|

市场调查报告书

商品编码

1755285

移动机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Mobile Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

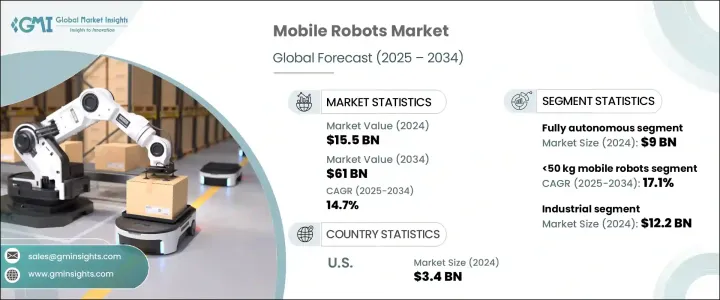

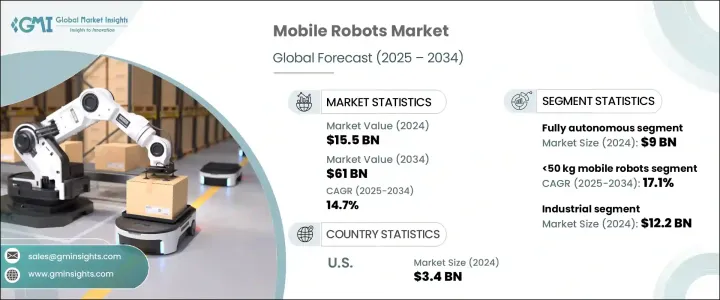

2024年,全球移动机器人市场规模达155亿美元,预计到2034年将以14.7%的复合年增长率成长,达到610亿美元,这主要得益于全球熟练劳动力的短缺,尤其是在製造业和物流领域。这种短缺促使企业采用机器人解决方案来处理重复性任务、订单履行和物料搬运。川普政府时期对机器人零件征收关税,导緻美国企业製造成本飙升,减缓了中小企业对自主移动机器人 (AMR) 和自动导引车 (AGV) 的采用。

因此,製造商们实现了供应链多元化,将生产转移到其他地区,并恢復了生产活动。从长远来看,这些策略透过建立区域枢纽来降低贸易风险,有助于增强供应链的韧性。已开发经济体最低工资的提高进一步推动了移动机器人的普及,证明了机器人解决方案的投资回报是合理的。电子商务等行业会经历季节性需求激增,它们依赖移动机器人来实现可扩展性,这种趋势在日本和德国等老龄化社会尤为明显,因为这些国家的劳动力缺口日益令人担忧。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 155亿美元 |

| 预测值 | 610亿美元 |

| 复合年增长率 | 14.7% |

2024年,全自动移动机器人市场规模达90亿美元,并将持续主导。这些机器人利用人工智慧和机器学习,无需人工输入即可即时决策,是仓库和医院等动态环境的理想选择。它们使用先进的感测器和SLAM(同步定位与地图建构)技术在复杂空间中导航。全自动设施(即无人值守仓库)的兴起加速了AMR的普及,尤其是在亚太地区和北美地区。然而,在需要类似人类灵活性的应用领域,挑战仍然存在,这推动了对电脑视觉和自适应夹持器等先进技术的投资。

2024年,有效载荷为50-500公斤的移动机器人市场规模达74亿美元,反映出其在各行各业的广泛应用。这些机器人对于仓库物料搬运、製造环境中重型零件的运输以及医院大型设备的移动都至关重要。这些机器人在处理中等载荷方面功能多样,使其成为连接用于小型任务的轻型机器人和用于更大工业规模作业的重型机器人的关键纽带。随着工业领域自动化程度的不断提升,这类移动机器人在简化操作和提高效率方面发挥越来越重要的作用。

受劳动力短缺、最低工资上涨以及物流、医疗保健和零售等行业对自动化技术日益增长的兴趣等因素推动,美国移动机器人市场规模在2024年达到34亿美元。由于劳动力成本高且营运效率要求日益提高,各行各业纷纷使用移动机器人来优化其供应链和物料搬运流程。美国市场也受益于政府推动机器人技术创新的措施和政策,这些措施和政策有助于企业提高生产力并减少对人力的依赖。

全球移动机器人产业的一些领导者包括库卡股份公司、ABB、海康机器人股份有限公司、泰瑞达公司和极智嘉。为了巩固市场地位,移动机器人产业的公司正专注于多种策略。一种关键方法是透过将人工智慧、机器学习和先进感测器等尖端技术整合到他们的机器人解决方案中来扩展其产品组合。公司也越来越多地将其製造业务本地化,以降低贸易风险并减少对国际供应链的依赖。此外,许多公司与物流、电子商务和製造业的行业领导者合作,根据特定行业需求量身定制机器人。研发投资是另一项重要策略,使公司能够透过在自主导航、灵活性和人机互动方面的创新来保持领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 劳动力短缺和劳动成本上升

- 电子商务成长与仓库自动化

- 人工智慧和感测器技术的进步

- 监管支援和工业 4.0 计划

- 产业陷阱与挑战

- 初期投资成本高

- 缺乏熟练的操作员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依自动化水平,2021 - 2034 年

- 主要趋势

- 完全自主

- 半自主

- 手动(遥控车辆)

第六章:市场估计与预测:依酬载容量,2021 - 2034 年

- 主要趋势

- <50公斤

- 50–500公斤

- 500–1000公斤

- >1000公斤

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅/家用

- 商业场所

- 工业的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- ABB

- KUKA AG

- Boston Dynamics

- OMRON Corporation

- Yaskawa America, Inc.

