|

市场调查报告书

商品编码

1435250

日本合约物流:市场占有率分析、产业趋势、成长预测(2024-2029)Japan Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

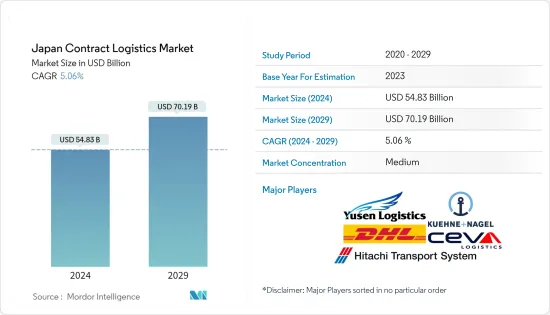

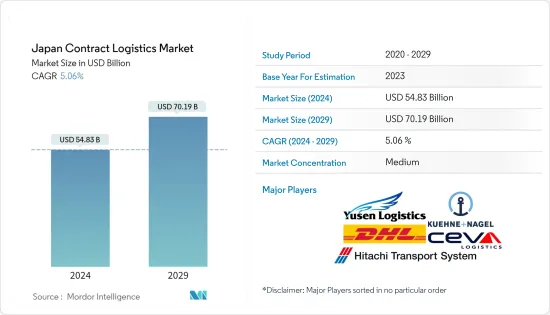

日本合约物流市场规模预计2024年为548.3亿美元,预计到2029年将达到701.9亿美元,在预测期内(2024-2029年)成长5.06%,以复合年增长率成长。

该行业的主要企业报告称,由于消费行为发生变化,收益增加。

随着日本消费者越来越多地使用互联网,带动了市场的物流需求,日本的小供应商正在积极转向线上市场。

日本合约物流市场趋势

电子商务成长

日本的电子商务零售业按销售不同行业产品的公司进行分类,包括时尚、电子和媒体、食品和个人护理、家具和电器产品以及玩具。随着市场的发展,大公司专注于采用最新技术,而小型零售商则依赖亚马逊和乐天等巨头提供库存管理、包装和运输等服务。我们积极与市场参与者合作。近期,Aeon(日本最大的购物中心开发商和营运商)已同意与Ocado(英国自动化仓库提供者)达成协议,开发自动化仓库,预计到2035年销售额将达到1兆韩元,预计将有所增长。

此外,在区块链设施在物流服务中的渗透以及零售和外食业对美式牛排的兴趣日益浓厚的背景下,牛肉产量下降了10%,而需求却在增加,我们正在推动需求的成长。管理零售电子商务的物流设施。

由于劳动力减少,物流自动化程度提高

劳动力短缺是世界各地物流公司面临的通用挑战,但日本是受人口老化和人口减少影响最严重的国家之一。劳动力短缺、电子商务的日益普及以及有趣的技术进步的引入是推动自动化机械和技术引入仓库设施的一些趋势。日本时尚巨头 Uniqlo 和DAIFUKU CO. LTD. 物流 Solutions 计划投资 1000 亿英镑开发机器人和物料输送系统,将员工对库存管理和交付的参与减少 100% 为此,我们与两家机器人Start-UpsMujin Inc. 和 Exotec Solutions 合作。亚马逊将与Family Mart、小田急电铁等合作,在东京、神奈川县等共计200个地点安装刷亚马逊发送的条码即可使用的“Amazon Hub Locker”服务。2020 年。这是一个时间表。使用阅读器发送电子邮件以接收该项目。

日本合约物流业概况

该市场相对集中,主要企业有邮船物流、日立运输系统和德迅,以及市场领先的零售商和製造商的内部物流部门。为了应对技术进步和劳动力下降而进行的物流设施集中正在支持物流服务的需求并推动市场成长。 2019年7月,美国投资公司黑石集团宣布将斥资超过1,000亿英镑收购日本配送中心,理由是日本电商市场有成长空间。 Yusen 物流和 Cinnamon AI 宣布建立合作伙伴关係,提供 Flax Scanner 等解决方案来改善空运出口物流业务。日本GLP(一家专门从事物流房地产和技术的公司)宣布将在相模原开发五个先进的物流设施,称为“GLP ALFALINK”,这是一个具有开放枢纽、综合连锁和共享解决方案功能的创造性连锁物流平台。 。

ZigZag Global 与日本市场领导Yamato Transport 合作推出首个退货管理解决方案,以支援全球零售商为日本客户提供退货服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 抑制因素

- 机会

- 产业吸引力-波特五力分析

- 价值链/供应链分析

- 行业法规政策

- 技术整合

第五章市场区隔

- 按类型

- 内部资源

- 外包

- 按最终用户

- 车

- 消费品/零售

- 活力

- 高科技医疗保健

- 工业/航太

- 科技

- 其他最终用户

第六章 竞争形势

- 市场集中度概况

- 公司简介

- DHL

- Ceva Logistics

- Daifuku Co. Ltd.

- Hitachi Transport System

- Honeywell International Inc.

- KION Group AG

- Kuehne+Nagel

- Nippon Logistics

- Yamato Holdings

- Yusen Logistics

第七章 投资分析

- 最近的併购

第八章 日本合约物流市场的未来性

第九章 免责声明

The Japan Contract Logistics Market size is estimated at USD 54.83 billion in 2024, and is expected to reach USD 70.19 billion by 2029, growing at a CAGR of 5.06% during the forecast period (2024-2029).

The major companies in the sector report their revenue growth as an output of change in the consumer behaviour towards e-commerce sector.

The small Japanese vendors are actively moving to the online market in response to the growing use of the internet by the Japanese consumers driving the demand for logistics in the market.

Japan Contract Logistics Market Trends

Growth in E-Commerce

The e-commerce retail in Japan is segmented by the companies selling products of various domains like fashion, electronics & media, food & personal care, furniture & appliances and Toys. With the growing market, the big companies are focusing adapting the updated technologies while the small retail companies are actively collaborating with the big market players like Amazon (Amazon Fulfilment Services) and Rakuten (Rakuten Fulfilment Services) for services like inventory management, packaging and delivery. Among the recent developments, Aeon (Japan's largest shopping mall developer and operator) agreed upon a deal to develop automated warehouses with Ocado (the UK automated warehouse provider), expecting its sales to increase to ¥ 1 trillion by 2035.

Further, the penetration of the blockchain facilities in logistics services and a 10% decrease in production and rising demand of beef - backed by the growing interest in American-style steak in retail and foodservice is also driving the growth in the demand for the temperature-controlled logistics facilities in the retail e-commerce.

Decreasing Workforce Pushing the Automation in Logistics

The labour skill shortage is a common issue faced by logistics companies worldwide, but Japan is one of the most affected countries due to its ageing and declining population. The labour shortage, increasing e-commerce penetration and introduction of intriguing technical advancements are some of the trends thrusting the inculcation of automated machines and technologies with the warehousing facilities. The Japanese fashion giant Uniqlo along with Daifuku Logistics Solutions plans on investing ¥ 100 billion and has partnered with two robotic startups - Mujin Inc. and Exotec Solutions to develop robotics and material handling systems reducing workforce involvement in the inventory management and delivery to 100%. Amazon, along with FamilyMart Co., Odakyu Electric Railway Co. and other firms is planning to set up the "Amazon Hub Locker" service at a total of 200 locations mainly in Tokyo and Kanagawa Prefecture by 2020 where Amazon customers can swipe barcodes sent by e-mail over reading machines to receive their goods.

Japan Contract Logistics Industry Overview

The market is relatively concentrated with Yusen Logistics, Hitachi Transport System, and Kuehne Nagel as its major players along with the inhouse logistic segments of the retail and manufacturing companies leading the market. The technological advancements and consolidation of the logistics facilities response to the declining workforce are supporting the demand for the logistics services and driving the growth in the market. The U.S. investment firm Blackstone Group in July 2019, announced to spend over ¥ 100 billion to buy distribution centres in Japan, seeing room for growth in the country's e-commerce market. Yusen Logistics and Cinnamon AI have announced a collaboration to provide solutions like Flax Scanner for improving the logistics operations for aviation exports. Japan GLP (a company specializing in logistics real estate and its technology) has announced the development of 5 advanced logistics facilities as GLP ALFALINK at Sagamihara, a creative chain logistics platform, which will include the functions of an Open Hub, Integrated Chain and Shared Solution for the tenant companies.

ZigZag Global partnered with Japanese market leader Yamato Transport to facilitate the first Returns Management Solution to support retailers from all over the world with their Japanese customer returns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 Technological Integration

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End-User

- 5.2.1 Automotive

- 5.2.2 Consumer & Retail

- 5.2.3 Energy

- 5.2.4 Hi-Tech and Healthcare

- 5.2.5 Industrial & Aerospace

- 5.2.6 Technology

- 5.2.7 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 Ceva Logistics

- 6.2.3 Daifuku Co. Ltd.

- 6.2.4 Hitachi Transport System

- 6.2.5 Honeywell International Inc.

- 6.2.6 KION Group AG

- 6.2.7 Kuehne + Nagel

- 6.2.8 Nippon Logistics

- 6.2.9 Yamato Holdings

- 6.2.10 Yusen Logistics

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers and Acquisitions