|

市场调查报告书

商品编码

1461435

零排放汽车市场:按车辆类型(两轮车、三轮车、小客车、轻型商用车、重型商用车)、按动力(电池电动车、氢燃料电池汽车)和地区划分Zero Emission Vehicles Market, By Vehicle Type (Two Wheelers, Three Wheelers, Passenger Vehicle, Light Commercial Vehicle, and Heavy Commercial Vehicle, By Propulsion (Battery-electric vehicles and Hydrogen fuel cell vehicles), By Geography . |

||||||

2024年零排放汽车市场规模预计为3,571.2亿美元,预计2031年将达到15,812.8亿美元, 年复合成长率(CAGR)23.70%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2023/2024年市场规模 | 3571.2亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024-2031 |

| 预测期间 2023/2024 至 2030/2031 年复合年增长率: | 23.70% | 2030/2031 年预测值 | 1,581,280 百万美元 |

零排放车辆(ZEV)是指汽车动力来源不排放任何排放气体的车辆。随着人们对空气污染和气候变迁的日益关注,ZEV 逐渐被认为是永续交通的可行解决方案。电池技术的进步和电池价格的下降使得电动车(EV)成为传统汽车的商业性替代品。世界各地许多政府都提供电动车购买诱因和补贴,以鼓励消费者采用电动车并支持电动车产业的发展。随着交通系统的广泛电气化,ZEV 有潜力显着减少温室气体排放并减轻气候变迁的影响。

市场动态:

驱动因素 市场驱动因素:世界各地监管机构实施的严格排放气体法规是推动零排放汽车市场成长的主要因素。更低的电池价格和更长的续航里程使电动车变得更加实惠和实用。日益增长的环境问题和消费者对环保行动解决方案观念的转变也推动了市场的成长。

阻碍因素:与汽油动力汽车相比,电动车的高成本仍然是一个主要障碍。由于公共充电基础设施不足,客户面临续航里程问题。随着标准的发展,消费者可能会对投资新的电动车技术感到犹豫。未来政府有关电动车补贴政策的不确定性是阻碍力。

机会:低成本、高能量电池的进步带来了诱人的机会。透过将电动车整合到智慧电网系统并启用车辆到电网应用来开拓新的收益来源。汽车OEM和高科技公司之间的创新合作扩大了机会。

本研究的主要特点

本报告对全球零排放汽车市场进行了详细分析,并列出了以2023年为基准年的预测期(2024-2031年)的市场规模和復合年增长率。

它还强调了各个细分市场的潜在收益成长机会,并说明了该市场有吸引力的投资提案矩阵。

它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的主要考察。

它根据公司亮点、产品系列、主要亮点、财务表现和策略等参数,介绍了全球零排放汽车市场的主要企业。

本研究涵盖的主要公司包括宝马汽车公司、雪佛兰汽车公司、福特汽车公司、通用汽车公司、英雄电气公司、现代汽车公司、马恆达电动汽车有限公司、塔塔汽车公司、特斯拉公司、丰田汽车公司、戴姆勒公司、 SEGWAY INC.、Motor Development International SA、大众汽车公司、本田汽车有限公司、工业公司、沃尔沃和广汽汽车。

该报告的见解将使负责人和公司经营团队能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

本研究报告针对该产业的各个相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

透过用于分析全球零排放汽车市场的各种策略矩阵,将有助于相关人员做出决策。

第一章 研究目的与前提

- 研究目标

- 先决条件

第二章 市场概况

- 报告说明

- 市场定义和范围

- 执行摘要

第三章市场动态与趋势分析

- 市场动态

- 促进因素

- 抑制因素

- 机会

- 影响分析

- PEST分析

- 波特分析

- COVID-19 影响分析

- 新产品核准

- 促销和行销工作

- 不同国家的市场吸引力

- 按细分市场分類的市场吸引力

- 主要进展及交易

- 趋势分析—过去与未来的趋势评估

- 主要进展

第四章 全球零排放汽车市场,依车型划分,2019-2031

- 摩托车

- 三轮车

- 小客车

- 轻型商用车

- 大型商用车

第五章 全球零排放汽车市场,按推进力,2019-2031

- 纯电动车(BEV)

- 氢燃料电池汽车(FCV)

第六章 全球零排放汽车市场(按地区),2019-2031

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- ASEAN

- 其他亚太地区

- 中东/非洲

- 波湾合作理事会

- 以色列

- 其他中东地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第七章 竞争格局

- Competitive Snapshot

- What Market Participants are Saying?

