|

市场调查报告书

商品编码

1641766

全球模具复合材料市场(按树脂类型、材料类型和最终用途行业划分)- 机会分析和行业预测,2024-2033 年Composites Materials in Tooling Market By Resin Type , By Material Type By End-Use Industry : Global Opportunity Analysis and Industry Forecast, 2024-2033 |

||||||

工具复合材料市场

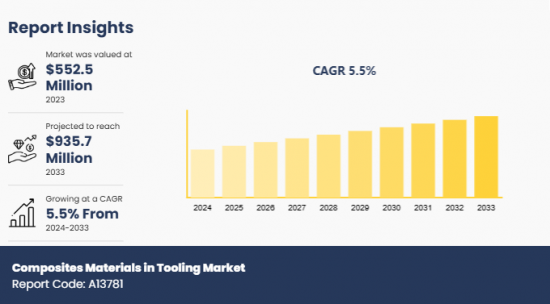

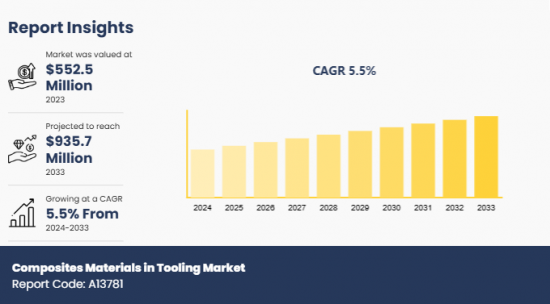

预计 2023 年工具复合材料市场价值将达到 5.525 亿美元,到 2033 年将达到 9.357 亿美元,2024 年至 2033 年的复合年增长率为 5.5%。

复合材料是由两种或多种具有不同性质的部件组合而成的具有优异性能的元素。复合材料具有独特的性能,例如高强度重量比、尺寸稳定性、耐腐蚀和耐热性以及製造灵活性,可用于提高工具应用的性能并降低成本。工具中常用的复合材料包括玻璃纤维增强聚合物、金属复合材料、碳纤维增强聚合物和陶瓷基质复合材料。

汽车和航太工业对轻量材料的需求不断增加,这是工具复合材料市场发展的主要驱动力。此外,复合材料因其耐用性和耐磨性而提供的长期成本效益也刺激了其需求并推动了市场成长。市场上最近出现的趋势是使用积层製造来销售复合材料。这种製造技术可以很好地控制聚合物的成分和形态,有助于开髮用于工具应用的复杂设计。

然而,复合材料在高衝击应力或突然加载等极端条件下无法发挥良好的性能,限制了其使用并阻碍了市场发展。此外,缺乏处理复杂工具的高效劳动力严重限制了市场的成长。相反,由于许多製造业企业都努力将永续性纳入其工作流程,因此工具复合材料市场预计将见证丰厚的利润机会。据环保署称,工业活动每年占全球碳排放的 24%。复合材料透过提高耐热性和促进机器的有效冷却来延长工具寿命和提高能源效率。这会减少浪费和排放,预示着工具复合材料市场前景光明。

部分回顾

工具复合材料市场根据树脂类型、材料类型、最终用途行业和地区进行细分。根据树脂类型,市场分为环氧树脂、聚氨酯和其他树脂。依材料类型,分为金属合金、钢、硅胶、橡胶、玻璃纤维等。根据最终用途行业,市场分为航太、汽车、可再生能源和其他。根据地区,分析范围涵盖北美、欧洲、亚太地区、拉丁美洲以及中东和非洲。

主要发现

按树脂类型划分,环氧树脂在 2023 年占据最高的市场占有率。

按材料类型划分,玻璃纤维在 2023 年的市场上占据显着地位。

根据最终用途产业,航太业将在 2023 年占据市场主导地位。

按地区划分,预计北美将在 2023 年创造最高收益。

此报告可进行客製化(可能需要支付额外费用和製定时间表)

- 产品所含原料分析(%)

- 生产能力

- 投资机会

- 产品基准/产品规格及应用

- 产品生命週期

- 供应链分析与供应商利润

- 新参与企业(按地区)

- 科技趋势分析

- 经销商利润分析

- 打入市场策略

- 新产品开发/主要製造商产品矩阵

- 痛点分析

- 监管指南

- 根据客户兴趣客製的其他公司简介

- 按国家或地区进行的额外分析 - 市场规模和预测

- 品牌占有率分析

- 扩展公司简介列表

- 历史市场资料

- 导入/汇出分析/资料

- Excel 格式的主要企业详细资料(包括位置、联络资讯、供应商/供应商网路等)

- 客户/消费者/原料供应商名单-价值链分析

- 全球/地区/国家层面的公司市场占有率分析

- 产品消费分析

- SWOT 分析

目录

第 1 章 简介

第 2 章执行摘要

第三章 市场状况

- 市场定义和范围

- 主要发现

- 重大投资机会

- 关键成功策略

- 波特五力分析

- 市场动态

- 驱动程式

- 限制因素

- 机会

第四章 模具复合材料市场(依树脂类型)

- 市场概况

- 环氧树脂

- 聚氨酯

- 其他的

第 5 章 模具复合材料市场(依材料类型)

- 市场概况

- 金属合金

- 钢

- 硅

- 橡皮

- 玻璃纤维

- 其他的

第六章 工具复合材料市场(依最终用途产业)

- 市场概况

- 航太

- 车

- 可再生能源

- 其他的

第 7 章 模具复合材料市场(按地区)

- 市场概况

- 北美洲

- 主要市场趋势和机会

- 美国工具复合材料市场

- 加拿大工具复合材料市场

- 墨西哥的工具复合材料市场

- 欧洲

- 主要市场趋势和机会

- 法国工具复合材料市场

- 德国工具复合材料市场

- 义大利工具复合材料市场

- 西班牙工具复合材料市场

- 英国工具复合材料市场

- 其他欧洲国家工具复合材料市场

- 亚太地区

- 主要市场趋势和机会

- 中国工具用复合材料市场

- 日本工具复合材料市场

- 印度模具复合材料市场

- 韩国工具复合材料市场

- 澳洲工具复合材料市场

- 其他亚太地区工具复合材料市场

- 拉丁美洲、中东和非洲

- 主要市场趋势和机会

- 巴西工具复合材料市场

- 南非复合工具材料市场

- 沙乌地阿拉伯的工具复合材料市场

- 拉丁美洲其他地区、中东和非洲的复合材料工具市场

第八章 竞争格局

- 介绍

- 关键成功策略

- 前 10 家公司的产品映射

- 竞争仪錶板

- 竞争热图

- 2023年主要企业的定位

第九章 公司简介

- Hexcel Corporation

- Toray Industries, Inc

- Solvay SA

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Owens Corning

- Teijin Limited

- Barrday Inc.

- SABIC

- Jushi Co., Ltd

Composites Materials in Tooling Market

The composites materials in tooling market was valued at $552.5 million in 2023 and is projected to reach $935.7 million by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

Composite materials are elements with exceptional properties formed by the combination of two or more components with distinguished characteristics. Composites are used to improve the performance and reduce the costs of tooling applications via their unique attributes such as high strength-to-weight ratio, dimensional stability, corrosion & thermal resistance, and manufacturing flexibility. The common types of composite materials used in tooling include glass fiber-reinforced polymer, metal matrix composites, carbon fiber-reinforced polymer, and ceramic matrix composites.

Increase in requirement for lightweight materials in the automotive and aerospace industries is a significant driver of the composites materials in tooling market as the materials offer remarkable strength with their lightweight property. In addition, the long-term cost-effectiveness offered by composite materials due to their durability and resistance to wear & tear fuels their demand, which propels the market growth. A significant trend gaining prominence in the market in recent times is the utilization of additive manufacturing for the development of composites. This manufacturing technique offers exceptional control over the composition and geometry of polymers, facilitating the development of intricate designs for tooling applications.

However, the inability of composite materials to perform in extreme situations such as high-impact stresses or sharp loading conditions limits their usage and hampers the development of the market. Moreover, lack of efficient workforce to handle the composite tooling restrains the market growth notably. On the contrary, as several manufacturing industries are striving to adopt sustainability in their workflow, the composites materials in tooling market is anticipated to witness lucrative opportunities. According to the Environmental Protection Agency, industrial activities contribute 24% of global carbon emissions annually. Composites materials increase the lifespan & energy efficiency of tooling by enhancing the heat resistance and facilitating efficient cooling of machinery. This results in reduced wastage and low emissions, indicating a promising future for the composites materials in tooling market.

Segment Review

The composites materials in tooling market is segmented into resin type, material type, end-use industry, and region. On the basis of resin type, the market is divided into epoxy, polyurethane, and others. According to material type, it is classified into metal alloys, steel, silicon, rubber, fiberglass, and others. By end-use industry, it is categorized into aerospace, automotive, renewable energy, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Findings

On the basis of resin type, the epoxy segment held the highest market share in 2023.

According to material type, the fiberglass segment acquired a notable stake in the market in 2023.

By end-use industry, the aerospace segment dominated the market in 2023.

Region wise, North America was the highest revenue generator in 2023.

Competition Analysis

The major players in the global composites materials in tooling market include Hexcel Corporation, Toray Industries, Inc., Solvay S.A., Huntsman Corporation, Mitsubishi Chemical Holdings Corporation, Owens Corning, Teijin Limited, Barrday Inc., SABIC, and Jushi Co., Ltd. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships to strengthen their foothold in the competitive market.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- Analysis of raw material in a product (by %)

- Manufacturing Capacity

- Investment Opportunities

- Product Benchmarking / Product specification and applications

- Product Life Cycles

- Supply Chain Analysis & Vendor Margins

- Upcoming/New Entrant by Regions

- Technology Trend Analysis

- Distributor margin Analysis

- Go To Market Strategy

- New Product Development/ Product Matrix of Key Players

- Pain Point Analysis

- Regulatory Guidelines

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Brands Share Analysis

- Expanded list for Company Profiles

- Historic market data

- Import Export Analysis/Data

- Key player details (including location, contact details, supplier/vendor network etc. in excel format)

- List of customers/consumers/raw material suppliers- value chain analysis

- Market share analysis of players at global/region/country level

- Product Consumption Analysis

- SWOT Analysis

Key Market Segments

By Resin Type

- Epoxy

- Polyurethane

- Others

By Material Type

- Metal Alloys

- Steel

- Silicon

- Rubber

- Fiberglass

- Others

By End-Use Industry

- Aerospace

- Automotive

- Renewable Energy

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Market Players:

- Hexcel Corporation

- Toray Industries, Inc

- Solvay S.A.

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Owens Corning

- Teijin Limited

- Barrday Inc.

- SABIC

- Jushi Co., Ltd

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report Description

- 1.2. Key Market Segments

- 1.3. Key Benefits

- 1.4. Research Methodology

- 1.4.1. Primary Research

- 1.4.2. Secondary Research

- 1.4.3. Analyst Tools and Models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET LANDSCAPE

- 3.1. Market Definition and Scope

- 3.2. Key Findings

- 3.2.1. Top Investment Pockets

- 3.2.2. Top Winning Strategies

- 3.3. Porter's Five Forces Analysis

- 3.3.1. Bargaining Power of Suppliers

- 3.3.2. Threat of New Entrants

- 3.3.3. Threat of Substitutes

- 3.3.4. Competitive Rivalry

- 3.3.5. Bargaining Power among Buyers

- 3.4. Market Dynamics

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.3. Opportunities

CHAPTER 4: COMPOSITES MATERIALS IN TOOLING MARKET, BY RESIN TYPE

- 4.1. Market Overview

- 4.1.1 Market Size and Forecast, By Resin Type

- 4.2. Epoxy

- 4.2.1. Key Market Trends, Growth Factors and Opportunities

- 4.2.2. Market Size and Forecast, By Region

- 4.2.3. Market Share Analysis, By Country

- 4.3. Polyurethane

- 4.3.1. Key Market Trends, Growth Factors and Opportunities

- 4.3.2. Market Size and Forecast, By Region

- 4.3.3. Market Share Analysis, By Country

- 4.4. Others

- 4.4.1. Key Market Trends, Growth Factors and Opportunities

- 4.4.2. Market Size and Forecast, By Region

- 4.4.3. Market Share Analysis, By Country

CHAPTER 5: COMPOSITES MATERIALS IN TOOLING MARKET, BY MATERIAL TYPE

- 5.1. Market Overview

- 5.1.1 Market Size and Forecast, By Material Type

- 5.2. Metal Alloys

- 5.2.1. Key Market Trends, Growth Factors and Opportunities

- 5.2.2. Market Size and Forecast, By Region

- 5.2.3. Market Share Analysis, By Country

- 5.3. Steel

- 5.3.1. Key Market Trends, Growth Factors and Opportunities

- 5.3.2. Market Size and Forecast, By Region

- 5.3.3. Market Share Analysis, By Country

- 5.4. Silicon

- 5.4.1. Key Market Trends, Growth Factors and Opportunities

- 5.4.2. Market Size and Forecast, By Region

- 5.4.3. Market Share Analysis, By Country

- 5.5. Rubber

- 5.5.1. Key Market Trends, Growth Factors and Opportunities

- 5.5.2. Market Size and Forecast, By Region

- 5.5.3. Market Share Analysis, By Country

- 5.6. Fiberglass

- 5.6.1. Key Market Trends, Growth Factors and Opportunities

- 5.6.2. Market Size and Forecast, By Region

- 5.6.3. Market Share Analysis, By Country

- 5.7. Others

- 5.7.1. Key Market Trends, Growth Factors and Opportunities

- 5.7.2. Market Size and Forecast, By Region

- 5.7.3. Market Share Analysis, By Country

CHAPTER 6: COMPOSITES MATERIALS IN TOOLING MARKET, BY END-USE INDUSTRY

- 6.1. Market Overview

- 6.1.1 Market Size and Forecast, By End-use Industry

- 6.2. Aerospace

- 6.2.1. Key Market Trends, Growth Factors and Opportunities

- 6.2.2. Market Size and Forecast, By Region

- 6.2.3. Market Share Analysis, By Country

- 6.3. Automotive

- 6.3.1. Key Market Trends, Growth Factors and Opportunities

- 6.3.2. Market Size and Forecast, By Region

- 6.3.3. Market Share Analysis, By Country

- 6.4. Renewable Energy

- 6.4.1. Key Market Trends, Growth Factors and Opportunities

- 6.4.2. Market Size and Forecast, By Region

- 6.4.3. Market Share Analysis, By Country

- 6.5. Others

- 6.5.1. Key Market Trends, Growth Factors and Opportunities

- 6.5.2. Market Size and Forecast, By Region

- 6.5.3. Market Share Analysis, By Country

CHAPTER 7: COMPOSITES MATERIALS IN TOOLING MARKET, BY REGION

- 7.1. Market Overview

- 7.1.1 Market Size and Forecast, By Region

- 7.2. North America

- 7.2.1. Key Market Trends and Opportunities

- 7.2.2. Market Size and Forecast, By Resin Type

- 7.2.3. Market Size and Forecast, By Material Type

- 7.2.4. Market Size and Forecast, By End-use Industry

- 7.2.5. Market Size and Forecast, By Country

- 7.2.6. U.S. Composites Materials in Tooling Market

- 7.2.6.1. Market Size and Forecast, By Resin Type

- 7.2.6.2. Market Size and Forecast, By Material Type

- 7.2.6.3. Market Size and Forecast, By End-use Industry

- 7.2.7. Canada Composites Materials in Tooling Market

- 7.2.7.1. Market Size and Forecast, By Resin Type

- 7.2.7.2. Market Size and Forecast, By Material Type

- 7.2.7.3. Market Size and Forecast, By End-use Industry

- 7.2.8. Mexico Composites Materials in Tooling Market

- 7.2.8.1. Market Size and Forecast, By Resin Type

- 7.2.8.2. Market Size and Forecast, By Material Type

- 7.2.8.3. Market Size and Forecast, By End-use Industry

- 7.3. Europe

- 7.3.1. Key Market Trends and Opportunities

- 7.3.2. Market Size and Forecast, By Resin Type

- 7.3.3. Market Size and Forecast, By Material Type

- 7.3.4. Market Size and Forecast, By End-use Industry

- 7.3.5. Market Size and Forecast, By Country

- 7.3.6. France Composites Materials in Tooling Market

- 7.3.6.1. Market Size and Forecast, By Resin Type

- 7.3.6.2. Market Size and Forecast, By Material Type

- 7.3.6.3. Market Size and Forecast, By End-use Industry

- 7.3.7. Germany Composites Materials in Tooling Market

- 7.3.7.1. Market Size and Forecast, By Resin Type

- 7.3.7.2. Market Size and Forecast, By Material Type

- 7.3.7.3. Market Size and Forecast, By End-use Industry

- 7.3.8. Italy Composites Materials in Tooling Market

- 7.3.8.1. Market Size and Forecast, By Resin Type

- 7.3.8.2. Market Size and Forecast, By Material Type

- 7.3.8.3. Market Size and Forecast, By End-use Industry

- 7.3.9. Spain Composites Materials in Tooling Market

- 7.3.9.1. Market Size and Forecast, By Resin Type

- 7.3.9.2. Market Size and Forecast, By Material Type

- 7.3.9.3. Market Size and Forecast, By End-use Industry

- 7.3.10. UK Composites Materials in Tooling Market

- 7.3.10.1. Market Size and Forecast, By Resin Type

- 7.3.10.2. Market Size and Forecast, By Material Type

- 7.3.10.3. Market Size and Forecast, By End-use Industry

- 7.3.11. Rest Of Europe Composites Materials in Tooling Market

- 7.3.11.1. Market Size and Forecast, By Resin Type

- 7.3.11.2. Market Size and Forecast, By Material Type

- 7.3.11.3. Market Size and Forecast, By End-use Industry

- 7.4. Asia-Pacific

- 7.4.1. Key Market Trends and Opportunities

- 7.4.2. Market Size and Forecast, By Resin Type

- 7.4.3. Market Size and Forecast, By Material Type

- 7.4.4. Market Size and Forecast, By End-use Industry

- 7.4.5. Market Size and Forecast, By Country

- 7.4.6. China Composites Materials in Tooling Market

- 7.4.6.1. Market Size and Forecast, By Resin Type

- 7.4.6.2. Market Size and Forecast, By Material Type

- 7.4.6.3. Market Size and Forecast, By End-use Industry

- 7.4.7. Japan Composites Materials in Tooling Market

- 7.4.7.1. Market Size and Forecast, By Resin Type

- 7.4.7.2. Market Size and Forecast, By Material Type

- 7.4.7.3. Market Size and Forecast, By End-use Industry

- 7.4.8. India Composites Materials in Tooling Market

- 7.4.8.1. Market Size and Forecast, By Resin Type

- 7.4.8.2. Market Size and Forecast, By Material Type

- 7.4.8.3. Market Size and Forecast, By End-use Industry

- 7.4.9. South Korea Composites Materials in Tooling Market

- 7.4.9.1. Market Size and Forecast, By Resin Type

- 7.4.9.2. Market Size and Forecast, By Material Type

- 7.4.9.3. Market Size and Forecast, By End-use Industry

- 7.4.10. Australia Composites Materials in Tooling Market

- 7.4.10.1. Market Size and Forecast, By Resin Type

- 7.4.10.2. Market Size and Forecast, By Material Type

- 7.4.10.3. Market Size and Forecast, By End-use Industry

- 7.4.11. Rest of Asia-Pacific Composites Materials in Tooling Market

- 7.4.11.1. Market Size and Forecast, By Resin Type

- 7.4.11.2. Market Size and Forecast, By Material Type

- 7.4.11.3. Market Size and Forecast, By End-use Industry

- 7.5. LAMEA

- 7.5.1. Key Market Trends and Opportunities

- 7.5.2. Market Size and Forecast, By Resin Type

- 7.5.3. Market Size and Forecast, By Material Type

- 7.5.4. Market Size and Forecast, By End-use Industry

- 7.5.5. Market Size and Forecast, By Country

- 7.5.6. Brazil Composites Materials in Tooling Market

- 7.5.6.1. Market Size and Forecast, By Resin Type

- 7.5.6.2. Market Size and Forecast, By Material Type

- 7.5.6.3. Market Size and Forecast, By End-use Industry

- 7.5.7. South Africa Composites Materials in Tooling Market

- 7.5.7.1. Market Size and Forecast, By Resin Type

- 7.5.7.2. Market Size and Forecast, By Material Type

- 7.5.7.3. Market Size and Forecast, By End-use Industry

- 7.5.8. Saudi Arabia Composites Materials in Tooling Market

- 7.5.8.1. Market Size and Forecast, By Resin Type

- 7.5.8.2. Market Size and Forecast, By Material Type

- 7.5.8.3. Market Size and Forecast, By End-use Industry

- 7.5.9. Rest of LAMEA Composites Materials in Tooling Market

- 7.5.9.1. Market Size and Forecast, By Resin Type

- 7.5.9.2. Market Size and Forecast, By Material Type

- 7.5.9.3. Market Size and Forecast, By End-use Industry

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top Winning Strategies

- 8.3. Product Mapping Of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top Player Positioning, 2023

CHAPTER 9: COMPANY PROFILES

- 9.1. Hexcel Corporation

- 9.1.1. Company Overview

- 9.1.2. Key Executives

- 9.1.3. Company Snapshot

- 9.1.4. Operating Business Segments

- 9.1.5. Product Portfolio

- 9.1.6. Business Performance

- 9.1.7. Key Strategic Moves and Developments

- 9.2. Toray Industries, Inc

- 9.2.1. Company Overview

- 9.2.2. Key Executives

- 9.2.3. Company Snapshot

- 9.2.4. Operating Business Segments

- 9.2.5. Product Portfolio

- 9.2.6. Business Performance

- 9.2.7. Key Strategic Moves and Developments

- 9.3. Solvay S.A.

- 9.3.1. Company Overview

- 9.3.2. Key Executives

- 9.3.3. Company Snapshot

- 9.3.4. Operating Business Segments

- 9.3.5. Product Portfolio

- 9.3.6. Business Performance

- 9.3.7. Key Strategic Moves and Developments

- 9.4. Huntsman Corporation

- 9.4.1. Company Overview

- 9.4.2. Key Executives

- 9.4.3. Company Snapshot

- 9.4.4. Operating Business Segments

- 9.4.5. Product Portfolio

- 9.4.6. Business Performance

- 9.4.7. Key Strategic Moves and Developments

- 9.5. Mitsubishi Chemical Holdings Corporation

- 9.5.1. Company Overview

- 9.5.2. Key Executives

- 9.5.3. Company Snapshot

- 9.5.4. Operating Business Segments

- 9.5.5. Product Portfolio

- 9.5.6. Business Performance

- 9.5.7. Key Strategic Moves and Developments

- 9.6. Owens Corning

- 9.6.1. Company Overview

- 9.6.2. Key Executives

- 9.6.3. Company Snapshot

- 9.6.4. Operating Business Segments

- 9.6.5. Product Portfolio

- 9.6.6. Business Performance

- 9.6.7. Key Strategic Moves and Developments

- 9.7. Teijin Limited

- 9.7.1. Company Overview

- 9.7.2. Key Executives

- 9.7.3. Company Snapshot

- 9.7.4. Operating Business Segments

- 9.7.5. Product Portfolio

- 9.7.6. Business Performance

- 9.7.7. Key Strategic Moves and Developments

- 9.8. Barrday Inc.

- 9.8.1. Company Overview

- 9.8.2. Key Executives

- 9.8.3. Company Snapshot

- 9.8.4. Operating Business Segments

- 9.8.5. Product Portfolio

- 9.8.6. Business Performance

- 9.8.7. Key Strategic Moves and Developments

- 9.9. SABIC

- 9.9.1. Company Overview

- 9.9.2. Key Executives

- 9.9.3. Company Snapshot

- 9.9.4. Operating Business Segments

- 9.9.5. Product Portfolio

- 9.9.6. Business Performance

- 9.9.7. Key Strategic Moves and Developments

- 9.10. Jushi Co., Ltd

- 9.10.1. Company Overview

- 9.10.2. Key Executives

- 9.10.3. Company Snapshot

- 9.10.4. Operating Business Segments

- 9.10.5. Product Portfolio

- 9.10.6. Business Performance

- 9.10.7. Key Strategic Moves and Developments