|

市场调查报告书

商品编码

1721371

行动机器人的全球市场(~2035年):各提供,按机器人,各尺寸规格,导航感测器,负载容量,各终端用户,各地区,产业趋势与预测Mobile Robots Market, Till 2035: Distribution by Type of Offering, Type of Robot, Type of Form Factors, Type of Navigation Sensor, Type of Payload Capacity, Type of End-User and Geographical Regions : Industry Trends and Global Forecasts |

||||||

移动机器人市场概览

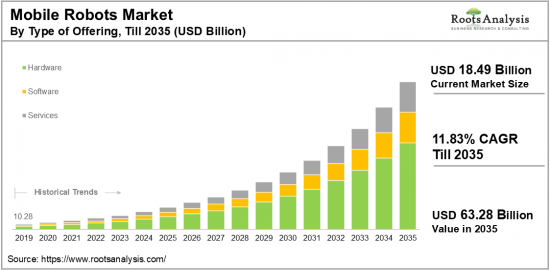

预计到 2035 年,全球移动机器人市场规模将从目前的 184.9 亿美元增至 632.8 亿美元,预测期内复合年增长率为 11.83%。

移动机器人市场:成长与趋势

2022 年,营运机器人数量达到创纪录的 390 万台。根据 "世界机器人报告" ,韩国每万名工人机器人拥有量居世界首位,其次是新加坡和德国。移动机器人将透过提高效率和鼓励创新来促进未来的业务成长。值得注意的是,移动机器人的应用在医疗保健、物流和製造业等各个领域都非常普遍。移动机器人的主要优势包括提高营运效率、降低人力成本,以及透过处理重复性或危险性任务来提高安全性。

此外,移动机器人市场拥有各种先进技术,包括尖端感测器技术和人工智慧,使机器人能够在复杂环境中高效工作并适应不断变化的条件。由于移动机器人与互联网和其他技术的快速融合,其应用正在快速增长。值得注意的是,工业自动化机器人的开发量年增了31%,数量已恢復到疫情前的水准。

移动机器人市场已成为全球向技术创新和数位转型、实现更高效率的重要因素。人工智慧和机器学习对于充分发挥其潜力并增强个人化能力至关重要。此外,现代转型正在融入雷射雷达、机器视觉和边缘运算等先进感测器,以实现即时决策。因此,由于技术的持续进步和对自动化技术的需求不断增长,因此预计移动机器人市场在预测期内将显着增长。

本报告提供全球行动机器人市场相关调查,提供市场规模的估计与机会分析,竞争情形,企业简介,SWOT分析等资讯。

目录

第1章 序文

第2章 调查手法

第3章 经济考虑事项,其他计划特有的考虑事项

第4章 宏观经济指标

第5章 摘要整理

第6章 简介

第7章 竞争情形

第8章 行动机器人市场上Start-Ups的生态系统

第9章 企业简介

- 章概要

- ABB Robotics

- Blue Skye Automation

- Boston Dynamics

- E-COBOT

- Geekplus Technology

- Gideon Brothers

- GreyOrange

- Honda Motor

- iRobot

- Kongsberg Maritime

- Kuka

- Locus Robotics

- Mobile Industrial Robots

- Northrop Grumman

- Omron Group

- SoftBank Robotics

- SuperDroid Robots

- Zebra Fetch Robotics

第10章 价值链分析

第11章 SWOT分析

第12章 全球行动机器人市场

第13章 市场机会:各提供

第14章 市场机会:机器人

第15章 市场机会:各尺寸规格

第16章 市场机会:导航感测器

第17章 市场机会:负载容量

第19章 市场机会:各流通管道

第20章 市场机会:各企业

第21章 市场机会:各终端用户

第22章 北美的行动机器人市场机会

第23章 欧洲的行动机器人市场机会

第24章 亚洲的行动机器人市场机会

第25章 中东·北非(MENA)的行动机器人市场机会

第26章 南美的行动机器人市场机会

第27章 其他地区的行动机器人市场机会

第28章 表格形式资料

第29章 企业·团体的清单

第30章 客制化的机会

第31章 Roots的订阅服务

第32章 着者详细内容

Mobile Robots Market Overview

As per Roots Analysis, the global mobile robots market size is estimated to grow from USD 18.49 billion in the current year to USD 63.28 billion by 2035, at a CAGR of 11.83% during the forecast period, till 2035.