- Universal Robots A/S

- Seiko Epson Corporation

- FANUC America Corporation

- Teradyne Inc.

- Geek+

- Hikrobot Co., Ltd.

- Locus Robotics

- Ocado Group plc.

- Rockwell Automation, Inc.

- Vecna Robotics

- Agility Robotics

The Global Mobile Robots Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 14.7% to reach USD 61 billion by 2034, driven by the global shortage of skilled labor, especially in manufacturing and logistics. This shortage encourages businesses to adopt robotic solutions for handling repetitive tasks, order fulfillment, and material handling. The imposition of tariffs on robotic components during the Trump administration led to a spike in manufacturing costs for U.S. companies, which slowed the adoption of autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) in small and medium-sized enterprises (SMEs).

As a result, manufacturers diversified their supply chains, shifted production to other regions, and restored manufacturing activities. In the long run, these strategies helped strengthen supply chain resilience by establishing regional hubs to mitigate trade risks. The adoption of mobile robots is further bolstered by rising minimum wages in developed economies, justifying the return on investment for robotic solutions. Industries like e-commerce, which experience seasonal demand surges, rely on mobile robots for scalability, a trend seen particularly in aging societies like Japan and Germany, where the labor gap is a growing concern.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $61 Billion |

| CAGR | 14.7% |

The fully autonomous mobile robot segment was valued at USD 9 billion in 2024 and remains a dominant segment. These robots, which leverage AI and machine learning, can make real-time decisions without human input, making them ideal for dynamic environments like warehouses and hospitals. They navigate complex spaces using advanced sensors and SLAM (Simultaneous Localization and Mapping) technology. The rise of fully automated facilities, known as lights-out warehouses, accelerated the adoption of AMRs, particularly in Asia-Pacific and North America. However, challenges remain in applications requiring human-like dexterity, driving investments in advanced technologies like computer vision and adaptive grippers.

The mobile robots market with a payload capacity of 50-500 kg segment was valued at USD 7.4 billion in 2024, reflecting their widespread application in various industries. These robots are essential for material handling in warehouses, facilitating the transport of heavy components in manufacturing environments, and moving large equipment in hospitals. The versatility of these robots in handling mid-range payloads makes them a critical link between lightweight robots used for smaller tasks and heavy-duty robots designed for more industrial-scale operations. As automation continues to expand in industrial sectors, this category of mobile robots is playing an increasingly vital role in streamlining operations and improving efficiency.

United States Mobile Robot Market reached USD 3.4 billion in 2024, driven by a combination of labor shortages, rising minimum wages, and growing interest in automation technologies across sectors such as logistics, healthcare, and retail. With high labor costs and an increasing need for operational efficiency, industries use mobile robots to optimize their supply chain and material handling processes. The U.S. market has also benefited from government initiatives and policies that foster innovation in robotics, helping companies improve productivity and reduce reliance on human labor.

Some leading players in the Global Mobile Robots Industry include KUKA AG, ABB, Hikrobot Co., Ltd., Teradyne Inc., and Geek+. To strengthen their market position, companies in the mobile robots industry are focusing on several strategies. One key approach is expanding their product portfolio by integrating cutting-edge technologies such as AI, machine learning, and advanced sensors into their robotic solutions. Companies are also increasingly localizing their manufacturing operations to mitigate trade risks and reduce reliance on international supply chains. Additionally, many partners with industry leaders in logistics, e-commerce, and manufacturing to tailor their robots to specific industry needs. Investment in R&D is another essential strategy, enabling companies to stay ahead of the curve with innovations in autonomous navigation, dexterity, and human-robot interaction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Labor shortages and rising workforce costs

- 3.3.1.2 E-commerce growth and warehouse automation

- 3.3.1.3 Advancements in AI and sensor technologies

- 3.3.1.4 Regulatory support and industry 4.0 initiatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment costs

- 3.3.2.2 Lack of skilled operators

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Automation Level, 2021 - 2034 (USD Billion & Thousand Units)

- 5.1 Key trends

- 5.2 Fully autonomous

- 5.3 Semi-autonomous

- 5.4 Manual (remotely operated vehicle)

Chapter 6 Market Estimates & Forecast, By Payload Capacity, 2021 - 2034 (USD Billion & Thousand Units)

- 6.1 Key trends

- 6.2 <50 kg

- 6.3 50–500 kg

- 6.4 500–1000 kg

- 6.5 >1000 kg

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion & Thousand Units)

- 7.1 Key trends

- 7.2 Residential/domestic

- 7.3 Commercial places

- 7.4 Industrial

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 KUKA AG

- 9.3 Boston Dynamics

- 9.4 OMRON Corporation

- 9.5 Yaskawa America, Inc.

- 9.6 Universal Robots A/S

- 9.7 Seiko Epson Corporation

- 9.8 FANUC America Corporation

- 9.9 Teradyne Inc.

- 9.10 Geek+

- 9.11 Hikrobot Co., Ltd.

- 9.12 Locus Robotics

- 9.13 Ocado Group plc.

- 9.14 Rockwell Automation, Inc.

- 9.15 Vecna Robotics

- 9.16 Agility Robotics