|

市场调查报告书

商品编码

1565778

LIB干电池电极流程的技术开发的趋势与预测<2024> Technology Development Trends and Prospects of Dry Battery Electrode Process for LIBs |

|||||||

虽然电动车本身不排放温室气体,但有人批评电动车的製造过程会排放碳,破坏环境。一个典型的例子是电池,它约占电动车製造成本的40%。

电池製造过程消耗大量电能,尤其是干燥和收集NMP,会造成温室气体排放。根据一项研究,湿式製造过程中的溶剂干燥每千瓦时会产生 42 公斤二氧化碳,也会将环境污染物挥发性有机化合物 (VOC) 释放到大气中。另一方面,干电极不需要溶剂干燥或回收过程,因此耗电量较少,不排放挥发性有机化合物,是一种环保製程。

为了提高能量密度,需要超过100μm的厚膜电极。在目前的湿式製程中,由于溶剂和材料的层分离现象,很难製造厚膜电极。活性物质、导电材料、黏结剂等的比重不同,因此如果涂层较厚,黏结剂和导电材料就会漂浮在电极表面。在湿式製程中,很难涂覆厚度大于约 100 μm 的电极。

透过使用干法,活性材料、导电材料和黏合剂可以均匀分散,而不会引起这种层分离现象,从而可以製造厚膜电极并提高电池容量和能量。

2019年,特斯拉收购了拥有干电极技术的超级电容器公司Maxwell Technologies,并在2020年9月的电池日上宣布推出干电极。两年后的 2021 年,特斯拉将 Maxwell 卖给了 UCAP,但却获得了干电极技术。据直接拿到并分析特斯拉4680电池的专家介绍,这款电池仅在负极上应用了干电极,在正极上采用了现有的湿电极。

目前尚不清楚特斯拉为何尚未将干电极製程应用到正极上,但有分析指出干电极製程良率较低,无法量产。外媒也有报导称,4680电池的低良率正在影响Cybertruck的生产。

儘管干沉积製程的原理很简单,但在实施的每个阶段都存在相当大的课题。在不使用溶剂的情况下,均匀地混合活性材料、导电材料和黏合剂并不容易。将非黏性粉末均匀地施加到集流体上更加困难。如果产量差,生产成本也会高。儘管引入干电极是为了降低成本,但它们实际上会增加成本。

目前,除了特斯拉之外,国内外企业均宣布正在开发P/P规模的干法工艺,但初期生产的直径46毫米的圆柱电池均将采用湿法工艺生产这就是前景。 LGES将于2024年第四季以P/P规模生产的4680电池,正负极均采用湿法工艺,该电池将供应给特斯拉。近日,LGES宣布将于2024年第四季完成梧仓能源工厂的干电极製程P/P线,并于2028年开始应用。三星SDI、SK On、松下、CATL和Kumyang近年来也宣布了干电极技术的进展。

此外,2023年6月,德国福斯宣布正在与德国专门生产印刷设备的製造商Koenig & Bauer一起开发干电极製程。大众汽车计划于 2027 年开始工业化生产。目前尚不清楚大众汽车和 Koenig & Bauer 是如何开发干电极的。

干燥过程无需干燥过程,可降低能源成本30%,干燥所需面积可减少50%。采用干式製程的4680电池理论上可能比磷酸铁锂电池便宜,但该技术尚未开发成功。

干法製程的引入作为碳中性锂二次电池製造製程具有巨大潜力,干电极技术的实际应用有望对提高性能和降低电池製造成本做出巨大贡献。虽然目前还没有一家公司成功量产,但随着各大公司加速技术开发,干电极製程很可能在不久的将来成为一种趋势。干电极製程的开发还可应用于下一代电池、全固态电池的製造流程。事实上,国内外对全固态电池的兴趣日益浓厚,量产计画也正在进行中。

在本报告中,我们对二次电池产业进行了研究和分析,并提供了开发碳中和製程的必要性、现有湿式製程的问题以及目前干式製程的问题等技术资讯。

电极製造中干製程与湿式製程的差异

| 优点 | 超级电容 | 紧凑 | ||

| 课题 | 偏旁析的风险 | 偏旁析的风险 | 偏旁析的风险 | 混合 |

| 主要企业 | Tesla (Maxwell Technologies) | Technical Univ. Dresden Fraunhofer IWS |

Technical Univ. Dresden Fraunhofer ISIT |

Technical Univ. Braunschweig Fraunhofer IPA |

| TRL | 6 | 5 | 4->6 | 4->6 |

| 参考文献 | US Patent US2006/0133012A1 10/817 590. Apr. 1. 2008. | Germany Patent DE102017208220A1. Nov. 22. 2018. | Proc. Fraunhofer ISIT - Achievements Results Annu. Rep., 2017.pp.32-33 | Energy Technol., vol. 8, no. 2. 2020. Art. no. 1900309 |

目录

第1章 LIB的厚膜电极干式电极流程

- 锂离子电池产业对碳中和製程的需求

- 锂离子电池对厚膜电极的需求

- 湿电极製造製程存在的问题

- 采用干式製程的背景

- 干电极製程的类型

- 干电极製程的问题

- 干法和湿式製程比较

- PTFE纤维化

第2章 下一代二次电池(全固体电池)干式电极流程

- 全球全固体电池的开发趋势

- 固体电池的干式电极流程采用的必要性

- 固体电池的干式电极流程的应用案例

第3章 各企业的开发趋势

- 韩国和国际产业上干式电极製程发展趋势

- 韩国企业的开发趋势

- LG Energy Solutions

- Samsung SDI

- SK On

- Cosmos Lab

- CNP Solutions

- 国外企业的开发趋势

- TESLA

- Sakuu (US)

- Anaphite (UK)

- LiCap Technology (US)

- AM Batteries (US)

- PowerCo SE

- Dragonfly Energy (US)

- ZEON

- Daikin

- Chemours (US)

- Huacai Technology (China)

- Baosheng Energy Technology (China)

- Li Yuanheng (China)

- 设备製造商开发趋势

- Hanwha Momentum

- CIS

- PNT

- Yunsung F&C

- NainTech

- GITech (Korea)

- KATOP (China)

- Shanghai Lianjing Automation Technology

- TOB New battery

- TMAX Battery Equipment

- Shenzhen Tsingyan Electronic Technology

- Huacai Technology

- ATEIOS System (US)

- EIRICH (Germany)

- Fraunhofer IWS

- 学术·研究机关的开发趋势

- Korea Institute of Energy Technology

- Yonsei University

- Korea University

- Ulsan Institute of Science and Technology

- Sungkyunkwan University

- Gacheon University

- Fraunhofer ISIT

- Karlsruhe Institute of Technology (KIT)

- Dry Coating Forum

第4章 专利分析

- 国外的干式製程发展专利

- 国外的干式製程发展专利的清单

- Maxwell Technologies

- Fraunhofer IWS

- TESLA

- Licap New Energy Technologies

- Dragonfly Energy

- Anaphite Ltd

- 韩国的干式製程发展专利

- LG Chem, LG Energy Solution patents

- Samsung SDI

- SK On

- Hyundai Kia

- Yunsung F&C

- Cosmos Lab

- Korea Ceramic Technology Institute

第5章 各国的调查计划

- 美国能源局的计划

- Oak Ridge National Lab

- NAVITAS Systems

- EU的计划

- ELIBAMA program

- HORIZON Europe : NOVOC project

- Horizon Europe : BatWoMan

- 韩国的国家计划

- Ministry of Trade and Industry

- Ministry of Education

- Ministry of Science and Technology

- Ministry of Economy and Finance

第6章 市场预测(调查预测)

- SNE Research

- EV Tank

- ESP Analysis

- Industry ARC

- QY Research

- Verified Market Reports

Electric vehicles themselves do not emit greenhouse gases, but the manufacturing process of electric vehicles has been criticized for emitting carbon and destroying the environment. A representative example is the battery, which accounts for about 40% of the manufacturing cost of electric vehicles.

During the battery manufacturing process, a considerable amount of electric energy is consumed, especially in drying and recovering NMP, which is a cause of greenhouse gas emissions. According to one research result, 42 kg of CO2 is generated per kWh due to solvent drying in the wet manufacturing process, and volatile organic compounds (VOCs), which are environmental pollutants, are also emitted into the atmosphere. In contrast, dry electrodes do not have a solvent drying and recovery process, so they consume less electric energy and do not emit VOCs, making them an environmentally friendly process.

In order to increase energy density, a thick film electrode of >100 micrometer or more is required. In the current wet process, it is difficult to make a thick film electrode due to the layer separation phenomenon between the solvent and the material. Since the specific gravity of each material such as the active material, conductive material, and binder is different, if the coating is thick, the binder and conductive material float to the electrode surface. In the wet process, it is difficult to coat the electrode with a thickness of about 100 micrometer or more.

By using a dry process, the active material-conductive material-binder can be evenly distributed without this layer separation phenomenon, so a thick-film electrode can be created, which can increase the capacity and energy density of the battery.

In 2019, Tesla acquired Maxwell Technologies, a supercapacitor company with dry electrode technology, and announced at Battery Day in September 2020 that it would introduce dry electrodes. Tesla sold Maxwell to UCAP in 2021, two years later, but was able to secure dry electrode technology. According to experts who directly obtained and analyzed the Tesla 4680 battery, the battery applied a dry electrode only to the anode, and the existing wet electrode was adopted for the cathode.

It is not known why Tesla has not yet applied the dry electrode process to the cathode, but there is analysis that the yield of the dry electrode process is low and cannot be mass-produced. There are also foreign media reports that the low yield of the 4680 battery is affecting the production of the Cybertruck.

The principle of the dry coating process is simple, but there are considerable challenges at each stage in implementing it in practice. It is not easy to evenly mix the active material, conductive material, and binder without using a solvent. It is even more difficult to evenly apply the non-viscous powder to the current collector. If the yield is low, the production cost increases. Dry electrodes were introduced to reduce costs, but they can actually act as a cost increase factor.

In addition to Tesla, domestic and foreign companies are currently announcing that they are developing a P/P scale dry process, but it is expected that all 46-phi cylindrical batteries to be initially produced will be produced using a wet process. The 4680 battery that LGES will produce in the fourth quarter of 2024 on a P/P scale will apply a wet process to both cathode and anode, and this battery will be supplied to Tesla. Recently, LGES announced that it will complete the construction of a dry electrode process P/P line in the Ochang Energy Plant in the fourth quarter of 2024 and will apply it starting in 2028. Samsung SDI, SK On, Panasonic, CATL, and Kumyang, which recently announced that they are also developing dry electrode technology.

In addition, Volkswagen of Germany announced in June 2023 that it was developing a dry electrode process with Koenig & Bauer, a German printing equipment specialist. Volkswagen plans to start industrial production by 2027. It is not known exactly how Volkswagen and Koenig & Bauer are developing the dry electrode.

The dry process can reduce energy costs by 30% because the drying process is unnecessary, and the area required for drying can be reduced by 50%. The 4680 battery using the dry process can theoretically be cheaper than the LFP battery, but the technology development has not been successful yet.

The introduction of the dry process has great potential as a carbon-neutral process for manufacturing lithium secondary batteries, and the commercialization of dry electrode technology is expected to greatly contribute to reducing battery manufacturing costs while improving performance. Although no company has succeeded in mass production so far, it is very likely that the dry electrode process will become a trend in the near future as major companies are spurring technology development. In addition, the development of the dry electrode process can be applied to the manufacturing process of all-solid-state batteries, which are next-generation batteries. In fact, interest in all-solid-state batteries is increasing both domestically and internationally, and plans for mass production are being established.

This report provides technical information such as the necessity of developing a carbon-neutral process in the secondary battery industry, issues with the existing wet process, and issues with the current dry process, as well as information on recent development trends in dry electrode processes and all-solid-state battery development by many companies, with the aim of forecasting the current and near-future status of the dry process.

Strong Points of This Report:

- 1. Includes rich technical content on the background and development of the dry electrode process

- 2. Includes detailed descriptions of the types of dry electrode processes and electrode process issues

- 3. Includes detailed comparisons of the pros and cons of dry and wet processes as well as battery applications

- 4. Includes detailed technical content on the application of the dry electrode process to the next-generation battery, the all-solid-state battery

- 5. Includes detailed information on the development trends of electrode processes, materials, and equipment companies in the domestic and international industries

- 6. Includes a list of patents related to the dry electrode process of domestic and foreign companies and an analysis of major patents

- 7. Includes research support projects and main contents by country related to dry electrodes

- 8. Includes market outlooks from major research companies on the dry electrode process

[Difference between dry and wet processes for electrode manufacturing]

| Advantages | Super caps | compact | ||

| Challenges | Risk of segregation | Risk of segregation | Risk of segregation | mixing |

| Key players | Tesla(Maxwell Technologies | Technical Univ. Dresden Fraunhofer IWS | Technical Univ. Dresden Fraunhofer ISIT | Technical Univ. Braunschweig Fraunhofer IPA |

| TRL | 6 | 5 | 4->6 | 4->6 |

| References | US Patent US2006/0133012A1 10/817 590. Apr. 1. 2008. | Germany Patent DE102017208220A1. Nov. 22. 2018. | Proc. Fraunhofer ISIT - Achievements Results Annu. Rep., 2017.pp.32-33 | Energy Technol., vol. 8, no. 2. 2020. Art. no. 1900309 |

Table of Contents

1. Dry Electrode Processes for Thick Film Electrodes in LIBs

- 1.1. The need for carbon-neutral processes in the LIB industry

- 1.1.1. Increased demand for EV due to carbon neutrality regulations

- 1.1.2. Plans to limit carbon emissions and ban sales of ICE vehicles

- 1.1.3. EV transition plans and verticalized secondary battery companies

- 1.1.4. Industry Issues related to carbon neutrality regulations

- 1.1.5. Secondary battery electrode process, costs and energy consumption

- 1.2. The need for thick film electrodes in Li-ion batteries

- 1.3. Wet-based electrode manufacturing process issues

- 1.4. Background on adopting dry processes

- 1.4.1. Historical and technological advances in dry electrode

- 1.4.2. History of key technology developments in dry film

- 1.4.3. Dry electrode technology: overcoming the limitations of wet coatings

- 1.4.4. Dry process and binder development: number of papers and patents

- 1.4.5. Dry process and binder development: patent analysis

- 1.4.6. Electrode manufacturing with extrusion technology

- 1.4.7. Extrusion and melt processing

- 1.4.8. Melt extrusion: solvent vs. solvent-free application differences

- 1.4.9. Dry electrode application: Tesla anode

- 1.4.10. Dry electrode application: Tesla cathode

- 1.4.11. Dry electrode application: composite cathode

- 1.4.12. Dry electrode application: Pre-lithiation

- 1.4.13. Battery binder characteristics: 7 types compared

- 1.4.14. Types of binders used in dry processes

- 1.4.15. Binder properties used in dry processes

- 1.4.16. Water (PTFE, PAA) vs. oil (PVDF) binders: Performance & tradeoffs

- 1.4.17. Applying PTFE binders

- 1.5. Dry electrode process types

- 1.5.1. Selection of a dry coating process for dry electrodes

- 1.5.2. Comparison and selection of dry coating technologies

- 1.5.3. Dry mixing and coating

- 1.5.4. Comparison of electrochemical behavior of dry and wet electrodes

- 1.5.5. Features of Dry electrode process technologies in LIB application

- 1.5.6. Free standing electrode technology

- 1.5.7. Direct calendaring technology

- 1.5.8. Powder sheeting technology

- 1.5.9. Electrostatic spraying technology

- 1.5.10. Melt deposition technology

- 1.5.11. Powder compaction technology

- 1.5.12. Melt extrusion technology

- 1.6. Issues with dry electrode process

- 1.6.1. Technical hurdles in dry process technology

- 1.6.2. Challenges of dry process in LIB manufacturing

- 1.6.3. Electrical properties of PTFE

- 1.7. Comparison of dry vs. wet processes

- 1.7.1. Comparison of wet and dry process manufacturing technologies

- 1.7.2. Comparison of cell characteristics for dry vs. wet process technologies

- 1.7.3. Disadvantages of the wet process

- 1.7.4. Pros and cons of wet process alternative options

- 1.7.5. Benefits of adopting dry process technology

- 1.7.6. Benefits of adopting dry process technology (speed performance)

- 1.7.7. Benefits of adopting dry process technology (ion channels)

- 1.7.8. Benefits of adopting dry process technology (low cost)

- 1.7.9. Benefits of adopting dry process technology (Machine characteristics)

- 1.7.10. Dry vs. wet characteristics: Applies to cathode, anode

- 1.7.11. Cell performance of electrochemical electrodes

- 1.7.12. Fabrication and characterization of dry electrodes for LIBs

- 1.7.13. Applying dry electrodes : (LFP + CNT + PTFE) cathode

- 1.7.14. Applying dry electrodes : (NCM622 + PVDF) cathode

- 1.7.15. A comprehensive comparison of dry vs. wet process technologies

- 1.8. PTFE fiberization

- 1.8.1. PTFE fiberization reaction

- 1.8.2. PTFE fiberization process

- 1.8.3. PTFE fiberization application

- 1.8.4. Factors affecting PTFE fibrillation

- 1.8.5. Side effects of PTFE binders

- 1.8.6. Blocking the adverse effects of PTFE binders: Graphite surface coat

- 1.8.7. Preparation of graphite anodes by PTFE fiberization method

- 1.8.8. Developing PTFE modified materials

- 1.8.9. Innovative technologies and systems for PTFE-based cells

2. Next Secondary Battery (All-Solid-State Battery) Dry Electrode Processes

- 2.1. Global development trends of solid-state batteries

- 2.1.1. Types and the system configurations of solid-state batteries

- 2.1.2. Design and solutions for high energy density LIBs

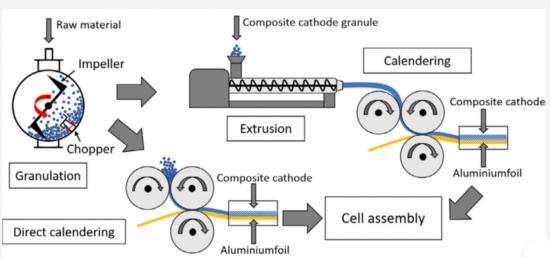

- 2.1.3. Dry composite cathode manufacturing methods

- 2.1.4. Overseas all-solid-state battery development trends

- 2.1.5. Korean all-solid-state battery development trends

- 2.2. The need for adopting dry electrode process in solid-state batteries

- 2.3. Examples of dry electrode process applications in solid-state batteries

- 2.3.1. Korean and international companies

- 2.3.2. Korean and international papers

- 2.3.3. Li-S batteries with PTFE

- 2.3.4. Cobalt-free (LNMO) cells with PTFE

- 2.3.5. Solid-state batteries with PTFE (sulfide, oxide, halide)

- 2.3.6. Solid-state electrolyte membranes for solid-state batteries with PTFE

- 2.3.7. Application of inorganic solid electrolytes

- 2.3.8. Application of polymeric solid-state electrolytes

- 2.3.9. Solid-state batteries with dry process (400 Wh/kg)

- 2.3.10. Solid-state batteries with dry process (energy density comparison)

3. Development Trends by Company

- 3.1. Dry electrode process development trends in Korean and international industry

- 3.1.1. International dry process development trends

- 3.1.2. Korean dry process development trends

- 3.1.3. Challenges to dry electrode processes

- 3.1.4. Pros and cons of the dry electrode process

- 3.2. Korean company development trends

- 3.2.1. LG Energy Solutions

- 3.2.2. Samsung SDI

- 3.2.3. SK On

- 3.2.4. Cosmos Lab

- 3.2.5. CNP Solutions

- 3.3. Overseas company development trends

- 3.3.1. TESLA

- 3.3.2. Sakuu (USA)

- 3.3.3. Anaphite (UK)

- 3.3.4. LiCap Technology (USA)

- 3.3.5. AM Batteries (USA)

- 3.3.6. PowerCo SE

- 3.3.7. Dragonfly Energy (USA)

- 3.3.8. ZEON

- 3.3.9. Daikin

- 3.3.10. Chemours (USA)

- 3.3.11. Huacai Technology (China)

- 3.3.12. Baosheng Energy Technology (China)

- 3.3.13. Li Yuanheng (China)

- 3.4. Equipment manufacturer development trends

- 3.4.1. Hanwha Momentum

- 3.4.2. CIS

- 3.4.3. PNT

- 3.4.4. Yunsung F&C

- 3.4.5. NainTech

- 3.4.6. GITech (Korea)

- 3.4.7. KATOP (China)

- 3.4.8. Shanghai Lianjing Automation Technology

- 3.4.9. TOB New battery

- 3.4.10. TMAX Battery Equipment

- 3.4.11. Shenzhen Tsingyan Electronic Technology

- 3.4.12. Huacai Technology

- 3.4.13. ATEIOS System (USA)

- 3.4.14. EIRICH (Germany)

- 3.4.15. Fraunhofer IWS

- 3.5. Development trends in academic and research institutions

- 3.5.1. Korea Institute of Energy Technology

- 3.5.2. Yonsei University

- 3.5.3. Korea University

- 3.5.4. Ulsan Institute of Science and Technology

- 3.5.5. Sungkyunkwan University

- 3.5.6. Gacheon University

- 3.5.7. Fraunhofer ISIT

- 3.5.8. Karlsruhe Institute of Technology (KIT)

- 3.5.9. Dry Coating Forum

4. Patent Analysis

- 4.1. Overseas dry process development patents

- 4.1.1. Overseas dry process development patent list

- 4.1.2. Maxwell Technologies

- 4.1.3. Fraunhofer IWS

- 4.1.4. TESLA

- 4.1.5. Licap New Energy Technologies

- 4.1.6. Dragonfly Energy

- 4.1.7. Anaphite Ltd

- 4.2. Korean dry process development patents

- 4.2.1. LG Chem, LG Energy Solution patents

- 4.2.2. Samsung SDI

- 4.2.3. SK On

- 4.2.4. Hyundai Kia

- 4.2.5. Yunsung F&C

- 4.2.6. Cosmos Lab

- 4.2.7. Korea Ceramic Technology Institute

5. Research Projects by Country

- 5.1. US DOE projects

- 5.1.1. Oak Ridge National Lab

- 5.1.2. NAVITAS Systems

- 5.2. EU projects

- 5.2.1. ELIBAMA program

- 5.2.2. HORIZON Europe : NOVOC project

- 5.2.3. Horizon Europe : BatWoMan

- 5.3. Korean national projects

- 5.3.1. Ministry of Trade and Industry

- 5.3.2. Ministry of Education

- 5.3.3. Ministry of Science and Technology

- 5.3.4. Ministry of Economy and Finance

6. Market outlook (research outlook)

- 6.1. SNE Research

- 6.2. EV Tank

- 6.3. ESP Analysis

- 6.4. Industry ARC

- 6.5. QY Research

- 6.6. Verified Market Reports