产品纯度达到美国药典(USP)级别,以此来支撑更高的价格。

动物性原料供应波动

牲畜疾病週期、肉类停工以及《濒危野生动植物种国际贸易公约》(CITES)对鲨鱼软骨的限制,都会週期性地限制原料供应并推高成本。製造商透过采购多种原料并建立库存来规避风险,但这会增加营运资金需求,并加大终端用户的价格压力。合成路线和发酵技术可以降低这种风险,从而推动可控生物加工的策略性资本投资。

细分市场分析

凭藉成熟的供应链和具有竞争力的价格,猪软骨预计到2025年将占销售额的25.12%。同时,合成软骨产品虽然目前占比仍不足10%,但正以5.81%的复合年增长率快速成长。采用基因改造大肠桿菌的发酵系统可在48小时内达到99%的纯度。此製程可产生符合药典测试标准的均匀硫酸化模式,并显着降低内毒素风险。这项转变符合生态标章、犹太洁食/清真食品需求以及纯素相容性要求,使领先采用者获得声誉优势。牛软骨仍然重要,但必须透过认证采购来应对疯牛症(牛脑病变)的担忧。由于《濒危野生动植物种国际贸易公约》(CITES)法规的不断扩展,鲨鱼软骨的需求持续下降,而禽类软骨则在满足宗教要求的配方中保持着一定的市场地位。

价格趋势显示存在权衡取舍:目前合成乳的每公斤成本高于牛基准值,但较低的精炼损耗和环境溢价正在缩小两者之间的差距。在发酵槽产能扩张带来的规模经济效益的推动下,预计到2031年,合成乳的市占率将接近15.3%,从而缓解原物料价格上涨对利润率的挤压。

到2025年,药用级产品将占市场份额的49.62%,随着临床证据的不断增强和医保覆盖范围的扩大,其价格也将水涨船高。 MOVES试验的结果表明,其疗效与塞罗昔布相当,且无胃肠道疾病等副作用。食品级配方推动的硫酸软骨素市场规模预计将以5.18%的复合年增长率成长,反映出消费者愿意为预防性关节护理付费。目前化妆品级产品仍占市占率小规模,主要用于抗老精华液以发挥保湿功效。

製药公司拥有完全符合ICH标准的品管系统、批次放行分析和可追溯的供应链——这些要素通常是小规模的食品级供应商所缺乏的。然而,膳食补充剂品牌如果能够透过USP认证的产品线弥补这一差距,就能提升产品吸引力,并使其更高的价格更具合理性,尤其是在强调透明度的电商管道中。因此,监管逐步实施并非一道难以逾越的障碍,反而为有能力的食品级企业进入製剂市场提供了一条途径——前提是他们愿意投入资源进行检验。

区域分析

预计到2025年,北美地区将占总收入的38.62%,这主要得益于处方笺硫酸软骨素的健保覆盖、大规模的骨关节炎患者群体以及成熟的膳食补充剂零售管道。食品用途的GRAS(公认安全)认证和FDA纯度标准指南增强了消费者的信心,而诉讼风险则促使製造商继续投资于精确分析。该地区2.78%的复合年增长率虽然稳健,但也反映了其市场的成熟度。

亚太地区是成长最快的地区,复合年增长率达6.54%,中国和印度产能的扩张支撑了国内和出口需求。人口老化以及人们对传统医学的接受度正在加速颗粒状硫酸软骨素速溶袋和气泡式饮料的普及。日本对治疗腰椎间盘突出症的药物Chondriaze的临床认可进一步推动了治疗方法的多样化。

在欧洲,已有13个国家核准了处方药,医生开始使用药用级硫酸软骨素取代非类固醇抗发炎药物来降低心血管风险。南欧的膳食补充剂消费者更倾向于含有地中海植物成分的复杂配方。南美洲以及中东和非洲地区虽然发展落后,但随着当地经销商与欧洲药品供应商达成许可协议,并将销售管道拓展至私人诊所和高端药房,其复合年增长率也保持在个位数水平。标籤法规和清真认证的区域差异仍然会影响产品的上市时间。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第4章 市场情势

