|

市场调查报告书

商品编码

1852178

二手卡车:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Used Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

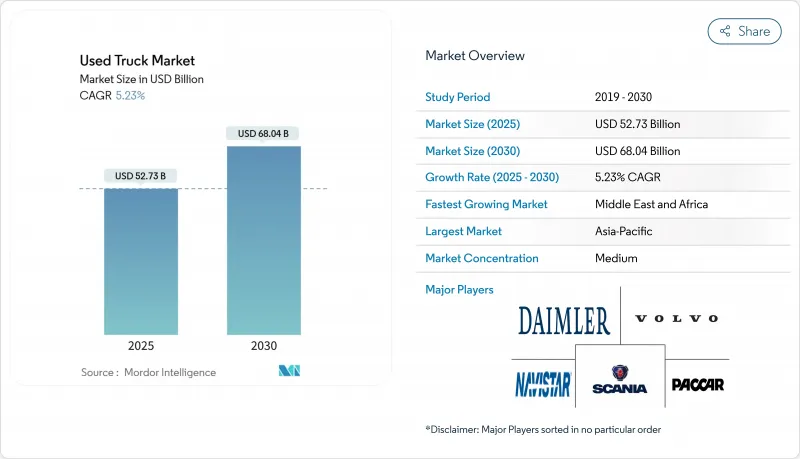

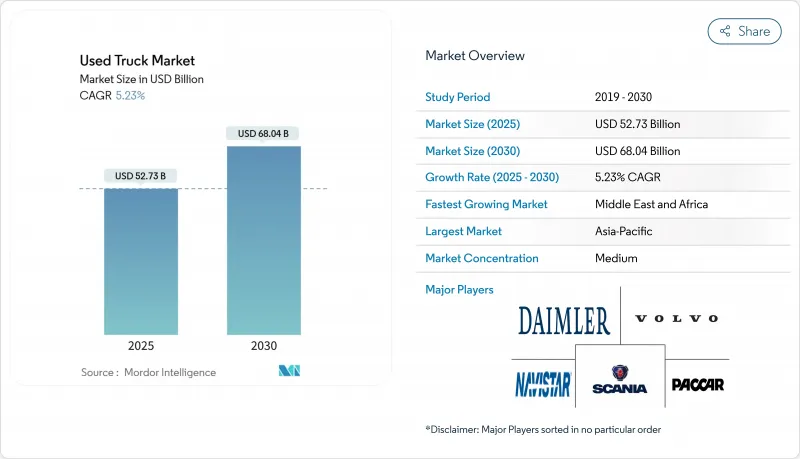

预计到 2025 年,二手卡车市场规模将达到 527.3 亿美元,到 2030 年将达到 680.4 亿美元。

由于车队管理者更重视整体拥有成本,市场对高品质二手8级卡车的需求强劲。虽然大型卡车仍保持着定价权,但随着电子商务加速最后一公里配送,小型卡车也越来越受欢迎。柴油卡车在动力系统方面占据主导地位,但随着竞标动力传动系统正在促进跨国交易,并降低小型企业的资讯取得门槛。

全球二手卡车市场趋势与洞察

印度和东协的主导设施建设热潮推动了重型二手卡车的流通。

印度和东南亚的大型企划建设项目正在加速车队更新换代,促使承包商采购更大、车龄四至七年的车辆,以兼顾可靠性和可控的资本支出。随着计划于2025年5月开工,敞篷货车运力趋紧,迫使托运人在竞标週期早期就锁定设备。儘管2024年轻型商用车销售量大幅下滑,但由于基础建设投资保障了货运量,商用车需求依然强劲。买家越来越重视车辆的检验记录,拥有完整远端资讯处理资料的车辆价格更高,这凸显了透明的车辆认证对二手卡车市场的重要性。

北美最后一公里电子商务的扩张正在推动对二手轻型卡车的需求。

小包裹量的快速成长正促使零售商和第三方物流供应商转向更适合狭窄都市区走廊且负载容量更大的3-5级新型货车。由于营运商既能避免不断上涨的新车价格,又能满足服务水准协议的要求,二手卡车市场从中受益。沿着州际公路环线建设的都市区仓库也支援缩短配送半径。环境研究表明,电动货车的碳排放强度更低,随着二手电动车型逐渐退出主力车队,其残值也更高。

欧盟VII/第三阶段:更严格的氮氧化物排放法规限制了老旧柴油引擎进口到欧盟

更严格的废气排放法规使欧洲二次性车市场分化:一部分是符合欧六排放标准的牵引车,另一部分则是需要进行成本高昂维修的老旧车辆。国际清洁交通委员会已确认,在不断扩大的低排放气体区,车龄超过七年的车辆将受到准入限制。出口商正将不符合欧六排放标准的车辆转运至中亚和北非,这暂时增加了这些地区的供应量,同时也加剧了欧盟内部来自低里程欧六排放标准车辆的竞争。

细分市场分析

由于重型卡车在远距货运和基础设施运输中发挥至关重要的作用,即使在景气衰退时期,其需求依然旺盛,预计2024年将占总销售量的43.05%。受包裹物流的推动,轻型卡车预计将在二手卡车市场实现最快成长,到2030年复合年增长率将达到7.69%。轻型卡车的机动性使其非常适合繁忙的城市道路,而且与新货车相比,其较低的购买成本也更受车队买家的青睐。

中型卡车(6-7级)占据战略性的中间位置,市场表现好坏参半。该细分市场库存激增,而要价却有所下降,显示其市场状况较为微妙。正在进行的自动驾驶测试,例如在2025年国际消费电子展(CES 2025)上展出的铰接式自动卸货卡车,预示着未来将出现一些专用的重型应用,一旦这些车辆进入二手车市场,可能会重新定义残值曲线。

2024年,柴油资产占车队总资产的92.25%,显示柴油车拥有完善的基础设施、成熟的维护体係以及车队管理者信赖的燃油效率记录。柴油车市场持续成长的动力源于其久经考验的可靠性、燃油效率和广泛的服务网络,使其成为优先考虑营运稳定性的二手车买家的首选。

混合动力车和纯电动车虽然目前绝对数量仍然较小,但预计到2030年将以22.55%的复合年增长率成长。由康明斯、戴姆勒卡车和帕卡集团合资成立的Accellera公司(投资额20亿至30亿美元)将建造一座年产能21吉瓦时的电池工厂,从而增强未来二手电动车的供应。电气化联盟计算得出,电动卡车的运作成本比柴油卡车低三分之二,这意味着完善的充电基础设施将提升其在次市场的吸引力。天然气和液化石油气(LPG)车型目前仍属于小众市场,主要集中在燃料供应充足且有市政奖励的地区。

区域分析

亚洲拥有全球最大的区域车队规模,占全球市场份额的47.35%,基础设施计划和电子商务的兴起持续扩大卡车运输需求。受严格的电气化目标驱动,中国正在加速减少柴油车队,并将高品质的欧V排放标准牵引车投放到邻近的发展中市场。印度快速发展的数位零售业预计到2030财年商品总值将成长两倍,该产业高度依赖中重型运输,从而推动了设备的持续更新换代。

北美市场将与全球成长趋势保持一致,预计到2030年复合年增长率将达到5.2%,这得益于完善的二手车市场网络和数据主导的估值工具能够维持市场流动性。即将实施的重型皮卡和厢型车企业平均燃油经济性标准(CAFE)可能会促使车队选择更新、更有效率的车型,这可能会为二手卡车市场增加更多新车型。

中东和非洲是成长最快的地区,预计到2030年复合年增长率将达到7.41%,这得益于数位竞标的流动性,该地区能够获得价格合理的资产。南美洲也经历了强劲成长,经济稳定和财政奖励推动了车队现代化。巴西GDP的復苏带动了卡车购买量的回升,而二手车税收优惠政策也鼓励自僱人士进行投资。跨境运输便利化措施,例如TIR系统,可望为南美洲运输商开闢新的出口通道,间接提升改装二手牵引车的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 印度和东协基础设施建设热潮主导了重型二手卡车的周转率。

- 北美最后一公里电子商务的扩张正在推动对二手轻型卡车的需求。

- 欧洲原厂认证二手车专案提升可靠性与残值

- 数位批发竞标扩大了买家群体,尤其是在中东地区。

- 中国汽车电气化目标推动柴油车产业结构调整

- 巴西二手商用车税收优惠政策支持自营商

- 市场限制

- 更严格的欧VII/第三阶段氮氧化物排放法规限制了欧盟老旧柴油引擎的进口。

- 中国新型低成本卡车降低了非洲二手车的溢价。

- 东协农村地区大型老旧资产的融资选择有限

- 晶片短缺缩短了新车的前置作业时间,使得二手车不再那么稀缺。

- 价值/供应链分析

- 监理与技术展望

- 排放气体法规过渡时程

- 利用数位产权和远端资讯处理技术的检测技术

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按车辆类型

- 轻型卡车(3-5级)

- 中型卡车(6-7级)

- 大型卡车(8级以上,15吨以上)

- 按燃料类型

- 柴油引擎

- 汽油

- 天然气和液化石油气

- 混合动力和纯电动

- 按年龄组

- 3岁以下

- 4至7岁

- 8至12岁

- 12岁以上

- 按汽车等级

- 三年级

- 四年级

- 五年级

- 六年级

- 七年级

- 八年级

- 按最终用途行业划分

- 建筑和基础设施

- 物流与电子商务配送

- 采矿和采石

- 农业/林业

- 地方政府与公共产业

- 其他的

- 按销售管道

- 独立经销商

- 特许经销商

- 经原厂认证的二手车

- 在线P2P交易和竞标

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daimler AG(SelecTrucks)

- PACCAR Inc.

- Volvo Group

- Scania AB

- MAN Truck and Bus SE

- Navistar International Corp.

- Tata Motors

- Ashok Leyland

- Isuzu Motors

- Hino Motors

- Mitsubishi Fuso Truck and Bus Corp.

- Eicher Motors(VECV)

- Iveco Group NV

- Ford Otosan

- Sinotruk(CNHTC)

- FAW Jiefang

- Dongfeng Commercial Vehicles

- UD Trucks

- Penske Used Trucks

- Enterprise Truck Rental

- Ryder Used Vehicle Sales

- AmeriQuest Used Trucks

- Copart Inc.

- Ritchie Bros. Auctioneers

- Mascus

- TruckPlanet(IronPlanet)

- AutoNation USA

- OLX Autos Commercial

第七章 市场机会与未来展望

The used trucks market stands at USD 52.73 billion in 2025 and is forecast to reach USD 68.04 billion by 2030, advancing at a 5.23% CAGR despite uneven economic signals and tightening emissions rules.

Fleet managers concentrate on total cost of ownership, prompting robust demand for quality pre-owned Class 8 units. Heavy-duty models retain pricing power, yet light trucks are gaining traction as e-commerce accelerates last-mile activity. Diesel assets dominate the powertrain mix, but first-generation battery-electric trucks are beginning to influence residual-value expectations as charging networks widen. Digital auction platforms are broadening cross-border trade, lowering information frictions for small operators.

Global Used Truck Market Trends and Insights

Infrastructure-Led Construction Booms in India and ASEAN Stimulating Heavy Used-Truck Turnover

Construction megaprojects across India and Southeast Asia are accelerating fleet replacement cycles, prompting contractors to source 4-7-year-old heavy-duty units that balance reliability with manageable capital outlay. Open-deck capacity tightened in May 2025 as projects commenced, forcing shippers to secure equipment earlier in tender cycles. Even with a significant dip in 2024 light-vehicle sales, commercial demand remained firm because infrastructure spending shielded haulage volumes. Buyers increasingly request verified maintenance histories, and units with documented telematics data command premiums, reinforcing the importance of transparent vehicle provenance for the used trucks market.

E-commerce Last-Mile Expansion in North America Triggering Demand for Used Light-Duty Trucks

Rapid parcel-volume growth is pushing retailers and third-party logistics providers toward late-model Class 3-5 vehicles that fit tight urban corridors yet carry sizable payloads. The used trucks market benefits as operators sidestep higher new-vehicle prices while still meeting service-level agreements. Urban warehouse development along interstate rings supports shorter delivery radii. Environmental studies show that electric delivery vans lower carbon intensity, implying that lightly used electric models will secure strong residual values once they begin cycling out of primary fleets.

Tightening Euro-VII/Phase-3 NOx Rules Discouraging Older Diesel Imports in EU

Stricter tail-pipe limits split the European secondary market between compliant Euro VI tractors and legacy stock facing costly retrofits. The International Council on Clean Transportation confirms that access restrictions in growing low-emission zones penalize vehicles older than seven years. Exporters reroute pre-Euro VI units toward Central Asia and North Africa, temporarily inflating supply in those destinations while intensifying competition for low-mileage Euro VI assets within the EU.

