|

市场调查报告书

商品编码

1677741

标靶药物传递设备市场 - 第二版:产业趋势与2035年全球预测 - 依设备类型、标靶器官、治疗类型、给药途径、治疗领域和主要地区进行预测Targeted Drug Delivery Device Market - 2nd Edition: Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Device, Target Organ, Type of Therapy Delivered, Route of Administration, Therapeutic Area, Key Geographical Regions Forecast |

||||||

全球标靶药物输送设备市场规模预计将从2026年的4亿美元增至2035年的21亿美元,预测期内的年复合成长率为 19.7%。

在过去的几十年里,製药业已经转向使用生物製剂而不是传统药物。这一趋势是由细胞生物学和药理学的进步所推动的,这些进步使得开发出具有更高功效和更大市场潜力的治疗方法成为可能。目前,有1000种细胞和基因治疗药物研发中,用于治疗各种疾病,包括心血管疾病、肿瘤疾病和神经系统疾病。此外,过去十年已经开发了多种治疗肺癌和黑色素瘤的免疫疗法。

儘管生物製剂具有许多优势,但它仍面临许多挑战,包括复杂的药物传递和免疫原性问题。为了避免这种全身毒性,通常会使用限量的药物,导致只有少量药物到达目标器官。此外,从药理学角度来看,生物製剂通常只能在目标部位停留有限的时间,降低了透过长时间控制药物传递所能达到的最终治疗效果。此外,某些治疗方法,例如细胞疗法,需要定期施用额外的治疗材料或补充产品,增加了原本就很复杂的侵入性施用程序。

为了克服这些挑战,製药业正致力于开发靶向药物输送装置,目的是提高治疗安全指数并增强治疗药物向目标部位的输送。用于靶向输送生物製剂的此类装置的范例包括 Extroducer 微导管、Helix 生物治疗输送系统、ImmunoPulse IL-12 和 SmartFlow 神经心室插管。这些药物输送装置可增强治疗效果,并且能够将生物製剂精确地输送到目标部位。

在生物製药市场快速成长和行业利益相关者兴趣的推动下,这些标靶药物输送设备的采用稳步增加。此外,随着技术的进步,此类设备的开发预计会增加,预计未来几年市场将稳定成长。

本报告调查全球标靶药物传输设备市场提供市场概述,以及依设备类型、目标器官、治疗类型、给药途径、治疗领域、主要地区的趋势和参与市场的公司简介。

目录

第一部分:报告概述

第1章 简介

第2章 研究方法

第3章 市场动态

第4章 宏观经济指标

第二部分:定性洞察

第5章 执行摘要

第6章 简介

第三部分:市场概览

第7章 市场状况

第四部分:公司简介

第8章 主要公司简介

- 章节概述

- Alcyone Therapeutics

- BioCardia

- ClearPint Neuro

- Mercator MedSystems

- Novartis

- Smartwise

- Key Winning Strategies

第9章 新兴公司的公司简介

- 章节概述

- Algorae Pharmaceuticals

- Gloriana Therapeutics

- Neurotech Pharmaceuticals

- OncoSec Medical

- PharmaCyte Biotech

- PulseSight Therapeutics

- Renishaw

- Silexion Therapeutics

第五部分:市场趋势

第10章 标靶药物传递装置的有前景的治疗领域

第11章 临床试验分析

第12章 候选药物

第六部分:市场机会分析

第13章 市场影响分析:驱动因素、限制因素、机会与挑战

第14章 全球标靶药物传输设备市场

第15章 标靶药物传输设备市场(依设备类型)

第16章 标靶药物传递设备市场(依目标器官)

第17章 标靶药物传输设备市场(依治疗类型)

第18章 标靶药物传输设备市场(依给药途径)

第19章 标靶药物传输设备市场(依治疗领域)

第20章 标靶药物传输设备市场(依主要地区)

第21章 标靶药物传输设备市场(依主要开发商)

第22章 标靶药物传输设备市场,设备销售预测

第8部分:其他独家见解

第23章 结论

第24章 高层洞察

第25章 附录1:表格资料

第26章 附录2:公司与组织名单

TARGETED DRUG DELIVERY DEVICE MARKET

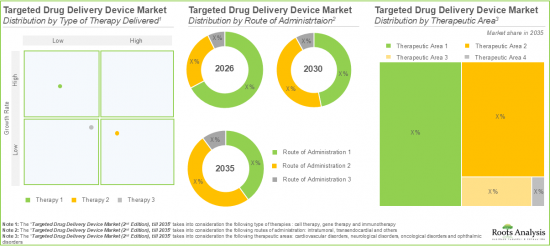

As per Roots Analysis, the global targeted drug delivery device market size is estimated to grow from USD 0.4 billion in 2026 to USD 2.1 billion by 2035, at a CAGR of 19.7% during the forecast period, till 2035.

The opportunity for targeted drug delivery device market has been distributed across the following segments:

Type of Device

- Cannula

- Catheter

- Others

Type of Organ

- Brain

- Breast

- Eyes

- Heart

Type of Therapy Delivered

- Cell Therapy

- Gene Therapy

- Immunotherapy

Route of Administration

- Intratumoral

- Transendocardial

- Others

Therapeutic Area

- Cardiovascular Disorders

- Oncological Disorders

- Ophthalmic Disorders

- Neurological Disorders

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

Leading Players

TARGETED DRUG DELIVERY DEVICE MARKET: GROWTH AND TRENDS

Over the past couple of decades, the pharmaceutical industry has been shifting towards the use of biologics over traditional drugs. This trend is fueled by the advancements in cell biology and pharmacology that enable the development of therapies with higher efficacy and significant market potential. Currently, 1,000 cell and gene therapies are under development for the treatment of various disorders, including cardiovascular disorders, oncological disorders, and neurological disorders. Moreover, in the past decade, several immunotherapies have been developed for treating lung cancer and melanoma.

