|

市场调查报告书

商品编码

1892755

二手车融资市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Used Car Financing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

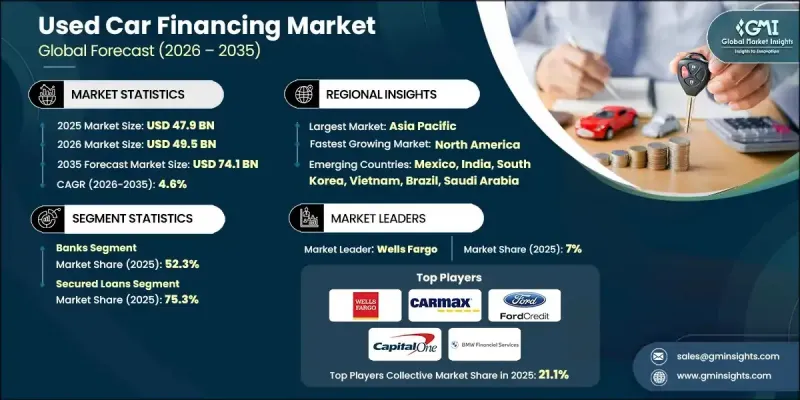

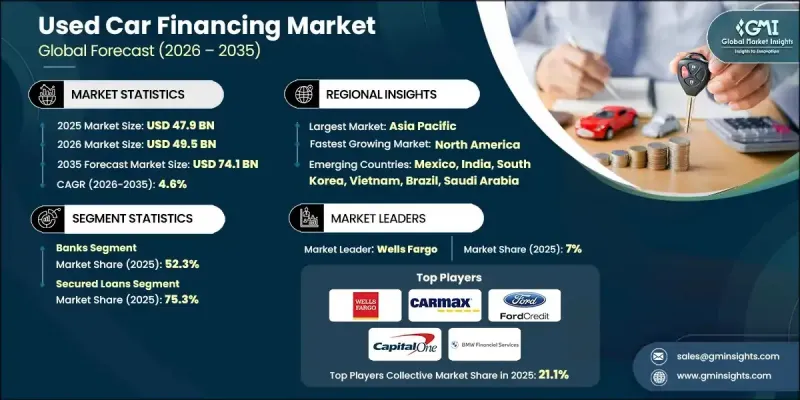

2025年全球二手车融资市场价值为479亿美元,预计2035年将以4.6%的复合年增长率成长至741亿美元。

可支配收入的成长推动了汽车需求,但新车的高昂价格仍然令购车者犹豫不决。二手车销售已成为一种切实可行的替代方案,使消费者能够以更低的价格购买汽车。包括分期付款在内的融资方案正在弥合这一差距,使汽车拥有变得更加容易和方便。贷款机构提供灵活的利率以适应不同的贷款期限,据行业协会称,目前12-36个月的平均利率约为4.79%,37-60个月的平均利率约为5.29%。亚太地区约占全球市场份额的一半,这主要得益于中国的经济规模、印度快速的汽车普及以及有组织的零售网路的扩张。北美和欧洲市场虽然仍较为成熟,但透过数位化融资平台、创新的保险解决方案以及针对电动车的专项融资,仍蕴藏着巨大的发展机会,从而支持着全球市场的稳步扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 479亿美元 |

| 预测值 | 741亿美元 |

| 复合年增长率 | 4.6% |

2024年,银行类股占据52.3%的市占率。其主导地位源自于低成本的存款能力、广泛的网点和线上管道,以及在低风险贷款方面的专业知识。借款人通常可获得80%至90%的贷款价值比,期限为36至72个月。抵押贷款占市场收入的75.3%,因为有抵押贷款既能降低贷款人的风险,又能为借款人提供优惠的利率和更长的还款期限。

到2025年,担保贷款市场将占据75.3%的份额。担保贷款之所以备受青睐,是因为车辆本身即可作为抵押品,从而降低了贷款机构的风险。信用良好的借款人可以享受更长的还款期限和更低的利率。从贷款机构的角度来看,这些贷款提供了保障,因为在必要时可以选择收回抵押物;而藉款人则可以获得优惠的融资方案。这种风险管理结构使担保贷款成为二手车融资市场的基石。

预计2025年,美国二手车融资市场规模将达83亿美元。新车价格高涨使得二手车成为许多人的首选,从而维持了融资需求。银行、信用社和附属金融公司积极为各类信用等级的消费者提供服务,包括优质、次优和次级信用借款人。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 二手车价格上涨扩大了潜在市场

- 数位化预审可减少摩擦并提高转换率

- 延长贷款期限,提高贷款负担能力及取得途径。

- 嵌入式金融合作关係扩大分销

- 产业陷阱与挑战

- 利率上升导致借贷成本增加。

- 汽车价格正常化可能导致利润空间压缩

- 市场机会

- 嵌入式金融伙伴关係

- 电动汽车二手车融资这一新兴细分市场

- 小型企业和车队融资成长

- 信用合作社-银行合作模式

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 技术路线图与演进

- 技术采纳生命週期分析

- 价格趋势

- 按地区

- 副产品

- 专利分析

- 投资与融资分析

- 汽车金融科技领域的创投

- 私募股权在次级贷款领域的活动

- 银行对数位化能力的投资

- 证券化市场趋势

- 定价与利率分析

- 利率基准

- 历史利率趋势

- 经销商加价经济学

- 附加产品定价

- 费用结构分析

- 信用分析总成本

- 宏观经济和市场週期敏感性

- 影响二手车融资需求的宏观经济因素

- 汽车市场动态

- 信贷週期动态

- 经济衰退和经济低迷敏感性

- 扩张与復苏动态

- 车辆拥有率

- 消费者信用评分分布分析

- 信用评分随时间变化的趋势

- 按人口统计资料分類的信用评分分布

- 信用评分对贷款期限的影响

- 信用评分提升与修復

- 客户行为分析

- 车辆购买决策过程

- 融资管道选择

- 贷款期限选择行为

- 首付行为

- 附加产品购买行为

- 支付行为与绩效

- 风险评估与缓解框架

- 信用风险

- 抵押品风险

- 营运风险

- 合规与监理风险

- 市场和经济风险

- 永续发展与ESG趋势

- 环境因素

- 社会因素

- 治理方面的考虑

- 将ESG因素纳入贷款实践

- 投资者和贷款机构的ESG承诺

- 未来展望与机会

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 供应商选择标准

第五章:市场估价与预测:依贷款机构划分,2022-2035年

- 银行

- 私人的

- 民众

- 非银行金融公司

- OEM专属融资公司

- 其他的

第六章:市场估计与预测:依贷款类型划分,2022-2035年

- 担保贷款

- 无担保贷款

- 租赁融资

第七章:市场估价与预测:依车辆类别划分,2022-2035年

- 经济型轿车

- 中檔

- 豪华轿车

第八章:市场估算与预测:依车辆类型划分,2022-2035年

- 轿车

- 掀背车

- SUV

第九章:市场估计与预测:依贷款期限划分,2022-2035年

- 短期(12-36个月)

- 中期(37-60个月)

- 长期(超过 60 个月)

第十章:市场估价与预测:依车龄划分,2022-2035年

- 较新的(不超过3年)

- 年龄较大(3岁以上)

第十一章:市场估计与预测:依用途划分,2022-2035年

- 个人/消费者

- 企业/商业

第十二章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 新加坡

- 马来西亚

- 印尼

- 越南

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- 全球公司

- Ally Financial

- Capital One Financial Corporation

- JPMorgan Chase

- Bank of America

- Wells Fargo

- Santander Consumer

- TD Auto Finance

- GM Financial

- Ford Motor Credit Company

- Toyota Financial Services

- Honda Financial Services

- Volkswagen Credit

- BMW Financial Services

- Mercedes-Benz Financial Services

- 区域公司

- Navy Federal Credit Union

- First Tech Federal Credit Union

- Truist Financial

- KeyBank

- Huntington National Bank

- PenFed Credit Union

- 新兴公司

- Carvana

- LendingClub

- Upstart Holdings

- AutoFi

- Exeter Finance

The Global Used Car Financing Market was valued at USD 47.9 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 74.1 billion by 2035.