- 市场概览

- 市场驱动因素

- 45岁及以上人群中骨关节炎的盛行率不断上升

- 关节保健品中膳食补充剂的采用率不断提高

- 欧盟和美国不断加强监管,鼓励使用药用级CS。

- 扩大中国和印度的牛软骨加工能力

- 注射用黏弹性补充剂的研究与开发进展(未报告)

- 再生医学领域对低分子量硫酸软骨素的需求不断增长(未报告)

- 市场限制

- 动物性原料供应波动

- 食品级CS的品质与诈欺问题

- 加强《濒危野生动植物种国际贸易公约》(CITES)关于鲨鱼软骨取得的规定(未报告)

- 植物来源的Glico类似物正变得越来越受欢迎(未报导)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按来源

- 牛软骨

- 猪软骨

- 鲨鱼软骨

- 鸟类软骨

- 合成

- 其他资讯来源

- 按年级

- 医药级

- 食品级

- 化妆品级

- 按形式

- 粉末

- 颗粒

- 片剂和胶囊

- 注射液/溶液

- 透过使用

- 处方药和非处方药

- 营养补充品

- 化妆品和个人护理

- 动物医药

- 按地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- 公司简介

- Bioiberica SAU

- Changzhou Qianhong Bio-pharma Co., Ltd.

- Focus Chem Biotech(Nantong Furuida)

- Gnosis by Lesaffre

- IBSA Institut Biochimique SA

- Jiaxing Hengtai Pharma Co., Ltd.

- Kraeber & Co. GmbH

- Pacific Rainbow International Inc.

- Qingdao WanTuMing Biological Co., Ltd.

- Seikagaku Corporation

- Shandong Dongcheng Pharmaceutical Co., Ltd.

- Summit Nutritionals International

- Synutra Ingredients

- Tidal Vision Products

- TSI Group Ltd.

- Zhaoqing Konson Nutraceutical Co., Ltd.

- Focus Chem Biotech

第七章 市场机会与未来展望

The chondroitin sulfate market was valued at USD 1.35 billion in 2025 and estimated to grow from USD 1.39 billion in 2026 to reach USD 1.63 billion by 2031, at a CAGR of 3.26% during the forecast period (2026-2031).

This steady trajectory is shaped by the rapid rise in osteoarthritis among adults over 45, mounting pressure on animal-derived sources, and growing clinical validation that positions pharmaceutical-grade material as the industry benchmark. Intensifying innovation around synthetic and fermentation-based production underpins long-term supply security, while combination formulations with collagen, hyaluronic acid or Boswellia serrata broaden application breadth. Competitive strategies increasingly emphasize vertical integration to control raw-material quality and leverage regulatory differentiation that rewards higher-grade offerings. Parallel growth opportunities lie in Asia-Pacific manufacturing capacity, which supports export markets and mitigates raw-material price swings that periodically tighten global supply.

Global Chondroitin Sulfate Market Trends and Insights

Intensifying Osteoarthritis Prevalence Among 45+ Population

Rising life expectancy and a larger cohort of adults over 45 sustain demand for pharmaceutical-grade chondroitin sulfate, with osteoarthritis affecting 32.5 million U.S. adults. Large-scale trials such as MOVES confirmed efficacy comparable to celecoxib over six-month regimens. Asia-Pacific mirrors this demographic wave, magnifying nutraceutical uptake. Recent C. elegans work showing 30.6% lifespan extension when endogenous chondroitin doubled adds mechanistic validation that resonates with preventive-care positioning. With musculoskeletal disorders climbing the global disability chart, healthcare systems adopt chondroitin sulfate in multi-modal management, embedding this driver as a long-term pillar.

