|

市场调查报告书

商品编码

1533185

6G通讯:光学、光电、航太材料和元件市场(2025-2045)6G Communications: Optical, Optronics and Aerospace Materials and Devices Markets 2025-2045 |

||||||

6G 通讯将始终使用高达 300GHz 的频率,但需要采用光学器件才能取得商业成功。这是因为它需要在许多地方可用,包括航空航天、陆地(包括室内)和水下。大多数这些地点都无法透过电缆到达,无线电频率很少达到也无法接近 1Tbps。因此,增加红外线和可见光通讯将非常重要,并且射频基础设施将变得越来越光学透明。增强或重新导向讯号的 6G 智慧窗户和透明建筑立面不会因美观原因而被拒绝,而最好的 6G RIS 则提供光学透明度,可增强或重新导向各个方向的讯号。

6G 基础设施变得越来越偏远、数量众多、昂贵、耗电且炎热,包括卫星、无人机和岛屿。因此,安装后可以保留的自发电和自冷却功能对于基础设施和客户端设备都极为重要。

| 章节架构: | 8 |

| SWOT 评级: | 18 |

| 2045年以前的预测线: | 25 |

| 主要结论: | 21 |

| 新资讯图表: | 27 |

| 公司: | 112 |

| 页数: | 367 |

本报告调查了6G通讯光学、光电和航空航天材料和装置市场,提供6G传输、冷却和私人发电中近红外线/可见光材料和装置在的重要性,以及航空航天材料和硬体中6G的机会,6G材料和硬体的路线图,6G材料和硬体市场的预测,各种技术的研究、进展和前景总结。

目录

第1章 执行摘要/结论

- 调查方法

- 主要结论:为什么6G只有大规模部署光技术才能成功

- 6G传输、冷却、自发电不可或缺的近红外线/可见光材料和装置

- 光学材料和装置对于 6G 的成功非常重要

- 用于6G通讯的光学材料的化合物和碳同素异形体:近期研究进展水准排名

- 主要结论:航空航太材料与硬体领域的 6G 机会

- 6G 航空太空船 - 7 种变速箱选项

- 主要结论:6G光无线通讯OWC

- OWC应用于6G的SWOT评估

- 6G VLC 的 SWOT 评估

- 主要结论:超越讯号处理的 6G 光学材料

- 按主题和技术成熟度划分的固体冷却研究管道

- 透过能量收集选项满足 6G 手机、平板电脑、主动 RIS 和 UM MIMO 基地台日益成长的功率需求

- 6G材料与硬体路线图

- 6G材料与硬体市场预测:~2045年

第2章 简介

- 显示光学技术的概述和状态资讯图

- 6G第一阶段:逐步成长

- 6G第二阶段:令人困惑且极为困难

- 6G 材料需求和工具包显示了许多光学功能的重要性

- 补充6G频率选择

- 6G RIS 的演进

- 6G基地台的演进

- 6G材料/设备製造商范例

第3章 6G卫星通讯与HAPS通信,低空无人机6G

- 摘要

- 6G-NTN:考虑将地面和非地面组件整合到6G中

- 6G航空航太平台比较

- 空中6G基地台 "天空之塔" 研究

- HAPS 以及其他 6G 通讯和感测的最新趋势

- 6G等通讯相关无人机研究:2024年48篇论文综述

- 透过卫星实现 6G 的进展:

- 有可能引进地面 6G 和低空太阳能来支援无人机服务以及其他无人机的 6G

第4章 6G OWC(光无线通讯)

- 定义/优点/范例

- 用于 6G 通讯的 OWC

- 5G FSO 的经验教训

- 包括 6G 在内的 OWC 研究进展:2024年

- OWC 组件及其材料

- 32 家 FSO 硬体和系统供应商的范例和国家分析

第5章 VLC(可见光通讯):航空航太、地面、水下

- 改变人们对 VLC 基础知识及其在 6G 中的重要性的看法

- 竞争地位与潜在用途

- 6G 的重要性

- VLC 格式

- 摘要

- LiFi

- 互动式 iVLC

- 组织光通信

- VLC技术的进展与展望

- 过去参数的改进

- 混合系统

- VLC光源的成就与现实目标

- VLC 接收器的成就与现实目标

- 2024年的干扰管理

- 2024年发射式太阳能聚光器的使用

- 2024室内VLC系统优化

- MIMO VLC 进展:2024年

- 水下 6G 通讯:VLC 现况、进展与替代方案

- 摘要

- 2024年的主要进展

- 水下无线通讯技术比较

- 6G VLC 的一般建议

- 6G VLC 的 SWOT 评估

第6章 ORIS:增强近红外线和可见频率传播路径的 6G ORIS 硬体和系统设计

- 摘要

- ORIS:室内、室外、水下

- 优先考虑研究和企业发展

- 近红外线与可见光 ORIS 及相关设备设计概述

- 用于远红外线太赫兹、近红外线和可见频率的 RIS 调谐的材料和装置

- 资讯图表:RIS 特性、调整标准、物理原理、启动选项

- 6G RIS 调谐材料的优点与挑战比较

- 在 6G RIS 研究中获胜的 RIS 调谐材料比较

- 液晶ORIS研究范例

- 其他超材料 ORIS 材料和设计

- 对 225 篇近期研究论文和企业活动的分析

- 推进近红外线和可见光 ORIS 及相关设备设计:2024年

- ORIS 应对的挑战

- 空气中的衰减如何互补

- 平流层及其他地区通讯的一部分

- ORIS 系统技术与架构:2024年进展

第7章 6G 0.3THz 至可见光 6G 传输的电介质、光学材料和半导体

- 摘要

- 降低风险和衍射光学元件 DOE 的范例

- 电介质

- 为 6G 光电选择半导体和具竞争力的材料

- 太赫兹波导电缆和小型单元

- 6G近红外线光纤的未来

第8章 用于 6G 基础设施和客户端设备的新型光学冷却和太阳能板载电源

- 用于 6G 基础设施和设备的新一代固态冷却技术

- 为客户端设备提供自供电 6G 基础设施和太阳能发电

Summary

6G Communications will always use frequencies up to 300GHz but, to succeed commercially, it must strongly adopt optical equipment. Reasons include the need to be far more available - in aerospace, on land, including indoors, and underwater - without defaulting to mere GHz performance. You cannot run cables to most of that, radio frequencies cannot reach much of that and the promised 1Tbps cannot be approached. Consequently infrared and visible light communication must be added. Indeed, RF infrastructure will increasingly become optically transparent - invisible. The 6G smart window and transparent building facade boosting and redirecting the signals do not get rejected for ugliness. Indeed, the best 6G reconfigurable intelligent surfaces have all-round reach enabled by optical transparency.

6G infrastructure will increasingly be more remote (satellites, drones, islands), numerous, expensive and power-hungry meaning hotter. Fit-and-forget self-powering and self-cooling of both infrastructure and client devices become very important. That photovoltaics and solid-state cooling also involves manipulation of infrared and visible light. Next generation fiber optics and maybe far infrared THz cables now being researched will be the 6G intermediaries - more optics. Aerospace technology optically provides both reach and customers. Time for a report on both. This is it. The 369 page, commercially oriented report, "6G Communications: Optical, Optronics and Aerospace Materials and Devices Markets 2025-2045" has it all. Vitally, that includes the flood of research breakthroughs and changes of strategy through 2024.

| Chapters: | 8 |

| SWOT appraisals: | 18 |

| Forecast lines to 2045: | 25 |

| Key conclusions: | 21 |

| New Infograms: | 27 |

| Companies: | 112 |

| Pages: | 367 |

The Executive Summary and Conclusions takes 33 pages to present the total picture including the roadmaps and 26 forecast lines. Infograms and comparison tables make it an easy read. The 38-page Introduction then explains how 6G will start with incremental improvement but a difficult, disruptive Phase Two will be essential to fully deliver on the promises and paybacks. Learn how this strongly introduces optics. See many of the manufacturers getting involved, some latest advances and an initial taster of your materials and device opportunities emerging.

The rest of the report consists of one chapter on aerospace 6G, four chapters on optical communication being prepared for 6G, and finally a chapter on that essential photovoltaics and optronic solid state cooling for both 6G infrastructure and client devices.

