|

市场调查报告书

商品编码

1892146

AI伺服器市场趋势(2026):DRAM和NAND快闪记忆体价格上涨的推动因素2026 AI Server Market Trends: Driving DRAM and NAND Flash Price Surge |

||||||

2026年,市场呈现明显的上涨趋势,DRAM供应趋紧,价格普遍上涨已成定局。云端服务供应商(CSP)正在推动市场成长,加速资料中心扩张以支援AI工作负载。这不仅推动了全球伺服器出货量的成长,也显着提高了每台伺服器的记忆体容量。

在NAND快闪记忆体市场,企业需求预计将在2026年成为成长的主要驱动力。同时,在经济復苏迹像明显、购买力提升、需求重振之前,消费市场预计将保持低迷。

展望2026年,AI伺服器需求的持续强劲,加上供应商以利润为先的策略,预计将维持DRAM和NAND快闪记忆体的价格上涨趋势,从而强化整个记忆体产业的结构性价格转变。

主要亮点

- 预计2026年DRAM市场将呈现明显的上涨趋势,DRAM供应紧张,价格普遍上涨。这主要是由于云端服务供应商(CSP)加速了AI工作负载的资料中心扩张,导致全球伺服器出货量和单一伺服器记忆体容量增加。

- 预计2026年NAND快闪记忆体市场将主要依靠企业需求作为其核心成长引擎,而消费者市场由于等待经济復苏以恢復购买力,将保持低迷。

- 持续的AI伺服器需求,加上供应商以利润为先的策略,将维持DRAM和NAND快闪记忆体价格的上涨趋势,进一步巩固记忆体产业的结构性价格波动。

目录

第一章:产能转向高利润伺服器产品,DRAM价格上涨难以逆转

第二章:PC DRAM:伺服器需求挤压供应,限制PC DRAM产量,导致被动价格上涨

第三章:伺服器DRAM:资料中心扩张推动强劲需求,供应商优先分配,推高价格

第四章:行动DRAM:位元成长限制和潜在的供应短缺可能引发价格大幅上涨

第五章:图形DRAM:人工智慧推动强劲需求。 GDDR7 引领成长,价格逐年上涨

第六章:消费级 DRAM:由于需求前景疲软和 DDR3/DDR4 供应短缺,合约价格上涨

第七章:2026 年展望:经济不确定性减缓消费需求,而企业 AI 的应用推动成长

第八章:客户端 SSD:512B 成为标准,容量成长放缓,而 QLC SSD 因成本优势获得市场占有率

第九章:企业级 SSD:AI 需求与 HDD 替换推动强劲成长,并带动其他细分市场价格上涨

第十章:eMMC/UFS:NAND快闪处理的进展提升了智慧型手机的储存容量,但由于需求疲弱及激烈竞争,价格上涨有限

第十一章:NAND 闪光晶圆:代工厂流程转变与利润导向策略收紧供应并推高价格

第十二章:TRI 视角

A clear uptrend is taking shape for 2026, with tighter DRAM supply and broad-based price increases now firmly in sight. The primary growth catalyst is CSPs, which are accelerating data center expansion to support AI workloads. This is not only driving higher global server shipments but also a notable increase in memory content per server.

In the NAND Flash market, enterprise demand will serve as the core growth engine in 2026, while the consumer segment is expected to remain muted until a more visible economic recovery boosts purchasing power and revitalizes demand.

Looking ahead to 2026, continued strength in AI server demand-combined with suppliers' profitability-first strategy-will keep both DRAM and NAND Flash prices on an upward trajectory, reinforcing a structural pricing shift across the memory industry.

Key Highlights

- Clear uptrend in 2026 with tighter DRAM supply and broad-based price increases, driven by CSPs accelerating data center expansion for AI workloads, boosting global server shipments and memory content per server.

- NAND Flash market relies on enterprise demand as core growth engine in 2026, while consumer segment stays muted pending economic recovery to revive purchasing power.

- Sustained AI server demand, paired with suppliers' profitability-first strategy, maintains upward trajectory for DRAM and NAND Flash prices, reinforcing structural pricing shift in memory industry.

Table of Contents

1. Capacity shifts toward high-margin server products, making DRAM price increases hard to reverse

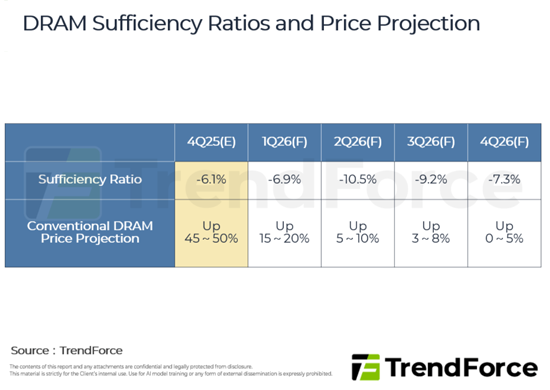

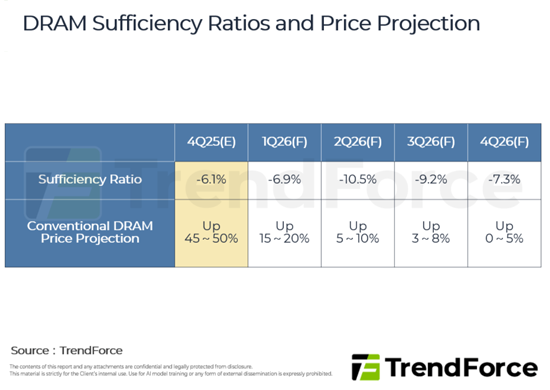

- Table 1: DRAM Sufficiency Ratios and Price Projection

2. PC DRAM: Server demand crowds out supply, limiting PC DRAM output and driving passive price increases

3. Server DRAM: Data-center expansion fuels strong demand; suppliers prioritize allocation, driving prices higher

4. Mobile DRAM: Limited Bit Growth and Potential Supply Squeeze Likely to Trigger Sharp Price Increases

5. Graphics DRAM: AI fuels strong demand; GDDR7 takes over as key growth driver with full-year price increases

6. Consumer DRAM: Weak Demand Outlook, Limited DDR3/DDR4 Supply to push Contract Prices Higher

7. 2026 outlook: Weak consumer demand under economic uncertainty, while enterprise AI adoption becomes the key growth driver

- Table 2: NAND Flash Sufficiency Ratios and Price Projection