|

市场调查报告书

商品编码

1619728

随着气候变迁迅速恶化,企业迈出永续发展的第一步Operators Take Baby Steps Towards Sustainability as Climate Change Worsens Rapidly |

|||||||

2023 年电信业者的能源使用量成长将放缓至年增 4%。但电信公司也是气候变迁的最大加剧者之一。排放量并没有下降,我们需要加快采用再生能源。中国则远远落后。

该报告重点关注全球网路营运商的能源消耗和环境政策,提供有关能源需求、再生能源使用、排放和能源效率努力的数据。本报告是 2023 年发布的报告的更新版,包含新的数据和分析。

视觉

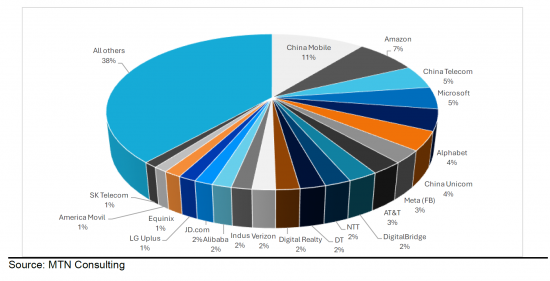

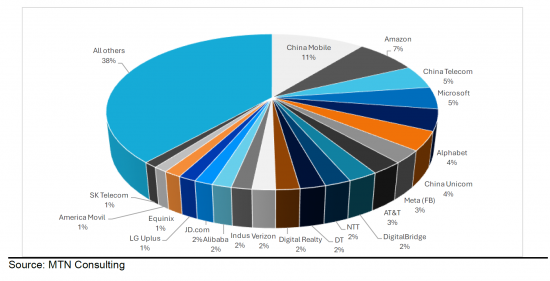

2023 年全球 20 大电信业者能源消耗明细

全球应对气候变迁的努力还远远不够。根据联合国预测,现行气候政策将导致2100年全球暖化超过3.1°C。这是2015年《巴黎协定》中同意的暖化水准的两倍。快速浏览全球新闻头条就会发现,我们已经看到了许多极端天气、人员流离失所和重大经济损失。长此以往,地球将越来越不适合人类居住。人类将花费时间和金钱来清理最后一场大风暴的后果,而不是让经济走上更永续的轨道。

理论上,科技公司有机会引领应对气候变迁的斗争,但现实是,网路营运商却失败得很惨。 2023 年,三个领域的能源消耗总量将持续成长。成长率已从过去三年的 9% 左右放缓至 2023 年的 4%。虽然成长放缓是好事,但营收成长进一步放缓可能反映了能源强度的轻微上升以及最近大规模领域人工智慧资料中心投资的激增。

那么再生能源呢?只要能源是再生且无碳的,能源消耗本质上并不是一件坏事。就像汽车需要燃料一样,经济也需要能源才能运作。但营运商的数据令人不安。 2023年,再生能源占电信业者总能源消耗的19.9%。这一数字逐年增加,高于 2019 年的 10.3%。但 20% 还很低,而且许多简单的改变已经完成了。此外,2023 年电信公司的温室气体排放量将达到约 1.334 亿吨(每 100 万美元收入排放 75 吨),这两个数字与 2019 年大致相同。如果承运商希望尽快实现碳中和目标,就需要积极解决这些排放问题,但这需要付出代价。至于网路扩展器,虽然他们的再生能源使用率很高,但在他们加入生成式人工智慧潮流之后,他们是否还能保持这项承诺还有待观察。而当谈到第三部分,即运营商中立时,情况就复杂了。一些CNNO正在大力投资能源效率和再生能源,并展示他们的绿色措施。其他人则基本上忽略了永续性问题。

提及的组织

|

|

目录

- 摘要

- 电信业者能源消耗成长:2023 年放缓至 4%

- 三个细分市场的相对规模

- 能源:网路营运商的关键投入

- 依业务类型划分的能源消耗

- 以公用事业类型划分的能源强度

- 再生能源消耗与排放

- 附录

Energy use growth by operators eased to 4% YoY in 2023 due to telcos, but they're also the worst climate offenders. Emissions are not falling; renewable energy adoption needs to accelerate. China lags badly.