Rising disposable income has fueled automotive demand, yet the high cost of new vehicles continues to make buyers hesitant. Used car sales have emerged as a practical alternative, enabling consumers to access vehicles at lower price points. Financing solutions, including EMIs, are bridging this gap, making car ownership more attainable and convenient. Lenders are offering flexible interest rates to accommodate varying loan tenures, with rates currently averaging around 4.79% for 12-36 months and 5.29% for 37-60 months, according to industry associations. The Asia-Pacific region accounts for roughly half of the market, driven by China's scale and India's rapid motorization alongside the growth of organized retail networks. North America and Europe remain mature markets but continue to present opportunities through digital financing platforms, innovative insurance solutions, and specialized financing for electric vehicles, supporting steady market expansion globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $47.9 Billion |

| Forecast Value | $74.1 Billion |

| CAGR | 4.6% |

The banks segment held a 52.3% share in 2024. Their dominance stems from low-cost deposit capabilities, wide branch and online networks, and expertise in low-risk lending. Borrowers typically secure 80-90% loan-to-value ratios over 36-72 months. Secured loans accounted for 75.3% of the market revenue, as collateralized loans reduce lender risk while offering borrowers favorable rates and longer tenures.

The secured loans segment held a 75.3% share in 2025. Secured loans are highly preferred because the vehicle itself serves as collateral, reducing risk for lenders. Borrowers with strong credit profiles can benefit from longer repayment terms and lower interest rates. From the lender's perspective, these loans provide assurance through the option to repossess the asset if needed, while borrowers gain access to favorable financing solutions. This risk-managed structure makes secured loans the cornerstone of the used car financing market.

U.S. Used Car Financing Market reached USD 8.3 billion in 2025. High new car prices have made used vehicles the preferred choice for many, sustaining demand for financing. Banks, credit unions, and captive finance companies actively serve consumers across credit categories, including prime, near-prime, and subprime borrowers.

Key players in the Used Car Financing Market include CarMax Auto Finance, Capital One Auto Finance, Ally Financial, Ford Motor Credit Company, Carvana, BMW Financial Services, JPMorgan Chase, GM Financial, Wells Fargo, and Toyota Financial Services. Companies in the Used Car Financing Market are leveraging flexible financing structures, including variable interest rates and customizable EMI plans, to attract a broader customer base. Many are investing in digital platforms and mobile applications to simplify loan applications, approvals, and repayments, increasing convenience for borrowers. Partnerships with dealerships, online marketplaces, and financial institutions allow lenders to expand distribution channels and tap into new regional markets. Risk assessment and credit scoring technologies are being enhanced to accommodate prime, near-prime, and subprime borrowers while minimizing defaults. Additionally, marketing initiatives emphasize affordability, convenience, and vehicle accessibility, strengthening brand presence.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Lender

- 2.2.3 Loan Type

- 2.2.4 Vehicle Class

- 2.2.5 Vehicle Type

- 2.2.6 Loan Duration

- 2.2.7 Vehicle Age

- 2.2.8 User

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising used vehicle prices expanding addressable market

- 3.2.1.2 Digital pre-qualification reducing friction & improving conversion

- 3.2.1.3 Extended loan terms improving affordability & access

- 3.2.1.4 Embedded finance partnerships expanding distribution

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rising interest rates increasing borrowing costs

- 3.2.2.2 Vehicle price normalization risk compressing margins

- 3.2.3 Market opportunities

- 3.2.3.1 Embedded finance partnerships

- 3.2.3.2 EV used car financing emerging niche

- 3.2.3.3 Small business & fleet financing growth

- 3.2.3.4 Credit union-bank partnership models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Investment & Funding Analysis

