|

市场调查报告书

商品编码

1883724

量子运算市场:产业趋势及2035年全球预测-依药物发现服务类型、治疗领域及主要地区划分Quantum Computing Market: Industry Trends and Global Forecasts,Till 2035 - Distribution by Type of Drug Discovery Service Offered, Therapeutic Area and Key Geographical Regions |

||||||

全球量子运算市场概览

根据Roots Analysis预测,全球量子运算市场在预测期内将以14.5%的复合年增长率成长,从目前的4.22亿美元成长至16.33亿美元。

市场规模与机会分析依下列参数分类:

提供的药物发现服务类型

- 标靶识别/验证

- 先导化合物发现/筛选

- 先导化合物优化

治疗领域

- 心血管疾病

- 中枢神经系统疾病

- 皮肤病

- 内分泌疾病

- 胃肠道疾病

- 免疫系统疾病

- 传染病

- 肌肉骨骼疾病

- 肿瘤疾病

- 呼吸系统疾病

- 其他

主要地区

- 北部美洲

- 欧洲

- 亚太地区

- 中东和北非

- 拉丁美洲

全球量子运算市场 - 成长与趋势

将一种药物推向市场平均需要 10-15 年的时间和 40-100 亿美元的投资,这使得药物研发过程漫长且资源密集。为了因应这些挑战,研究人员正摒弃传统方法,转而采用创新的药物研发策略。量子运算在药物研发领域正成为一项关键技术,用于识别具有所需理化和药物动力学特性的有前景的先导化合物,从而无需进行大量的筛选。量子计算的工作原理与依赖电压驱动原理的传统二进位计算机截然不同。与传统计算中单一位元的 0-1 态不同,量子运算利用量子力学的概念,采用超导电路和离子阱等技术。这使得量子迭加成为可能——量子位元(qubit)可以同时处于 0 和 1 状态。

近年来,量子计算取得了显着进展,透过改进药物与目标患者相互作用的映射,并减少与药物研发相关的时间和成本,对製药和医疗保健行业产生了深远影响。此外,量子运算带来的优势和日益增长的需求,尤其是在生物製药领域用于药物发现和生产,预计将为服务提供者创造丰厚的商机。

全球量子运算市场-关键洞察

本报告深入分析了全球量子运算市场的现状,并指出了该行业潜在的成长机会。主要发现包括:

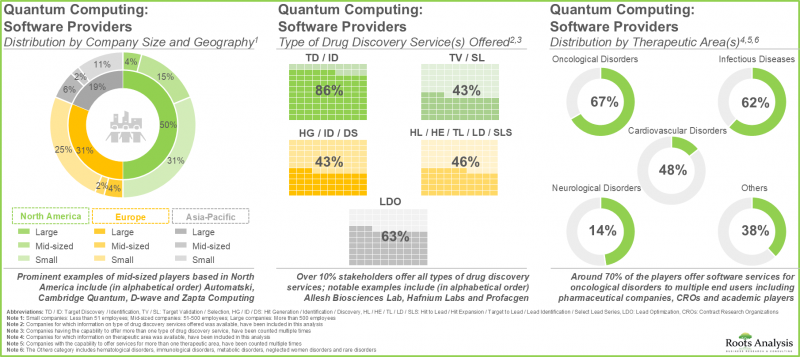

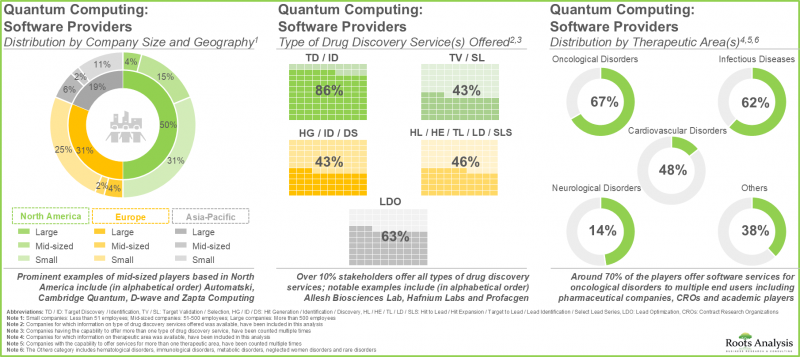

- 目前,全球已有超过 45 家公司致力于在药物发现过程的各个阶段提供量子运算服务。

- 凭藉自身专业知识,86% 的利害关係人提供涵盖整个标靶发现和识别流程的服务,主要专注于肿瘤疾病。

- 为了获得竞争优势,製造商声称正在稳步扩展其现有能力,以加强其量子计算相关服务组合。

- 已向积极进行研发工作的各个组织授予超过 7000 万美元的资助,以评估量子计算在药物发现中的潜力。

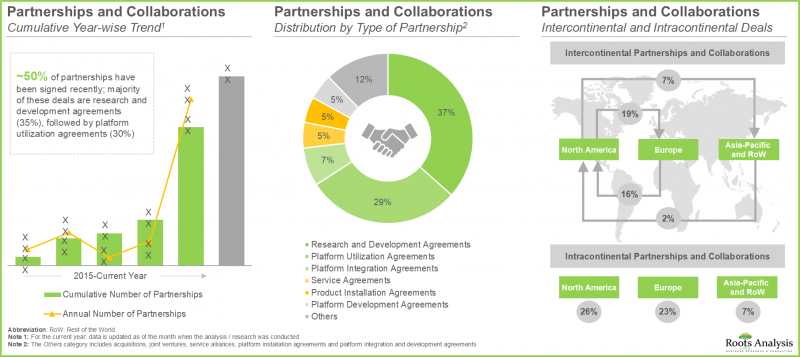

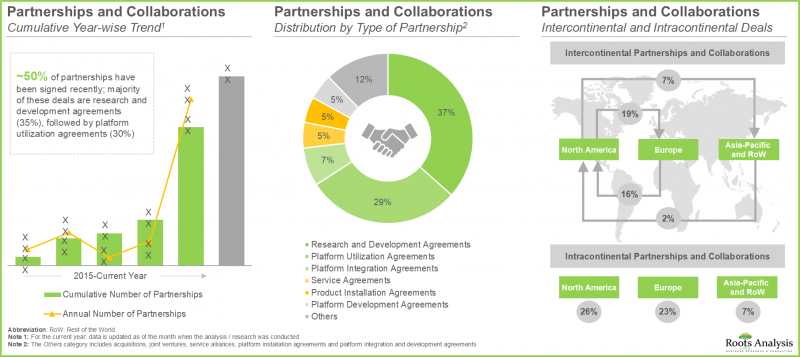

- 近年来,合作活动显着增加,近 50% 的合作关係是在同一地区的公司之间达成的。

- 这些协定中,大部分是研发协议(35%),其次是平台存取协定(30%)。

- 全球有超过30家公司声称提供用于药物研发的量子计算硬体即服务 (HaaS),并开发了各种计算方法所需的专业知识。

- 大多数量子运算硬体供应商总部位于北美,成立于2000年之前。事实上,大约50%的市场占有率由大型公司占。

- 量子运算在生物製药产业的日益普及预计将为软体和硬体供应商创造丰厚的商机。

- 根据先锋、推手和坚持者的分类图,将软体供应商分为不同类别。预期部分先锋公司将在长期内提供市场领先的价值主张。

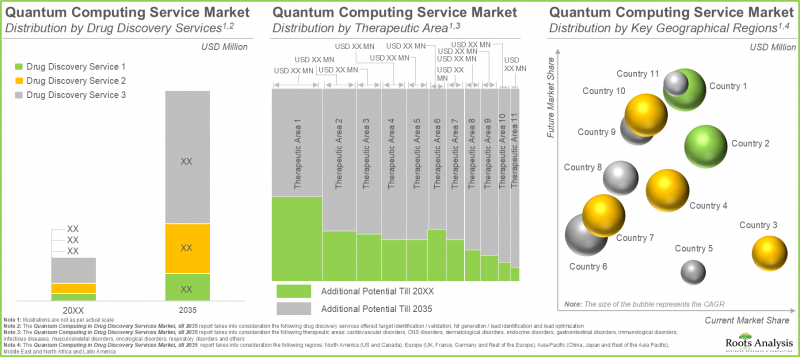

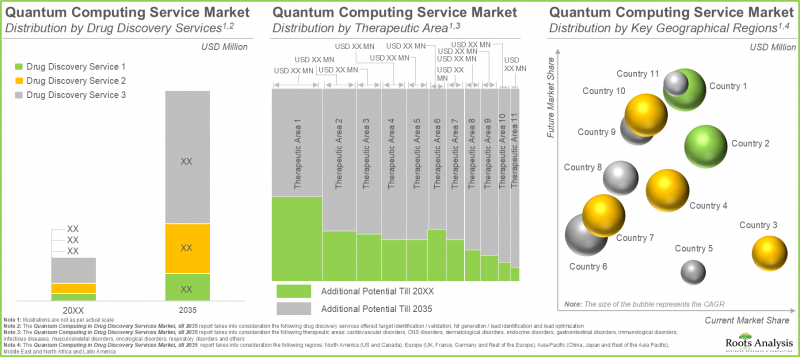

- 预计未来十年,市场将以每年 14.5% 的速度成长。这一机会很可能均匀分布在药物研发服务类型、治疗领域和主要地区。

全球量子运算市场 - 主要区隔市场

先导化合物优化区隔市场占量子运算市场最大占有率

根据所提供的药物发现服务,市场可区隔为标靶识别/验证、先导化合物生成/识别和先导化合物优化。目前,先导化合物优化区隔市场占了大部分市场占有率(约 62%)。此外,该区隔市场的成长速度可能快于其他区隔市场。

量子运算市场中成长最快的治疗领域是中枢神经系统疾病。

依治疗领域划分,市场可分为心血管疾病、中枢神经系统疾病、皮肤病、内分泌疾病、胃肠道疾病、免疫系统疾病、传染病、肌肉骨骼疾病、肿瘤疾病、呼吸系统疾病及其他疾病。目前,肿瘤疾病领域在量子计算市场中占最大占有率。此外,中枢神经系统疾病领域预计将以相对较高的复合年增长率成长。

北美占最大的市占率。

依主要地区划分,市场分为北美、欧洲、亚太、中东和北非以及拉丁美洲。目前,北美(48%)在量子计算市场中处于领先地位,占最大的收入占有率。然而,预计亚太地区的市场将以更高的复合年增长率成长。

全球量子运算市场代表性公司

- 埃森哲

- 亚马逊网路服务

- Atos

- 富士通

- 华为

- IBM

- 微软

- Xanadu

- XtalPi

全球量子计算市场 - 研究范围

- 市场规模和机会分析:本报告对全球量子计算市场进行了详细分析,重点关注关键市场区隔领域,例如[A] 提供的药物发现服务类型,[B] 治疗领域,以及[C] 主要地区。

- 软体供应商市场概览:本报告对量子计算软体公司进行了全面评估,考虑了以下各项参数:[A] 成立年份,[B] 公司规模,[C] 总部所在地,[D] 业务能力,[E] 平台能力,[F] 提供的药物发现服务类型,[G] 支持的分子类型,[E] 平台能力,[F] 提供的药物发现服务类型,[G] 支持的分子类型,[H] 兼容的计算方法,

- 公司竞争分析:对量子运算软体公司进行深入的竞争分析。检视以下因素:[A] 公司实力,[B] 产品组合实力,以及 [C] 产品组合多样性。

- 公司简介:详细介绍量子运算软体/硬体公司。重点关注:[A] 公司概况,[B] 财务资讯(如有),[C] 服务组合,以及 [E] 近期发展和未来展望。

- 软体供应商市场概况:对量子运算硬体公司进行全面评估,考虑以下各项参数:[A] 成立年份,[B] 公司规模,[C] 总部所在地,[D] 提供的服务类型,[E] 云端资料存储,以及 [F] 支援的运算技术。

- 资助分析:基于以下相关参数,对 170 多项专注于药物研发中量子计算的学术资助项目进行深入分析:[A] 资助年份,[B] 资助金额,[C] 资助期限,[D] 研究部门类型,[E] 管理中心,[F] 资助类型,[G] 活动代码,[H] 资助机制和资助机构受资助机构所在地,[L] 主要受资助机构,[M] 机构类型,[N] 授予主要受资助机构的资助金额。

