|

市场调查报告书

商品编码

1298927

合约物流的全球市场(2023年)Global Contract Logistics Report 2023 |

||||||

预计到 2027 年,全球合同物流市场规模将以 4.7% 的复合年增长率增长。

本报告提供全球合约物流市场相关调查,提供市场规模与预测,供需要素和供应链的混乱等趋势的分析,竞争分析等资讯。

目录

第1章 市场规模的决策

- 概要

- 供需

- 世界

- 亚太地区

- 北美

- 欧洲

- 市场区隔

- 流通

- 仓库保管

- 附加价值服务

第2章 市场趋势

- 合约物流市场调查(2023年)

- 样品的特性

- 收益分割

- 保证金

- 课题

- 电子商务

- 仓库保管:市场现状

- 仓库的可用性和空间的成本

- 人事费用

- 合约物流市场上M&A(2023年)

- GXO

- Ryder

- DHL

- CMA CGM

- Maersk

- Geodis

- 预测

- 仓库的机器人工学和自动化

- 仓库的自动化的影响因素(2023年~)

- 关注的仓库技术

第3章 竞争情形

- 合约物流企业的市场定位

- 前十大企业

- GXO

- Ryder

- Kuehne + Nagel

- UPS

- DSV

- GEODIS

- DHL

- Nippon Express

- LOGISTEED

- LX Pantos

- Rhenus

- CEVA

第4章 市场预测

- 世界

- 2023年

- 2027年

- 2023年

- 2027年

- 北美

- 2023年

- 2027年

- 欧洲

- 2023年

- 2027年

关于TI

许可证和着作权

Inflation, increased competition and strained warehousing space creates increasingly challenging environment for contract logistics providers.

What's the outlook and key trends for 2023 - 2027?

Find out with our new market report - published TODAY

The last 12 months has brought an increasingly challenging operating environment for contract logistics providers. High inflation, softened demand, increased competition and strained warehousing space has created a potent mix of industry challenges.

Global Contract Logistics 2023, examines current and future market trends and breaks down Ti's brand new market size, forecast and segementation data for 2022, 2023 through to 2027. The report also examines Ti's State of the Logistics survey results and provides competitive analysis and Top 10 rankings. Use the report to plan for the rest of 2023 through to 2027 and navigate increasingly challenging market dynamics.

SAMPLE VIEW

GLOBAL CONTRACT LOGISTICS 2023 - KEY FINDINGS & DATA:

- In 2022 the market grew by just 2.9% y-o-y.

- Ti projects the market will exhibit a slightly quicker pace of growth in 2023, growing by 3.8% y-o-y.

- 2023 growth will be driven by Asia Pacific, which is forecast to grow 7.8%.

- Out to 2027, the market will grow at a CAGR of 4.1%.

- 90% of survey respondents are currently experiencing increased pressure on margins.

- The main factor driving increased margin pressure is increasing costs.

- DHL Supply Chain has continued to maintain its place as the global market leader in contract logistics.

- Warehouse robotics are a popular choice among providers, driven by the flourishing e-commerce landscape.

WHAT DOES THE REPORT CONTAIN?

- 2022 market sizes, and forecasts for 2023 through to 2027, split by region and market segment.

- Contract logistics trend analysis, including supply and demand factors, supply chain disruption, innovation, M&A activity, vertical sector influences and economic activity.

- Analysis of Ti's State of the Contract Logistics Market Survey results.

- Competitive analysis.

- In depth company profiles.

- Top 10 rankings.

Table of Contents

1. Market Sizing

- 1.1. OVERVIEW

- 1.2. SUPPLY AND DEMAND

- 1.3. GLOBAL

- 1.4. ASIA PACIFIC

- 1.5. NORTH AMERICA

- 1.6. EUROPE

- 1.7. SEGMENTATION

- 1.7.1. Distribution

- 1.7.2. Warehousing

- 1.7.3. Value-added services

2. Market Trends

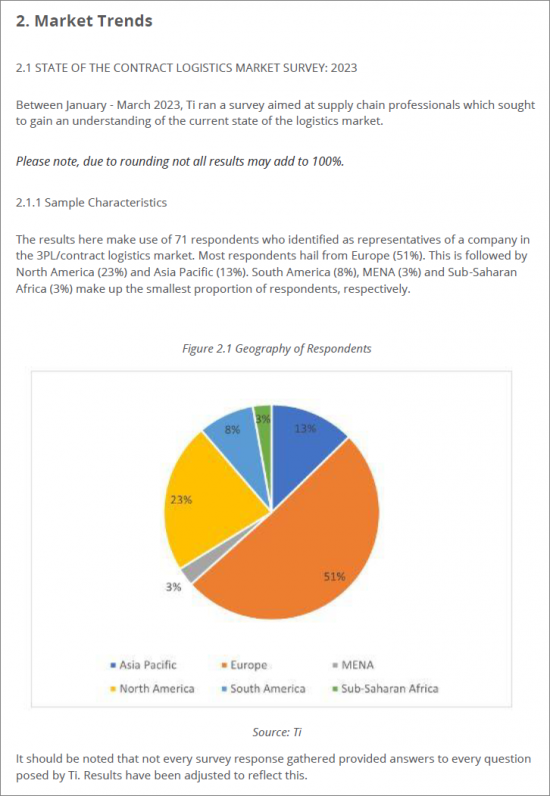

- 2.1. STATE OF THE CONTRACT LOGISTICS MARKET SURVEY: 2023

- 2.1.1. Sample Characteristics

- 2.1.2. Revenue Split

- 2.1.3. Margins

- 2.1.4. Challenges

- 2.1.5. e-commerce

- 2.1.5.1. Outsourcing Trends

- 2.1.5.2. Challenges

- 2.2. WAREHOUSING: STATE OF THE MARKET

- 2.2.1. Warehousing Availability and Cost of Space

- 2.2.1.1. North America

- 2.2.1.2. Europe

- 2.2.1.3. Asia Pacific

- 2.2.2. Cost of Labour

- 2.2.2.1. North America

- 2.2.2.2. Europe

- 2.2.2.3. Asia Pacific

- 2.2.1. Warehousing Availability and Cost of Space

- 2.3. M&A in the contract logistics market: 2023

- 2.3.1. GXO

- 2.3.2. Ryder

- 2.3.3. DHL

- 2.3.4. CMA CGM

- 2.3.5. Maersk

- 2.3.6. Geodis

- 2.3.7. Outlook

- 2.4. Robotics and Automation in the Warehouse

- 2.4.2. Factors affecting warehouse automation in 2023 and beyond

- 2.4.3. Up-and-Coming Warehouse Technology

3. Competitive Landscape

- 3.1. MARKET POSITIONING OF CONTRACT LOGISTICS COMPANIES

- 3.1.1. Vertical Sectors Served

- 3.1.2. Geographic Coverage

- 3.1.3. Profit Margins

- 3.1.4. Comparison of Value-added Services

- 3.1.5. Comparison of Global Warehousing Space

- 3.1.6. Comparison of Technology and Robotics Solutions Employed by Contract Logistics Providers

- 3.1.7. Comparison of Sustainability Targets

- 3.2. Top 10

- 4.1. GXO

- 4.2. Ryder

- 4.3. Kuehne + Nagel

- 4.4. UPS

- 4.5. DSV

- 4.6. GEODIS

- 4.7. DHL

- 4.8. Nippon Express

- 4.9. LOGISTEED

- 4.10. LX Pantos

- 4.11. Rhenus

- 4.12. CEVA

5. Market Forecast

- 5.1. GLOBAL

- 5.1.1. 2023

- 5.1.2. 2027

- 5.2.1. 2023

- 5.2.2. 2027

- 5.3. NORTH AMERICA

- 5.3.1. 2023

- 5.3.2. 2027

- 5.4. EUROPE

- 5.4.1. 2023

- 5.4.2. 2027