|

市场调查报告书

商品编码

1287801

医药品物流的全球市场:2023年Global Pharmaceutical Logistics Report 2023 |

||||||

价格

简介目录

本报告提供全球医药品物流市场相关调查,市场概要,以及各地区的趋势,医药品物流服务供应商的简介等彙整资讯。

样本图

目录

第1章 市场规模的决策

第2章 主要趋势

- 数位化

- 出售与收购

- 永续性

- 生技药品

- 对患者的直接发送

- 线上药局

第3章 製药公司

- 製药公司销售额前10名(100万欧元)

- 案例研究

- Johnson & Johnson

- Merck

- Pfizer

- Roche

- Novartis

第4章 医药品提供者

- DSV

- BOLLORE

- CMA CGM GROUP

- DEUTSCHE POST DHL GROUP

- GXO

- IMPERIAL LOGISTICS

- KUEHNE + NAGEL

- YUSEN

关于TI

许可证和着作权

简介目录

Pharmaceutical supply chain models are evolving as a result of new manufacturing techniques, customized treatments, supply chain risks and political tensions.

Use our new report to understand pharmaceutical logistics dynamics and opportunities.

‘Global Pharmaceutical Logistics 2023’ provides a detailed analysis of global pharmaceutical market sizing, broken down by region and select countries.

The report provides an overview of the top trends in pharma and the developing pharmaceutical market , as well as an analysis of the top 10 pharmaceutical company revenues and their inventory levels 2018-2023, with accompanying case studies.

The report also examines the top pharmaceutical logistics service providers .

SAMPLE VIEW

‘Global Pharmaceutical Logistics 2023’ - Key Findings:

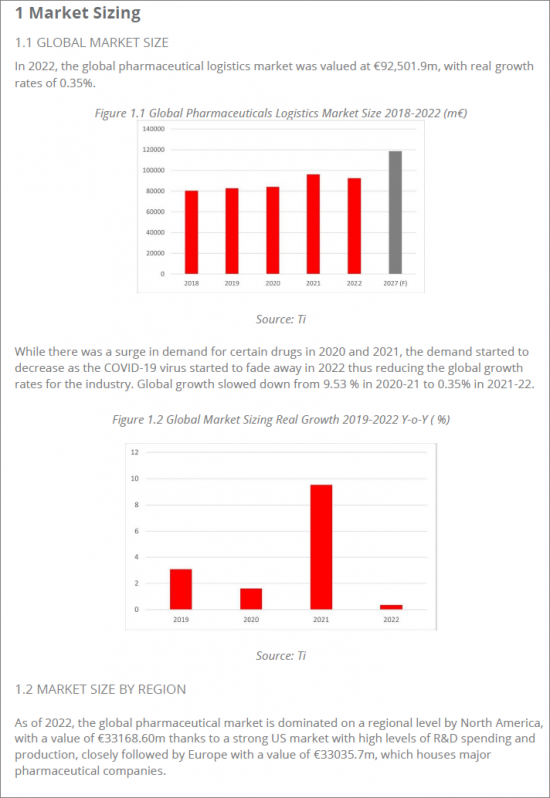

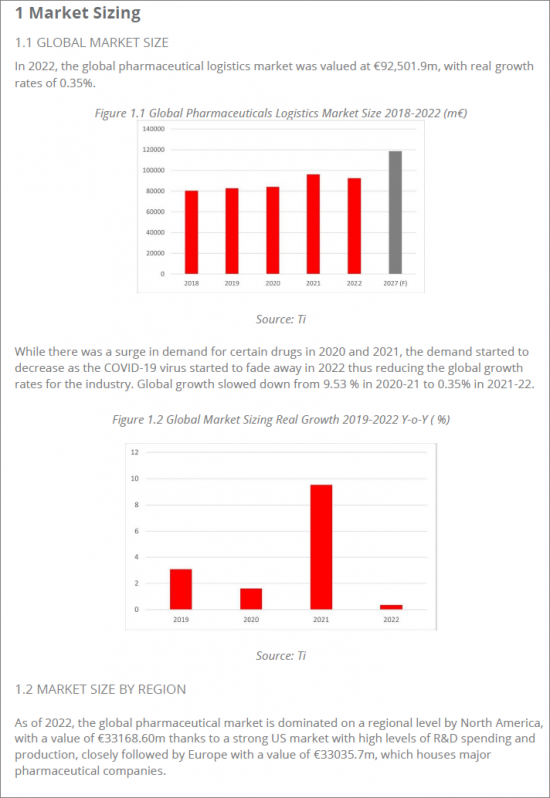

- 1. The global pharmaceutical logistics market is estimated to grow at a 2022-2027 CAGR of 5.09%.

- 2. The global market is still dominated on a regional level by North America.

- 3. 'Big pharma' companies have turned their attention to 'biologics' or 'biopharmaceuticals' which have the potential for much higher profit margins than OTC drugs.

- 4. Global pharma companies are looking at how they can bring industry 4.0 technologies into their business strategy.

- 5. Many pharma organizations are divesting parts of themselves in order to fund acquisitions.

What does the report contain?

- Global pharmaceutical logistics market sizing and analysis for 2022-2027 - global and regional figures, and specific countries of particular interest.

- An overview of top trends in the pharmaceutical market, including digitilization, online pharmacies, sustainability, divestment & acquisition, biologics and direct to patient.

- An overview of pharmaceutical logistics service providers, including GXO, DSV, Bolloré & Deutsche Post DHL Group.

- Top 10 pharmaceutical company revenues 2018-2023.

- Case studies of pharmaceutical companies.

TABLE OF CONTENTS

1. MARKET SIZING

- 1.1. GLOBAL MARKET SIZE

- 1.2. MARKET SIZE BY REGION

- 1.2.1. Growth Rates by Region: Overview

- 1.2.2. Market Forecasts and 2022-27 CAGR by Region: Overview

- 1.2.3. North America

- Forecast and CAGR Rates

- US

- 1.2.4. Europe

- Europe 2020-27 CAGR Overview

- Belgium

- Switzerland

- Germany

- France

- 1.2.6. Asia Pacific

- Asia Pacific 2022-2027 CAGR

- India

- China

- Japan

- 1.2.7. South America

- Brazil

- Biosimilars

- 1.2.8. MENA

- 1.2.9. Russia, Caucasus and Central Asia

- 1.2.10. Sub-Saharan Africa

2. TOP TRENDS

- 2.1. DIGITALIZATION

- 2.2. DIVESTMENT AND ACQUISITION

- 2.3. SUSTAINABILITY

- 2.3.1. Transportation

- 2.4. BIOLOGICS

- 2.4.1. The Logistics of Biologics

- 2.4.2. Clinical Trials

- 2.4.3. Logistics Giants Leading the Way

- 2.5. DIRECT TO PATIENT

- 2.5.1. Growing need for 'cool chain'

- 2.5.2. Home Healthcare Market

- 2.6. ONLINE PHARMACIES

3. PHARMACEUTICAL COMPANIES

- 3.1. TOP 10 PHARMACEUTICAL COMPANIES BY REVENUE (€M)

- 3.2. CASE STUDIES

- 3.2.1. Johnson & Johnson

- 3.2.2. Merck

- 3.2.3. Pfizer

- 3.2.4. Roche

- 3.2.5. Novartis

4. PHARMACEUTICAL PROVIDERS

- 4.1. DSV

- 4.2. BOLLORE

- 4.3. CMA CGM GROUP

- 4.4. DEUTSCHE POST DHL GROUP

- 4.5. GXO

- 4.6. IMPERIAL LOGISTICS

- 4.7. KUEHNE + NAGEL

- 4.8. YUSEN

ABOUT TI

LICENCE AND COPYRIGHT

02-2729-4219

+886-2-2729-4219