- 合作伙伴关係与合作:对该领域利害关係人之间达成的各种合作关係和伙伴关係进行全面分析。分析以[A]合作年份、[B]合作类型和[C]区域活动为基础。

- 应用案例研究:对量子计算应用进行深入分析,重点介绍其在各个行业的应用,例如[A]化学工业、[B]网路安全、[C]金融建模、[D]太空科学、[E]石油和天然气行业以及[F]天气预报。

- 波特五力分析:深入分析量子运算药物研发市场的五种竞争力量,包括新进业者的威胁、买方的议价能力、供应商的议价能力、替代品的威胁以及现有竞争对手之间的竞争动态。

- 蓝海策略:新创企业进入竞争激烈市场的策略指南:基于蓝海策略对当前和未来市场进行详细分析。本综合指南为该行业的新兴企业提供策略规划和指导,帮助他们开发尚未开发的市场。

目录

第一章:引言

第二章:摘要整理

第三章:导论

第四章:市场格局:软体供应商

- 量子运算软体供应商:市场格局

第五章:竞争分析

- 研究方法与关键参数

- 评分标准

- 公司竞争分析:北美公司(同业组 I)

- 公司竞争分析:欧洲公司(同业组 II)

- 公司竞争分析:亚太及其他地区(同业组 III)

第六章:公司简介:软体供应商

- 埃森哲

- Atos

- 富士通

- 华为

- 微软

- Xanadu

- XtalPi

第七章:市场概况:硬体供应商

- 量子运算硬体供应商:市场概览

第八章:公司简介:硬体供应商

- 亚马逊网路服务

- IBM

- 微软

第九章:学术资助分析

第十章:合作伙伴关係与合作

第十一章:应用个案研究

- 量子计算概述

- 量子计算在各行业的应用

- 量子运算的未来趋势

- 未来展望

第十二章:波特五力分析

第十三章:蓝海策略:新创企业进入竞争激烈市场的策略指引

- 蓝海策略概述

第十四章 市场规模与机会分析

- 预测研究方法与关键假设

- 药物发现服务中的量子运算市场:至2035年

- 药物发现服务中的量子计算市场(至2035年):依药物发现服务类型分析

- 药物发现服务中的量子计算市场(至2035年):依治疗领域分析

- 药物发现服务中的量子计算市场(至2035年):依主要地区分析

第十五章 高阶主管洞察

第十六章 附录1:表格资料

第十七章 附录2:公司与组织清单

Global Quantum Computing Market: Overview

As per Roots Analysis, the global quantum computing market is expected to grow from USD 422 million in the current year to USD 1,633 million, at a CAGR of 14.5% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Drug Discovery Service Offered

- Target Identification / Validation

- Hit Generation / Lead Identification

- Lead Optimization

Therapeutic Area

- Cardiovascular Disorders

- CNS Disorders

- Dermatological Disorders

- Endocrine Disorders

- Gastrointestinal Disorders

- Immunological Disorders

- Infectious Diseases

- Musculoskeletal Disorders

- Oncological Disorders

- Respiratory Disorders

- Others

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Global Quantum Computing Market: Growth and Trends

On average, it requires 10-15 years and investments ranging from USD 4-10 billion to bring a drug to market, which renders the drug discovery process lengthy and resource intensive. To tackle these issues, developers are moving away from conventional methods towards the implementation of innovative discovery approaches. Quantum computing in drug discovery has become a key technology that helps identify promising lead candidates with the necessary physiochemical and pharmacokinetic properties, eliminating the need for extensive screening processes. Quantum computing functions in a fundamentally different manner compared to conventional binary computers, which depend on voltage-driven principles. In contrast to the distinct 0 and 1 states of single bits in conventional computing. Quantum computing leverages the concepts of quantum mechanics, using methods such as superconducting circuits or ion traps. This allows them to attain quantum superposition - a condition where quantum bits (qubits) can be in a concurrent state of both 0 and 1.

In recent years, quantum computing has advanced considerably and influenced the pharmaceutical and healthcare sectors by improving the mapping of interactions between a medication and its intended patient while decreasing the time and expenses related to the development processes. Moreover, due to the advantages linked to quantum computing and its growing demand, particularly in the biopharmaceutical sector for drug discovery and production, this area is anticipated to generate profitable business prospects for service providers.

Global Quantum Computing Market: Key Insights

The report delves into the current state of global quantum computing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 45 players around the globe claim to offer quantum computing services across different steps of drug discovery.

- Leveraging their expertise, 86% stakeholders offer such services across target discovery / identification, primarily focusing on oncological disorders.

- In pursuit of gaining a competitive edge, manufacturers claim to be steadily expanding their existing capabilities in order to enhance their service portfolios related to quantum computing.

- Grants worth over USD 70 million have been awarded to various organizations that have actively undertaken R&D efforts to evaluate the potential of quantum computing in drug discovery.

- A considerable increase in the partnership activity has been witnessed in the past few years; close to 50% of the collaborations were inked by firms based in the same region.

- Majority of these deals are research and development agreements (35%), followed by platform utilization agreements (30%).

- More than 30 players, worldwide, claim to offer hardware-as-a-service for quantum computing in drug discovery, and have developed the required expertise in different types of computational approaches.

- Majority of the quantum computing hardware providers, headquartered in North America, were established before the year 2000; in fact, ~50% of the overall market landscape is catered by large companies.

- The rise in the adoption of quantum computing in the biopharmaceutical industry is anticipated to create profitable business opportunities for both software and hardware providers.

- Based on the pioneer-migrator-settler map, we have classified the software providers into different categories; a selection of pioneers is expected to provide valuable offerings to lead the market in the long term.

- We expect the market to grow at an annualized rate of 14.5% in the coming decade; the opportunity is likely to be well distributed across types of drug discovery services, therapeutic areas and key geographical regions.

Global Quantum Computing Market: Key Segments

Lead Optimization Segment Occupies the Largest Share of the Quantum Computing Market

In terms of drug discovery service offered, the market is segmented into target identification / validation, hit generation / lead identification and lead optimization. At present, majority (~62%) of the market share is captured by lead optimization segment. Additionally, this segment is likely to grow at a faster pace compared to the other segments.

