|

市场调查报告书

商品编码

1797390

通讯业的主要供应商 (2025年第2季):市场復苏,但资费影响深远Telecom's Biggest Vendors, 2Q25: Vendor Market Bounces Back, but Tariffs Cast a Long Shadow |

|||||||

本系列报告旨在为电信决策者提供全面的产业支出趋势和供应商市场影响力视角。为此,我们评估了电信业各种公司类型和技术细分领域的技术供应商的收入。

本报告追踪了 137 家电信网路基础设施供应商,并提供了 2013 年第一季至 2025 年第二季的收入和市场占有率估算。在这 137 家公司中,有 111 家仍在向电信业者销售产品,而许多其他公司已被我们资料库中的其他公司收购。例如,ADVA 现已被 Adtran 收购,但由于其过去的销售历史,这两家公司仍保留在我们的资料库中。

视觉

报告亮点:

- 营收:2025年第二季度,电信网路基础设施供应商营收达到约543亿美元,年增2.0%。年化收入成长0.7%,至约2,077亿美元,打破了连续九个季度的萎缩,显示网路基础设施投资正在逐步復苏。华为在 2024 年上半年帮助缓解了市场下滑,但在 2025 年第二季又恢復了下滑趋势。剔除华为的数据,市场收入成长更为强劲。

- 主要供应商: 传统领先者华为、爱立信和诺基亚以年率计算占了约 35% 的市场占有率,仅 2025 年第二季就占了 36.8% 的市场占有率。自 2021 年以来,华为的市占率已明显减弱,2025 年华为在中国以外的市场仍面临持续压力。同时,中国通讯服务、中兴通讯等供应商继续争夺第四和第五的位置。

- 按收入同比增长划分的主要供应商: 2025 年第二季度,Dixon Technologies 和 Wiwynn 在收入同比增长方面领先。 Dixon 的成长得益于与前一年相比较低的基数,而 Wiwynn 的成长则得益于与人工智慧驱动的数位转型相关的资料中心基础设施扩张。博通也因收购 VMware 而持续成长,而 Alphabet、微软、亚马逊、戴尔科技和 Harmonic 也透过其数位转型相关的产品实现了成长。

- 支出展望: 对 2025 年下半年及以后的前景依然保持谨慎,预计增长温和,但受到宏观经济不确定性、关税和地缘政治紧张局势的限制。随着整个市场应对不断变化的技术週期和地缘政治复杂性,资本支出将因地区和营运商准备而异。

调查对象

记载企业

|

|

目录

第1章 报告亮点

第2章 摘要:调查结果的说明

第3章 通讯网路基础设施市场:最新结果

第4章 前25名供应商:印刷可能的层级薄板

第5章 表(图表):各供应商的概述

第6章 表(图表):5家供应商的比较

第7章 各供应商的研究开发费

第8章 原始数据:各企业的收益预测

第9章 调查手法·前提

第10章 关于MTN Consulting

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 137 Telco NI vendors, providing revenue and market share estimates for the 1Q13-2Q25 period (i.e. 50 quarters). Of these 137 vendors, 111 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

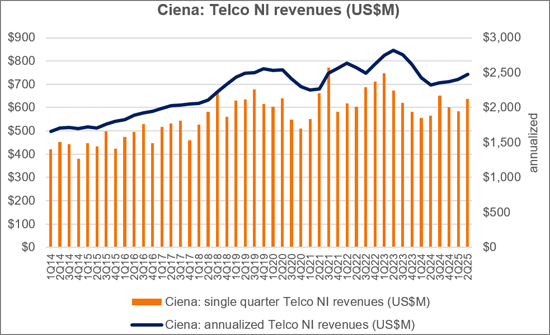

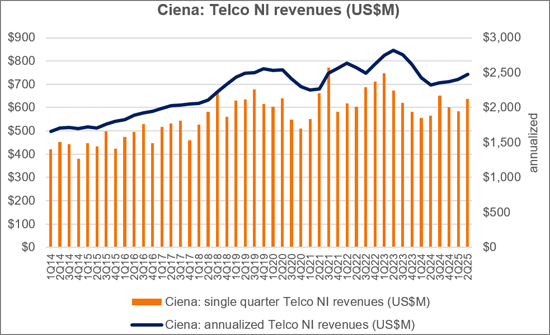

- Revenues: Telco Network Infrastructure (NI) vendor revenues reached approximately $54.3 billion in 2Q25, representing a 2.0% YoY increase. Annualized revenue edged up 0.7% to about $207.7 billion, snapping a nine-quarter contraction and signaling a modest recovery in network infrastructure investments. Huawei, which assisted in softening the market decline earlier in 2024, reverted to a downtrend in 2Q25. Without Huawei's data included, market revenue growth is much stronger.

- Top vendors: The traditional leaders Huawei, Ericsson, and Nokia accounted for roughly 35% of the Telco NI market on an annualized basis and 36.8% in 2Q25 alone. Huawei's market share has weakened notably since 2021 and faced persistent pressure outside China in 2025. Meanwhile, vendors like China Comservice and ZTE maintained their fight for the 4th and 5th positions.

- Key vendors by YoY revenue growth: Dixon Technologies and Wiwynn led YoY revenue growth in 2Q25, fueled by Dixon's a low year-ago base, and Wiwynn's expansion in data center infrastructure linked to AI-driven digital transformation. Broadcom's surge continues, boosted by its VMware acquisition. Meanwhile, Alphabet, Microsoft, Amazon, Dell Technologies, and Harmonic grew through their digital transformation offerings.

- Spending outlook: The outlook for 2H25 and beyond remains cautious, with gradual growth expected but tempered by macroeconomic uncertainty, tariffs, and geopolitical tensions. Capital spending will vary by region and operator readiness, as the broader market navigates evolving technology cycles and geopolitical complexities.

Note: Several companies, including Ciena, were estimated for 2Q results due to the unavailability of official financial reports for the April-June period on a calendar-year basis. These estimates will be revised and updated as more accurate data becomes available.

Research Coverage

Companies Listed:

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

List of Figures (Partial):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 2Q25 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 2Q25 ($B)

- Top 25 vendors based on Telco NI revenues in 2Q25 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 2Q25 TTM vs. 2Q24 TTM

- Telco NI annualized revenue changes, 2Q25 vs. 2Q24

- YoY growth in Telco NI revenues (2Q25)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 2Q25 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 2Q25 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (2Q23-2Q25)