|

市场调查报告书

商品编码

1692160

移动机器人-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Mobile Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

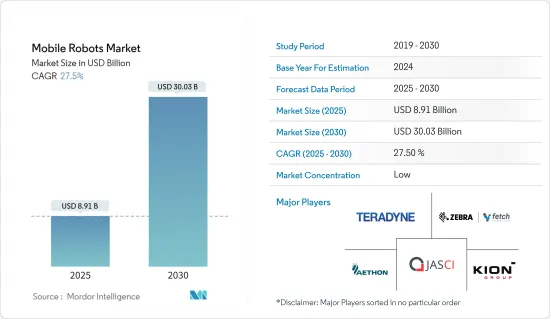

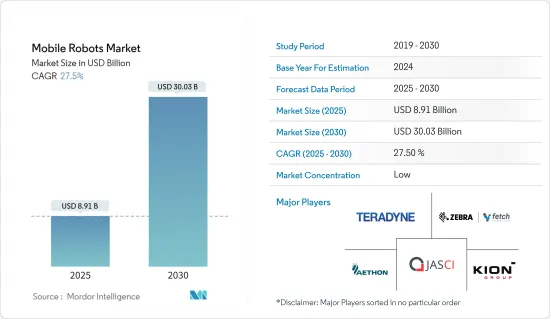

2025年移动机器人市场规模预计为89.1亿美元,预计到2030年将达到300.3亿美元,预测期内(2025-2030年)的复合年增长率为27.5%。

主要亮点

- 电子商务的成长推动仓库自动化:电子商务的快速扩张正在改变行动机器人市场。预计到 2024 年,全球零售电子商务销售额将达到 6.38 兆美元,高于 2020 年的 4.28 兆美元。这一大幅成长推动了对仓库自动化的需求,其中自主移动机器人 (AMR) 和自动导引运输车在简化业务方面发挥关键作用。亚马逊和沃尔玛等公司正在大力投资,其中亚马逊投入了 10 亿美元,沃尔玛投入了 140 亿美元用于自动化工作。

- 电子商务的成长:这在很大程度上受到全球疫情和不断变化的消费者习惯的影响。

- 市场预测:预计到 2026 年,电子商务将占美国总销售额的 31%,高于目前的 23%。

- 产业采用:到 2022 年,消费性电子产业的销售额将达到 9,884 亿美元,引领全球 B2C 电子商务。

- 部署范例:Geodis 计划在未来两年内在世界各地的设施中部署 1,000 台自主移动机器人。

- 人事费用与劳动挑战:已开发国家人事费用的上升正在加速移动机器人的采用。出生率下降和人口老化导致的全球劳动力短缺正在推动各行各业走向自动化。在美国,工业卡车拖拉机操作员的平均年薪在 34,488 美元到 50,110 美元之间。这一趋势在全球范围内都有所体现,2022年第二季欧元区人事费用年增4.0%。

- 人事费用上升:欧元区每小时人事费用上涨 4.0%,欧盟每小时劳动成本上涨 4.4%(2022 年第二季与 2021 年第二季相比)。

- 薪资统计:在美国,工业卡车拖拉机操作员的平均年薪为 39,210 美元。

- 自动化的优势:AMR 可以将人事费用降低 30-100%。

- 潜在投资回报率:对 AGV 和 AMR 的投资减少了对非熟练劳动力的依赖,并且通常可以快速获得投资回报。

- 技术进步与市场扩张:移动机器人市场正在经历快速的技术进步,其应用正在各个行业中扩展。人工智慧 (AI) 在使 AMR 无需大量编程即可处理复杂任务方面发挥关键作用。 5G技术的推出有望透过增强多机器人的部署和管理带来新的机会。

- 整合人工智慧:人工智慧使机器人能够识别物体并在复杂环境中导航,从而实现更智慧。

- 5G影响:预计5G连线数将在2022年超过10亿,到2025年将超过20亿,AMR将受益于效能的提升。

- 市场区隔:2022 年,AMR 将占据移动机器人市场的 57.8%,其次是单元货载,占 34.8%。

- 地理趋势:预计到 2022 年,中国将以 33.2% 的份额领先市场,其次是亚太地区,预计成长率最快,为 30.5%。

- 产业应用与市场动态:移动机器人被广泛应用于各行各业,其中製造业和物流业占据最前线。在汽车领域,AMR 优化了生产并提高了安全性。电子产品製造商也在使用移动机器人来简化其供应链并最大限度地减少错误。趋势是朝着更复杂的自主系统发展,AMR 的表现将优于传统的 AGV。

- 製造业应用:汽车产业正在利用 AMR 实现灵活的物料输送和更安全的工作环境。

- 电子产品:AMR 正在改善内部物流,预计到 2024 年,该行业的很大一部分将采用 AMR。

- 市场驱动因素:电子商务的快速成长、人事费用的上升以及技术的进步正在推动市场成长。

- 挑战:虽然长期投资回报潜力巨大,但高昂的初始成本仍是一个问题。

移动机器人市场趋势

自主移动机器人(AMR)推动市场成长

- 自主移动机器人 (AMR):按产品类型分類的最大细分市场:AMR 是移动机器人市场中最大的细分市场,2022 年的市场占有率为 57.8%。到 2028 年,AMR 预计将从 32.9 亿美元成长到 132.9 亿美元,复合年增长率高达 32.2%。

- 技术进步:AMR 因其灵活性和在非结构化环境中导航的智慧性而越来越受欢迎,其性能优于传统的 AGV。

- 加速电子商务:电子商务的快速成长推动了仓库和履约中心采用 AMR,从而提高了业务效率。

- 工业应用:AMR 正在部署到从汽车製造到医疗保健等各个领域,以协助物流和消毒作业。

- 协作能力:AMR 越来越多地被设计用于与人类工人协作处理重复性任务并提高职场的安全性和人体工学。

中国的快速成长

- 中国:成长最快的区域细分市场:中国移动机器人市场预计将快速成长,2023 年至 2028 年的复合年增长率将达到 30.5%。中国的快速工业化和对自动化的重视是这一成长的主要驱动力。

- 政府倡议:中国的「中国製造2025」计画正在创造有利于自动化的环境,鼓励在工厂引入移动机器人。

- 人事费用上升:中国人事费用上升正在加速向自动化转变,尤其是在电子和汽车等产业。

- 本地公司:像 Geek+Inc. 这样的公司。正在开发本地化的AMR解决方案,以开拓新市场并与全球参与者竞争。

- 电子商务和物流需求:中国电子商务的蓬勃发展,加上其庞大的物流网络,正在推动对行动机器人的需求,尤其是在仓库自动化领域。

移动机器人产业概况

全球参与者主导分散的市场移动机器人市场分散,许多全球和地区参与者都在争夺市场占有率。欧洲在专业应用服务机器人供应商方面处于领先地位。这种分散性正在推动企业之间的创新和激烈竞争,尤其是在 AMR 领域。

主要参与者 Teradyne Inc.(行动工业机器人)、Fetch Robotics(Zebra Technologies)和 Clearpath Robotics 等主要企业透过持续的产品创新和策略伙伴关係关係主导市场。

产品多样性:这些公司提供各种各样的移动机器人,旨在满足从物流到製造等各种行业需求。

策略伙伴关係:透过与系统整合和技术合作伙伴合作,市场领导者能够扩大其产品供应并提高市场渗透率。

未来成功因素:在不断发展的行动机器人市场中取得成功需要专注于持续创新、多功能解决方案和策略性全球扩张。此外,开发配备人工智慧和用户友好介面的移动机器人对于促进其在各个行业的广泛应用也具有重要意义。向新兴经济体扩张,尤其是透过战略伙伴关係,将成为在自动化需求日益增长的地区获得市场占有率的关键。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 宏观趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 电子商务的快速成长推动仓库自动化

- 已开发国家人事费用上升

- 市场限制

- 高资本要求和连接问题

第六章市场区隔

- 按产品

- 自动导引运输车(AGV)

- 自主移动机器人(AMR)

- 外形规格

- 堆高机

- 牵引车/拖拉机/拖船

- 单元货载

- 组装

- 透过导航感测器

- 反射镜

- QR 图码

- 雷射/LiDAR

- 摄影机、混合感测器(摄影机和光达)和其他导航感测器

- 按使用环境

- 製造业(汽车、电气/电子、食品/饮料、化学/製药和其他商业环境)

- 非製造业(物流中心/配送中心/仓库)

- 按地区

- 美国

- 欧洲

- 亚洲

- 中国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Teradyne Inc(Mobile Industrial Robots ApS(MIR))

- Fetch Robotics

- JASCI LLC

- Aethon Inc.

- KION Group AG

- SCOTT TECHNOLOGY LIMITED

- Murata Machinery Ltd

- Toyota Material Handling US

- John Bean Technologies(JBT)Corporation

- 6 River Systems Inc

- inVia Robotics Inc.

- IAM Robotics LLC

- GreyOrange Pte Ltd

- Clearpath Robotics Inc.

- Geek+Inc

- Omron Corporation

- Daifuku Co. Ltd

第 8 章 供应商排名分析

第九章投资分析

第十章 投资分析 未来展望

The Mobile Robots Market size is estimated at USD 8.91 billion in 2025, and is expected to reach USD 30.03 billion by 2030, at a CAGR of 27.5% during the forecast period (2025-2030).

Key Highlights

- E-commerce Growth Drives Warehouse Automation: The rapid expansion of e-commerce is transforming the mobile robots market. Global retail e-commerce sales are expected to hit USD 6.38 trillion by 2024, up from USD 4.28 trillion in 2020. This significant increase is fueling the need for warehouse automation, with mobile robots such as Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) playing a vital role in streamlining operations. Companies like Amazon and Walmart have made substantial investments, with Amazon allocating USD 1 billion and Walmart committing USD 14 billion towards automation initiatives.

- E-commerce growth: A 43% increase in 2020, largely influenced by the global pandemic and evolving consumer habits.

- Market projections: E-commerce is forecasted to represent 31% of total sales in the US by 2026, up from its current 23%.

- Industry adoption: The consumer electronics sector leads B2C e-commerce globally, generating USD 988.4 billion in 2022.

- Deployment examples: Geodis plans to deploy 1,000 autonomous mobile robots across its global facilities over the next two years.

- Labor Costs and Workforce Challenges: Rising labor costs in developed nations are accelerating the deployment of mobile robots. A global labor shortage, driven by declining birthrates and aging populations, is pushing industries toward automation. In the US, the average salary for Industrial Truck and Tractor Operators ranges between USD 34,488 and USD 50,110 annually. The trend is reflected globally, with labor costs in the euro area increasing by 4.0% year-over-year in Q2 2022.

- Labor cost increase: The euro area saw a 4.0% rise in hourly labor costs, while the EU experienced a 4.4% increase (Q2 2022 vs. Q2 2021).

- Wage statistics: In the US, Industrial Truck and Tractor Operators earn an average wage of USD 39,210 annually.

- Automation benefits: Embracing AMRs can reduce labor costs by 30-100%.

- ROI potential: Investing in AGVs or AMRs often yields quick returns, lowering reliance on unskilled labor.

- Technological Advancements and Market Expansion: The mobile robots market is undergoing rapid technological advancements, expanding its applications across industries. Artificial Intelligence (AI) is playing a crucial role in enabling AMRs to complete complex tasks without extensive programming. The rollout of 5G technology is anticipated to open new opportunities by enhancing the deployment and management of multiple robots.

- AI integration: AI is enabling more intelligent robots capable of recognizing objects and navigating complex environments.

- 5G impact: With 5G connections expected to surpass 1 billion in 2022 and 2 billion by 2025, AMRs will benefit from improved performance.

- Market segmentation: AMRs accounted for 57.8% of the mobile robots market in 2022, with the unit load segment holding 34.8% of the form-factor market.

- Geographical trends: China led the market with a 33.2% share in 2022, while the Asia Pacific region is expected to witness the fastest growth rate at 30.5%.

- Industry Applications and Market Dynamics: Mobile robots are increasingly being used across industries, with manufacturing and logistics at the forefront. In the automotive sector, AMRs are optimizing production and improving safety. Electronics manufacturers are also leveraging mobile robots to enhance supply chain efficiency and minimize errors. The trend is moving towards more sophisticated autonomous systems, with AMRs surpassing traditional AGVs in terms of adoption.

- Manufacturing applications: The automotive industry is using AMRs for flexible material handling and to create safer work environments.

- Electronics sector: AMRs are improving internal logistics, and by 2024, a significant portion of the industry is expected to employ them.

- Market drivers: Rapid growth in e-commerce, rising labor costs, and technological innovation are driving market growth.

- Challenges: High initial costs remain a concern, although the potential for long-term ROI is significant.

Mobile Robots Market Trends

Autonomous Mobile Robot (AMR) to Witness the Market Growth

- Autonomous Mobile Robots (AMRs): The Largest Segment by Product Type: AMRs have become the largest segment in the mobile robots market, capturing a 57.8% market share in 2022. By 2028, AMRs are projected to grow from USD 3.29 billion to USD 13.29 billion, reflecting a robust CAGR of 32.2%.

- Technological advancements: AMRs are gaining popularity due to their flexibility and intelligence in navigating unstructured environments, outperforming traditional AGVs.

- E-commerce acceleration: The rapid growth of e-commerce is driving the adoption of AMRs in warehouses and fulfillment centers, where they are enhancing operational efficiency.

- Industry applications: AMRs are being deployed across a variety of sectors, from automotive manufacturing to healthcare, where they assist in logistics and disinfection tasks.

- Collaborative capabilities: AMRs are increasingly designed to collaborate with human workers, handling repetitive tasks and improving workplace safety and ergonomics.

China to Witness Rapid Growth

- China: The Fastest-Growing Regional Segment: China's mobile robots market is expected to grow rapidly, with a projected CAGR of 30.5% from 2023 to 2028. The country's rapid industrialization and focus on automation are key drivers of this growth.

- Government initiatives: China's "Made in China 2025" initiative is fostering a favorable environment for automation, pushing factories to deploy mobile robots.

- Rising labor costs: Increasing labor expenses in China are accelerating the shift towards automation, especially in industries like electronics and automotive.

- Domestic players: Companies like Geek+ Inc. are leading the market by developing localized AMR solutions and competing with global players.

- E-commerce and logistics demand: China's e-commerce boom, coupled with its vast logistics network, is driving demand for mobile robots, especially in warehouse automation.

Mobile Robots Industry Overview

Global players dominate a fragmented market: The Mobile Robots Market is fragmented, with numerous global and regional players competing for market share. Europe leads in hosting service robot suppliers for professional applications. This fragmentation is encouraging innovation and intense competition among players, particularly in the AMR segment.

Key players: Leading companies like Teradyne Inc. (Mobile Industrial Robots), Fetch Robotics (Zebra Technologies), and Clearpath Robotics are dominating the market through continuous product innovation and strategic partnerships.

Product diversity: These companies offer a broad range of mobile robots designed to meet diverse industry needs, from logistics to manufacturing.

Strategic partnerships: Collaborations with system integrators and technology partners are helping market leaders expand their product offerings and increase market penetration.

Factors for future success: To succeed in the evolving mobile robots market, players must focus on continuous innovation, versatile solutions, and strategic global expansion. Developing AI-powered mobile robots and user-friendly interfaces will also be critical to encourage broader adoption across industries. Expanding into emerging economies, especially through strategic partnerships, will be key to capturing market share in regions with growing automation needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth of E-commerce Leading to Warehouse Automation

- 5.1.2 Increasing Labor Costs in the Developed Nations

- 5.2 Market Restraints

- 5.2.1 High Capital Requirements and Connectivity Issues

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Automated Guided Vehicle (AGV)

- 6.1.2 Autonomous Mobile Robot (AMR)

- 6.2 By Form Factor

- 6.2.1 Forklifts

- 6.2.2 Tow/Tractor/Tug

- 6.2.3 Unit Load

- 6.2.4 Assembly Line

- 6.3 By Navigation Sensor

- 6.3.1 Reflector

- 6.3.2 QR Code

- 6.3.3 Laser/LiDAR

- 6.3.4 Camera, Hybrid (Camera & LiDAR) and Other navigation sensors

- 6.4 By Environment of Operation

- 6.4.1 Manufacturing (Automotive, Electrical & Electronics, Food & Beverage, Chemical & Pharmaceuticals and Other Environments of Operation)

- 6.4.2 Non-Manufacting (Logistics Centers/Distribution Centers/Warehouses)

- 6.5 By Geography

- 6.5.1 United States

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 China

- 6.5.5 Australia and New Zealand

- 6.5.6 Latin America

- 6.5.7 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teradyne Inc (Mobile Industrial Robots ApS (MIR))

- 7.1.2 Fetch Robotics

- 7.1.3 JASCI LLC

- 7.1.4 Aethon Inc.

- 7.1.5 KION Group AG

- 7.1.6 SCOTT TECHNOLOGY LIMITED

- 7.1.7 Murata Machinery Ltd

- 7.1.8 Toyota Material Handling US

- 7.1.9 John Bean Technologies (JBT) Corporation

- 7.1.10 6 River Systems Inc

- 7.1.11 inVia Robotics Inc.

- 7.1.12 IAM Robotics LLC

- 7.1.13 GreyOrange Pte Ltd

- 7.1.14 Clearpath Robotics Inc.

- 7.1.15 Geek+ Inc

- 7.1.16 Omron Corporation

- 7.1.17 Daifuku Co. Ltd