|

市场调查报告书

商品编码

1692447

印尼二手车市场:市场份额分析、行业趋势和成长预测(2025-2030 年)Indonesia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

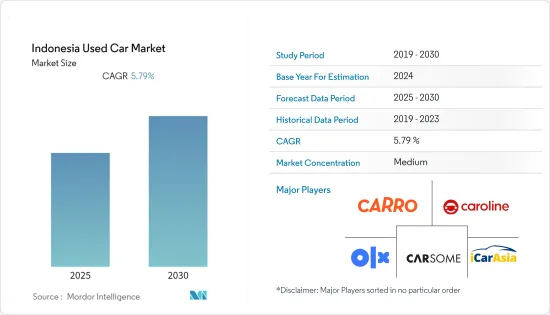

预计预测期内印尼二手车市场的复合年增长率将达到 5.79%。

主要亮点

- 由于新冠疫情爆发和随后的封锁,二手车市场遭遇了严重下滑。然而,由于购车意愿不强以及用于购买新车的可支配收入减少,降幅并不像新车销售那么大。但现在,随着生活恢復正常,预计未来几年印尼的二手车市场将会回升。

- 由于搭乘公共运输工具不安全,疫情使得拥有汽车成为个人生活中不可避免的一部分。在疫情之前偏爱公共交通的人现在成为了二手车市场的潜在客户。

- 随着数位化的进步以及该公司能够提供远端身临其境型购买体验,印尼的二手车市场预计将显着增长。此外,附加价值服务产品的增加和提供二手车信贷的贷款机构的多样化也可能促进该地区二手车市场的成长。然而,利率上升也可能吓跑潜在客户,阻碍市场成长。

- 例如,2021年9月,Mobil88推出了Mo88i应用程序,使二手车的买卖变得更加容易。 Mo88i 是一个值得信赖、简单、快速、高效的二手车买卖平台,从车辆检查和估价中标,到提交融资和车辆保险。

- 此外,各种非银行金融公司的出现,提供比银行更低的利率和灵活的分期付款方式,也是推动市场成长的主要因素。

印尼二手车市场的趋势

运动型多用途车 (SUV) 销量的上升推动了市场

- 近年来,运动型多功能车(SUV)在印尼的二手车买家中越来越受欢迎。消费者总是渴望看到市场上现有的SUV车型,而经销商也在竞相为这个不断成长的市场提供新的SUV。年轻人对SUV的追捧或许会推动国内SUV市场的发展。

- 在这种情况下,具有豪华和运动外观的SUV的出现通常迎合了高级阶层的需求,同时提供了合理的舒适度。对于有这些顾虑的顾客来说,SUV 提供了更好的性价比。有些低成本的 SUV 即使预算有限,也给人坚固、现代的印象。对于中等经济阶层来说,这款 SUV 车型是比较划算的。

- 此外,小型SUV的出现也为经销商提供了许多可能性,因为这些车型兼具性能和预算。一些最畅销的 SUV 车型包括本田 BR-V、大发 Terios、丰田 Rush、雪佛兰 Trax 和东风小康 Glory 580。

- 根据OLX Autos Indonesia统计,近年来二手车销售趋势已从MPV转向SUV。到 2020 年,MPV 仍然是轿车和二手车领域的首选。不过,2022年,SUV占了更多的市场占有率,从2021年的25%上升到31%。

- 多用途汽车(MPV)是印尼最受欢迎的汽车之一。对于预算紧张的个人来说,二手MPV 仍然是受欢迎的选择。 MPV 的需求仍然很大,因为它们的车身尺寸足够大,可以容纳许多乘客和行李。

- 由于印尼家庭规模扩大,对大型车辆的需求不断增长,MPV 近年来一直是最畅销的二手车。从目前情况来看,印尼MPV车款的动能依然强劲,约占市场总销售量的45%。

- 品牌知名度的提高和家庭规模的扩大可能会推动市场发展,豪华车和 MPV 的销售量将会上升。印尼的二手车销售传统上以 MPV 为主,但最近掀背车、城市车和 SUV 的需求激增。这些汽车的需求是由社会从大家庭向核心家庭的转变以及根据个人需求购买汽车所推动的。

西爪哇在二手车市场占据主导地位

- 西爪哇省是印尼人口最多的省份,根据 2020 年人口普查,人口为 48,274,160。该省的主要城市勿加泗和万隆分别是印尼第三大和第四大人口城市。万隆也是世界上人口最稠密的城市之一。还有茂物等大城市。

- 西爪哇省占印尼汽车销售的20%以上,每年汽车销量高达6,000辆。 SUV 在西爪哇的二手车销售中日益受到青睐。人们更喜欢 SUV,因为它们可以在西爪哇地区的偏远地区行驶。

- 丰田、大发和本田等品牌是西爪哇二手车销售最受欢迎的选择。 Toyota Fortuner、大发 Terios 和本田 CR-V 等车型是二手车市场上最畅销的 SUV 车型,行驶里程 50,000 公里的车型平均售价约为 2 亿至 2.5 亿印尼币(14,286 至 17,858 美元)。

- 以金额为准。主要OEM授权经销商集中在万隆及其周边地区以及二、三线城市。然而,全州各地都可以找到多频段经销商,无论是线上或线下。由于市场潜力巨大,许多二手车平台和OEM授权经销商如Carmudi、OLX、Cars24、Carro、Mobil88等都已在各大城市设立。

- 受新冠疫情影响,2020 年二手车市场下滑。受冠状病毒影响,包括勿加泗、万隆、卡拉旺等城市的西爪哇省实施了PSBB(大规模社会限制措施)。

- 然而,自疫情爆发以来,由于供需停滞,二手车价格上涨。经销商将价格提高了 10% 至 15% 左右以清仓,而由于人们出于对未来的担忧而不愿购买,需求正在下降。

- 在二手车产业蓬勃发展的印尼,西爪哇市场上二手日本二手车因成本绩效较高而价格颇受欢迎。

印尼二手车产业概况

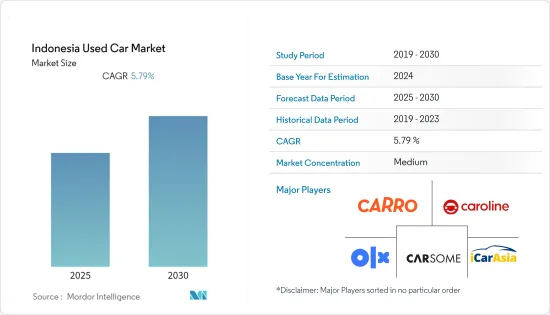

印尼的二手车市场较为分散,主要由网路参与者和企业经营的二手车经销商主导。主要公司包括 Carsome、Caroline、Carro、OLX、iCarAsia、Diamond Smart Auto、PT Tunas Ridean Tbk、Toyota Trust、Suzuki Auto Value 等。

主要企业正在结盟、收购和伙伴关係以增加市场占有率。例如,2022 年 2 月,Carsome 从 Catcha 集团收购了 iCar Asia。我们主要在2021年收购了19.9%的股份,随后在2022年2月从Catcha集团收购了剩余的股份(80.1%),此次收购的总投资约为2亿美元。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 扩大分销管道

- 其他的

- 市场限制

- 缺乏信任和透明度

- 其他的

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 车型

- 掀背车

- 轿车

- 运动型多用途车 (SUV)

- 多用途汽车(MPV)

- 预订管道

- 在线的

- OEM认证/授权经销商

- 多品牌经销商

- 融资供应商

- OEM

- 银行

- 非银行金融公司

- 状态

- 西爪哇

- 东爪哇

- 中爪哇省

- 北苏门答腊

- 万丹省

- 其他州

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Mobil88

- Toyota Astra Motor(Toyota Trust)

- Pt Tunas Ridean Tbk.

- Diamond Smart Auto

- Suzuki Auto Value

- Mercedes Certified

- BMW Premium Selection

- OLX Indonesia

- Cars24

- Caroline

第七章 市场机会与未来趋势

The Indonesia Used Car Market is expected to register a CAGR of 5.79% during the forecast period.

Key Highlights

- The used car market saw a significant dip due to the COVID-19 outbreak and subsequent lockdowns. Though the slump was not as significant when compared to the new car sales due to the buyer's reluctance and lower disposable cash in hand for new vehicle purchases. But now, as life comes to normalcy, the Indonesian Used Car Market is expected to gain back its pace in the following years.

- The pandemic made owning a car an unavoidable aspect of an individual's life, as traveling via public transport was risky. People who preferred public transport during the pre-Covid times are now potential customers of the used cars market.

- Due to the increasing digitization and the ability of companies to provide immersive purchase experiences remotely, the Indonesian used car market is expected to witness significant growth. Furthermore, the rise in the value-added service offering and the variety of finance providers offering credit for used cars will also contribute to the growth of the used car market in the region. However, the higher interest rates might turn around some potential customers hampering the market's growth.

- For instance, in September 2021, Mobil88 launched the Mo88i application to make buying and selling used cars easier. Mo88i is a platform for buying and selling used cars that are trusted, easy, fast, and efficient, beginning with car inspections and estimated bid prices and ending with financing and vehicle insurance submissions.

- Another major factor aiding the market growth is the emergence of various Non-Banking Finance Companies offering low-interest rates compared to banks and flexible installment options.

Indonesia Used Car Market Trends

Growing Sport Utility Vehicle (SUV) Sales Aiding the Market

- Sport utility vehicles (SUVs) have become increasingly popular among Indonesian used car buyers in recent years. Consumers are always interested in looking at the current SUV models in the market, while dealers compete to offer new SUVs for this growing market. The SUV trend in the youth may be the driving force for the SUV segment among domestic buyers.

- In this situation, the existence of SUVs with luxurious and sporty looks generally cater to the higher class while yet providing a reasonable level of comfort. SUVs offer more fantastic deals to customers who have these concerns. Even for a low budget, there is a low-cost SUV that nonetheless gives the image of a robust and latest vehicle. This SUV sector is a good value for money in the middle-class economy.

