|

市场调查报告书

商品编码

1343611

锂离子电池电解液:技术趋势与市场预测(至2030年)<2023> Lithium-Ion Battery Electrolyte Technology Trends and Market Forecast (~2030) |

||||||

近年来,二次电池市场已从小型IT应用扩展到ESS和电动车。 Panasonic等研发充电电池并引领该行业的日本企业正在输给LGES等韩国巨头,而CATL、BYD、CALB等中国企业则在中国政府的支持和无限的国内市场中苦苦挣扎。在此背景下进一步扩大M/S。 韩国、中国和日本的 "三边体系" 预计将暂时持续,但随着电动车市场的扩大,北美和欧洲也对大型製造和材料市场表现出持续的兴趣。容量二次电池。马苏。 特别是,由于每个国家的市场状况以及法规和政策,二次电池市场的性质预计将发生重大变化。

电解液主要由溶剂、锂盐和添加剂组成。 根据产品的性质,电解质是与锂离子二次电池製造商合作开发的。 小型IT类产品的开发週期短至3至4个月,但xEV电解液的开发和评估需要一年以上的时间。 需要卓越的研发能力来开发和应对各种满足客户需求的产品。

电解液市场曾经由日本和韩国占据主导地位,但由于近年来中国企业的快速成长,前三名的份额已经输给了中国企业。 在韩国,Donghwa Electrolyte、Soulbrain和Enchem与三大锂离子二次电池公司(Samsung SDI、LG Energy Solution和SK energy)一起成长为电解液供应商。 在日本,Mitsubishi Chemical正在使其客户组合多元化,生产 IT 小型电池、xEV 中型电池和大型电池。 在中国,Tinci、Guotai-Huarong、Capchem占据市场主导地位。

电解液的主要成分锂盐(LiPF6)先前主要由日本企业供应,但随着中国企业扩大产能,情况发生了变化。 在韩国,Foosung 量产通用锂盐(LiPF6),Chunbo 量产特殊锂盐(LiFSI、LiPO2F2、LiDFOP、LiBOB)。 在电解液製造过程中添加添加剂以提高锂离子二次电池的寿命和稳定性,包括SEI保护、防过充剂和导电性。 添加剂市场由日本公司主导,但在韩国,Chunbo和Chemtros是主要供应商。

电解质是构成二次电池的四种主要材料之一。 在典型的锂离子二次电池的製造成本结构中,重要性按以下顺序排列:阳极材料>隔膜>阴极材料>电解质。 为了提高单位电池的能量密度,二次电池製造商正在增加阳极和阴极材料的用量并减少电解液的用量。 不过,从2022年到2030年,电池市场预计将以每年平均约23%(容量比)的速度成长。 电解液市场预计将相应成长。

在用于电动车和ESS的大型二次电池中,每个单元电池的电解液用量约为IT的200至4,000倍,因此确保稳定性是一个特别重要的问题。 除了目前已实用化的液态电解质和凝胶状聚合物电解质(聚合物)外,正在研究开发提高高温稳定性优异的固态聚合物电解质和全固态陶瓷电解质的稳定性。

这份报告提供了锂离子二次电池所用电解液的成品和成分的详细技术信息,还根据我们的各种预测对粘合剂的需求和市场进行了预测,现在可以了解整体规模。

最后,本报告的目的是总结主要电池製造商的电解液需求以及电解液製造商的供应现状和前景,为该领域的研究人员和相关各方提供广泛的技术知识市场。

此报告的特点

- 1.电解质成品和组件的总体概述和技术讯息

- 2. 应用于传统LiB以外的下一代电池的固态电解质和聚合物电解质概述

- 3.根据我们的预测数据提供电解液市场前景的客观数据

- 4.韩国、中国、日本主要电解液生产商产品及生产状况详细介绍

目录

报告摘要

第一章电解质概述

- 什么是电解质?

- 电解质的发展趋势及主要问题

第二章液体电解质发展趋势

- 液体电解质的成分

- 液体电解质的特性

- 阻燃材料

第三章聚合物电解质发展趋势

- 聚合物电解质的类型

- 聚合物电解质的特性

- 聚合物电解质的生产方法

第 4 章固体电解质

- 需要开发固体电解质

- 固体电解质的种类及技术特点

- 固态电解质的发展趋势

第五章电解质最新发展趋势

- 高压电解液溶剂

- 锂盐

- 添加剂

- 聚电解质

第六章电解质溶剂

- 环状碳酸酯

- 直链碳酸盐

- 在电极表面形成保护膜的添加剂产生气体的机制

第七章电解质添加剂

- 用于高镍阴极界面稳定性的电解质添加剂

- 改善输出特性的电解质添加剂

- 使用LiFSI盐的电解液

- 提高热稳定性的阻燃添加剂

- 用于高容量阳极界面稳定的添加剂

第8-1章电解液市场趋势与展望

- 电解质需求:依国家划分

- 电解液的用量:依用途

- 市场状况:依供应商分类

- 电解液需求:依 LiB 公司划分

- (SDI/LGES/SKon/Panasonic/CATL/ATL/比亚迪/力神/国轩/AESC)

- 电解液需求预测

- 电解液产能及供需展望

- 电解液价格趋势

- 电解液市场规模预测

第8-2章电解质材料现况

- 通用锂盐(LiPF6)

- 非LiPF6锂盐

- 功能性添加剂

第九章电解液生产企业现况

- 韩国电解液公司

- Dongwha Electrolyte/Soulbrain/Enchem/Foosung/Chunbo/Chemtros

- 日本电解质公司

- Mitsubishi/Ube/Centralglass/Tomiyama/MUIS/Nippon Shokubai

- 中国电解液企业

- Tinci/Capchem/Guotai Huarong/Shanshan/Jinniu/DFD/Shinghwa

Recently, the secondary battery market has expanded from small IT applications to ESS and electric vehicles. Japanese companies such as Panasonic, which developed secondary batteries and pioneered the industry, are losing out to Korean powerhouses such as LGES, while Chinese companies such as CATL, BYD, and CALB are further expanding their M/S with the support of the Chinese government and an unlimited domestic market. Although the Korean, Chinese, and Japanese "trilateral system" is expected to continue for the foreseeable future, North America and Europe are also showing continued interest in the large-capacity secondary battery manufacturing and materials market due to the expansion of the electric vehicle market. In particular, the policies and regulations of each country, such as the IRA, are expected to significantly change the landscape of the secondary battery market.

The electrolyte is mainly composed of solvents, lithium salts, and additives. Depending on the nature of the product, the electrolyte will be developed in collaboration with lithium-ion secondary battery manufacturers. For small IT-type products, the development period is as short as three to four months, while electrolytes for xEVs are developed and evaluated for more than a year. Excellent R&D capabilities are required to develop and respond to various products according to customer needs.

In the past, the electrolyte market was dominated by Japan and South Korea, but with the recent rapid growth of Chinese companies, the top three market shares have been taken over by Chinese companies. In Korea, Donghwa Electrolyte, Soulbrain, and Enchem have been able to grow together as electrolyte suppliers with the three major lithium-ion secondary battery companies (Samsung SDI, LG Energy Solution, and SK energy). In Japan, Mitsubishi Chemical has diversified its portfolio of customers producing IT small, xEV medium and large cells. In China, Tinci, Guotai-Huarong, and Capchem dominate the market.

Lithium salts (LiPF6), the main ingredient of electrolyte, have been mostly supplied by Japanese companies in the past, but the game has changed as Chinese companies have increased their CAPA. In South Korea, Foosung provides general-purpose lithium salts (LiPF6), while Chunbo mass-produces specialized lithium salts (LiFSI, LiPO2F2, LiDFOP, LiBOB). Additives are added during the electrolyte manufacturing process to improve the lifespan and stability of Li-ion secondary batteries, such as SEI protection, overcharge prevention agents, and conductive properties. While Japanese companies dominate the additives market, in Korea Chunbo and Chemtros are among the main suppliers.

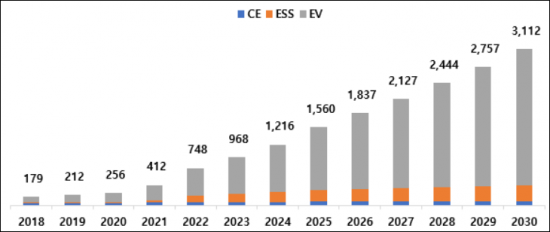

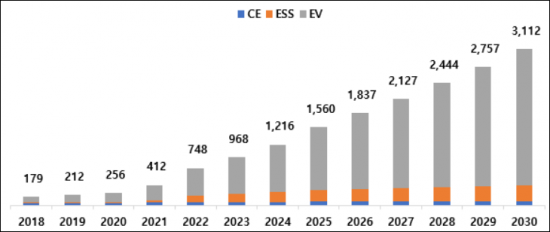

Electrolyte is one of the four key materials that make up a secondary battery. In the manufacturing cost composition of a typical Li-ion battery, the order of importance is anode material > separator > cathode material > electrolyte. To increase the energy density per unit cell, secondary battery manufacturers are increasing the input of anode and cathode materials, while reducing the input of electrolyte. However, from 2022 to 2030, the battery market is expected to grow at an average annual rate of around 23% (by capacity). The electrolyte market is expected to grow accordingly.

For large-scale rechargeable batteries for electric vehicles and ESS, the amount of electrolyte used is about 200 times to 4,000 times higher on a unit cell basis than for IT, so securing stability is becoming a particularly important issue. In addition to liquid electrolytes and gel polymer electrolytes (polymers) that are currently commercialized, research and development is underway to improve the stability of solid polymer electrolytes and all-solid ceramic electrolytes with excellent high temperature stability.

This report provides detailed technical information on finished electrolyte products and their components for application in lithium-ion secondary batteries and forecasts the demand and market for binders based on our various forecasts to help readers understand the overall scale.

Finally, by summarizing the electrolyte demand of major battery manufacturers and the supply status and outlook of electrolyte companies, the report aims to provide researchers and interested parties in this field with a wide range of insights from technology to market.

Strong points of this report:

- 1. overall overview and technical information on electrolyte finished products and components

- 2. Introduction to solid and polymer electrolytes that will be applied to next-generation batteries other than conventional LIBs

- 3. Provides objective data on the electrolyte market outlook based on our forecast data

- 4. Detailed information on the product and production status of major electrolyte players in Korea, China, and Japan

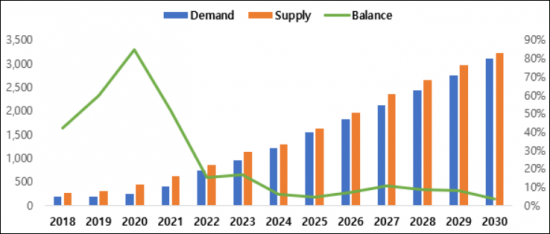

<Global Electrolytes Market Demand Forecas (~2030)>

*Based on SNE battery demand forecasts.

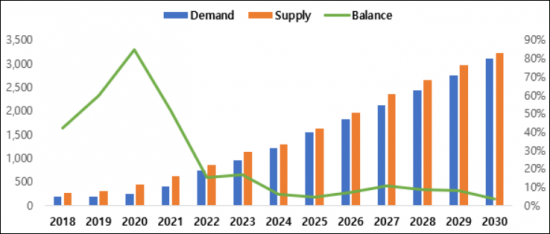

<Global Electrolyte Supply and Demand Outlook (2018~2030)>

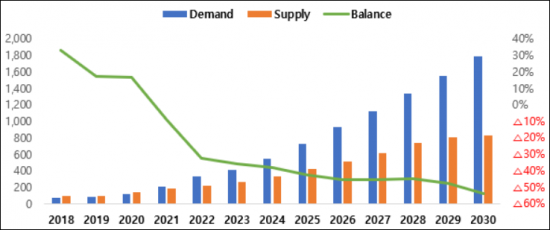

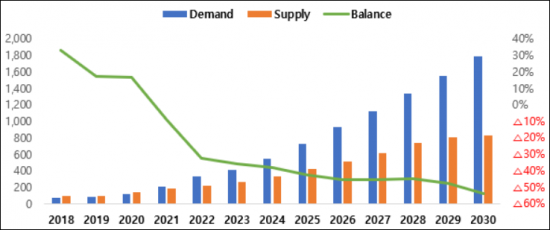

<Electrolyte Supply and Demand Outlook for Non-Chinese Markets (2018~2030)>

*Except for Chinese market supply and demand.

Table of Contents

Outline of Report

Chapter I. Electrolyte Overview

- 1.1. Understanding of electrolytes

- 1.2. Development trends and major issues of electrolytes

Chapter II. Development Trend of Liquid Electrolytes

- 2.1. Composition of liquid electrolytes

- 2.2. Characteristics of liquid electrolytes

- 2.3. Flame retardant material

Chapter III. Development Trend of Polymer Electrolyte

- 3.1. Types of polymer electrolytes

- 3.2. Characteristics of polymer electrolytes

- 3.3. Manufacturing method of polymer electrolytes

Chapter IV. Solid Electrolytes

- 4.1. Necessity for development of solid electrolytes

- 4.2. Types and technical characteristics of solid electrolytes

- 4.3. Development trends of solid electrolytes

Chapter V. Latest Development Trends of Electrolytes

- 5.1. High voltage electrolyte solvents

- 5.2. Lithium salts

- 5.3. Additives

- 5.4. Polyelectrolytes

Chapter VI. Electrolyte Solvents

- 6.1. Cyclic carbonate

- 6.2. Linear carbonate

- 6.3. Gas generation mechanism by additives for forming the protective film on the electrode surface

Chapter VII. Electrolyte Additives

- 7.1. Electrolyte additives for high-Ni cathode interface stabilization

- 7.2. Electrolyte additives for improved output characteristics

- 7.3. Electrolytes using LiFSI salts

- 7.4. Flame retardant additives for improved thermal stability

- 7.5. Additives for high-capacity anode interface stabilization

Chapter VIII-1. Electrolyte Market Trends and Outlook

- 8.1.1. Electrolyte demand by country

- 8.1.2. Electrolyte usage by application

- 8.1.3. Market status by suppliers

- 8.1.4. Electrolyte demand by LIB companies

- (SDI/LGES/SKon/Panasonic/CATL/ATL/BYD/Lishen/Guoxuan(Gotion)/AESC)

- 8.1.5. Electrolyte demand outlook

- 8.1.6. Electrolyte CAPA and supply & demand outlook

- 8.1.7. Electrolyte price trends

- 8.1.8. Electrolyte market size forecast

Chapter VIII-2. Electrolyte Material Status

- 8.2.1. General lithium salts (LiPF6)

- 8.2.2. Non-LiPF6 lithium salts

- 8.2.3. Functional additives

Chapter IX. Electrolyte Manufacturer Status

- 9.1. Korean electrolyte companies

- Dongwha Electrolyte / Soulbrain / Enchem / Foosung / Chunbo / Chemtros

- 9.2. Japanese electrolyte companies

- Mitsubishi / Ube / Centralglass / Tomiyama / MUIS / Nippon Shokubai

- 9.3. Chines electrolyte companies

- Tinci / Capchem / Guotai Huarong / Shanshan / Jinniu / DFD / Shinghwa