CNS Disorders are the Fastest Growing Therapeutic Area Segment in the Quantum Computing Market

In terms of the therapeutic area, the market is segmented into cardiovascular disorders, CNS disorders, dermatological disorders, endocrine disorders, gastrointestinal disorders, immunological disorders, infectious diseases, musculoskeletal disorders, oncological disorders, respiratory disorders and others. Currently, oncological disorders segment captures the highest proportion of quantum computing market. Further, the CNS disorders segment is expected to grow at a relatively higher CAGR.

North America Accounts for the Largest Share of the Market

In terms of key geographical regions, the market is segmented into North America, Europe, Asia- Pacific, Middle East and North Africa, and Latin America. Currently, North America (48%) dominates the quantum computing market and accounts for the largest revenue share. However, the market in Asia Pacific is expected to grow at a higher CAGR.

Example Players in the Global Quantum Computing Market

- Accenture

- Amazon Web Services

- Atos

- Fujitsu

- Huawei

- IBM

- Microsoft

- Xanadu

- XtalPi

Global Quantum Computing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global quantum computing market, focusing on key market segments, including [A] type of drug discovery service offered, [B] therapeutic area and [C] key geographical regions.

- Software Providers Market Landscape: A comprehensive evaluation of quantum computing software companies, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] business capabilities, [E] platform capabilities, [F] type of drug discovery service(s) offered, [G] type of molecule(s) supported, [H] compatible computational approaches, [I] end user(s) and [J] therapeutic area(s).

- Company Competitiveness Analysis: An insightful competitive analysis of quantum computing software companies, examining factors, such as [A] company strength, [B] portfolio strength and [C] portfolio diversity.

- Company Profiles: In-depth profiles of quantum computing software / hardware companies, focusing on [A] company overview, [B] financial information (if available), [C] service portfolio, and [E] recent developments and an informed future outlook.

- Software Providers Market Landscape: A comprehensive evaluation of quantum computing hardware companies, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of offering(s), [E] data storage on cloud and [F] compatible computational approaches.

- Grant Analysis: An in-depth analysis of over 170 academic grants focused on quantum computing in drug discovery across various relevant parameters, such as [A] year of grants awarded, [B] amount awarded, [C] support period, [D] type of study section, [E] administering institute center, [F] type of grant, [G] activity code, [H] funding mechanism and amount granted, [I] funding institute and support period, [J] prominent program officers, [K] location of recipient organizations, [L] popular recipient organizations, [M] organization type and [N] amount granted to popular recipient.

- Partnerships and Collaborations: A comprehensive analysis of various collaborations and partnerships that have been inked amongst stakeholders in this domain, based on [A] year of partnership, [B] type of partnership and [C] regional activity.

- Use Case Study: A detailed analysis of quantum computing use cases highlighting the applications of quantum computing across various industries, such as [A] chemical industry, [B] cybersecurity, [C] financial modeling, [D] space sciences, [E] oil and gas industry and [F] weather forecasting.

- Porter's Five Forces Analysis: An insightful analysis of the five competitive forces prevalent in quantum computing market supporting drug discovery, including threats for new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute product and rivalry among existing competitors.

- Blue Ocean Strategy: A Strategic Guide for Start-Ups to Enter into Highly Competitive Market: A detailed analysis of the current and future market based on blue ocean strategy, covering a strategic plan / guide for emerging players in this industry to help unlock an uncontested market.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Quantum Computing in Drug Discovery

- 3.3. Drug Discovery and Development Timeline

- 3.4. Historical Evolution of Computational Drug Discovery Approaches

- 3.5. Classification of Quantum Computing Approaches

- 3.6. Applications of Quantum Computing in Drug Discovery Process

- 3.7. Advantages of Quantum Computing in Drug Discovery

- 3.8. Challenges Associated with Quantum Computing in Drug Discovery

- 3.9. Future Perspectives

4. MARKET LANDSCAPE: SOFTWARE PROVIDERS

- 4.1. Quantum Computing Software Providers: Overall Market Landscape

- 4.1.1. Analysis by Year of Establishment

- 4.1.2. Analysis by Company Size

- 4.1.3. Analysis by Location of Headquarters

- 4.1.4. Analysis by Business Capabilities

- 4.1.5. Analysis by Platform Capabilities

- 4.1.6. Analysis by Type of Drug Discovery Service(s) Offered

- 4.1.7. Analysis by Type of Molecule(s) Supported

- 4.1.8. Analysis by Compatible Computational Approaches

- 4.1.9. Analysis by End User(s)

- 4.1.10. Analysis by Therapeutic Area(s)

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Methodology and Key Parameters

- 5.2. Scoring Criteria

- 5.3. Company Competitiveness Analysis: Players based in North America (Peer Group I)

- 5.4. Company Competitiveness Analysis: Players based in Europe (Peer Group II)

- 5.5. Company Competitiveness Analysis: Players based in Asia-Pacific and Rest of the World (Peer Group III)

6. COMPANY PROFILES: SOFTWARE PROVIDERS

- 6.1. Accenture

- 6.1.1. Company Overview

- 6.1.2. Financial Information

- 6.1.3. Service Portfolio

- 6.1.4. Recent Developments and Future Outlook

- 6.2. Atos

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Service Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Fujitsu

- 6.3.1. Company Overview

- 6.3.2. Financial Information

- 6.3.3. Service Portfolio

- 6.3.4. Recent Developments and Future Outlook

- 6.4. Huawei

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Service Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Microsoft

- 6.5.1. Company Overview

- 6.5.2. Financial Information

- 6.5.3. Service Portfolio

- 6.5.4. Recent Developments and Future Outlook

- 6.6. Xanadu

- 6.6.1. Company Overview

- 6.6.2. Service Portfolio

- 6.6.3. Recent Developments and Future Outlook

- 6.7. XtalPi

- 6.7.1. Company Overview

- 6.7.2. Service Portfolio

- 6.7.3. Recent Developments and Future Outlook

7. MARKET LANDSCAPE: HARDWARE PROVIDERS

- 7.1. Quantum Computing Hardware Providers: Overall Market Landscape

- 7.1.1. Analysis by Year of Establishment

- 7.1.2. Analysis by Company Size

- 7.1.3. Analysis by Region of Headquarters

- 7.1.4. Analysis by Location of Headquarters

- 7.1.5. Analysis by Type of Offering(s)