- The emergence of the sub-compact SUVs has also offered dealers many possibilities as these models come with both performance and budget. The top-selling SUV models include Honda BR-V, Daihatsu Terios, Toyota Rush, Chevrolet Trax, DFSK Glory 580, etc.

- According to OLX Autos Indonesia's statistics, the trend of used car sales shifting from MPV to SUV has been witnessed in recent years. Although MPVs remained the top choice in the automotive and used car segment until 2020. However, by 2022, SUVs had taken over the market share, which had climbed by 31% from the previous 25% in 2021.

- In Indonesia, nulti-purpose vehicles (MPVs) have become one of the most popular vehicles. Used MPVs are still a popular choice for individuals on a tight budget. MPVs have large enough body dimensions to accommodate greater passenger capacity with significant luggage, which is why they are still in high demand.

- Due to an increase in demand for larger cars due to Indonesia's expanding family sizes, MPVs topped the used car sales over the past few years. According to current conditions, the MPV car trend is still strong in Indonesia and occupies around 45% of total market sales.

- Owing to the increased brand awareness and the growth of the number of families, the market is likely to be driven by rising sales of luxury cars and MPVs. Although MPVs have typically dominated used car sales in Indonesia, there has recently been a surge in demand for Hatchbacks, City Cars, and SUVs. The demand for these cars is driven by the societal transition from large families to nuclear families and the purchase of vehicles for individual requirements.

West Java Dominates the Used Car Market

- West Java is Indonesia's most populated province, with a population of 48,274,160 people, according to the 2020 Census. Bekasi and Bandung, the province's two main cities, are Indonesia's third and fourth most populous cities, respectively. In addition, Bandung is one of the world's most densely populated cities. It is also home to major cities like Bogor, etc.

- West Java accounts for more than 20 percent of the total car sales in Indonesia, with as many as 6 lakh units sold every year. SUVs are gaining momentum in used car sales in west java. SUVs are preferred because they can be driven in the region of West Java, even into remote areas.

- Brands like Toyota, Daihatsu, and Honda are the most opted when it comes to used car sales in the province. Models like Toyota Fortuner, Daihatsu Terios, and Honda CR-V are the most sold SUV models in the used car market, selling at an average price of around Rp 200-250 million (USD 14286 - 17858) for models with 50000 km.

- Based on volume and value. Major OEM-certified dealerships are centered in Bandung, its environs, and Tier-2/Tier-3 cities. However, multiband dealers may be found all around the province, both online and offline. Owing to the huge market potential, many used car platforms and OEM-certified dealerships are present in major cities such as Carmudi, OLX, Cars24, Carro, Mobil88, etc.

- Due to the COVID-19 pandemic, the used car market witnessed a decline in 2020. PSBB (Massive Social Restriction) was imposed due to the impact of the novel coronavirus in West Java, the province where Bekasi, Bandung, Karawang, and other cities are located.

- However, post-pandemic, the price of used cars has been increasing as a result of the stagnation of both supply and demand. Dealerships have hiked the priced around 10-15% in order to clear the inventory, and demand has decreased due to restrained buying due to uncertainty about the future.

- The price of Japanese used cars in the medium and lower classes of the West Java market is most preferred as these cars come at good value for money readily in Indonesia, where the used car industry is quite active.

Indonesia Used Car Industry Overview

Indonesia used car market is fragmented and is occupied by online players and company-operated used car dealers. The major players include Carsome, Caroline, Carro, OLX, iCarAsia, Diamond Smart Auto, PT Tunas Ridean Tbk, Toyota Trust, Suzuki Auto Value, and others.

Key players are engaging in collaborations, acquisitions, and partnerships to gain market share. For instance, in February 2022, Carsome acquired iCar Asia from the Catcha group. Primarily, in 2021, the company acquired a 19.9% stake in the company, and further, in February 2022, the company took over the rest stake (80.1%) from the Catcha Group. The total investment in the acquisition was around USD 200 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Expanding Distribution Channels

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Lack Of Trust And Transparency

- 4.2.2 Others

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport Utility Vehicle (SUV)

- 5.1.4 Multi-purpose Vehicle (MPV)

- 5.2 Booking Channel

- 5.2.1 Online

- 5.2.2 OEM Certified/Authorized Dealerships

- 5.2.3 Multi Brand Dealerships

- 5.3 Financing Providers

- 5.3.1 OEMs

- 5.3.2 Banks

- 5.3.3 Non-Banking Financial Companies

- 5.4 Province

- 5.4.1 West Java

- 5.4.2 East Java

- 5.4.3 Central Java

- 5.4.4 North Sumatra

- 5.4.5 Banten

- 5.4.6 Other Provinces

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Mobil88

- 6.2.2 Toyota Astra Motor (Toyota Trust)

- 6.2.3 Pt Tunas Ridean Tbk.

- 6.2.4 Diamond Smart Auto

- 6.2.5 Suzuki Auto Value

- 6.2.6 Mercedes Certified

- 6.2.7 BMW Premium Selection

- 6.2.8 OLX Indonesia

- 6.2.9 Cars24

- 6.2.10 Caroline