Chapter 3, "6G satellite and HAPS communication and 6G for low-level drones" is 46 pages. It includes new low-level solar drones announced in 2024 and use of 6G to manage drones. It strongly investigates high-altitude pseudo satellite HAPS, drones and dirigibles, aloft for years on advanced photovoltaic power. At least in part, they will use optical communication to vastly extend 6G reach. They hold position, reposition to serve disaster areas and to get around weather when signalling to Earth. They even land for repair and repurposing and they beat the cost, latency and Doppler challenges of Low Earth Orbit LEO satellites that are also key for ubiquitous 6G and are covered here. Learn about HAPS acting as both base stations and relays.

Chapters 4 and 5 respectively cover the overall picture of optical wireless communications then the subset of visible light communications. Chapter 4. "6G Optical Wireless Communication OWC" (40 pages) concentrates mainly on issues, progress in 2024, materials and devices. Learn how, across space, many optical frequencies can be used, certainly far infrared to visible, but, through air, such as satellite and HAPS to Earth communications, near infrared is currently favoured for high bit rate. Can LiFi succeed for streetlights and indoors, forming a part of 6G?

Chapter 5, "Visible Light Communication VLC: aerospace, terrestrial, underwater" is 39 pages. For example, it reports new advances in underwater high data rate communication where it is visible light that penetrates best with several hundred meters now in prospect.

Chapter 6, "Optical reconfigurable intelligent surfaces: 6G ORIS hardware and system design enhancing the propagation path at infrared and visible frequencies" (47 pages) Learn here of much research on Far IR THz RIS and far more on Near IR/visible but the analysis shows too little focus on hardware aspects of ORIS overall. See how much of the visible light work involves moving micro-mirror arrays, particularly that in 2024. However, the superior life, reliability and functionality of solid-state options described is essential. Enjoy much analysis of the tuning materials.

Chapter 7, "Dielectrics, optical materials, semiconductors for 6G 0.3THz to visible light 6G transmission" needs 75 pages. This is because it is a deep dive into low loss dielectrics, semiconductors and alternatives in optical transmission but also the optical hardware intermediary options meaning next generation fiber optic cable materials and the new work on Far IR THz waveguides even as cables.

The report closes with 33 pages of Chapter 8, "New photonic cooling and photovoltaic on-board power for 6G infrastructure and client devices". The optronic cooling choices here include passive daylight radiative cooling PDRC, Janus and Anti-Stokes. Observe how the appropriate photovoltaics is moving to triple and quadruple junctions, sometimes bifacial and certainly ultra-light weight. The emerging materials and likely progress are closely assessed.

Overall, the essential report, "6G Communications: Optical, Optronics and Aerospace Materials and Devices Markets 2025-2045" provides PhD level analysis and a great deal of further reading and insights from 2024. It is particularly focussed on your materials, device and systems opportunities emerging as all these optical needs arrive, optically providing transmission, detection, wider reach, power, and cooling.

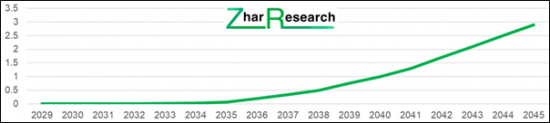

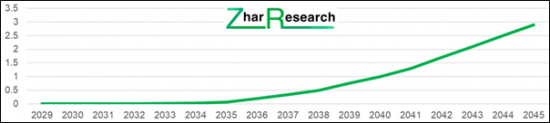

CAPTION 6G fully passive transparent metamaterial reflect-array market $ billion 2029-2045. Source: "6G Communications: Optical, Optronics and Aerospace Materials and Devices Markets 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Methodology of this analysis

- 1.2. Key conclusions: Why 6G can only succeed by massive adoption of optics

- 1.3. Near IR/ visible light materials and devices essential for 6G transmission, cooling and self-powering

- 1.4. How optical materials and devices are essential for 6G success

- 1.5. Ranking of number of recent research advances by compound and carbon allotrope for optical materials useful in 6G Communications

- 1.6. Key conclusions: 6G opportunities for aerospace materials and hardware

- 1.7. Aerospace vehicles for 6G - transmission options for 7 types

- 1.8. Key conclusions: Optical wireless communication OWC for 6G

- 1.9. SWOT appraisal of OWC as applied to 6G

- 1.10. SWOT appraisal of VLC for 6G

- 1.11. Key conclusions: 6G optical materials beyond signal handling

- 1.12. Research pipeline of solid-state cooling by topic and technology readiness level

- 1.13. Increased 6G mobile phone, tablet, active RIS and UM MIMO base station power demands matched to energy harvesting options

- 1.14. Roadmaps of 6G materials and hardware 2025-2045

- 1.15. Market forecasts for 6G materials and hardware to 2045 in 15 lines and graphs

- 1.15.1. Market for 6G vs 5G base stations units millions yearly 2024-2045

- 1.15.2. Market for 6G base stations market value $bn if successful 2025-2045

- 1.15.3. 6G RIS value market $ billion: active and three semi-passive categories 2029-2045: table, graphs

- 1.15.4. 6G fully passive transparent metamaterial reflect-array market $ billion 2029-2045

- 1.15.5. 6G added value materials value market by segment: Thermal, Low Loss, Other 2028-2045

- 1.15.6. 6G infrastructure/ client device market for materials manipulating IR and visible light: four categories $ billion 2029-2045

- 1.15.7. Smartphone billion units sold globally 2023-2045 if 6G is successful

- 1.15.8. Fiber optic cable market global with possible 6G impact $billion 2025-2045

- 1.15.9. Indium phosphide semiconductor market global with possible 6G impact $billion 2025-2045

- 1.15.10. Global metamaterial and metasurface market billion square meters 2025-2045

- 1.15.11. Terahertz hardware market excluding 6G $ billion globally 2025-2045

2. Introduction

- 2.1. Overview and landscape infogram showing optics technology

- 2.2. 6G Phase One will be incremental

- 2.2.1. Overview

- 2.2.2. New needs, 5G inadequacies, massive overlap 4G, 5G, 6G

- 2.3 6G Phase Two will be disruptive and extremely difficult

- 2.3.1. Overview

- 2.3.2. Some objectives of 6G mostly not achievable at start

- 2.3.3. View of a Japanese MNO heavily involved in hardware

- 2.3.4. ITU proposals and 3GPP initiatives also go far beyond what is achievable at start

- 2.3.5. Ultimate objectives and perceptions of those most heavily investing in 6G

- 2.4. Some 6G material needs and toolkit showing importance of many optical functions

- 2.5. Choosing complementary 6G frequencies

- 2.5.1. Overview

- 2.5.2. How attenuation in air by frequency and type 0.1THz to visible is complementary

- 2.5.3. Infogram: The Terahertz Gap and optics demands 6G RIS tuning materials and devices different from 5G

- 2.5.4. Spectrum for 6G Phase One and Two in context of current general use of spectrum

- 2.5.5. Essential frequencies for 6G success and some hardware resulting

- 2.6. Evolution of 6G reconfigurable intelligent surfaces RIS

- 2.6.1. Multifunctional and using many optical technologies

- 2.6.2. Infogram: RIS specificity, tuning criteria, physical principles, activation options

- 2.6.3. 6G RIS tuning material benefits and challenges compared

- 2.6.4. RIS will become zero energy devices and they will enable ZED client devices

- 2.6.5. Examples of 2024 research advances with far infrared THz RIS

- 2.6.6. 6G RIS SWOT appraisal

- 2.7. Evolution of 6G base stations

- 2.7.1. Trend to use more optical technology

- 2.7.2. 6G Self-powered ultra-massive UM-MIMO base station design

- 2.8. Examples of manufacturers of 6G materials and equipment

- 2.8.1. Across the landscape infogram

- 2.8.2. Mapped across the globe

3. 6G satellite and HAPS communication and 6G for low-level drones

- 3.1. Overview

- 3.2. 6G-NTN examines integration of terrestrial and non-terrestrial components into 6G

- 3.3. Aerospace platforms for 6G compared

- 3.4. Aerial 6G base station research "tower in the sky"

- 3.5. Latest advances in HAPS for 6G and other communication and sensing

- 3.5.1. SWOT appraisal of HAPS as a 6G aerospace platform

- 3.5.2. HAPS for 6G Networks: Potential Use Cases, Open Challenges, Possible Solutions

- 3.5.3. HAPS Alliance progressing HAPS communication

- 3.5.4. AVIC China Caihong (Rainbow) CH-T4

- 3.5.5. AALTO HAPS UK, Germany, France

- 3.5.6. BAE Systems Prismatic UK PHASA-35

- 3.5.7. EuroHAPS, CIRA, ESG, TAO Europe

- 3.5.8. Softbank Japan HAPS communication research in 2024

- 3.5.9. Thales Alenia Space France Italy Stratobus

- 3.6. Research on UAV involved in 6G and other communication: 48 papers from 2024 examined

- 3.7. Progress towards 6G with satellites: relevant advances in 2024

- 3.7.1. Overview

- 3.7.2. SpaceX Starlink and Omnispace objection

- 3.7.3. Research through 2024: 13 papers examined

- 3.8. Terrestrial 6G aiding drone services and low level solar and other drones potentially deploying 6G announced in 2024

- 3.8.1. Company initiatives in 2024 and new research

- 3.8.2. Artificial Intelligence Reflective Surface AIRS enhancing drone management

- 3.8.3. Three 2024 research advances in potential collaboration between 6G terrestrial base stations and aerial RIS

- 3.8.4. 2024 breakthroughs in low-level solar drones

- 3.8.5. 44 other relevant research advances announced in 2024

4. 6G Optical Wireless Communication OWC

- 4.1. Definitions, justification, examples

- 4.1.1. Context

- 4.1.2. Definitions and scope of OWC and its subsets

- 4.1.3. Infogram: Potential 6G transmission systems using OWC

- 4.1.4. FSO attenuation in air: physics, issues and solutions

- 4.1.5 Actual and emerging applications of OWC before 6G arrives

- 4.1.6. Recent example of FSO inter-space/ stratosphere

- 4.1.7. Other emerging OWC applications

- 4.1.8. Infrared IR, visible light VL and ultraviolet UV for 6G in air: issues and parameters

- 4.2. OWC for 6G Communications

- 4.2.1. Most promising frequencies

- 4.2.2. Massively heterogeneous

- 4.2.3. Non-coherent vs coherent

- 4.2.4. Importance of FSOC for 6G by location and interconnect

- 4.2.5. SWOT appraisal of OWC as applied to 6G

- 4.3. Lessons from 5G FSO

- 4.4. OWC research advances in 2024 including those oriented to 6G

- 4.5. OWC components and their materials

- 4.6. 32 examples of suppliers of FSO hardware and systems with country analysis

5. Visible Light Communication VLC: aerospace, terrestrial, underwater

- 5.1. VLC basics and changing views on its relevance to 6G

- 5.1.1. Competitive position and potential applications

- 5.1.2. Relevance to 6G

- 5.2. Forms of VLC

- 5.2.1. Overview

- 5.2.2. LiFi

- 5.2.4. Interactive iVLC

- 5.2.5. Through the tissue optical communications

- 5.3. VLC technological progress and prospects

- 5.3.1. Past improvement of parameters

- 5.3.2. Hybrid systems

- 5.3.3. Achievements and realistic objectives for VLC light sources

- 5.3.3. Achievements and realistic objectives for VLC receivers

- 5.3.4. Interference management in 2024

- 5.3.5. Use of luminescent solar concentrators in 2024

- 5.3.6. Indoor VLC system optimisation in 2024

- 5.3.6. MIMO VLC advances in 2024

- 5.4. Underwater 6G Communication: VLC situation and progress vs alternatives

- 5.4.1. Overview

- 5.4.2. Major advances in 2024

- 5.4.3. Comparison of underwater wireless communication technologies

- 5.5. General recommendations concerning 6G VLC

- 5.6. SWOT appraisal of VLC for 6G

6. Optical reconfigurable intelligent surfaces: 6G ORIS hardware and system design enhancing the propagation path at near infrared and visible frequencies

- 6.1. Overview

- 6.2. ORIS indoor, outdoor and underwater

- 6.3. Prioritisation of research and company development are inappropriate; analysis

- 6.4. Overview of near-infrared and visible light ORIS and allied device design

- 6.4.1. How metasurface RIS hardware operates

- 6.4.2. Basic RIS and its potential capabilities

- 6.4.3. Metamaterial ORIS for 6G Communication

- 6.5. Materials and devices for RIS tuning at Far IR THz, Near IR and visible light frequencies

- 6.5.1. Infogram: RIS specificity, tuning criteria, physical principles, activation options

- 6.5.2. 6G RIS tuning material benefits and challenges compared

- 6.5.3. Comparison of RIS tuning materials winning in 6G RIS-related research

- 6.5.4. Examples of liquid crystal ORIS research

- 6.5.5. Other metamaterial ORIS materials and designs

- 6.5.6. Analysis of 225 recent research papers and company activity

- 6.6. Near-infrared and visible light ORIS and allied device design with advances in 2024

- 6.7. Challenges addressed by ORIS

- 6.8. How attenuation in air by frequency and type 0.1THz to visible is complementary

- 6.9. Part of stratospheric communications and beyond

- 6.10. ORIS system technologies and architectures: progress through 2024

7. Dielectrics, optical materials and semiconductors for 6G 0.3THz to visible light 6G transmission

- 7.1. Overview

- 7.2. Derisking and example Diffractive Optical Elements DOE

- 7.3. Dielectrics

- 7.3.1. Overview

- 7.3.2. Dielectric requirements at 6G far IR, near IR and visible light frequencies with examples

- 7.3.3. Low loss and allied materials for RIS by popularity in research

- 7.3.4. Different dielectrics from 5G to 6G: better parameters, lower costs, larger areas

- 7.3.5. SWOT appraisal of low-loss dielectrics for 6G infrastructure and client devices

- 7.3.6. Dielectric optimisation for 6G in four tables and infograms

- 7.3.7. Example: Development of advanced polyimide dielectrics

- 7.3.8. The quest for high and low permittivity 6G low loss materials

- 7.3.9. Permittivity 0.1-1THz for 19 low loss compounds simplified

- 7.3.10. Dissipation factor optimisation across THz frequency for 19 material families

- 7.3.11. Examples of research in 2024

- 7.3.12. Seeking THz low loss through composites and porosity

- 7.3.13. Special case: high resistivity silicon for 6G at 1THz

- 7.4. Semiconductor and competitive material choices for 6G optronics beyond earlier coverage

- 7.4.1. Overview

- 7.4.2. Status of 11 semiconductor and active layer candidates

- 7.4.3. Liquid crystal adopting many more 6G optronic roles: advantages, challenges

- 7.4.4. Vanadium dioxide adopting many more 6G optronic roles: advantages, challenges

- 7.5. Terahertz waveguide cables and small units

- 7.5.1. Need, and state of play

- 7.5.2. Advances in THz waveguides in 2025 (pre-publication), 2024 and 2023

- 7.5.3. Design and materials of 6G waveguide cables including fluoropolymers and polypropylenes

- 7.5.4. THz waveguides from InAs, GaP, sapphire etc. for boosting emitters, sensing etc.

- 7.5.5. Manufacturing polymer THz cable in long reels

- 7.5.6. THz waveguide gratings etched on metal-wires

- 7.5.7. SWOT appraisal of terahertz cable waveguides in 6G systems

- 7.6. Future near IR fiber optics for 6G

- 7.6.1. 5G experience

- 7.6.2. Fundamental types

- 7.6.3. Vulnerability of fiber optic cable: Serious attacks occurring

- 7.6.4. Limiting use of the fiber and its electronics to save cost

- 7.6.5. Fiber optic cable design and materials

- 7.6.6. SWOT appraisal of fiber optics in 6G system design

8. New photonic cooling and photovoltaic on-board power for 6G infrastructure and client devices

- 8.1. Next technologies for solid-state cooling 6G infrastructure and devices

- 8.1.1. Overview

- 8.1.2. Infogram: Cooling toolkit with 6 optical and part-optical technologies for 6G starred

- 8.1.3. 2024 research announcing new multifunctional composites providing cooling by manipulating near IR, mid IR and visible light

- 8.1.4. Research pipeline of solid-state cooling by topic and technology readiness level

- 8.1.5. The most needed compounds for future solid-state cooling from 211 recent researches

- 8.1.6. Eight SWOT appraisals for solid-state cooling in general and seven emerging versions

- 8.1.7. Thermoelectric temperature control materials for 6G chips, lasers with SWOT appraisal

- 8.2. Photovoltaics for self-powered 6G infrastructure and client devices

- 8.2.1. Overview

- 8.2.2. Increased 6G mobile phone, tablet, active RIS and UM MIMO base station power demands matched to energy harvesting options

- 8.2.3. Best photovoltaic research efficiencies trend to 2025

- 8.2.4. 2024 proposal of "Perpetual" 6G RIS using energy harvesting

- 8.2.5. 2024: 23 examples of new tandem and triple junction photovoltaics and allied research advances suitable for 6G

- 8.2.6. Prospect of doubling the power per unit area of photovoltaics for 6G infrastructure and clint devices