- 7.1.6. Analysis by Data Storage on Cloud

- 7.1.7. Analysis by Compatible Computational Approaches

- 7.1.8. Analysis by Type of Offering(s) and Compatible Computational Approaches

8. COMPANY PROFILES: HARDWARE PROVIDERS

- 8.1. Amazon Web Services

- 8.1.1. Company Overview

- 8.1.2. Financial Information

- 8.1.3. Service Portfolio

- 8.1.4. Recent Developments and Future Outlook

- 8.2. IBM

- 8.2.1. Company Overview

- 8.2.2. Financial Information

- 8.2.3. Service Portfolio

- 8.2.4. Recent Developments and Future Outlook

- 8.3. Microsoft

- 8.3.1. Company Overview

- 8.3.2. Financial Information

- 8.3.3. Service Portfolio

- 8.3.4. Recent Developments and Future Outlook

9. ACADEMIC GRANTS ANALYSIS

- 9.1. Analysis Methodology

- 9.2. Key Parameters

- 9.3. Analysis by Year of Grant

- 9.4. Analysis by Amount Awarded

- 9.5. Analysis by Support Period

- 9.6. Analysis by Study Section

- 9.7. Word Cloud Analysis: Emerging Focus Areas

- 9.8. Analysis by Administering Institute Center

- 9.9. Analysis by Type of Grant

- 9.10. Analysis by Activity Code

- 9.11. Analysis by Purpose of Grant

- 9.12. Analysis by Administering Institute Center and Support Period

- 9.13. Prominent Program Officers: Analysis by Number of Grants

- 9.14. Analysis by Location of Recipient Organizations

- 9.15. Analysis by Type of Organization

- 9.16. Popular Recipient Organizations: Analysis by Number of Grants

- 9.17. Popular Recipient Organizations: Analysis by Amount Awarded

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Partnership Models

- 10.2. Quantum Computing in Drug Discovery, Drug Manufacturing and Other Services: Partnerships and Collaborations

- 10.3. Analysis by Year of Partnership

- 10.4. Analysis by Type of Partnership

- 10.5. Analysis by Year and Type of Partnership

- 10.6. Most Active Players: Analysis by Number of Partnerships

- 10.7. Word Cloud Analysis: Key Focus Areas

- 10.8. Analysis by Type of Continent

- 10.9. Analysis by Company Size and Type of Partnership

- 10.10. Local and Intercontinental Agreements

- 10.11. Intercontinental and Intracontinental Agreements

11. USE CASE STUDY

- 11.1. Overview of Quantum Computing

- 11.2. Applications of Quantum Computing Across Various Industries

- 11.3. Upcoming Trends in Quantum Computing

- 11.4. Future Perspectives

12. PORTER'S FIVE FORCES ANALYSIS

- 12.1. Methodology and Assumptions

- 12.2. Key Parameters

- 12.2.1. Threats of New Entrants

- 12.2.2. Bargaining Power of Buyers

- 12.2.3. Bargaining Power of Suppliers

- 12.2.4. Threats of Substitute Products

- 12.2.5. Rivalry among Existing Competitors

13. BLUE OCEAN STRATEGY: A STRATEGIC GUIDE FOR START-UPS TO ENTER INTO HIGHLY COMPETITIVE MARKET

- 13.1. Overview of Blue Ocean Strategy

- 13.1.1. Red Oceans

- 13.1.2. Blue Oceans

- 13.1.3. Comparison of Red Ocean Strategy and Blue Ocean Strategy

- 13.1.4. Quantum Computing in Drug Discovery Services Market: Blue Ocean Strategy and Shift Tools

- 13.1.4.1. Value Innovation

- 13.1.4.2. Strategy Canvas

- 13.1.4.3. Four Action Framework

- 13.1.4.4. Eliminate-Raise-Reduce-Create (ERRC) Grid

- 13.1.4.5. Six Path Framework

- 13.1.4.6. Pioneer-Migrator-Settler (PMS) Map

- 13.1.4.7. Three Tiers of Non-customers

- 13.1.4.8. Sequence of Blue Ocean Strategy

- 13.1.4.9. Buyer Utility Map

- 13.1.4.10. The Price Corridor of the Mass

- 13.1.4.11. Four Hurdles to Strategy Execution

- 13.1.4.12. Tipping Point Leadership

- 13.1.4.13. Fair Process

14. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 14.1. Forecast Methodology and Key Assumptions

- 14.2. Quantum Computing in Drug Discovery Services Market, Till 2035

- 14.2.1. Quantum Computing in Drug Discovery Services Market, Till 2035: Analysis by Type of Drug Discovery Service Offered

- 14.2.1.1. Quantum Computing in Drug Discovery Services Market for Target Identification / Validation, Till 2035

- 14.2.1.2. Quantum Computing in Drug Discovery Services Market for Hit Generation / Lead Identification, Till 2035

- 14.2.1.3. Quantum Computing in Drug Discovery Services Market for Target Lead Optimization, Till 2035

- 14.2.2. Quantum Computing in Drug Discovery Services Market, Till 2035: Analysis by Therapeutic Area

- 14.2.2.1. Quantum Computing in Drug Discovery Services Market for Cardiovascular Disorders, Till 2035

- 14.2.2.2. Quantum Computing in Drug Discovery Services Market for CNS Disorders, Till 2035

- 14.2.2.3. Quantum Computing in Drug Discovery Services Market for Dermatological Disorders, Till 2035

- 14.2.2.4. Quantum Computing in Drug Discovery Services Market for Endocrine Disorders, Till 2035

- 14.2.2.5. Quantum Computing in Drug Discovery Services Market for Gastrointestinal Disorders, Till 2035

- 14.2.2.6. Quantum Computing in Drug Discovery Services Market for Immunological Disorders, Till 2035

- 14.2.2.7. Quantum Computing in Drug Discovery Services Market for Infectious Diseases, Till 2035

- 14.2.2.8. Quantum Computing in Drug Discovery Services Market for Musculoskeletal Disorders, Till 2035

- 14.2.2.9. Quantum Computing in Drug Discovery Services Market for Oncological Disorders, Till 2035

- 14.2.2.10. Quantum Computing in Drug Discovery Services Market for Respiratory Disorders, Till 2035

- 14.2.2.11. Quantum Computing in Drug Discovery Services Market for Others, Till 2035

- 14.2.3. Quantum Computing in Drug Discovery Services Market, Till 2035: Analysis by Key Geographical Regions

- 14.2.3.1. Quantum Computing in Drug Discovery Services Market in North America, Till 2035

- 14.2.3.1.1. Quantum Computing in Drug Discovery Services Market in the US, Till 2035

- 14.2.3.1.2. Quantum Computing in Drug Discovery Services Market in Canada, Till 2035

- 14.2.3.2. Quantum Computing in Drug Discovery Services Market for Europe, Till 2035

- 14.2.3.2.1. Quantum Computing in Drug Discovery Services Market in the UK, Till 2035

- 14.2.3.2.2. Quantum Computing in Drug Discovery Services Market in France, Till 2035

- 14.2.3.2.3. Quantum Computing in Drug Discovery Services Market in Germany, Till 2035

- 14.2.3.2.4. Quantum Computing in Drug Discovery Services Market in Rest of Europe, Till 2035

- 14.2.3.3. Quantum Computing in Drug Discovery Services Market in Asia-Pacific, Till 2035

- 14.2.3.3.1. Quantum Computing in Drug Discovery Services Market in China, Till 2035

- 14.2.3.3.2. Quantum Computing in Drug Discovery Services Market in Japan, Till 2035

- 14.2.3.3.3. Quantum Computing in Drug Discovery Services Market in Rest of Asia-Pacific, Till 2035

- 14.2.3.4. Quantum Computing in Drug Discovery Services Market in Latin America, Till 2035

- 14.2.3.5. Quantum Computing in Drug Discovery Services Market in Middle East and North Africa, Till 2035

- 14.2.3.1. Quantum Computing in Drug Discovery Services Market in North America, Till 2035

- 14.2.1. Quantum Computing in Drug Discovery Services Market, Till 2035: Analysis by Type of Drug Discovery Service Offered

15. EXECUTIVE INSIGHTS

16. APPENDIX 1: TABULATED DATA

17. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 List of Quantum Computing Software Providers

- Table 6.1 Accenture: Service Portfolio

- Table 6.2 Accenture: Recent Developments and Future Outlook

- Table 6.3 Atos: Service Portfolio

- Table 6.4 Atos: Recent Developments and Future Outlook

- Table 6.5 Fujitsu: Service Portfolio

- Table 6.6 Fujitsu: Recent Developments and Future Outlook

- Table 6.7 Huawei: Service Portfolio

- Table 6.8 Huawei: Recent Developments and Future Outlook

- Table 6.9 Microsoft: Service Portfolio

- Table 6.10 Microsoft: Recent Developments and Future Outlook

- Table 6.11 Xanadu: Service Portfolio

- Table 6.12 Xanadu: Recent Developments and Future Outlook

- Table 6.13 XtalPi: Service Portfolio

- Table 6.14 XtalPi: Recent Developments and Future Outlook

- Table 7.1 List of Quantum Computing Hardware Providers

- Table 8.1 Amazon Web Services: Recent Developments and Future Outlook

- Table 8.2 IBM: Recent Developments and Future Outlook

- Table 8.3 Microsoft: Recent Developments and Future Outlook

- Table 10.1 Quantum Computing in Drug Discovery Services: List of Partnerships and Collaborations

- Table 16.1 Quantum Computing Software Providers: Distribution by Year of Establishment

- Table 16.2 Quantum Computing Software Providers: Distribution by Company Size

- Table 16.3 Quantum Computing Software Providers: Distribution by Location of Headquarters

- Table 16.4 Quantum Computing Software Providers: Distribution by Business Capabilities

- Table 16.5 Quantum Computing Software Providers: Distribution by Platform Capabilities

- Table 16.6 Quantum Computing Software Providers: Distribution by Type of Drug Discovery Service(s) Offered

- Table 16.7 Quantum Computing Software Providers: Distribution by Type of Molecule(s) Supported

- Table 16.8 Quantum Computing Software Providers: Distribution by Type Compatible Computational Approaches

- Table 16.9 Quantum Computing Software Providers: Distribution by End user(s)

- Table 16.10 Quantum Computing Software Providers: Distribution by Therapeutic Area(s)

- Table 16.11 Accenture: Revenues in USD Billion (Since FY 2017)

- Table 16.12 Atos: Revenues in EUR Billion (Since FY 2017)

- Table 16.13 Fujitsu: Revenues in Yen Billion (Since FY 2017)

- Table 16.14 Huawei: Revenues in CNY Billion (Since FY 2017)

- Table 16.15 Microsoft: Revenues in USD Billion (Since FY 2017)

- Table 16.16 Quantum Computing Hardware Providers: Distribution by Year of Establishment

- Table 16.17 Quantum Computing Hardware Providers: Distribution by Company Size

- Table 16.18 Quantum Computing Hardware Providers: Distribution by Region of Headquarters

- Table 16.19 Quantum Computing Hardware Providers: Distribution by Location of Headquarters

- Table 16.20 Quantum Computing Hardware Providers: Distribution by Type of Offering(s)

- Table 16.21 Quantum Computing Hardware Providers: Distribution by Data Storage on Cloud

- Table 16.22 Quantum Computing Hardware Providers: Distribution by Compatible Computational Approaches

- Table 16.23 Quantum Computing Hardware Providers: Distribution by Type of offering(s) and Compatible Computational Approaches

- Table 16.24 Amazon Web Services: Revenues in USD Billion (Since FY 2017)

- Table 16.25 IBM: Revenues in USD Billion (Since FY 2017)

- Table 16.26 Microsoft: Revenues in USD Billion (Since FY 2017)

- Table 16.27 Academic Grants Analysis: Distribution by Year of Grant

- Table 16.28 Academic Grants Analysis: Distribution by Amount Awarded

- Table 16.29 Academic Grants Analysis: Distribution by Support Period

- Table 16.30 Academic Grants Analysis: Distribution by Study Section

- Table 16.31 Academic Grants Analysis: Distribution by Administrating Institute Center