Other drivers and restraints analyzed in the detailed report include:

- OEM Certified Pre-Owned Programs in Europe Enhancing Trust and Residual Values

- Digital Wholesale Auctions Broadening Buyer Pool, Especially in Middle East

- Low-Cost New Chinese Trucks Compressing Used Price Premiums in Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heavy-duty units commanded 43.05% of 2024 revenues as their pivotal role in long-haul freight and infrastructure haulage shielded demand during cyclical slowdowns. Light trucks, propelled by parcel logistics, are forecast to register a 7.69% CAGR to 2030, the quickest clip in the used trucks market. Their maneuverability suits congested inner-city routes, and fleet buyers value the lower acquisition cost relative to new vans.

Medium-duty trucks (Class 6-7) occupy a strategic middle ground, experiencing mixed market results. The segment witnessed a surge in inventory, while asking prices softened, signaling nuanced sub-segment conditions. Ongoing autonomous trials, such as an articulated dump truck showcased at CES 2025, foreshadow specialized heavy-duty applications that could redefine residual-value curves once these vehicles cycle into the used trucks industry.

Diesel assets held 92.25% of the 2024 pool, underlining the entrenched infrastructure, familiar maintenance regimes, and fuel-efficiency track record that fleet managers trust. The segment's staying power stems from diesel's proven reliability, fuel efficiency, and widespread service network, making it the default choice for secondary market buyers prioritizing operational certainty.

Hybrid and battery-electric entries, while small in absolute numbers, are projected to expand at a 22.55% CAGR through 2030. A USD 2-3 billion joint venture among Accelera by Cummins, Daimler Truck, and PACCAR will create a 21 GWh battery-cell plant, bolstering future used-EV supply. The Electrification Coalition calculates two-thirds lower running costs for electric trucks versus diesel, suggesting robust secondary-market appeal once adequate charging coverage emerges. Natural-gas and LPG variants remain niche, concentrated in regions with price-advantaged fuel supplies and municipal incentives.

The Used Truck Market Report is Segmented by Vehicle Type (Light Trucks, Medium-Duty Trucks, and More), Fuel Type (Diesel, Gasoline, and More), Age Bracket (Up To 3 Years, 4-7 Years, and More), Vehicle Class (Class 3 and More), End-Use Industry (Construction and Infrastructure and More), Sales Channel (Independent Dealer and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia retains the world's largest regional fleet base and accounts for 47.35% of the global market share, as infrastructure projects and e-commerce penetration continue to expand trucking demand. China's accelerated diesel-fleet liquidation, prompted by stringent electrification targets, releases high-quality Euro V tractors into neighboring developing markets. India's rapidly scaling digital retail sector, expected to triple in gross merchandise value by FY30, relies heavily on medium and heavy-duty haulage, reinforcing sustained equipment turnover.

North America mirrors global growth at a projected 5.2% CAGR to 2030 as sophisticated remarketing networks and data-driven valuation tools sustain liquidity. Forthcoming Corporate Average Fuel Economy standards for heavy-duty pickups and vans could nudge fleets toward newer, more efficient units, feeding additional late-model supply into the used trucks market.

The Middle East and Africa are the fastest-growing regions, posting a CAGR of 7.41% through 2030, capitalizing on digital-auction liquidity to source affordable assets, while Europe concentrates on tightening emissions compliance that skews demand toward newer Euro VI vehicles. South America is also growing significantly as economic stabilization and fiscal incentives spur fleet modernization. Brazil's GDP recovery supports renewed truck purchases, and tax breaks for used equipment encourage owner-operator investment. Cross-border transport facilitation measures such as the TIR system promise to open fresh export lanes for South American carriers, indirectly boosting demand for compliant used tractors.

- Daimler AG (SelecTrucks)

- PACCAR Inc.

- Volvo Group

- Scania AB

- MAN Truck and Bus SE

- Navistar International Corp.

- Tata Motors

- Ashok Leyland

- Isuzu Motors

- Hino Motors

- Mitsubishi Fuso Truck and Bus Corp.

- Eicher Motors (VECV)

- Iveco Group N.V.

- Ford Otosan

- Sinotruk (CNHTC)

- FAW Jiefang

- Dongfeng Commercial Vehicles

- UD Trucks

- Penske Used Trucks

- Enterprise Truck Rental

- Ryder Used Vehicle Sales

- AmeriQuest Used Trucks

- Copart Inc.

- Ritchie Bros. Auctioneers

- Mascus

- TruckPlanet (IronPlanet)

- AutoNation USA

- OLX Autos Commercial

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure-Led Construction Booms in India and ASEAN Stimulating Heavy Used-Truck Turnover

- 4.2.2 E-commerce Last-Mile Expansion in North America Triggering Demand for Used Light-Duty Trucks

- 4.2.3 OEM Certified Pre-Owned Programs in Europe Enhancing Trust and Residual Values

- 4.2.4 Digital Wholesale Auctions Broadening Buyer Pool, Especially in Middle East

- 4.2.5 Fleet Electrification Targets in China Pushing Diesel Fleet Liquidation

- 4.2.6 Tax Incentives on Used Commercial Vehicles in Brazil Supporting Owner-Operators

- 4.3 Market Restraints

- 4.3.1 Tightening Euro-VII/Phase-3 NOx Rules Discouraging Older Diesel Imports in EU

- 4.3.2 Low-Cost New Chinese Trucks Compressing Used Price Premiums in Africa

- 4.3.3 Limited Financing Options for Aged Heavy-Duty Assets in ASEAN Rural Regions

- 4.3.4 Chip Shortages Easing New-Truck Lead Times, Reducing Used-Vehicle Scarcity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.5.1 Emission-Norm Transition Timelines

- 4.5.2 Digital Title and Telematics-Enabled Inspection Technologies

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Vehicle Type

- 5.1.1 Light Trucks (Class 3-5)

- 5.1.2 Medium-Duty Trucks (Class 6-7)

- 5.1.3 Heavy-Duty Trucks (Class 8 and Over 15 t)

- 5.2 By Fuel Type

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Natural Gas and LPG

- 5.2.4 Hybrid and Battery-Electric

- 5.3 By Age Bracket

- 5.3.1 Up to 3 Years

- 5.3.2 4 to 7 Years

- 5.3.3 8 to 12 Years

- 5.3.4 Above 12 Years

- 5.4 By Vehicle Class

- 5.4.1 Class 3

- 5.4.2 Class 4

- 5.4.3 Class 5

- 5.4.4 Class 6

- 5.4.5 Class 7

- 5.4.6 Class 8

- 5.5 By End-use Industry

- 5.5.1 Construction and Infrastructure

- 5.5.2 Logistics and E-commerce Delivery

- 5.5.3 Mining and Quarrying

- 5.5.4 Agriculture and Forestry

- 5.5.5 Municipal and Utilities

- 5.5.6 Others

- 5.6 By Sales Channel

- 5.6.1 Independent Dealer

- 5.6.2 Franchised Dealer

- 5.6.3 OEM-Backed Certified Pre-Owned

- 5.6.4 Online Peer-to-Peer and Auction

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Chile

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Qatar

- 5.7.5.4 South Africa

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Daimler AG (SelecTrucks)

- 6.4.2 PACCAR Inc.

- 6.4.3 Volvo Group

- 6.4.4 Scania AB

- 6.4.5 MAN Truck and Bus SE

- 6.4.6 Navistar International Corp.

- 6.4.7 Tata Motors

- 6.4.8 Ashok Leyland

- 6.4.9 Isuzu Motors

- 6.4.10 Hino Motors

- 6.4.11 Mitsubishi Fuso Truck and Bus Corp.

- 6.4.12 Eicher Motors (VECV)

- 6.4.13 Iveco Group N.V.

- 6.4.14 Ford Otosan

- 6.4.15 Sinotruk (CNHTC)

- 6.4.16 FAW Jiefang

- 6.4.17 Dongfeng Commercial Vehicles

- 6.4.18 UD Trucks

- 6.4.19 Penske Used Trucks

- 6.4.20 Enterprise Truck Rental

- 6.4.21 Ryder Used Vehicle Sales

- 6.4.22 AmeriQuest Used Trucks

- 6.4.23 Copart Inc.

- 6.4.24 Ritchie Bros. Auctioneers

- 6.4.25 Mascus

- 6.4.26 TruckPlanet (IronPlanet)

- 6.4.27 AutoNation USA

- 6.4.28 OLX Autos Commercial

7 Market Opportunities and Future Outlook

- 7.1 Digital Inspection-as-a-Service for Cross-Border Buyers

- 7.2 Subscription and Pay-per-mile Financing Models for SMEs

- 7.3 Electrified Truck After-market and Second-life Batteries