Rising Nutraceutical Adoption in Joint-Health Supplements

Preventive self-care trends convert pharmaceutical insights into over-the-counter formats, propelling joint-health supplements past USD 100 billion globally. In Asia-Pacific, middle-class consumers integrate chondroitin sulfate powders, granules and chewables into daily routines, attracted by combination formats that cut pain in as few as five days when paired with collagen and Boswellia serrata. Standardization gaps still differentiate pharmaceutical-grade from food-grade, but premium nutraceuticals bridge this divide as brands tout USP-level purity to justify higher price points.

Volatility in Animal-Derived Raw-Material Supply

Livestock disease cycles, slaughterhouse shutdowns and CITES constraints on shark cartilage periodically curtail raw-material flows and elevate costs. Manufacturers hedge through multi-species sourcing and higher inventories, which lift working-capital requirements and price tags for end users. Synthetic pathways and fermentation reduce this exposure, encouraging strategic capex toward controlled bioprocessing.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Upgrades Endorsing Pharmaceutical-Grade CS in EU & US

- Expansion of Bovine Cartilage Processing Capacity in China & India

- Quality & Adulteration Concerns in Food-Grade CS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

2025 revenue shows swine cartilage at 25.12%, supported by mature supply chains and competitive pricing. Yet synthetic output, still below 10% share, races ahead at a 5.81% CAGR. Fermentation systems using engineered E. coli achieve 99% purity in 48 hours. This process yields consistent sulfation patterns that satisfy pharmacopoeia tests and greatly reduce endotoxin risk. The pivot aligns with eco-labeling, kosher/halal demand and vegan positioning, granting first movers a reputational moat. Bovine cartilage remains relevant but must manage BSE perception through certified sourcing. Shark cartilage continues to fall as CITES listings expand, and avian cartilage holds niche status for religious-compliance formulations.

Pricing dynamics illustrate the trade-off: synthetic costs per kilogram currently exceed bovine benchmarks, yet lower purification losses and environmental premiums narrow the gap. As expanded fermenter capacity drives economies of scale, synthetic share is projected to approach 15.3% by 2031, moderating raw-material price spikes that historically pinched margins.

Pharmaceutical-grade products contributed 49.62% of 2025 value and command a widening premium amid stronger clinical evidence and reimbursement recognition. MOVES trial outcomes showed equivalence to celecoxib without gastrointestinal side effects. The chondroitin sulfate market size attributable to food-grade formulations climbs at 5.18% CAGR, reflecting consumer willingness to pay for proactive joint care. Cosmetics-grade remains a micro-segment, integrated in anti-aging serums for moisture retention.

Pharmaceutical manufacturers showcase full ICH-compliant quality systems, batch-release analytics and traceable supply chains that smaller food-grade suppliers often lack. However, nutraceutical brands closing this gap with USP-verified product lines improve shelf appeal and justify higher price points, especially through e-commerce channels emphasizing transparency. The regulatory gradient therefore acts less as an impermeable wall and more as a pathway for capable food-grade players to ascend into prescription markets, provided they allocate resources to validation.

The Chondroitin Sulfate Market Report is Segmented by Source (Bovine Cartilage, Porcine Cartilage, Shark Cartilage, Avian Cartilage, Synthetic, Other Sources), Grade (Pharmaceutical Grade, Food Grade, Cosmetics Grade), Form (Powder, Granules, and More), Application (Pharmaceuticals & OTC Drugs, Dietary Supplements, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 38.62% of 2025 revenue, anchored by insurance coverage for prescription chondroitin sulfate, a large osteoarthritis patient pool and well-established nutraceutical retail channels. GRAS acceptance for food use and FDA guidance on purity thresholds reinforce consumer trust, though litigation risk keeps manufacturers invested in high-end analytics. The region's stable yet modest 2.78% CAGR reflects maturity.

Asia-Pacific rises fastest at 6.54% CAGR, propelled by capacity buildouts in China and India that feed both domestic and export demand. Aging demographics intersect with traditional medicine openness, accelerating uptake of sachet sticks and effervescent drinks that dissolve granulated chondroitin sulfate. Japanese clinical acceptance of condoliase for lumbar disc herniation further diversifies therapeutic landscapes.

Europe benefits from ethical-drug approvals across 13 countries, with physicians prescribing pharmaceutical-grade chondroitin sulfate in place of NSAIDs to mitigate cardiovascular risk. Southern European nutraceutical consumers favor combination formulas featuring Mediterranean botanicals. South America and Middle East & Africa trail but post mid-single-digit CAGR as local distributors negotiate licensing deals with European API suppliers, extending reach into private clinics and upscale pharmacies. Regional heterogeneity in labeling rules and halal certification continues to affect product-launch timelines.

- Bioiberica

- Changzhou Qianhong Bio-pharma Co., Ltd.

- Focus Chem Biotech (Nantong Furuida)

- Gnosis by Lesaffre

- IBSA Institut Biochimique SA

- Jiaxing Hengtai Pharma Co., Ltd.

- Kraeber & Co. GmbH

- Pacific Rainbow International Inc.

- Qingdao WanTuMing Biological Co., Ltd.

- Seikagaku

- Shandong Dongcheng Pharmaceutical Co., Ltd.

- Summit Nutritionals International

- Synutra Ingredients

- Tidal Vision Products

- TSI Group

- Zhaoqing Konson Nutraceutical Co., Ltd.

- Focus Chem Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensifying osteoarthritis prevalence among 45 + population

- 4.2.2 Rising nutraceutical adoption in joint-health supplements

- 4.2.3 Regulatory upgrades endorsing pharmaceutical-grade CS in EU & US

- 4.2.4 Expansion of bovine cartilage processing capacity in China & India

- 4.2.5 Growth of injectable viscosupplement R&D (under-reported)

- 4.2.6 Emerging demand for low-molecular-weight CS in regenerative medicine (under-reported)

- 4.3 Market Restraints

- 4.3.1 Volatility in animal-derived raw-material supply

- 4.3.2 Quality & adulteration concerns in food-grade CS

- 4.3.3 Stricter CITES controls on shark cartilage sourcing (under-reported)

- 4.3.4 Plant-based glycosaminoglycan analogues gaining traction (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Source (Value)

- 5.1.1 Bovine Cartilage

- 5.1.2 Porcine Cartilage

- 5.1.3 Shark Cartilage

- 5.1.4 Avian Cartilage

- 5.1.5 Synthetic

- 5.1.6 Other Sources

- 5.2 By Grade (Value)

- 5.2.1 Pharmaceutical Grade

- 5.2.2 Food Grade

- 5.2.3 Cosmetics Grade

- 5.3 By Form (Value)

- 5.3.1 Powder

- 5.3.2 Granules

- 5.3.3 Tablets & Capsules

- 5.3.4 Injectable / Solution

- 5.4 By Application (Value)

- 5.4.1 Pharmaceuticals & OTC Drugs

- 5.4.2 Dietary Supplements

- 5.4.3 Cosmetics & Personal Care

- 5.4.4 Veterinary Medicine

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Bioiberica S.A.U.

- 6.3.2 Changzhou Qianhong Bio-pharma Co., Ltd.

- 6.3.3 Focus Chem Biotech (Nantong Furuida)

- 6.3.4 Gnosis by Lesaffre

- 6.3.5 IBSA Institut Biochimique SA

- 6.3.6 Jiaxing Hengtai Pharma Co., Ltd.

- 6.3.7 Kraeber & Co. GmbH

- 6.3.8 Pacific Rainbow International Inc.

- 6.3.9 Qingdao WanTuMing Biological Co., Ltd.

- 6.3.10 Seikagaku Corporation

- 6.3.11 Shandong Dongcheng Pharmaceutical Co., Ltd.

- 6.3.12 Summit Nutritionals International

- 6.3.13 Synutra Ingredients

- 6.3.14 Tidal Vision Products

- 6.3.15 TSI Group Ltd.

- 6.3.16 Zhaoqing Konson Nutraceutical Co., Ltd.

- 6.3.17 Focus Chem Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment