|

市场调查报告书

商品编码

1891251

一次性生物製程市场:产业趋势及全球预测(至 2035 年)-依产品类型、企业规模及主要地区划分Single Use Bioprocessing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Product, Scale of Operation and Key Geographical Regions |

||||||

一次性生物製程市场概述

预计到 2035 年,一次性生物製程市场规模将从目前的 51 亿美元增长至 155 亿美元,预测期内(至 2035 年)的复合年增长率 (CAGR) 为 11.7%。

一次性生物工艺市场

市场规模和机会分析基于以下参数进行细分:

产品类型

- 一次性生物反应器

- 抛弃式混合器

- 一次性培养基袋

- 一次性过滤器

- 一次取样系统

- 抛弃式连接器

- 其他

业务规模

- 临床前/临床

- 商业

地理区域

- 北美

- 欧洲

- 亚太地区

- 中东和北非

- 拉丁美洲

一次性生物製程市场 - 成长与趋势

生物製剂因其疗效显着、安全性良好,且能够治疗多种其他疗法难以控制的疾病,而日益受到欢迎。这些疗法的有效性促使利害关係人改进传统的生物製剂合约生产技术。对更高生产效率和灵活性、更高盈利能力以及更快上市时间的需求,进一步加速了从传统不銹钢设备向一次性技术(例如一次性混合器和一次性生物反应器)的过渡。这些一次性技术在相对较短的时间内就被广泛接受,并已成为许多生物技术製程发展的关键资源。

此外,COVID-19 大流行也促使生物製药产业采用一次性技术。这些一次性生物製程技术在研发阶段减少了占地面积和清洁成本。 此外,一次性生物製程技术解决了传统生物製程系统面临的许多挑战,包括降低水和能源消耗(约 45%)、减少资本投资(40%)、缩短生物製药加工时间(33%)、降低交叉污染风险(8%)以及提高成本节约潜力(30-40%)。

许多一次性生物製程公司目前正在开发和生产一次性上游生物製程技术和工具,包括一次性生物反应器、一次性混合器、一次性过滤器、一次性培养基袋和容器、一次性取样系统以及一次性连接器。此外,部分生物製程公司也致力于为其产品配备更多功能,例如警报/通知系统、整合式製程控制感测器、数位製程日誌、远端监控功能、触控萤幕介面以及增强的安全措施。 一次性技术的使用面临许多挑战,包括与可萃取物相关的风险、一次性技术的处置、灭菌/辐照的复杂性以及树脂的异质性。然而,我们相信,对永续性和其他技术发展的持续研究将在整个预测期内推动一次性生物加工市场技术供应商的显着成长。

一次性生物加工市场 - 主要洞察

本报告深入分析了一次性生物加工市场的现状,并指出了该行业的潜在成长机会。报告的主要发现包括:

- 目前,市面上已有超过500种一次性上游生物加工设备,或正在研发中。一次性生物反应器、一次性感测器和一次性混合器正日益普及。

- 此外,各公司正在开发各种一次性培养基袋、一次性过滤器、一次性连接器和一次性取样系统,每种产品都融合了多种关键特性。

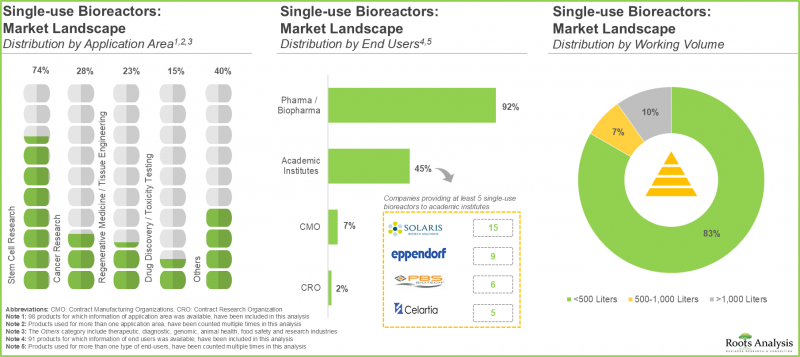

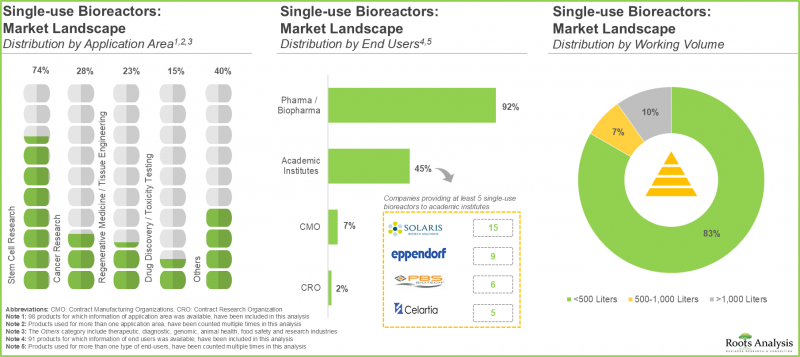

- 大多数一次性生物反应器应用于製药和生物製药行业,许多产品也被应用于各种不同的领域。

- 超过90%的一次性混合器采用液/液混合系统来实现组分的均匀混合,其中很大一部分混合器可用于各种规模的操作。

- 为了获得竞争优势,开发人员正致力于将先进功能融入每款产品中。

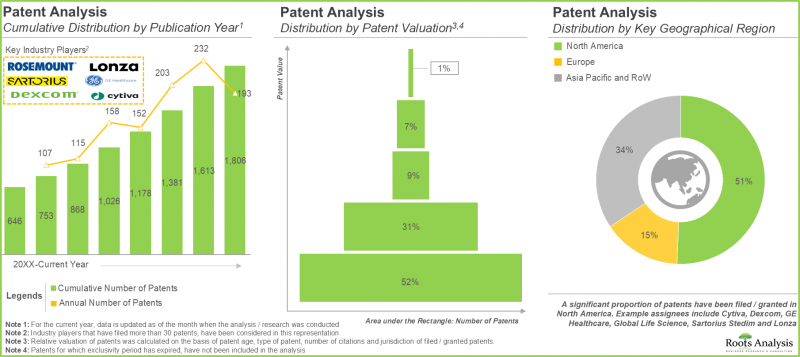

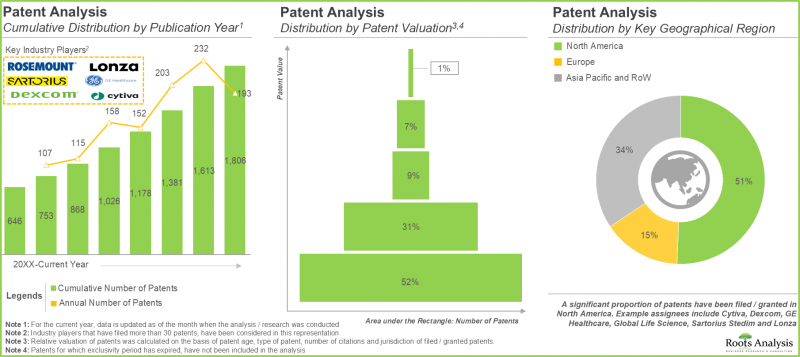

- 已有超过1,800项与一次性生物加工技术相关的专利申请,这些专利申请来自业内外的各方,显示该领域的研究和创新步伐正在加快。

- 潜在的成本节约和其他优势预计将推动一次性技术的应用。

- 57%的预校准感测器是流量感测器,所有一次性感测器均采用伽马射线辐照灭菌技术。

- 当前市场格局的特征是既有老牌企业,也有新进者。多数公司总部位于已开发地区。

- 多年来,各利益相关者已建立起强大的品牌地位,以满足日益增长的一次性技术需求,并强化各自的产品组合。

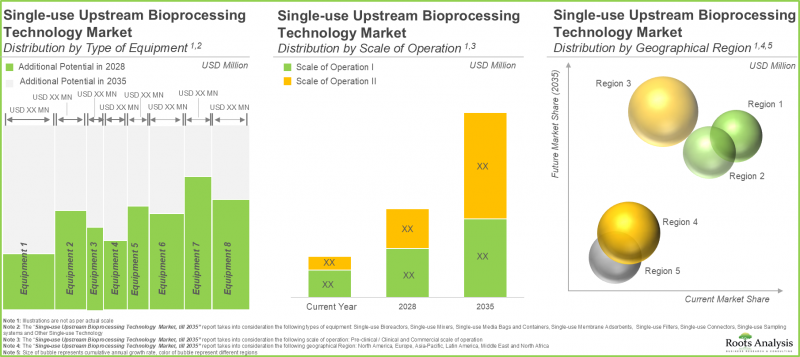

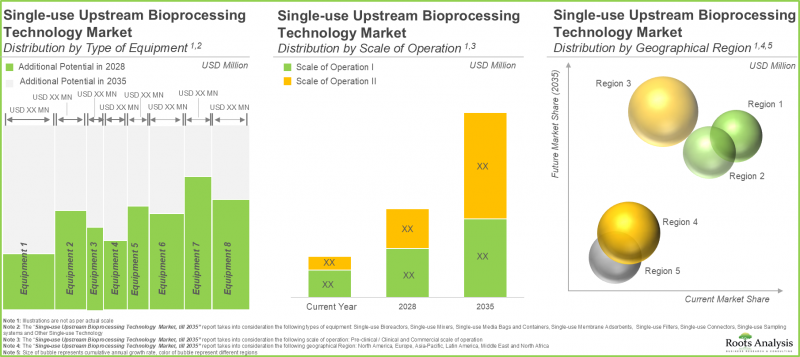

- 预计未来十年,该市场将以11.7%的复合年增长率成长。这项机会预计将广泛分布于各个细分市场,包括营运规模、设备类型和地理区域。

一次性生物加工市场 - 市场区隔

益生菌市场中成长最快的细分市场是临床前/临床规模

就营运规模而言,全球一次性生物加工技术市场分为临床前/临床规模和商业规模。目前,大部分市场占有率(87%)为临床前和临床规模。此外,预计未来几年临床规模细分市场的复合年增长率将更高(10%)。

预计一次性滤芯在预测期内的复合年增长率也会更高。

预测期

依产品类型划分,全球市场分为一次性生物反应器、一次性混合系统、一次性培养基袋、一次性过滤器、一次性取样系统、一次性连接器和一次性膜吸附器。 在这些产品类型中,预计一次性滤芯在预测期内将呈现最高的成长率,其次是培养基袋和一次性采样系统。

预计一次性滤芯在预测期内将以更高的复合年增长率成长。

预测期

依产品类型划分,全球市场分为一次性生物反应器、一次性混合系统、一次性培养基袋、一次性过滤器、一次性采样系统、一次性连接器、一次性膜吸附器和一次性膜吸附器。在这些产品类型中,预计一次性滤芯在预测期内将呈现最高的成长率,其次是培养基袋和一次性采样系统。

预计亚太地区将在预测期内引领市场成长。

依地区划分,全球市场分为北美、欧洲、亚太、拉丁美洲以及中东和北非。 其中,亚太地区预计将占最大的市场占有率(35%),其次是北美(30%)和欧洲(25%)。

一次性生物製程技术市场的主要参与者

- Avantor

- Cytiva

- Eppendorf

- Merck KGaA

- Pall

- Premas Biotech

- REPROCELL

- Saint-Gobain

- Sartorius

- Satake Multimix

- Thermo Fisher Scientific

一次性生物工艺市场 - 研究范围

- 市场规模和机会分析:本报告对一次性生物製程市场进行了详细分析,重点关注以下关键市场细分:[A] 产品类型,[B] 营运规模,以及 [C] 地理区域。

- 市场概况 1:基于多个相关参数对一次性生物反应器的整体市场概况进行详细评估,这些参数包括:[A] 操作规模,[B] 细胞培养系统类型,[C] 细胞培养类型,[D] 分子类型,[E] 主要特性,[F] 应用领域,以及 [G] 最终用户。

- 市场概况 2:基于以下相关参数对一次性混合器的整体市场概况进行详细评估:[A] 操作规模,[B] 混合系统类型,[C] 分子类型,[D] 主要特性,[E] 应用领域,[F] 成立年份,[G] 公司规模,以及 [H] 地理分布。

- 市场概况 3:基于以下相关参数对一次性感测器市场概况进行详细评估:[A] 感测器类型,[B] 生物製程类型,[C] 测量范围,[D] 工作温度,[E] 灭菌技术,[F] 所用材料,[G] 应用领域,[H] 成立年份,[I] 公司地理分布。

- 公司竞争分析:对一次性生物反应器进行全面的竞争分析。我们检视了以下因素:[A] 产品适用性,[B] 产品优势等。

- 公司简介:详细介绍该领域的主要公司。我们专注于目前提供一次性上游生物製程技术的主要生物製程公司,并从以下几个方面分析总部位于北美、欧洲和亚太地区的公司:[A] 成立年份,[B] 总部所在地,[C] 製药产品组合,[D] 近期发展,以及 [E] 未来前景。

- 专利分析:对与一次性上游生物加工技术相关的各类已申请和已授权专利进行详细分析。基于相关参数,我们分析:[A] 专利类型,[B] 公开年份,[C] 申请年份,[D] 授权机构,[E] 机构类型,[F] 新兴重点领域,[G] 专利年龄,[H] CPC 分类号,[I] 主要专利持有人,[J] 专利特征,以及 [K] 地区。

- 品牌定位分析:我们分析主要产业参与者。对每位顾客进行详细的品牌定位分析。我们将阐明每位客户独特产品的当前市场认知,并考虑以下几个相关因素:[A] 製造商历史,[B] 产品数量,[C] 产品多样性,以及 [D] 已公布专利数量。

- 成本和时间节省潜力:我们将对每项一次性上游生物製程技术的成本和时间节省潜力进行详细分析。

目录

第一章:前言

第二章:摘要整理

第三章:导论

- 章节概要

- 一次性上游生物製程技术概述

- 一次性上游生物製程技术的历史发展

- 一次性上游生物製程技术类型

- 一次性上游生物製程技术的应用

- 一次性上游生物製程技术面临的主要挑战

- 未来展望

第四章:市场概况:一次性生物反应器

- 章节概要

- 一次性生物反应器:产品列表

- 一次性生物反应器:开发者视角

第五章 市场概况:一次性混合器

- 章节概述

- 一次性混合器:产品列表

- 一次性混合器:开发者概况

第六章:市场概况:一次性感测器

- 章节概述

- 一次性感测器:产品列表

- 一次性感测器:开发者概况

第七章:市场概况:其他一次性上游生物加工技术

- 章节概述

- 一次性培养基袋和容器

- 一次性过滤器

- 一次取样系统

- 抛弃式连接器

第八章 产品竞争分析

- 章节概述

- 研究方法

- 假设/关键参数

- 产品竞争分析:一次性生物反应器

- 产品竞争分析:一次性混合器

- 产品竞争分析:一次性感测器

第九章:北美一次性上游生物製程技术供应商:公司简介

- 章节概述

- Aantor

- Cytiva

- Merck KGaA

- Pall

- Thermo Fisher Scientific

第十章:欧洲一次性上游生物製程技术供应商:公司简介

- 章节概述

- Eppendorf

- Saint-Gobain

- Sartorius

第11章 亚太地区一次性上游生物製程技术供应商:公司简介

- 章节概述

- Satake Multimix

- REPROCELL

- Premas Biotech

第12章 专利分析

- 章节概述

- 研究范围与方法

- 一次性上游生物製程技术:专利分析

- 专利基准分析

- 专利估值分析

第13章 品牌定位矩阵

- 章节概述

- 研究方法

- 关键参数

- 一次性生物反应器开发商的品牌定位矩阵

- 一次性混合器开发商的品牌定位矩阵

- 一次性感测器开发商的品牌定位矩阵

第14章 案例研究:一次性上游生物製程技术的潜在成本和时间节省

第15章 供需分析

- 章节概述

- 关键假设与研究方法

- 2035年全球生物製药需求预测

- 结论

第16章 市场预测与机会分析

- 章节概述

- 预测研究方法与关键假设

- 2035 年前全球一次性上游生物製程技术市场

第 17 章:结论

- 章节概述

第 18 章:高阶主管洞察

第 19 章:附录 1:表格资料

第 20 章:附录 2:公司与机构清单

Single Use Bioprocessing Market: Overview

As per Roots Analysis, the single use bioprocessing market is estimated to grow from USD 5.1 billion in the current year to USD 15.5 billion by 2035, at a CAGR of 11.7% during the forecast period, till 2035.

Single Use Bioprocessing Market

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Product

- Single Use Bioreactors

- Single Use Mixers

- Single Use Media Bags

- Single Use Filters

- Single Use Sampling Systems

- Single Use Connectors

- Others

Scale of Operation

- Preclinical / Clinical

- Commercial

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Single Use Bioprocessing Market: Growth and Trends

Biologics has become increasingly popular due to their therapeutic effectiveness, positive safety profiles, and capacity to address a range of disease indications that are otherwise difficult to manage. The effectiveness of these interventions encouraged the stakeholders to enhance the conventional biologics contract manufacturing technology. The need for enhanced productivity and flexibility, improved profitability, and quicker market delivery is further accelerating the shift from conventional stainless-steel equipment to single-use technologies, such as single-use mixers and single-use bioreactors. These disposable technologies have gained acceptance in a relatively brief time frame and have emerged as a crucial resource in the advancement of numerous biotechnological processes.

Additionally, the COVID-19 pandemic has driven the biopharmaceutical sector to adopt single-use technology. These single-use bioprocessing technologies reduce the footprint requirement and remove cleaning expenses during the development phase. Moreover, single-use bioprocessing technologies can tackle several issues linked to conventional bioprocessing systems and provide numerous extra advantages, including reduced water and energy use (by approximately 45%), lower capital investment (by 40%), shorter processing time for biologics (by 33%), diminished cross-contamination risk (by 8%), and greater potential for cost savings (by 30-40%).

Currently, numerous single-use bioprocessing firms are involved in developing and producing single-use upstream bioprocessing technologies and tools, including single-use bioreactors, single-use mixers, single-use filters, single-use media bags and containers, single-use sampling systems, and single-use connectors. Additionally, several of these bioprocessing firms are concentrating on adding extra functionalities, such as alert / notification systems, integrated process control sensors, digital process logs, remote supervision capabilities, touchscreen interfaces, and enhanced safety measures, to their proprietary products. The utilization of this single-use technology comes with various challenges, including the risks associated with extractables and leachable, disposal of single-use technology, sterilization / irradiation complications, and possible inconsistencies in the resins. However, due to ongoing sustainability research and other technical developments, we believe that the potential for technology providers in the single-use bioprocessing market is expected to see significant growth throughout the forecast period.

Single Use Bioprocessing Market: Key Insights

The report delves into the current state of the single use bioprocessing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Over 500 single-use upstream bioprocessing equipment are currently commercially available / being developed; single-use bioreactors, single-use sensors and single-use mixers are steadily gaining traction.

- In addition, companies have developed a variety of single-use media bags, single-use filters, single-use connectors and single-use sampling systems; these systems are inbuilt with various key features.

- Majority of the single-use bioreactors are being used by the pharmaceutical / biopharmaceutical industry; of these, several have been deployed across different application areas.

- Over 90% of the single-use mixers use liquid / liquid mixing system to obtain uniform composition of the components; a significant proportion of these mixers can be used across all scales of operations.

- In pursuit of gaining a competitive edge, developers are focusing on introducing advanced features in their respective products.

- More than 1,800 patents related to single-use bioprocessing technology have been filed by various industry and non-industry players; this is indicative of the heightened pace of research and innovation in this field.

- Owing to the cost saving potential and other benefits of single-use technology, the adoption of this technology is expected to ration.

- 57% of the pre-calibrated sensors are flow sensors; all the single-use sensors use gamma-irradiation sterilization technique.

- The current market landscape features the presence of both well-established firms and new entrants; most of the companies are headquartered in developed regions.

- Over time, stakeholders have established strong brand positions in order to cater to the increasing demand for single-use technology and to enhance their respective product portfolio.

- The market is anticipated to grow at a CAGR of 11.7% in the coming decade; the opportunity is likely to be well distributed across different scales of operation, type of equipment and geographical regions.

Single Use Bioprocessing Market: Market Segments

Preclinical and Clinical Scale is the Fastest Growing Segment of the Probiotics Market

In terms of scale of operation, the global market for single-use bioprocessing technology market is segmented into preclinical and clinical scale, and commercial scale. Currently, majority share (87%) of the market is captured by preclinical and clinical scale. Further, the clinical scale segment is likely to grow at a higher CAGR (10%) in the coming years.

Disposable Filter Cartridges are Likely to Grow at a Higher CAGR During the Forecast

Period

Based on the type of product, the global market is segmented into single-use bioreactors, single-use mixing systems, single-use media-bags, single-use filters, single-use sampling system, single-use connectors, single-use membrane adsorbents, and single-use membrane adsorbents. amongst these types, the disposable filter cartridges are likely to witness highest growth during the forecast period, followed by media bags and single-use sampling system.

Disposable Filter Cartridges are Likely to Grow at a Higher CAGR During the Forecast

Period

In terms of the type of product, the global market is segmented into single-use bioreactors, single-use mixing systems, single-use media-bags, single-use filters, single-use sampling system, single-use connectors, single-use membrane adsorbents, and single-use membrane adsorbents. amongst these types, the disposable filter cartridges are likely to witness highest growth during the forecast period, followed by media bags and single-use sampling system.

Asia-Pacific is Likely to Propel the Market Growth During the Forecast Period

In terms of the geographical regions, the global market is segmented into North America, Europe, Asia-Pacific, Latin America and Middel East and North Africa. Amongst these, Asia-Pacific is likely to capture most of the market share (35%), followed by North America (30%) and Europe (25%).

Example Players in the Single-use Bioprocessing Technology Market

- Avantor

- Cytiva

- Eppendorf

- Merck KGaA

- Pall

- Premas Biotech

- REPROCELL

- Saint-Gobain

- Sartorius

- Satake Multimix

- Thermo Fisher Scientific

Single Use Bioprocessing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the single use bioprocessing market, focusing on key market segments, including [A] type of product, [B] scale of operation, and [C] geographical regions.

- Market Landscape 1: A detailed assessment of overall market landscape of single-use bioreactors based on several relevant parameters, such as [A] scale of operation, [B] type of cell culture system, [C] type of cell culture, [D] type of molecule, [E] key features, [F] application and [G] end users.

- Market Landscape 2: A detailed assessment of the overall market landscape of single-use mixers based on a number of relevant parameters, such as [A] scale of operation, [B] type of mixing system, [C] type of molecule, [D] key features [E] application area, [F] year of establishment, [G] company size, and [H] geographical presence.

- Market Landscape 3: A detailed assessment of the overall market landscape of single-use sensors, based on several relevant parameters, such as [A] type of sensor, [B] type of bioprocessing, [C] measurement range, [D] operating temperature, [E] sterilization technique, [F] material used [G] application area, [H] year of establishment, [I] company size, and [J] geographical presence.

- Company Competitiveness Analysis: A comprehensive competitive analysis of single use bioreactors, examining factors, such as [A] product applicability and [B] product strength.

- Company Profiles: In-depth profiles of prominent players engaged in this domain, that are currently involved key bioprocessing companies providing single-use upstream bioprocessing technologies, which are headquartered in North America, Europe and Asia-Pacific, focusing on [A] year of establishment, [B] location of headquarters, [C] drug portfolio, [D] recent developments and [E] an informed future outlook.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted for single-use upstream bioprocessing technology, based on relevant parameters, including [A] type of patents, [B] publication year, [C] application year, [D] issuing authorities involved, [E] type of organizations, [F] emerging focus area, [G] patent age, [H] CPC symbols, [I] leading patent assignees, [J] patent characteristics and [K] geography.

- Brand Positioning Analysis: A detailed brand positioning analysis of the key industry players, highlighting the current perceptions regarding their proprietary products by taking into consideration several relevant aspects, such as [A] experience of the manufacturer, [B] number of products offered, [C] product diversity, and [D] number of patents published.

- Cost and Time Saving Potential: An in-depth analysis of the cost and time saving potential of single-use upstream bioprocessing technology.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Overview

- 1.2. Scope of the Report

- 1.3. Research Methodology

- 1.4. Key Questions Answered

- 1.5. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Single-use Upstream Bioprocessing Technology

- 3.3. Historical Evolution of Single-use Upstream Bioprocessing Technology

- 3.4. Types of Single-use Upstream Bioprocessing Technology

- 3.5. Applications of Single-use Upstream Bioprocessing Technology

- 3.6. Key Challenges Associated with Single-use Upstream Bioprocessing Technology

- 3.7. Future Perspective

4. MARKET LANDSCAPE: SINGLE-USE BIOREACTORS

- 4.1. Chapter Overview

- 4.2. Single-use Bioreactors: List of Products

- 4.2.1. Analysis by Type of Bioreactor

- 4.2.2. Analysis by Scale of Operation

- 4.2.3. Analysis by Type of Cell Culture System

- 4.2.4. Analysis by Type of Cell Culture

- 4.2.5. Analysis by Type of Molecule Processed

- 4.2.6. Analysis by Key Features

- 4.2.7. Analysis by Application Area

- 4.2.8. Analysis by End Users

- 4.3. Single-use Bioreactors: Developer Landscape

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.2. Analysis by Year of Establishment and Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Leading Developers: Analysis by Number of Single-use Bioreactors

5. MARKET LANDSCAPE: SINGLE-USE MIXERS

- 5.1. Chapter Overview

- 5.2. Single-use Mixers: List of Products

- 5.2.1. Analysis by Scale of Operation

- 5.2.2. Analysis by Type of Mixing System

- 5.2.3. Analysis by Stage of Bioprocessing

- 5.2.4. Analysis by Type of Molecule Processed

- 5.2.5. Analysis by Key Features

- 5.2.6. Analysis by Application Area

- 5.3. Single-use Mixers: Developer Landscape

- 5.3.1. Analysis by Year of Establishment

- 5.3.2. Analysis by Company Size

- 5.3.3. Analysis by Location of Headquarters

- 5.3.4. Analysis by Year of Establishment and Location of Headquarters

- 5.3.5. Leading Developers: Analysis by Number of Single-use Mixers

6. MARKET LANDSCAPE: SINGLE-USE SENSORS

- 6.1. Chapter Overview

- 6.2. Single-use Sensors: List of Products

- 6.2.1 Analysis by Type of Sensor

- 6.2.2. Analysis by Stage of Bioprocessing

- 6.2.3. Analysis by Operating Temperature

- 6.2.4. Analysis by Sterilization Technique

- 6.2.5. Analysis by Sensor Calibration

- 6.2.6. Analysis by Type of Material Used

- 6.2.7. Analysis by Application Area

- 6.3. Single-use Sensors: Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Leading Developers: Analysis by Number of Single-use Sensors

7. MARKET LANDSCAPE: OTHER SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGIES

- 7.1. Chapter Overview

- 7.2. Single-use Media Bags and Containers

- 7.3. Single-use Filters

- 7.4. Single-use Sampling Systems

- 7.5. Single-use Connectors

8. PRODUCT COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Methodology

- 8.3. Assumptions / Key Parameters

- 8.4. Product Competitiveness Analysis: Single-use Bioreactors

- 8.4.1. Companies Headquartered in North America

- 8.4.2. Companies Headquartered in Europe

- 8.4.3. Companies Headquartered in Asia-Pacific and Rest of the World

- 8.5. Product Competitiveness Analysis: Single-use Mixers

- 8.5.1. Companies Headquartered in North America

- 8.5.2. Companies Headquartered in Europe

- 8.5.3. Companies Headquartered in Asia-Pacific and Rest of the World

- 8.6. Product Competitiveness Analysis: Single-use Sensors

- 8.6.1. Companies Headquartered in North America

- 8.6.2. Companies Headquartered in Europe

- 8.6.3. Companies Headquartered in Asia-Pacific and Rest of the World

9. SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY PROVIDERS IN NORTH AMERICA: COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Avantor

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Service Portfolio

- 9.2.4. Product Portfolio

- 9.2.5. Recent Developments and Future Outlook

- 9.3. Cytiva

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Service Portfolio

- 9.3.4. Product Portfolio

- 9.3.5. Recent Developments and Future Outlook

- 9.4. Merck KGaA

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Service Portfolio

- 9.4.4. Product Portfolio

- 9.4.5. Recent Developments and Future Outlook

- 9.5. Pall

- 9.5.1. Company Overview

- 9.5.2. Financial Information

- 9.5.3. Service Portfolio

- 9.5.4. Product Portfolio

- 9.5.5. Recent Developments and Future Outlook

- 9.6. Thermo Fisher Scientific

- 9.6.1. Company Overview

- 9.6.2. Financial Information

- 9.6.3. Service Portfolio

- 9.6.4. Product Portfolio

- 9.6.5. Recent Developments and Future Outlook

10. SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY PROVIDERS IN EUROPE: COMPANY PROFILES

- 10.1. Chapter Overview

- 10.2. Eppendorf

- 10.2.1. Company Overview

- 10.2.2. Financial Information

- 10.2.3. Service Portfolio

- 10.2.4. Product Portfolio

- 10.2.5. Recent Developments and Future Outlook

- 10.3. Saint-Gobain

- 10.3.1. Company Overview

- 10.3.2. Financial Information

- 10.3.3. Service Portfolio

- 10.3.4. Product Portfolio

- 10.3.5. Recent Developments and Future Outlook

- 10.4. Sartorius

- 10.4.1. Company Overview

- 10.4.2. Financial Information

- 10.4.3. Service Portfolio

- 10.4.4. Product Portfolio

- 10.4.5. Recent Developments and Future Outlook

11. SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY PROVIDERS IN ASIA-PACIFIC: COMPANY PROFILES

- 11.1. Chapter Overview

- 11.2. Satake Multimix

- 11.2.1. Company Overview

- 11.2.2. Financial Information

- 11.2.3. Service Portfolio

- 11.2.4. Product Portfolio

- 11.2.5. Recent Developments and Future Outlook

- 11.3. REPROCELL

- 11.3.1. Company Overview

- 11.3.2. Financial Information

- 11.3.3. Service Portfolio

- 11.3.4. Product Portfolio

- 11.3.5. Recent Developments and Future Outlook

- 11.4. Premas Biotech

- 11.4.1. Company Overview

- 11.4.2. Financial Information

- 11.4.3. Service Portfolio

- 11.4.4. Product Portfolio

- 11.4.5. Recent Developments and Future Outlook

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope and Methodology

- 12.3. Single-use Upstream Bioprocessing Technology: Patent Analysis

- 12.3.1. Analysis by Publication Year

- 12.3.2. Analysis by Application Year

- 12.3.3. Analysis by Patent Office

- 12.3.4. Analysis by Geographical Location

- 12.3.5. Analysis by CPC Symbols

- 12.3.6. Emerging Focus Area

- 12.3.7. Analysis by Type of Organization

- 12.3.8. Leading Players: Analysis by Number of Patents

- 12.4. Patent Benchmarking Analysis

- 12.4.1. Analysis by Patent Characteristics

- 12.5. Analysis by Patent Valuation

13. BRAND POSITIONING MATRIX

- 13.1. Chapter Overview

- 13.2 Methodology

- 13.3. Key Parameters

- 13.4. Brand Positioning Matrix of Single-use Bioreactor Developers

- 13.4.1. Brand Positioning Matrix: Pall Corporation

- 13.4.2. Brand Positioning Matrix: Eppendorf

- 13.4.3. Brand Positioning Matrix: Solaris Biotech

- 13.4.4. Brand Positioning Matrix: Sartorius Stedim Biotech

- 13.4.5. Brand Positioning Matrix: Applikon Biotechnology

- 13.4.6. Brand Positioning Matrix: CerCell

- 13.4.7. Brand Positioning Matrix: Synthecon

- 13.5. Brand Positioning Matrix of Single-use Mixer Developers

- 13.5.1. Brand Positioning Matrix: Thermo Fisher Scientific

- 13.5.2. Brand Positioning Matrix: Merck Millipore

- 13.5.3. Brand Positioning Matrix: Cytiva Lifesciences

- 13.5.4. Brand Positioning Matrix: Pall Corporation

- 13.6. Brand Positioning Matrix of Single-use Sensors Developers

- 13.6.1. Brand Positioning Matrix: Masterflex

- 13.6.2. Brand Positioning Matrix: Levitronix

- 13.6.3. Brand Positioning Matrix: Malema Engineering

- 13.6.4. Brand Positioning Matrix: Parken Hannifin

- 13.6.5. Brand Positioning Matrix: Pendo TECH

14. CASE STUDY: COST AND TIME SAVING POTENTIAL OF SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY

- 14.1. Chapter Overview

- 14.2. Overall Cost Saving Potential of Single-Use Upstream Bioprocessing Technology, Till 2035

- 14.2.1. Scenario 1

- 14.2.1.1. Key Assumptions and Methodology

- 14.2.1.2. Cost Saving Potential with Acquisition of Single-Use Upstream Technology, Till 2035

- 14.2.2. Scenario 2

- 14.2.2.1. Key Assumptions and Methodology

- 14.2.2.2. Cost Saving Potential with Implementation of Single-Use Upstream Bioprocessing Technology, Till 2035

- 14.2.1. Scenario 1

- 14.3. Overall Time Saving Potential of Single-Use Upstream Bioprocessing Technology, Till 2035

- 14.4. Concluding Remarks

15. DEMAND AND SUPPLY ANALYSIS

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Global Demand for Biologics, Till 2035

- 15.3.1. Demand Vs Supply Scenario 1

- 15.3.2. Demand Vs Supply Scenario 2

- 15.3.3. Demand Vs Supply Scenario 3

- 15.3.4. Demand Vs Supply Scenario 4

- 15.4. Concluding Remarks

16. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 16.1. Chapter Overview

- 16.2. Forecast Methodology and Key Assumptions

- 16.3. Global Single-use Upstream Bioprocessing Technology Market, Till 2035

- 16.3.1. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Scale of Operation

- 16.3.1.1. Global Single-use Upstream Bioprocessing Technology Market for Preclinical / Clinical Operations, Till 2035

- 16.3.1.2. Global Single-use Upstream Bioprocessing Technology Market for Commercial Operations, Till 2035

- 16.3.2. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Type of Equipment

- 16.3.2.1. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Bioreactors, Till 2035

- 16.3.2.2. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Mixers, Till 2035

- 16.3.2.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags, Till 2035

- 16.3.2.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters, Till 2035

- 16.3.2.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems, Till 2035

- 16.3.2.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors, Till 2035

- 16.3.2.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers, Till 2035

- 16.3.2.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies, Till 2035

- 16.3.3. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Geographical Region

- 16.3.3.1. Global Single-use Upstream Bioprocessing Technology Market in North America, Till 2035

- 16.3.2.1.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in North America, Till 2035

- 16.3.2.1.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in North America, Till 2035

- 16.3.2.1.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in North America, Till 2035

- 16.3.2.1.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in North America, Till 2035

- 16.3.2.1.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in North America, Till 2035

- 16.3.2.1.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in North America, Till 2035

- 16.3.2.1.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in North America, Till 2035

- 16.3.2.1.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in North America, Till 2035

- 16.3.3.2. Global Single-use Upstream Bioprocessing Technology Market in Europe, Till 2035

- 16.3.2.2.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Europe, Till 2035

- 16.3.2.2.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Europe, Till 2035

- 16.3.2.2.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Europe, Till 2035

- 16.3.2.2.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Europe, Till 2035

- 16.3.2.2.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Europe, Till 2035

- 16.3.2.2.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Europe, Till 2035

- 16.3.2.2.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Europe, Till 2035

- 16.3.2.2.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Europe, Till 2035

- 16.3.3.3. Global Single-use Upstream Bioprocessing Technology Market in Asia-Pacific, Till 2035

- 16.3.2.3.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Asia-Pacific, Till 2035

- 16.3.2.3.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Asia-Pacific, Till 2035

- 16.3.2.3.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Asia-Pacific, Till 2035

- 16.3.2.3.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Asia-Pacific, Till 2035

- 16.3.2.3.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Asia-Pacific, Till 2035

- 16.3.2.3.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Asia-Pacific, Till 2035

- 16.3.2.3.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Asia-Pacific, Till 2035

- 16.3.2.3.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Asia-Pacific, Till 2035

- 16.3.3.4. Global Single-use Upstream Bioprocessing Technology Market in Latin America, Till 2035

- 16.3.2.4.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Latin America, Till 2035

- 16.3.2.4.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Latin America, Till 2035

- 16.3.2.4.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Latin America, Till 2035

- 16.3.2.4.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Latin America, Till 2035

- 16.3.2.4.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Latin America, Till 2035

- 16.3.2.4.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Latin America, Till 2035

- 16.3.2.4.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Latin America, Till 2035

