|

市场调查报告书

商品编码

1132150

锂金属负极技术发展趋势与市场展望:2022年<2022> Li Metal Anode Technology Development Trends and Market Outlook |

||||||

进入21世纪,为保护地球环境和建设可持续发展社会开展了各种活动,发展清洁能源技术的需求日益增加。 充电电池产业是环保能源的代表产业之一。 随着交通工具从以内燃机为动力的车辆向电动汽车转变,对各种锂离子电池的研究比以往任何时候都更加活跃。

本报告聚焦被认为是未来最具发展前景的负极材料之一的金属锂,探讨了近期的技术趋势以及韩国、中国、日本等国家的金属锂技术,内容涵盖详细的研发现状 它从供应商和消费者的角度分析市场趋势,并基于 ICE xEV 市场提供到 2030 年锂金属负极市场的需求和市场规模预测。

报告优势:

- 1.金属锂生产技术概述及存在的问题

- 2.了解锂金属负极整体研发趋势

- 3. 主要锂金属正极企业及其技术趋势和战略

内容

第一章介绍

- LIB 要求

- LIB发展趋势

第2章正极材料技术及发展趋势

- LIB 阳极概述

- 锂离子电池正极材料发展趋势

第3章金属锂生产技术及供应情况

- 锂生产供应情况

- 锂金属生产技术

- 锂金属生产问题

第 4 章锂金属负极技术和主要特征

- 锂金属阳极概述

- 锂金属负极发展史

- 锂金属负极研究与发展趋势

- 锂金属负极问题

第五章锂金属发展现状:分公司

- 概览

- 亚洲公司

- Samsung SDI

- LGES

- SK on

- CATL

- Prologium

- Hyundai Motor

- POSCO Chem.

- Neba Corp

- Ulvac Inc

- Santoku

- Honjo metal

- Wuxi Sunenergy Lithium Industrial Co

- China Energy Lithium Co

- Ganfeng Lithium

- Tianqi Lithium

- Softbank Next-generation Lab

- AIST

- NIMS - ALCA SPRING

- 欧洲企业

- Blue Solutions

- Volkswagen

- DAIMLER

- SIDRABE

- IMEC

- 北美企业

- SES

- QuantumScape

- Solid Power

- SOELECT

- TeraWatt

- Hydro Quebec

- Brightvolt

- Sion Power

- SEEO

- Cuberg

- Enpower Greentech

- PolyPlus

- Sepion Technologies Inc

- Ion Storage Systems

- GM

- Li Metal Corp

- Ionic Materials

- Albemarle

- SQM

- Livent Corp

- Pure Lithium Corp

- 主要公司概览

第 6 章锂金属负极市场展望(至 2030 年)

- 概览

- 锂金属正极电池的种类及锂金属的成本构成

- 锂金属阳极应用路线图

- 锂金属负极的商业化场景

- 锂金属负极市场展望

- 锂金属阳极的需求前景

- 锂金属阳极的价格展望(保守情景)

- 锂金属阳极的价格前景(乐观情景)

- 锂金属负极价格展望基础

- 锂金属阳极的市场规模前景(保守情景)

- 锂金属阳极的市场规模前景(乐观情景)

- 整体 LMB 价格前景(保守情景)

- LMB 价格前景稳定(乐观情景)

- 整体 LMB 价格前景(保守情景)

- LMB 价格前景稳定(乐观情景)

- 全固态LMB使用率

- 锂金属阳极前景:按应用分类

Amidst various activities to conserve the environment and establish a sustainable society carried out across the board and stricter environment regulations in place to address ever-worsening climate change issues in the 21st century, there has been a growing significance on the necessity of developing renewable energy and clean energy technologies. The secondary battery industry is one of the representative industries for eco-friendly energy. As our means of transportation has been transformed from vehicles with internal combustion engine to electric vehicles, research on various types of lithium-ion battery has become more active than ever before.

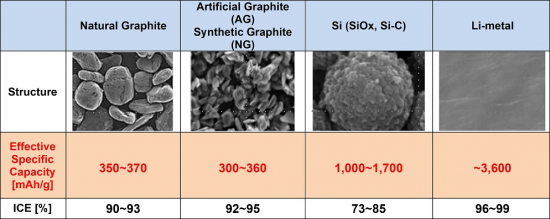

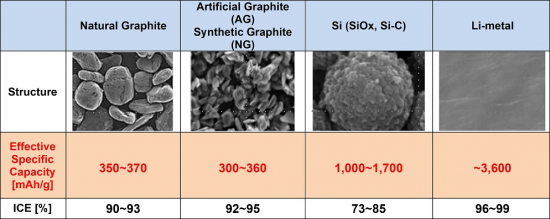

Since the commercialization of lithium-ion battery in the 1990s, lithium-ion battery has been successfully utilized as a power source for commercial electronic products and electric vehicles for the past several decades. However, the existing lithium-ion battery using a graphite anode has low theoretical capacity (~372 mAh/g) and volumetric capacity (~735 mAh/cm3) of anode, which imposes a limit on the upward adjustment of energy density achieved by lithium-ion battery. To meet a growing demand of lithium secondary battery, a new battery technology transcending the existing lithium-ion battery should be inevitably pursued.

Lithium metal has significantly high, theoretical capacity (~3860 mAh/g), very low electrochemical potential (-3.04 V, compared to hydrogen electrode), and very low density (0.53g/cm3). Thanks to these characteristics, lithium metal anode is evaluated as the most potential material that can achieve high capacity and power output per unit weight and unit volume.

This report covers the recent technology trend with a focus on lithium metal that is regarded as one of the most promising materials for anode in future. In addition, the report also takes a close look at the status of research and development of lithium metal technology in Korea, China, Japan, and other countries. In the final part, the report analyzes the market trend both from the perspectives of suppliers and consumers. In addition, the report offers a forecast on the lithium metal anode market demand and market scale till 2030 based on the ICE and xEV markets.

This report has the following strong points:

- 1. Overview of Li Metal Production Technology and Issues

- 2. Understanding of Overall Research and Development Trend for Li Metal Anode

- 3. Major Players for Li Metal Anode and Their Technology Trend and Strategy

Table of Contents

1. Introduction

- 1.1 LIB Requirements

- 1.2 LIB Development Trend

2. Anode Material Technology and Development Trend

- 2.1 LIB Anode Overview

- 2.2 LIB Anode Material Development Trend

3. Li Metal Manufacturing Technology and Supply Status

- 3.1 Lithium Production and Supply Status

- 3.1.1 Lithium world reserves - consumption

- 3.1.2 World Li Volumes - Current Production

- 3.1.3 World Li mine Production - Demand

- 3.1.4 Li resources : Mineral

- 3.1.5 Li resources : Ores

- 3.1.6 Li resources : Brines

- 3.1.7 Li Materials Supply Structure

- 3.2 Li Metal Manufacturing Technology

- 3.2.1 Li material technology

- 3.2.2 Li thin film technology

- 3.3 Li Metal Production Issues

- 3.3.1 Li thin film technology limitations

- 3.3.2 Cost Structure

4. Li Metal Anode Technology and Major Characteristics

- 4.1 Li Metal Anode Overview

- 4.2 Li Metal Anode Development History

- 4.2.1 History Overview

- 4.2.2 Li metal battery(LMB) History

- 4.2.3 Li metal battery(LMB) Initial Development

- 4.2.4 LIB Development & Market Domination

- 4.2.5 Emergence of Necessity for LMB

- 4.3 Li metal anode R&D Trend

- 4.3.1 Artificial surface protective film (ASEI formation)

- 4.3.2 New Structure

- 4.3.3 Electrolyte modification

- 4.4 Li metal anode issue

- 4.4.1 Li dendritic growth

- 4.4.2 SEI Layer issue

5. Li Metal Development Status by Company

- 5.1 Overview

- 5.2 Companies in Asia

- 5.2.1 Samsung SDI

- 5.2.2 LGES

- 5.2.3 SK on

- 5.2.4 CATL

- 5.2.5 Prologium

- 5.2.6 Hyundai Motor

- 5.2.7 POSCO Chem.

- 5.2.8 Neba Corp

- 5.2.9 Ulvac Inc

- 5.2.10 Santoku

- 5.2.11 Honjo metal

- 5.2.12 Wuxi Sunenergy Lithium Industrial Co

- 5.2.13 China Energy Lithium Co

- 5.2.14 Ganfeng Lithium

- 5.2.15 Tianqi Lithium

- 5.2.16 Softbank Next-generation Lab

- 5.2.17 AIST

- 5.2.18 NIMS - ALCA SPRING

- 5.3 Companies in Europe

- 5.3.1 Blue Solutions

- 5.3.2 Volkswagen

- 5.3.3 DAIMLER

- 5.3.4 SIDRABE

- 5.3.5 IMEC

- 5.4 Companies in North America

- 5.4.1 SES

- 5.4.2 QuantumScape

- 5.4.3 Solid Power

- 5.4.4 SOELECT

- 5.4.5 TeraWatt

- 5.4.6 Hydro Quebec

- 5.4.7 Brightvolt

- 5.4.8 Sion Power

- 5.4.9 SEEO

- 5.4.10 Cuberg

- 5.4.11 Enpower Greentech

- 5.4.12 PolyPlus

- 5.4.13 Sepion Technologies Inc

- 5.4.14 Ion Storage Systems

- 5.4.15 GM

- 5.4.16 Li Metal Corp

- 5.4.17 Ionic Materials

- 5.4.18 Albemarle

- 5.4.19 SQM

- 5.4.20 Livent Corp

- 5.4.21 Pure Lithium Corp

- 5.5 Summary of Major Companies

6. Outlook for Li Metal Anode Market (~`30)

- 6.1 Overview

- 6.1.1 Types of Li metal anode batteries & Composition of Li metal costs

- 6.1.2 Roadmap of Li-metal-anode application

- 6.1.3 Commercialization scenario of Li metal anode

- 6.2 Outlook for Li metal anode market

- 6.2.1 Outlook for Li metal anode demand

- 6.2.2 Outlook for Li metal anode price (Conservative Scenario)

- 6.2.3 Outlook for Li metal anode price (Optimistic Scenario)

- 6.2.4 Base for Price Outlook of Li metal anode

- 6.2.5 Outlook for Li metal anode market mize (Conservative Scenario)

- 6.2.6 Outlook for Li metal anode market mize (Optimistic Scenario)

- 6.2.7 Outlook for Price of All-solid-state LMBs (Conservative)

- 6.2.8 Outlook for price of all-solid-state LMBs (Optimistic)

- 6.2.9 Outlook for Price of All-solid-state LMBs (Conservative)

- 6.2.10 Outlook for Price of All-solid-state LMBs (Optimistic)

- 6.2.11 Percentage of usage of all-solid-state LMBs

- 6.2.12 Outlook for Li metal anode by Application