- Table 16.32 Academic Grants Analysis: Distribution by Type of Grant

- Table 16.33 Academic Grants Analysis: Distribution by Activity Code

- Table 16.34 Academic Grants Analysis: Distribution by Purpose of Grant

- Table 16.35 Academic Grants Analysis: Distribution by Administering Institute Center and Support Period

- Table 16.36 Prominent Program Officers: Distribution by Number of Grants

- Table 16.37 Academic Grants Analysis: Distribution by Location of Organizations

- Table 16.38 Academic Grants Analysis: Distribution by Type of Organization

- Table 16.39 Popular Recipient Organizations: Analysis by Number of Grants

- Table 16.40 Popular Recipient Organizations: Analysis by Amount Awarded

- Table 16.41 Partnerships and Collaborations: Distribution by Year

- Table 16.42 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 16.43 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 16.44 Most Active Players: Distribution by Number of Partnerships

- Table 16.45 Partnerships and Collaborations: Distribution by Type of Continent

- Table 16.46 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

- Table 16.47 Partnerships and Collaborations: Local and International Agreements

- Table 16.48 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 16.49 Quantum Computing in Drug Discovery Services Market, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.50 Quantum Computing in Drug Discovery Services Market: Distribution by Type of Drug Discovery Service Offered

- Table 16.51 Quantum Computing in Drug Discovery Services Market for Target Identification / Validation, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.52 Quantum Computing in Drug Discovery Services Market for Hit Generation / Lead Identification, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.53 Quantum Computing in Drug Discovery Services Market for Target Lead Optimization, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.54 Quantum Computing in Drug Discovery Services Market: Distribution by Therapeutic Area

- Table 16.55 Quantum Computing in Drug Discovery Services Market for Cardiovascular Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.56 Quantum Computing in Drug Discovery Services Market for CNS Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.57 Quantum Computing in Drug Discovery Services Market for Dermatological Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.58 Quantum Computing in Drug Discovery Services Market for Endocrine Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.59 Quantum Computing in Drug Discovery Services Market for Gastrointestinal Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.60 Quantum Computing in Drug Discovery Services Market for Immunological Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.61 Quantum Computing in Drug Discovery Services Market for Infectious Diseases, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.62 Quantum Computing in Drug Discovery Services Market for Musculoskeletal Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.63 Quantum Computing in Drug Discovery Services Market for Oncological Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.64 Quantum Computing in Drug Discovery Services Market for Respiratory Disorders, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.65 Quantum Computing in Drug Discovery Services Market for Others, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.66 Quantum Computing in Drug Discovery Services Market: Distribution by Key Geographical Regions

- Table 16.67 Quantum Computing in Drug Discovery Services Market in North America, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.68 Quantum Computing in Drug Discovery Services Market in the US, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.69 Quantum Computing in Drug Discovery Services Market in Canada, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.70 Quantum Computing in Drug Discovery Services Market for Europe, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.71 Quantum Computing in Drug Discovery Services Market in the UK, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.72 Quantum Computing in Drug Discovery Services Market in France, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.73 Quantum Computing in Drug Discovery Services Market in Germany, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.74 Quantum Computing in Drug Discovery Services Market in Rest of Europe, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.75 Quantum Computing in Drug Discovery Services Market in Asia-Pacific, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.76 Quantum Computing in Drug Discovery Services Market in China, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.77 Quantum Computing in Drug Discovery Services Market in Japan, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.78 Quantum Computing in Drug Discovery Services Market in Rest of Asia-Pacific, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.79 Quantum Computing in Drug Discovery Services Market in Latin America, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

- Table 16.80 Quantum Computing in Drug Discovery Services Market in Middle East and North Africa, Till 2035: Scenario I, Scenario II and Scenario III (USD Million)

List of Figures

- Figure 4.1 Quantum Computing Software Providers: Distribution by Year of Establishment

- Figure 4.2 Quantum Computing Software Providers: Distribution by Company Size

- Figure 4.3 Quantum Computing Software Providers: Distribution by Location of Headquarters

- Figure 4.4 Quantum Computing Software Providers: Distribution by Business Capabilities

- Figure 4.5 Quantum Computing Software Providers: Distribution by Platform Capabilities

- Figure 4.6 Quantum Computing Software Providers: Distribution by Type of Drug Discovery Service(s) Offered

- Figure 4.7 Quantum Computing Software Providers: Distribution by Type of Molecule(s) Supported

- Figure 4.8 Quantum Computing Software Providers: Distribution by Compatible Computational Approaches

- Figure 4.9 Quantum Computing Software Providers: Distribution by End user(s)

- Figure 4.10 Quantum Computing Software Providers: Distribution by Therapeutic Area(s)

- Figure 5.1 Company Competitiveness Analysis: Players based in North America (Peer Group I)

- Figure 5.2 Company Competitiveness Analysis: Players based in Europe (Peer Group II)

- Figure 5.3 Company Competitiveness Analysis: Players based in Asia-Pacific and Rest of the World (Peer Group III)

- Figure 6.1 Accenture: Revenues in USD Billion (Since FY 2017)

- Figure 6.2 Atos: Revenues in EUR Billion (Since FY 2017)

- Figure 6.3 Fujitsu: Revenues in Yen Billion (Since FY 2017)

- Figure 6.4 Huawei: Revenues in CNY Billion (Since FY 2017)

- Figure 6.5 Microsoft: Revenues in USD Billion (Since FY 2017)

- Figure 7.1 Quantum Computing Hardware Providers: Distribution by Year of Establishment

- Figure 7.2 Quantum Computing Hardware Providers: Distribution by Company Size

- Figure 7.3 Quantum Computing Hardware Providers: Distribution by Region of Headquarters

- Figure 7.4 Quantum Computing Hardware Providers: Distribution by Location of Headquarters

- Figure 7.5 Quantum Computing Hardware Providers: Distribution by Type of Offering(s)

- Figure 7.6 Quantum Computing Hardware Providers: Distribution by Data Storage on Cloud

- Figure 7.6 Quantum Computing Hardware Providers: Distribution by Compatible Computational Approaches

- Figure 7.7 Quantum Computing Hardware Providers: Distribution by Type of Offering(s) and Compatible Computational Approaches

- Figure 8.1 Amazon Web Services: Revenues in USD Billion (Since FY 2017)

- Figure 8.2 Amazon Web Services: Service Portfolio

- Figure 8.3 IBM: Revenues in USD Billion (Since FY 2017)