- 16.3.2.4.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Latin America, Till 2035

- 16.3.3.5. Global Single-Use Upstream Bioprocessing Technology Market in Middle East and North Africa, Till 2035

- 16.3.2.5.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Middle East and North Africa, Till 2035

- 16.3.2.5.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Middle East and North Africa, Till 2035

- 16.3.2.5.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Middle East and North Africa, Till 2035

- 16.3.2.5.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Middle East and North Africa, Till 2035

- 16.3.2.5.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Middle East and North Africa, Till 2035

- 16.3.2.5.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Middle East and North Africa, Till 2035

- 16.3.2.5.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Middle East and North Africa, Till 2035

- 16.3.2.5.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Middle East and North Africa, Till 2035

- 16.3.3.1. Global Single-use Upstream Bioprocessing Technology Market in North America, Till 2035

- 16.3.1. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Scale of Operation

17. CONCLUSION

- 17.1. Chapter Overview

18. EXECUTIVE INSIGHTS

19. APPENDIX 1: TABULATED DATA

20. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1. Single-use Bioreactors: Information on Developers, Scale of Operation, Key Features, Type of Cell Culture System, Type of Cell Culture, Type of Molecule and Application Areas

- Table 5.1. Single-use Mixers: Information on Developers, Scale of Operation, Type of Mixing System, Type of Molecule used, Key Features and Application Areas

- Table 6.1. Single-use Sensors: Information on Developers, Product Specific Details, Type of Bioprocessing, Sterilization Techniques used and Application Areas

- Table 7.1. Single-use Media Bags and Containers: Information on Developers, Purpose of Product, Type of Material / Tubing used, Key Features and Application Areas

- Table 7.2. Single-use Filters: Information on Developers, Material of Construction, Key Features and Application Areas

- Table 7.3. Single-use Connectors: Information on Developers, Material of Construction, Gender / Valve, Sterilizability, Key Features and Application Areas

- Table 7.4. Single-use Sampling Systems: Information on Developers, Tubing Material, Sampling Unit, Sterilizability, Key Features and Application Areas

- Table 9.1. Avantor: Product Portfolio (Single-use Bags and Containers)

- Table 9.2. Avantor: Product Portfolio (Single-use Mixers)

- Table 9.3. Cytiva: Product Portfolio (Single-use Bioreactors)

- Table 9.4. Cytiva: Product Portfolio (Single-use Mixers)

- Table 9.5. Merck KGaA: Product Portfolio (Single-use Bioreactors)

- Table 9.6. Merck KGaA: Product Portfolio (Single-use Mixers)

- Table 9.7. Merck KGaA: Product Portfolio (Single-use Filters)

- Table 9.8. Pall: Product Portfolio (Single-use Bioreactors)

- Table 9.9. Pall: Product Portfolio (Single-use Media Bags and Containers)

- Table 9.10. Pall: Product Portfolio (Single-use Mixers)

- Table 9.11. Thermo Fisher Scientific: Product Portfolio (Single-use Media Bags and Containers)

- Table 9.12. Thermo Fisher Scientific: Product Portfolio (Single-use Mixers)

- Table 10.1. Eppendorf: Product Portfolio (Single-use Bioreactors)

- Table 10.2. Saint Gobain: Product Portfolio (Single-use Media Bags and Containers)

- Table 10.3. Sartorius: Product Portfolio (Single-use Media Bags and Containers)

- Table 11.1. Satake Multimix: Product Portfolio (Single-use Bioreactors)

- Table 11.2. Reprocell: Product Portfolio (Single-use Bioreactors)

- Table 11.3. Premas Biotech: Product Portfolio (Single-use Bioreactors)

List of Figures

- Figure 4.1. Single-use Bioreactors: Distribution by Type of Bioreactor

- Figure 4.2. Single-use Bioreactors: Distribution by Scale of Operation

- Figure 4.3. Single-use Bioreactors: Distribution by Type of Cell Culture System

- Figure 4.4. Single-use Bioreactors: Distribution by Type of Cell Culture

- Figure 4.5. Single-use Bioreactors: Distribution by Type of Molecule Processed

- Figure 4.6. Single-use Bioreactors: Distribution by Key Features

- Figure 4.7. Single-use Bioreactors: Distribution by Application Area

- Figure 4.8. Single-use Bioreactors: Distribution by End Users

- Figure 4.9. Single-use Bioreactors: Distribution of Developers by Year of Establishment

- Figure 4.10. Single-use Bioreactors: Distribution of Developers by Company Size

- Figure 4.11. Single-use Bioreactors: Distribution of Developers by Leading Players

- Figure 4.12. Single-use Bioreactors: Distribution of Developers by Location of Headquarters

- Figure 5.1. Single-use Mixers: Distribution by Scale of Operation

- Figure 5.2. Single-use Mixers: Distribution by Type of Mixing System

- Figure 5.3. Single-use Mixers: Distribution by Type of Molecule Processed

- Figure 5.4. Single-use Mixers: Distribution by Key Features

- Figure 5.5. Single-use Mixers: Distribution by Application Area

- Figure 5.6. Single-use Mixers: Distribution of Developers by Year of Establishment

- Figure 5.7. Single-use Mixers: Distribution of Developers by Company Size

- Figure 5.8. Single-use Mixers: Distribution of Developers by Geographical Region

- Figure 5.9. Single-use Mixers: Distribution of Developers by Year of Establishment and Company Size

- Figure 5.10. Single-use Mixers: Distribution of Developers by Leading Players

- Figure 6.1. Single-use Sensors: Distribution by Type of Sensor

- Figure 6.2. Single-use Sensors: Distribution by Type of Sensor Calibration

- Figure 6.3. Single-use Sensors: Distribution by Sterilization Techniques

- Figure 6.4. Single-use Sensors: Distribution by Application Area

- Figure 6.5. Single-use Sensors: Distribution by Material of Construction

- Figure 6.6. Single-use Sensors: Distribution of Developers by Year of Establishment

- Figure 6.7. Single-use Sensors: Distribution of Developers by Company Size

- Figure 6.8. Single-use Sensors: Distribution of Developers by Geographical Region

- Figure 8.1. Product Competitiveness Analysis: Single-use Bioreactor developers based in North America

- Figure 8.2. Product Competitiveness Analysis: Single-use Bioreactor developers based in Europe

- Figure 8.3. Product Competitiveness Analysis: Single-use Bioreactor developers based in Asia-Pacific

- Figure 8.4. Product Competitiveness Analysis: Single-use Mixer developers based in North America

- Figure 8.5. Product Competitiveness Analysis: Single-use Mixer developers based in Europe

- Figure 8.6. Product Competitiveness Analysis: Single-use Sensor developers based in North America

- Figure 8.7. Product Competitiveness Analysis: Single-use Sensor developers based in Europe

- Figure 9.1. Avantor: Annual Revenues, 2016- 9M 2021 (USD Billion)

- Figure 9.2. Cytiva: Annual Revenues, 2016- 9M 2021 (USD Billion)

- Figure 9.3. Merck KGaA: Annual Revenues, 2017- 9M 2021 (USD Billion)

- Figure 9.4. Thermo Fisher Scientific: Annual Revenues, 2016- 9M 2021 (USD Billion)

- Figure 10.1. Eppendorf: Annual Revenues, 2016- 2020 (EUR Billion)

- Figure 10.2. Saint-Gobain: Annual Revenues, 2016- 9M 2021 (EUR Billion)

- Figure 10.3. Sartorius: Annual Revenues, 2016- 9M 2021 (EUR Billion)

- Figure 12.1. Patent Analysis: Cumulative Distribution by Publication Year

- Figure 12.2. Patent Analysis: Distribution by Type of Patents

- Figure 12.3. Patent Analysis: Geographical Distribution by Issuing Authority

- Figure 12.4. Patent Analysis: Cumulative Year wise trend of Patents

- Figure 12.5. Patent Analysis: Distribution by Type of Organization

- Figure 12.6. Patent Analysis: Distribution by Patent Age

- Figure 12.7. Patent Analysis: Distribution by Patent Valuation

- Figure 12.8. Patent Analysis: Distribution by Most Popular CPC Symbol

- Figure 12.9. Patent Analysis: Leading Industry Players

- Figure 12.10. Patent Analysis: Leading Academic Players

- Figure 12.11. Patent Analysis: Leading Patent Assignees

- Figure 13.1. Brand Positioning Matrix of Single-use Bioreactors: Pall

- Figure 13.2. Brand Positioning Matrix of Single-use Bioreactors: Eppendorf

- Figure 13.3. Brand Positioning Matrix of Single-use Bioreactors: Solaris Biotech

- Figure 13.4. Brand Positioning Matrix of Single-use Bioreactors: Sartorius Stedim Biotech

- Figure 13.5. Brand Positioning Matrix of Single-use Bioreactors: Applikon Biotechnology

- Figure 13.6. Brand Positioning Matrix of Single-use Bioreactors: CerCell

- Figure 13.7. Brand Positioning Matrix of Single-use Bioreactors: Sythecon

- Figure 13.8. Brand Positioning Matrix of Single-use Mixers: Thermo Fisher Scientific

- Figure 13.9. Brand Positioning Matrix of Single-use Mixers: Merck Millipore

- Figure 13.10. Brand Positioning Matrix of Single-use Mixers: Cytiva

- Figure 13.11. Brand Positioning Matrix of Single-use Mixers: Pall

- Figure 13.12. Brand Positioning Matrix of Single-use Sensors: Masterflex

- Figure 13.13. Brand Positioning Matrix of Single-use Sensors: Levitronix

- Figure 13.14. Brand Positioning Matrix of Single-use Sensors: Malema Engineering

- Figure 13.15. Brand Positioning Matrix of Single-use Sensors: Parken Hannif

- Figure 13.16. Brand Positioning Matrix of Single-use Sensors: Pendo TECH

- Figure 14.1. Cost Saving Analysis (Equipment Cost)

- Figure 14.2. Cost Saving Analysis (Manufacturing Cost)

- Figure 15.1. Demand and Supply Analysis: Demand for Biologics, Till 2035

- Figure 15.2. Demand and Supply Analysis: Demand and Supply, Till 2035

- Figure 16.1. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Scale of Operation

- Figure 16.2. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Type of Equipment

- Figure 16.3. Single-use Upstream Bioprocessing Technology Market for Single-use Filters, Till 2035

- Figure 16.4. Single-use Upstream Bioprocessing Technology Market for Single-use Media Bags, Till 2035

- Figure 16.5. Single-use Upstream Bioprocessing Technology Market for Single-use Bioreactors, Till 2035

- Figure 16.6. Single-use Upstream Bioprocessing Technology Market for Single-use Mixers, Till 2035

- Figure 16.7. Single-use Upstream Bioprocessing Technology Market for Single-use Connectors, Till 2035

- Figure 16.8. Single-use Upstream Bioprocessing Technology Market for Single-use Sampling Systems, Till 2035

- Figure 16.9. Single-use Upstream Bioprocessing Technology Market for Single-use Membrane Adsorbents, Till 2035

- Figure 16.10. Single-use Upstream Bioprocessing Technology Market for Other Single-use Technology, Till 2035

- Figure 16.11. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Geography

- Figure 16.12. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Geography

- Figure 16.13. Single-use Upstream Bioprocessing Technology Market in North America, Till 2035

- Figure 16.14. Single-use Upstream Bioprocessing Technology Market in North America, Till 2035: Distribution by Type of Equipment

- Figure 16.15. Single-use Upstream Bioprocessing Technology Market in Europe, Till 2035

- Figure 16.16. Single-use Upstream Bioprocessing Technology Market in Europe, Till 2035: Distribution by Type of Equipment

- Figure 16.17. Single-use Upstream Bioprocessing Technology Market in Asia-Pacific, Till 2035

- Figure 16.18. Single-use Upstream Bioprocessing Technology Market, Till 2035 in Asia-Pacific: Distribution by Type of Equipment

- Figure 16.19. Single-use Upstream Bioprocessing Technology Market in Latin America, Till 2035

- Figure 16.20. Single-use Upstream Bioprocessing Technology Market in Latin America, Till 2035: Distribution by Type of Equipment

- Figure 16.21. Single-use Upstream Bioprocessing Technology Market in Middle East and North Africa, Till 2035

- Figure 16.22. Single-use Upstream Bioprocessing Technology Market in Middle East and North Africa, Till 2035: Distribution by Type of Equipment