Despite their benefits, biologics present a number of challenges, such as drug delivery-related complexities and immunogenicity concerns, which have been shown to result in systemic toxicity following therapy administration. To avoid such systemic toxic effects, a limited volume of drug is often administered, which results in a small amount of drug reaching the target organ. Further, from a pharmacological point of view, biologics typically remain at the target site for a limited time, thereby decreasing the final therapeutic effect that can be achieved through prolonged and controlled drug delivery. Moreover, some treatment options, such as cell therapies, require periodic administration of additional therapy materials or complementary products, thereby adding to the already complex invasive dosing procedures.

To overcome these challenges, the pharmaceutical industry is focusing on the development of targeted drug delivery devices aimed at improving the therapeutic safety index and enhancing the delivery of therapies to the targeted site. Examples of such devices intended for the targeted delivery of biologics include Extroducer microcatheter, Helix biotherapeutic delivery system, ImmunoPulse IL-12 and SmartFlow neuro ventricular cannula. These drug delivery devices offer enhanced therapeutic effects and enable precise delivery of biologics to the target site.

Driven by the rapid growth of the biopharmaceutical market and the interest of industry stakeholders, the adoption of these targeted drug delivery devices is steadily increasing. Moreover, owing to technological advancements, the development of such devices is expected to increase, positioning the market for steady growth in the forthcoming years.

TARGETED DRUG DELIVERY DEVICE MARKET: KEY INSIGHTS

The report delves into the current state of the targeted drug delivery device market and identifies potential growth opportunities within the industry. Some key findings from the report include:

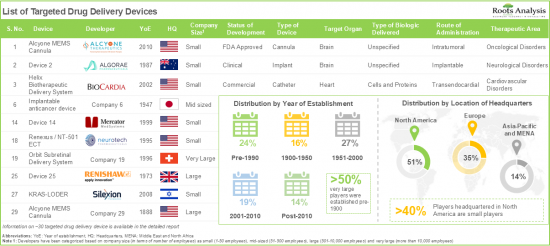

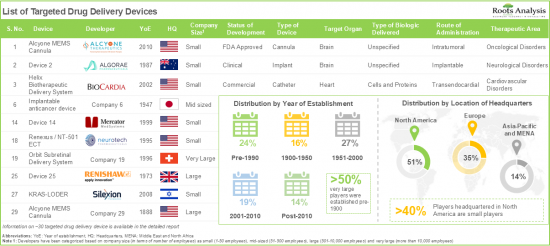

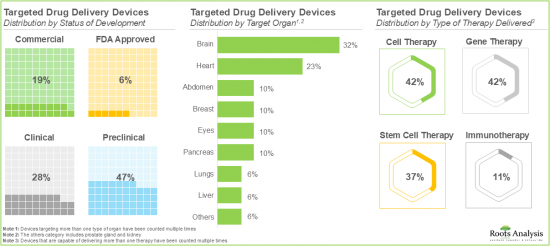

- Presently, around 40 developers are engaged in the development of targeted drug delivery devices for various disorders; of these, more than 50% of players are headquartered in the US alone.

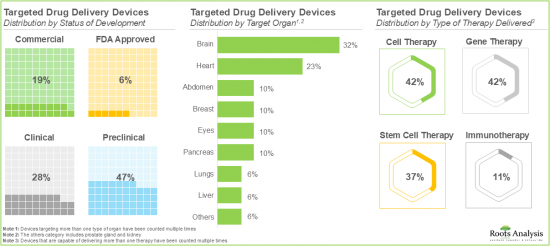

- Over 30% of the devices are focused on delivering biologics directly to the brain, followed by the devices targeting the heart.

- A sizeable proportion of trials, focused on the evaluation of stem cell and gene therapies that can be administered in combination with targeted drug delivery devices, are actively recruiting patients.

- 15 stem cell therapies and 8 gene therapies emerged as the most likely drug candidates for delivery via targeted drug delivery devices; notably, 60% of these therapies are currently in phase II of clinical development.

- The growing demand for personalized medicines has emerged as a key driving factor supporting the rapid evolution of the targeted drug delivery device market.

- The targeted drug delivery device market is likely to grow at a CAGR of 19.7% till 2035; majority of the market share is likely to be occupied by North America, followed by Europe.

TARGETED DRUG DELIVERY DEVICE MARKET: KEY SEGMENTS

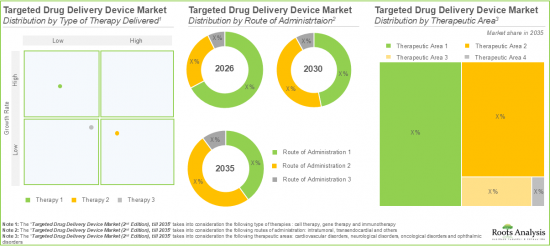

Catheter is the Fastest Growing Segment of the Targeted Drug Delivery Device Market

Based on the type of device, the global market for targeted drug delivery devices is segmented into cannulas, catheters and others. Currently, the majority share of the targeted drug delivery devices market is captured by the cannula segment. It is worth mentioning that the catheter segment is likely to grow at a higher CAGR in the coming years. This can be attributed to the ability of catheters to deliver drugs for extended periods, providing consistent treatment to patients with chronic disorders.

Targeted Drug Delivery Devices for Brain is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the type of organ, the global market value is segmented across brain, breast, eyes and heart. Whilst the devices focused on delivering biologics directly to the breast will be the primary driver of the overall market, it is worth highlighting that the market for devices delivering biologics to the brain is likely to grow at a relatively higher CAGR.

Intratumoral Segment is Likely to Hold the Largest Share of the Targeted Drug Delivery Device Market During the Forecast Period

Based on the route of administration, the global market is segmented into intratumoral, transendocardial and others. Currently, the intratumoral segment is likely to dominate and drive the overall market growth due to its ability to reduce the side effects of systemic circulation and restrict the exposure of highly toxic drugs to healthy tissues.

By Type Of Therapy Delivered, Immunotherapy Segment is Likely to Dominate the Market During the Forecast Period

Based on the type of therapy delivered, the global market for targeted drug delivery devices is distributed across cell therapy, gene therapy and immunotherapy. Currently, the immunotherapy market segment holds the largest market share due to the remarkable success of these therapies in targeting specific cells. However, the targeted drug delivery device market for gene therapy is expected to grow at a higher CAGR in the coming years.