The opportunity for mobile robots market has been distributed across the following segments:

Type of Offering

- Hardware

- Software

- Services

Type of Robot

- Automated Guided Vehicle (AGV)

- Autonomous

- Mobile Robot (AMR)

- Others

Type of Form-Factors

- Assembly Line

- Forklift

- Tow Tractor

- Tug

- Unit Load

Type of Navigation Sensor

- Camera

- Hybrid

- Laser/Lidar

- QR Code

- Reflector

Type of Payload Capacity

- <100 kg

- 100-500 kg

- >500 kg

Type of Distribution Channel

- Direct Sales

- Indirect Sales

- Leasing / Rental Model

- Robot-as-a-Service (RaaS)

Type of Enterprise

- Large

- Small and Medium Enterprise

Type of End-User

- Automotive

- FMCG Food & Beverage

- Logistics

- Semiconductor & Electronics

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

MOBILE ROBOTS MARKET: GROWTH AND TRENDS

In 2022, the number of operational robots hit a record high of 3.9 million. Notably, the Republic of Korea leads the world in robots per 10,000 workers, followed by Singapore and Germany, as per the World Robotics report. Mobile robots are driving future business growth by enhancing efficiency and fostering innovation. It's important to note that mobile robot applications are prevalent across multiple sectors, such as healthcare, logistics, and manufacturing. Some key benefits of mobile robots include improved operational efficiency, lower labor costs, and enhanced safety by handling repetitive or dangerous tasks.

Moreover, the mobile robots market features various advancements, including state-of-the-art sensor technologies and artificial intelligence, which allow robots to maneuver through complex settings and adjust to evolving circumstances. The adoption of mobile robots is rapidly increasing due to the swift integration of the internet and other technologies. Interestingly, there was a substantial year-on-year increase of 31% in the development of industrial automation robots, bringing their count back to pre-pandemic levels.

The mobile robots market is emerging as an essential element in the global transformation toward innovation and digital progress to achieve greater efficiency. Artificial intelligence and machine learning have been crucial in realizing its full capabilities, enhancing personalization features. Furthermore, modern shifts involve advanced sensors like LiDAR and machine vision, combined with edge computing, to enable real-time decision-making. As a result, with ongoing technological advancements and a growing demand for automation technologies, significant growth in the mobile robots market is expected during the forecast period.

MOBILE ROBOTS MARKET: KEY SEGMENTS

Market Share by Type of Offering

Based on the type of offering, the global mobile robots market is segmented into hardware, software and services. According to our estimates, currently, hardware segment captures the majority share of the market, owing to its essential function in enabling autonomous capabilities and continuous advancements. However, software segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Robot

Based on type of robot, the mobile robots market is segmented into automated guided vehicle (AGV), autonomous mobile robot (AMR) and others. According to our estimates, currently, automated guided vehicle segment captures the majority share of the market. This can be attributed to its widespread use in various sectors for material handling and logistics, especially in warehouse automation and manufacturing settings.

Market Share by Type of Form Factors

Based on type of form factors, the mobile robots market is segmented into assembly line, forklift, tow tractor, tug and unit load. According to our estimates, currently, forklift segment captures the majority share of the market. Additionally, the rising demand for robotic process automation in material handling and logistics is projected to propel the growth of this segment at a faster compound annual growth rate (CAGR) throughout the forecast period.

Market Share by Type of Navigation Sensor

Based on type of navigation sensor, the mobile robots market is segmented into camera, hybrid, laser/lidar, QR code and reflector. According to our estimates, currently, laser/lidar segment captures the majority share of the market. This can be attributed to the increasing demand, along with its ability to provide accurate environmental sensing, reliable performance in diverse conditions, and integration with AI.

Market Share by Type of Payload Capacity

Based on type of payload capacity, the mobile robots market is segmented into <100 kg, 100-500 kg and >500 kg. According to our estimates, currently, 100-500 kg segment captures the majority share of the market, owing to its adaptability and scalability resulting from its medium dimensions. However, <100 kg segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Distribution Channel

Based on type of distribution channel, the mobile robots market is segmented into direct sales, indirect sales, leasing / rental model and robot-as-a-service (RaaS). According to our estimates, currently, direct sales segment captures the majority share of the market. This can be attributed to the fact that manufacturers sell their robots directly to end-users, fostering strong customer relationships. However, robot-as-a-service (RaaS) segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Enterprise Size

Based on type of enterprise size, the mobile robots market is segmented into large enterprise and small & medium enterprise (SMEs). According to our estimates, currently, large enterprises segment captures the majority share of the market. This can be attributed to their ability to invest in advanced mobile robot strategies, such as customer relationship management (CRM) and content management systems, which aim to improve customer engagement and facilitate business expansion.

Market Share by Type of End-User

Based on type of end-user, the mobile robots market is segmented into automotive, FMCG, food & beverage, logistics, semiconductor & electronics and others. According to our estimates, currently, logistics segment captures the majority share of the market. This can be attributed to the increasing need for robotic process automation within warehouses, fueled by the expansion of e-commerce. However, automotive sector is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Geography

Based on geography, the mobile robots market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, North America captures the majority share of the market, owing to its well-established infrastructure. However, Asia is anticipated to grow at a higher CAGR during forecast period, due to the growing need for automation and increasing investments in digital infrastructure in emerging nations like India, China, and Japan.

Example Players in Mobile Robots Market

- ABB Robotics

- Blue Skye Automation

- Boston Dynamics

- E-COBOT

- Geekplus Technology

- Gideon Brothers

- GreyOrange

- Honda Motor

- iRobot

- Kongsberg Maritime

- Kuka

- Locus Robotics

- Mobile Industrial Robots

- Northrop Grumman

- Omron Group

- SoftBank Robotics

- SuperDroid Robots

- Zebra Fetch Robotics

MOBILE ROBOTS MARKET: RESEARCH COVERAGE

The report on the mobile robots market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the mobile robots market, focusing on key market segments, including [A] type of offering, [B] type of robot, [C] type of form-factors, [D] type of navigation sensor, [E] type of payload capacity, [F] type of distribution channel, [G] type of enterprise, [H] type of end-user, and [I] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the mobile robots market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the mobile robots market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] mobile robots portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in mobile robots market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Mobile Robots Market

- 6.2.1. Type of Offering

- 6.2.2. Type of Robot

- 6.2.3. Type of Form Factors

- 6.2.4. Type of Navigation Sensor

- 6.2.5. Type of Payload Capacity

- 6.2.6. Type of Distribution Channel

- 6.2.7. Type of Enterprise

- 6.2.8. Type of End-User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Mobile Robots: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. STARTUP ECOSYSTEM IN THE MOBILE ROBOTS MARKET

- 8.1. Mobile Robots Market: Market Landscape of Startups

- 8.1.1. Analysis by Year of Establishment

- 8.1.2. Analysis by Company Size

- 8.1.3. Analysis by Company Size and Year of Establishment

- 8.1.4. Analysis by Location of Headquarters

- 8.1.5. Analysis by Company Size and Location of Headquarters

- 8.1.6. Analysis by Ownership Structure

- 8.2. Key Findings

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. ABB Robotics *

- 9.2.1. Company Overview

- 9.2.2. Company Mission

- 9.2.3. Company Footprint

- 9.2.4. Management Team

- 9.2.5. Contact Details

- 9.2.6. Financial Performance

- 9.2.7. Operating Business Segments

- 9.2.8. Service / Product Portfolio (project specific)

