|

市场调查报告书

商品编码

1498831

图:2024-2025年全球CMP浆料垫市场(关键材料)CMP Slurry & Pads Market Report 2024-2025 (Critical Materials Report) |

||||||

CMP(化学机械抛光)浆料垫在半导体製造中非常重要。製程整合需要生产薄的、均匀的平面层,以在半导体晶圆上建构装置结构。随着新装置技术的出现,CMP 製程步骤的数量不断增加。新装置技术具有更多的层数、新材料、更严格的製程控制要求以及先进封装的新技术。解决这些製造课题需要开发新的 CMP 浆料垫。

本报告分析了半导体装置製造中使用的CMP 耗材(特别是CMP 浆料和抛光垫)的市场和供应链,并分析了市场的基本结构、关键驱动因素以及浆料和抛光垫应用的细分预测、市场占有率、讨论了磨料供应商,特别关注先进封装。

目录

第 1 章执行摘要

第二章分析范围、目的与方法

第三章产业/市场现况与展望

- 世界经济与展望

- 半导体产业与全球经济的联繫

- 半导体销售额的成长

- 台湾外包厂商每月销售趋势

- 晶片销售:依电子产品细分市场划分

- 电子产品的前景

- 汽车产业的前景

- 智慧型手机前景

- 电脑展望

- 伺服器/IT 市场

- 半导体製造业的成长与扩张

- 在晶片扩张方面投入巨资

- 美国新厂

- 世界各地製造工厂的扩张推动了成长

- 资本投资趋势

- 製造工厂投资评估

- 政策/贸易趋势与影响

- 半导体材料概述

- 预测引入的晶圆数量(~2028 年)

- 材料市场预测(~2028 年)

第 4 章 CMP 耗材趋势

- CMP 垫/浆料(消耗品)市场趋势:概述

- 区域趋势

- 区域趋势与驱动因素

- CMP耗材市场趋势

- 技术驱动因素/材料变化与过渡 - 高级逻辑

- 技术驱动/材料变化与转变 - 内存

- 技术驱动/材料变化与转型

- 先进封装技术趋势

- 先进封装技术趋势(续)

- 化合物半导体技术趋势

- 新材料的 EHS(环境、健康与安全)问题

- 与浆料处置、回收和再生相关的 EHS 问题

- 物流问题

第五章CMP浆料供应商市场

- CMP浆料利润预测(5年)

- CMP浆料预测(基于数量,5年)

- CMP浆料市场的领导者

- 浆料市场占有率:依地区划分

- 浆料市场占有率

- CMP 浆料市场的併购 (M&A) 活动、投资、公告和合作伙伴关係

- CMP 浆料厂关闭 - 无

- 新进入公司

- 供应商或零件/产品线面临停产风险

- CMP浆料价格趋势

- 分析师对CMP浆料市场的评价

第六章 CMP 抛光垫市场统计与预测

- CMP 抛光垫获利预测(5 年)

- CMP 抛光垫获利预测(5 年)

- CMP 抛光垫预测(基于数量,5 年)

- 煞车片供应商的竞争格局

- 新进入公司

- CMP 抛光垫物流问题、企业併购 (M&A) 活动、公告和合作伙伴关係

- CMP 抛光垫趋势

- 分析师评估

第七章 下级(虚拟部门)物资供应

- 磨料供应商

- 垂直整合供应商

- 原料供应链的破坏者

- 原物料领域的併购活动

- 磨料供应链中的 EHS 与物流问题

- 磨料供应链中的 "新" 进入者 - 无

- 磨料供应链的趋势

- 次级供应链:分析师评估

第 8 章供应商简介

- 3M Company

- Abrasive Technology

- Ace NanoChem

- Anji Micro Shanghai

- Asahi Glass

- 另外 40 多个

第 9 章附录

This report covers the CMP Consumables market (specifically CMP slurry and pads) and supply-chain for those consumables used in semiconductor device fabrication. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research. CMP slurries and pads are a critical in semiconductor manufacturing as process integration requires the fabrication of thin and uniformly flat layers to build up device structures across the semiconductor wafers.

SAMPLE VIEW

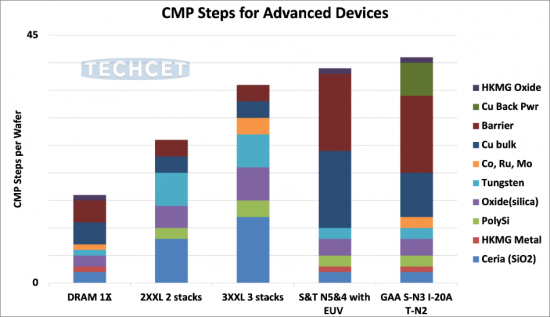

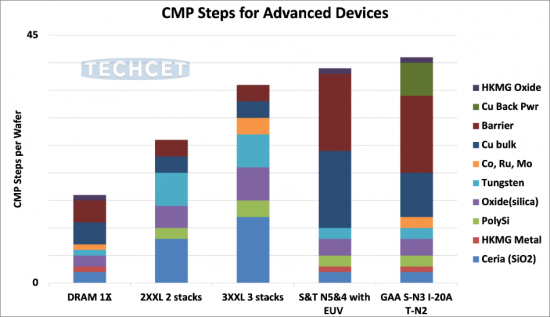

The number of CMP process steps continue to increase with each generation of new device technology. New device technology is characterized by more layers, new materials, tighter process control requirements, and new techniques for advanced packaging. These manufacturing challenges require new developments in CMP slurries and pads. This report looks at the market drivers, slurry and pad forecasts by application, market shares, abrasive suppliers, and includes a special focus on advanced packaging.

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 CMP CONSUMABLES MARKET OVERVIEW

- 1.2 CMP CONSUMABLES REVENUE TRENDS

- 1.3 MARKET TRENDS IMPACTING CMP CONSUMABLES OUTLOOK

- 1.4 YEAR 2023 IN REVIEW

- 1.5 CMP CONSUMABLES FORECASTS BY MATERIAL SEGMENT

- 1.5.1 CMP SLURRIES 5-YEAR REVENUE FORECAST

- 1.5.2 CMP PADS 5-YEAR REVENUE FORECAST

- 1.6 TECHNOLOGY TRENDS

- 1.7 SLURRY SUPPLIER COMPETITIVE LANDSCAPE

- 1.8 PAD SUPPLIER COMPETITIVE LANDSCAPE

- 1.9 ANALYST ASSESSMENT

- 1.9.1 ANALYST ASSESSMENT CONTINUED SEMICONDUCTOR

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 PURPOSE

- 2.3 METHODOLOGY

- 2.4 OVERVIEW OF OTHER TECHCET CMR OFFERINGS

3 INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.4.1 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.4.2 DRAM TECHNOLOGY ROADMAPS

- 3.3.4.3 3D NAND TECHNOLOGY ROADMAPS

- 3.3.5 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY - TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 CMP CONSUMABLES TRENDS

- 4.1 CMP PADS AND SLURRIES (CONSUMABLES) MARKET TRENDS - OUTLINE

- 4.2 REGIONAL TRENDS

- 4.2.1 REGIONAL TRENDS AND DRIVERS

- 4.3 CMP CONSUMABLES MARKET TRENDS

- 4.3.1 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS - ADVANCED LOGIC

- 4.3.1.1 ADVANCED LOGIC TRANSISTOR EST. ROADMAP

- 4.3.2 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS - MEMORY

- 4.3.2.1 3D NAND ROADMAP

- 4.3.2.2 3D NAND STACKING

- 4.3.3 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS

- 4.3.4 TECHNICAL TRENDS IN ADVANCED PACKAGING

- 4.3.5 TECHNICAL TRENDS IN ADVANCED PACKAGING, CONTINUED

- 4.3.5.1 CMP FOR TSV - GAA BACKSIDE POWER

- 4.3.6 TECHNICAL TRENDS IN COMPOUND SEMICONDUCTOR

- 4.3.1 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS - ADVANCED LOGIC

- 4.4 EHS ISSUES FOR NEW MATERIALS

- 4.4.1 EHS ISSUES FOR SLURRY DISPOSAL, RECYCLING AND RECLAIM

- 4.5 LOGISTIC ISSUES

5 CMP SLURRY SUPPLIER MARKET

- 5.1 CMP SLURRIES 5-YEAR REVENUE FORECAST

- 5.2 CMP SLURRIES 5-YEAR FORECAST BY UNITS

- 5.3 CMP SLURRY MARKET LEADERS

- 5.3.1 TOTAL SLURRY MARKET SHARE BY REGION

- 5.3.2 TOTAL SLURRY MARKET SHARE

- 5.3.2.1 OXIDE (CERIA) SLURRY MARKET

- 5.3.2.2 HKMG SLURRY MARKET

- 5.3.2.3 POLYSILICON SLURRY MARKET

- 5.3.2.4 OXIDE (SILICA) SLURRY MARKET

- 5.3.2.5 TUNGSTEN SLURRY MARKET

- 5.3.2.6 CU BULK SLURRY MARKET

- 5.3.2.7 COPPER BARRIER SLURRY MARKET

- 5.3.2.8 NEW METALS (CO, MO, RU, ETC.) SLURRY MARKET

- 5.3.2.9 CU BACKSIDE POWER SLURRY MARKET

- 5.4 CMP SLURRY M-A ACTIVITY, INVESTMENTS, ANNOUNCEMENTS AND PARTNERSHIPS

- 5.5 CMP SLURRY PLANT CLOSURES - NONE

- 5.6 NEW ENTRANTS

- 5.7 SUPPLIERS OR PARTS/PRODUCT LINE THAT ARE AT RISK OF DISCONTINUATIONS

- 5.8 CMP SLURRY PRICING TRENDS

- 5.9 TECHCET ANALYST ASSESSMENT OF CMP SLURRY MARKET

6 CMP PAD MARKET STATISTICS & FORECASTS

- 6.1 CMP PADS 5-YEAR REVENUE FORECAST

- 6.2 CMP PADS 5-YEAR REVENUE FORECAST

- 6.2.1 CMP PADS 5-YEAR FORECAST BY UNITS

- 6.3 PAD SUPPLIER COMPETITIVE LANDSCAPE

- 6.4 NEW ENTRANTS

- 6.5 CMP PAD LOGISTICS ISSUES, M&A ACTIVITY, ANNOUNCEMENTS AND PARTNERSHIPS

- 6.6 CMP PAD PRICING TRENDS

- 6.7 TECHCET ANALYST ASSESSMENT

7 MATERIAL SUB-TIER SUPPLY

- 7.1 ABRASIVE SUPPLIERS

- 7.2 VERTICALLY INTEGRATED SUPPLIERS

- 7.3 RAW SUPPLY CHAIN DISRUPTORS

- 7.4 RAW MATERIALS M-A ACTIVITY

- 7.5 ABRASIVE SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 7.6 ABRASIVE SUPPLY-CHAIN "NEW" ENTRANTS - NONE

- 7.7 ABRASIVE SUPPLY-CHAIN PRICING TRENDS

- 7.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

8 SUPPLIER PROFILES

- 3M Company

- Abrasive Technology

- Ace NanoChem

- Anji Micro Shanghai

- Asahi Glass

- ...and 40+ more

9 APPENDIX

- 9.1 BACKSIDE TECHNOLOGY TRENDS

- 9.2 CMP OF SILICON CARBIDE

- 9.2.1 SILICON CARBIDE DEFECTS

- 9.2.2 CMP CHALLENGES IN SILICON CARBIDE

- 9.3 OXIDE (CERIA) SLURRY USES

- 9.4 HKMG SLURRY MARKET

- 9.5 POLYSILICON SLURRY FOR MEMS

TABLE OF FIGURES

- FIGURE 1.1: FORECASTED 2024 MARKET SIZE

- FIGURE 1.2: CMP CONSUMABLES FORECAST

- FIGURE 1.3: CMP STEPS FOR ADVANCED DEVICES

- FIGURE 1.4: 2023 CMP CONSUMABLES REVENUE

- FIGURE 1.5: CMP CONSUMABLES REVENUE BY APPLICATION

- FIGURE 1.6: CMP SLURRY REVENUE BY APPLICATION

- FIGURE 1.7: CMP PAD REVENUE BY APPLICATION

- FIGURE 1.8: CMOS TECHNOLOGY ROADMAP

- FIGURE 1.9: 2023 SLURRY SUPPLIER MARKET SHARES

- FIGURE 1.10: 2023 PAD SUPPLIER MARKET SHARES

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX INVESTMENT ESTIMATED TO BE US $40 B

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: SLURRY AND PAD REVENUE BY HQ REGION

- FIGURE 4.2: CMP SLURRIES AND PADS REVENUE

- FIGURE 4.3: CMP STEPS FOR LOGIC NODES

- FIGURE 4.4: NUMBER OF CMP STEPS FOR MEMORY TECHNOLOGY NODES

- FIGURE 4.5: 3D NAND ROADMAP BY NODE

- FIGURE 4.6: STACKING FOR 3D NAND

- FIGURE 4.7: COMPARISON OF METALS RESISTIVITIES BY DIMENSION

- FIGURE 4.8: ADV LOGIC TRANSITION TO BACKSIDE POWER

- FIGURE 4.9: CMP OPPORTUNITIES IN ADVANCED PACKAGING

- FIGURE 4.10: KEY TRENDS IN ADVANCED PACKAGING

- FIGURE 4.11: CMP OPPORTUNITIES IN ADVANCED PACKAGING

- FIGURE 5.1: CMP SLURRY REVENUE BY APPLICATION

- FIGURE 5.2: FORECASTED SLURRY VOLUME DEMAND

- FIGURE 5.3: SLURRY REGIONAL MARKET SHARES IN 2023- $2B

- FIGURE 5.4: SLURRY SUPPLIER MARKET SHARES IN 2023- $2B

- FIGURE 5.5: OXIDE (CERIA) CMP SLURRY 2023 - $399M MARKET SHARE

- FIGURE 5.6: HKMG/FRONT-END CMP SLURRY 2023 - $67M MARKET SHARE

- FIGURE 5.7: POLYSILICON CMP SLURRY 2023 - $40M MARKET SHARE

- FIGURE 5.8: OXIDE (SILICA) CMP SLURRY 2023 - $236M MARKET SHARE

- FIGURE 5.9: TUNGSTEN CMP SLURRY 2023 - $429M MARKET SHARE

- FIGURE 5.10: CU-BULK CMP SLURRY 2023 - $302M MARKET SHARE

- FIGURE 5.11: CU-BARRIER CMP SLURRY 2023 SUPPLIER MARKET SHARE

- FIGURE 5.12: NEW METALS CMP SLURRY 2023 MARKET SHARE - $3M

- FIGURE 5.13: CU BACKSIDE POWER CMP SLURRY 2023 MARKET SHARE - $1M

- FIGURE 6.1: CMP PAD REVENUE FORECAST BY APPLICATION

- FIGURE 6.2: CMP PAD REVENUE BY WAFER SIZE

- FIGURE 6.3: FORECASTED QUANTITY PAD USAGE

- FIGURE 6.4: 2022 PAD SUPPLIER MARKET SHARES

- FIGURE 9.1: LIMITATIONS OF FS-PDN

- FIGURE 9.2: 2D DEVICE ARCHITECTURE EVOLUTION

- FIGURE 9.3: SILICON CARBIDE-BASED POWER DEVICE

- FIGURE 9.4: DEFECTS IN SILICON CARBIDE SUBSTRATES AND EPI WAFERS

- FIGURE 9.5: SILICON CARBIDE DEFECTS

- FIGURE 9.6: BATCH POLISH VS. CMP

- FIGURE 9.7: STI CMP PROCESS

- FIGURE 9.8: MEMS CMP CROSS SECTION

TABLES

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: REGIONAL WAFER MARKETS

- TABLE 4.2: REGIONAL WAFER MARKETS BY SUPPLIER HEADQUARTER REGION

- TABLE 4.3: SILICON CARBIDE WAFER MANUFACTURERS AND CONSUMABLES SUPPLIERS

- TABLE 5.1: 2023 SLURRY MARKET LEADERS AND TAM BY APPLICATION

- TABLE 7.1: ABRASIVE SUPPLIERS

- TABLE 7.2: VERTICALLY INTEGRATED SUPPLIERS