|

市场调查报告书

商品编码

1672655

金融科技业市场,按金融科技卡、按解决方案、按技术、按最终用途、按地区Fintech Industry Market, By FinTech Cards, By Solution, By Technology, By End User, By Geography |

||||||

2025 年全球金融科技产业市场规模估计为 3.772 亿美元,预计到 2032 年将达到 7.262 亿美元,2025 年至 2032 年的复合年增长率为 9.8%。

| 报告范围 | 报告详细信息 | ||

|---|---|---|---|

| 基准年 | 2024 | 2025 年市场规模 | 3.772亿美元 |

| 效能资料 | 从 2020 年到 2024 年 | 预测期 | 2025 至 2032 年 |

| 预测期:2025-2032年复合年增长率: | 9.80% | 2032 年价值预测 | 7.262亿美元 |

许多因素推动了全球金融科技产业的蓬勃发展,包括数位付款的兴起、电子商务产业的成长以及创业投资资金的涌入。人工智慧、机器学习和区块链等先进技术的使用正在改善金融服务的管道并提高效率。然而,安全和隐私问题仍然是该行业持续成长的挑战。

市场动态:

全球金融科技产业市场的成长受到多种因素的推动。数位化的进步以及人工智慧、机器学习和物联网等技术的出现推动了创新金融产品和服务的发展。智慧型手机和互联网普及率的提高以及电子商务行业的成长正在推动数位付款和网路借贷的发展。这正在刺激产品创新和市场扩张。然而,对资料隐私和安全的担忧带来了挑战。此外,标准化和互通性问题也阻碍了无缝操作。然而,金融服务渗透率较低的新兴经济体为金融科技参与者提供了巨大的成长机会。

本研究的主要特点

本报告对全球金融科技行业市场进行了详细分析,并以 2024 年为基准年,给出了预测期(2025-2032 年)的市场规模和年复合成长率(CAGR%)。

它还强调了各个领域的潜在商机并说明了该市场的有吸引力的投资提案矩阵。

它还提供了对市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景以及主要企业采用的竞争策略的重要见解。

全球金融科技市场的主要企业是根据公司亮点、产品系列、关键亮点、财务绩效和策略等参数进行的分析。

主要公司包括美国运通公司、Square、Stripe、PayPal、Capital One、花旗集团、摩根大通、万事达卡公司、Visa 公司、Brex、Revolut 和 Pivot Payables。

本报告的见解将使负责人和企业经营团队能够就未来产品发布、新兴趋势、市场扩张和行销策略做出明智的决策。

全球金融科技市场报告迎合了该行业的各个相关人员,包括投资者、供应商、产品製造商、经销商、新进业者和金融分析师。

相关人员将透过用于分析全球金融科技市场的各种策略矩阵更轻鬆地做出决策。

目录

第一章 调查目的与前提条件

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告描述

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规与趋势分析

- 市场动态

第 4 章 全球金融科技产业市场-冠状病毒 (COVID-19) 大流行的影响

- 影响全球金融科技产业市场的因素 - COVID-19

- 影响分析

第五章 全球金融科技产业市场按金融科技卡划分(2020-2032 年,(百万美元))

- 商务卡

- 虚拟卡

6. 2020 年至 2032 年全球金融科技产业市场(按解决方案划分)(百万美元)

- 付款和转帐

- 融资解决方案

- 保险及个人理财

- 资产管理

- 数位银行

- 其他(汇款解决方案、加密解决方案)

7. 2020 年至 2032 年全球金融科技业市场(按技术划分)(百万美元)

- 应用程式介面 (API)

- 巨量资料分析

- 人工智慧(AI)

- 区块链

- 网路安全

8. 全球金融科技产业市场,依最终用途划分,2025-2032 年(百万美元)

- 个人消费者

- 商业金融科技

- 企业金融科技

第 9 章。 2020-2032 年全球金融科技产业市场,按地区划分,价值(百万美元)

- 北美洲

- 拉丁美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

第十章 竞争格局

- American Express Company

- Recent Developments/Updates

- Square

- Recent Developments/Updates

- Stripe

- Recent Developments/Updates

- PayPal

- Recent Developments/Updates

- Capital One

- Recent Developments/Updates

- Citigroup Inc.