Targeted Drug Delivery Devices Designed for Oncological Disorders are Likely to Dominate the Targeted Drug Delivery Device Market During the Forecast Period

Based on therapeutic area, the global targeted drug delivery device market is distributed across cardiovascular disorders, neurological disorders, oncological disorders and ophthalmic disorders. Whilst the targeted drug delivery devices designed for oncological disorders hold the majority of market share, it is worth noting that targeted drug delivery devices targeting cardiovascular disorders is likely to grow at a relatively higher CAGR during the forecast period.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. In the current scenario, North America is likely to capture the largest market share owing to the increasing prevalence of chronic diseases and advanced healthcare infrastructure in this region. However, the targeted drug delivery devices market in Europe is expected to grow at a higher CAGR during the forecast period.

Example Players in the Targeted Drug Delivery Devices Market

- Alcyone Lifesciences

- Algorae Pharmaceuticals

- BioCradia

- ClearPoint Neuro

- Gloriana Therapeutics

- Mercator MedSystems

- Neurotech Pharmaceuticals

- Novartis

- OncoSec

- PharmaCyte Biotech

- PulseSight Therapeutics

- Renishaw

- Silexion Therapeutics

- SmartCella

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and Chief Executive Officer, Small Company, US

- Junior Business Developer, Small Company, France

- Assistant Professor, Large Organization, US

- Postdoctoral Associate, Large Organization, US

TARGETED DRUG DELIVERY DEVICES MARKET: RESEARCH COVERAGE

The report on targeted drug delivery devices features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the targeted drug delivery devices market, focusing on key market segments, including [A] type of device, [B] target organ, [C] type of therapy delivered, [D] route of administration, [E] therapeutic area, [F] key geographical regions, and [G] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- Targeted Drug Delivery Device Providers Market Landscape: The report features an analysis of the players engaged in the development of targeted drug delivery devices, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] status of development, [E] type of device, [F] target organ, [G] type of therapy delivered, [H] route of administration and [I] target therapeutic area.

- Company Profiles: Elaborate profiles of prominent players developing targeted drug delivery devices across various geographies, providing details on [A] company overview, [B] financial information (if available), [C] information on its device portfolio, [D] recent developments and [E] an informed future outlook.

- Clinical Trial Analysis: A comprehensive assessment of clinical trials registered for evaluating the efficacy of targeted drug delivery devices, based on various relevant parameters, such as [A] trial registration year, [B] trial recruitment status, [C] trial phase, [D] study design, [E] type of sponsor / collaborator, [F] therapeutic area, [G] type of therapy delivered, [H] leading players and [I] geographical distribution of trials.

- Likely Drug Candidates: An analysis of the drug candidates (stem cell and gene therapy) that are likely to be delivered by targeted drug delivery devices, based on several parameters, such as [A] phase of development and [B] therapeutic area.

- Case Study: A detailed assessment of research activity in targeted drug delivery devices for promising therapeutic areas, namely neurological and cardiovascular disorders. Additionally, this section includes analysis of recent publications and grants awarded for these devices.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Who are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What type of partnership models are commonly adopted by industry stakeholders?

- What is the ongoing investment trend in this market?

- What is the patent filing activity trend in the market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Drug Delivery Devices for Biologics

- 6.3. Route of Drug Administration

- 6.4. Challenges Associated with Delivery of Biologics

- 6.5. Need for Targeted Drug Delivery

- 6.6. Types of Targeted Delivery Devices of Biologics

- 6.7. Benefits of Targeted Delivery Devices of Biologics

- 6.8. Concluding Remarks

SECTION III: MARKET OVERVIEW

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Targeted Drug Delivery Devices for Biologics: Overall Market Landscape

- 7.2.1. Analysis by Status of Development

- 7.2.2. Analysis by Type of Device

- 7.2.3. Analysis by Target Organ

- 7.2.4. Analysis by Type of Biologic Delivered

- 7.2.5. Analysis by Type of Therapy Delivered

- 7.2.6. Analysis by Route of Administration

- 7.2.7. Analysis by Target Therapeutic Area

- 7.3. Targeted Drug Delivery Device Providers: Overall Market Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

