|

市场调查报告书

商品编码

1919787

人工智慧在临床试验中的应用市场-产业趋势及全球预测(至2040年)-依试验阶段、治疗领域、最终使用者及主要地区划分AI in Clinical Trials Market, till 2040: Distribution by Trial Phase, Target Therapeutic Area, End User and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

人工智慧(AI)在临床试验中的市场展望

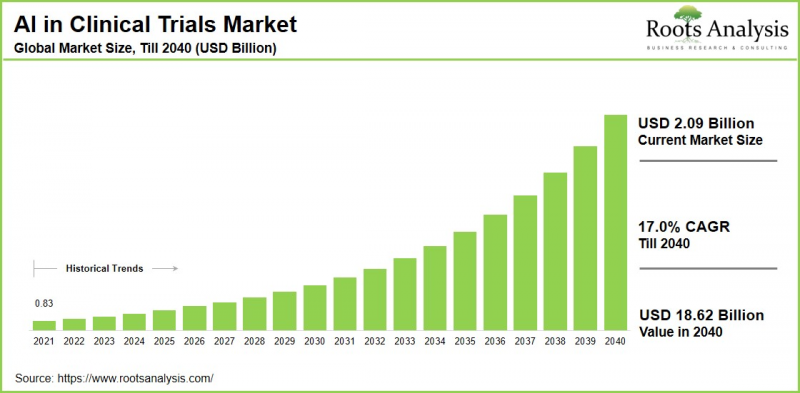

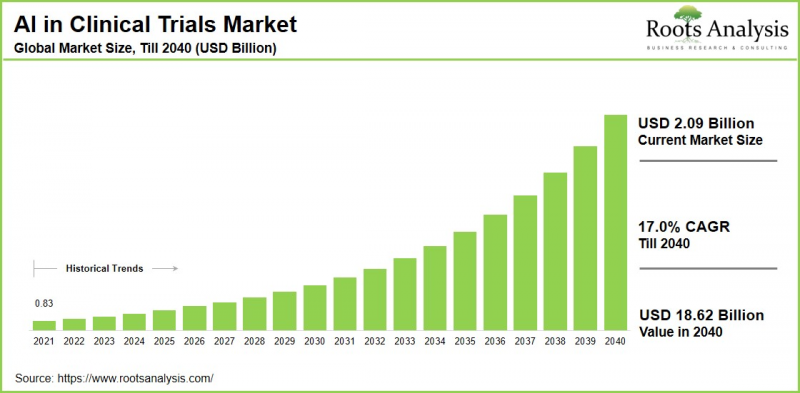

全球人工智慧在临床试验中的应用市场预计将从目前的20.9亿美元增长到2040年的186.2亿美元,在预测期内(至2040年)的复合年增长率(CAGR)为17.0%。

开发新疗法需要大量的时间和资金,通常需要10到15年。临床试验对于评估药物在人体的疗效和安全性至关重要,约占这些时间和预算的50%到70%。然而,许多试验由于设计缺陷、招募问题、分层错误和高脱落率而失败。为了应对这些挑战,製药业的利害关係人正在加速采用人工智慧,利用其处理大量资料集和优化试验的能力。

人工智慧正在变革临床试验。它透过精准匹配加速患者招募,利用数位孪生技术优化试验设计,并从包括电子健康记录 (EHR) 和诊断影像在内的多个资料来源中提取安全性和有效性讯号。它还能自动执行报告和监测等日常任务。鑑于这些因素,预计全球临床试验人工智慧市场在预测期内将显着成长。

高阶主管的策略洞察

人工智慧在临床试验中的关键角色与应用

人工智慧在整个临床试验过程中发挥着至关重要的作用,从患者招募和研究中心选择到研究设计、数据管理和结果预测。关键应用包括透过分析电子健康记录 (EHR) 和真实世界数据,利用机器学习进行精准的患者配对。人工智慧也被用于减少筛检失败率并加快患者招募。此外,人工智慧还能自动清理资料、侦测异常值、预测不良事件,并透过持续分析各种资料集来加强监测。这提高了效率、降低了成本并提高了试验成功率,从而支持个人化医疗方法。

推动临床试验市场人工智慧成长的关键市场驱动因素

由于几个关键的市场驱动因素,临床试验中的人工智慧市场正在快速扩张,其中包括透过分析电子健康记录和基因数据来简化患者招募流程。这种方法可以加快识别合适的候选者,并缩短试验时间和降低成本。预测分析和机器学习可以透过预测结果来优化试验设计,而真实世界数据的整合则可以深入了解患者行为。此外,对个人化医疗日益增长的需求、精准医疗的发展以及管理大量临床数据集的需求都在推动这些技术的应用。

人工智慧在临床试验中的应用:竞争格局

人工智慧在临床试验中的应用市场竞争激烈,大型企业和小型企业并存。 IQVIA、Medidata(达梭系统)、IBM Watson Health、Oracle Health Sciences 和 Phesi 等主要参与者凭藉其用于数据分析、患者匹配和试验优化的综合平台引领行业,并经常与辉瑞和诺华等製药公司合作。

AiCure、Deep 6 AI、Mendel.ai、Saama Technologies、Unlearn.ai、ConcertAI 和 Tempus AI 等新兴公司凭藉实时监测和预测建模等细分解决方案崭露头角,在对更高效药物研发的需求不断增长的背景下,加剧了市场竞争。

人工智慧在临床试验中的演进:新兴产业趋势

该领域的新兴趋势包括流程自动化、高阶患者配对和预测分析,这些技术可以显着降低成本并缩短时间。基于代理的人工智慧能够自主管理试验工作流程,从患者招募到即时风险监测以及自适应试验中的方案调整。与生成式人工智慧不同,它能够独立执行决策,从而减少人工操作并加快患者招募。生成式人工智慧可以自动起草方案,产生用于模型训练的合成资料集以及面向患者的内容,例如电子知情同意书。利用历史资料模拟场景可以优化试验设计,从而将开发时间缩短高达 50%,成本降低 25%。此外,数位孪生技术利用人工智慧和历史数据来模拟个别患者的反应,从而能够进行规模更小但统计效力更高的试验。

主要市场挑战

人工智慧在临床试验领域的市场面临诸多挑战,包括由于GDPR和HIPAA等严格的数据隐私法规而难以处理敏感的患者信息,以及与需要大量定制和互操作性标准的旧系统集成所面临的挑战。其他障碍还包括资料品质问题,例如真实世界资料集中的不完整性和偏差,以及在人工智慧专家短缺的情况下,基础设施开发前期成本高昂。这些因素要求製药公司、技术提供者和监管机构之间开展合作,以释放人工智慧在简化患者招募、监测和适应性设计方面的潜力。

临床试验中的人工智慧市场:主要市场区隔

试验阶段

- I期

- II期

- III期

目标治疗领域

- 心血管疾病

- 中枢神经系统疾病

- 传染病

- 代谢性疾病

- 肿瘤疾病

- 其他疾病

最终使用者

- 製药和生技公司

- 其他

地区

- 北美

- 美国美国

- 加拿大

- 墨西哥

- 其他北美国家

- 欧洲

- 奥地利

- 比利时

- 丹麦

- 法国

- 德国

- 爱尔兰

- 义大利

- 荷兰

- 挪威

- 俄罗斯

- 西班牙

- 瑞典

- 瑞士

- 英国

- 欧洲其他国家

- 亚洲

- 中国

- 印度

- 日本

- 新加坡

- 韩国

- 亚洲其他国家

- 拉丁美洲

- 巴西

- 智利

- 哥伦比亚

- 委内瑞拉

- 拉丁美洲其他国家

- 中东和北非非洲

- 埃及

- 伊朗

- 伊拉克

- 以色列

- 科威特

- 沙乌地阿拉伯

- 阿拉伯联合大公国

- 中东和北非其他地区

- 世界其他地区

- 澳大利亚

- 纽西兰

- 世界其他地区

人工智慧在临床试验市场中的应用:关键市场份额洞察

依治疗领域划分的市占率

依治疗领域划分,全球市场可细分为心血管疾病、中枢神经系统疾病、传染病、代谢性疾病、肿瘤和其他疾病。据我们估计,肿瘤目前占据了大部分市场份额。这主要是由于癌症临床试验规模庞大且复杂。这些试验会从基因组分析、影像诊断和电子健康记录中产生大量且多样化的数据集,而人工智慧可以有效分析这些数据,从而提高患者招募的准确性。

依地区划分的市占率

据我们估计,亚太地区目前在人工智慧临床试验市场中占据较大份额。这主要得益于该地区庞大且多元化的患者群体,使得在癌症和糖尿病等慢性疾病负担日益加重的情况下,能够快速招募患者参与临床试验。此外,该地区成本效益高的营运结构、不断完善的监管框架、政府激励措施以及不断扩展的生物技术基础设施,都在推动市场成长。

临床试验人工智慧市场代表性企业

- AiCure

- Antidote Technologies

- Deep 6 AI

- Innoplexus

- IQVIA

- Median Technologies

- Medidata

- Mendel.ai

- Phesi

- Saama Technologies

- Signant Health

- Trials.ai

临床试验人工智慧市场:报告内容

本报告涵盖以下关于临床试验人工智慧市场的章节:

- 市场规模与机会分析:对临床试验人工智慧市场进行详细分析,重点在于以下关键市场细分:[A] 试验阶段,[B] 目标治疗领域,[C] 最终用户,以及 [D] 主要地区。

- 竞争格局:基于多个相关参数,对参与人工智慧在临床试验市场中的公司进行全面分析,包括[A]成立年份、[B]公司规模、[C]总部所在地、[D]所有权结构。

- 公司简介:提供参与人工智慧在临床试验市场中的主要公司的详细简介,包括[A]总部所在地、[B]公司规模、[C]公司使命、[D]营运区域、[E]管理团队、[F]联络资讯、[G]财务资讯、[H]业务板块、[I]产品组合以及[J]近期发展和未来展望。

- 宏观趋势:评估人工智慧在临床试验产业当前的宏观趋势。

- 专利分析:基于相关参数,对人工智慧在临床试验领域已提交和授权的专利进行深入分析,这些参数包括:[A] 专利类型,[B] 专利公开年份,[C] 专利年龄,以及 [D] 主要参与者。

- 近期发展:概述人工智慧在临床试验市场近期的发展动态,并基于相关参数进行分析,这些参数包括:[A] 启动年份,[B] 启动类型,[C] 地理分布,以及 [D] 最活跃的参与者。

- 波特五力分析:分析人工智慧在临床试验市场的五种竞争力量(新进入者的威胁、买方的议价能力、供应商的议价能力、替代品的威胁、以及现有竞争对手之间的竞争)。

- SWOT 分析:深入的 SWOT 分析框架,突显该领域的优势、劣势、机会和威胁。此外,哈维鲍尔分析突显了每个 SWOT 参数的相对影响。

- 价值链分析:提供全面的价值链分析,介绍人工智慧在临床试验市场中涉及的各个阶段和利害关係人的资讯。

本报告解答的关键问题

- 当前市场规模与未来展望市场规模有多大?

- 该市场的主要参与者有哪些?

- 哪些成长因素可能影响该市场的发展?

- 哪些关键的合作和融资趋势正在塑造该产业?

- 预计到 2040 年,哪些地区的复合年增长率会较高?

- 当前和未来的市场机会预计将如何在主要细分市场中分布?

目录

第一章:引言

第二章:执行摘要

第三章:导论

- 章节概述

- 人工智慧的演进

- 人工智慧子领域

- 人工智慧在医疗保健领域的应用

- 人工智慧在临床试验的应用

- 人工智慧实施面临的挑战

- 未来展望

第四章:竞争格局

- 章节概述

- 人工智慧在临床试验中的应用:人工智慧软体和服务提供者的现状

第五章:公司简介

- 章节概述

- AiCure

- Antidote Technologies

- Deep 6 AI

- Innoplexus

- IQVIA

- Median Technologies

- Medidata

- Mendel.ai

- Phesi

- Saama Technologies

- Signant Health

- Trials.ai

第六章 临床试验分析

- 章节概述

- 研究范围与方法

- 人工智慧在临床试验的应用

第七章:合作与伙伴关係

- 章节概述

- 合作模式

- 人工智慧在临床试验中的应用:合作与伙伴关係合作

第八章:资金与投资

- 章节概述

- 资金类型

- 人工智慧在临床试验中的应用:资金与投资

- 结论

第九章:主要药学项目

- 章节概述

- 范围与研究方法

- 依专案年份分析

- 依项目类型分析

- 按人工智慧应用领域分析

- 依治疗领域分析

- 基准分析:主要药厂公司

第十章 人工智慧在临床试验中的应用:用例

- 章节概述

- 用例 1:罗氏与 AiCure 的合作

- 用例 2:武田与AiCure 合作案例

- 用例 3:梯瓦製药与英特尔合作案例

- 用例 4:私人製药公司与 Antidote 合作案例

- 用例 5:私人製药公司与 Cognizant 合作案例

- 用例 6:西达赛奈医疗中心与 Deep 6 AI 合作案例

- 用例 7:葛兰素史克 (GSK) 与 PathAI 合作案例

- 用例 8:百时美施贵宝 (BMS) 与 Concert AI 合作案例

第 11 章:价值创造架构:解决临床试验中未满足需求的策略指引

第 12 章:成本降低分析

第 13 章:市场预测与机会分析

- 章节概述

- 关键假设与预测研究方法

- 全球人工智慧在临床试验中的应用市场

- 按试验阶段划分的人工智慧在临床试验中的应用市场

- 按治疗领域划分的人工智慧在临床试验中的应用市场

- 按最终用户划分的人工智慧在临床试验中的应用市场

- 按主要地区划分的人工智慧在临床试验中的应用市场

第14章:结论

第15章:高阶主管洞察

第16章:附录一:表格资料

第17章:附录二:公司与组织清单

AI In Clinical Trials Market Outlook

As per Roots Analysis, the global artificial intelligence in clinical trials market size is estimated to grow from USD 2.09 billion in the current year to USD 18.62 billion by 2040, at a CAGR of 17.0% during the forecast period, till 2040.

Developing novel therapeutic interventions demands substantial time and financial resources, typically spanning about 10-15 years. Clinical trials, essential for evaluating efficacy and safety in humans, consume roughly 50-70% of this timeline and budget, yet many fail due to design flaws, recruitment issues, stratification errors, and high dropout rates. Therefore, pharma stakeholders are increasingly adopting AI to mitigate these hurdles, leveraging its capacity to process vast datasets for smarter trial optimization.

It is worth mentioning that artificial intelligence transforms clinical trials by accelerating patient recruitment through precise matching, refining trial designs via digital twins, and extracting safety and efficacy signals from multifaceted data sources like EHRs and imaging. Further, it automates the routine tasks such as reporting and monitoring. Overall, considering the above mentioned factors, the global AI in clinical trials market is expected to grow significantly during the forecast period.

Strategic Insights for Senior Leaders

Key Roles and Applications of AI in Clinical Trials

AI plays pivotal roles across clinical trials, from patient recruitment and site selection to trial design, data management, and outcome prediction. Key applications include using machine learning to analyze electronic health records and real-world data for precise patient matching. Further, it is used for reducing screen failures and accelerating enrollment. AI also automates data cleaning, detects anomalies, forecasts adverse events, and enhances monitoring through continuous analysis of diverse datasets. This enables improvement in efficiency, cutting costs, and boosting trial success rates while supporting personalized medicine approaches.

Prominent Drivers Propelling Growth of AI in Clinical Trials Market

The AI in clinical trials market is expanding rapidly due to several critical drivers, including enhanced patient recruitment through analysis of electronic health records and genetic data. This approach accelerates identification of suitable candidates and reduces trial timelines and costs. Predictive analytics and machine learning enable optimized trial designs by forecasting outcomes, while integration of real-world data provides deeper insights into patient behaviors. Further, rising demand for personalized medicine, growth in precision therapies, and the need to manage vast clinical datasets fuel adoption of such technologies.

AI in Clinical Trials Market: Competitive Landscape of Companies in this Industry

The competitive landscape of AI in clinical trials market is characterized by intense competition, featuring a combination of large and smaller firms. Key players such as IQVIA, Medidata (Dassault Systemes), IBM Watson Health, Oracle Health Sciences, and Phesi dominate through comprehensive platforms for data analytics, patient matching, and trial optimization, often collaborating with pharmaceutical firms like Pfizer and Novartis.

Emerging companies including AiCure, Deep 6 AI, Mendel.ai, Saama Technologies, Unlearn.ai, ConcertAI, and Tempus AI are gaining traction with niche solutions like real-time monitoring, and predictive modeling, intensifying competition amid rising demand for efficiency in drug development.

AI in Clinical Trials Evolution: Emerging Trends in the Industry

Emerging trends in this domain include automating processes, enhancing patient matching, and enabling predictive analytics to cut costs and timelines significantly. Agentic AI autonomously manages trial workflows, from patient recruitment to real-time risk monitoring and protocol adjustments in adaptive trials. Unlike generative AI, it executes decisions independently, reducing manual tasks and accelerating enrollment. Generative AI draft protocols, creates synthetic datasets for training models, and automates patient-facing content like eConsent. It optimizes trial design by simulating scenarios from historical data, potentially cutting development time by 50% and costs by 25%. Additionally, digital twins simulate individual patient responses using AI and historical data, enabling smaller trials with higher statistical power.

Key Market Challenges

The market for AI in clinical trials faces significant challenges, including stringent data privacy regulations like GDPR and HIPAA that complicate handling sensitive patient information, integration hurdles with legacy systems requiring substantial customization and interoperability standards. Additional barriers encompass data quality issues such as incompleteness and bias in real-world datasets, high upfront costs for infrastructure amid a shortage of AI-savvy clinicians. These factors necessitate collaborative efforts between pharma firms, tech providers, and regulators to unlock AI's potential in streamlining recruitment, monitoring, and adaptive designs.

AI In Clinical Trials Market: Key Market Segmentation

Trial Phase

- Phase I

- Phase II

- Phase III

Target Therapeutic Area

- Cardiovascular Disorders

- CNS Disorders

- Infectious Diseases

- Metabolic Disorders

- Oncological Disorders

- Other Disorders

End-user

- Pharmaceutical and Biotechnology Companies

- Other End-users

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

AI in clinical trials Market: Key Market Share Insights

Market Share by Therapeutic Area

Based on the therapeutic area, the global market is segmented into cardiovascular disorders, CNS disorders, infectious diseases, metabolic disorders, oncological disorders and other disorders. According to our estimates, currently, oncological disorders capture majority share of the market. This is due to the high volume and complexity of cancer trials; these trials generate vast, heterogeneous datasets from genomics, imaging, and electronic health records, which AI efficiently analyzes for precise patient recruitment.

Market Share by Geography

According to our estimates Asia-Pacific currently captures a significant share of the AI in clinical trials market. This is due to the massive, diverse patient population, offering rapid recruitment for trials amid rising chronic disease burdens like cancer and diabetes. Further, the region has cost-effective operations along with improving regulatory frameworks, government incentives, and expanding biotech infrastructure which fuels the growth.

Example Players in AI in Clinical Trials Market

- AiCure

- Antidote Technologies

- Deep 6 AI

- Innoplexus

- IQVIA

- Median Technologies

- Medidata

- Mendel.ai

- Phesi

- Saama Technologies

- Signant Health

- Trials.ai

AI in Clinical Trials Market: Report Coverage

The report on the AI in clinical trials market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the AI in clinical trials market, focusing on key market segments, including [A] trial phase, [B] target therapeutic area, [C] end user, and [D] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the AI in clinical trials market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the AI in clinical trials market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the AI in clinical trials industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the AI in clinical trials domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the AI in clinical trials market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the AI in clinical trials market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the AI in clinical trials market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2040?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Evolution of AI

- 3.3. Subfields of AI

- 3.4. Applications of AI in Healthcare

- 3.4.1. Drug Discovery

- 3.4.2. Drug Manufacturing

- 3.4.3. Marketing

- 3.4.4. Diagnosis and Treatment

- 3.4.5. Clinical Trials

- 3.5. Applications of AI in Clinical Trials

- 3.6. Challenges Associated with the Adoption of AI

- 3.7. Future Perspective

4. COMPETITIVE LANDSCAPE

- 4.1. Chapter Overview

- 4.2. AI in Clinical Trials: AI Software and Service Providers Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters (Region-wise)

- 4.2.5. Analysis by Key Offering

- 4.2.6. Analysis by Business Model

- 4.2.7. Analysis by Deployment Option

- 4.2.8. Analysis by Type of AI Technology

- 4.2.9. Analysis by Application Area

- 4.2.10. Analysis by Potential End-user

5. COMPANY PROFILES

- 5.1. Chapter Overview

- 5.2. AiCure

- 5.2.1. Company Overview

- 5.2.2. AI-based Clinical Trial Offerings

- 5.2.3. Recent Developments and Future Outlook

- 5.3. Antidote Technologies

- 5.3.1. Company Overview

- 5.3.2. AI-based Clinical Trial Offerings

- 5.3.3. Recent Developments and Future Outlook

- 5.4. Deep 6 AI

- 5.4.1. Company Overview

- 5.4.2. AI-based Clinical Trial Offerings

- 5.4.3. Recent Developments and Future Outlook

- 5.5. Innoplexus

- 5.5.1. Company Overview

- 5.5.2. AI-based Clinical Trial Offerings

- 5.5.3. Recent Developments and Future Outlook

- 5.6. IQVIA

- 5.6.1. Company Overview

- 5.6.2. Financial Information

- 5.6.3. AI-based Clinical Trial Offerings

- 5.6.4. Recent Developments and Future Outlook

- 5.7. Median Technologies

- 5.7.1. Company Overview

- 5.7.2. Financial Information

- 5.7.3. AI-based Clinical Trial Offerings

- 5.7.4. Recent Developments and Future Outlook

- 5.8. Medidata

- 5.8.1. Company Overview

- 5.8.2. Financial Information

- 5.8.3. AI-based Clinical Trial Offerings

- 5.8.4. Recent Developments and Future Outlook

- 5.9. Mendel.ai

- 5.9.1. Company Overview

- 5.9.2. AI-based Clinical Trial Offerings

- 5.9.3. Recent Developments and Future Outlook

- 5.10. Phesi

- 5.10.1. Company Overview

- 5.10.2. AI-based Clinical Trial Offerings

- 5.10.3. Recent Developments and Future Outlook

- 5.11. Saama Technologies

- 5.11.1. Company Overview

- 5.11.2. AI-based Clinical Trial Offerings

- 5.11.3. Recent Developments and Future Outlook

- 5.12. Signant Health

- 5.12.1. Company Overview

- 5.12.2. AI-based Clinical Trial Offerings

- 5.12.3. Recent Developments and Future Outlook

- 5.13. Trials.ai

- 5.13.1. Company Overview

- 5.13.2. AI-based Clinical Trial Offerings

- 5.13.3. Recent Developments and Future Outlook

6. CLINICAL TRIAL ANALYSIS

- 6.1. Chapter Overview

- 6.2. Scope and Methodology

- 6.3. AI in Clinical Trials

- 6.3.1. Analysis by Trial Registration Year

- 6.3.2. Analysis by Number of Patients Enrolled

- 6.3.3. Analysis by Trial Phase

- 6.3.4. Analysis by Trial Status

- 6.3.5. Analysis by Trial Registration Year and Status

- 6.3.6. Analysis by Type of Sponsor

- 6.3.7. Analysis by Patient Gender

- 6.3.8. Analysis by Patient Age

- 6.3.9. Word Cloud Analysis: Emerging Focus Areas

- 6.3.10. Analysis by Target Therapeutic Area

- 6.3.11. Analysis by Study Design

- 6.3.11.1. Analysis by Type of Patient Allocation Model Used

- 6.3.11.2. Analysis by Type of Trial Masking Adopted

- 6.3.11.3. Analysis by Type of Intervention

- 6.3.11.4. Analysis by Trial Purpose

- 6.3.12. Most Active Players: Analysis by Number of Clinical Trials

- 6.3.13. Analysis of Clinical Trials by Geography

- 6.3.14. Analysis of Clinical Trials by Geography and Trial Status

- 6.3.15. Analysis of Patients Enrolled by Geography and Trial Registration Year

- 6.3.16. Analysis of Patients Enrolled by Geography and Trial Status

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Chapter Overview

- 7.2. Partnership Models

- 7.3. AI in Clinical Trials: Partnerships and Collaborations

- 7.3.1. Analysis by Year of Partnership

- 7.3.2. Analysis by Type of Partnership

- 7.3.3. Analysis by Year and Type of Partnership

- 7.3.4. Analysis by Application Area

- 7.3.5. Analysis by Target Therapeutic Area

- 7.3.6. Analysis by Type of Partner

- 7.3.7. Most Active Players: Analysis by Number of Partnerships

- 7.3.8. Analysis by Geography

- 7.3.8.1. Local and International Agreements

- 7.3.8.2. Intercontinental and Intracontinental Agreements

8. FUNDING AND INVESTMENTS

- 8.1. Chapter Overview

- 8.2. Types of Funding

- 8.3. AI in Clinical Trials: Funding and Investments

- 8.3.1. Analysis by Year of Funding

- 8.3.2. Analysis by Amount Invested

- 8.3.3. Analysis by Type of Funding

- 8.3.4. Analysis by Year and Type of Funding

- 8.3.5. Analysis by Type of Funding and Amount Invested

- 8.3.6. Analysis by Application Area

- 8.3.7. Analysis by Geography

- 8.3.8. Most Active Players: Analysis by Number of Funding Instances and Amount Raised

- 8.3.9. Leading Investors: Analysis by Number of Funding Instances

- 8.4. Concluding Remarks

9. BIG PHARMA INITIATIVES

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Analysis by Year of Initiative

- 9.4. Analysis by Type of Initiative

- 9.5. Analysis by Application Area of AI

- 9.6. Analysis by Target Therapeutic Area

- 9.7. Benchmarking Analysis: Big Pharma Players

10. AI IN CLINICAL TRIALS: USE CASES

- 10.1. Chapter Overview

- 10.2. Use Case 1: Collaboration between Roche and AiCure

- 10.2.1. Roche

- 10.2.2. AiCure

- 10.2.3. Business Needs

- 10.2.4. Objectives Achieved and Solutions Provided

- 10.3. Use Case 2: Collaboration between Takeda and AiCure

- 10.3.1. Takeda

- 10.3.2. AiCure

- 10.3.3. Business Needs

- 10.3.4. Objectives Achieved and Solutions Provided

- 10.4. Use Case 3: Collaboration between Teva Pharmaceuticals and Intel

- 10.4.1. Teva Pharmaceuticals

- 10.4.2. Intel

- 10.4.3. Business Needs

- 10.4.4. Objectives Achieved and Solutions Provided

- 10.5. Use Case 4: Collaboration between Undisclosed Pharmaceutical Company and Antidote

- 10.5.1. Antidote

- 10.5.2. Business Needs

- 10.5.3. Objectives Achieved and Solutions Provided

- 10.6. Use Case 5: Collaboration between Undisclosed Pharmaceutical Company and Cognizant

- 10.6.1. Cognizant

- 10.6.2. Business Needs

- 10.6.3. Objectives Achieved and Solutions Offered

- 10.7. Use Case 6: Collaboration between Cedars-Sinai Medical Center and Deep 6 AI

- 10.7.1. Cedars-Sinai Medical Center

- 10.7.2. Deep 6 AI

- 10.7.3. Business Needs

- 10.7.4. Objectives Achieved and Solutions Offered

- 10.8. Use Case 7: Collaboration between GlaxoSmithKline (GSK) and PathAI

- 10.8.1. PathAI

- 10.8.2. GlaxoSmithKline (GSK)

- 10.8.3. Business Needs

- 10.8.4. Objectives Achieved and Solutions Provided

- 10.9. Use Case 8: Collaboration between Bristol Myers Squibb (BMS) and Concert AI

- 10.9.1. Concert AI

- 10.9.2. Bristol Myers Squibb (BMS)

- 10.9.3. Business Needs

- 10.9.4. Objectives Achieved and Solutions Provided

11. VALUE CREATION FRAMEWORK: A STRATEGIC GUIDE TO ADDRESS UNMET NEEDS IN CLINICAL TRIALS

12. COST SAVING ANALYSIS

13. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Forecast Methodology

- 13.3. Global AI in Clinical Trials Market

- 13.3.1. AI in Clinical Trials Market: Distribution by Trial Phase

- 13.3.1.1. AI in Clinical Trials Market for Phase I

- 13.3.1.2. AI in Clinical Trials Market for Phase II

- 13.3.1.3. AI in Clinical Trials Market for Phase III

- 13.3.2. AI in Clinical Trials Market: Distribution by Target Therapeutic Area

- 13.3.2.1. AI in Clinical Trials Market for Cardiovascular Disorders

- 13.3.2.2. AI in Clinical Trials Market for CNS Disorders

- 13.3.2.3. AI in Clinical Trials Market for Infectious Diseases

- 13.3.2.4. AI in Clinical Trials Market for Metabolic Disorders

- 13.3.2.5. AI in Clinical Trials Market for Oncological Disorders

- 13.3.2.6. AI in Clinical Trials Market for Other Disorders

- 13.3.3. AI in Clinical Trials Market: Distribution by End-user

- 13.3.3.1. AI in Clinical Trials Market for Pharmaceutical and Biotechnology Companies

- 13.3.3.2. AI in Clinical Trials Market for Other End-users

- 13.3.4. AI in Clinical Trials Market: Distribution by Key Geographical Regions

- 13.3.4.1. AI in Clinical Trials Market in North America

- 13.3.4.2. AI in Clinical Trials Market in Europe

- 13.3.4.3. AI in Clinical Trials Market in Asia-Pacific

- 13.3.4.4. AI in Clinical Trials Market in Middle East and North Africa

- 13.3.4.5. AI in Clinical Trials Market in Latin America

- 13.3.1. AI in Clinical Trials Market: Distribution by Trial Phase

14. CONCLUSION

15.. EXECUTIVE INSIGHTS

- 15.1. Chapter Overview

- 15.2. Company A

- 15.2.1. Company Snapshot

- 15.2.2. Interview Transcript: Danielle Ralic, Co-Founder, Chief Executive Officer and Chief Technology Officer

- 15.3. Company B

- 15.3.1. Company Snapshot

- 15.3.2. Interview Transcript: Wout Brusselaers, Founder and Chief Executive Officer

- 15.4. Company C

- 15.4.1. Company Snapshot

- 15.4.2. Interview Transcript: Dimitrios Skaltsas, Co-Founder and Executive Director

- 15.5. Company D

- 15.5.1. Company Snapshot

- 15.5.2. Interview Transcript: R. A. Bavasso, Founder and Chief Executive Officer

- 15.6. Company E

- 15.6.1. Company Snapshot

- 15.6.2. Interview Transcript: Troy Bryenton (Chief Technology Officer), Michael Shipton (Chief Commercial Officer), Darcy Forman (Chief Delivery Officer), Grazia Mohren (Head of Marketing)