|

市场调查报告书

商品编码

1564131

LED电视墙的全球市场预测,价格成本分析(2025年)2025 Global LED Video Wall Market Outlook and Price Cost Analysis |

|||||||

TrendForce 观察到,欧洲和北美的 LED 拼接显示市场将持续成长,尤其是 LED 户外显示器。然而,由于激烈的价格竞争,室内显示市场的成长已经放缓。总体而言,预计到 2024 年这些地区的需求将保持稳定。相较之下,中国市场正经历需求下降、政府预算削减以及社会投资胃口下降,定价竞争加剧,促使2024年LED显示器市场规模预计出现下滑。包括中东和东南亚在内的亚洲地区对LED视讯墙的需求持续快速成长,并将在2024年成为最强劲的地区。非洲、拉丁美洲和大洋洲等其他市场预计也会成长,儘管规模较小。 LED视讯墙的使用,加上对高解析度显示器的需求,在全球范围内继续以更高的渗透率成长,预计2025年全球LED视讯墙市场规模将达到79.91亿美元。室内/室外小间距显示器将继续成为市场成长的主要驱动力,预计2023年至2028年复合年增长率分别为10%和4%。

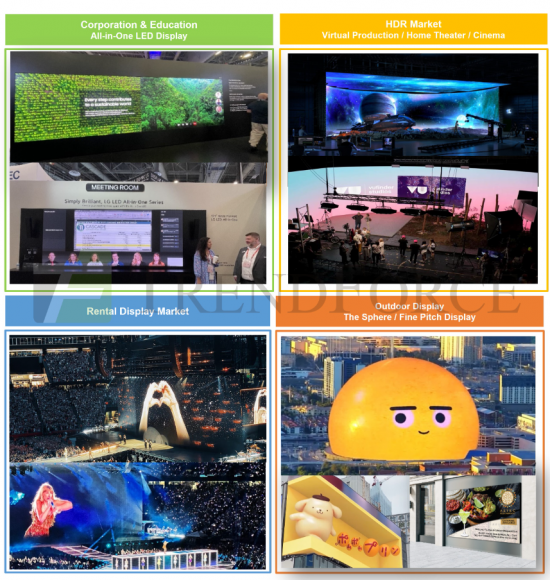

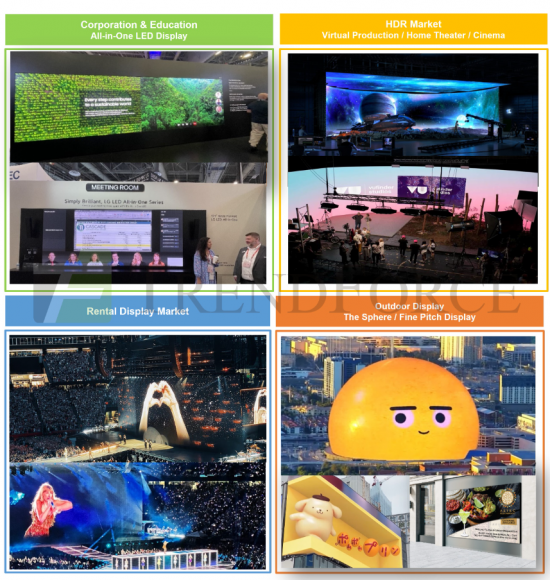

室内显示:由于对高解析度和 HDR 功能的需求不断增加,企业/教育、虚拟製作、家庭剧院和电影院等市场预计将稳定成长。一体式LED显示器规格朝向135-146吋2K、16:9解析度迈进,欧美视讯会议用21:9显示器、讲座用32:9显示器需求增加。在东南亚,虚拟製作正在蓬勃发展,音乐会电影拍摄(例如泰勒丝的音乐会电影院)推动了优质虚拟製作市场机会。自推出以来,Micro LED电视已应用于家庭剧院、展览、企业和教育领域。 Micro LED透明显示器非常适合零售空间、艺术场馆(画廊、博物馆、水族馆)和饭店业,提供补充产品展示。 Micro LED电视和透明显示器都将在2025年普及。

户外显示器:由于现场活动、体育和教育应用,对户外显示器的需求正在稳步增长。此外,球体、裸眼3D装置等创新展示可显着提升城市景观,吸引人们的注意力,产生视觉衝击。 LED户外小间距显示器主要用于街道设施显示器和公车候车亭显示屏,在美国和欧洲(如英国、荷兰、德国)需求不断增长。特别值得一提的是,NBC 正在选择利亚德的 LUO-1.5 LED 户外小间距显示器用于 2024 年巴黎奥运会的转播。

Micro/Mini LED 显示器市场

2025年,2025年Micro LED电视市场规模将达到1.85亿美元,三星、LG出货量将稳定成长,京东方、Vistar、天马、海信也计画进入该市场。成长率将达到119%。

受惠于市场需求增加及品牌推广,预计2024年Mini LED显示器市场规模将达6.76亿美元。 P1.2显示器将成为主流,三星110吋The Wall将是P0.625以下机型的主力产品。随着Mini LED技术的成熟和产能的增加,Mini LED显示器预计将从P1.2型号扩展到P1.5~P1.6及以上和P0.625及以下产品。

本报告提供全球LED电视墙市场相关调查,提供2025年的市场预测与用途市场趋势,主要LED电视墙企业的收益与产品开发,LED电视墙的价格和成本的分析等资讯。

目录

第一章LED显示器市场趋势及分析

- LED显示器市场定义

- 全球LED显示器市场规模(2024-2028)

- LED显示器20强企业营收排名(2022-2023)

- LED显示器20强企业市占率分析(2023年)

- 十大 LED 视讯墙公司营收与市占率(2024 年)

- LED显示器十大企业收入与出货量(2023-2024年)

- 全球LED小间距显示器市场规模(2024-2028)

- 全球LED小间距显示器市场出货量(2024-2028)

- LED小间距显示器20强营收排名(2022-2023)

- LED小间距显示器20强市占率分析(2023年)

- LED小间距显示器十大企业营收及市占率(2024年)

- LED小间距显示器十大企业收入与出货量(2023-2024年)

- 全球LED显示器区域市场规模(2023-2024年)

- 全球LED小间距显示器区域市场规模(2023-2024年)

- 全球 LED 小间距显示器区域市场:依应用分类(2023 年)

- 全球 LED 小间距显示器区域市场:依应用分类(2024 年)

- 全球LED小间距显示器应用市场分析(2023-2024年)

- P2.1-P2.5 LED显示器应用市场分析(2023-2024)

- P1.7~P2.0 LED显示器应用市场分析(2023~2024)

- P1.2-P1.6 LED显示器应用市场分析(2023-2024)

- P1.0以下超小间距显示器应用市场分析(2023-2024年)

- P1.0以下的超小间距显示器市场-产品间距分析(2024-2028)

- P1.0以下的超小间距显示器市场-技术分析(2024-2028)

- P1.0以下超小间距显示企业营收及市占率(2022-2023)

第二章Micro/Mini LED显示器市场趋势

- Micro/Mini LED 视讯墙

- Mini LED 显示器市场 - 产品推广分析(2024-2028)

- Mini LED显示器企业营收排名(2022-2023)

- Micro LED 视讯墙市场 - 产品推广分析(2024-2028 年)

- Mini LED晶片规格、良率、价格趋势、品牌目标

- Mini LED 贴片技术的趋势

- Micro LED晶片良率及品牌目标

- 6吋Micro LED COC价格趋势(2021-2028)

- Micro LED质传技术分析及趋势

- 背板技术分析

- COG(侧边布线)技术问题分析/公司路线图

- TGV玻璃优缺点分析

- 主动/被动矩阵分析

- 控制器市场趋势

- Micro/Mini LED显示器製造商供应链分析

- Mini LED显示器规格及公司进展

- Micro LED显示器製造分析

- Micro LED (COG) 拼接显示系统规格及公司进展

- Micro/Mini LED (COG) 拼接显示系统规格及公司进展

- Samsung/LG/BOE/Vistar侧线製造分析

- 三星/友达LTPS驱动矩阵分析

- P0.625 LED 电视/视讯墙成本分析 - 主动矩阵与被动矩阵

- 三星89吋4K P0.51 Micro LED电视成本分析

- 三星101吋4K P0.51 Micro LED电视成本分析

- 三星114吋4K P0.51 Micro LED电视成本分析

- LG 136吋4K P0.78Micro LED电视成本分析

- LG 136吋4K P0.78Micro LED电视/Mini LED拼接墙成本分析

- 京东方Mini LED显示器成本分析-主动矩阵与被动矩阵

- LED显示器尺寸与像素间距分析

- Micro LED透明显示应用市场

- Micro LED透明显示器成本分析(2024年)

- OLED透明显示器市场规模(2023-2024)

第三章LED显示器市场前景与亮点(2025年)

- LED 显示器市场展望与亮点(2025 年)

- 3.1.企业/教育市场

- 公司/教育 - LED 视讯墙产品的趋势(2023-2024 年)

- 一体式LED显示产品的优点与应用

- LED一体化显示器市场产值及出货量分析(2022-2024年)

- LED一体化显示器企业出货量排名及市占率(2023年)

- 一体式LED显示器需求市场分析(2023-2024年)

- 一体化LED显示屏产品概述

- 一体式 LED/LCD 显示器价格分析(2024 年)

- 一体化LED显示器品牌产品及价格分析(2024年)

- 3.2.HDR 市场趋势 - 虚拟製作、戏院、家庭剧院

- 娱乐剧院 - LED 拼接墙产品趋势(2023-2024 年)

- 虚拟製作市场实力分析

- 虚拟製作应用市场分析

- 虚拟生产LED显示器市场规模分析(2023-2024年)

- 虚拟生产LED显示器企业营收排名(2022-2023)

- 虚拟生产LED显示屏产品规格概述(2024年)

- 虚拟生产LED显示屏产品规格分析

- 虚拟生产案例研究分析

- 虚拟製作市场现况分析

- 优质剧院 - 定义与政策支持

- 戏院 LED 显示器 - 市场机会与挑战

- 戏院LED显示规格分析

- 戏院LED显示器企业进展分析(2018-2024年)

- 全球影院LED显示器市场规模(2018-2024年)

- 家庭剧院应用市场定义

- 家庭剧院市场趋势 - LED 视讯墙和投影机市场规模、规格和价格

- 家庭剧院市场的机会与未来前景

- 家庭剧院LED显示器/电视品牌价格(2024年)

- 3.3.LED租赁显示器市场

- LED租赁显示器市场用途

- LED租赁屏市场规模分析(2024-2028)

- LED租赁显示器企业营收排名及市占率(2023年)

- LED租赁显示器规格分析

- LED租赁显示器规格要求

- 3.4.LED户外显示器市场

- LED户外显示应用市场概况

- LED户外显示器市场(2024-2028)/应用分析(2023-2024)

- P1.2-P10 LED户外显示器规格定义

- P1.2-P10 LED户外显示器价格分析(2024年)

- LED户外小间距显示器应用市场分析

- LED户外小间距显示规格概述

- LED户外小间距显示器规格分析

- 户外显示器 LED 规格及价格调查(2024 年)

- 无需眼镜的 3D 显示产品概述

- 球体

- 附录:电子纸户外显示市场

第四章LED显示器市场价格及成本分析

- LED 显示器市场价格研究 – 研究方法与定义

- LED显示价格分析(2024-2025)

- P2.5 LED显示器价格分析(2024-2025)

- P1.9 LED显示器价格分析(2024-2025)

- P1.5-P1.6 LED显示器价格分析(2024-2025)

- P1.2 LED显示器价格分析(2024-2025)

- P0.9 LED显示器价格分析(2024-2025)

- P0.7~P0.8 LED显示器价格分析(2024~2025)

- P0.625 LED显示器价格分析(2024-2025)

- 4K LED 视讯墙/电视价格(2024 年)

- P1.68 LED 显示器成本分析(2024 年)

- P1.26 LED 显示器成本分析(2024 年)

- P0.9375 LED 视讯墙成本分析(2024 年)

- P0.84 LED 视讯墙成本分析(2024 年)

- P0.78 LED 视讯墙成本分析(2024 年)

- P0.625 LED 视讯墙成本分析(2024 年)

第5章 LED电视墙企业的策略

- 全球LED电视墙企业清单

- LED电视墙企业的ODM/OEM供应链分析

- P1.0以下的ultrafine沥青显示器企业的进步的分析

- LED电视墙企业的产品策略和销售额实际成果

- Samsung Electronics

- LG Electronics

- Sony

- BOE

- Leyard

- Unilumin

- Absen

- Liantronics

- Ledman

- Qiangli Jucai

- INFiLED

- CVTE/MaxHub

- HCP

- Cedar

- AOTO

- CREATELED

- Hikvision

- Dahua

- GKGD

- Cai Liang

- Sansi

- LP Display

- MTC

- CSOT

- Daktronics

第六章显示器LED市场趋势及产品分析

- 6.1.室内小间距显示器LED产品分析

- 显示LED产品应用市场

- 小间距显示LED技术概述

- 显示器 LED 技术趋势(2024-2025 年)

- 显示器LED技术分析——MiP/COB/4合1 Mini LED

- MiP(0202/0404 LED)优缺点分析

- Mini LED显示器企业产能排名(2023-2024年)

- 虚拟解析 - 原理

- 虚拟解析 - 解决方案分析

- 虚拟解决方案 - 成本分析

- 虚拟解析度 - 控制器需求

- 虚拟解析 - 市场情势分析

- 虚拟解析度 - LED 显示器规格/价格分析

- 6.2.显示器LED市场趋势及分析

- LED显示器市场价值分析(2024-2028)

- LED显示器市场规模分析(2024-2028)

- 显示 LED 市值分析 - 包括 Micro/Mini LED(2024-2028 年)

- 显示LED市值低于P2.5——LED产品分析(2024-2028)

- 显示LED市值低于P1.0——LED产品分析(2024-2028)

- 显示器 LED 价格趋势 - SMD LED/MiP (0202/0404 LED) (2021-2024)

- 显示器 LED 价格趋势 - 4 合 1 Mini LED(2021-2024 年)

- 显示器 LED 价格趋势 - RGB Mini LED 晶片(2021-2024 年)

- 显示LED晶片企业营收排名(2022-2023)

- 显示LED封装企业营收排名(2022-2023)

第七章驱动IC市场趋势及企业策略

- 2024-2028年LED显示驱动IC市场产值/出货量分析

- LED显示驱动IC企业营收排名(2022-2024年)

- LED显示驱动IC公司营收市占率分析(2022-2023)

- LED显示驱动IC厂商出货量排名(2022-2024年)

- LED显示驱动IC厂商出货量市占率分析(2022-2023年)

- 共阴驱动IC市场渗透率分析(2023-2024年)

- LED显示驱动IC产品趋势及规格概览

- LED显示器驱动IC价格调查(2023-2024年)

- 驱动IC厂商营收表现及产品分析

- 聚积科技

- 集创北方

- Xm-Plus

- 联咏科技

- 开发人员

- 世信

- 日月

- 製作精良

- 晶片喷泉

附录商业影音系统整合商/经销商(经销商)名单

TrendForce 2025 Global LED Video Wall Market Outlook and Price Cost Analysis- To Infinity and Beyond

According to TrendForce's observations, the LED video wall market in Europe and North America, particularly for LED outdoor displays, will continue to grow. However, the indoor display market's growth has slowed coupled with intense price competition. Overall, the demand in these regions is expected to remain stable throughout 2024. In contrast, the Chinese market is experiencing declining demand, reduced government budgets, and weakened social investment intentions, exacerbating competitive pricing, which is likely to lead to a downturn in the LED video wall market value in 2024. In Asia, including the Middle East and Southeast Asia, the demand for LED video walls continues to grow rapidly, making it the best-performing region in 2024. Other markets, such as Africa, Latin America, and Oceania, are expected to grow, albeit on a smaller scale. As the applications for LED video walls continue to expand with higher penetration rates throughout the world, coupled with high-resolution display requirements, the global LED video wall market scale is expected to reach USD 7.991 billion in 2025. Indoor and outdoor fine pitch displays will remain the main drivers of market growth, with a CAGR of 10% and 4% respectively, from 2023 to 2028.

Indoor Displays: Benefiting from the rising demand for high-resolution and HDR capabilities, markets such as corporation & education, virtual production, home theaters, and cinemas are expected to experience steady growth. The specifications for all-in-one LED displays are moving towards 135-146 inches with a 2K 16:9 resolution, while the demand for 21:9 displays for video conferencing and 32:9 displays for lectures is rising in Europe and North America. In Southeast Asia, virtual production is booming, and the filming of concert movies (e.g., Taylor Swift's concert film) is driving opportunities in the premium virtual production market. After their debut, Micro LED TVs are being applied to home theaters, exhibitions, and the corporation & education sector. Micro LED transparent displays are highly suitable for retail spaces, art venues (galleries, museums, and aquariums), and the hospitality industry, providing auxiliary product presentations. Both Micro LED TVs and transparent displays will start to take off in 2025.