- Figure 8.4 IBM: Service Portfolio

- Figure 8.5 Microsoft: Revenues in USD Billion (Since FY 2017)

- Figure 8.6 Microsoft: Service Portfolio

- Figure 9.1 Academic Grants Analysis: Distribution by Year of Grant

- Figure 9.2 Academic Grants Analysis: Distribution by Amount Awarded

- Figure 9.3 Academic Grants Analysis: Distribution by Support Period

- Figure 9.4 Academic Grants Analysis: Distribution by Study Section

- Figure 9.5 Word Cloud Analysis: Emerging Focus Areas

- Figure 9.6 Academic Grants Analysis: Distribution by Administrating Institute Center

- Figure 9.7 Academic Grants Analysis: Distribution by Type of Grant

- Figure 9.8 Academic Grants Analysis: Distribution by Activity Code

- Figure 9.9 Academic Grants Analysis: Distribution by Purpose of Grant

- Figure 9.10 Academic Grants Analysis: Distribution by Funding Institute Center and Support Period

- Figure 9.11 Prominent Program Officers: Distribution by Number of Grants

- Figure 9.12 Academic Grants Analysis: Distribution by Location of Recipient Organizations

- Figure 9.13 Academic Grants Analysis: Distribution by Type of Organization

- Figure 9.14 Popular Recipient Organizations: Analysis by Number of Grants

- Figure 9.15 Popular Recipient Organizations: Analysis by Amount Awarded

- Figure 10.1 Partnerships and Collaborations: Cumulative Year-wise Trend

- Figure 10.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 10.4 Most Active Players: Distribution by Number of Partnerships

- Figure 10.5 Word Cloud Analysis: Emerging Focus Areas

- Figure 10.6 Partnerships and Collaborations: Distribution by Type of Continent

- Figure 10.7 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

- Figure 10.8 Partnerships and Collaborations: Local and International Agreements

- Figure 10.9 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 10.10 Partnerships and Collaborations: Key Value Drivers

- Figure 12.1 Porter's Five Forces: Key Parameters

- Figure 12.2 Porter's Five Forces: Harvey Ball Analysis

- Figure 13.1 Blue Ocean Strategy: Strategy Canvas

- Figure 13.2 Blue Ocean Strategy: Pioneer-Migrator-Settler (PMS) Map

- Figure 14.1 Quantum Computing in Drug Discovery Services Market, Till 2035 (USD Million)

- Figure 14.2 Quantum Computing in Drug Discovery Services Market: Distribution by Type of Drug Discovery Service Offered

- Figure 14.3 Quantum Computing in Drug Discovery Services Market for Target Identification / Validation, Till 2035 (USD Million)

- Figure 14.4 Quantum Computing in Drug Discovery Services Market for Hit Generation / Lead Identification, Till 2035 (USD Million)

- Figure 14.5 Quantum Computing in Drug Discovery Services Market for Target Lead Optimization, Till 2035 (USD Million)

- Figure 14.6 Quantum Computing in Drug Discovery Services Market: Distribution by Therapeutic Area

- Figure 14.7 Quantum Computing in Drug Discovery Services Market for Cardiovascular Disorders, Till 2035 (USD Million)

- Figure 14.8 Quantum Computing in Drug Discovery Services Market for CNS Disorders, Till 2035 (USD Million)

- Figure 14.9 Quantum Computing in Drug Discovery Services Market for Dermatological Disorders, Till 2035 (USD Million)

- Figure 14.10 Quantum Computing in Drug Discovery Services Market for Endocrine Disorders, Till 2035 (USD Million)

- Figure 14.11 Quantum Computing in Drug Discovery Services Market for Gastrointestinal Disorders, Till 2035 (USD Million)

- Figure 14.12 Quantum Computing in Drug Discovery Services Market for Immunological Disorders, Till 2035 (USD Million)

- Figure 14.13 Quantum Computing in Drug Discovery Services Market for Infectious Diseases, Till 2035 (USD Million)

- Figure 14.14 Quantum Computing in Drug Discovery Services Market for Musculoskeletal Disorders, Till 2035 (USD Million)

- Figure 14.15 Quantum Computing in Drug Discovery Services Market for Oncological Disorders, Till 2035 (USD Million)

- Figure 14.16 Quantum Computing in Drug Discovery Services Market for Respiratory Disorders, Till 2035 (USD Million)

- Figure 14.17 Quantum Computing in Drug Discovery Services Market for Others, Till 2035 (USD Million)

- Figure 14.18 Quantum Computing in Drug Discovery Services Market: Distribution by Key Geographical Regions

- Figure 14.19 Quantum Computing in Drug Discovery Services Market in North America, Till 2035 (USD Million)

- Figure 14.20 Quantum Computing in Drug Discovery Services Market in the US, Till 2035 (USD Million)

- Figure 14.21 Quantum Computing in Drug Discovery Services Market in Canada, Till 2035 (USD Million)

- Figure 14.22 Quantum Computing in Drug Discovery Services Market for Europe, Till 2035 (USD Million)

- Figure 14.23 Quantum Computing in Drug Discovery Services Market in the UK, Till 2035 (USD Million)

- Figure 14.24 Quantum Computing in Drug Discovery Services Market in France, Till 2035 (USD Million)

- Figure 14.25 Quantum Computing in Drug Discovery Services Market in Germany, Till 2035 (USD Million)

- Figure 14.26 Quantum Computing in Drug Discovery Services Market in Rest of Europe, Till 2035 (USD Million)

- Figure 14.27 Quantum Computing in Drug Discovery Services Market in Asia-Pacific, Till 2035 (USD Million)

- Figure 14.28 Quantum Computing in Drug Discovery Services Market in China, Till 2035 (USD Million)

- Figure 14.29 Quantum Computing in Drug Discovery Services Market in Japan, Till 2035 (USD Million)

- Figure 14.30 Quantum Computing in Drug Discovery Services Market in Rest of Asia-Pacific, Till 2035 (USD Million)

- Figure 14.31 Quantum Computing in Drug Discovery Services Market in Latin America, Till 2035 (USD Million)

- Figure 14.32 Quantum Computing in Drug Discovery Services Market in Middle East and North Africa, Till 2035 (USD Million)