|

市场调查报告书

商品编码

1246787

家庭能源管理和服务Energy Management and Services in the Home |

||||||

随着能源成本的上升和频繁的停电,消费者正在寻找了解能源消耗、减少使用量并自行发电的方法。

在这份报告中,我们调查了家庭能源管理的状况和使用该服务的意愿、消费者对电费的认识、节能工作、能源消耗管理服务、能源计划、发电机/电动汽车/它总结了意识、支付意愿、使用状况等对太阳能电池板、智能恆温器等。

内容

调查方法及定义

能源监测介绍

执行摘要

通行费支付方:努力减少支付

- 消费者对每月电费的了解

- 消费者对电价的认知度:按收入

- 消费者对电价的认知度:按家庭规模

- 消费者对电价的认知度:按房屋大小

- 过去 12 个月的节能行为

- 节能措施

- 节能行为分类

- 对家庭能源消耗的态度

- 对家庭能源消耗的态度:按消费者类型

能源管理理念和支付意愿

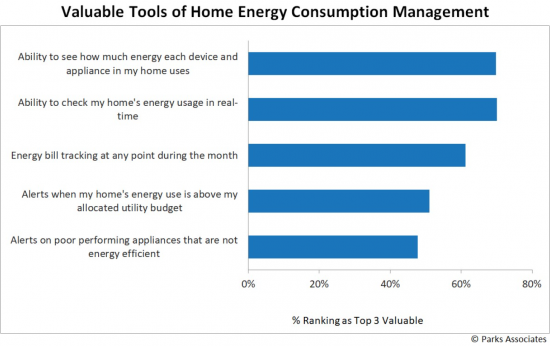

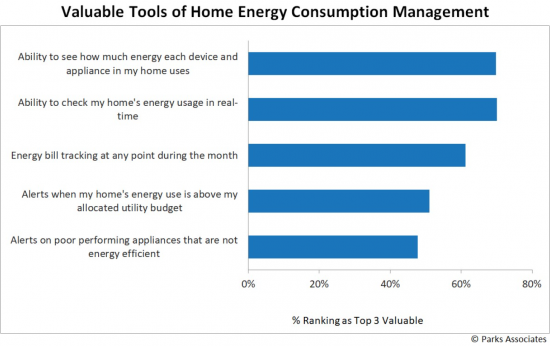

- 家庭能源消耗管理的重要工具

- 家庭能源消耗管理的价值和支付意愿

- 所有列出的家庭能源消耗管理服务的平均价格

- 家庭能耗管理服务费用

- 家庭能源消耗管理服务成本:按收入分类

- 按房屋大小划分的家庭能源消耗管理服务成本

- 对能源监控设备非常感兴趣

- 最有可能购买能源解决方案

- 能源监控解决方案的首选来源

- 首选能源支付方式

- 首选付款方式:按家庭能源管理服务的支付意愿

能源服务和计划的知识

- 运营商提供的电力类型

- 使用能源计划

- 使用能源计划的详细信息

- 有兴趣参与特殊能源计划

- 参与能源计划所需的成本节约量

- 非常熟悉我们提供的能源计划

- 熟悉面向电动汽车车主的电动汽车特价计划

- 有关电动汽车车主特别计划的信息来源

- 参与需求响应计划的主要动机

- 参与需求响应计划的激励措施

- 需求响应事件的持续时间

- 需求响应事件经验

- 终止需求响应计划的原因

- 未参与需求响应计划的原因

- 愿意为能源监测服务付费

家庭用电:发电机、电动汽车、太阳能电池板

- 拥有主要家用能源设备

- 蓄电池的使用

- 主要家用能源设备的拥有量(按消费者类型分类)

- 熟悉主要家用能源设备

- 主要家用能源电器的购买意向高

- 主要家用能源设备的高购买意向:按消费者类型

- 主要家用能源设备的高购买意愿:按收入

- 主要家用能源设备的高购买意愿:按房屋大小

- 主要家用能源电器的高购买意向:按对家庭能源消耗的态度

太阳能和可充电电动汽车的销售

- 最具吸引力的能源设备采购渠道

- 购买能源设备最具吸引力的付款方式

- 有兴趣为希望安装太阳能的人提供设备融资

- 有兴趣为那些希望安装太阳能的人预付购买设备的费用

- 为什么不购买太阳能产品?

- 购买太阳能电池板的驱动因素

- 将来有可能购买插电式电动汽车

- EV 充电频率:按地点

智能恆温器及使用

- 拥有一个智能恆温器

- 智能恆温器的分类

- 智能恆温器的使用频率

- 智能恆温器很少运行的原因

- 使用智能恆温器的月度节能表

- 消费者的节能意识

- 估计智能恆温器所有者/用户每月可节省的费用

- 因搬家处置智能温控器

- 智能恆温器时代

- 推动购买智能恆温器和传统恆温器的因素

- 总体智能恆温器购买意向

- 总体智能恆温器购买意向:用户可能会在未来 6 个月内迁移

- 目前不拥有或不打算购买智能恆温器的家庭

- 为什么不买一个智能恆温器?

- 让您更有可能购买智能恆温器的因素

SYNOPSIS:

As energy costs rise and outages become more common, consumers seek ways to track their energy consumption, reduce what they use, or generate their own. There is no one-size-fits-all energy solution because habits and trends differ from big families in freestanding homes to singles in apartments. This research examines how customer groups differ in their adoption of devices and programs they use to save energy, money, and avoid blackouts. It includes trending adoption, purchase intention, and shifting consumer perspectives on home solar, energy monitoring solutions, battery storage, and electric vehicles.

ANALYST INSIGHT:

"After a strong 2021, metrics around household energy technology industry dipped. The story, though, is more complex than a simple regression following a spike." - Chris White, Research Director, Parks Associates.

Table of Contents

Survey Methodology and Definitions

Introducing Energy Monitoring

Executive Summary

- Electricity costs are too high

- Key demographics reporting electricity costs are too high

- Actions Taken to Reduce Energy Consumption

- Home Solar PV Systems

- Demand Response Program Engagement

- Time of Use Program Engagement

- Smart Thermostat Ownership

- Savings by Estimated Percentage of Bill

- Savings vs. Expectations

- Average Price Willing to Pay for All Listed Home Energy Consumption Management Services

- High Interest in Energy Monitoring Devices

Ratepayers: Trying To Pay Less

- Consumers' Perception Regarding Monthly Electricity Bill

- Consumers' Perception Regarding Electricity Bill by Income

- Consumers' Perception Regarding Electricity Bill by Family Size

- Consumers' Perception Regarding Electricity Bill by Home Size

- Energy-Saving Actions Taken Over the Past 12 Months

- Energy Saving Actions

- Energy Saving Action Segments

- Attitudes Towards Home Energy Consumption

- Attitudes Towards Home Energy Consumption by Consumer Type

Energy Management Concepts & Willingness to Pay

- Valuable Tools of Home Energy Consumption Management

- Home Energy Consumption Management Value and Willingness to Pay

- Average Price Willing to Pay for All Listed Home Energy Consumption Management Services

- Cost You Would Pay for Home Energy Consumption Management Service

- Cost You Would Pay for Home Energy Consumption Management Service by Income

- Cost You Would Pay for Home Energy Consumption Management Service by Home Size

- High Interest in Energy Monitoring Devices

- Most Likely to Buy Energy Solutions

- Preferred Source of Energy Monitoring Solutions

- Preferred Energy Payment Methods

- Preferred Payment Methods by Willingness to Pay For Home Energy Management Services

Familiarity with Energy Services and Programs

- Type of Electricity Provided by the Provider

- Energy Program Use

- Energy Program Use Details

- Interest in Special Energy Program Enrollment

- Required Cost-Saving Amount to Participate in Energy Program

- High Familiarity with Energy Programs Offered

- EV Owner Familiarity with Special EV Rate Plans

- Information Source of Special Plan for EV Owners

- Top Motivation to Participant in Demand Response Program

- Incentive to Participate in Demand Response Program

- Duration of Demand Response Event

- Demand Response Event Experience

- Reasons for Churning Demand Response Program

- Reasons for not Participating in Demand Response Program

- Likelihood of Paying for Energy Monitoring Service

Power at Home: Generators, EVs, and Solar Panels

- Ownership of Major Home Energy Equipment

- Adoption of Battery Storage

- Major Home Energy Equipment Ownership by Consumer Type

- High Familiarity with Major Home Energy Equipment

- High Intention of Purchasing Major Home Energy Equipment

- High Intention of Purchasing Major Home Energy Equipment by Consumer Type

- High Intention of Purchasing Major Home Energy Equipment by Income

- High Intention of Purchasing Major Home Energy Equipment by Home Size

- High Intention of Purchasing Major Home Energy Equipment by Attitudes Towards Home Energy Consumption

Selling Solar and Charging EVs

- Most Appealing Purchase Channel of Energy Device

- Most Appealing Payment Method for Energy Device Purchase

- Interest Among Solar Intenders who Prefer to Finance the Equipment (31% of all Intenders)

- Interest Among Solar Intenders who Prefer Upfront Purchase of the Equipment (35% of all intenders)

- Reasons for Not Purchasing Solar Power Products

- Purchase Drivers of Solar Panels

- Likelihood of Purchasing a Plug-in Electric Vehicle in the Future

- Electric Vehicles Charging Frequency by Locations

Smart Thermostats and How They're Used

- Smart Thermostat Ownership

- Smart Thermostat Segments Q4/2022

- Smart Thermostat Use Frequency

- Reasons for Rarely Interacting with Smart Thermostat

- Monthly Energy Saving by Using Smart Thermostat

- Consumer Perception Regarding Energy Saving

- Estimated Monthly Savings by Smart Thermostat Owner/Users

- Smart Thermostat Disposal When Moving Home

- Age of Smart Thermostat

- Smart Thermostat vs. Traditional Thermostat Purchase Drivers

- Overall Smart Thermostat Purchase Intention

- Overall Smart Thermostat Purchase Intention Among Those Likely to Move in the next 6 months

- Households that Don't Currently Own or Intend to Purchase a Smart Thermostat

- Reasons for Not Purchasing a Smart Thermostat

- Factors Increasing Likelihood of Purchasing Smart Thermostat