SECTION IV: COMPANY PROFILES

8. COMPANY PROFILES OF PROMINENT PLAYERS

- 8.1. Chapter Overview

- 8.2. Alcyone Therapeutics

- 8.2.1. Company Overview

- 8.2.2. Financial Information

- 8.2.3. Targeted Drug Delivery Device Portfolio

- 8.2.4. Recent Developments and Future Outlook

- 8.3. BioCardia

- 8.3.1. Company Overview

- 8.3.2. Financial Information

- 8.3.3. Targeted Drug Delivery Device Portfolio

- 8.3.4. Recent Developments and Future Outlook

- 8.4. ClearPint Neuro

- 8.4.1. Company Overview

- 8.4.2. Financial Information

- 8.4.3. Targeted Drug Delivery Device Portfolio

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Mercator MedSystems

- 8.5.1. Company Overview

- 8.5.2. Financial Information

- 8.5.3. Targeted Drug Delivery Device Portfolio

- 8.5.4. Recent Developments and Future Outlook

- 8.6. Novartis

- 8.6.1. Company Overview

- 8.6.2. Financial Information

- 8.6.3. Targeted Drug Delivery Device Portfolio

- 8.6.4. Recent Developments and Future Outlook

- 8.7. Smartwise

- 8.7.1. Company Overview

- 8.7.2. Financial Information

- 8.7.3. Targeted Drug Delivery Device Portfolio

- 8.7.4. Recent Developments and Future Outlook

- 8.8. Key Winning Strategies

9. COMPANY PROFILES OF EMERGING PLAYERS

- 9.1. Chapter Overview

- 9.2. Algorae Pharmaceuticals

- 9.2.1. Company Overview

- 9.2.2. Targeted Drug Delivery Device Portfolio

- 9.3. Gloriana Therapeutics

- 9.3.1. Company Overview

- 9.3.2. Targeted Drug Delivery Device Portfolio

- 9.4. Neurotech Pharmaceuticals

- 9.4.1. Company Overview

- 9.4.2. Targeted Drug Delivery Device Portfolio

- 9.5. OncoSec Medical

- 9.5.1. Company Overview

- 9.5.2. Targeted Drug Delivery Device Portfolio

- 9.6. PharmaCyte Biotech

- 9.6.1. Company Overview

- 9.6.2. Device Portfolio

- 9.7. PulseSight Therapeutics

- 9.7.1. Company Overview

- 9.7.2. Targeted Drug Delivery Device Portfolio

- 9.8. Renishaw

- 9.8.1. Company Overview

- 9.8.2. Targeted Drug Delivery Device Portfolio

- 9.9. Silexion Therapeutics

- 9.9.1. Company Overview

- 9.9.2. Targeted Drug Delivery Device Portfolio

SECTION V: MARKET TRENDS

10. PROMISING THERAPEUTIC AREA FOR TARGETED DRUG DELIVERY DEVICES

- 10.1. Chapter Overview

- 10.2. Neurological Disorders

- 10.2.1. Stem Cell Therapies

- 10.2.1.1. Publication Analysis

- 10.2.1.1.1. Methodology

- 10.2.1.1.2. List of Publications

- 10.2.1.1.3. Analysis by Year of Publication

- 10.2.1.2. Grant Analysis

- 10.2.1.2.1. Methodology

- 10.2.1.2.2. List of Academic Grants

- 10.2.1.2.3. Analysis by Year of Grant Awarded

- 10.2.1.2.4. Analysis by Amount Awarded

- 10.2.1.1. Publication Analysis

- 10.2.2. Gene Therapies

- 10.2.2.1. Publication Analysis

- 10.2.2.1.1. Methodology

- 10.2.2.1.2. List of Publications

- 10.2.2.1.3. Analysis by Year of Publication

- 10.2.2.2. Grant Analysis

- 10.2.2.2.1. Methodology

- 10.2.2.2.2. List of Academic Grants

- 10.2.2.2.3. Analysis by Year of Grant Awarded

- 10.2.2.2.4. Analysis by Amount Awarded

- 10.2.2.1. Publication Analysis

- 10.2.1. Stem Cell Therapies

- 10.3. Cardiovascular Disorders

- 10.3.1. Stem Cell Therapies

- 10.3.1.1. Publication Analysis

- 10.3.1.1.1. Methodology

- 10.3.1.1.2. List of Publications

- 10.3.1.1.3. Analysis by Year of Publication

- 10.3.1.2. Grant Analysis

- 10.3.1.2.1. Methodology

- 10.3.1.2.2. List of Academic Grants

- 10.3.1.2.3. Analysis by Year of Grant Awarded

- 10.3.1.2.4. Analysis by Amount Awarded

- 10.3.1.1. Publication Analysis

- 10.3.2. Gene Therapies

- 10.3.2.1. Publication Analysis

- 10.3.2.1.1. Methodology

- 10.3.2.1.2. List of Publications

- 10.3.2.1.3. Analysis by Year of Publication

- 10.3.2.2. Grant Analysis

- 10.3.2.2.1. Methodology

- 10.3.2.2.2. List of Academic Grants

- 10.3.2.2.3. Analysis by Year of Grant Awarded

- 10.3.2.2.4. Analysis by Amount Awarded

- 10.3.2.1. Publication Analysis

- 10.3.1. Stem Cell Therapies

11. CLINICAL TRIAL ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Targeted Drug Delivery Devices: Clinical Trial Analysis

- 11.3.1. Analysis by Trial Registration Year

- 11.3.2. Analysis by Trial Recruitment Status

- 11.3.3. Analysis of Enrolled Patient Population by Trial Registration Year

- 11.3.4. Analysis by Trial Registration Year and Trial Recruitment Status

- 11.3.5. Analysis by Trial Phase

- 11.3.6. Analysis of Enrolled Patient Population by Trial Phase

- 11.3.7. Analysis by Study Design

- 11.3.8. Analysis by Type of Sponsor / Collaborator

- 11.3.9. Analysis by Therapeutic Area

- 11.3.10. Analysis by Type of Therapy

- 11.3.11. Leading Players: Analysis by Number of Registered Trials

- 11.3.12. Analysis by Geography

- 11.3.13. Analysis by Trial Recruitment Status and Geography

- 11.3.14. Analysis of Enrolled Patient Population by Trial Recruitment Status and Geography

12. LIKELY DRUG CANDIDATES

- 12.1. Chapter Overview

- 12.2. Key Parameters and Scoring Criteria

- 12.3. Gene Therapy Drug Candidates

- 12.3.1. Most Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.3.2. Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.3.3. Less Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.3.4. Least Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.4. Stem Cell Therapy Drug Candidates

- 12.4.1. Most Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.4.2. Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.4.3. Less Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

- 12.4.4. Least Likely Drug Candidates for Delivery Via Targeted Drug Delivery Device

SECTION VI: MARKET OPPORTUNITY ANALYSIS

13. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 13.1. Chapter Overview

- 13.2. Market Drivers

- 13.3. Market Restraints

- 13.4. Market Opportunities

- 13.5. Market Challenges

- 13.6. Conclusion

14. GLOBAL TARGETED DRUG DELIVERY DEVICE MARKET

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Global Targeted Drug Delivery Device Market, Forecasted Estimates (2026- 2035)

- 14.3.1. Scenario Analysis

- 14.3.2. Conservative Scenario

- 14.3.3. Optimistic Scenario

- 14.4. Key Market Segmentations

15. TARGETED DRUG DELIVERY DEVICE MARKET, BY TYPE OF DEVICE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Targeted Drug Delivery Device Market: Distribution by Type of Device

- 15.3.1. Targeted Drug Delivery Device Market for Cannulas, Forecasted Estimates (Till 2035)

- 15.3.2. Targeted Drug Delivery Device Market for Catheters, Forecasted Estimates (Till 2035)

- 15.3.3. Targeted Drug Delivery Device Market for Other Devices, Forecasted Estimates (Till 2035)

- 15.4. Data Triangulation and Validation

16. TARGETED DRUG DELIVERY DEVICE MARKET, BY TARGET ORGAN

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Targeted Drug Delivery Market: Distribution by Target Organ

- 16.3.1. Targeted Drug Delivery Device Market for Breast, Forecasted Estimates (Till 2035)

- 16.3.2. Targeted Drug Delivery Device Market for Brain, Forecasted Estimates (Till 2035)

- 16.3.3. Targeted Drug Delivery Device Market for Heart, Forecasted Estimates (Till 2035)

- 16.3.4. Targeted Drug Delivery Device Market for Eyes, Forecasted Estimates (Till 2035)

- 16.4. Data Triangulation and Validation

17. TARGETED DRUG DELIVERY DEVICE MARKET, BY TYPE OF THERAPY DELIVERED

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Targeted Drug Delivery Market: Distribution by Type of Therapy Delivered

- 17.3.1. Targeted Drug Delivery Device Market for Immunotherapies, Forecasted Estimates (Till 2035)

- 17.3.2. Targeted Drug Delivery Device Market for Gene Therapies, Forecasted Estimates (Till 2035)

- 17.3.3. Targeted Drug Delivery Device Market for Cell Therapies, Forecasted Estimates (Till 2035)

- 17.4. Data Triangulation and Validation

18. TARGETED DRUG DELIVERY DEVICE MARKET, BY ROUTE OF ADMINISTRATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Targeted Drug Delivery Market: Distribution by Route of Administration

- 18.3.1. Targeted Drug Delivery Device Market for Intratumoral, Forecasted Estimates (Till 2035)

- 18.3.2. Targeted Drug Delivery Device Market for Transendocardial, Forecasted Estimates, (Till 2035)

- 18.3.3. Targeted Drug Delivery Device Market for Others, Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. TARGETED DRUG DELIVERY DEVICE MARKET, BY THERAPEUTIC AREA

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Targeted Drug Delivery Market: Distribution by Therapeutic Area

- 19.3.1. Targeted Drug Delivery Device Market for Oncological Disorders, Forecasted Estimates (Till 2035)

- 19.3.2. Targeted Drug Delivery Device Market for Cardiovascular Disorders, Forecasted Estimates (Till 2035)

- 19.3.3. Targeted Drug Delivery Device Market for Neurological Disorders, Forecasted Estimates (Till 2035)

- 19.3.4. Targeted Drug Delivery Device Market for Ophthalmic Disorders, Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. TARGETED DRUG DELIVERY DEVICE MARKET, BY KEY GEOGRAPHICAL REGIONS

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Targeted Drug Delivery Market: Distribution by Key Geographical Regions

- 20.3.1. Targeted Drug Delivery Device Market in North America, Forecasted Estimates (Till 2035)

- 20.3.2. Targeted Drug Delivery Device Market in Europe, Forecasted Estimates (Till 2035)

- 20.3.3. Targeted Drug Delivery Device Market in Asia-Pacific, Forecasted Estimates (Till 2035)

- 20.4. Market Dynamics Assessment

- 20.4.1. Penetration Growth (P-G) Matrix

- 20.4.2. Data Triangulation and Validation

21. TARGETED DRUG DELIVERY DEVICE MARKET, BY LEADING DEVELOPERS

- 21.1. Chapter Overview

- 21.2. Targeted Drug Delivery Device Market: Distribution by Leading Developers

22. TARGETED DRUG DELIVERY DEVICE MARKET, SALES FORECAST OF DEVICES

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Targeted Drug Delivery Devices Market for Biologics: Sales Forecast

- 22.3.1. Alcyone's MEMS Cannula: Sales Forecast

- 22.3.2. Electro-Transfection Injection System: Sales Forecast

- 22.3.3. Helix Biotherapeutic Delivery System: Sales Forecast

- 22.3.4. ImmunoPulse: Sales Forecast

- 22.3.5. SmartFlow Neuro Ventricular Cannula: Sales Forecast

SECTION VIII: OTHER EXCLUSIVE INSIGHTS

23. CONCLUDING REMARKS

24. EXECUTIVE INSIGHTS

- 24.1. Seraxis

- 24.1.1. Company Snapshot

- 24.1.2. Interview Transcript: William Rust, Founder and Chief Executive Officer

- 24.2. Defymed

- 24.2.1. Company Snapshot

- 24.2.2. Interview Transcript: Manuel Pires, Junior Business Developer

- 24.3. University of Texas at San Antonio

- 24.3.1. Organization Snapshot

- 24.3.2. Interview Transcript: Lyle Hood, Assistant Professor

- 24.4. Massachusetts Institute of Technology

- 24.4.1. Organization Snapshot

- 24.4.2. Interview Transcript: Anonymous, Postdoctoral Associate

25. APPENDIX I: TABULATED DATA

26. APPENDIX II: LIST OF COMPANIES AND ORGANIZATION

List of Tables

- Table 7.1 Targeted Drug Delivery Devices: Information on Developer, Status of Development and Type of Device

- Table 7.2 Targeted Drug Delivery Devices: Information on Target Organ, Type of Biologic Delivered and Type of Therapy Delivered

- Table 7.3 Targeted Drug Delivery Devices: Information on Route of Administration and Therapeutic Area

- Table 7.4 Targeted Drug Delivery Devices for Biologics: List of Developers

- Table 8.1 Targeted Drug Delivery Device Developers: List of Prominent Companies Profiled

- Table 8.2 Alcyone Therapeutics: Company Overview

- Table 8.3 Alcyone Therapeutics: Device Portfolio

- Table 8.4 BioCardia: Company Overview

- Table 8.5 BioCardia: Targeted Drug Delivery Device Portfolio

- Table 8.6 BioCardia: Recent Developments and Future Outlook

- Table 8.7 ClearPoint Neuro: Company Overview

- Table 8.8 ClearPoint Neuro: Targeted Drug Delivery Device Portfolio

- Table 8.9 ClearPoint Neuro: Recent Developments and Future Outlook

- Table 8.10 Mercator MedSystems: Company Overview

- Table 8.11 Mercator MedSystems: Targeted Drug Delivery Device Portfolio

- Table 8.12 Novartis: Company Overview

- Table 8.13 Novartis: Targeted Drug Delivery Device Portfolio

- Table 8.14 Novartis: Recent Developments and Future Outlook

- Table 8.15 Smartcella: Company Overview

- Table 8.16 SmartCella: Targeted Drug Delivery Device Portfolio

- Table 8.17 Smartcella: Recent Developments and Future Outlook

- Table 9.1 Targeted Drug Delivery Device Developers: List of Emerging Companies Profiled

- Table 9.2 Algorae Pharmaceuticals: Company Overview

- Table 9.3 Algorae Pharmaceuticals: Targeted Drug Delivery Device Portfolio

- Table 9.4 BioCardia: Company Overview

- Table 9.5 BioCardia: Targeted Drug Delivery Device Portfolio

- Table 9.6 Gloriana Therapeutics: Company Overview

- Table 9.7 Gloriana Therapeutics: Targeted Drug Delivery Device Portfolio

- Table 9.8 Neurotech Pharmaceuticals: Company Overview

- Table 9.9 Neurotech Pharmaceuticals: Targeted Drug Delivery Device Portfolio

- Table 9.10 OncoSec: Company Overview

- Table 9.11 OncoSec: Targeted Drug Delivery Device Portfolio

- Table 9.12 PharmaCyte Biotech: Company Overview

- Table 9.13 PharmaCyte Biotech: Targeted Drug Delivery Device Portfolio

- Table 9.14 PulseSight Therapeutics: Company Overview

- Table 9.15 PulseSight Therapeutics: Targeted Drug Delivery Device Portfolio

- Table 9.16 Renishaw: Company Overview

- Table 9.17 Renishaw: Targeted Drug Delivery Device Portfolio

- Table 9.18 Silexion Therapeutics: Company Overview

- Table 9.19 Silexion Therapeutics: Targeted Drug Delivery Device Portfolio

- Table 10.1 Stem Cell Therapies for Neurological Disorders: List of Approved / Under Development Therapies

- Table 10.2 Stem Cell Therapies for Neurological Disorders: List of Publications, Since 2015

- Table 10.3 Stem Cell Therapies for Neurological Disorders: List of Academic Grants, Since 2015

- Table 10.4 Gene Therapies for Neurological Disorders: List of Approved / Under Development Therapies

- Table 10.5 Gene Therapies for Neurological Disorders: List of Publications, Since 2015

- Table 10.6 Gene Therapies for Neurological Disorders: List of Academic Grants, Since 2015

- Table 10.7 Stem Cell Therapies for Cardiovascular Disorders: List of Approved / Under Development Therapies

- Table 10.8 Stem Cell Therapies for Cardiovascular Disorders: List of Publications, Since 2015

- Table 10.9 Stem Cell Therapies for Cardiovascular Disorders: List of Academic Grants, Since 2015

- Table 10.10 Gene Therapies for Cardiovascular Disorders: List of Approved / Under Development Therapies

- Table 10.11 Gene Therapies for Cardiovascular Disorders: List of Publications, Since 2015

- Table 10.12 Gene Therapies for Cardiovascular Disorders: List of Academic Grants, Since 2015

- Table 12.1 Gene Therapy: Most Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.2 Gene Therapy: Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.3 Gene Therapy: Less Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.4 Gene Therapy: Least Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.5 Stem Cell Therapy: Most Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.6 Stem Cell Therapy: Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.7 Stem Cell Therapy: Less Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.8 Stem Cell Therapy: Least Likely Candidates for Delivery via Targeted Drug Delivery Device

- Table 12.9 Stem Cell Therapy Drug Candidates: Top 10 Drugs for Delivery via Targeted Drug Delivery Devices

- Table 12.10 Gene Therapy Drug Candidates: Top 10 Drugs for Delivery via Targeted Drug Delivery Devices

- Table 24.1 Seraxis: Key Highlights

- Table 24.2 Defymed: Key Highlights

- Table 24.3 University of Texas: Key Highlights

- Table 24.4 Massachusetts Institute of Technology: Key Highlights

- Table 25.1 Targeted Drug Delivery Devices: Distribution by Status of Development

- Table 25.2 Targeted Drug Delivery Devices: Distribution of Type of Device

- Table 25.3 Targeted Drug Delivery Devices: Distribution by Target Organ

- Table 25.4 Targeted Drug Delivery Devices: Distribution by Type of Biologic Delivered

- Table 25.5 Targeted Drug Delivery Devices: Distribution by Type of Therapy Delivered

- Table 25.6 Targeted Drug Delivery Devices: Distribution by Route of Administration

- Table 25.7 Targeted Drug Delivery Devices: Distribution by Target Therapeutic Area

- Table 25.8 Targeted Drug Delivery Device Developers: Distribution by Year of Establishment

- Table 25.9 Targeted Drug Delivery Device Developers: Distribution by Company Size

- Table 25.10 Targeted Drug Delivery Device Developers: Distribution by Location of Headquarters (Region)

- Table 25.11 Targeted Drug Delivery Device Developers: Distribution by Location of Headquarters (Country)

- Table 25.12 BioCardia: Annual Revenues, FY 2021 onwards (USD Million)

- Table 25.13 ClearPoint Neuro: Annual Revenues, FY 2021 onwards (USD Million)

- Table 25.14 Novartis: Annual Revenues, FY 2021 onwards (USD Million)

- Table 25.15 Stem Cell Therapy for Neurological Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Table 25.16 Stem Cell Therapy for Neurological Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Table 25.17 Stem Cell Therapy for Neurological Disorders, Grant Analysis: Distribution by Cumulative Amount Awarded (USD Million), Since 2015

- Table 25.18 Gene Therapy for Neurological Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Table 25.19 Gene Therapy for Neurological Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Table 25.20 Gene Therapy for Neurological Disorders, Grant Analysis: Distribution by Cumulative Amount Granted, Since 2015 (USD Million)

- Table 25.21 Stem Cell Therapy for Cardiovascular Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Table 25.22 Stem Cell Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Table 25.23 Stem Cell Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Cumulative Amount Granted, Since 2015 (USD Million)

- Table 25.24 Gene Therapy for Cardiovascular Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Table 25.25 Gene Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Table 25.26 Gene Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Cumulative Amount Granted (USD Million)

- Table 25.27 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year, Since 2018

- Table 25.28 Clinical Trial Analysis: Distribution by Trial Recruitment Status

- Table 25.29 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Registration Year, Since 2018

- Table 25.30 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year and Trial Recruitment Status

- Table 25.31 Clinical Trial Analysis: Distribution by Trial Phase

- Table 25.32 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Phase

- Table 25.33 Clinical Trial Analysis: Distribution by Study Design

- Table 25.34 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 25.35 Clinical Trial Analysis: Distribution by Therapeutic Area

- Table 25.36 Clinical Trial Analysis: Distribution by Type of Therapy

- Table 25.37 Leading Players: Distribution by Number of Registered Trials

- Table 25.38 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Table 25.39 Clinical Trial Analysis: Distribution by Trial Recruitment Status and Geography

- Table 25.40 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Recruitment Status and Geography

- Table 25.41 Global Targeted Drug Delivery Device Market, Forecasted Estimates (Till 2035) (USD Million)

- Table 25.42 Global Targeted Drug Delivery Device Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Million)

- Table 25.43 Global Targeted Drug Delivery Device Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Million)

- Table 25.44 Targeted Drug Delivery Device Market: Distribution by Type of Device

- Table 25.45 Targeted Drug Delivery Device Market for Cannulas, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.46 Targeted Drug Delivery Device Market for Catheters, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.47 Targeted Drug Delivery Device Market for Other Devices, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.48 Targeted Drug Delivery Device Market: Distribution by Target Organ

- Table 25.49 Targeted Drug Delivery Device Market for Breast, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.50 Targeted Drug Delivery Device Market for Brain, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.51 Targeted Drug Delivery Device Market for Heart, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.52 Targeted Drug Delivery Device Market for Eyes, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.53 Targeted Drug Delivery Device Market: Distribution by Type of Therapy Delivered

- Table 25.54 Targeted Drug Delivery Device Market for Immunotherapies, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.55 Targeted Drug Delivery Device Market for Gene Therapies, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.56 Targeted Drug Delivery Device Market for Cell Therapies, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.57 Targeted Drug Delivery Device Market: Distribution by Route of Administration Delivered

- Table 25.58 Targeted Drug Delivery Device Market for Intratumoral, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.59 Targeted Drug Delivery Device Market for Transendocardial, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.60 Targeted Drug Delivery Device Market for Others, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.61 Targeted Drug Delivery Device Market: Distribution by Therapeutic Area Delivered

- Table 25.62 Targeted Drug Delivery Device Market for Oncological Disorders, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.63 Targeted Drug Delivery Device Market for Cardiovascular Disorders, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.64 Targeted Drug Delivery Device Market for Neurological Disorders, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.65 Targeted Drug Delivery Device Market for Ophthalmic Disorders, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.66 Targeted Drug Delivery Device Market: Distribution by Key Geographical Regions

- Table 25.67 Targeted Drug Delivery Device Market in North America, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.68 Targeted Drug Delivery Device Market in Europe, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.69 Targeted Drug Delivery Device Market in Asia-Pacific, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.70 Targeted Drug Delivery Device Market: Distribution by Leading Targeted Drug Delivery Developers (based on sales of targeted drug delivery devices in the current year (USD Million))

- Table 25.71 Targeted Drug Delivery Device Market: Distribution by Leading Targeted Drug Delivery Developers (based on sales of targeted drug delivery devices in the year 2035 (USD Million))

- Table 25.72 Targeted Drug Delivery Device Market: Alcyone's MEMS Cannula (AMCTM) Sales Forecast, (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.73 Targeted Drug Delivery Device Market: Electro-Transfection Injection System Sales Forecast, (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.74 Targeted Drug Delivery Device Market: Helix Biotherapeutic Delivery System Sales Forecast, (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.75 Targeted Drug Delivery Device Market: ImmunoPulse Sales Forecast, (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 25.76 Targeted Drug Delivery Device Market: SmartFlow Neuro Ventricular Cannula Sales Forecast, (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Market Assessment Framework

- Figure 4.1 Lesson Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Clinical Trial Analysis

- Figure 5.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Popular Drug Delivery Devices

- Figure 6.2 Most Prominent Routes of Drug Administration for Biologics

- Figure 7.1 Targeted Drug Delivery Devices: Distribution by Status of Development

- Figure 7.2 Targeted Drug Delivery Devices: Distribution by Type of Device

- Figure 7.3 Targeted Drug Delivery Devices: Distribution by Target Organ

- Figure 7.4 Targeted Drug Delivery Devices: Distribution by Type of Biologic Delivered

- Figure 7.5 Targeted Drug Delivery Devices: Distribution by Type of Therapy Delivered

- Figure 7.6 Targeted Drug Delivery Devices: Distribution by Route of Administration

- Figure 7.7 Targeted Drug Delivery Devices: Distribution by Target Therapeutic Area

- Figure 7.8 Targeted Drug Delivery Device Developers: Distribution by Year of Establishment

- Figure 7.9 Targeted Drug Delivery Device Developers: Distribution by Company Size

- Figure 7.10 Targeted Drug Delivery Device Developers: Distribution by Location of Headquarters (Region)

- Figure 7.11 Targeted Drug Delivery Device Developers: Distribution by Location of Headquarters (Country)

- Figure 8.1 BioCardia: Annual Revenues, FY 2021 onwards (USD Million)

- Figure 8.2 ClearPoint Neuro: Annual Revenues, FY 2021 onwards (USD Million)

- Figure 8.3 Novartis: Annual Revenues, FY 2021 onwards (USD Million)

- Figure 10.1 Stem Cell Therapy for Neurological Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Figure 10.2 Stem Cell Therapy for Neurological Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Figure 10.3 Stem Cell Therapy for Neurological Disorders, Grant Analysis, Distribution by Cumulative Amount Awarded (USD Million), Since 2015

- Figure 10.4 Gene Therapy for Neurological Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Figure 10.5 Gene Therapy for Neurological Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Figure 10.6 Gene Therapy for Neurological Disorders, Grant Analysis: Distribution by Cumulative Amount Awarded (USD Million), Since 2015

- Figure 10.7 Stem Cell Therapy for Cardiovascular Disorders, Publication Analysis: Distribution by Year of Publication, Since 2015

- Figure 10.8 Stem Cell Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Figure 10.9 Stem Cell Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Cumulative Amount Awarded (USD Million), Since 2015

