|

市场调查报告书

商品编码

1891246

疫苗市场:产业趋势及全球预测(至 2035 年)-依疫苗原料药类型、目标病患群体、疫苗类型、给药途径及主要地区划分Vaccines Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Vaccine API, Targeted Patient Population, Type of Vaccines, Route of Administration and Key Geographical Region |

||||||

疫苗市场概览

预计到 2030 年,疫苗市场规模将从目前的 480 亿美元增长至 940 亿美元,预测期内(至 2030 年)复合年增长率 (CAGR) 为 11.9%。

疫苗市场

市场规模与机会分析依下列参数细分:

疫苗原料药类型

- 结合疫苗

- 灭活疫苗和次单位疫苗

- 减毒活疫苗

- 重组疫苗

- 类毒素疫苗

- 其他

目标族群

- 儿童

- 成人

疫苗类型

- 肺炎链球菌结合疫苗

- 人类乳突病毒疫苗

- 流感疫苗

- 轮状病毒疫苗

- 水痘疫苗

- 百白破-肝炎疫苗B-Hib联合疫苗

- 其他

给药途径

- 肌肉注射

- 皮下注射

- 口服

- 静脉注射

- 其他

主要地区

- 北美

- 欧洲

- 世界其他地区

疫苗市场 - 成长与趋势

随着传染病威胁的日益加剧,全球对疫苗的需求也不断增长。疫苗是一种生物製品,由减毒或灭活的微生物及其表面蛋白质或毒素製成。这些疫苗能够提供针对特定疾病的主动免疫,使免疫系统在未来再次遇到相同病原体时产生强烈的免疫反应。如今,接种疫苗已成为降低传染病风险和全球死亡率的关键手段。全球传染病疫情凸显了改善疫苗以降低疾病风险的必要性。世界卫生组织(世卫组织)近期发布了一份关于疾病爆发的报告,指出禽流感A和猴痘的感染人数不断增加。

此外,欧洲疾病预防控制中心(ECDC)报告称,全球约有450万例登革热确诊病例,造成约4000人死亡。世卫组织也报告称,全球每年约有64种新的传染病影响着人们。每年约有200万人因轮状病毒感染而住院。面对这些情况,许多产业领袖、政府机构和公共卫生组织已启动各种免疫接种计划,并致力于研发先进疫苗。近期,Biovac和Sanfoy宣布合作在非洲生产灭活小儿麻痹疫苗。该合作旨在提高小儿麻痹疫苗的产量,以满足40多个非洲国家日益增长的需求。

此外,法国总统马克宏与多位非洲领导人共同决定启动一项11亿美元的计划,旨在加速非洲国家的疫苗生产。目前,各利益相关者正在启动多个研究项目,以促进医学创新并降低传染病传播的风险。在疫苗需求持续成长和合作不断扩大的推动下,预计疫苗市场将在预测期内稳步扩张。

疫苗市场-关键洞察

本报告深入分析了疫苗市场的现状,并指出了该行业的潜在成长机会。主要发现包括:

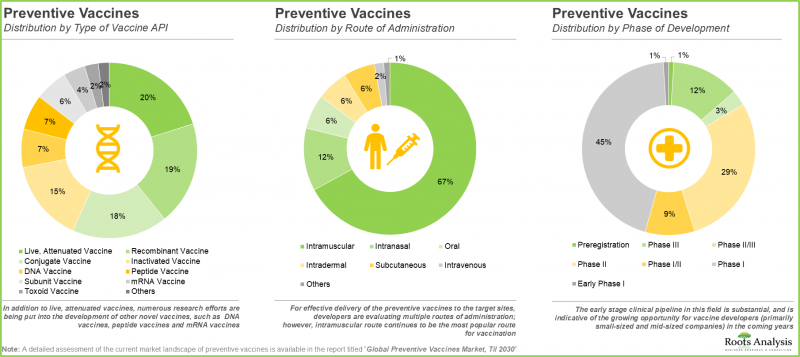

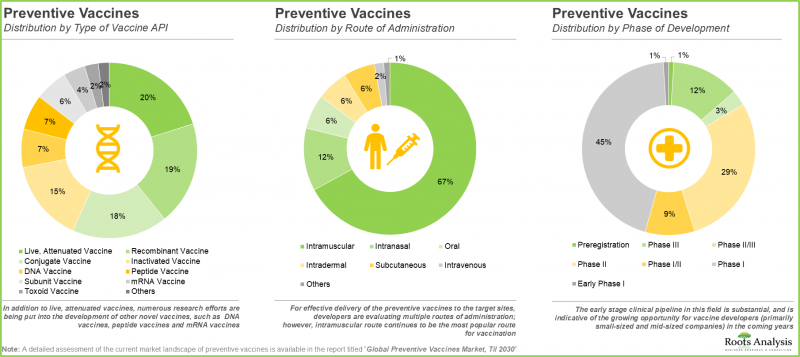

- 目前,由国内外参与者开发的200多种预防性疫苗正在进行临床开发评估。

- 目前,多种疫苗活性成分 (API) 正被研究用于不同的给药途径,其中大多数仍处于早期研发阶段。

- 为了建立竞争优势,疫苗研发人员正投入大量精力,以确保其候选疫苗的临床和商业可行性。

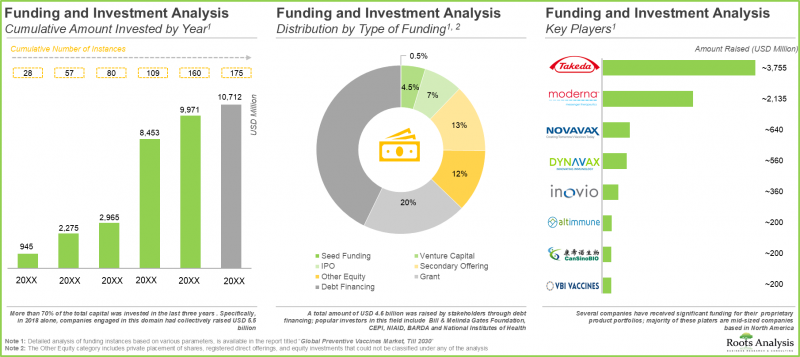

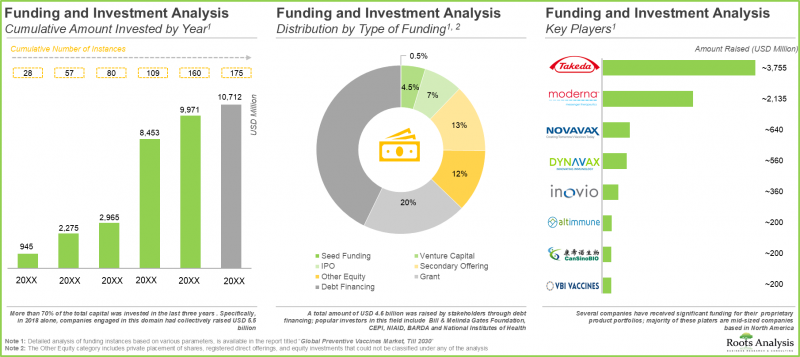

- 鑑于该领域的潜力,自 2015 年以来,私人和公共投资者已向 175 个疫苗研发项目投资超过 100 亿美元。

- 近年来,已註册超过 1400 项评估各类预防性疫苗的临床试验,显示该领域发展迅速。

- 全球约有 70 家公司声称除了生产服务外,还提供合约开发、灌装和包装以及法规支援。

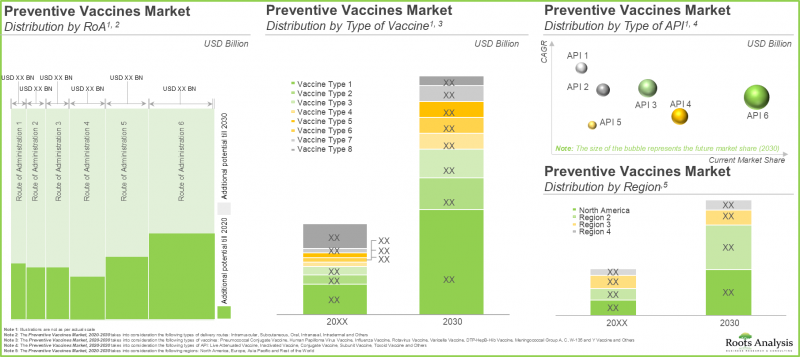

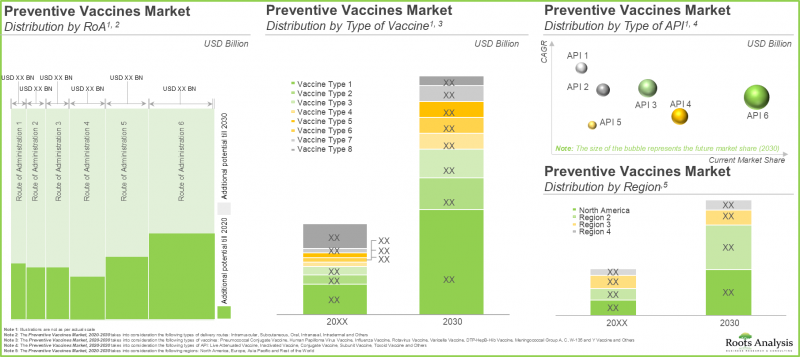

- 预计到2030年,疫苗市场将以11.9%的复合年增长率成长,潜在机会涵盖各种给药途径、疫苗类型和主要地区。

疫苗市场 - 主要细分市场

预计减毒活疫苗细分市场将占大部分市场占有率

依技术类型划分,全球疫苗市场可细分为结合疫苗、灭活疫苗和次单位疫苗、减毒活疫苗、重组疫苗、类毒素疫苗和其他疫苗。受对抗各种传染病的强效疫苗需求不断增长的推动,减毒活疫苗占了最大的市场占有率,预计今年将占疫苗市场整体占有率的28%。由于新型疫苗(例如DNA疫苗)的研究不断深入,其他类型疫苗在预测期内的复合年增长率预计将达到16.8%。

儿科疫苗市场占最大占有率

根据目标患者的人口统计数据,全球疫苗市场分为儿科疫苗和成人疫苗。根据我们的市场调查,儿科疫苗市场今年将占疫苗市场整体占有率的最大部分(56%)。儿科疫苗市场的成长主要归功于对婴幼儿疫苗接种的日益重视以及政府加强推广儿童疫苗接种。长期来看,受地方性流行病和全球性流行病病例增加的推动,预计成人疫苗市场在预测期内将以12.1%的复合年增长率高速成长。

目前,肌肉注射途径占主导地位。

依给药途径,疫苗市场可分为肌肉注射、皮下注射、口服、静脉注射及其他途径。据我们预测,今年肌肉注射途径将占疫苗市场的大部分占有率(52%)。这一增长主要得益于人们对肠外疫苗的偏好日益增长,而肠外疫苗可以绕过胃肠道。肌肉注射具有给药方便、副作用少等优点。长期来看,静脉注射疫苗市场预计在预测期内将以14.6%的复合年增长率(CAGR)成长。

预计麻疹、腮腺炎、德国麻疹(MMR)疫苗在预测期内将以12.3%的复合年增长率(CAGR)增长。

依疫苗类型划分,市场可分为肺炎链球菌结合疫苗、人类乳突病毒疫苗、轮状病毒疫苗、流感疫苗、MMR疫苗、破伤风-白喉加强疫苗、水痘疫苗、DTaP-Hib-IPV疫苗、DTaP-HepB-Hib-IPV疫苗及其他疫苗。受传染病发生率上升的推动,预计其他疫苗类别今年将占最大的疫苗市场占有率(32.4%)。此外,肺炎链球菌结合疫苗目前占第二大市场占有率(25.8%)。辉瑞的沛儿(Prevnar)系列疫苗和默克公司在肺炎链球菌疫苗市场占领先地位。默克近期获得了美国FDA对其21价肺炎球菌疫苗CAPVAXIVE的批准。长期来看,麻疹、腮腺炎、德国麻疹(MMR)疫苗预计在预测期内将以12.3%的复合年增长率(CAGR)高速成长。 北美地区今年将占全球疫苗市场最大的收入占有率。 依主要地区划分,全球市场分为北美、欧洲、亚太地区和其他地区。根据我们的预测,北美地区今年将占最大的市场占有率(44%)。该地区疫苗市场成长的主要驱动因素包括:对疫苗接种的日益重视、医疗保健行业的快速发展以及美国疫苗监测力度的加强。然而,亚太地区的疫苗需求预计也将成长,在预测期内将以14.7%的复合年增长率高速成长。 2023年2月,印度政府与全球疫苗免疫联盟(Gavi)签署了一项为期三年的新合作协议,为印度数百万名儿童提供合适的疫苗。根据协议,Gavi将出资2.5亿美元,用于识别和接种未接种疫苗的儿童,加强卫生系统建设,并支持将人类乳头瘤病毒疫苗(HPV)和伤寒结合疫苗(TCV)纳入印度的国家免疫规划。

主要公司市占率

该行业的主要公司包括Bio Farma、Emergent BioSolutions、GC Pharma、葛兰素史克、强生、默克、诺瓦瓦克斯、莫德纳、辉瑞、赛诺菲巴斯德和Valneva。葛兰素史克在本财年占了疫苗市场21%的占有率。该公司之所以能占如此高的市场占有率,很可能是因为其疫苗产品组合丰富,并且在疫苗领域加速了研发进程。

疫苗市场代表性公司

- Bio Farma

- Emergent BioSolutions

- GC Pharma

- 葛兰素史克

- 强生

- 默克

- 诺瓦瓦克斯

- 摩德纳

- 辉瑞

- 赛诺菲巴斯德

- 瓦尔内瓦

疫苗市场概览

- 市场规模及机会分析:本报告对疫苗市场进行了详细分析,重点关注以下关键市场细分:[A] 疫苗活性成分类型,[B] 目标人群,[C] 疫苗类型,[D] 给药途径,以及 [E] 主要地区。

- 市场概况:基于多项参数,对目前处于不同研发阶段的200多种预防性疫苗的现状进行详细评估,这些参数包括:[A] 研发公司类型,[B] 主要候选疫苗的研发阶段,[C] 给药途径,[D] 疫苗活性成分类型,[E] 剂型/剂量,[F] 目标疾病,[D] 目标群体。

- 公司竞争分析:对总部位于北美、欧洲和亚太地区的预防性疫苗研发公司进行全面的竞争分析,考察[A] 供应能力,[B] 研发管线实力等因素。

- 公司简介:详细介绍总部位于北美、欧洲和亚太地区的领先预防性疫苗研发和生产商,重点关注[A] 成立年份,[B] 总部所在地,[C] 产品组合,[D] 近期发展,以及 [E] 未来展望。

- 临床试验分析:针对已完成、正在进行和计划中的预防性疫苗临床试验,包括:[A] 研究入组年份,[B] 研发阶段,[C] 受试者招募状态,[D] 研究设计,[E] 研究目标领域,[F] 预防性疫苗类型,[G] 目标疾病适应症,[E] 研究目标领域,[F] 预防性疫苗类型,[G] 目标疾病适应症,[E] 合作,I/? [K] 地理分布。

- 复杂疾病疫苗研发进展:概述针对复杂疾病(例如 [A] COVID-19,[B] 伊波拉病毒疾病,[C] HIV/AIDS,[D] 疟疾,以及 [E] 寨卡病毒感染)的正在进行的疫苗研发进展。内容包括疾病资讯、全球负担、目前治疗状况以及预防性疫苗研究进展。

目录

第一章:前言

第二章:摘要整理

第三章:导论

- 章节概述

- 预防性疫苗

第四章:市场概况

- 章节概述

- 预防性疫苗:市场概况

第五章:竞争分析

- 章节概述

- 研究方法

- 假设和关键参数

- 竞争分析:预防性疫苗研发企业

第六章:公司公司简介

- 章节概述

- Bio Farma

- Emergent BioSolutions

- GC Pharma

- 葛兰素史克

- 强生

- 默克

- 诺瓦瓦克斯

- 辉瑞

- 赛诺菲巴斯德

- 瓦尔内瓦

第七章:临床试验分析

- 章节概述

- 研究范围与方法

- 预防性疫苗:临床试验分析

第八章:针对复杂疾病的持续疫苗研发计画

- 章节概述

- 冠状病毒疾病(COVID-19)

- 伊波拉病毒病 (EVD)

- 爱滋病毒/爱滋病

- 疟疾

- 寨卡病毒病

第九章 资金与投资分析

- 章节概述

- 资金类型

- 预防性疫苗:资金与投资分析

第十章:市场规模与机会分析

- 章节概述

- 预测研究方法与关键假设

- 2030 年预防性疫苗市场总量

第十一章:案例研究:疫苗合约生产

- 章节概述

- 疫苗合约生产

- 疫苗合约生产:市场景观

第十二章:结论

第十三章:高阶主管洞察

第十四章:附录一:表格资料

第十五章:附录二:公司与组织清单

Vaccines Market: Overview

As per Roots Analysis, the vaccines market is estimated to grow from USD 48 billion in the current year to USD 94 billion by 2030, at a CAGR of 11.9% during the forecast period, till 2030.

Vaccines Market

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Vaccine API

- Conjugate Vaccines

- Inactivated and Subunit Vaccines

- Live Attenuated Vaccines

- Recombinant Vaccines

- Toxoid Vaccines

- Others

Targeted Patient Population

- Pediatric

- Adult

Type of Vaccines

- Pneumococcal Conjugate Vaccine

- Human Papillomavirus Vaccine

- Influenza Vaccine

- Rotavirus Vaccine

- Varicella Vaccine

- DTP-HepB-Hib Vaccine

- Others

Route of Administration

- Intramuscular

- Subcutaneous

- Oral Administration

- Intravenous

- Others

Key Geographical Region

- North America

- Europe

- Rest of the World

Vaccines Market: Growth and Trends

With the increasing threat of infectious diseases, there has been a rise in the need for vaccines worldwide. A vaccine is a type of biological formulation created using weakened or inactive microbes, along with their surface proteins and toxins. These vaccines offer active acquired immunity against specific diseases and allow the immune system to produce a robust response if a person encounters the same pathogen in the future. Vaccination is now a critical means of lowering the risk of infectious diseases and decreasing global mortality rates. The global emergence of infectious diseases has highlighted the need for improved vaccines to mitigate disease risks. Recently, the World Health Organization published a report on disease outbreaks, revealing the rising number of people affected by Avian influenza A and Mpox.

Moreover, the European Centre for Disease Prevention and Control reported that approximately 4.5 million dengue cases had been documented worldwide, with about 4,000 fatalities confirmed. In addition, the World Health Organization announced approximately 64 new infectious diseases impacting individuals worldwide. Further, approximately 2 million individuals affected by rotavirus are admitted to the hospital annually. In this context, numerous industry leaders, governmental bodies, and public health organizations have launched diverse immunization initiatives and concentrated on creating advanced vaccines. In was also recently reported that Biovac and Sanfoi established a collaboration for the manufacturing of inactivated polio vaccines in Africa. The aim of the collaboration is to increase the production of polio vaccines to satisfy the rising need for these vaccines in more than 40 African nations.

Additionally, French President Emmanuel Macron opted to collaborate with several African leaders in organizing a USD 1.1 billion initiative aimed at speeding up vaccine production in African nations. At present, various research projects have been launched by stakeholders to promote innovation in the healthcare sector and reduce the risk of transmitting infectious diseases. Due to the continuous need for vaccines and rising collaborations, the vaccine market is expected to expand at a consistent pace during the forecast period.

Vaccines Market: Key Insights

The report delves into the current state of the vaccines market and identifies potential growth opportunities within industry. Some key findings from the report include:

- More than 200 preventive vaccines, developed by both industry and non-industry players, are being evaluated in clinical stages of development.

- A variety of vaccine APIs, designed for administration via multiple routes of delivery, are presently being investigated; most such candidates are in the early stages of development.

- In order to achieve a competitive edge, vaccine developers are putting in significant efforts to ensure that their candidates are clinically and commercially competent.

- Foreseeing a lucrative future in this domain, several private and public investors have invested over USD 10 billion in vaccine development initiatives, across 175 instances, in the time period since 2015.

- Over the last few years, 1,400+ clinical trials evaluating various types of preventive vaccines have been registered, indicating the rapid pace of development in this field.

- Around 70 companies, situated in different regions across the globe, claim to provide contract development, fill / finish and regulatory support, in addition to manufacturing services.

- The market is anticipated to grow at a CAGR of 11.9%, till 2030, and the projected opportunity is likely to be distributed across various routes of administration, vaccine types and key geographical regions.

Vaccines Market: Key Segments

Live Attenuated Vaccines Segment is Likely to Capture the Majority of the Market Share

In terms of the type of technology, the global market for vaccines is segmented into conjugate vaccines, inactivated and subunit vaccines, live attenuated vaccines, recombinant vaccines, toxoid vaccines, and others. Fueled by the rising need for potent vaccines to combat various infectious diseases, live attenuated vaccines are projected to occupy the largest segment, securing 28% of the total vaccines market share in the current year. Other types of vaccines will grow at a higher CAGR of 16.8% during the forecast period owing to the growing research on novel vaccines such as DNA vaccines.

Pediatric Segment Holds the Highest Vaccines Market Share

In terms of target patient population, the global market has been distributed into pediatrics and adults. According to our market study, the pediatric segment accounts for the largest share (56%) of the vaccines market in the current year. The expansion of the pediatric market segment is due to the rising emphasis on immunizing infants against illnesses and the increasing government efforts to promote vaccination among children. In the long run, the adult segment will grow at a higher CAGR of 12.1% during the forecast period, driven by the increasing cases of endemic and pandemics.

The Current Market Share is Captured by Intramuscular Segment

In terms of route of administration, the vaccines market is segmented into intramuscular, subcutaneous, oral, intravenous and others. According to our projection, the intramuscular segment capture majority (52%) of the overall vaccine market in the current year. The increase can be attributed to the rising preference for parenteral vaccines, as they can avoid the gastrointestinal tract. The intramuscular route facilitates easy administration and produces fewer side effects. In the long term, the intravenous segment is expected to grow at a higher CAGR of 14.6% throughout the forecast period.

MMR Vaccines will Grow at a Higher CAGR of 12.3% during the Forecast Period

In terms of the type of vaccines, the market is segmented into Pneumococcal Conjugate Vaccine, Human Papillomavirus Vaccine, Rotavirus Vaccine, Influenza Vaccine, MMR Vaccine, Tetanus and Diphtheria Booster Vaccine, Varicella Vaccine, DTaP-Hib-IPV Vaccine, DTaP-HepB-Hib-IPV Vaccine and other. Driven by the growing incidences of infectious diseases, the others segment accounts to hold the largest (32.4%) vaccines market share in the current year. Additionally, the pneumococcal conjugate vaccine accounts to hold the second highest share 25.8% of the market currently. Pfizer with its Prevnar series and Merck are the market leaders in pneumococcal vaccine market. Merck received US FDA approval for its 21-valent pneumococcal vaccine, CAPVAXIVE recently. In the long run, MMR vaccines will grow at a higher CAGR of 12.3% during the forecast period.

North America Accounts for the Highest Revenues in the Global Vaccines Market in the Current Year

In terms of key geographies, the global market has been distributed across North America, Europe, Asia-Pacific and Rest of the World. According to our projections, North America accounts for the largest share (44%) of the market in the current year. The primary factors driving the growth of the vaccine market in this area are the heightened focus on vaccination implementation, the fast-expanding healthcare industry, and a rise in vaccine research in the US. However, the demand for vaccines in Asia-Pacific is estimated to witness growth and is likely to grow at a substantial CAGR of 14.7% during the forecast period. In February 2023, the Government of India forged a new three-year partnership with Gavi (Leading Vaccine Alliance) with the aim of immunizing millions of children in India with appropriate vaccines. Under this agreement, Gavi has allocated USD 250 million for the identification and vaccination of children who haven't received any vaccine strengthening healthcare systems and supporting the introduction of HPV (human papillomavirus vaccine) along with TCV (typhoid conjugate vaccine) into India's national routine immunization schedule.

Market Share by Key Players

The key players active in this industry are Bio Farma, Emergent BioSolutions, GC Pharma, GlaxoSmithKline, Janssen, Merck, Novavax, Moderna, Pfizer, Sanofi Pasteur and Valneva. Currently, GlaxoSmithKline accounts to hold 21% of the overall vaccines market share in the current year. The highest share can be attributed to its extensive range of vaccines and GlaxoSmithKline's acceleration of research and development efforts in the vaccine sector.

Example Players in Vaccines Market

- Bio Farma

- Emergent BioSolutions

- GC Pharma

- GlaxoSmithKline

- Janssen

- Merck

- Novavax

- Moderna

- Pfizer

- Sanofi Pasteur

- Valneva

Vaccines Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the vaccines market, focusing on key market segments, including [A] type of vaccine API, [B] targeted patient population, [C] type of vaccines, [D] route of administration, and [E] key geographical regions.

- Market Landscape: A detailed assessment of the current market landscape of over 200 preventive vaccines that are currently being evaluated in different stages of development, based on a number of parameters, such as [A] type of developer, [B] phase of development of lead candidates, [C] route of administration, [D] type of vaccine API, [E] dosage form, dosage, [F] target disease indication and [G] target patient population.

- Company Competitiveness Analysis: A comprehensive competitive analysis of of preventive vaccine developers based in North America, Europe and Asia-Pacific, examining factors, such as [A] supplier strength and [B] pipeline strength.

- Company Profiles: In-depth profiles of the key preventive vaccine developers based in North America, Europe and Asia-Pacific that are engaged in manufacturing focusing on [A] year of establishment, [B] location of headquarters, [C] product portfolio, [D] recent developments and [E] an informed future outlook.

- Clinical Trial Analysis: A detailed analysis of various completed, ongoing and planned clinical studies of preventive vaccines based on various relevant parameters, including [A] trial registration year, [B] phase of development, [C] trial recruitment status, [D] study design, [E] trial focus area, [F] type of preventive vaccine, [G] target disease indication(s), [H] type of sponsor / collaborator, [I] leading industry sponsors / collaborators, [J] enrolled patients population and [K] regional distribution.

- Ongoing Vaccine Development Initiatives for Complex Conditions: An overview of the ongoing vaccine development initiatives for complex conditions, such as [A] COVID-19, [B] Ebola virus disease, [C] HIV / AIDS, [D] malaria and [E] zika virus infection, including information on disease, its global burden, current treatment landscape and preventive vaccine research landscape.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Preventive Vaccines

- 3.2.1. Classification of Vaccines

- 3.2.1.1. Live, Attenuated Vaccines

- 3.2.1.2. Inactivated Vaccines

- 3.2.1.3. Subunit Vaccines

- 3.2.1.4. Toxoid Vaccines

- 3.2.1.5. DNA Vaccines

- 3.2.2. Key Components of a Vaccine Formulation

- 3.2.3. Production of Vaccines using Different Expression Systems

- 3.2.3.1. Embryonated Chicken Eggs and Primary Chicken Embryonic Fibroblasts (CEFs)

- 3.2.3.2. Mammalian Expression Systems

- 3.2.3.3. Avian Expression Systems

- 3.2.3.4. Plant Expression Systems

- 3.2.3.5. Bacterial Expression Systems

- 3.2.3.6. Yeast Expression Systems

- 3.2.3.7. Insect Expression System

- 3.2.4. Routes of Vaccine Administration

- 3.2.4.1. Intramuscular Route

- 3.2.4.2. Subcutaneous Route

- 3.2.4.3. Oral Route

- 3.2.4.4. Intranasal Route

- 3.2.4.5. Intradermal Route

- 3.2.4.6. Inhalation

- 3.2.5. Clinical Development and Approval of Vaccines

- 3.2.6. Future Perspectives

- 3.2.1. Classification of Vaccines

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Preventive Vaccines: Overall Market Landscape

- 4.2.1. Marketed Vaccines Landscape

- 4.2.2. Clinical-Stage Vaccines Landscape

- 4.2.2.1. Analysis by Type of Developer

- 4.2.2.2. Analysis by Phase of Development

- 4.2.2.3. Analysis by Route of Administration

- 4.2.2.4. Analysis by Type of Vaccine API

- 4.2.2.5. Analysis by Dosage Form

- 4.2.2.6. Analysis by Dosage

- 4.2.2.7. Analysis by Target Disease Indication

- 4.2.2.8. Analysis by Target Patient Population

- 4.2.2.9. Key Industry Players: Analysis by Number of Vaccines in Clinical Development

- 4.2.2.10. Key Non-Industry Players: Analysis by Number of Vaccines in Clinical Development

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Methodology

- 5.3. Assumptions and Key Parameters

- 5.4. Competitiveness Analysis: Preventive Vaccine Developers

- 5.4.1. Preventive Vaccine Developers based in North America

- 5.4.2. Preventive Vaccine Developers based in Europe

- 5.4.3. Preventive Vaccine Developers based in Asia Pacific

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Bio Farma

- 6.2.1. Company Overview

- 6.2.2. Preventive Vaccines Portfolio

- 6.2.3. Recent Developments and Future Outlook

- 6.3. Emergent BioSolutions

- 6.3.1. Company Overview

- 6.3.2. Preventive Vaccines Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. GC Pharma

- 6.4.1. Company Overview

- 6.4.2. Preventive Vaccines Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. GlaxoSmithKline

- 6.5.1. Company Overview

- 6.5.2. Preventive Vaccines Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. Janssen

- 6.6.1. Company Overview

- 6.6.2. Preventive Vaccines Portfolio

- 6.6.3. Recent Developments and Future Outlook

- 6.7. Merck

- 6.7.1. Company Overview

- 6.7.2. Preventive Vaccines Portfolio

- 6.7.3. Recent Developments and Future Outlook

- 6.8. Novavax

- 6.8.1. Company Overview

- 6.8.2. Preventive Vaccines Portfolio

- 6.8.3. Recent Developments and Future Outlook

- 6.9. Pfizer

- 6.9.1. Company Overview

- 6.9.2. Preventive Vaccines Portfolio

- 6.9.3. Recent Developments and Future Outlook

- 6.10. Sanofi Pasteur

- 6.10.1. Company Overview

- 6.10.2. Preventive Vaccines Portfolio

- 6.10.3. Recent Developments and Future Outlook

- 6.11. Valneva

- 6.11.1. Company Overview

- 6.11.2. Preventive Vaccines Portfolio

- 6.11.3. Recent Developments and Future Outlook

7. CLINICAL TRIAL ANALYSIS

- 7.1. Chapter Overview

- 7.2. Scope and Methodology

- 7.3. Preventive Vaccines: Clinical Trial Analysis

- 7.3.1. Analysis by Trial Registration Year

- 7.3.2. Analysis by Enrolled Patient Population and Trial Registration Year

- 7.3.3. Analysis by Trial Phase

- 7.3.4. Analysis by Trial Recruitment Status

- 7.3.5. Analysis by Study Design

- 7.3.6. Analysis by Trial Focus Area

- 7.3.7. Analysis by Type of Preventive Vaccine (based on Pathogen)

- 7.3.8. Analysis by Target Disease Indication

- 7.3.9. Analysis by Type of Sponsor / Collaborator

- 7.3.10. Leading Industry Players: Analysis by Number of Registered Trials

- 7.3.11. Geographical Analysis by Number of Registered Trials

- 7.3.12. Geographical Analysis by Enrolled Patient Population

- 7.3.13. Geographical Analysis by Trial Recruitment Status

8. ONGOING VACCINE DEVELOPMENT INITIATIVES FOR COMPLEX CONDITIONS

- 8.1. Chapter Overview

- 8.2. Coronavirus Disease (COVID-19)

- 8.2.1. Disease Overview

- 8.2.2. Global Burden of COVID-19

- 8.2.3. Current Treatment Landscape

- 8.2.4. Preventive Vaccines for COVID-19

- 8.2.4.1. Historical Background of COVID-19 Vaccine Research

- 8.2.4.2. COVID-19 and Affiliated Research Landscape

- 8.2.5. Funding Instances

- 8.2.6. Recent Developments

- 8.3. Ebola Virus Disease (EVD)

- 8.3.1. Disease Overview

- 8.3.2. Global Burden of EVD

- 8.3.3. Current Treatment Landscape

- 8.3.4. Preventive Vaccines for EVD

- 8.3.4.1. Historical Background of Ebola Virus Vaccine Research

- 8.3.4.2. Anti-Ebola Virus Vaccines and Affiliated Research Landscape

- 8.3.5. Funding Instances

- 8.3.6. Recent Developments

- 8.4. HIV/AIDS

- 8.4.1. Disease Overview

- 8.4.2. Global Burden of HIV/AIDS

- 8.4.3. Current Treatment Landscape

- 8.4.4. Preventive Vaccines for HIV/AIDS

- 8.4.4.1. Historical Background of HIV/AIDS Vaccine Research

- 8.4.4.2. Anti-HIV Vaccines and Affiliated Research Landscape

- 8.4.5. Funding Instances

- 8.4.6. Recent Developments

- 8.5. Malaria

- 8.5.1. Disease Overview

- 8.5.2. Global Burden of Malaria

- 8.5.3. Current Treatment Landscape

- 8.5.4. Preventive Vaccines for Malaria

- 8.5.4.1. Historical Background of Malaria Vaccine Research

- 8.5.4.2. Anti-Malaria Vaccines and Affiliated Research Landscape

- 8.5.5. Funding Instances

- 8.5.6. Recent Developments

- 8.6. Zika Virus Infection

- 8.6.1. Disease Overview

- 8.6.2. Global Burden of Zika Virus Infection

- 8.6.3. Current Treatment Landscape

- 8.6.4. Preventive Vaccines for Zika Virus Infection

- 8.6.4.1. Historical Background of Zika Virus Vaccine Research

- 8.6.4.2. Anti-Zika Virus Vaccines and Affiliated Research Landscape

- 8.6.5. Funding Instances

- 8.6.6. Recent Developments

9. FUNDING AND INVESTMENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Types of Funding

- 9.3. Preventive Vaccines: Funding and Investment Analysis

- 9.3.1. Analysis by Number of Funding Instances

- 9.3.2. Analysis by Amount Invested

- 9.3.3. Analysis by Type of Funding

- 9.3.4. Analysis by Amount Invested across Different Types of Vaccine API

- 9.3.5. Analysis by Focus Area

- 9.3.6. Analysis by Amount Invested by Different Type of Investors

- 9.3.7. Most Active Players: Analysis by Number of Funding Instances

- 9.3.8. Most Active Investors: Analysis by Number of Funding Instances

- 9.3.9. Analysis by Geography

- 9.3.9.1. Continent-wise Analysis

- 9.3.9.2. Country-wise Analysis

10. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 10.1. Chapter Overview

- 10.2. Forecast Methodology and Key Assumptions

- 10.3. Overall Preventive Vaccines Market, till 2030

- 10.3.1. Preventive Vaccines Market, till 2030: Distribution by Route of Administration

- 10.3.2. Preventive Vaccines Market, till 2030: Distribution by Type of Vaccine

- 10.3.3. Preventive Vaccines Market, till 2030: Distribution by Type of Vaccine API

- 10.3.4. Preventive Vaccines Market, till 2030: Distribution by Target Patient Population

- 10.3.5. Preventive Vaccines Market, till 2030: Distribution by Key Geographical Regions

- 10.3.5.1. Preventive Vaccines Market in North America, till 2030

- 10.3.5.1.1. Preventive Vaccines Market in the US, till 2030

- 10.3.5.1.2. Preventive Vaccines Market in Mexico, till 2030

- 10.3.5.1.3. Preventive Vaccines Market in Canada, till 2030

- 10.3.5.2. Preventive Vaccines Market in Europe, till 2030

- 10.3.5.2.1. Preventive Vaccines Market in Spain, till 2030

- 10.3.5.2.2. Preventive Vaccines Market in the UK, till 2030

- 10.3.5.2.3. Preventive Vaccines Market in Italy, till 2030

- 10.3.5.2.4. Preventive Vaccines Market in France, till 2030

- 10.3.5.2.5. Preventive Vaccines Market in Germany, till 2030

- 10.3.5.2.6. Preventive Vaccines Market in Rest of Europe, till 2030

- 10.3.5.3. Preventive Vaccines Market in Asia Pacific, till 2030

- 10.3.5.3.1. Preventive Vaccines Market in India, till 2030

- 10.3.5.3.2. Preventive Vaccines Market in China, till 2030

- 10.3.5.3.3. Preventive Vaccines Market in Australia, till 2030

- 10.3.5.3.4. Preventive Vaccines Market in Rest of Asia Pacific, till 2030

- 10.3.5.4. Preventive Vaccines Market in Rest of the World, till 2030

- 10.3.5.1. Preventive Vaccines Market in North America, till 2030

11. CASE-IN-POINT: CONTRACT MANUFACTURING OF VACCINES

- 11.1. Chapter Overview

- 11.2. Vaccine Contract Manufacturing

- 11.2.1. Addressing an Unmet Need

- 11.2.2. Commonly Outsourced Operations

- 11.2.3. Selecting a CMO Partner

- 11.2.4. Advantages of Outsourcing Manufacturing Services

- 11.2.5. Associated Risks and Challenges

- 11.3. Vaccine Contract Manufacturing: Overall Market Landscape

- 11.3.1. Analysis by Year of Establishment

- 11.3.2. Analysis by Company Size

- 11.3.3. Analysis by Scale of Operation

- 11.3.4. Analysis by Location of Headquarters

- 11.3.5. Analysis by Location of Manufacturing Facilities

- 11.3.6. Analysis by Type of Service(s) Offered

- 11.3.7. Analysis by Expression System Used

- 11.3.8. Analysis by Type of Vaccine Manufactured

- 11.3.9. Analysis by Type of Vaccine Manufactured and Location of Headquarters

12. CONCLUDING REMARKS

13. EXECUTIVE INSIGHTS

- 13.1. Chapter Overview

- 13.2. Company A

- 13.2.1. Company Snapshot

- 13.2.2. Interview Transcript: Chief Executive Officer

14. APPENDIX 1: TABULATED DATA

15. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 Classification of Vaccines

- Table 3.2 Live, Attenuated Vaccines: Commonly Reported Adverse Events

- Table 3.3 Inactivated Vaccines: Commonly Reported Adverse Events

- Table 3.4 Subunit Vaccines: Commonly Reported Adverse Events

- Table 3.5 Toxoid Vaccines: Commonly Reported Adverse Events

- Table 3.6 Vaccine Excipients and their Functions

- Table 3.7 Routes of Administration and Type of Delivery Devices for Vaccine Administration

- Table 3.8 Common Pediatric Vaccines and their Routes of Administration

- Table 4.1 List of Marketed Preventive Vaccines

- Table 4.2 List of Clinical-Stage Preventive Vaccines

- Table 6.1 Preventive Vaccine Developers: List of Companies Profiled

- Table 6.2 Bio Farma: Company Overview

- Table 6.3 Bio Farma: Preventive Vaccine Pipeline

- Table 6.4 Bio Farma: Recent Developments and Future Outlook

- Table 6.5 Emergent BioSolutions: Company Overview

- Table 6.6 Emergent BioSolutions: Preventive Vaccine Pipeline

- Table 6.7 Emergent BioSolutions: Recent Developments and Future Outlook

- Table 6.8 GC Pharma: Company Overview

- Table 6.9 GC Pharma: Preventive Vaccine Pipeline

- Table 6.10 GC Pharma: Recent Developments and Future Outlook

- Table 6.11 GlaxoSmithKline: Company Overview

- Table 6.12 GlaxoSmithKline: Preventive Vaccine Pipeline

- Table 6.13 GlaxoSmithKline: Recent Developments and Future Outlook

- Table 6.14 Janssen: Company Overview

- Table 6.15 Janssen: Preventive Vaccine Pipeline

- Table 6.16 Janssen: Recent Developments and Future Outlook

- Table 6.17 Merck: Company Overview

- Table 6.18 Merck: Preventive Vaccine Pipeline

- Table 6.19 Merck: Recent Developments and Future Outlook

- Table 6.20 Novavax: Company Overview

- Table 6.21 Novavax: Preventive Vaccine Pipeline

- Table 6.22 Novavax: Recent Developments and Future Outlook

- Table 6.23 Pfizer: Company Overview

- Table 6.24 Pfizer: Preventive Vaccine Pipeline

- Table 6.25 Pfizer: Recent Developments and Future Outlook

- Table 6.26 Sanofi Pasteur: Company Overview

- Table 6.27 Sanofi Pasteur: Preventive Vaccine Pipeline

- Table 6.28 Sanofi Pasteur: Recent Developments and Future Outlook

- Table 6.29 Valneva: Company Overview

- Table 6.30 Valneva: Preventive Vaccine Pipeline

- Table 6.31 Valneva: Recent Developments and Future Outlook

- Table 8.1 Preventive Vaccines under Investigation for COVID-19

- Table 8.2 COVID-19 Vaccines: Funding Instances

- Table 8.3 Ebola Virus Disease: List of Marketed Therapeutics

- Table 8.4 Preventive Vaccines under Investigation for Ebola Virus Disease

- Table 8.5 Anti-Ebola Virus Vaccines: Funding Instances

- Table 8.6 HIV/AIDS: List of Marketed Therapeutics

- Table 8.7 Preventive Vaccines under Investigation for HIV/AIDS

- Table 8.8 Anti-HIV Vaccines: Funding Instances

- Table 8.9 Malaria: List of Marketed Therapeutics

- Table 8.10 Preventive Vaccines under Investigation for Malaria

- Table 8.11 Anti-Malaria Vaccines: Funding Instances

- Table 8.12 Preventive Vaccines under Investigation for Zika Virus Infection

- Table 8.13 Anti-Zika Virus Vaccines: Funding Instances

- Table 9.1 Preventive Vaccines: List of Funding and Investments

- Table 11.1 Vaccine Contract Manufacturers: List of Service Providers

- Table 11.2 Vaccine CMOs: Information on Type of Services Offered

- Table 11.3 Vaccine CMOs: Information on Scale of Operation

- Table 11.4 Vaccine CMOs: Information on Expression System Used

- Table 11.5 Vaccine CMOs: Information on Type of Vaccines Manufactured

- Table 11.6 List of Ad hoc Vaccine Manufacturers

- Table 12.1 Preventive Vaccines Market: Summary of the Report

- Table 14.1 Clinical-Stage Preventive Vaccines: Distribution by Type of Developer

- Table 14.2 Clinical-Stage Preventive Vaccines: Distribution by Phase of Development

- Table 14.3 Clinical-Stage Preventive Vaccines: Distribution by Route of Administration

- Table 14.4 Clinical-Stage Preventive Vaccines: Distribution by Type of Vaccine API

- Table 14.5 Clinical-Stage Preventive Vaccines: Distribution by Type of Vaccine API and Phase of Development

- Table 14.6 Clinical-Stage Preventive Vaccines: Distribution by Dosage Form

- Table 14.7 Clinical-Stage Preventive Vaccines: Distribution by Dosage

- Table 14.8 Clinical-Stage Preventive Vaccines: Distribution by Target Disease Indication

- Table 14.9 Clinical-Stage Preventive Vaccines: Distribution by Target Patient Population

- Table 14.10 Key Industry Players: Distribution by Number of Vaccines in Clinical Development

- Table 14.11 Key Non-Industry Players: Distribution by Number of Vaccines in Clinical Development

- Table 14.12 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year, Since 2010

- Table 14.13 Clinical Trial Analysis: Distribution by Number of Patients Enrolled by Trial Registration Year, Since 2010

- Table 14.14 Clinical Trial Analysis: Distribution by Trial Phase

- Table 14.15 Clinical Trial Analysis: Distribution by Trial Recruitment Status

- Table 14.16 Clinical Trial Analysis: Cumulative Year-wise Trend by Trial Recruitment Status

- Table 14.17 Clinical Trial Analysis: Distribution by Study Design

- Table 14.18 Clinical Trial Analysis: Distribution by Trial Focus Area

- Table 14.19 Clinical Trial Analysis: Distribution by Type of Preventive Vaccine (based on Pathogen)

- Table 14.20 Clinical Trial Analysis: Cumulative Year-wise Trend by Type of Preventive Vaccines

- Table 14.21 Clinical Trial Analysis: Distribution by Target Disease Indication

- Table 14.22 Clinical Trial Analysis: Distribution by Patient Enrollment and Target Disease Indication

- Table 14.23 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 14.24 Leading Industry Players: Distribution by Number of Registered Trials

- Table 14.25 Funding and Investment Analysis: Cumulative Number of Instances by Year, Since 2015

- Table 14.26 Funding and Investment Analysis: Cumulative Amount Invested, Since 2015 (USD Million)

- Table 14.27 Funding and Investment Analysis: Distribution by Type of Funding, Since 2015

- Table 14.28 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding, Since 2015 (USD Million)

- Table 14.29 Funding and Investment Analysis: Distribution of Amount Invested by Type of Vaccine API

- Table 14.30 Funding and Investment Analysis: Distribution of Amount Invested by Focus Area

- Table 14.31 Funding and Investment Analysis: Distribution of Amount Invested by Different Type of Investors

- Table 14.32 Most Active Players: Distribution by Number of Funding Instances

- Table 14.33 Most Active Investors: Distribution by Number of Funding Instances

- Table 14.34 Funding and Investment Analysis: Regional Distribution by Number of Funding Instances and Amount Raised (USD Million)

- Table 14.35 Funding and Investment Analysis: Country-wise Distribution by Total Amount Invested (USD Million)

- Table 14.36 Overall Preventive Vaccines Market, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.37 Preventive Vaccines Market, Till 2030: Distribution by Route of Administration (USD Billion)

- Table 14.38 Preventive Vaccines Market, Till 2030: Distribution by Type of Vaccine (USD Billion)

- Table 14.39 Preventive Vaccines Market, Till 2030: Distribution by Type of Vaccine API (USD Billion)

- Table 14.40 Preventive Vaccines Market, Till 2030: Distribution by Target Patient Population (USD Billion)

- Table 14.41 Preventive Vaccines Market, Till 2030: Distribution by Key Geographical Regions (USD Billion)

- Table 14.42 Preventive Vaccines Market in North America, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.43 Preventive Vaccines Market in the US, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.44 Preventive Vaccines Market in Mexico, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.45 Preventive Vaccines Market in Canada, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.46 Preventive Vaccines Market in Europe, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.47 Preventive Vaccines Market in Spain, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.48 Preventive Vaccines Market in the UK, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.49 Preventive Vaccines Market in Italy, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.50 Preventive Vaccines Market in France, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.51 Preventive Vaccines Market in Germany, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.52 Preventive Vaccines Market in Rest of Europe, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.53 Preventive Vaccines Market in Asia Pacific, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.54 Preventive Vaccines Market in India, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.55 Preventive Vaccines Market in China, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.56 Preventive Vaccines Market in Australia, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.57 Preventive Vaccines Market in Rest of Asia Pacific, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.58 Preventive Vaccines Market in Rest of the World, Conservative, Base and Optimistic Scenarios, Till 2030 (USD Billion)

- Table 14.59 Vaccine CMOs: Distribution by Year of Establishment

- Table 14.60 Vaccine CMOs: Distribution by Company Size

- Table 14.61 Vaccine CMOs: Distribution by Scale of Operation

- Table 14.62 Vaccine CMOs: Distribution by Location of Headquarters (Region and Country-wise)

- Table 14.63 Vaccine CMOs: Distribution by Location of Manufacturing Facility (Region-wise)

- Table 14.64 Vaccine CMOs: Distribution by Type of Services Offered

- Table 14.65 Vaccine CMOs: Distribution by Expression System Used

- Table 14.66 Vaccine CMOs: Distribution by Type of Vaccines Manufactured

- Table 14.67 Vaccine CMOs: Region-wise Distribution by Type of Vaccine Manufactured

List of Figures

- Figure 3.1 Difference Between Vaccines and Small Molecules

- Figure 3.2 Classification of Vaccines

- Figure 3.3 Routes for Vaccine Administration

- Figure 4.1 Clinical-Stage Preventive Vaccines: Distribution by Type of Developer

- Figure 4.2 Clinical-Stage Preventive Vaccines: Distribution by Phase of Development

- Figure 4.3 Clinical-Stage Preventive Vaccines: Distribution by Route of Administration

- Figure 4.4 Clinical-Stage Preventive Vaccines: Distribution by Type of Vaccine API

- Figure 4.5 Clinical-Stage Preventive Vaccines: Distribution by Type of Vaccine API and Phase of Development

- Figure 4.6 Clinical-Stage Preventive Vaccines: Distribution by Dosage Form

- Figure 4.7 Clinical-Stage Preventive Vaccines: Distribution by Dosage

- Figure 4.8 Clinical-Stage Preventive Vaccines: Distribution by Target Disease Indication

- Figure 4.9 Clinical-Stage Preventive Vaccines: Distribution by Target Patient Population

- Figure 4.10 Key Industry Players: Distribution by Number of Vaccines in Clinical Development

- Figure 4.11 Key Non-Industry Players: Distribution by Number of Vaccines in Clinical Development

- Figure 5.1 Company Competitiveness Analysis: Preventive Vaccine Developers based in North America

- Figure 5.2 Company Competitiveness Analysis: Preventive Vaccine Developers based in Europe

- Figure 5.3 Company Competitiveness Analysis: Preventive Vaccine Developers based in Asia Pacific

- Figure 7.1 Clinical Trial Analysis: Scope and Methodology

- Figure 7.2 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year, Since 2010

- Figure 7.3 Clinical Trial Analysis: Distribution by Number of Patients Enrolled by Trial Registration Year, Since 2010

- Figure 7.4 Clinical Trial Analysis: Distribution by Trial Phase

- Figure 7.5 Clinical Trial Analysis: Distribution by Trial Recruitment Status

- Figure 7.6 Clinical Trial Analysis: Cumulative Year-wise Trend by Trial Recruitment Status

- Figure 7.7 Clinical Trial Analysis: Distribution by Study Design

- Figure 7.8 Clinical Trial Analysis: Distribution by Trial Focus Area

- Figure 7.9 Clinical Trial Analysis: Distribution by Type of Preventive Vaccine (based on Pathogen)

- Figure 7.10 Clinical Trial Analysis: Cumulative Year-wise Trend by Type of Preventive Vaccines

- Figure 7.11 Clinical Trial Analysis: Distribution by Target Disease Indication

- Figure 7.12 Clinical Trial Analysis: Distribution by Patient Enrollment and Target Disease Indication

- Figure 7.13 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Figure 7.14 Leading Industry Players: Distribution by Number of Registered Trials

- Figure 7.15 Clinical Trial Analysis: Geographical Distribution by Number of Registered Trials

- Figure 7.16 Clinical Trial Analysis: Geographical Distribution by Enrolled Patient Population

- Figure 7.17 Clinical Trial Analysis: Geographical Distribution by Trial Registration Year and Recruitment Status

- Figure 8.1 Historical Timeline of COVID-19 Vaccine Development

- Figure 8.2 Historical Timeline of Anti-Ebola Virus Vaccine Development

- Figure 8.3 Historical Timeline of Anti-HIV Vaccine Development

- Figure 8.4 Historical Timeline of Anti-Malaria Vaccine Development

- Figure 8.5 Historical Timeline of Anti-Zika Virus Vaccine Development

- Figure 9.1 Funding and Investment Analysis: Cumulative Number of Instances by Year, Since 2015

- Figure 9.2 Funding and Investment Analysis: Cumulative Amount Invested, Since 2015 (USD Million)

- Figure 9.3 Funding and Investment Analysis: Distribution by Type of Funding, Since 2015

- Figure 9.4 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding, Since 2015 (USD Million)

- Figure 9.5 Funding and Investment Analysis: Distribution of Amount Invested by Type of Vaccine API

- Figure 9.6 Funding and Investment Analysis: Distribution of Amount Invested and Focus Area

- Figure 9.7 Funding and Investment Analysis: Distribution of Amount Invested by Different Type of Investors

- Figure 9.8 Most Active Players: Distribution by Number of Funding Instances

- Figure 9.9 Most Active Investors: Distribution by Number of Funding Instances

- Figure 9.10 Funding and Investment Analysis: Regional Distribution by Number of Funding Instances and Amount Raised (USD Million)

- Figure 9.11 Funding and Investment Analysis: Country-wise Distribution by Total Amount Invested (USD Million)

- Figure 10.1 Overall Preventive Vaccines Market, Till 2030 (USD Billion)

- Figure 10.2 Preventive Vaccines Market, Till 2030: Distribution by Route of Administration (USD Billion)

- Figure 10.3 Preventive Vaccines Market, Till 2030: Distribution by Type of Vaccine (USD Billion)

- Figure 10.4 Preventive Vaccines Market, Till 2030: Distribution by Type of Vaccine API (USD Billion)

- Figure 10.5 Preventive Vaccines Market, Till 2030: Distribution by Target Patient Population (USD Billion)

- Figure 10.6 Preventive Vaccines Market, Till 2030: Distribution by Key Geographical Regions (USD Billion)

- Figure 10.7 Preventive Vaccines Market in North America, Till 2030 (USD Billion)

- Figure 10.8 Preventive Vaccines Market in the US, Till 2030 (USD Billion)

- Figure 10.9 Preventive Vaccines Market in Mexico, Till 2030 (USD Billion)

- Figure 10.10 Preventive Vaccines Market in Canada, Till 2030 (USD Billion)

- Figure 10.11 Preventive Vaccines Market in Europe, Till 2030 (USD Billion)

- Figure 10.12 Preventive Vaccines Market in Spain, Till 2030 (USD Billion)

- Figure 10.13 Preventive Vaccines Market in the UK, Till 2030 (USD Billion)

- Figure 10.14 Preventive Vaccines Market in Italy, Till 2030 (USD Billion)

- Figure 10.15 Preventive Vaccines Market in France, Till 2030 (USD Billion)

- Figure 10.16 Preventive Vaccines Market in Germany, Till 2030 (USD Billion)

- Figure 10.17 Preventive Vaccines Market in Rest of Europe, Till 2030 (USD Billion)

- Figure 10.18 Preventive Vaccines Market in Asia Pacific, Till 2030 (USD Billion)

- Figure 10.19 Preventive Vaccines Market in India, Till 2030 (USD Billion)

- Figure 10.20 Preventive Vaccines Market in China, Till 2030 (USD Billion)

- Figure 10.21 Preventive Vaccines Market in Australia, Till 2030 (USD Billion)

- Figure 10.22 Preventive Vaccines Market in Rest of Asia Pacific, Till 2030 (USD Billion)

- Figure 10.23 Preventive Vaccines Market in Rest of the World, Till 2030 (USD Billion)

- Figure 11.1 Type of Third-Party Service Providers in the Pharmaceutical Industry

- Figure 11.2 Commonly Outsourced Vaccine Development Operations

- Figure 11.3 Key Factors to Consider while Selecting a CMO Partner

- Figure 11.4 Risks and Challenges Associated with Contract Manufacturing

- Figure 11.5 Vaccine CMOs: Distribution by Year of Establishment

- Figure 11.6 Vaccine CMOs: Distribution by Company Size

- Figure 11.7 Vaccine CMOs: Distribution by Scale of Operation

- Figure 11.8 Vaccine CMOs: Distribution by Location of Headquarters (Region and Country-wise)

- Figure 11.9 Vaccine CMOs: Distribution by Location of Manufacturing Facility (Region-wise)

- Figure 11.10 Vaccine CMOs: Distribution by Type of Services Offered

- Figure 11.11 Vaccine CMOs: Distribution by Expression System Used

- Figure 11.12 Vaccine CMOs: Distribution by Type of Vaccine Manufactured

- Figure 11.13 Vaccine CMOs: Distribution by Type of Vaccine Manufactured and Location of Headquarters