Outdoor Displays: Driven by live events and sports / education applications, the demand for outdoor displays is steadily growing. Moreover, innovative displays such as spheres and glasses-free 3D installations significantly enhance urban landscapes and attract public attention, providing visual impact. LED outdoor fine pitch displays are primarily used for street furniture displays and bus shelter displays, with growing demand in the United States and Europe (e.g., the UK, Netherlands, and Germany). Notably, NBC has adopted Leyard's LUO-1.5 LED outdoor fine pitch display for broadcasting the 2024 Paris Olympics.

Micro/Mini LED Video Wall Market

In 2025, with stable growth in shipments from Samsung and LG as well as plans of BOE, Vistar, Tianma, and Hisense to enter the market, the Micro LED TV market value in 2025 is expected to reach USD 185 million, with a 119% CAGR from 2023 to 2028.

Benefiting from increasing market demand and brand promotion, the Mini LED video wall market scale is expected to reach USD 676 million in 2024. P1.2 displays will be the mainstream, accounting for up to >55% of the total, and Samsung's 110-inch The Wall will be the major product for less than or equal to P0.625 models. With the annual maturity of Mini LED technology and increased production capacity, the Mini LED video wall is expected to extend from P1.2 models to greater than or equal to P1.5-P1.6 and less than or equal to P0.625 products.

Global LED Fine Pitch Display Market

With price reductions, the penetration rate of fine pitch displays will increase not only in Europe and North America but also in Asia, Africa, and Latin America in 2024. Overall, despite a lackluster demand in the Chinese market, overseas markets are expected to maintain growth. Looking ahead to 2025, the penetration rate of LED fine pitch displays is expected to further increase in overseas, particularly in Asia. The increased penetration is expected to drive the global market value of LED fine pitch displays to USD 4.866 billion in 2025. As TrendForce analyzes, top 10 LED fine pitch display manufacturers in 2023 include Unilumin, Leyard, Absen, Qiangli Jucai, Hikvision, Samsung, Cai Liang, GKGD, LG, and Dahua.

less than or equal to P1.0 Ultra-Fine Pitch Display Market

According to TrendForce's analysis of the less than or equal to P1.0 ultra-fine pitch display market, in 2024, the penetration rates for less than or equal to P0.625 and P0.7-P0.8 LED displays are expected to reach 20% and 25%, respectively. As Micro/Mini LED technology matures annually and applications expand, the market value for less than or equal to P0.625 LED displays is expected to reach USD 334 million by 2028, with a CAGR of 66% from 2023 to 2028.

Virtual Production Market Trend

According to TrendForce, the LED video wall market scale for Entertainment & Cinema is estimated to grow by 18%. Applications in this sector include virtual production, home theaters, and cinemas, emphasizing high resolution, high grayscale, high refresh rates, and HDR imaging, making it a competitive market for LED display manufacturers.

Looking ahead to the development of the virtual production market in 2024, the Thai government has announced a certain rebate for foreign film production companies conducting location shoots in Thailand. Therefore, growth in virtual production in Southeast Asian countries is expected to flourish. The production of concert films (such as the Taylor Swift concert film) is also driving opportunities in the high-end virtual production market, extending the industry into movies, television, theater, music, and advertising production. In brief, TrendForce estimates the market value of virtual production LED displays in 2024 to reach USD 311 million.

With budget concerns, mainstream specifications for general background displays are typically >P2.1, such as P2.3, P2.6, and P2.8. However, premium film and television production demands higher brightness and display quality. For close-up shots, P1.2-P1.6 Mini LED video walls are used. The specifications for floor displays are mostly P2-P4, with the adoption of Mini LED video walls for better immersive experiences, while ceiling screens typically range from P3.9 to P6, emphasizing high brightness. Combining Mini LED video walls with common-cathode drive ICs can help enhance brightness (+30-40%), and display effect (wide viewing angle, high contrast, moire-free), and offer significant energy savings up to 50-60%.

All-in-One LED Display Market Trend

All-in-One LED displays are controller-integrated standardized products, mainly applied to corporate meeting rooms, event, retail and exhibition, lecture halls, control rooms, gaming events, and even home theaters. In 2023, all-in-one LED display manufacturers ramped up their efforts in overseas market promotion. In addition to the Chinese market, shipments to Europe, America, and Asia also continued to increase. Overall, the global shipments of all-in-one LED displays grew by 34% in 2023, with significant increases from Leyard and Samsung. As more manufacturers enter the all-in-one LED display market, global shipments are expected to reach 6,400 sets in 2024.

TrendForce's analysis focuses on 2025 LED video wall market outlook and application market trends; major LED video wall players' revenue and product development; LED video wall price and cost analysis; suppliers' technology and product specification cost development of the Micro/Mini LED and less than or equal to P1.0 ultra-fine pitch display markets, etc. TrendForce aims to provide readers with a comprehensive understanding of marketing and sales in the LED video wall market.

Table of Contents

Chapter I. LED Video Wall Market Trend and Analysis

- LED Video Wall Market Definition

- 2024-2028 Global LED Video Wall Market Scale

- 2022-2023 Top 20 LED Video Wall Player Revenue Ranking

- 2023 Top 20 LED Video Wall Player Market Share Analysis

- 2024(E) Top 10 LED Video Wall Player Revenue vs. Market Share

- 2023-2024(E) Top 10 LED Video Wall Player Revenue vs. Shipment

- 2024-2028 Global LED Fine Pitch Display Market Scale

- 2024-2028 Global LED Fine Pitch Display Market Shipment

- 2022-2023 Top 20 LED Fine Pitch Display Player Revenue Ranking

- 2023 Top 20 LED Fine Pitch Display Player Market Share Analysis

- 2024(E) Top 10 LED Fine Pitch Display Player Revenue vs. Market Share

- 2023-2024(E) Top 10 LED Fine Pitch Display Player Revenue vs. Shipment

- 2023-2024(E) Global LED Video Wall Regional Market Scale

- 2023-2024(E) Global LED Fine Pitch Display Regional Market Scale

- 2023 Global LED Fine Pitch Display Regional Market- By Application

- 2024(E) Global LED Fine Pitch Display Regional Market- By Application

- 2023-2024(E) Global LED Fine Pitch Display Application Market Analysis

- 2023-2024(E) P2.1-P2.5 LED Video Wall Application Market Analysis

- 2023-2024(E) P1.7-P2.0 LED Video Wall Application Market Analysis

- 2023-2024(E) P1.2-P1.6 LED Video Wall Application Market Analysis

- 2023-2024(E) less than or equal to P1.0 Ultra-Fine Pitch Display Application Market Analysis

- 2024-2028 less than or equal to P1.0 Ultra-Fine Pitch Display Market- Product Pitch Analysis

- 2024-2028 less than or equal to P1.0 Ultra-Fine Pitch Display Market- Technology Analysis

- 2022-2023 less than or equal to P1.0 Ultra-Fine Pitch Display Player Revenue vs. Market Share

Chapter II. Micro/Mini LED Video Wall Market Trend

- Micro/Mini LED Video Wall

- 2024-2028 Mini LED Video Wall Market- Product Pitch Analysis

- 2022-2023 Mini LED Video Wall Player Revenue Ranking

- 2024-2028 Micro LED Video Wall Market- Product Pitch Analysis

- Mini LED Chip Specification, Yield Rate, Price Trend, and Brand Target

- Mini LED Pick-and-Place Technology Trend

- Micro LED Chip Yield Rate and Brand Target

- 2021-2028 6-inch Micro LED COC Price Trend

- Micro LED Mass Transfer Technology Analysis and Trend

- Backplane Technology Analysis

- COG (Side Wiring) Technology Challenge Analysis / Player's Roadmap

- TGV Glass Pros and Cons Analysis

- Active / Passive Matrix Analysis

- Controller Market Trend

- Micro/Mini LED Video Wall Manufacturer's Supply Chain Analysis

- Mini LED Video Wall Specification and Player Progress

- Micro LED Video Wall Manufacturing Analysis

- Micro LED (COG) Video Wall Specification and Player Progress

- Micro/Mini LED (COG) Video Wall Specification and Player Progress

- Samsung / LG / BOE / Vistar's Side Wiring Manufacturing Analysis

- Samsung / AUO LTPS Driving Matrix Analysis

- P0.625 LED TV / Video Wall Cost Analysis- Active Matrix vs. Passive Matrix

- Samsung 89-inch 4K P0.51 Micro LED TV Cost Analysis

- Samsung 101-inch 4K P0.51 Micro LED TV Cost Analysis

- Samsung 114-inch 4K P0.51 Micro LED TV Cost Analysis

- LG 136-inch 4K P0.78 Micro LED TV Cost Analysis

- LG 136-inch 4K P0.78 Micro LED TV / Mini LED Video Wall Cost Analysis

- BOE Mini LED Video Wall Cost Analysis- Active Matrix vs. Passive Matrix

- LED Video Wall Size and Pixel Pitch Analysis

- Micro LED Transparent Display Application Market

- 2024 Micro LED Transparent Display Cost Analysis

- 2023-2024 OLED Transparent Display Market Scale

Chapter III. 2025 LED Video Wall Market Outlook and Highlight

- 2025 LED Video Wall Market Outlook and Highlight

- 3.1. Corporation and Education Market

- 2023-2024(E) Corporation & Education- LED Video Wall Product Trend

- All-in-One LED Display Product Strengths and Applications

- 2022-2024(E) All-in-One LED Display Market Value and Shipment Analysis

- 2023 All-in-One LED Display Player Shipment Ranking vs. Market Share

- 2023-2024(E) All-in-One LED Display Demand Market Analysis

- All-in-One LED Display Product Overview

- 2024 All-in-One LED / LCD Display Price Analysis

- 2024 All-in-One LED Display Brand Product and Price Analysis

- 3.2. HDR Market Trend- Virtual Production, Cinema, and Home Theater

- 2023-2024(E) Entertainment & Cinema- LED Video Wall Product Trend

- Virtual Production Market Strength Analysis

- Virtual Production Application Market Analysis

- 2023-2024(E) Virtual Production LED Display Market Scale Analysis

- 2022-2023 Virtual Production LED Display Player Revenue Ranking

- 2024 Virtual Production LED Display Product Specification Overview

- Virtual Production LED Display Product Specification Analysis

- Virtual Production Case Study Analysis

- Virtual Production Market Landscape Analysis

- Premium Cinema- Definition vs. Policy Support

- Cinema LED Display- Market Opportunities and Challenges

- Cinema LED Display Specification Analysis

- 2018-2024 Cinema LED Display Player Progress Analysis

- 2018-2024 Global Cinema LED Display Market Scale

- Home Theater Application Market Definition

- Home Theater Market Trend- LED Video Wall vs. Projector Market Scale, Specification and Price

- Home Theater Market Opportunities and Potentials

- 2024 Home Theater LED Display / TV Brand Price

- 3.3. LED Rental Display Market

- LED Rental Display Market Applications

- 2024-2028 LED Rental Display Market Scale Analysis

- 2023 LED Rental Display Player Revenue Ranking vs. Market Share

- LED Rental Display Specification Analysis

- LED Rental Display Specification Requirement

- 3.4. LED Outdoor Display Market

- LED Outdoor Display Application Market Overview

- 2024-2028 LED Outdoor Display Market / 2023-2024(E) Application Analysis

- P1.2-P10 LED Outdoor Display Specification Definition

- 2024 P1.2-P10 LED Outdoor Display Price Analysis

- LED Outdoor Fine Pitch Display Application Market Analysis

- LED Outdoor Fine Pitch Display Specification Overview

- LED Outdoor Fine Pitch Display Specification Analysis

- 2024 Outdoor Display LED Specification and Price Survey

- Glasses-Free 3D Display Product Overview

- The Sphere

- Appendix: ePaper Outdoor Display Market

Chapter IV. LED Video Wall Market Price and Cost Analysis

- LED Video Wall Market Price Survey- Methodology and Definition

- 2024-2025(E) LED Video Wall Price Analysis

- 2024-2025(E) P2.5 LED Video Wall Price Analysis

- 2024-2025(E) P1.9 LED Video Wall Price Analysis

- 2024-2025(E) P1.5-P1.6 LED Video Wall Price Analysis

- 2024-2025(E) P1.2 LED Video Wall Price Analysis

- 2024-2025(E) P0.9 LED Video Wall Price Analysis

- 2024-2025(E) P0.7-P0.8 LED Video Wall Price Analysis

- 2024-2025(E) P0.625 LED Video Wall Price Analysis

- 2024 4K LED Video Wall / TV Price

- 2024 P1.68 LED Video Wall Cost Analysis

- 2024 P1.26 LED Video Wall Cost Analysis

- 2024 P0.9375 LED Video Wall Cost Analysis

- 2024 P0.84 LED Video Wall Cost Analysis

- 2024 P0.78 LED Video Wall Cost Analysis

- 2024 P0.625 LED Video Wall Cost Analysis

Chapter V. LED Video Wall Player Strategies

- Global LED Video Wall Player List

- LED Video Wall Player's ODM/OEM Supply Chain Analysis

- less than or equal to P1.0 Ultra-Fine Pitch Display Player Progress Analysis

- LED Video Wall Player Product Strategy and Sales Performance

- Samsung Electronics

- LG Electronics

- Sony

- BOE

- Leyard

- Unilumin

- Absen

- Liantronics

- Ledman

- Qiangli Jucai

- INFiLED

- CVTE / MaxHub

- HCP

- Cedar

- AOTO

- CREATELED

- Hikvision

- Dahua

- GKGD

- Cai Liang

- Sansi

- LP Display

- MTC

- CSOT

- Daktronics

Chapter VI. Display LED Market Trend and Product Analysis

- 6.1. Indoor Fine Pitch Display LED Product Analysis

- Display LED Product Application Market

- Fine Pitch Display LED Technology Overview

- 2024-2025 Display LED Technology Trend

- Display LED Technology Analysis- MiP / COB / 4-in-1 Mini LED

- MiP (0202 / 0404 LED) Pros and Cons Analysis

- 2023-2024(E) Mini LED Video Wall Player Capacity Ranking

- Virtual Resolution- Principle

- Virtual Resolution- Solution Analysis

- Virtual Resolution- Cost Analysis

- Virtual Resolution- Controller Requirement

- Virtual Resolution- Market Landscape Analysis

- Virtual Resolution- LED Video Wall Specification / Price Analysis

- 6.2. Display LED Market Trend and Analysis

- 2024-2028 Display LED Market Value Analysis

- 2024-2028 Display LED Market Volume Analysis

- 2024-2028 Display LED Market Value Analysis- Incl. Micro/Mini LED

- 2024-2028 less than or equal to P2.5 Display LED Market Value- LED Product Analysis

- 2024-2028 less than or equal to P1.0 Display LED Market Value- LED Product Analysis

- 2021-2024 Display LED Price Trend- SMD LED / MiP (0202 / 0404 LED)

- 2021-2024 Display LED Price Trend- 4-in-1 Mini LED

- 2021-2024 Display LED Price Trend- RGB Mini LED Chips

- 2022-2023 Display LED Chip Player Revenue Ranking

- 2022-2023 Display LED Package Player Revenue Ranking

Chapter VII. Driver IC Market Trend and Player Strategies

- 2024-2028 LED Display Driver IC Market Value / Shipment Analysis

- 2022-2024(E) LED Display Driver IC Player Revenue Ranking

- 2022-2023 LED Display Driver IC Player Revenue Market Share Analysis

- 2022-2024(E) LED Display Driver IC Player Shipment Ranking

- 2022-2023 LED Display Driver IC Player Shipment Market Share Analysis

- 2023-2024(E) Common-Cathode Driver IC Market Penetration Rate Analysis

- LED Display Driver IC Product Trend vs. Specification Summaries

- 2023-2024 LED Display Driver IC Price Survey

- Driver IC Player Revenue Performance and Product Analysis

- Macroblock

- Chipone

- Xm-Plus

- Novatek

- Developer

- SHIXIN

- Sunmoon

- Fine Made

- Chipfountain

Appendix. Pro A/V System Integrator / Distributor (Dealer) List

- North America- Pro A/V System Integrator List

- North America- Pro A/V Distributor (Dealer) List

- EMEA- Pro A/V System Integrator and Distributor (Dealer) List

- APAC- Pro A/V System Integrator and Distributor (Dealer) List

- China- LED Video Wall Distributor (Dealer) List