|

市场调查报告书

商品编码

1934730

欧洲豪华车市场-份额分析、产业趋势、统计和成长预测(2026-2031)Europe Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

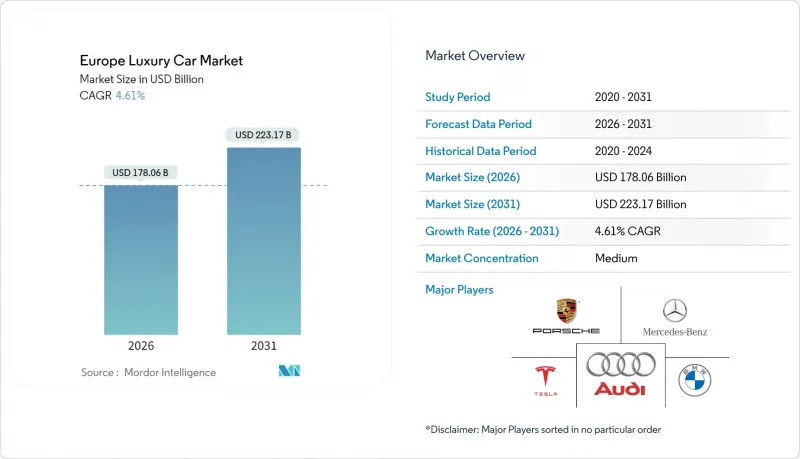

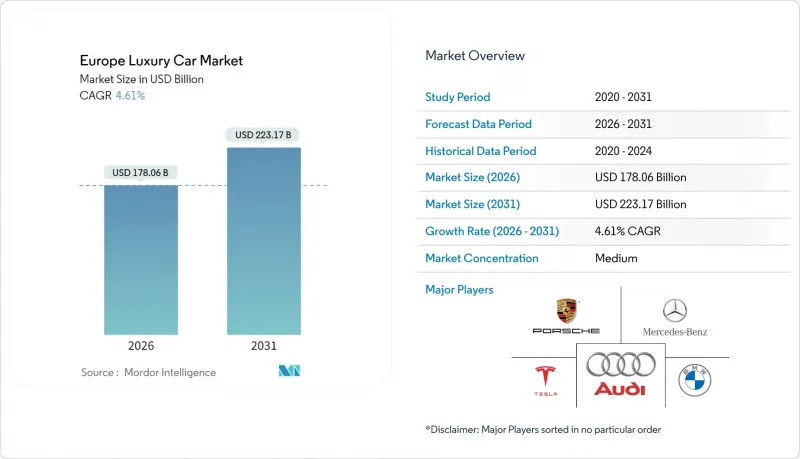

2025年欧洲豪华车市场价值1,702.1亿美元,预计到2031年将达到2,231.7亿美元,高于2026年的1,780.6亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.61%。

需求韧性归功于富裕家庭持续的资产累积、老牌製造商强大的品牌资产,以及加速推广电动车款的扶持性政策框架。运动型多用途车(SUV)依然拥有最大的基本客群,但人们对小轿车和敞篷车的兴趣日益浓厚,预示着对体验式驾驶的新需求。儘管向纯电动动力传动系统的转型正在加速,但内燃机汽车仍占据市场主导地位,迫使製造商在规模经济和监管合规之间寻求平衡。订阅和其他灵活的出行模式成长最为迅速,反映了消费者出行方式向服务型出行方式的转变,并创造了与车载数位化功能相关的新收入来源。

欧洲豪华车市场趋势与洞察

超高净值人士(UHNWI)和高净值人士(HNWI)的数量不断增长

欧洲富裕阶层持续累积金融资产,支撑着不断成长的潜在豪华车买家群体。儘管宏观经济不确定性日益加剧,但财富调查证实,超级富豪阶级(UHNWI)的数量稳步增长,尤其是在瑞士和德国。这些消费者对专属客製化、最尖端科技和品牌传承的追求,即使在大众市场疲软的情况下,也支撑着市场需求。由于这一消费群体偏好客製化配置,製造商得以享受更高的毛利率。随着经济实力日益集中于高收入群体,高购买力使高端汽车製造商免受週期性经济衰退的影响,并增强了其定价权。

豪华车领域的快速电气化

将于2026年11月生效的欧盟7排放气体标准将迫使汽车製造商逐步淘汰高排放发动机,并加速推广纯电动车(BEV)。豪华车客户通常是先进技术的早期使用者,只要性能标准得到满足,他们越来越愿意驾驶电动车。汽车製造商正在大力投资于专用电动车平台、固态电池研发以及全欧洲范围内的充电基础设施合作。监管政策的利好,加上各地零排放区政策的实施,正推动着展示室中电动车的比例不断增长。从长远来看,电气化有望重塑竞争格局,使那些掌控电池供应链和软体定义架构的公司占优势。

宏观经济不确定性与通货膨胀

持续的通货膨胀会削弱实际购买力,而地缘政治紧张局势和供应链中断则会动摇消费者信心。景气衰退风险和股市动盪的消息甚至会让高所得家庭推迟非必要支出。製造商还面临从电池矿物到半导体等不断上涨的投入成本,这将挤压利润空间或迫使他们调整售价。在货币政策稳定、通膨预期稳定之前,豪华车的需求可能仍将呈现季度间波动。

细分市场分析

到2025年,SUV将占据欧洲豪华车市场52.05%的份额,这反映出其凭藉较高的驾驶位置、灵活的载物空间和全天候的可靠性,持续受到富裕家庭和高管的青睐。儘管销量有所下降,但受休閒旅行復苏和消费者对激情驾驶体验需求成长的推动,预计到2031年,小轿车和敞篷车的年复合成长率将达到6.09%。这些极具个性的细分市场的成长表明,高端市场的需求既注重实用性,也注重生活方式的表达。製造商正在拓展产品线,将旗舰SUV与限量版运动车型结合,以增强品牌吸引力。在高阶轿小轿车中首次亮相的设计元素和技术经常被应用于销售量较高的跨界车,从而提升产品阵容的一致性并保持定价优势。

儘管轿车仍然是豪华车的经典之选,但随着消费者转向更实用的运动型多用途车(SUV),轿车的市场份额正逐渐受到挤压。汽车製造商透过在轿车中引入先进的驾驶辅助系统和身临其境型资讯娱乐系统来维持其市场地位。多用途车(MPV)仍然是一个小众市场,主要限于大都会圈的专车服务,在这些地区,车内空间比外观更为重要。掀背车虽然在其细分市场中并不常见,但在停车位有限的拥挤都市区却找到了自己的市场定位。车型多样化使欧洲豪华车市场能够满足不同的生活方式需求,同时透过差异化的车身造型来维持利润率。

目前,内燃机汽车的出货量占比高达75.62%,反映了现有产能的惯性和消费者对其的熟悉程度。然而,随着基础设施的不断改善和监管期限的临近,电池式电动车的年复合成长率预计到2031年将达到9.87%。插电混合动力汽车作为一种过渡技术,为消费者提供了一种无需担心里程的纯电动驾驶模式,这对于长途通勤者来说尤其重要。汽车製造商正在透过开发多能源平台来分散研发成本,从而降低投资风险,这些平台可以将研发成本分摊到汽油、混合动力汽车和纯电动车的各种车型上。

纯电动车在欧洲豪华车市场的份额逐年增长,这主要得益于高功率充电网路的普及以及高端品牌推出续航里程高达600公里的GT跑车。透过软体调校的底盘配置,旗舰电动车能够复製以往只有V8引擎才能实现的动态特性。然而,仍有一部分车迷珍惜高性能动力传动系统带来的声浪和触感回馈,这确保了在排放气体法规全面实施之前,两者能够长期共存。这种双轨策略使得製造商能够在投资下一代电池技术的同时,保留内燃机资产的摊销期。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 超高净值人士 (UHNWIS) 和高净值人士 (HNWIS) 人口增长

- 豪华车领域的快速电气化

- 车载数位化体验的需求

- 某些市场提供电动车购买奖励

- 联网汽车数据流货币化

- 订阅模式与产权模式

- 市场限制

- 采购成本上升和信贷紧缩

- 宏观经济不确定性与通货膨胀

- 豪华电动车残值波动

- 标靶化碳强度税

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元)及销售量(单位))

- 按车辆类型

- 掀背车

- 轿车

- 运动型多用途车(SUV)

- 多用途汽车(MPV)

- 小轿车与敞篷车

- 依动力传动系统类型

- 内燃机

- 混合动力电动车(HEV)

- 插电式混合动力电动车(PHEV)

- 电池式电动车(BEV)

- 按价格范围

- 45,000 美元至 100,000 美元

- 100,001美元至200,000美元

- 超过20万美元

- 依所有权类型

- 大量购买

- 融资/租赁

- 订阅

- 公寓和俱乐部所有权

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 丹麦

- 比利时

- 瑞士

- 奥地利

- 挪威

- 俄罗斯

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mercedes-Benz Group AG

- BMW AG

- Audi AG

- Porsche AG

- Tesla Inc.