- Figure 10.10 Gene Therapy for Cardiovascular Disorders, Publication Analysis: Distribution by Year of Publication, 2015-2024

- Figure 10.11 Gene Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Year of Grant Awarded, Since 2015

- Figure 10.12 Gene Therapy for Cardiovascular Disorders, Grant Analysis: Distribution by Cumulative Amount Awarded (USD Million), Since 2015

- Figure 11.1 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year, Since 2018

- Figure 11.2 Clinical Trial Analysis: Distribution by Trial Recruitment Status

- Figure 11.3 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Registration Year, Since 2018

- Figure 11.4 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year and Trial Recruitment Status

- Figure 11.5 Clinical Trial Analysis: Distribution by Trial Phase

- Figure 11.6 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Phase

- Figure 11.7 Clinical Trial Analysis: Distribution by Study Design

- Figure 11.8 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Figure 11.9 Clinical Trial Analysis: Distribution by Therapeutic Area

- Figure 11.10 Clinical Trial Analysis: Distribution by Type of Therapy

- Figure 11.11 Leading Players: Distribution by Number of Registered Trials

- Figure 11.12 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Figure 11.13 Clinical Trial Analysis: Distribution by Trial Recruitment Status and Geography

- Figure 11.14 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Recruitment Status and Geography

- Figure 14.1 Global Targeted Drug Delivery Device Market, Forecasted Estimates (Till 2035) (USD Million)

- Figure 14.2 Global Targeted Drug Delivery Device Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Million)

- Figure 14.3 Global Targeted Drug Delivery Device Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Million)

- Figure 15.1 Targeted Drug Delivery Device Market: Distribution by Type of Device

- Figure 15.2 Targeted Drug Delivery Device Market for Catheters, Forecasted Estimates (Till 2035) (USD Million)

- Figure 15.3 Targeted Drug Delivery Device Market for Cannulas, Forecasted Estimates (Till 2035) (USD Million)

- Figure 15.4 Targeted Drug Delivery Device Market for Other Devices, Forecasted Estimates (Till 2035) (USD Million)

- Figure 16.1 Targeted Drug Delivery Device Market: Distribution by Target Organ

- Figure 16.2 Targeted Drug Delivery Device Market for Brain, Forecasted Estimates (Till 2035) (USD Million)

- Figure 16.3 Targeted Drug Delivery Device Market for Breast, Forecasted Estimates (Till 2035) (USD Million)

- Figure 16.4 Targeted Drug Delivery Device Market for Eyes, Forecasted Estimates (Till 2035) (USD Million)

- Figure 16.5 Targeted Drug Delivery Device Market for Heart, Forecasted Estimates (Till 2035) (USD Million)

- Figure 17.1 Targeted Drug Delivery Device Market: Distribution by Type of Therapy Delivered

- Figure 17.2 Targeted Drug Delivery Device Market for Cell Therapies, Forecasted Estimates (Till 2035) (USD Million)

- Figure 17.3 Targeted Drug Delivery Device Market for Gene Therapies, Forecasted Estimates (Till 2035) (USD Million)

- Figure 17.4 Targeted Drug Delivery Device Market for Immunotherapies, Forecasted Estimates (Till 2035) (USD Million)

- Figure 18.1 Targeted Drug Delivery Device Market: Distribution by Route of Administration Delivered

- Figure 18.2 Targeted Drug Delivery Device Market for Intratumoral, Forecasted Estimates (Till 2035) (USD Million)

- Figure 18.3 Targeted Drug Delivery Device Market for Transendocardial, Forecasted Estimates (Till 2035) (USD Million)

- Figure 18.4 Targeted Drug Delivery Device Market for Others, Forecasted Estimates (Till 2035) (USD Million)

- Figure 19.1 Targeted Drug Delivery Device Market: Distribution by Therapeutic Area

- Figure 19.2 Targeted Drug Delivery Device Market for Cardiovascular Disorders, Forecasted Estimates (Till 2035) (USD Million)

- Figure 19.3 Targeted Drug Delivery Device Market for Neurological Disorders, Forecasted Estimates (Till 2035) (USD Million)

- Figure 19.4 Targeted Drug Delivery Device Market for Oncological Disorders, Forecasted Estimates (Till 2035) (USD Million)

- Figure 19.5 Targeted Drug Delivery Device Market for Ophthalmic Disorders, Forecasted Estimates (Till 2035) (USD Million)

- Figure 20.1 Targeted Drug Delivery Device Market: Distribution by Key Geographical Regions

- Figure 20.2 Targeted Drug Delivery Device Market in North America, Forecasted Estimates (Till 2035) (USD Million)

- Figure 20.3 Targeted Drug Delivery Device Market in Europe, Forecasted Estimates (Till 2035) (USD Million)

- Figure 20.4 Targeted Drug Delivery Device Market in Asia-Pacific, Forecasted Estimates (Till 2035) (USD Million)

- Figure 21.1 Targeted Drug Delivery Device Market: Distribution by Leading Developers, Current Year (USD Million)

- Figure 21.2 Targeted Drug Delivery Device Market: Distribution by Leading Developers, 2035 (USD Million)

- Figure 22.1 Targeted Drug Delivery Device Market: Alcyone's MEMS Cannula Sales Forecast, Till 2035 (USD Million)

- Figure 22.2 Targeted Drug Delivery Device Market: Electro-Transfection Injection System Sales Forecast, Till 2035 (USD Million)

- Figure 22.3 Targeted Drug Delivery Device Market: Helix Biotherapeutic Delivery System Sales Forecast, Till 2035 (USD Million)

- Figure 22.4 Targeted Drug Delivery Device Market: ImmunoPulse Sales Forecast, Till 2035 (USD Million)

- Figure 22.5 Targeted Drug Delivery Device Market: SmartFlow Neuro Ventricular Cannula Sales Forecast, Till 2035 (USD Million)

- Figure 23.1 Concluding Remarks: Market Landscape

- Figure 23.2 Concluding Remarks: Clinical Trial Analysis

- Figure 23.3 Concluding Remarks: Market Forecast and Opportunity Analysis (1/2)

- Figure 23.4 Concluding Remarks: Market Forecast and Opportunity Analysis (2/2)