|

市场调查报告书

商品编码

1498836

微影材料的全球市场(重要材料),2024~2025年Lithography Materials Market Report 2024-2025 (Critical Materials Report) |

||||||

价格

本报告调查了半导体装置製造中使用的微影材料(包括微影配件和扩展部件的材料)的市场和供应链。

范例视图

目录

第1章 摘要整理

第2章 调查范围、目的、手法

第3章 半导体产业:市场现状与展望

- 世界经济与展望

- 半导体产业和世界经济的关联

- 半导体的销售额成长

- 台湾的外包製造商月销售趋势

- 晶片的销售趋势:电子各产品区隔

- 电子产品的展望

- 汽车产业的展望

- 智慧型手机的展望

- PC的展望

- 伺服器/IT市场

- 半导体製造的成长与扩大

- 在晶片扩张方面投入巨资

- 美国新厂

- 全球工厂扩编推动成长

- 资本投资趋势

- 先进逻辑技术路线图

- 工厂投资评估

- 政策与贸易的趋势与影响

- 半导体材料概要

- 晶圆的投入张数:未来预测(~2028年)

- 材料市场预测(~2028年)

第4章 光阻剂、市场区隔的市场趋势

- 光阻剂、市场区隔的市场趋势:概要

- 光阻剂、市场区隔市场(2023年):2024年的关联

- 光阻剂、市场区隔市场展望

- 光阻剂材料市场预测:各市场区隔(以数量为准,5年)

- 光阻剂材料市场预测:各市场区隔(以金额为准,5年)

- 供给能力与需求、投资:概要

- 光阻剂材料的生产能力:主要供应商

- 光阻剂材料的生产量:各地区

- 光阻剂生产能力的扩大

- 投资发表概要

- 价格趋势

- 技术趋势/技术促进因素:概要

- 光阻剂技术趋势

- 特殊/新的光阻剂材料/相关

- 地区性的考虑事项

- 地区的方面与推动因素

- EHS(环境、健康、安全)问题

- 光阻剂领域的市场趋势相关分析师的评估

第5章 微影配件、扩张零件市场区隔的市场趋势

- 配件、扩张零件市场区隔的市场趋势:概要

- 配件、扩张零件市场区隔的市场展望

- 配件材料的市场预测:各市场区隔(以数量为准,5年分)

- 配件材料的市场预测:各市场区隔(以金额为准,5年分)

- 扩张零件材料的市场预测:各市场区隔(以数量为准,5年分)

- 扩张零件材料的市场预测:各市场区隔(以金额为准,5年分)

- 配件、扩张零件材料的市场形势与投资:概要

- 市场形势/附属品的主要供应商

- 市场形势/附属品的主要供应商(光阻剂以外的厂商)

- 市场形势/扩张零件材料的主要供应商

- 投资发表概要

- 技术趋势/技术促进因素:概要

- 微影附属品、扩张零件材料的通用技术:概要

- 微影附属品、扩张零件材料技术趋势

- 附属品、扩张零件相关EHS、贸易/物流的问题

- 补助品 市场区隔的市场趋势:分析师的评估

- 扩张零件市场区隔的市场趋势:分析师的评估

第6章 微影材料市场:供应商的形势

- 光阻剂材料的市场占有率

- 近期的季报告的收益和供应商的活动

- 併购 (M&A) 活动与合作伙伴关係:无报告

- 工厂关闭:无报告

- 新加入企业

- 供应商的混乱(阻碍)

- 面临停产风险的供应商或零件/产品线:未报告

- 其他的想法

- 对微影材料供应商的分析师评估

第7章 低阶供应链:微影材料

- 低阶(次级)供应链:光阻零件

- 光阻树脂

- 光阻树脂

- 光阻溶剂

- 其他的光阻部件

- 光阻部件的参考文献和资讯来源

第8章 供应商的简介

- AUECC

- AVANTOR

- ALLRESIST GESELLSCHAFT FUR CHEMISCHE

- BASF

- BREWER SCIENCE

- 其他20公司以上

第9章 附录

This report covers the market and supply-chain for Photolithography Materials used in semiconductor device fabrication. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 PHOTOLITHOGRAPHY MARKET OVERVIEW

- 1.2 PHOTOLITHOGRAPHY MATERIALS BUSINESS - MARKET OVERVIEW

- 1.2.1 PHOTOLITHOGRAPHY MATERIALS BUSINESS - MARKET OVERVIEW

- 1.3 INTERNATIONAL TRENDS IMPACTING PHOTOLITHOGRAPHY 2024 OUTLOOK

- 1.4 PHOTOLITHOGRAPHY APPLICATIONS EFFECTING MARKET TRENDS

- 1.5 PHOTORESIST MATERIALS 5-YEAR VOLUME FORECAST BY SEGMENT

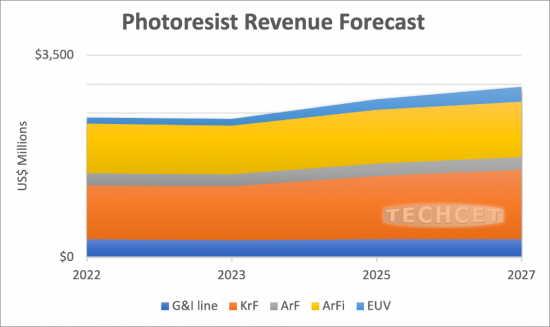

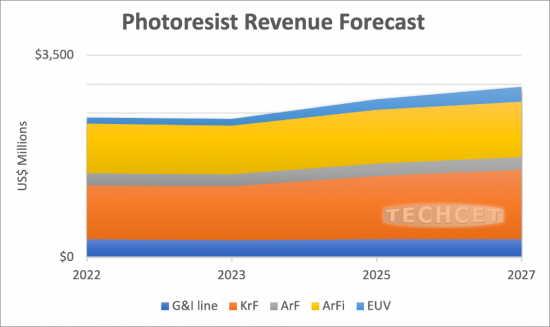

- 1.6 PHOTORESIST MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.7 TECHNOLOGY TRENDS

- 1.8 PHOTOLITHOGRAPHY COMPETITIVE LANDSCAPE

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF PHOTOLITHOGRAPHY MATERIALS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 PURPOSE

- 2.3 METHODOLOGY

- 2.4 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.4.1 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.4.2 DRAM TECHNOLOGY ROADMAPS

- 3.3.4.3 3D NAND TECHNOLOGY ROADMAPS

- 3.3.5 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 PHOTORESIST SEGMENT MARKET TRENDS

- 4.1 PHOTORESIST SEGMENT MARKET TRENDS - OUTLINE

- 4.1.1 2023 PHOTORESIST SEGMENT MARKET LEADING INTO 2024

- 4.1.2 PHOTORESIST SEGMENT MARKET OUTLOOK

- 4.1.3 PHOTORESIST MATERIALS 5-YEAR VOLUME FORECAST BY SEGMENT

- 4.1.3.1 EUV PHOTORESIST MATERIALS 5-YEAR VOLUME FORECAST BY SEGMENT

- 4.1.3.2 ARF (193NM) AND ARFI PHOTORESIST MATERIALS 5-YEAR VOLUME FORECAST BY SEGMENT

- 4.1.3.3 KRF, I & G-LINE PHOTORESIST MATERIALS 5-YEAR VOLUME FORECAST BY SEGMENT

- 4.1.4 PHOTORESIST MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4.1 EUV PHOTORESIST MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4.2 ARF (193NM) AND ARFI PHOTORESIST MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4.3 KRF, I & G-LINE PHOTORESIST MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.2 SUPPLY CAPACITY AND DEMAND, INVESTMENTS - OUTLINE

- 4.2.1 PHOTORESIST MATERIALS PRODUCTION CAPACITY OF TOP SUPPLIERS

- 4.2.2 PHOTORESIST MATERIALS PRODUCTION BY REGION

- 4.2.3 PHOTORESIST PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.1 CANON PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.2 DUPONT PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.3 DONGJIN PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.4 FUJIFILM PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.5 JSR PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.6 MERCK KGAA, EMD ELECTRONICS PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.7 SHIN-ETSU PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.8 SUMITOMO PRODUCTION CAPACITY EXPANSIONS

- 4.2.3.9 TOK PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.3 PRICING TRENDS

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1.1 PHOTORESIST MATERIALS GENERAL TECHNOLOGY OVERVIEW

- 4.4.1.2 PATTERNING TECHNOLOGY TRENDS

- 4.4.1.3 PRODUCTION LAYERS BY LITHOGRAPHIC EXPOSURE TYPE

- 4.4.1.4 3D NAND TRENDS

- 4.4.2 PHOTORESIST TECHNOLOGY TRENDS

- 4.4.3 SPECIALTY/EMERGING PHOTORESIST MATERIALS/RELATED

- 4.5 REGIONAL CONSIDERATIONS

- 4.5.1 REGIONAL ASPECTS AND DRIVERS

- 4.5.2 EHS ISSUES

- 4.7 ANALYST ASSESSMENT OF PHOTORESIST SEGMENT MARKET TRENDS

5 PHOTOLITHOGRAPHY ANCILLARIES & EXTENSIONS SEGMENT MARKET TRENDS

- 5.1 ANCILLARIES AND EXTENSIONS SEGMENT MARKET TRENDS - OUTLINE

- 5.1.1 ANCILLARIES AND EXTENSION SEGMENT MARKET OUTLOOK

- 5.1.2 ANCILLARIES MATERIALS 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.2.1 ANCILLARIES MATERIALS (EBR AND PREWET) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.2.2 ANCILLARIES MATERIALS (NTD AND RINSE) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.2.3 ANCILLARIES MATERIALS (PTD) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.3 ANCILLARIES MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.3.1 ANCILLARIES MATERIALS (EBR AND PREWET) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.3.2 ANCILLARIES MATERIALS (NTD AND RINSE) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.3.3 ANCILLARIES MATERIALS (PTD) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.4 EXTENSIONS MATERIALS 5-YEAR VOLUME FORECAST Y SEGMENT

- 5.1.4.1 EXTENSIONS (KRF BARC) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.4.2 EXTENSIONS (ARF BARC) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.4.3 EXTENSIONS (SOC) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.4.4 EXTENSIONS (SI BARC) 5-YEAR VOLUME FORECAST BY SEGMENT

- 5.1.5 EXTENSIONS MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.5.1 EXTENSIONS (KRF BARC) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.5.2 EXTENSIONS (ARF BARC) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.5.3 EXTENSIONS (SOC) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.1.5.4 EXTENSIONS (SI BARC) 5-YEAR REVENUE FORECAST BY SEGMENT

- 5.2 ANCILLARIES AND EXTENSIONS MATERIALS MARKET LANDSCAPE AND INVESTMENTS - OUTLINE

- 5.2.1 MARKET LANDSCAPE / KEY SUPPLIERS OF ANCILLARIES

- 5.2.2 MARKET LANDSCAPE / KEY SUPPLIERS OF ANCILLARIES (NON-PHOTORESIST MAKERS)

- 5.2.3 MARKET LANDSCAPE / KEY SUPPLIERS OF EXTENSION MATERIALS

- 5.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 5.3 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 5.3.1 PHOTOLITHOGRAPHY ANCILLARIES & EXTENSION MATERIALS GENERAL TECHNOLOGY OVERVIEW

- 5.3.2 PHOTOLITHOGRAPHY ANCILLARIES & EXTENSION MATERIALS TECHNOLOGY TRENDS

- 5.4 EHS AND TRADE/LOGISTIC ISSUES FOR ANCILLARIES AND EXTENSION MATERIALS

- 5.5.1 ANALYST ASSESSMENT OF ANCILLARIES SEGMENT MARKET TRENDS

- 5.5.2 ANALYST ASSESSMENT OF EXTENSIONS SEGMENT MARKET TRENDS

6 PHOTOLITHOGRAPHY MATERIALS MARKET SUPPLIER LANDSCAPE

- 6.1 PHOTORESIST MATERIALS MARKET SHARE

- 6.2.1 CURRENT QUARTER - REPORTED REVENUES & SUPPLIERS' ACTIVITIES

- 6.3 M&A ACTIVITY AND PARTNERSHIPS - NON REPORTED

- 6.4 PLANT CLOSURES - NONE REPORTED

- 6.5 NEW ENTRANTS

- 6.6 SUPPLIER DISRUPTIONS

- 6.6.1 SUPPLIERS OR PARTS/PRODUCT LINES AT RISK OF DISCONTINUATION - NONE REPORTED

- 6.7 OTHER THOUGHTS

- 6.8 TECHCET ANALYST ASSESSMENT OF PHOTOLITHOGRAPHIC MATERIALS SUPPLIERS

7 SUB-TIER SUPPLY-CHAIN, PHOTOLITHOGRAPHY MATERIALS

- 7.1 SUB-TIER SUPPLY CHAIN: PHOTORESISTS COMPONENTS

- 7.2 PHOTORESIST RESINS

- 7.2.1 PHOTORESIST RESINS

- 7.3 PHOTORESIST SOLVENTS

- 7.4 PHOTORESIST OTHER COMPONENTS

- 7.5 PHOTORESIST COMPONENTS REFERENCES & SOURCES

8 SUPPLIER PROFILES

- AUECC

- AVANTOR

- ALLRESIST GESELLSCHAFT FUR CHEMISCHE

- BASF

- BREWER SCIENCE

- ...and 20+ more

9 APPENDIX

- SELECT EXTENSION AND ANCILLARY SUPPLIERS*

LIST OF FIGURES

- FIGURE 1.1: A HISTORY OF PHOTOLITHOGRAPHY ADVANCEMENT

- FIGURE 1.2: PHOTOLITHOGRAPHY MATERIALS VOLUME FORECAST BY SEGMENT

- FIGURE 1.3: PHOTOLITHOGRAPHY MATERIALS REVENUE FORECAST BY SEGMENT

- FIGURE 1.4: TRADE OFFS WITH EUV

- FIGURE 1.5: BOTTOM ANTI-REFLECTIVE COATING (BARC)

- FIGURE 1.6: 2023 MARKET SHARE ESTIMATES OF TOP 3 PHOTORESIST COMPANIES

- FIGURE 1.7: ASML HIGH NA EUV SYSTEM

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX INVESTMENT ESTIMATED TO BE US $40 B

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: PHOTORESIST VOLUME FORECAST BY SEGMENT

- FIGURE 4.2: EUV PHOTORESIST VOLUME FORECAST BY SEGMENT

- FIGURE 4.3: ARF AND ARFI PHOTORESIST VOLUME FORECAST BY SEGMENT

- FIGURE 4.4: KRF, I & G-LINE PHOTORESIST VOLUME FORECAST BY SEGMENT

- FIGURE 4.5: PHOTORESIST REVENUE FORECAST BY SEGMENT

- FIGURE 4.6: EUV PHOTORESIST REVENUE FORECAST BY SEGMENT

- FIGURE 4.7: ARF AND ARFI PHOTORESIST REVENUE FORECAST BY SEGMENT

- FIGURE 4.8: KRF, I & G-LINE PHOTORESIST REVENUE FORECAST BY SEGMENT

- FIGURE 4.9: MARKET SHARES OF TOP PHOTORESIST COMPANIES IN 2023

- FIGURE 4.10: OVERVIEW AND EVOLUTION OF PHOTORESIST CHEMISTRY

- FIGURE 4.11: SCANNER TECHNOLOGY TRENDS ARF TO EUV

- FIGURE 4.12: EUV RESIST RECTIFICATION

- FIGURE 4.13: SELECTIVE DSA EXAMPLE

- FIGURE 4.14. RECTIFICATION FLOW USING DSA

- FIGURE 4.15: NANOIMPRINT LITHOGRAPHY

- FIGURE 4.16: GENERAL SCHEMATIC OF LITHO EXPOSURES BY DEVICE TYPE

- FIGURE 4.17: EXAMPLE OF 3D NAND SCALING BY STACKS/TIERS

- FIGURE 4.18: CHINESE VERSION OF EUV LITHOGRAPHY TOOL IN DEVELOPMENT

- FIGURE 4.19: 2023 ESTIMATED PHOTORESIST REVENUE SHARE BY REGION

- FIGURE 5.1: ANCILLARIES VOLUME FORECAST BY SEGMENT

- FIGURE 5.2: EBR AND PREWET VOLUME FORECAST BY SEGMENT

- FIGURE 5.3: NTD CHEMICALS VOLUME FORECAST BY SEGMENT

- FIGURE 5.4: PTD VOLUME FORECAST BY SEGMENT

- FIGURE 5.5: ANCILLARIES REVENUE FORECAST BY SEGMENT

- FIGURE 5.6: EBR AND PREWET REVENUE FORECAST BY SEGMENT

- FIGURE 5.7: NTD CHEMICALS REVENUE FORECAST BY SEGMENT

- FIGURE 5.8: PTD REVENUE FORECAST BY SEGMENT

- FIGURE 5.9: EXTENSIONS VOLUME FORECAST BY SEGMENT

- FIGURE 5.10: KRF BARC VOLUME FORECAST BY SEGMENT

- FIGURE 5.11: ARF BARC VOLUME FORECAST BY SEGMENT

- FIGURE 5.12: SOC VOLUME FORECAST BY SEGMENT

- FIGURE 5.13: SI BARC VOLUME FORECAST BY SEGMENT

- FIGURE 5.14: EXTENSIONS REVENUE FORECAST BY SEGMENT

- FIGURE 5.15: KRF BARC REVENUE FORECAST BY SEGMENT

- FIGURE 5.16: ARF BARC REVENUE FORECAST BY SEGMENT

- FIGURE 5.17: SOC REVENUE FORECAST BY SEGMENT

- FIGURE 5.18: SI BARC REVENUE FORECAST BY SEGMENT

- FIGURE 5.19: DEVELOPER TRANSITION

- FIGURE 5.20: SOLVENT IMPACT FOR POSITIVE VS. NEGATIVE PHOTORESIST

- FIGURE 6.1: LAM RESEARCH DRY RESIST

LIST OF TABLES

- TABLE 1.1: PHOTOLITHOGRAPHY MATERIALS GROWTH OVERVIEW

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: MATERIAL SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: OVERVIEW OF ANNOUNCED 2023/2024 PHOTORESIST MATERIALS SUPPLIER INVESTMENTS

- TABLE 4.3: REGIONAL PHOTOLITHOGRAPHY MATERIALS TRENDS

- TABLE 4.4: REGIONAL LITHOGRAPHY MATERIALS SUPPLIER EXPANSION SUMMARY

- TABLE 4.5: COMPARISON OF PERFORMANCE OF PAGS VERSUS ALTERNATIVES

- TABLE 5.1: SOLVENT SUPPLIERS

- TABLE 5.2: ANCILLARY SUPPLIER LANDSCAPE

- TABLE 5.3: KEY SUPPLIERS OF EXTENSION MATERIALS

- TABLE 5.4: OVERVIEW OF ANNOUNCED 2023/2024 ANCILLARY & EXTENSION MATERIALS SUPPLIER INVESTMENTS

- TABLE 6.1: ESTIMATED TOTAL PHOTORESIST MARKET SHARE BY SUPPLIER

- TABLE 6.2: MOST RECENT REPORTED QUARTERLY LITHO MATERIAL SUPPLIER SALES

02-2729-4219

+886-2-2729-4219