- Volvo Car AB

- Jaguar Land Rover Automotive plc

- Bentley Motors Ltd

- Rolls-Royce Motor Cars Ltd

- Aston Martin Lagonda Global Holdings plc

- Ferrari NV

- Automobili Lamborghini SpA

- Maserati SpA

- Lucid Group Inc.

- Polestar Automotive Holding UK plc

- Genesis Motor Europe(Hyundai)

- Rivian Automotive Inc.

- BYD Auto Co., Ltd.

第七章 市场机会与未来展望

The European luxury car market was valued at USD 170.21 billion in 2025 and estimated to grow from USD 178.06 billion in 2026 to reach USD 223.17 billion by 2031, at a CAGR of 4.61% during the forecast period (2026-2031).

Demand resilience stems from sustained wealth creation among affluent households, robust brand equity built by long-established manufacturers, and supportive policy frameworks accelerating electrified model launches. Sport utility vehicles (SUVs) continue to draw the largest customer base, while rising interest in coupe and convertible body styles reveals a renewed appetite for experiential driving. The transition toward battery-electric powertrains is gaining momentum, yet internal-combustion vehicles still dominate volumes, forcing producers to balance scale economics with regulatory compliance. Subscription and other flexible access models are expanding fastest, reflecting a generational shift toward service-based mobility and creating fresh revenue avenues tied to in-car digital features.

Europe Luxury Car Market Trends and Insights

Rising Population of UHNWIs and HNWIs

Affluent Europeans continue to accumulate financial assets, underpinning the addressable pool of potential luxury-car buyers. Despite broader macroeconomic uncertainty, wealth surveys show steady growth in ultra-high-net-worth cohorts, especially in Switzerland and Germany. These consumers seek exclusive personalization, state-of-the-art technology, and branded heritage, reinforcing demand even when mass-market segments soften. Manufacturers benefit from higher gross margins on bespoke trims that this clientele favors. As economic power concentrates further in the top income brackets, the purchasing buffer shields premium automakers from cyclical downturns and supports pricing power.

Rapid Electrification of Luxury Segment

Euro 7 emissions limits, effective in November 2026, compel producers to phase out high-emitting engines and accelerate battery-electric launches. Luxury customers, often early adopters of advanced technology, are increasingly open to driving electric vehicles, provided performance benchmarks remain intact. Carmakers invest heavily in dedicated EV platforms, solid-state battery research, and pan-European charging alliances. The regulatory tailwind combines with municipal zero-emission zones to elevate electric models within showroom mixes. Over time, electrification is expected to reshape the competitive hierarchy by rewarding firms that master battery supply chains and software-defined architectures.

Macroeconomic Uncertainty and Inflation

Persistent inflation erodes real purchasing power, while geopolitical tensions and supply-chain disruptions unsettle consumer sentiment. Even high-income households delay discretionary outlays when headlines signal recession risk or stock-market turbulence. Manufacturers also contend with higher input costs-ranging from battery minerals to semiconductors-that squeeze margins or require sticker-price adjustments. Premium car demand may progress unevenly across quarters until monetary policy stabilizes and inflation expectations anchor.

Other drivers and restraints analyzed in the detailed report include:

- Digitally Enabled In-Car Experience Demand

- Micro-Market-Specific BEV Purchase Incentives

- Luxury-EV Residual-Value Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs represented 52.05% of the European luxury car market share in 2025, reflecting an enduring appeal for elevated seating, flexible cargo capacity, and all-weather confidence that resonates with affluent families and executives. Coupe and convertible nameplates, although smaller in volume, are enrolling a 6.09% CAGR to 2031 as leisure travel rebounds and consumers seek more emotive driving experiences. Growth in these expressive segments underscores that demand at the top encompasses practicality and lifestyle identity. Manufacturers expand portfolio breadth, pairing flagship SUVs with limited-run sports models that reinforce brand desirability. Design cues and technology debuted on halo coupes frequently cascade to high-volume crossovers, strengthening coherence across lineups and sustaining pricing power.

The sedan's archetypal luxury status endures yet faces incremental share pressure as buyers migrate toward sport-utility practicality. Automakers respond by injecting sedans with advanced driver assistance and immersive infotainment to preserve relevance. Multi-purpose vehicles remain a niche, mostly confined to chauffeur-driven use in select metropolitan areas where interior space overrides exterior presence. Although uncommon in this echelon, Hatchbacks find pockets of demand in congested cities that restrict parking footprints. Vehicle-type diversification ensures that the European luxury car market meets heterogeneous lifestyle needs while safeguarding margins through differentiated body styles.

Internal-combustion engines account for 75.62% of deliveries today, illustrating the inertia of legacy production capacity and consumer familiarity. However, battery-electric vehicles are pacing at a 9.87% CAGR through 2031 as infrastructure expands and regulatory deadlines near. Plug-in hybrids serve as a bridge technology, giving buyers an electric driving mode without range anxiety-especially valuable for rural long-distance commuters. Automakers hedge investments by deriving multi-energy platforms that spread R&D costs across gasoline, hybrid, and full-electric variants.

The European luxury car market size attributable to BEVs grows each year as high-capacity charging corridors become ubiquitous and luxury marques introduce grand-touring EVs boasting 600 km real-world range. Software-adjustable chassis settings allow electric flagships to replicate the dynamic character traditionally delivered by bespoke V-8 engines. Nevertheless, some connoisseurs still cherish the aural and tactile feedback of performance combustion powertrains, ensuring a prolonged coexistence until emission bans fully materialize. This twin-track strategy affords manufacturers time to amortize ICE assets while funding next-generation battery programs.

The European Luxury Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Powertrain Type (ICE, and More), Price Range (USD 45, 000-100, 000, USD 100, 001-200, 000, and Above USD 200, 000), Ownership Model (Outright Purchase, Finance/Lease, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Mercedes-Benz Group AG

- BMW AG

- Audi AG

- Porsche AG

- Tesla Inc.

- Volvo Car AB

- Jaguar Land Rover Automotive plc

- Bentley Motors Ltd

- Rolls-Royce Motor Cars Ltd

- Aston Martin Lagonda Global Holdings plc

- Ferrari N.V.

- Automobili Lamborghini S.p.A.

- Maserati S.p.A.

- Lucid Group Inc.

- Polestar Automotive Holding UK plc

- Genesis Motor Europe (Hyundai)

- Rivian Automotive Inc.

- BYD Auto Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Population of UHNWIS and HNWIS

- 4.2.2 Rapid Electrification of Luxury Segment

- 4.2.3 Digitally Enabled In-Car Experience Demand

- 4.2.4 Micro market-Specific BEV Purchase Incentives

- 4.2.5 Monetization of Connected-Vehicle Data Streams

- 4.2.6 Subscription and Fractional-Ownership Models

- 4.3 Market Restraints

- 4.3.1 High Purchase Cost and Tightening Credit

- 4.3.2 Macroeconomic Uncertainty and Inflation

- 4.3.3 Luxury-EV Residual-Value Volatility

- 4.3.4 Carbon-Intensity Taxes Targeting

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport Utility Vehicle (SUV)

- 5.1.4 Multi-purpose Vehicle (MPV)

- 5.1.5 Coupe and Convertible

- 5.2 By Powertrain Type

- 5.2.1 Internal-Combustion Engine

- 5.2.2 Hybrid Electric Vehicle (HEV)

- 5.2.3 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.4 Battery Electric Vehicle (BEV)

- 5.3 By Price Range

- 5.3.1 USD 45,000 - USD 100,000

- 5.3.2 USD 100,001 - USD 200,000

- 5.3.3 Above USD 200,000

- 5.4 By Ownership Model

- 5.4.1 Outright Purchase

- 5.4.2 Finance/Lease

- 5.4.3 Subscription

- 5.4.4 Fractional and Club Ownership

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Belgium

- 5.5.10 Switzerland

- 5.5.11 Austria

- 5.5.12 Norway

- 5.5.13 Russia

- 5.5.14 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Mercedes-Benz Group AG

- 6.4.2 BMW AG

- 6.4.3 Audi AG

- 6.4.4 Porsche AG

- 6.4.5 Tesla Inc.

- 6.4.6 Volvo Car AB

- 6.4.7 Jaguar Land Rover Automotive plc

- 6.4.8 Bentley Motors Ltd

- 6.4.9 Rolls-Royce Motor Cars Ltd

- 6.4.10 Aston Martin Lagonda Global Holdings plc

- 6.4.11 Ferrari N.V.

- 6.4.12 Automobili Lamborghini S.p.A.

- 6.4.13 Maserati S.p.A.

- 6.4.14 Lucid Group Inc.

- 6.4.15 Polestar Automotive Holding UK plc

- 6.4.16 Genesis Motor Europe (Hyundai)

- 6.4.17 Rivian Automotive Inc.

- 6.4.18 BYD Auto Co., Ltd.