|

市场调查报告书

商品编码

1498830

2024-2025年全球电子材料气体(包括Ne和Xe)(重要材料)市场Electronic Gases including Ne & Xe Market Report 2024-2025 (Critical Materials Report) |

||||||

价格

本报告涵盖了半导体装置製造中使用的电子材料气体的市场环境和供应链。它还包括主要供应商的资讯、材料供应链中的问题和趋势、供应商市场占有率的估计和预测以及材料细分市场的市场预测。

目录

第 1 章执行摘要

第二章研究范围、目的与方法

第三章半导体产业:市场现况与展望

- 世界经济与展望

- 半导体产业与全球经济的联繫

- 半导体销售额成长

- 台湾外包厂商每月销售趋势

- 晶片销售趋势:以电子产品领域划分

- 电子产品的前景

- 汽车产业的前景

- 智慧型手机前景

- 电脑展望

- 伺服器/IT 市场

- 半导体製造业的成长与扩张

- 在晶片扩张方面投入巨资

- 美国新厂

- 全球工厂扩编推动成长

- 资本投资趋势

- 先进逻辑技术路线图

- 工厂投资评估

- 政策和贸易趋势及影响

- 半导体材料概述

- 引入的晶圆数量:未来预测(截至 2028 年)

- 材料市场预测(~2028 年)

第四章电子材料气体市场趋势

- 电子材料气体市场趋势:概述

- 电子材料气体市场趋势:2023-2024

- 电子材料气体市场展望

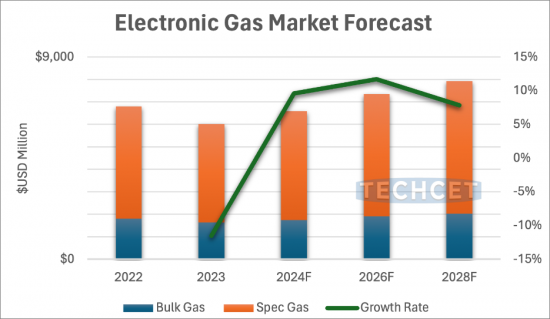

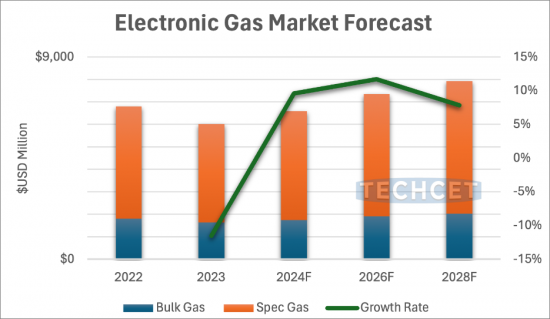

- 电子材料气体的获利预测(5年):依细分市场

- 电子材料气体的获利预测(5年):依细分市场 - 依主要资料概述

- 电子材料气体供应能力与需求:概览

- 电子材料气体供应能力、需求及投资

- 电子材料气体产量:依地区划分

- 扩大电子材料气体产能

- 投资公告摘要

- 有关投资活动的其他评论

- 稀有气体(Xe、Kr、Ne):平衡供需:- 概述

- 氦气供应与需求

- 供需平衡:NF3、三氟化氮

- 供需平衡:WF6、六氟化钨

- 价格趋势

- 价格趋势:霓虹灯

- 价格趋势:氙气

- 价格趋势:氪

- 氦气价格趋势与预测

- 技术趋势/技术驱动因素:概述

- 通用电子材料气体技术:概述

- 电子材料气体技术趋势

- 特种/新兴材料及其应用

- WF6 的市场需求:潜在的钼替代品

- ALE(原子层)蚀刻气体列表

- 技术趋势与机会概述

- 区域考虑因素

- EHS(环境、健康与安全)和贸易/物流问题

- 俄罗斯入侵乌克兰

- 也门胡塞武装在红海和亚丁湾发动的攻击扰乱了全球航运

- 新兴的中东衝突可能会扰乱全球技术供应链和英特尔的扩张计划

- 巴拿马运河历史性干旱

- EHS 问题

- EHS 问题

- 贸易/物流问题

- 分析师对电子材料气体市场趋势的评估

第五章供给面市场状况

- 电子材料气体市场占有率

- 工业气体市场占有率

- 全球前 5 名领先电子材料气体供应商:本季的活动和报告收入

- 美国供应商排名

- LINDE PLC(2023 年全年及第四季):儘管销售额下降,利润仍保持稳定成长,预计业绩将持续强劲

- 液化空气集团(2023 年第四季及全年):2023 年获利将受到能源价格下跌的压力,但指标良好

- 由于半导体放缓和市场压力,勒克电子部门 2023 年第三季的有机销售额将下降 4%

- TAIYO NIPPON SANSO:第三季销售额

- 区域趋势:韩国

- 区域趋势:日本

- 区域趋势:中国

- 区域趋势:俄罗斯

- 区域趋势:美国

- 区域趋势:欧洲

- 併购 (M&A) 活动与业务合作(伙伴关係)

- 工厂关闭/出售

- 新进入公司

- 供应商或零件/产品线面临停产风险

- 电子材料气体供应商:分析师评估

第六章下游供应链:电子材料气体

- 下游(次级)供应链:供应商与市场概览

- 大宗气体及其来源

- 萤石供应

- 溴供应

- 下游供应链:EHS 与物流问题

- 底层供应链:分析师评估

第 7 章供应商简介

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- 超过 20 个其他项目

第 8 章附录

- 天然气用于多个产业

- 特种气体产业矩阵

- 半导体元件製造所使用的气体

- 显示器产业使用的气体

- 供应商清单:依气体类型

- 氢化物

- 硅前驱物(硅烷)

- 蚀刻剂/腔室清洁

- 气相沉积/其他

- 散装气体

- 蚀刻气体路线图

This report covers the market landscape and supply-chain for Electronic Gases used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 ELECTRONIC GASES BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 1.5 ELECTRONIC GASES SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE - ELECTRONIC GASES

- 1.7.1 COMPETITIVE LANDSCAPE - INDUSTRIAL GASES

- 1.8 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF ELECTRONIC GASES

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 ELECTRONIC GASES MARKET TRENDS

- 4.1 ELECTRONIC GASES MARKET TRENDS - OUTLINE

- 4.1.1 2023 ELECTRONIC GASES MARKET LEADING INTO 2024

- 4.1.2 ELECTRONIC GASES MARKET OUTLOOK

- 4.1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 4.2 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, OVERVIEW

- 4.2.1 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.2 ELECTRONIC GASES PRODUCTION BY REGION

- 4.2.3 ELECTRONIC GASES PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.4.1 REGIONAL ACTIVITY SPECIALTY GAS INVESTMENTS

- 4.2.5 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.2.6 RARE GASES - XE, KR, NE - SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.2.6.1 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND, SELECT GASES

- 4.2.6.2 SUPPLY VS. DEMAND BALANCE - NEON

- 4.2.6.3 SUPPLY VS. DEMAND BALANCE - NEON (CONTINUED)

- 4.2.6.4 SUPPLY VS. DEMAND BALANCE - XENON

- 4.2.6.5 SUPPLY VS. DEMAND BALANCE - KRYPTON

- 4.2.7 HELIUM SUPPLY V. DEMAND

- 4.2.7.1 SUPPLY VS. DEMAND BALANCE - HELIUM

- 4.2.7.2 SUPPLY VS. DEMAND BALANCE - REGIONAL HELIUM SUPPLY

- 4.2.7.3 HELIUM SUPPLY RISK BY COUNTRY 2030

- 4.2.7.4 KEY PLAYERS IN THE HELIUM SUPPLY CHAIN

- 4.2.8 SUPPLY VS. DEMAND BALANCE - NF3, NITROGEN TRIFLUORIDE

- 4.2.8.1 ELECTRONIC GASES MARKET OUTLOOK - NF3

- 4.2.9 SUPPLY VS. DEMAND BALANCE - WF6, TUNGSTEN HEXAFLUORIDE

- 4.3 PRICING TRENDS

- 4.3.1 PRICING TRENDS - NEON

- 4.3.2 PRICING TRENDS - XENON

- 4.3.3 PRICING TRENDS - KRYPTON

- 4.3.4 HELIUM PRICE TREND & FORECAST

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 ELECTRONIC GASES GENERAL TECHNOLOGY OVERVIEW

- 4.4.2 ELECTRONIC GASES TECHNOLOGY TRENDS

- 4.4.3 SPECIALTY/EMERGING MATERIAL AND APPLICATIONS

- 4.4.4 WF6 MARKET DEMAND, POTENTIAL DISPLACEMENT BY MOLYBDENUM

- 4.4.5 ALE ETCH GAS LISTING

- 4.4.6 SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.5 REGIONAL CONSIDERATIONS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES

- 4.6.1 RUSSIA INVASION OF UKRAINE

- 4.6.2 YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.6.3 NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.6.4 PANAMA CANAL HISTORIC DROUGHT

- 4.6.5 EHS ISSUES

- 4.6.6 EHS ISSUES

- 4.6.7 TRADE/LOGISTICS ISSUES

- 4.7 ANALYST ASSESSMENT OF ELECTRONIC GASES MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 ELECTRONIC GASES MARKET SHARE

- 5.1.1 INDUSTRIAL GASES MARKET SHARE

- 5.2 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 5.2.1 US SUPPLIER RANKING

- 5.3 LINDE PLC FULL YEAR 2023 AND Q4 - ROBUST EARNINGS GROWTH DESPITE SALES DECLINE, FORECASTS CONTINUED STRONG PERFORMANCE

- 5.3.1 AIR LIQUIDE'S Q4 AND 2023 REVENUES WEIGHED BY DECLINING ENERGY PRICES, BUT SHOWING POSITIVE METRICS

- 5.3.2 MERCK'S ELECTRONICS SECTOR FACES 4% ORGANIC SALES DECLINE IN Q3 2023, IMPACTED BY SEMICONDUCTOR SLOWDOWN AND MARKET PRESSURES

- 5.3.3 TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- 5.4 REGIONAL TRENDS- KOREA

- 5.4.1 REGIONAL TRENDS- JAPAN

- 5.4.2 REGIONAL TRENDS- CHINA

- 5.4.3 REGIONAL TRENDS - RUSSIA

- 5.4.4 REGIONAL TRENDS- USA

- 5.4.5 REGIONAL TRENDS- EU

- 5.5 M&A ACTIVITY AND PARTNERSHIPS

- 5.5.1 M&A ACTIVITY AND PARTNERSHIPS

- 5.6 PLANT CLOSURES / DIVESTITURES

- 5.7 NEW ENTRANTS

- 5.8 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.9 TECHCET ANALYST ASSESSMENT OF ELECTRONIC GAS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, ELECTRONIC GASES

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 BULK GASES AND THEIR SOURCES

- 6.1.2 FLUORSPAR SUPPLY

- 6.1.2.1 FLUORSPAR WORLD RESERVES

- 6.1.2.2 FLUORSPAR SUPPLY, DEMAND AND PRICING IMPACTS

- 6.1.3 BROMINE SUPPLY

- 6.2 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 6.3 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- ...AND 20+ MORE

8 APPENDIX

- 8.1 GASES USED BY MULTIPLE INDUSTRIES

- 8.1.1 SPECIALTY GAS INDUSTRY MATRIX

- 8.1.2 GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 8.1.3 GASES USED IN THE DISPLAY INDUSTRY

- 8.2 SUPPLIER LISTING BY GAS TYPE

- 8.2.1 HYDRIDES

- 8.2.2 SILICON PRECURSORS (SILANES)

- 8.2.3 ETCHANTS/CHAMBER CLEAN

- 8.2.4 DEPOSITION/MISC

- 8.2.5 BULK GASES

- 8.3 ETCH GAS ROADMAPS

- 8.3.1 ETCH ROADMAPS 1 OF 3

- 8.3.2 ETCH ROADMAPS 2 OF 3

- 8.3.3 ETCH ROADMAPS 3 OF 3

LIST OF FIGURES

- FIGURE 1.1: ELECTRONIC GAS MARKET

- FIGURE 1.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 1.3: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 1.4: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104B

- FIGURE 1.5: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.5: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.6: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.7: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.8: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.9: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.10: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.11: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.12: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.13: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.14: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.15: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.19: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: ELECTRONIC GAS MARKET

- FIGURE 4.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 4.3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- FIGURE 4.4: NEON SUPPLY/DEMAND FORECAST

- FIGURE 4.5: GLOBAL NEON REVENUES

- FIGURE 4.6: XENON SUPPLY/DEMAND FORECAST

- FIGURE 4.7: GLOBAL XENON REVENUES

- FIGURE 4.8: KRYPTON SUPPLY/DEMAND FORECAST

- FIGURE 4.9: GLOBAL KRYPTON REVENUES

- FIGURE 4.10: HELIUM SUPPLY & DEMAND (BCF)

- FIGURE 4.11: HELIUM DEMAND BY APPLICATION 2023 - 5.9 BCF

- FIGURE 4.12: WW HELIUM CAPACITY BY REGION 2023 VS. 2028 (BCF)

- FIGURE 4.13: HELIUM SUPPLY RISK BY COUNTRY 2030

- FIGURE 4.14: NF3 SUPPLY/DEMAND FORECAST

- FIGURE 4.15: WF6 SUPPLY/DEMAND FORECAST

- FIGURE 4.16: WORLDWIDE NOBLE GASES ASP TREND

- FIGURE 4.17: MO PRECURSORS

- FIGURE 4.18: PLASMA AND THERMAL ALE PROCESSES

- FIGURE 4.19: 2023 SEMICONDUCTOR ELECTRONIC GASES REVENUE SHARE BY REGION

- FIGURE 4.20: GREENHOUSE GAS PROTOCOL, DETAILED CATEGORIES

- FIGURE 4.21: SCOPE 3 EMISSIONS FOR SEMICONDUCTOR COMPANIES

- FIGURE 4.22: CO2-EQUIVALENT EMISSIONS FOR TYPICAL FAB

- FIGURE 5.1: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 5.2: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104 B

- FIGURE 5.3: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 5.4: AIR LIQUIDE'S Q4 AND 2023 REVENUES

- FIGURE 5.5: MERCK'S 2023 REVENUES

- FIGURE 5.6: TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- FIGURE 5.7: KOREA SEMICONDUCTOR DEVELOPMENT PLAN

- FIGURE 6.1: LEADING COUNTRIES BASED ON MINE PRODUCTION OF FLUORSPAR WORLDWIDE IN 2023

- FIGURE 6.2: WW RESERVES OF FLUORSPAR IN 2023, BY COUNTRY (US$/KILOTONNE)

- FIGURE 6.3: FLUORSPAR PRICE IN US 2014-2023 (US$/KILOTONNE)

- FIGURE 6.4: WW BROMINE SUPPLY 2023 (KILOTONNES)

- FIGURE 8.1: ELECTRONIC SPECIALTY GASES

- FIGURE 8.2: BULK GASES

LIST OF TABLES

- TABLE 1.1: ELECTRONIC GASES(S) GROWTH OVERVIEW

- TABLE 1.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 1.3: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: ELECTRONIC GASES SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: OVERVIEW OF ANNOUNCED 2023/2024 ELECTRONIC GASES SUPPLIER INVESTMENTS

- TABLE 4.3: REGIONAL SUMMARY OF GAS MARKET

- TABLE 4.4: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 4.5: SUPPLIERS WITH LOCATIONS IN AREAS OF HIGH RISK

- TABLE 4.6: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE

- TABLE 5.1: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.3: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING

- TABLE 6.1: BULK AND INERT GAS APPLICATION AND SOURCE DESCRIPTION

- TABLE 8.1: SPECIALTY GAS INDUSTRY MATRIX

- TABLE 8.2: GASES USED IN FPD MANUFACTURING

- TABLE 8.3: HYDRIDE GAS SUPPLIERS

- TABLE 8.4: SILICON PRECURSOR SUPPLIERS

- TABLE 8.5: ETCHANT GAS SUPPLIERS

- TABLE 8.6: DEPOSITION/MISC. GAS SUPPLIERS

- TABLE 8.7: BULK GAS SUPPLIERS

- TABLE 8.8: ETCH ROADMAPS

- TABLE 8.9: ETCH ROADMAPS

- TABLE 8.10: ETCH ROADMAPS

02-2729-4219

+886-2-2729-4219