This short report is focused on the energy consumption and environmental policies of the world's network operators. It presents data on energy demand, use of renewables, emissions, and energy efficiency efforts. This is an update of a report published in 2023 with new data and new analysis.

VISUALS

Breakdown of 2023 energy consumption by top 20 operators

The world's disparate efforts to address climate change are falling miserably short. Per the United Nations, current climate policies will result in global warming of more than 3.1C by the year 2100. That's twice the level of warming agreed upon in the 2015 Paris Agreement. A quick scan of the world's headlines will find many extreme weather events, population dislocations, and heavy economic damage already. If things continue, the planet will be less habitable for humans every year. Humanity will spend more time and money simply treading water - cleaning up after the last mega storm rather than putting economies on a more sustainable trajectory.

In theory, tech companies have an opportunity to lead in the fight against climate change. In practice, network operators are failing badly. Energy consumption continued to grow for the aggregate of the three segments in 2023. The growth rate dipped to 4% in 2023, from about 9% the previous three years. The slower growth is a plus, but: (1) revenues grew even more slowly, so energy intensity (consumption divided by revenue) increased slightly, and (2) a recent explosion of AI data center investment in the webscale sector will probably change the trendline in 2024.

How about renewables? There is nothing inherently bad about consuming energy, if it's renewable and carbon free. Economies need energy to run, just as your car needs fuel. However, data from the telco sector is disconcerting. In 2023, renewables accounted for 19.9% of total energy consumed by telcos. This figure has been rising by year, up from 10.3% in 2019. But 20% is low, and many easy changes have been made already. Further, greenhouse gas emissions (GHG) from telcos were about 133.4 million tons in 2023, or 75 tons per $1M in revenues; both figures are roughly the same as in 2019. If telcos are going to meet their carbon neutrality goals anytime soon, they need to attack these emissions aggressively, and that will cost. As for webscalers, they have a high rate of renewable use. Yet it's unclear if they will sustain this commitment now that they are on the GenAI bandwagon. For the third segment, carrier-neutral, it's a mixed bag. Some CNNOs invest heavily in energy efficiency and renewables, and some brag about their green practices. Others largely ignore questions of sustainability. The CNNO sector has absorbed assets from other segments over the years, so their infrastructure can have a patchwork quality, with different standards and designs in different regions. Also, sometimes CNNOs buy assets that are known to be energy hogs using dirty energy. Moreover, many CNNOs are owned by private equity or similar asset management firms, and don't publish financial data regularly, much less energy data. They face little to no public pressure to "go green." With right wing conservatives taking power in the US, there will be even less pressure on such companies.

Organizations mentioned:

|

|

Table of Contents

- Summary

- Operator energy consumption growth slows to 4% in 2023

- Relative size of three market segments

- Energy a key input for network operators

- Energy consumption by operator type

- Energy intensity by operator type

- Renewable energy use and emissions

- Appendix

List of Figures

- Figure 1: Three operator segments and their shares of global total in 2023

- Figure 2: Total energy consumption by operator type, GWh

- Figure 3: Total energy consumption, YoY growth rate by segment

- Figure 4: Breakdown of 2023 energy consumption by top 20 operators

- Figure 5: Energy intensity by operator type (MWH per US$M revenue)

- Figure 6: Energy intensity (MWh per $M in revenue): 2023 results for select operators

- Figure 7: Biggest improvements (i.e. reductions) in energy intensity since 2019

- Figure 8: Use of renewable energy in telecom, China v. rest of world

- Figure 9: Top 20 telcos based on renewable energy use adoption rates (2023)

- Figure 10: Use of renewable energy in telecom, China v. rest of world