- 3.10.1 Venture capital in auto fintech

- 3.10.2 Private equity activity in subprime lending

- 3.10.3 Bank investment in digital capabilities

- 3.10.4 Securitization market trends

- 3.11 Pricing & interest rate analysis

- 3.11.1 Interest rate benchmarking

- 3.11.2 Historical interest rate trends

- 3.11.3 Dealer markup economics

- 3.11.4 Add-on product pricing

- 3.11.5 Fee structure analysis

- 3.11.6 Total cost of credit analysis

- 3.12 Macroeconomic & market cycle sensitivity

- 3.12.1 Macroeconomic drivers of used car financing demand

- 3.12.2 Vehicle market dynamics

- 3.12.3 Credit cycle dynamics

- 3.12.4 Recession & economic downturn sensitivity

- 3.12.5 Expansion & recovery dynamics

- 3.12.6 Vehicle ownership rates

- 3.13 Consumer credit score distribution analysis

- 3.13.1 Credit score trends over time

- 3.13.2 Credit score distribution by demographics

- 3.13.3 Credit score impact on loan terms

- 3.13.4 Credit score improvement & rehabilitation

- 3.14 Customer behavior analysis

- 3.14.1 Vehicle purchase decision process

- 3.14.2 Financing channel selection

- 3.14.3 Loan term selection behavior

- 3.14.4 Down payment behavior

- 3.14.5 Add-on product purchase behavior

- 3.14.6 Payment behavior & performance

- 3.15 Risk assessment & mitigation framework

- 3.15.1 Credit risk

- 3.15.2 Collateral risk

- 3.15.3 Operational risk

- 3.15.4 Compliance & regulatory risk

- 3.15.5 Market & economic risk

- 3.16 Sustainability & ESG trends

- 3.16.1 Environmental considerations

- 3.16.2 Social considerations

- 3.16.3 Governance considerations

- 3.16.4 ESG integration in lending practices

- 3.16.5 Investor & lender ESG commitments

- 3.17 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Lender, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Banks

- 5.2.1 Private

- 5.2.2 Public

- 5.3 NBFCs

- 5.4 OEM captive finance companies

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Loan Type, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Secured Loans

- 6.3 Unsecured Loans

- 6.4 Lease Financing

Chapter 7 Market Estimates & Forecast, By Vehicle Class, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Economy Cars

- 7.3 Mid-range

- 7.4 Luxury Cars

Chapter 8 Market Estimates & Forecast, By Vehicle Type, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 Sedan

- 8.3 Hatchbacks

- 8.4 SUVs

Chapter 9 Market Estimates & Forecast, By Loan Duration, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 Short-term (12-36 months)

- 9.3 Medium-term (37-60 months)

- 9.4 Long-term (Above 60 months)

Chapter 10 Market Estimates & Forecast, By Vehicle Age, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 Newer (Upto 3 years)

- 10.3 Older (Above 3 years)

Chapter 11 Market Estimates & Forecast, By Use, 2022 - 2035 ($Mn)

- 11.1 Key trends

- 11.2 Individuals/consumers

- 11.3 Businesses/commercial

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Benelux

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 ANZ

- 12.4.6 Singapore

- 12.4.7 Malaysia

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.4.10 Thailand

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global companies

- 13.1.1 Ally Financial

- 13.1.2 Capital One Financial Corporation

- 13.1.3 JPMorgan Chase

- 13.1.4 Bank of America

- 13.1.5 Wells Fargo

- 13.1.6 Santander Consumer

- 13.1.7 TD Auto Finance

- 13.1.8 GM Financial

- 13.1.9 Ford Motor Credit Company

- 13.1.10 Toyota Financial Services

- 13.1.11 Honda Financial Services

- 13.1.12 Volkswagen Credit

- 13.1.13 BMW Financial Services

- 13.1.14 Mercedes-Benz Financial Services

- 13.2 Regional companies

- 13.2.1 Navy Federal Credit Union

- 13.2.2 First Tech Federal Credit Union

- 13.2.3 Truist Financial

- 13.2.4 KeyBank

- 13.2.5 Huntington National Bank

- 13.2.6 PenFed Credit Union

- 13.3 Emerging companies

- 13.3.1 Carvana

- 13.3.2 LendingClub

- 13.3.3 Upstart Holdings

- 13.3.4 AutoFi

- 13.3.5 Exeter Finance