- Competitive Dashboard

- Company Market Share Analysis, 2024-Global

第八章公司简介-全球零排放汽车市场

- BMW AG

- 公司简介

- 产品/服务组合

- 财务绩效

- 最新动态/更新

- 策略概览

- Chevrolet Motor Company

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Mahindra Electric Mobility Limited

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Daimler AG

- SEGWAY INC.

- Motor Development International SA

- Volkswagen AG

- Honda Motor Co. Ltd.

- MITSUBISHI MOTORS CORPORATION

- Volvo

- GAC Motor

第9章 命运之轮

- 命运之轮

- 分析师观点

- 一致的机会图

第10章 参考文献与调查方法

- 参考

- 调查方法

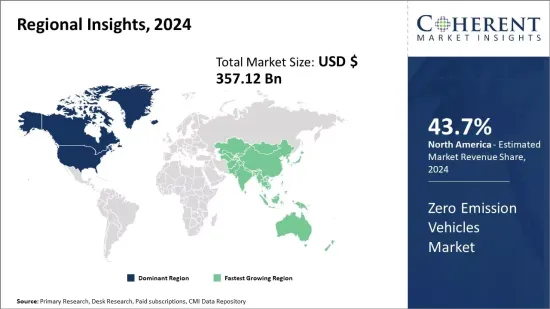

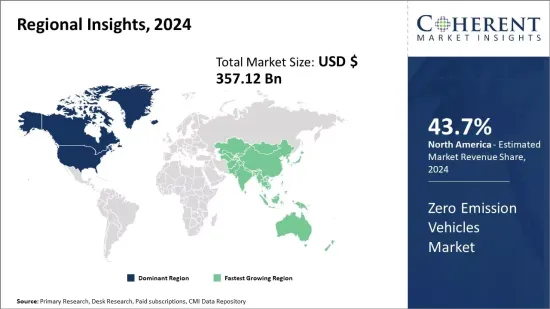

The zero emission vehicles market is estimated to be valued at USD 357.12 billion in 2024 and is expected to reach USD 1,581.28 billion by 2031, growing at a compound annual growth rate (CAGR) of 23.70% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2023/2024: | US$ 357.12 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2023/2024 to 2030/2031 CAGR: | 23.70% | 2030/2031 Value Projection: | US$ 1,581.28 Bn |

Zero emission vehicles (ZEVs) are automobiles that do not produce any emissions from the onboard source of power. With growing concerns over air pollution and climate change, ZEVs are being increasingly recognized as a viable solution for sustainable mobility. Advancements in battery technology and declining battery prices have made electric vehicles (EVs) a commercially attractive alternative to conventional vehicles. Many governments around the world offer purchase incentives and subsidies for EVs to encourage their adoption among consumers and support the growth of the EV industry. With widespread electrification of transport systems, ZEVs have the potential to significantly reduce greenhouse gas emissions and mitigate the impacts of climate change.

Market Dynamics:

Drivers: Stringent emission regulations imposed by regulatory bodies around the world are a key driver fueling the growth of the Zero Emission Vehicle market. Declining battery prices and longer driving ranges are making EVs more affordable and practical. Rising environmental concerns and changing consumer attitudes towards green mobility solutions also boosts the market growth.

Restraints: High cost of EVs compared to gasoline vehicles remains a major barrier. Insufficient public charging infrastructure poses vehicle range issues for customers. Consumers may hesitate investing in new EV technologies with evolving standards. Uncertainties over future government policies for EV subsidies act as a deterrent.

Opportunities: Advancements in batteries with higher energy densities at lower costs present attractive opportunities. Integration of EVs into smart grid systems for Vehicle-to-Grid applications can open new revenue streams. Collaborations across automotive OEMs and tech companies for innovation are expanding opportunities.