- 9.2.9. MOAT Analysis

- 9.2.10. Recent Developments and Future Outlook

- 9.3. Blue Skye Automation

- 9.4. Boston Dynamics

- 9.5. E-COBOT

- 9.6. Geekplus Technology

- 9.7. Gideon Brothers

- 9.8. GreyOrange

- 9.9. Honda Motor

- 9.10. iRobot

- 9.11. Kongsberg Maritime

- 9.12. Kuka

- 9.13. Locus Robotics

- 9.14. Mobile Industrial Robots

- 9.15. Northrop Grumman

- 9.16. Omron Group

- 9.17. SoftBank Robotics

- 9.18. SuperDroid Robots

- 9.19. Zebra Fetch Robotics

10. VALUE CHAIN ANALYSIS

11. SWOT ANALYSIS

12. GLOBAL MOBILE ROBOTS MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Trends Disruption Impacting Market

- 12.4. Global Mobile Robots Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.5. Multivariate Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. MARKET OPPORTUNITIES BASED ON TYPE OF OFFERING

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Mobile Robots Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Mobile Robots Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Mobile Robots Market for Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF ROBOT

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Mobile Robots Market for Automated Guided Vehicle (AGV): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Mobile Robots Market for Autonomous Mobile Robot (AMR): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Mobile Robots Market for Others Mobile Robot (AMR): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF FORM FACTORS

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Mobile Robots Market for Assembly Line: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Mobile Robots Market for Forklift: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Mobile Robots Market for Tow Tractor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Mobile Robots Market for Tug: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Mobile Robots Market for Unit Load: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.11. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF NAVIGATION SENSOR

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Mobile Robots Market for Camera: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Mobile Robots Market for Hybrid: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Mobile Robots Market for Laser/Lidar: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Mobile Robots Market for QR Code: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.10. Mobile Robots Market for Reflector: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.11. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF PAYLOAD CAPACITY

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Mobile Robots Market for <100 kg: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Mobile Robots Market for 100-500 kg: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Mobile Robots Market for >500 kg: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF PAYLOAD CAPACITY

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Mobile Robots Market for <100 kg: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Mobile Robots Market for 100-500 kg: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Mobile Robots Market for >500 kg: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON TYPE OF DISTRIBUTION CHANNEL

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Mobile Robots Market for Direct Sales: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Mobile Robots Market for Indirect Sales: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Mobile Robots Market for Leasing / Rental Model: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Mobile Robots Market for Robot-as-a-Service (RaaS): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Mobile Robots Market for Large: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Mobile Robots Market for Small and Medium Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON TYPE OF END-USER

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Mobile Robots Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Mobile Robots Market for FMCG: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Mobile Robots Market for Food & Beverage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Mobile Robots Market for Logistics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.10. Mobile Robots Market for Semiconductor & Electronics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.11. Mobile Robots Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.12. Data Triangulation and Validation

22. MARKET OPPORTUNITIES MOBILE ROBOTS IN NORTH AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Mobile Robots Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Mobile Robots Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Mobile Robots Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Mobile Robots Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Mobile Robots Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR MOBILE ROBOTS IN EUROPE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Mobile Robots Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Mobile Robots Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Mobile Robots Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Mobile Robots Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Mobile Robots Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Mobile Robots Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Mobile Robots Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.7. Mobile Robots Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.8. Mobile Robots Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.9. Mobile Robots Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.10. Mobile Robots Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.11. Mobile Robots Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.12. Mobile Robots Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.13. Mobile Robots Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.14. Mobile Robots Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.15. Mobile Robots Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.16. Mobile Robots Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR MOBILE ROBOTS IN ASIA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Mobile Robots Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Mobile Robots Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Mobile Robots Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Mobile Robots Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Mobile Robots Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Mobile Robots Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Mobile Robots Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR MOBILE ROBOTS IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Mobile Robots Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Mobile Robots Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 25.6.2. Mobile Robots Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Mobile Robots Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Mobile Robots Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Mobile Robots Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Mobile Robots Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Mobile Robots Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Mobile Robots Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR MOBILE ROBOTS IN LATIN AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Mobile Robots Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Mobile Robots Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Mobile Robots Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Mobile Robots Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Mobile Robots Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Mobile Robots Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Mobile Robots Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR MOBILE ROBOTS IN REST OF THE WORLD

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Mobile Robots Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Mobile Robots Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Mobile Robots Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Mobile Robots Market in Other Countries

- 27.7. Data Triangulation and Validation