- Recent Developments/Updates

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

第 11 章 分析师建议

- 命运之轮

- 分析师观点

- 一致的机会地图

第 12 章参考文献与调查方法

- 参考

- 调查方法

- 关于出版商

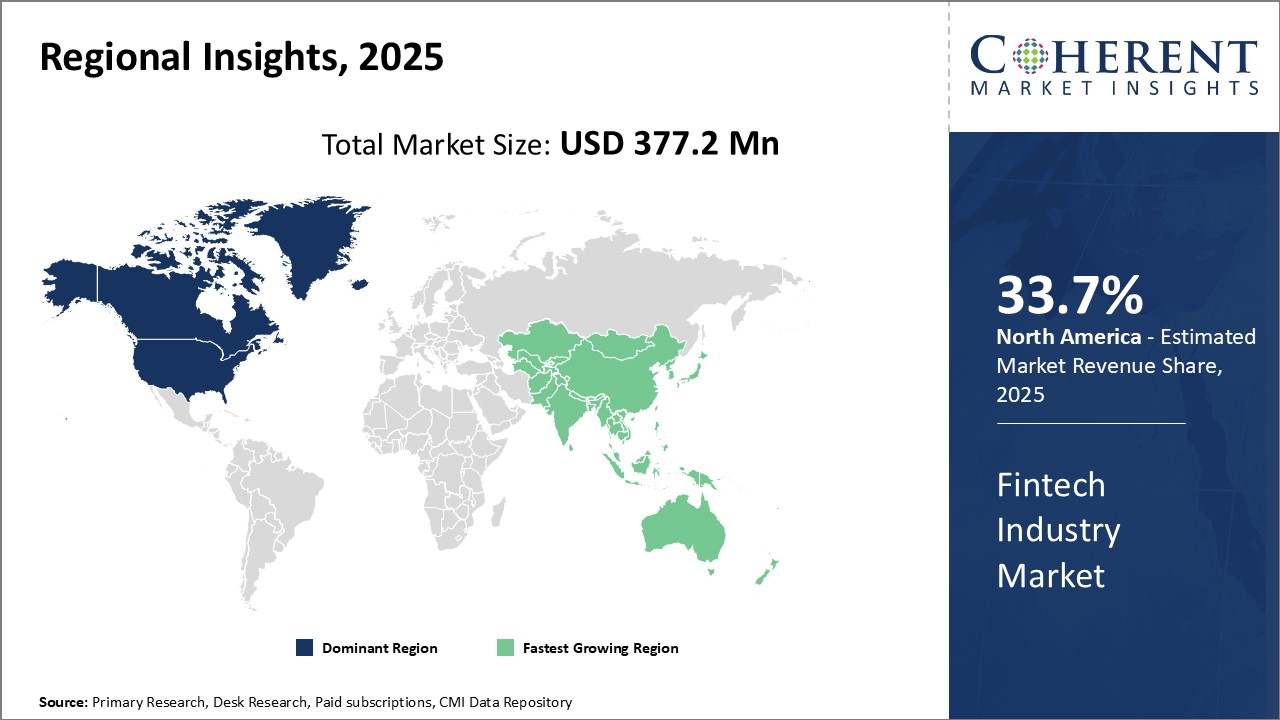

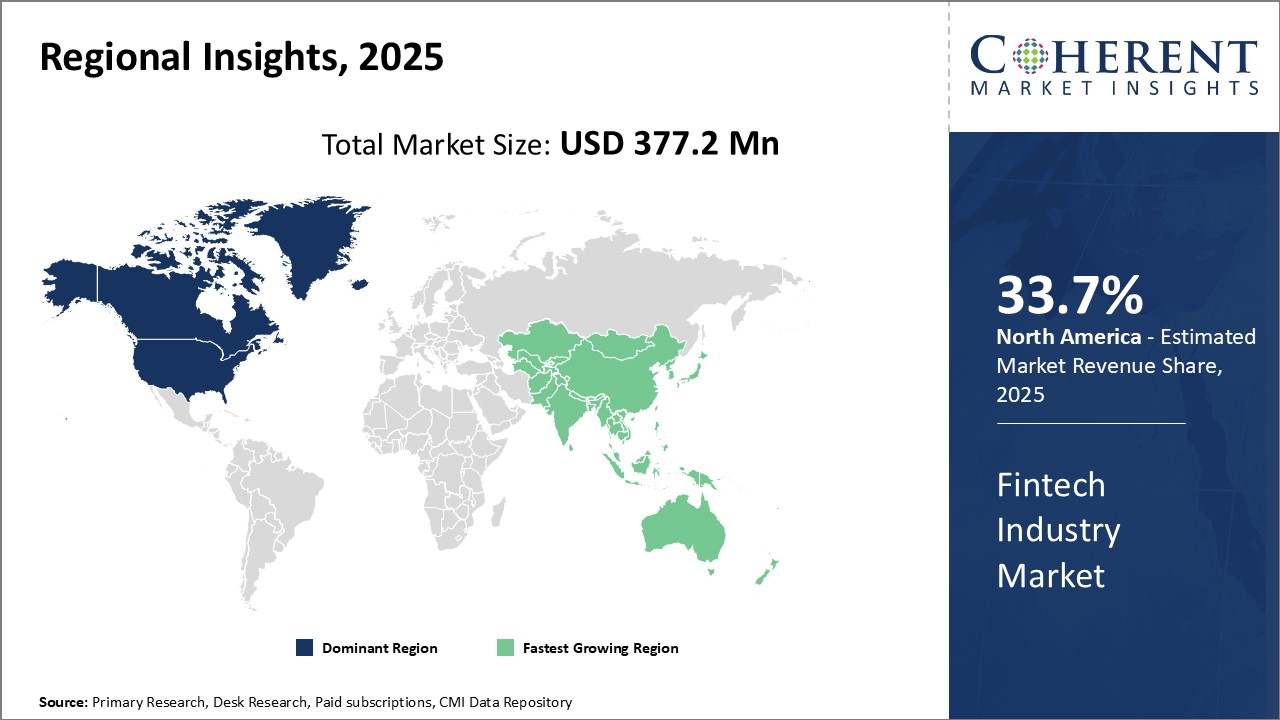

Global Fintech Industry Market is estimated to be valued at USD 377.2 Mn in 2025 and is expected to reach USD 726.2 Mn by 2032, growing at a compound annual growth rate (CAGR) of 9.8% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 377.2 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.80% | 2032 Value Projection: | USD 726.2 Mn |

Various factors such as rise of digital payments, growing e-commerce industry, influx of venture capital funding have contributed to the boom in the fintech sector globally. It has increased accessibility of financial services, driven efficiencies through use of advanced technologies like AI, ML and blockchain. However, security and privacy concerns continue to pose challenges for continued growth of the industry.

Market Dynamics:

The growth of the global fintech industry market is driven by several factors. The increasing digitization and emergence of technologies such as AI, ML and IoT have enabled development of innovative financial products and services. Rising smartphone and internet penetration along with growing ecommerce industry has boosted digital payments and online lending. This has fueled product innovation and market expansion. However, data privacy and security concerns pose challenges. Lack of standardization and interoperability issues also challenge seamless operations. Nevertheless, developing economies with underpenetrated financial services present huge opportunities for fintech players for growth.

Key features of the study:

This report provides in-depth analysis of the global fintech industry market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global fintech market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include American Express Company, Square, Stripe, PayPal, Capital One, Citigroup Inc., JPMorgan Chase, Mastercard Inc., Visa Inc., Brex, Revolut, and Pivot Payables

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global fintech market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global fintech market

Market Segmentation

- FinTech Cards Insights (Revenue, USD, 2019 - 2032)

- Commercial Cards

- Virtual Cards

- Solution Insights (Revenue, USD, 2019 - 2032)

- Payment & Fund Transfer

- Lending Solutions

- Insurance & Personal Finance

- Wealth Management

- Digital Banking

- Others (Remittance Solutions, Crypto Solutions)

- Technology Insights (Revenue, USD, 2019 - 2032)

- Application Programming Interface (API)

- Big Data Analytics

- Artificial Intelligence (AI)

- Blockchain

- Cybersecurity

- End User Insights (Revenue, USD, 2019 - 2032)

- Individual Consumers

- Business FinTech

- Enterprise FinTech

- Regional Insights (Revenue, USD, 2019 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- American Express Company

- Square

- Stripe

- PayPal

- Capital One

- Citigroup Inc.

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Fintech Industry Market, By FinTech Cards

- Global Fintech Industry Market, By Solution

- Global Fintech Industry Market, By Technology

- Global Fintech Industry Market, By End User

- Global Fintech Industry Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Recent Developments/Updates

- Industry Trend

4. Global Fintech Industry Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Fintech Industry Market - COVID-19

- Impact Analysis

5. Global Fintech Industry Market, By FinTech Cards, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Commercial Cards

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Virtual Cards

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

6. Global Fintech Industry Market, By Solution, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Payment & Fund Transfer

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Lending Solutions

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Insurance & Personal Finance

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Wealth Management

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Digital Banking

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Others (Remittance Solutions, Crypto Solutions)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

7. Global Fintech Industry Market, By Technology, 2020-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Application Programming Interface (API)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Big Data Analytics

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Artificial Intelligence (AI)

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Blockchain

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Cybersecurity

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

8. Global Fintech Industry Market, By End User, 2025-2032, (USD MN)

- Introduction

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Individual Consumers

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Business FinTech

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Enterprise FinTech

- Market Share Analysis, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

9. Global Fintech Industry Market, By Region, 2020 - 2032, Value (USD MN)

- Introduction

- Market Share Analysis, By Region, 2025, 2028, and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- North America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- U.S.

- Canada

- Latin America

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Market Share Analysis, By Country, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2021 - 2032

- Market Size and Forecast, By FinTech Cards, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Solution, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Technology, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By End User, 2020 - 2032, Value (USD MN)

- Market Size and Forecast, By Country, 2020- 2032, (US$ Mn)

- South Africa

- North Africa

- Central Africa

10. Competitive Landscape

- American Express Company

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Square

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Stripe

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- PayPal

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Capital One

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- Citigroup Inc.

- Company Overview

- Product Portfolio

- Recent Developments/ Updates

- JPMorgan Chase

- Mastercard Inc.

- Visa Inc.

- Brex

- Revolut

- Pivot Payables

11. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. References and Research Methodology

- References

- Research Methodology

- About us