Key features of the study:

This report provides an in-depth analysis of the global zero emission vehicles market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2024-2031), considering 2023 as the base year

It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global zero emission vehicles market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include BMW AG, Chevrolet Motor Company, Ford Motor Company, General Motors, Hero Electric, Hyundai Motor Company, Mahindra Electric Mobility Limited, Tata Motors, Tesla Inc., Toyota Motor Corporation, Daimler AG, SEGWAY INC., Motor Development International SA, Volkswagen AG, Honda Motor Co. Ltd., MITSUBISHI MOTORS CORPORATION, Volvo, and GAC Motor

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global zero emission vehicles market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global zero emission vehicles market

Market Segmentation

- By Vehicle Type

- Two Wheelers

- Three Wheelers

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Propulsion

- Battery-electric vehicles (BEVs)

- Hydrogen fuel cell vehicles (FCVs)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- BMW AG

- Chevrolet Motor Company

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Mahindra Electric Mobility Limited

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Daimler AG

- SEGWAY INC.

- Motor Development International SA

- Volkswagen AG

- Honda Motor Co. Ltd.

- MITSUBISHI MOTORS CORPORATION

- Volvo

- GAC Motor

Table of Content

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

2. Market Overview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Vehicle Type

- Market Snapshot, By Propulsion

- Market Snapshot, By Region

- Market Scenario - Conservative, Likely, Opportunistic

- Market Opportunity Map

3. Market Dynamics and Trend Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Pest Analysis

- Porters Analysis

- COVID-19 Impact Analysis

- New Product Approvals

- Promotion and Marketing Initiatives

- Market Attractiveness, By Country

- Market Attractiveness, By Market Segment

- Key Developments & Deals

- Trend Analysis - Historic and Future Trend Assessment

- Key Developments

4. Global Zero Emission Vehicles Market, By Vehicle Type, 2019 - 2031 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2024 and 2031

- Market Y-o-Y Growth Comparison (%), 2020 - 2031

- Segment Trends

- Two Wheelers, 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

- Three Wheelers, 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

- Passenger Vehicle, 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

- Light Commercial Vehicle, 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

- Heavy Commercial Vehicle, 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

5. Global Zero Emission Vehicles Market, By Propulsion, 2019 - 2031 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2024 and 2031

- Market Y-o-Y Growth Comparison (%), 2020 - 2031

- Segment Trends

- Battery-electric vehicles (BEVs), 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

- Hydrogen fuel cell vehicles (FCVs), 2019 - 2031(US$ Billion)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Billion)

6. Global Zero Emission Vehicles Market, By Region, 2019 - 2031 (US$ Billion)

- Introduction

- Market Share (%) Analysis, 2024 and 2031, (US$ Billion)

- Market Y-o-Y Growth Comparison (%), 2024 - 2031, (US$ Billion)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Vehicle Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, By Vehicle Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Vehicle Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- China

- India

- Japan

- Australia

- South Korea

- Asean

- Rest Of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Vehicle Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country/Sub-region, 2019 - 2031, (US$ Billion)

- GCC

- Israel

- Rest Of Middle East

- Latin America

- Introduction

- Market Size and Forecast, By Vehicle Type, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Propulsion, 2019 - 2031, (US$ Billion)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Billion)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

7. Competitive Landscape

- Competitive Snapshot

- What Market Participants are Saying?

- Competitive Dashboard

- Company Market Share Analysis, 2024 - Global

8. Company Profiles - Global Zero Emission Vehicles Market

- BMW AG*

- Company Overview

- Product/Service Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- Chevrolet Motor Company

- Ford Motor Company

- General Motors

- Hero Electric

- Hyundai Motor Company

- Mahindra Electric Mobility Limited

- Tata Motors

- Tesla Inc.

- Toyota Motor Corporation

- Daimler AG

- SEGWAY INC.

- Motor Development International SA

- Volkswagen AG

- Honda Motor Co. Ltd.

- MITSUBISHI MOTORS CORPORATION

- Volvo

- GAC Motor

9. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact