|

市场调查报告书

商品编码

1522886

穿戴式装置:健康与安全的进步Wearables: Advances in Health & Safety |

||||||

概括:

穿戴式装置的消费者渗透率处于历史最高水平,近一半的美国网路家庭拥有至少一款智慧手錶或健身追踪器。设备製造商必须仔细考虑他们的下一步策略:是增加吸引力并进入未开发的市场,还是透过先进的特性和功能吸引现有用户。这项研究评估了穿戴式装置市场的当前范围,重点关注健康和安全领域的新进展。

主要调查项目

- 1.智慧手錶、健身追踪器、混合手錶、智慧珠宝等穿戴式平台的消费者渗透率是多少?

- 2.过去几年品牌知名度发生了什么样的变化?

- 3.对戒指和智慧珠宝等新形式的需求是什么?

- 4.消费者如何评估新功能和可用的附加功能,例如健身订阅和手机连线?

- 5.顾客购买行为背后的驱动力是什么?

- 6.对人身安全功能和服务的需求是什么?

该报告调查了全球穿戴式装置市场,检视了智慧手錶、健身追踪器和混合手錶等穿戴式平台的消费者渗透率、消费者品牌认知度、功能和外形等各种消费者偏好,并总结了对各种穿戴式装置的支付意愿。

目录

研究方法和定义

定义穿戴式市场

执行摘要

- 将穿戴式装置引入家庭

- 穿戴式品牌采用:智慧手錶、健身追踪器、GPS运动手錶

- 拥有智慧手錶

- 额外订阅

- 智慧手錶购买意向

- 购买的智慧手錶品牌

- 打算在未来 6 个月内购买穿戴式装置

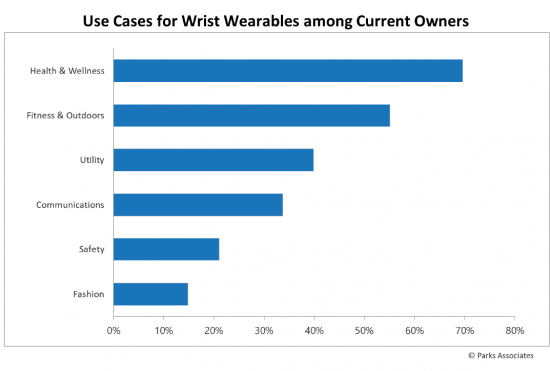

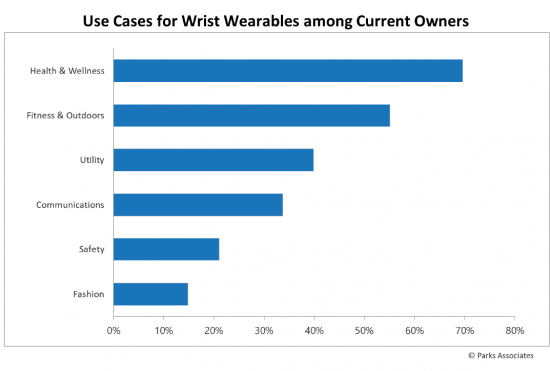

- 穿戴式装置所有者的用例

- 引入紧急呼叫设备/应用程式的原因

市场状况

- 穿戴式装置:美国网路家庭的采用、购买与购买意向

- 穿戴式装置: 购买型

- 消费性电子产品净推荐值

- 穿戴式装置:净推荐值

- 穿戴式装置使用者的人口统计区隔

美国网路家庭的品牌采用率

- 美国网路家庭对穿戴品牌的采用率

- 智慧手錶家庭的品牌采用率

- 智慧手錶nps

- 拥有健身追踪器的家庭对品牌的接受程度

- 健身追踪器 nps

- GPS运动手錶在家庭中的品牌采用率

- GPS 运动手錶 NPS

- 智慧环家庭的品牌采用率

对功能的兴趣和付费意愿

- 对健康相关穿戴功能的认识

- 穿戴式装置买家愿意为具有特定功能的型号/品牌支付更多费用:医疗和健康功能。

- 愿意为与健康相关的可穿戴功能付费

- 为拥有穿戴式装置的家庭提供优质应用程式和服务

- 对穿戴式装置的满意度:付费应用程式和服务

- 应用整合:远距医疗、第二萤幕

- 美国网路家庭的受欢迎程度

- 智慧手錶拥有者与非拥有者

- 穿戴式产品购买意愿:单一产品 vs 多个产品

穿戴式装置的主要用例

- 腕式穿戴装置使用范例

- 穿戴式装置所有者的用例

- 推荐的健康与保健功能:智慧手錶、健身追踪器、GPS 运动手錶、穿戴式用户

- 推荐的健身与户外功能:智慧手錶、健身追踪器、GPS运动手錶、穿戴式用户

- 首选实用功能:智慧手錶、健身追踪器、GPS运动手錶、穿戴式用户

- 推荐通讯功能:智慧手錶、健身追踪器、GPS运动手錶、穿戴式用户

- 穿戴式装置最受欢迎的时尚特征:使用者介面、边框、风格、錶带、形状、社交环境

- 智慧型手錶控制机制

- 连接到智慧手錶的周边设备

人身安全及应急监控

- 在紧急情况下使用设备/应用程式寻求协助

- 使用的应急解决方案类型

- 引入紧急呼叫设备/应用程式的原因

- 使用的紧急服务类型

- 愿意为经过测试的安全功能付费

- 购买最新的可穿戴设备以确保安全

- 对安全相关穿戴功能的认识

- 购买时优先考虑的安全功能

附录

SYNOPSIS:

Consumer adoption of wearables has hit an all-time high, with nearly half of US internet households owning one or more smart watches or fitness trackers. Device makers must carefully evaluate their next strategies - to widen appeal and break into the remaining untapped market, or to hone-in on existing users with advanced features and functionalities. This research evaluates the current scope of the wearables market, looking at new advances in health and safety.

Key questions addressed:

- 1. What is the consumer adoption of wearables platforms such as smart watches, fitness trackers, hybrid watches, and smart jewelry?

- 2. How has brand awareness and brand perception changed over the past several years?

- 3. What is the demand for new form factors, including smart jewelry such as rings?

- 4. How are consumers evaluating new features and available add-ons, such as fitness subscriptions and cellular connectivity?

- 5. What drives customer purchase behavior?

- 6. What is the demand for personal safety features and services?

ANALYST INSIGHT:

"Wearables adoption is following the pattern laid out by smartphones, coalescing around two major platforms - Apple and Google. Garmin is the largest independent brand remaining." - Kristen Hanich, Research Director, Parks Associates.

Table of Contents

Survey Methodology and Definitions

Defining the Wearables Market

Executive Summary

- Household Adoption of Wearables

- Adoption of Wearables Brands - Smart Watches, Fitness Trackers, GPS Sports Watches

- Smart Watch Ownership

- Additional Subscriptions

- Smart Watch Purchase Intention

- Brand of Smart Watch Purchased

- Intent to Purchase Wearables in Next 6 Months

- Use Cases Among Wearables Type Owners

- Reasons for Adopting a Device/App for Emergency Call

Market Landscape

- Wearable Devices: Adoption, Purchases, & Purchase Intention Among US Internet Households

- Wearable Devices: Purchase Type

- Net Promoter Score for Consumer Electronics Devices

- Wearable Devices: Net Promoter Score

- Demographic Breakdown of Wearable Device Owners

Brand Adoption Among US Internet Households

- Wearables Brand Adoption by US Internet Households

- Brand Adoption Among Smart Watch Households

- Smart Watch NPS

- Brand Adoption Among Fitness Tracker Households

- Fitness Tracker NPS

- Brand Adoption Among GPS Sports Watch Households

- GPS Sports Watch NPS

- Brand Adoption Among Smart Ring Households

Feature Interest and Willingness to Pay

- Attitudes Towards Health-Related Wearable Features

- Wearables Intenders Willing to Pay More for Model/Brand with Select Features: Medical Features and Wellness Features

- Willingness to Pay for Health-Related Wearable Features

- Premium Apps or Services Among Wearables Households

- Satisfaction for Wearable Device by Paid App or Service

- Application Integrations: Telehealth, Second Screens

- Appeal Among US Internet Households

- Smart Watch Owners vs. Non-Owners

- Wearable Purchase Intention: Single Product vs Multiple Products

Wearables Key Use Cases

- Use Cases for Wrist Wearables

- Use Cases Among Wearables Type Owners

- Preferred Health and Wellness Capabilities: Smart Watches, Fitness Trackers, GPS Sports Watches, Wearables Users

- Preferred Fitness and Outdoors Capabilities: Smart Watches, Fitness Trackers, GPS Sports Watches, Wearables Users

- Preferred Utilitarian Capabilities: Smart Watches, Fitness Trackers, GPS Sports Watches, Wearables Users

- Preferred Communications Capabilities: Smart Watches, Fitness Trackers, GPS Sports Watches, Wearables Users

- Preferred Fashion Characteristics for Wearables: User Interface, Bezels, Styling, Watch Bands, Shape, Social Setting

- Smart Watch Control Mechanism

- Peripherals Connected to Smart Watch

Personal Safety and Emergency Monitoring

- Use of Device/App to Call for Help in Case of Emergency

- Type of Emergency Solution Used

- Reasons for Adopting a Device/App for Emergency Call

- Type of Emergency Service Used

- Willingness to Pay for Tested Safety Features

- Purchased Current Wearable for Safety

- Attitudes Towards Safety-Related Wearable Features

- Preferred Safety Features When Purchasing