|

市场调查报告书

商品编码

1699523

全球二手车市场按供应商类型、车辆类型、销售管道和地区划分Used Cars Market, By Vendor Type, By Vehicle Type, By Sales Channel, By Geography |

||||||

预计 2025 年全球二手车市场价值将达到 10.2 亿美元,到 2032 年将达到 18.5 亿美元,2025 年至 2032 年的年复合成长率(CAGR)为 8.9%。

| 报告范围 | 报告详细信息 | ||

|---|---|---|---|

| 基准年 | 2024 | 2025年的市场规模 | 10.2亿美元 |

| 效能数据 | 2020-2024 | 预测期 | 2025-2032 |

| 预测期:2025-2032年复合年增长率 | 8.90% | 2032年价值预测 | 18.5亿美元 |

由于消费者对经济实惠的行动解决方案的偏好日益增长、汽车持有成本不断增加以及线上二手车平台的渗透率不断提高,市场正在稳步增长。数位化进步为买家和卖家提供了更高的透明度和更便利的车辆历史、定价和融资选择。此外,二手车市场对电动和混合动力汽车的采用正在增加,大大改变了行业趋势。然而,车辆品质不稳定、经销商网路混乱以及监管限制等挑战继续影响着市场动态。

市场动态:

全球二手车市场主要受到对新车经济实惠替代品日益增长的需求的推动,消费者越来越多地选择保证可靠性和保固范围的认证二手(CPO) 计划。线上市场空间和数销售管道的扩大正在彻底改变消费者购买和销售二手车的方式,提高信任度和便利性。此外,经济的不确定性和各地区可支配收入的波动也促使买家将二手车视为可行的选择。然而,二手车市场面临着价格波动、部分地区融资选择有限以及对非法贸易的担忧等挑战。儘管存在这些障碍,但人们对永续性的日益关注、二手电动车(EV)的日益普及以及人工智慧汽车评估和检查工具的出现,正在为二手车行业创造新的成长机会。

本研究的主要特点

本报告对全球二手车市场进行了详细分析,并以 2024 年为基准年,展示了预测期(2025-2032 年)的市场规模和复合年增长率。

它还强调了各个领域的潜在商机,并说明了该市场的引人注目的投资提案矩阵。

此外,它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景以及主要企业采用的竞争策略的重要见解。

根据公司亮点、产品系列、主要亮点、业绩和策略等参数列出了全球二手车市场的主要企业。

主要企业包括 CarMax, Inc.、Carvana、Lithia Motors, Inc.、Penske Automotive Group Inc.、AutoNation, Inc.、AUTO1 Group、Group 1 Automotive, Inc.、Emil Frey Group、Sonic Automotive、Hendrick Automotive Group、Asbury Automotive Group、Lookers Motors Motor、Sonic Automotive、Pendrick Automotive Group、Asbury Automotive Group、Lookers Motors Motor、Atendras)。

本报告的见解将使负责人和公司经营团队能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

全球二手车市场报告迎合了该行业的各个相关人员,包括投资者、供应商、产品製造商、经销商、新进业者和金融分析师。

目录

第一章 调查目的与前提条件

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告描述

- 市场定义和范围

- 执行摘要

第三章市场动态、法规与趋势分析

- 市场动态

- 影响分析

- 主要亮点

- 监管情景

- 产品发布/核准

- PEST分析

- 波特的分析

- 市场机会

- 监管情景

- 主要进展

- 产业趋势

4. 2020-2032 年全球二手车市场(依供应商类型)

- 有组织的经销商

- 无组织的经销商

5. 2020-2032 年全球二手车市场(依车型划分)

- 传统车辆

- 混合动力汽车

- 电动车

6. 2020-2032 年全球二手车市场依销售管道

- 线下销售

- 网上销售

7. 2020-2032 年全球二手车市场(按地区)

- 北美洲

- 拉丁美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

第八章 竞争态势

- CarMax, Inc.

- Carvana

- Lithia Motors, Inc.

- Penske Automotive Group Inc.

- AutoNation, Inc.

- AUTO1 Group

- Group 1 Automotive, Inc.

- Emil Frey Group

- Sonic Automotive

- Hendrick Automotive Group

- Asbury Automotive Group

- Lookers

- Pendragon Plc

- Vertu Motors

- Jardine Motors Group

第九章分析师建议

- 命运之轮

- 分析师观点

- Coherent Opportunity Map(COM)

第十章参考文献与调查方法

- 参考

- 调查方法

- 关于出版商

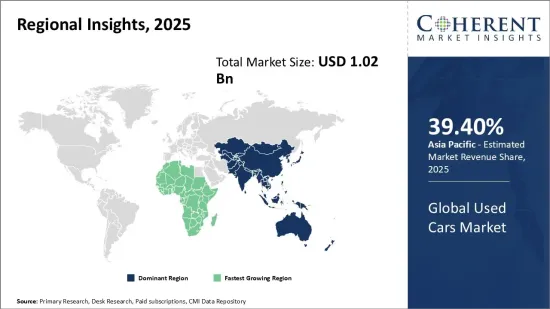

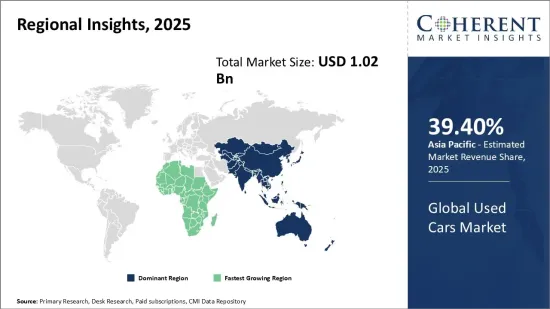

Global Used Cars Market is estimated to be valued at US$ 1.02 Bn in 2025 and is expected to reach US$ 1.85 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.9% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 1.02 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 8.90% | 2032 Value Projection: | USD 1.85 Bn |

The market has experienced steady growth due to rising consumer preference for affordable mobility solutions, increasing vehicle ownership costs, and the growing penetration of online used car platforms. With advancements in digitalization, buyers and sellers now have greater transparency and accessibility to vehicle history, pricing, and financing options. Additionally, the increasing adoption of electric and hybrid vehicles in the used cars market is reshaping industry trends. However, challenges such as inconsistent vehicle quality, unorganized dealership networks, and regulatory constraints continue to impact market dynamics.

Market Dynamics:

The global used cars market is primarily driven by rising demand for cost-effective alternatives to new vehicles, with consumers increasingly opting for certified pre-owned (CPO) programs that ensure reliability and warranty coverage. The expansion of online marketplaces and digital sales channels has revolutionized how consumers purchase and sell used vehicles, enhancing trust and convenience. Additionally, economic uncertainties and fluctuating disposable incomes in various regions have encouraged buyers to consider used cars as a practical choice. However, the market faces challenges such as price volatility, limited financing options in some regions, and concerns over fraudulent transactions. Despite these obstacles, the increasing focus on sustainability, the rising availability of used electric vehicles (EVs), and the emergence of AI-driven vehicle valuation and inspection tools are creating new opportunities for growth in the used cars industry.

Key Features of the Study:

This report provides in-depth analysis of the global used cars market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global used cars market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include CarMax, Inc., Carvana, Lithia Motors, Inc., Penske Automotive Group Inc., AutoNation, Inc., AUTO1 Group, Group 1 Automotive, Inc., Emil Frey Group, Sonic Automotive, Hendrick Automotive Group, Asbury Automotive Group, Lookers, Pendragon Plc, Vertu Motors, and Jardine Motors Group

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global used cars market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Vendor Type Insights (Revenue, USD Bn, 2020 - 2032)

- Organized Dealers

- Unorganized Dealers

- Vehicle Type Insights (Revenue, USD Bn, 2020 - 2032)

- Conventional Vehicles

- Hybrid Vehicles

- Electric Vehicles

- Sales Channel Insights (Revenue, USD Bn, 2020 - 2032)

- Offline Sales

- Online Sales

- Regional Insights (Revenue, USD Tn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- CarMax, Inc.

- Carvana

- Lithia Motors, Inc.

- Penske Automotive Group Inc.

- AutoNation, Inc.

- AUTO1 Group

- Group 1 Automotive, Inc.

- Emil Frey Group

- Sonic Automotive

- Hendrick Automotive Group

- Asbury Automotive Group

- Lookers

- Pendragon Plc

- Vertu Motors

- Jardine Motors Group

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Used Cars Market, By Vendor Type

- Global Used Cars Market, By Vehicle Type

- Global Used Cars Market, By Sales Channel

- Global Used Cars Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Used Cars Market, By Vendor Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Organized Dealers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Organized Dealers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Used Cars Market, By Vehicle Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Conventional Vehicles

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Hybrid Vehicles

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Electric Vehicles

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Used Cars Market, By Sales Channel, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Offline Sales

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Online Sales

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Used Cars Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025,2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Vendor Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Sales Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Vendor Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Sales Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Vendor Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Sales Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Vendor Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Sales Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Vendor Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Sales Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Vendor Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Vehicle Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Sales Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

8. Competitive Landscape

- CarMax, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Carvana

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Lithia Motors, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Penske Automotive Group Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- AutoNation, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- AUTO1 Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Group 1 Automotive, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Emil Frey Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Sonic Automotive

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Hendrick Automotive Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Asbury Automotive Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Lookers

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Pendragon Plc

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Vertu Motors

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Jardine Motors Group

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. References and Research Methodology

- References

- Research Methodology

- About us